JaysonPhotography/iStock by way of Getty Pictures

Scary Headlines

The headlines in monetary and financial information articles may be scary, particularly when the inventory market is tanking week after week. Even the Dividend Aristocrat shares are taking a beating, so we all know there should be issues. This is a type of occasions when cooler heads should prevail. Persistence, younger padawan, this too shall finish, and the market (pressure) shall as soon as once more rise. It at all times does over time. It’s simply these pace bumps that show to be such an virtually insufferable nuisance. However bear markets inevitably find yourself turning into bull markets and this time will show no totally different. It’s only a matter of time earlier than we are able to see the sunshine on the finish of the tunnel.

A part of the issue is that the scary headlines are warranted at the moment. The inventory market has been falling, the financial system is slowing, and inflation has gotten the higher of the Fed to this point. Fears introduced on by these three scary phrases (inflation, stagflation, and recession) are the first explanation for our present bear market. We’ll focus on every of these phrases, what they imply, and the way scared we needs to be. This isn’t the substances for an incredible bedtime story so whether it is late, I recommend you may be higher off studying this text within the morning.

Inflation

There isn’t a denying that inflation is going on now and can proceed till the Fed has gained management of rising costs. The most important concern is whether or not the Fed can achieve sway since a number of elements outdoors its management are contributing to inflationary pressures.

The 2 most typical conventions (variations) of inflation are cost-push and demand-pull. At present’s model is brought on by each: demand exceeding provide (demand-pull) in a number of classes forcing prices and costs to rise; after which, as a result of shortage or provide chain disruptions, prices of uncooked supplies are rising and being handed on to shoppers (cost-push). However each are sometimes brought on by an imbalance of provide and demand.

In at the moment’s case, shortages in each uncooked supplies and completed merchandise are being brought on by many elements. The zero-tolerance (COVID-19) coverage in China causes many cities to lock down requiring factories and ports to shut. On this case, the motion of each uncooked supplies and completed merchandise are halted till the COVID-19 outbreak has handed inflicting a backlog of orders and lack of provide in a broad variety of gadgets.

The invasion of Ukraine by Russia has brought on shortages of many agricultural items resembling wheat, corn, sunflower oil, sunflower seeds, and fertilizer. Fossil gas shortages are additionally an final result of sanctions towards Russia (by the U.S., Europe, and different allies) as a result of aggressive, war-like insurance policies. Thus, power prices have risen dramatically inflicting transportation prices and electrical energy to rise.

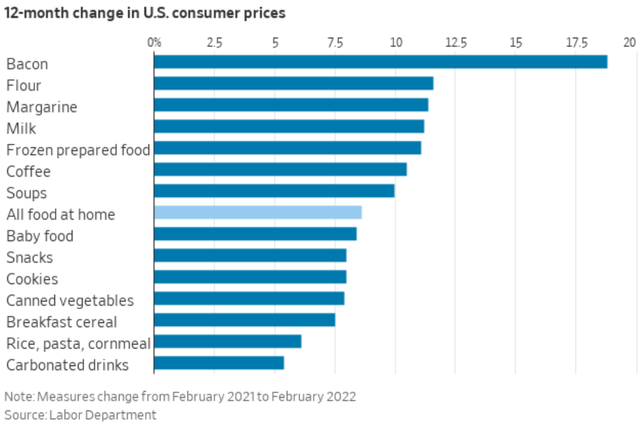

wsj.com

Folks in Africa are dealing with hunger whereas populations in additional developed international locations pays extra for primary meals, each at dwelling and whereas eating out. Grains are a supply of feedstock for livestock. The misplaced provide of grains from Ukraine as a result of a Russian sea blockage of Ukraine ports will trigger an increase in costs for not simply processed meals that embody grains and sunflower oil (that accounts for lots of meals consumed within the West), but additionally for all types of meat as a result of rising prices of feeding herds and flocks.

The nationwide common of fuel on the pump is now over $5 per gallon. Utilities are warning of rolling electrical energy blackouts this summer time as a result of the U.S. not has ample electrical energy technology capability to fulfill peak power calls for of summer time cooling. Coal-fired electrical technology vegetation have closed early as a result of extra stringent and expensive laws that made it unprofitable to proceed working, leading to lower-than-expected electrical energy technology capability heading into the warmer than regular summer time months. That lowered provide will lead to increased costs for electrical energy this yr, regardless that thousands and thousands of Individuals shall be inconvenienced by having to do with out for brief durations of time.

Pay extra, get much less. That’s one other type of inflation. Even when costs for some merchandise don’t rise, it’s typically the case that producers will put much less in each bundle whereas not altering the value. That has been taking place for a very long time. I’m not certain whether or not the CPI (client value index) captures all such types of inflation which might be borne by shoppers. I keep in mind shopping for a pack of chewing gum for five cents once I was a child!

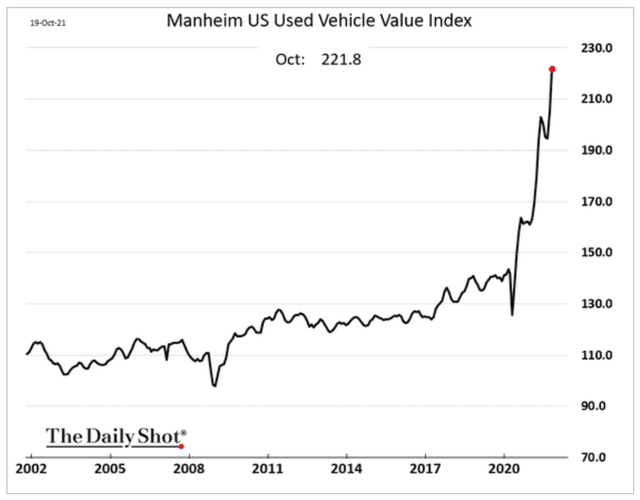

Auto costs have risen dramatically due to the shortage of completed autos obtainable to promote as a result of a chronic scarcity of semiconductor and microprocessor chips that regulate a larger share of every car’s techniques. I’ve learn {that a} Taiwan Semiconductor (TSM) govt lately acknowledged that the provision scarcity is unlikely to be absolutely overcome till 2024. The scarcity of recent autos has brought on not solely new automobile costs to surge increased however used automobile costs have gone up much more. That is one space the place value pressures will ultimately abate however it isn’t clear that costs will come down or simply rise extra slowly.

The Every day Shot

Airways do not need sufficient workers to deal with the elevated calls for of summer time trip vacationers. These firms laid off staff throughout the 2020 lockdown to scale back prices whereas preventing for survival. Now those self same firms can’t rent sufficient staff when they’re wanted. Flights are being cancelled and costs are rising as a result of individuals are keen to pay extra to take these holidays that needed to be postponed for 2 years throughout the pandemic.

There are a lot of different examples of inflation that we might record however you get the image. Now allow us to swap to what different elements are concerned in addition to the plain ones talked about above.

Demographics

Demographics have performed a big position in inflicting this spherical of inflation, however only a few perceive that a part of the equation. Even with no pandemic or a Russian invasion of Ukraine, we might have had rising strain from the demand facet inflicting inflation. The millennial technology (Gen Y) has lastly reached the stage of full-on consumerism, hitting their stride in family formations, and commanding increased earnings. The height of Gen Y members has reached 30 years of age in giant numbers and are spending in a sample like what the Boomer technology did throughout the Nineteen Seventies. Does anybody keep in mind what occurred throughout the Nineteen Seventies and early Eighties? I do. Inflation rose in out-of-control trend and mortgage charges hit 18.5% or extra. The true property business turned stagnant as a result of the Fed was preventing inflation by elevating rates of interest similar to at the moment and housing turned unaffordable for a lot of. Sound acquainted?

Then got here the frenzy to construct flats to accommodate all of the individuals who couldn’t afford to purchase a house. Lenders supplied the funding, elevating the cash by time deposits with excessive charges which attracted monumental quantities of money. In fact, all the cash obtainable led to overbuilding which, in flip, led to low occupancy charges leading to bankruptcies by condo house owners and monetary establishments which brought on a recession or two till the financial system had flushed out all of the unmanageable debt and have become wholesome once more. The Fed beat inflation again then, lastly, and by 1984 the financial system was rising once more with rates of interest coming down making the whole lot extra inexpensive once more. However the course of was painful; very painful.

The Fed has extra instruments this time

At present could also be totally different in some respects as a result of the Fed has extra instruments with which to combat inflation. With a stability sheet of about $9 trillion, the Fed can scale back liquidity thereby lowering the danger urge for food of traders and companies. Additionally, by decreasing its stability sheet it will likely be unable to buy debt from the U.S. Treasury. That signifies that the Treasury might want to discover different patrons for its debt devices, decreasing demand and forcing costs decrease which leads to increased yields on longer-term bonds. That, in flip, makes borrowing costlier and will scale back demand for capital tasks in addition to mortgages.

Residential actual property gross sales are already slowing however dwelling costs proceed to rise at unsustainable charges, no less than for now. That brings up one other issue that results in future inflation: rents haven’t saved tempo with dwelling costs. Lease will increase are inclined to lag dwelling costs however ultimately catch up and are a significant factor included within the calculation of CPI (Shopper Worth Index). There’s nonetheless extra upward strain to come back from this space.

The Fed can also be starting its fee hikes from a a lot decrease base and with a a lot stronger financial system than we had again within the Nineteen Seventies. These two elements alone ought to imply that rates of interest is not going to have to rise as a lot as they did again then. However that shall be decided by how the Fed proceeds. We’re not out of the woods but.

Some facets of inflation are more likely to proceed for a number of years extra, into 2024 or later. COVID-19 is just not over, irrespective of how a lot we would like it to be. New strains or variants will undoubtedly type and require our consideration, which is able to proceed to trigger provide chain disruptions for a pair extra years. We don’t know how lengthy the battle in Ukraine goes to final. As Gen Y continues to develop in its affect over our financial system, demand pressures will develop together with it (similar to with Boomers – anybody keep in mind the pig within the python?).

So, there shall be an overhang of inflationary pressures that the Fed might not have the ability to handle, however we consider inflation ought to come all the way down to below 4% over the subsequent two to a few years. That may trigger some lingering issues which shall be addressed later on this article.

Stagflation

Stagflation is when the financial system is rising very slowly (or in no way) whereas excessive inflation makes the whole lot costlier. Wages stagnate as a result of companies are dealing with narrowing revenue margins as a result of increased materials prices. Actual earnings and buying energy drop. Imagine me once I say it’s a very painful actuality to stay by.

The Nineteen Seventies are a case research in stagflation. Inflation was stubbornly excessive within the first half of the last decade after which started rising to even increased ranges within the second half and into the early Eighties. Worth controls have been put in place by the Nixon administration, however it didn’t have the specified impact. Prices saved rising and the financial system suffered. It was not till the Federal Reserve began elevating rates of interest to double digits that inflation started to ease and was lastly introduced below management. Wages couldn’t sustain with inflation, so the typical family felt its high quality of life undergo.

The whole lot saved getting costlier and the fee to borrow skyrocketed leading to an financial system that stagnated. However, on the similar time, the newborn boomer technology was coming into its personal and starting to eat extra. So, the demand was there however firms didn’t have the capability to supply sufficient to fulfill rising demand. The price of borrowing being restrictive, firms elevated capability at extraordinarily excessive capital prices. If that weren’t sufficient, with all the brand new, younger staff coming into the workforce, productiveness took successful as inexperience took its toll.

Companies had a tough decade and so did shoppers. Stagflation is just not one thing anybody desires to expertise. However do we actually want to fret about stagflation coming to America once more? A latest research from the Nationwide Bureau of Financial Analysis, “Evaluating Previous and Current Inflation,” signifies that we could possibly be in for a reenactment of the Nineteen Seventies and early Eighties. In it, the authors recommend that for the Fed to get inflation again all the way down to its goal of two% will “require practically the identical quantity of disinflation as achieved below Chairman Volker.” What they’re saying is that rates of interest might have to rise to double digits once more. Whereas that will be painful, for savers and retirees it will likely be a blessing as a result of we can lock in excessive returns with long-term bonds.

But when that situation occurs, many bankruptcies will happen as a result of too many companies have change into depending on low cost debt. It is not going to be low cost anymore. Even well-managed firms may have bother sustaining their margins. Shares might languish for years making investing for development exceedingly tough.

However stagflation is just not right here but. That’s the excellent news. The unhappy information is that there are too many similarities between now and the Nineteen Seventies to write down it off as inconceivable. Once more, a lot of how the financial system responds will rely upon how properly the Fed manages its tightening regime going ahead. Extra about that later.

Recession

Beforehand, when requested, I’ve mentioned that I count on the U.S. financial system to fall into recession by early subsequent yr (2023). Nevertheless, I used to be overly optimistic then. Now I count on a recession to happen in 2022. I can’t say for certain when it’ll (or has) begin(ed), however the mounting variety of indicators now flashing a recession warning are too many to disregard.

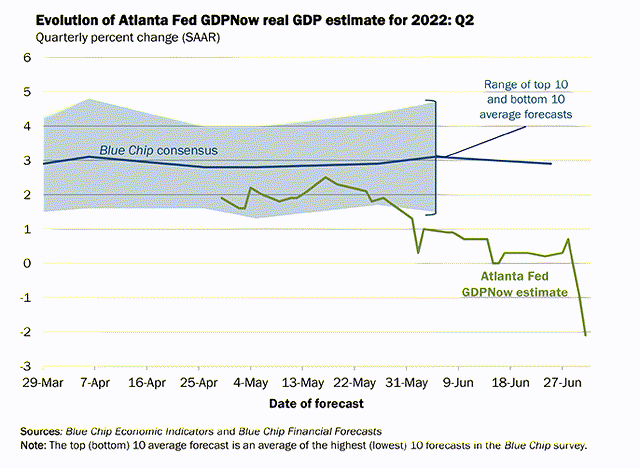

The Atlanta Federal Reserve Financial institution’s GDPNow, which tracks in actual time the elements of GDP development, lately up to date its 2nd Quarter GDP forecast. The studying is a adverse 2.1%.

Atlanta Fed

The economists at S&P International Market Intelligence additionally lowered their estimate for GDP for the 2nd Quarter to adverse 1.5%. If these two prognosticators are right, it might imply that we’re already in a recession. The accepted back-of-the-envelope definition of a recession is 2 sequential quarters of contraction however that’s lower than absolutely correct. The NBER (Nationwide Bureau of Financial Analysis) defines a recession as a big decline in financial exercise unfold throughout the financial system, lasting various months, usually seen in actual GDP, actual earnings, employment, industrial manufacturing, and wholesale-retail gross sales.

By that definition, we could also be in a recession, or not fairly, as a result of employment continues to be sturdy and retail gross sales, whereas off the height, are nonetheless comparatively sturdy on a relative foundation. In different phrases, to be formally in a recession, unemployment wants to start to rise and retail gross sales have to drop additional. Retail gross sales development has slowed in Q2, so that doesn’t meet the requirement. But when inflation stays elevated sufficient to maintain the Consumed its aggressive path of elevating rates of interest and eradicating liquidity from the financial system, I consider it is just a matter of time that the NBER declares a recession. However the announcement will come months after the very fact. So, it stays to be seen if the U.S. financial system is already in a recession now or not.

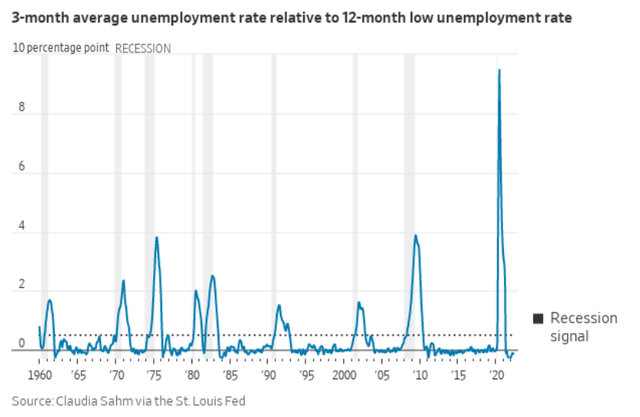

Top-of-the-line indicators for predicting a recession is imminent known as the Sahm Indicator, named after Claudia Sahm (an economist on the St. Louis Federal Reserve Financial institution), which reveals that since 1960, each time the unemployment fee rises by 0.5% off its backside a recession happens.

wsj.com

Discover that the predictive worth has been 100% correct to this point. Additionally discover that when the indicator is triggered the financial system is both in a recession or a recession is simply beginning. It’s one thing to look at.

The Fed is making an attempt to scale back demand for jobs (job openings) with out forcing layoffs. It will be a neat trick if it may be profitable, however I’ve main doubts concerning the Fed’s skill on this matter. Apparently, so does Fed Chairman Powell. (Click on on the hyperlink to view quick video of Chairman Powell)

“Economists surveyed by The Wall Road Journal have dramatically raised the likelihood of recession, now placing it at 44% within the subsequent 12 months, a stage normally seen solely getting ready to or throughout precise recessions.” – WSJ

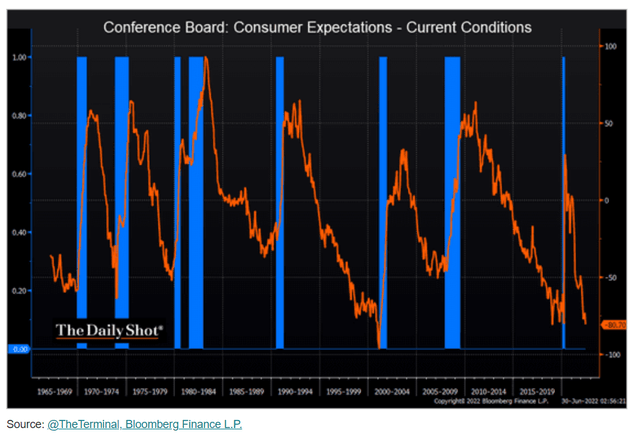

But different indicators that bode ailing for the U.S. financial system are client sentiment and client confidence. Each are trending all the way down to ranges indicative of a recession brewing. One particular indicator is the unfold between client expectations and present situations from the Convention Board.

The Every day Shot

Discover that this indicator bottoms close to the start of every recession on the chart above. We’re already at about the identical stage as in Spring of 2020 and beneath all however the stage previous the 2001 tech bubble recession.

In some methods it doesn’t really feel like we’re in a recession but, however the writing is on the wall: a recession is both right here or coming quickly. It seems that if we’re in a recession already it could possibly be shallow and never final lengthy. However how unhealthy it will get and the way lengthy it lasts depends upon how properly the Fed handles inflation. As Chairman Powell indicated, some issues which might be including to the inflationary setting are outdoors the Feds management: battle in Ukraine and provide chain disruptions.

Conclusion

Properly, I advised you it will be bleak proper from the start. I consider a recession is imminent (throughout the subsequent six months), elevated inflation goes to be with us for a number of years, and {that a} extended interval of stagflation could possibly be within the playing cards. If stagflation happens, I count on the inventory market to commerce in a broad vary for a number of years, till inflation is again below management and the financial system is in restoration mode. Of the three, I contemplate stagflation to be the least doubtless due to the underlying power of the financial system.

Within the coming situations it will likely be paramount for traders to carry onto high quality shares and dump these with extreme debt. High quality, in my guide, means wonderful administration in a position to ship superior leads to any setting, sturdy free money stream and a pristine stability sheet. These are the sorts of firms we proceed to carry in our mannequin portfolios. We additionally maintain lots of money in anticipation of outstanding bargains that can seem when the bear market has run its course.

Please keep in mind that the inventory market is ahead wanting and can start to show up earlier than the financial system has recovered. We’re not there but, however we shall be watching the symptoms for bottoming. We can’t choose bottoms, however we are able to choose cut price costs. Market tops and bottoms are simpler to see within the rear-view mirror. As soon as a market backside is clearly shaped, there’s loads of time to select up the very best shares at opportunistic costs.