Noah Berger/Getty Photographs Leisure

Amazon (NASDAQ:NASDAQ:AMZN) is in an fascinating place presently due its a number of segments having completely different futures. Buyers are fearful concerning the firm’s core retail section on account of rising gasoline costs and inflation inflicting pressure on revenue margins. Nonetheless, the corporate’s secondary segments are set to prosper within the upcoming durations. AWS continues to be an trade chief within the cloud market and is ready to profit closely from exponential trade progress and better demand.

Prime Video and Music are also rising to turn into main threats of their respective industries and may very well be on observe to overhaul every trade’s chief. Since these segments will doubtless assist the corporate’s fundamentals in a market downturn, in addition to the present worth the inventory is buying and selling at, buyers could need to think about leaping into the inventory.

The Retail Business Will Probably Battle As a consequence of Rising Prices and Decrease Demand

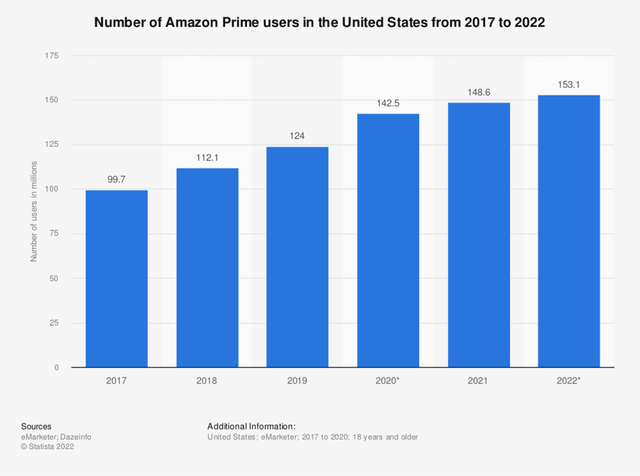

The largest downside for a lot of buyers is the way forward for Amazon’s core retail section, and rightfully so. The corporate noticed highly-inflated demand in the course of the pandemic on account of customers procuring from house on a a lot larger scale. From 2019-2021, Amazon elevated its income by 67%. In the identical time interval, its prime subscribers in the USA grew from 124 million to about 149 million. This pattern is anticipated to proceed all through the tip of 2022 with the U.S. prime subscriber depend anticipated to succeed in about 153 million customers.

Amazon Prime Subscribers, 2017-2022 (Statista)

Nonetheless, the fading of COVID-19 is now inflicting e-commerce to fade with it and reduce the demand for Amazon’s retail companies. In a current Mastercard SpendingPulse report, e-commerce transactions noticed a decline of 1.8% from 2021. Then again, in-store gross sales grew by 10% in the identical time span. This report harm e-commerce shares closely, together with Amazon. This slowdown and return to in-person procuring brought on Amazon to expertise its slowest income progress for the reason that dot com crash in 2001 and additional frighten buyers.

Together with decreased demand, Amazon’s retail section is seeing a lot larger prices. Rising gasoline costs hurt the already low margins retail corporations expertise. Not too long ago, nationwide gasoline costs reached about $5 per gallon and diesel costs reached about $5.81 per gallon. Since most of Amazon’s delivery is carried out by huge vehicles with very low gasoline effectivity, the vastly larger value of diesel is detrimental to Amazon’s enterprise as delivery prices are one of the crucial essential elements for the corporate’s margins.

Due to these elevated prices, Amazon has knowledgeable its third-party sellers will probably be implementing a 5% gasoline and inflation surcharge to fight the results of those rising costs. These prices will doubtless be handed on to the patron and result in decrease volumes on Amazon. Subsequently, the issues buyers are having about Amazon’s retail section are doubtless justified. This implies the corporate should depend on its secondary segments to assist the enterprise throughout market downturns.

AWS Will Proceed to Be the Business Chief and Capitalize on Exponential Progress

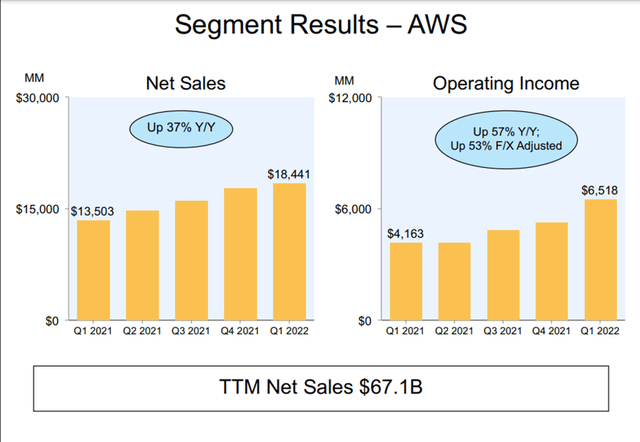

AWS is seen by buyers as one of many key shiny spots of Amazon’s upcoming future. AWS is presently the biggest cloud companies supplier with a 33% market share whereas solely accounting for 14% of Amazon’s complete income. This doubtless signifies that AWS has room to develop for Amazon’s complete gross sales, in addition to within the trade. Within the firm’s most up-to-date earnings report, AWS thrived whereas retail struggled. The section grew by 36.5% Y/Y and beat analyst projections for income and working earnings. The section’s working margin additionally elevated from 29.8% to 35.3%. All of this has allowed AWS to generate $67.1 billion in gross sales up to now 12 months and proceed to rise as cloud companies see extra demand.

AWS Section Outcomes (1Q22 Earnings Report)

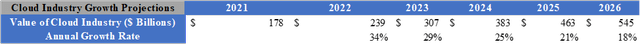

The rationale behind AWS’s huge progress is because of the rising demand for cloud companies and exponential progress of the trade. Over the previous few years, the cloud trade has persistently grown at about 34% per 12 months. With this progress charge, we will challenge how giant the cloud companies trade could also be in upcoming years. By beginning with the trade’s present measurement of about $178 billion and a 34% progress charge that wanes by 15% annually, the cloud trade may very well be price about $545 billion in 2026.

For a conservative estimate, as an example Amazon loses a few of its market share from Microsoft (MSFT), Google (GOOG)(GOOGL), and different small opponents and would solely maintain a 25% market share. This is able to worth AWS at about $136 billion in comparison with the $59 billion it’s presently price. Subsequently, AWS will doubtless proceed to thrive regardless of future points with the retail section. This might give Amazon a aggressive benefit over different fashionable retailers and turn into a lovely decide as an funding.

Cloud Business Progress Projections (Created by Creator)

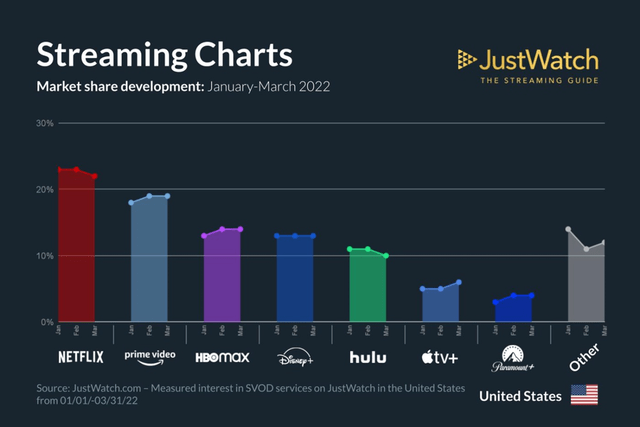

Prime Video and Music Are Rising to Overtake Business Leaders

Prime Video is rapidly changing into one of many largest names in streaming primarily because of the giant rise in prime subscribers talked about beforehand. This has brought on Prime Video’s market share to extend at a gentle tempo and much outperform its opponents. Presently, Prime Video’s market share of the streaming trade is nineteen% and on the rise. Conversely, Netflix’s (NFLX) presently sits at 23% however is declining. With the variety of U.S. prime subscribers anticipated to succeed in 168.3 million by 2025, Prime Video might surpass Netflix as the highest streaming service. This is able to additional assist assist the corporate throughout a market downturn whereas the retail section struggles.

Market Share of Streaming Companies (JustWatch.com)

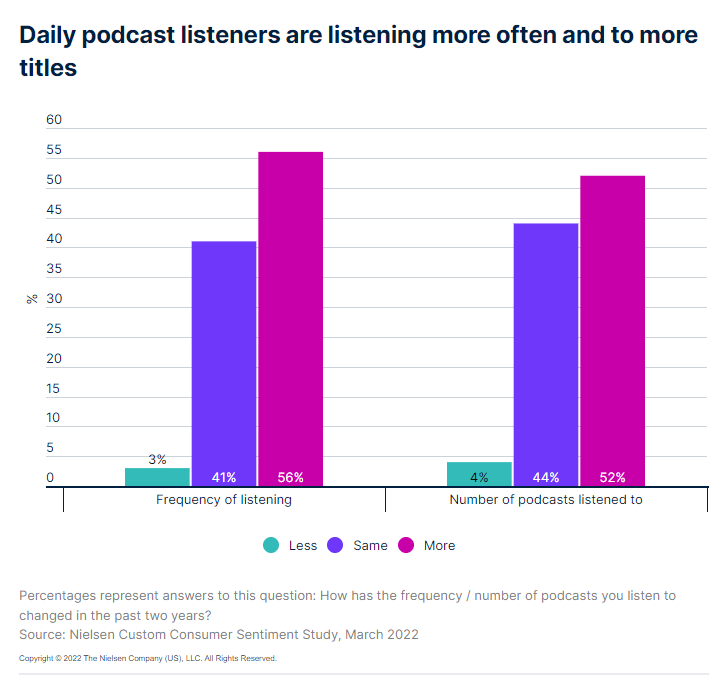

Amazon Music and Audible are also rising in recognition and will turn into a house to many fashionable podcasts within the upcoming future. Presently, Amazon Music’s market share is the third largest within the trade at 13%. That is behind Apple (AAPL) at 15% and Spotify (SPOT) at 31%. Nonetheless, every music streaming service has almost an identical libraries. This implies the one separating elements throughout every platform is unique podcast expertise. Amazon could need to think about signing unique podcast expertise as the marketplace for podcasts has risen drastically in earlier durations. Over the previous three years, the listener base for podcasts has grown by over 40%, with 51% of customers beginning to take heed to podcasts over the previous two years.

Podcast Listener Base Statistics (Nielsen)

Different podcast corporations like Spotify have captured this rising market by signing unique offers with lots of the high podcast skills, akin to Name Her Daddy and The Joe Rogan Expertise. Now, Amazon could have its likelihood to achieve an unique take care of a high podcast expertise by signing Greater Floor by Barack and Michelle Obama. The Obamas are planning to depart Spotify and are actually in search of a brand new deal price tens of thousands and thousands of {dollars}. Two of the most certainly touchdown spots for the podcast are Amazon and iHeartMedia (IHRT).

Nonetheless, iHeartMedia could not have sufficient money to undergo with this deal. The corporate presently has about $280 million in money, that means a deal price tens of thousands and thousands of {dollars} might put the corporate in a troublesome monetary place. Nonetheless, Amazon has greater than $66 billion in money. Subsequently, a deal price tens of thousands and thousands of {dollars} wouldn’t be an enormous expense for the corporate whereas additionally making its platforms rather more fashionable amongst opponents and additional assist the corporate throughout a downturn.

Valuation

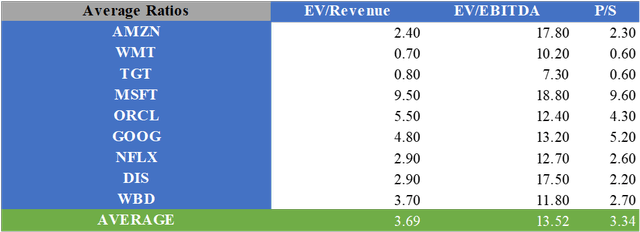

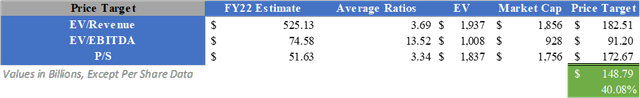

Amazon’s share worth is down over 35% YTD, resulting in many buyers believing the inventory is at a discount. By multiplying consensus analyst estimates for FY22 by the typical multiples for EV/Income, EV/EBITDA, and P/S of Amazon and its opponents, a good worth of $148.79 might be calculated after adjusting for the corporate’s money and debt. This provides the inventory an implied upside of about 40.08%. As for analysts, the typical 12-month worth goal presently sits at $178.56, giving an implied upside of 68.21%.

Relative Valuation for AMZN

What Does This Imply for Buyers?

Buyers are frightened for the way forward for Amazon due to the decreased demand and better bills for its core retail enterprise. Nonetheless, the corporate’s secondary segments will doubtless assist the general enterprise throughout a market downturn. AWS continues to be the trade chief within the cloud companies trade and can profit closely from rising demand and exponential trade progress. Prime Video is on observe to surpass Netflix as the highest streaming service when it comes to market share on account of rising prime subscriptions.

Moreover, Amazon Music and Audible are a number of the high platforms within the audio trade and will solidify itself among the many strongest gamers by signing unique podcast expertise. With all of this in thoughts, the concept to be grasping when others are fearful, and the present worth the inventory is buying and selling at, I imagine making use of a Purchase ranking is acceptable right now.