© Reuters. FILE PHOTO: The emblem of French oil and fuel firm TotalEnergies is pictured at an electrical automobile charging station and petrol station on the monetary and enterprise district of La Protection in Courbevoie close to Paris, France, June 22, 2021. REUTERS/Gonzalo Fuent

By Shadia Nasralla, Benjamin Mallet and Michel Rose

LONDON (Reuters) – France’s TotalEnergies cuts a lonely determine hanging onto its Russian investments throughout a mass exodus of western oil majors from the nation after its invasion of Ukraine, although no sanctions have compelled such divestments.

“For present property, the corporate says it should respect European sanctions regardless of the penalties. However for the second, there aren’t any sanctions on power,” stated a supply acquainted with the pondering inside TotalEnergies.

TotalEnergies has a future-oriented place in Russia, closely weighted in the direction of liquefied (LNG), with stakes within the yet-to-be constructed $21 billion Arctic LNG 2 challenge in addition to within the producing Yamal LNG operation.

With the world making an attempt to slash carbon emissions, oil majors are betting on LNG to switch more-polluting coal and oil. TotalEnergies first purchased a stake in Russian fuel producer Novatek in 2011 for $4 billion and steadily elevated its stake to only below 20% by 2018.

“The corporate can’t divest property from in the future to the following until sanctions power it to take action. One should take time to replicate,” stated the supply.

The French authorities has declined to touch upon particular firms and Russia. French President Emmanuel Macron, who convened members of a Franco-Russian discussion board on Tuesday, didn’t urge TotalEnergies or French firms to depart Russia, two members advised Reuters. Amongst these current was TotalEnergies Chief Government Patrick Pouyanne.

In distinction, Britain’s authorities instantly applauded Shell (LON:)’s and BP (NYSE:)’s determination to exit Russia. Chief Government Officer Bernard Looney advised staff BP “could not moderately stick with it in Russia given the battle in Ukraine,” in line with an organization supply.

Billions of {dollars} of impending write-downs are piling up for the businesses which have stated they might exit their Russian property: BP, Shell, Equinor and Exxon Mobil (NYSE:). For now, there are few potential patrons for the stakes and operations they’re leaving in Russia.

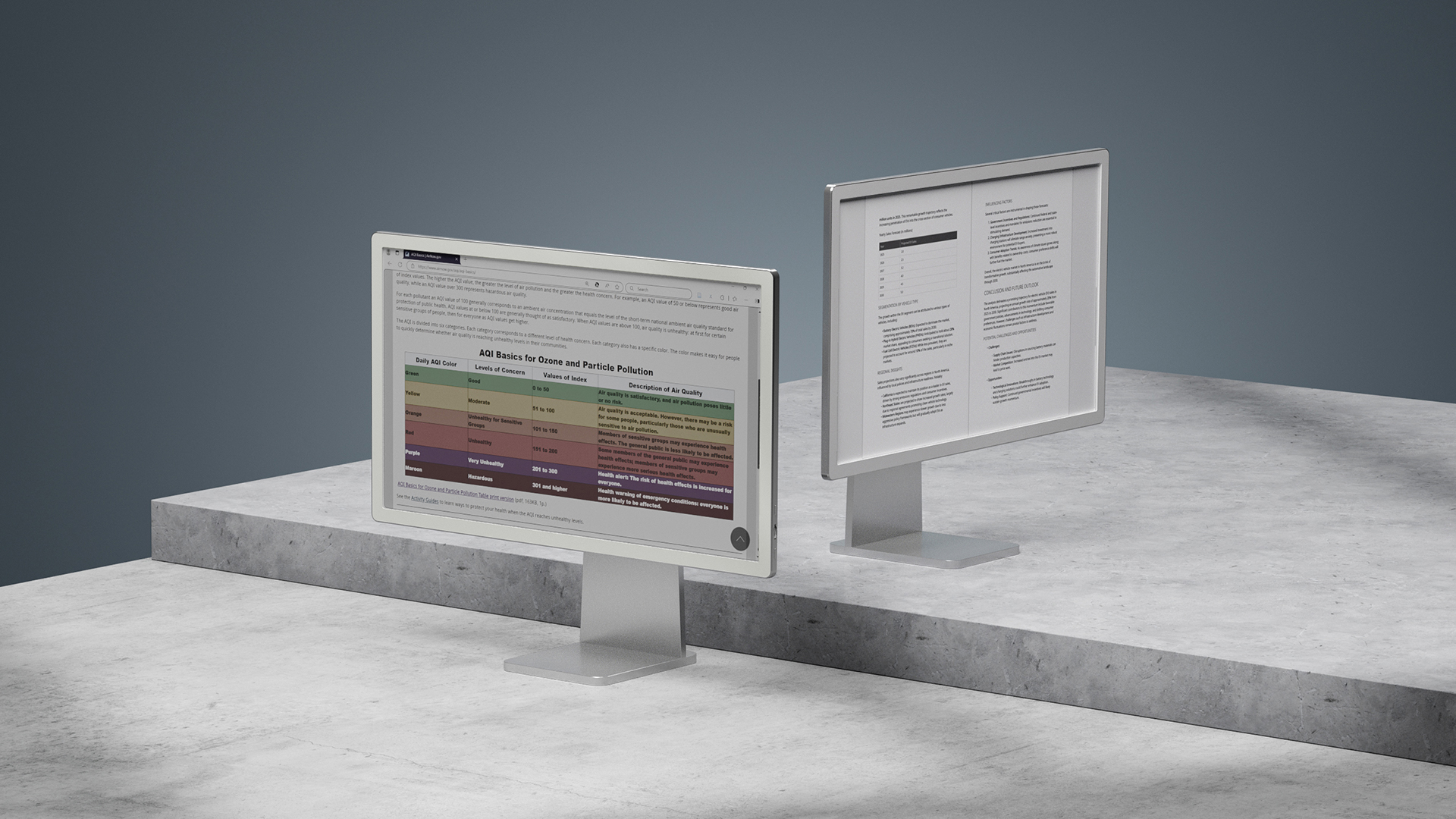

Share costs of the businesses which have exited Russia have outperformed TotalEnergies in latest days.

Graphic – TotalEnergies shares underperforming friends: https://fingfx.thomsonreuters.com/gfx/ce/xmpjoebwlvr/Pastedpercent20imagepercent201646312060659.png

“We see a possible exit by TTE being far more difficult than it’s for friends,” stated RBC fairness analyst Biraj Borkhataria

on Wednesday. “We see Russia as strategically necessary for TTE, significantly for its LNG enterprise.”

TotalEnergies goals to fulfill 10% of worldwide LNG markets by 2025 with 50 million tonnes a yr. Russia accounts for six million tonnes from Yamal and one other 4 million tonnes from Arctic LNG 2 as soon as operational, in line with RBC.

Reuters couldn’t confirm complete returns on investments in Russia by the oil majors, which don’t often publish asset and country-specific financials. Nonetheless, it was clear that BP, for instance, has already made good on its investments.

When former U.S. President Donald Trump hit Iran with sanctions, TotalEnergies additionally caught with its funding in an enormous fuel discipline, dropping it solely after failing to acquire a sanctions waiver from Washington in 2018.

On the time, media reported that Pouyanne advised Trump that continued funding may assist democratic progress in Iran.

In 2021, TotalEnergies’ cashflow from Russia amounted to $1.5 billion. It declined to provide additional particulars on its Russian investments and former years’ cashflows.

In the meantime, BP faces a write-down of as much as $25 billion for dropping Russia and shedding out on annual dividends from Rosneft which have fluctuated between round $300 million and $780 million, in line with its quarterly outcomes.

However the cashflow it has obtained from Russia through the years would possibly soothe a few of that ache.

In 2003, BP and Russian traders created TNK-BP through which BP invested $8 billion. Within the 10 years that adopted, BP obtained round $19 billion in dividends.

In 2013, Rosneft purchased BP’s stake in TNK-BP for round $12 billion in money and Rosneft shares which have yielded dividends for BP of over $4 billion.

Shell, which was an early accomplice in Russia’s first LNG plant, Sakhalin II, bought half of its 55% stake to Gazprom (MCX:) in 2007 for $4.1 billion, two years earlier than the challenge got here on-line.

Its 2021 internet earnings from Sakhalin II and its Salym oilfields, which began full manufacturing in 2006, have been $700 million, it stated. Tax reviews confirmed gathered earnings from Russia have been round $384 million in 2020, $455 million in 2019 and a lack of $16 million in 2018.

Flagging impairments from its Russian exit, Shell stated it had round $3 billion in non-current property. A Shell spokesperson declined to provide additional particulars.

As for Exxon Mobil shutting the door on its $4 billion in property in Russia and triggering what may develop into a write-down, it has benefited from working giant offshore oil and fuel fields close to Sakhalin Island since 2005.

Exxon didn’t break down its investments in Russia and declined to touch upon a possible writedown. However Chief Monetary Officer Kathryn Mikells stated on Wednesday that leaving its Russian oil and fuel operations would shave 1%-2% from earnings.

“All of them will battle to repatriate future earnings from Russia. A distinction between them is that TotalEnergies’ can argue they’ve much less direct ties the federal government as a result of Novatek is privately-owned. The query is how lengthy that argument can maintain,” stated Giacomo Romeo, Jefferies equities analyst.

“By way of funding recoverability, direct stakes in LNG property comparable to Sakhalin, Yamal and Arctic LNG are totally different from stakes in firms comparable to Rosneft and Novatek. Chinese language or Indian traders is perhaps enthusiastic about stakes in LNG property, if the worth is low sufficient and there are sufficient uncontracted volumes.”

(extra reporting by Ron Bousso, Sabrina Valle, writing by Shadia Nasralla; Modifying by David Gregorio)