SteveLuker/E+ through Getty Pictures

DISCLAIMER: This observe is meant for US recipients solely and, particularly, just isn’t directed at, nor meant to be relied upon by any UK recipients. Any info or evaluation on this observe just isn’t a suggestion to promote or the solicitation of a suggestion to purchase any securities. Nothing on this observe is meant to be funding recommendation and nor ought to it’s relied upon to make funding choices. Cestrian Capital Analysis, Inc., its workers, brokers or associates, together with the writer of this observe, or associated individuals, might have a place in any shares, safety, or monetary instrument referenced on this observe. Any opinions, analyses, or chances expressed on this observe are these of the writer as of the observe’s date of publication and are topic to vary with out discover. Firms referenced on this observe or their workers or associates could also be prospects of Cestrian Capital Analysis, Inc. Cestrian Capital Analysis, Inc. values each its independence and transparency and doesn’t imagine that this presents a fabric potential battle of curiosity or impacts the content material of its analysis or publications.

Simply As a result of You Do not Use It Does not Imply It Cannot Make You Cash

We do not know, however we’d be keen to guess, that not so many Looking for Alpha customers reside on Pinterest (NYSE:PINS) all day lengthy. If temper boards and palettes are your factor, you most likely aren’t additionally motivated by stock-shaming hapless authors who dare lob foolhardy concepts your method. In actual fact had been we to take a ballot right here we might most likely discover the typical opinion on Pinterest ranged from “who?” to “LMAO no,” with a detour via “get off my garden.”

However look, lets say the corporate under is named Acme Inc and it sells cleaning soap or one thing. Check out the numbers.

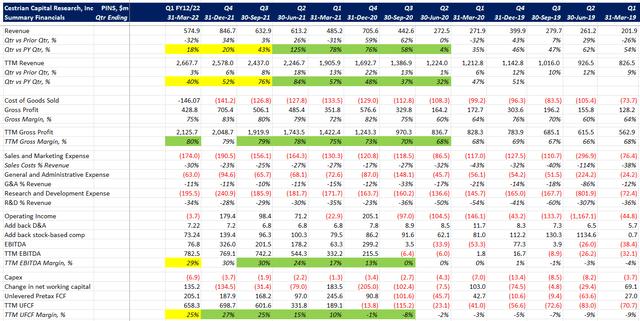

PINS Monetary Desk I (Firm SEC filings, YCharts.com, Cestrian Evaluation)

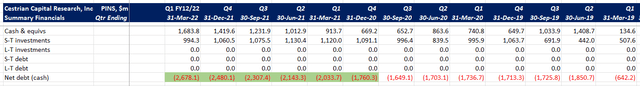

PINS Monetary Desk II (Firm SEC Filings, YCharts.com, Cestrian Evaluation)

Let’s take a look at some highlights right here:

- 18% year-on-year income progress in the latest quarter, and that was a foul quarter

- 80% gross margins on a TTM foundation

- 29% TTM EBITDA margins

- 25% TTM unlevered pre-tax free money movement margins

- $2.7bn internet money on the stability sheet

Now, run that via the grump-pa screener and slightly curiosity will get piqued at these fats money movement margins and the large ol pile of Jeromes on the stability sheet.

How about valuation? Usually that is the “Ha! You youngsters won’t ever study” second.

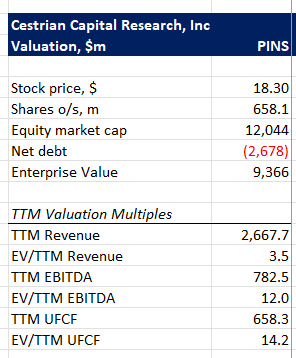

PINS Valuation Desk (Firm SEC Filings, YCharts.com, Cestrian Evaluation)

14.2x TTM unlevered pretax free money movement is lower than you’ll pay to your gramps’ favourite protection contractor. And but mentioned member of the military-retiree complicated is more likely to be rising at 1%-2% on a superb day.

OK. Subsequent objection to this light-weight piece of fluff. Inventory-based comp. There is a good chunk of it right here. Round $400m within the final 4 quarters, which is a big share of income. Sure it is a price to shareholders. No it is not excluded from the inventory worth. Have at it within the feedback do you have to so want. By no means will get previous.

Now, except for the overall slide in progress names, one purpose that PINS has been on the wane for a while now – earlier than the broader selloff – is that the prior administration group had been considered to have undermonetized the person base. You’ll be able to measure this each which method until Tuesday, or you could possibly simply have a look at the Pinterest web site or app. (Go on. Do it. You already know you need to.) There’s loads of attention-grabbing stuff on there, however the name to motion, the temptation to hit the Purchase Now! button and get the nice dopamine shot, that is noticeable primarily by its absence. Which is why the board of administrators simply employed a brand new CEO with – sure – a funds background. As The Verge places it: He has one job.

We imagine it is a Purchase sign for PINS inventory. The valuation is low, fundamentals are robust even earlier than Enterprise Dad was introduced in to indicate the children a factor or two about being profitable, and sensible sufficient the board has arrange the comp plan and/or the company internet of mutual oblivion simply so – and in consequence the outgoing CEO, founder Ben Silbermann, even has good issues to say in regards to the grownup supervision (see that very same Verge hyperlink above).

Our technique with PINS inventory in employees private accounts is – do nothing. We personal half our unique stake – the primary half acquired bought for a pleasant achieve on the PayPal acquisition rumor, and the remaining bag-holding chunk can simply sit tight ready for both (1) new Rock Star CEO to get the {dollars} rolling into the topline, thus amping up the valuation multiples, and/or (2) Rock Star to resolve it is too onerous after which to spend a yr or so crafting the enterprise to be bought and Jedi-mind-tricking Silbermann into agreeing that sure, it could be finest if Evil Megacorp, Inc or Masters Of The Universe Companions, LP had been to purchase PINS in an effort to, er, “assist” its customers and employees “fulfil their desires.” But when we did not personal any PINS proper now we’d most definitely be shopping for some. And relying on how deep everybody’s pals at JPMorgan push the S&P down, we might but common down our place.

In case you’re in any method inclined to imagine that progress just isn’t the truth is Doomed Eternally – and in monetary markets most issues aren’t Doomed Eternally, they’re often simply being collected or distributed by the Market Gods – then we imagine PINS to be a compelling purchase at this stage.

Cestrian Capital Analysis, Inc – 30 June 2022.