Up to date on June ninth, 2022 by Aristofanis Papadatos

Usually, power shares are extremely regarded amongst revenue buyers for his or her excessive dividends. This makes the sector a favourite of revenue buyers on the lookout for potential excessive yield shares.

There are numerous power shares that fall on our checklist of high-dividend shares. You possibly can obtain your full checklist of all 100+ shares with 5%+ yields, together with monetary metrics like dividend yield and payout ratios, by clicking on the hyperlink beneath:

Oil shares incurred a fierce downturn in 2020 as a result of influence of the pandemic on international oil consumption. Nevertheless, because of the large distribution of vaccines worldwide, consumption of oil is recovering strongly.

As well as, the invasion of Russia in Ukraine has led western international locations to impose sanctions on Russia. As Russia produces 10% of world oil output and about one-third of the pure gasoline consumed in Europe, the oil and gasoline markets have tightened to the acute. Because of this, the costs of oil and gasoline have rallied to 13-year highs.

In different phrases, oil shares are thriving because of the exceptionally favorable circumstances prevailing proper now. So long as the sanctions stay in place, oil shares will maintain having fun with extreme earnings.

However, buyers ought to at all times concentrate on the excessive cyclicality of the oil business, which is characterised by dramatic boom-and-bust cycles. Given the steep rally of all of the oil shares within the final 12 months, buyers ought to be particularly cautious of their decisions within the sector.

This text will talk about the 6 largest international oil supermajors, ranked from greatest to worst.

Desk of Contents

The phrases “Massive Oil” and “super-majors” are interchangable, and consult with the 6 largest oil firms that aren’t state owned. The 6 Massive Oil supermajors are:

On this article, we’ll rank the six oil supermajors primarily based on their anticipated 5-year returns. We calculate anticipated returns primarily based on the mix of valuation adjustments, anticipated earnings development, and dividend yields. The shares are listed so as of annual anticipated return, from highest to lowest.

Massive Oil Supermajor #1: TotalEnergies SE (TTE)

In 2021, Whole SA (TOT) modified its identify to TotalEnergies SE (TTE) to emphasise its efforts to remodel within the altering power panorama. TotalEnergies is the fourth-largest oil and gasoline firm on the planet primarily based on market capitalization. Like the opposite oil and gasoline tremendous majors, it’s a absolutely built-in firm. TotalEnergies operates in 4 segments: upstream, downstream (principally refining), advertising & companies and gasoline, renewables & energy.

The coronavirus disaster brought about an unprecedented collapse within the demand for oil merchandise in 2020 however international oil consumption has been recovering strongly since then because of the large vaccine rollout. Worldwide Power Administration (IEA) expects the worldwide demand for oil merchandise to develop from 97.4 million barrels per day in 2021 to 99.6 million barrels per day this yr and get well to its pre-pandemic degree of 101.0 million barrels per day subsequent yr.

Even higher for oil and gasoline producers, the aforementioned sanctions of western international locations on Russia have led the costs of oil and gasoline to skyrocket to 13-year highs this yr. That is a particularly robust tailwind for all of the oil producers, together with TotalEnergies.

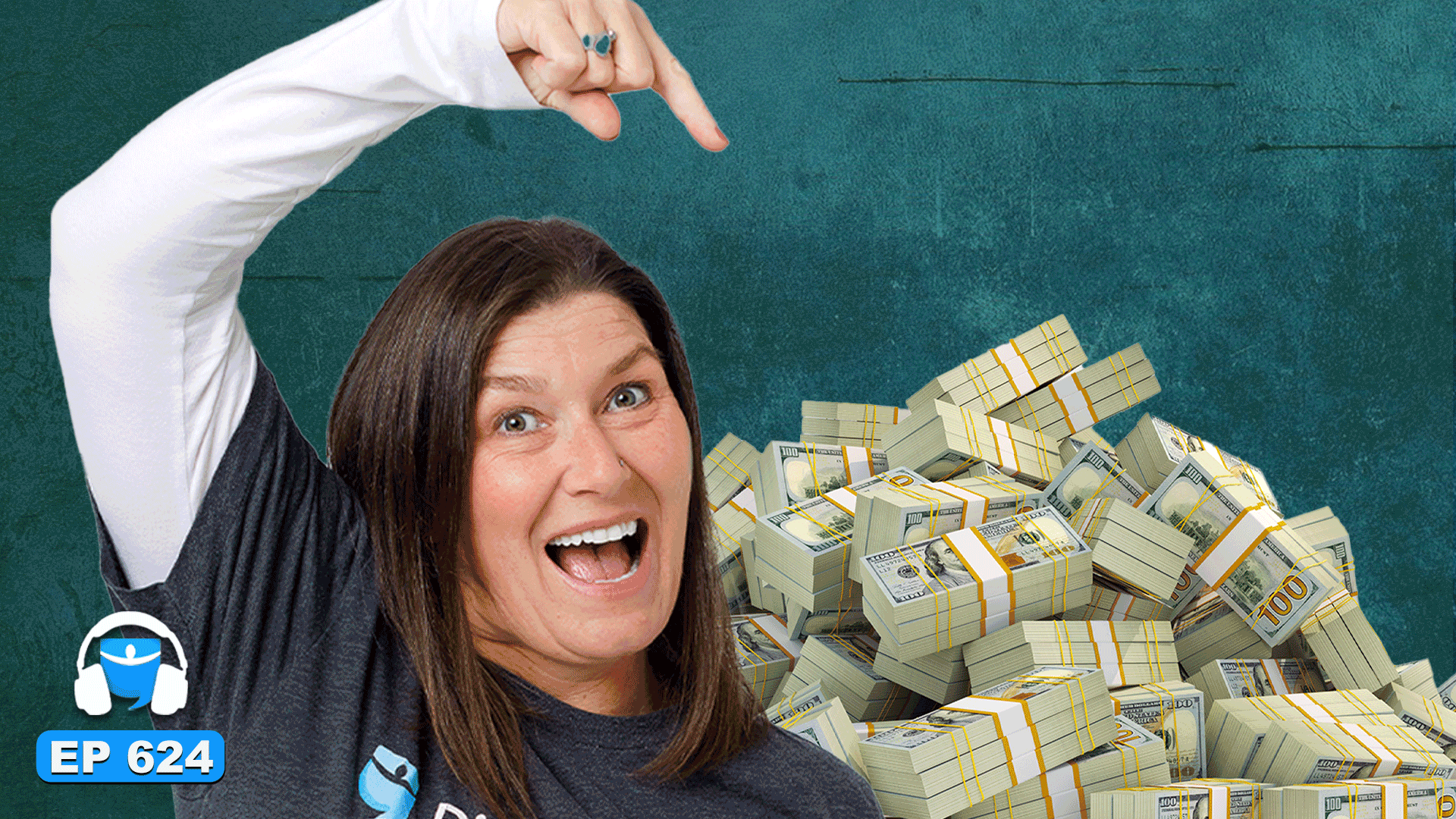

In late April, TotalEnergies reported (4/26/22) monetary outcomes for the primary quarter of 2022. It posted flat output vs. final yr’s quarter however thrived because of favorable costs. The value of oil rallied to a 13-year excessive as a result of aforementioned sanctions of western international locations on Russia. Fuel costs in Asia and Europe remained round all-time highs amid low inventories. Because of this, TotalEnergies grew its earnings per share 33% sequentially, from $2.55 to an all-time excessive of $3.40, and beat the analysts’ consensus by a powerful $0.61.

It is usually exceptional that TotalEnergies has drastically improved the standard of its asset portfolio and its resilience because the earlier downturn of the power sector, in 2014. It has diminished its working price by almost 50% and its money breakeven level from greater than $100 to $25 per barrel.

Supply: Investor Presentation

Because of this, the oil main has acknowledged that its dividend is sustainable even at Brent costs round $40. Because of its high-quality, defensive asset portfolio, TotalEnergies has proved probably the most resilient oil main to downturns. This proved to be the case through the coronavirus disaster in 2020, as TotalEnergies and Shell had been the one oil majors that remained worthwhile. It is usually necessary to notice that TotalEnergies has not reduce its dividend lately, whereas Shell and BP reduce their dividends as a result of pandemic in 2020.

Furthermore, on April 26th, 2022, TotalEnergies reported a big discovery of oil and gasoline offshore Namibia. In response to a report, the discover might exceed 13 billion barrels and thus it could possibly be the biggest deep-water oil discipline on the planet, surpassing the invention of Exxon Mobil offshore Guyana. TotalEnergies acknowledged that it’ll present particulars at a later stage. If the share of TotalEnergies is at the least 6 billion barrels, will probably be price at the least $100 billion, which is ~2/3 of the market cap of the inventory. The inventory might have important upside.

TotalEnergies is at present providing a 4.8% dividend, which is exceptionally enticing for buyers centered on the power sector because of the defensive nature of the inventory and the huge margin of security of the dividend. U.S. buyers ought to be aware they might be topic to dividend withholding taxes as TotalEnergies relies in France.

Given the excessive comparability base shaped by the all-time excessive anticipated earnings per share of $12.00 of TotalEnergies this yr, we anticipate a 12% common annual decline of earnings per share over the subsequent 5 years. However, TotalEnergies is at present buying and selling at a price-to-earnings ratio of 5.1, which is far decrease than our honest worth estimate of 12. If the inventory reaches our honest valuation degree in 5 years, it can get pleasure from an 18.7% annualized enlargement of its earnings a number of. Given additionally its 4.8% ahead dividend yield, we consider the inventory can provide an 8.6% common annual return over the subsequent 5 years.

Massive Oil Supermajor #2: Eni (E)

Eni is a serious oil and gasoline producer primarily based in Italy. It has exploration exercise in additional than 40 international locations and operates in three segments: exploration & manufacturing, gasoline & energy, and refining & advertising. Its upstream phase is by far the biggest. In 2018, 2019 and 2021, this phase generated 92%, 93% and 89% of whole working revenue, respectively. This can be a main distinction between Eni and the opposite power tremendous majors; Eni’s enterprise is far much less diversified.

In late April, Eni reported (4/29/22) monetary outcomes for the primary quarter of 2022. Its manufacturing dipped 5% sequentially as a result of pure decline of fields. Nevertheless, the aforementioned rally of oil and gasoline costs led Eni to almost double its adjusted revenue per share sequentially, from €0.47 to €0.91.

Because of its almost pure upstream nature, Eni outperformed its extra diversified friends Exxon and Chevron, which grew their earnings modestly versus the earlier quarter. Eni posted a 10-year excessive revenue within the quarter. Given the tailwind from the conflict in Ukraine and the resultant rally of oil and gasoline costs, Eni is on monitor to put up 10-year excessive earnings per share of about $5.10 this yr.

Eni expects to develop its output by roughly 3.5% per yr on common till 2025. One of many development drivers would be the ramp-up of the Zohr discipline in Egypt, the biggest gasoline discipline within the Mediterranean, which holds about 30 trillion cubic ft of gasoline. Eni has a 50% stake on this discipline.

However, Eni has about 7.2 billion barrels of oil equal in proved reserves, that are enough for 10.4 years of manufacturing given the present manufacturing charge of the corporate. The length of its reserves is decrease than the ~12-year length of the reserves of sure friends.

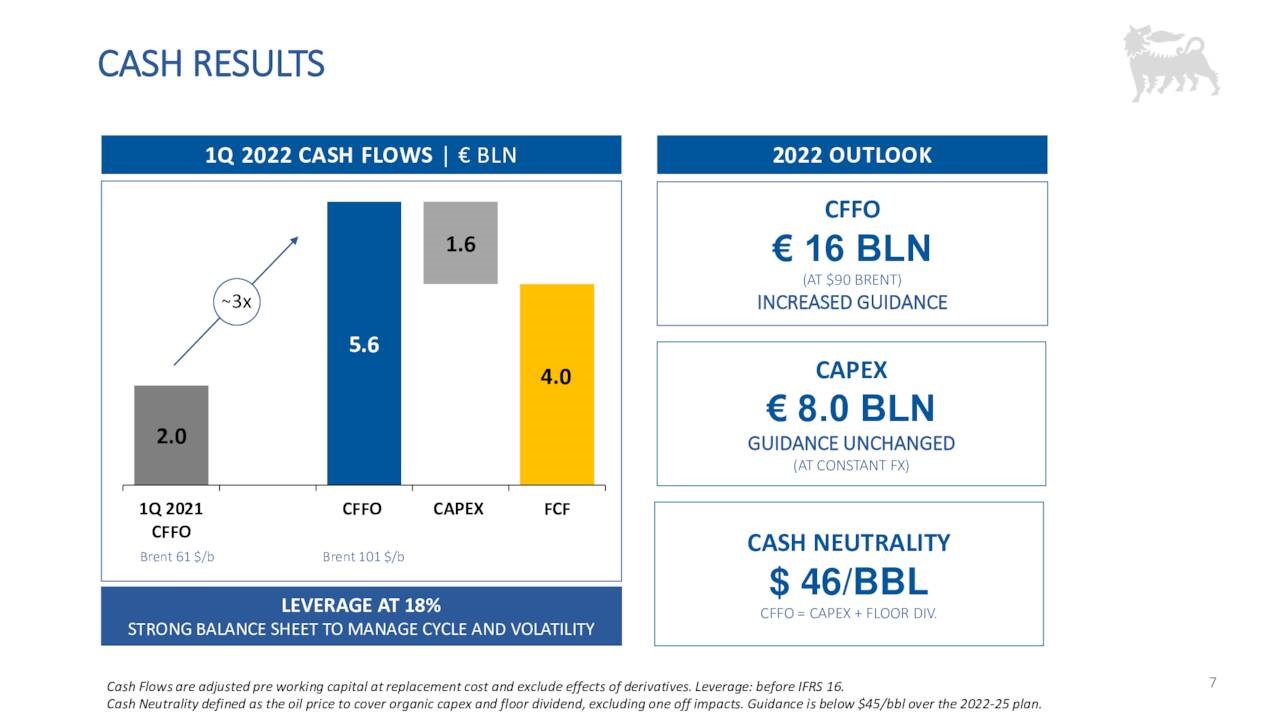

Eni has a breakeven level of $46 per barrel.

Supply: Investor Presentation

That is a lot greater than the breakeven level of most oil majors, which have reduce their bills and reshaped their portfolios extra drastically than Eni. For perspective, TotalEnergies has a breakeven level round $25.

The excessive breakeven level of Eni helps clarify its 70% dividend reduce in 2020. Relating to the dividend, U.S. buyers ought to be aware that they might be accountable for dividend withholding taxes as a result of Eni relies in Italy.

The excessive breakeven level of Eni can be a testomony to the a lot greater vulnerability of Eni to the downturns of the power sector. This is a crucial threat issue for buyers to think about earlier than initiating a place on this nearly pure upstream oil main.

Given the excessive comparability base shaped by the 10-year excessive anticipated earnings per share of $5.10 of Eni this yr, we anticipate a ten% common annual decline of earnings per share over the subsequent 5 years. However, Eni is at present buying and selling at a price-to-earnings ratio of 6.1, which is far decrease than our honest worth estimate of 12.5.

If the inventory reaches our honest valuation degree in 5 years, it can get pleasure from a 15.4% annualized enlargement of its earnings a number of. Given additionally its 5.9% dividend yield, we consider the inventory can provide an 8.6% common annual return over the subsequent 5 years.

Massive Oil Supermajor #3: BP plc (BP)

BP has gone by way of excessive challenges since its main accident in 2010. It has paid roughly $70 billion for this accident to date. This quantity is sort of equal to all its earnings since. Even in 2019, 9 years after the accident, BP paid $2.4 billion (24% of its earnings) for it. The corporate expects to pay $1.4 billion for the accident this yr.

BP has drastically improved its portfolio through the addition of low-cost reserves and has markedly elevated its manufacturing within the final six years. Final yr, BP accomplished its 6- yr development program, which delivered 900,000 barrels of oil equal per day.

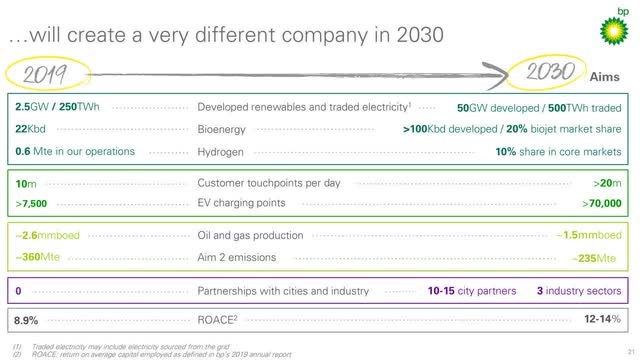

Nevertheless, it introduced a serious shift in its technique in 2020. BP will enhance its funding in renewable power sources 10-fold, and it’ll concurrently cut back its funding in oil and gasoline tasks a lot that it expects to cut back its oil and gasoline manufacturing by -42%, from 2.6 million barrels per day now to 1.5 million barrels per day in 2030.

Supply: Investor Presentation

This historic strategic shift from its core enterprise has drastically raised the uncertainty of future efficiency of BP. A shift from the core enterprise is at all times a purple flag for any inventory, notably for BP, which has at all times been notorious for its aversion of renewable power tasks.

Furthermore, BP has posted remarkably low reserve substitute ratios lately. It’s thus evident that the corporate has already begun its transition at a quick tempo. On the brilliant aspect, BP is flourishing proper now.

In early Might, BP reported (5/3/22) monetary outcomes for the primary quarter of 2022. The oil main drastically benefited from the rally of the costs of oil and gasoline to 13-year highs and sky-high refining margins because of the conflict in Ukraine. Because of this, BP grew its earnings per share 56%, from $1.23 within the fourth quarter to $1.92. This degree of earnings per share, which is the very best of BP within the final decade, exceeded the analysts’ consensus by an eye-opening $0.53.

BP outperformed Exxon and Chevron, which posted primarily flat sequential earnings. BP additionally diminished its debt for an eighth consecutive quarter and acknowledged that it expects to maintain elevating its dividend by 4% per yr if the value of oil stays round $60 or greater. In such a state of affairs, BP additionally expects to repurchase $4 billion of shares per yr (~4%).

BP was caught within the coronavirus disaster with an enormous debt load. The oil main defended its dividend within the earlier downturn of the power market, in 2014-2016, however slashed its dividend by 50% in 2020 resulting from its leveraged steadiness sheet and the extreme losses incurred in that yr.

Whereas BP has raised its dividend since 2020, it’s at present providing a 10-year low dividend yield of three.9%. The low yield has resulted from the dividend reduce in 2020 and the 25% rally of the inventory this yr amid favorable commodity costs.

Given the excessive comparability base shaped by the 10-year excessive anticipated earnings per share of $6.50 of BP this yr, we anticipate a 12% common annual decline of earnings per share over the subsequent 5 years. However, BP is at present buying and selling at a price-to-earnings ratio of 5.2, which is far decrease than our honest worth estimate of 12.

If the inventory reaches our honest valuation degree in 5 years, it can get pleasure from an 18.1% annualized enlargement of its earnings a number of. Given additionally its 3.9% dividend yield, we consider the inventory can provide a 7.3% common annual return over the subsequent 5 years.

Massive Oil Supermajor #4: Shell (SHEL)

Shell is an oil and gasoline supermajor, the second largest behind Exxon Mobil when it comes to annual manufacturing volumes. Shell is headquartered in London (UK).

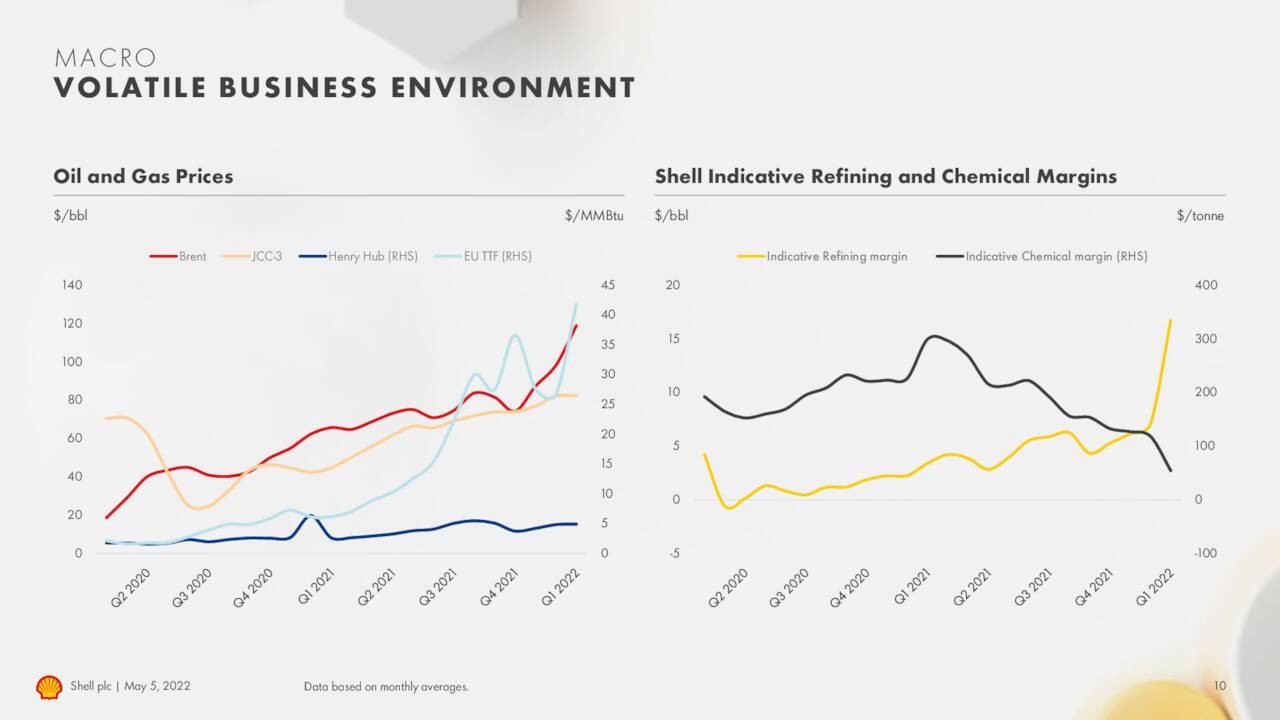

In early Might, Shell reported (5/5/22) monetary outcomes for the primary quarter of 2022. Because of the spectacular rally of oil and gasoline costs, Shell grew its adjusted earnings 43% sequentially, from $6.4 billion to $9.1 billion. Notably it outperformed its friends Exxon and Chevron, which posted primarily flat earnings vs. the earlier quarter. Shell additionally continued lowering its debt load, from $52.6 billion on the finish of 2021 to $48.5 billion. Furthermore, it expects to repurchase shares price of $8.5 billion (~4% of the share depend) within the first half of 2022.

Not solely have the costs of oil and gasoline skyrocketed, but in addition the refining margins have jumped to report ranges, because the sanctions on Russia have a good larger influence on the worldwide provide of some distillates. Because of this, each the upstream and the downstream segments of Shell are thriving proper now.

Supply: Investor Presentation

In 2020, as a result of uncertainty attributable to the onset of the pandemic, Shell reduce its dividend by 66%. It was the primary dividend reduce for Shell since World Warfare II. Nevertheless, because of its restoration from the pandemic, the oil main has raised its dividend thrice since then and the inventory is now providing a 3.3% dividend yield. Notably, this can be a 10-year low dividend yield of the inventory, which has resulted primarily from the steep rally of the inventory amid favorable commodity costs.

Shell acquired BG Group, a deep-water pure gasoline centered upstream firm in 2015, in a $53 billion deal. Shell grew its output significantly because of that acquisition, however its output has remained flat within the final 5 years as a result of pure decline of its fields and the asset gross sales executed to fund that immense acquisition. These two elements have additionally brought about the length of the reserves of Shell to fall for six years in a row and attain 7.9 years, which is far shorter than the common length of the peer group (~11 years).

Furthermore, Shell has introduced a serious transformation plan, which entails a transition from oil and gasoline to renewable power sources. The corporate will rework its refining portfolio from 14 websites to six power and chemical substances parks and can cut back its upstream portfolio to 9 core positions, which can generate greater than 80% of the money flows of the upstream phase. It additionally expects to provide ~75% of its proved reserves till 2030. This historic transition from fossil fuels to wash power sources makes it arduous to forecast future outcomes.

However, through the earlier downturn of the power sector, between 2014 and 2016, Shell drastically diminished its working bills and invested in high-quality, low-cost reserves, which have rendered the corporate extra worthwhile than up to now at a given oil value. Shell posted report natural free money flows of $31 billion in 2018 regardless that Brent was about -40% decrease than it was earlier than the earlier downturn.

Whereas Shell is flourishing proper now, buyers ought to always remember the dramatic cyclicality of the oil and gasoline business. Given the excessive comparability base shaped by the anticipated 10-year excessive earnings per share of $9.50 of Shell this yr, we anticipate a 9% common annual decline of earnings per share over the subsequent 5 years.

However, Shell is at present buying and selling at a price-to-earnings ratio of 6.4, which is far decrease than our honest worth estimate of 12. If the inventory reaches our honest valuation degree in 5 years, it can get pleasure from a 13.3% annualized enlargement of its earnings a number of. Given additionally its 3.3% ahead dividend yield, we consider the inventory can provide a 6.6% common annual return over the subsequent 5 years.

Massive Oil Supermajor #5: ExxonMobil (XOM)

Exxon Mobil is an built-in super-major, with operations throughout the oil and gasoline business. In 2021, the oil main generated 62% of its earnings from its upstream phase, with the rest from its downstream (principally refining) phase and its chemical substances phase.

In late April, Exxon reported (4/29/22) monetary outcomes for the primary quarter of 2022. Its manufacturing dipped 4% sequentially resulting from climate and upkeep however the oil big benefited from the rally of the costs of oil and gasoline to 13-year highs. However, it grew its adjusted earnings per share only one% sequentially, from $2.05 to $2.07, and missed the analysts’ consensus by $0.16. The disappointing efficiency was brought about principally by losses from hedges within the downstream enterprise.

Nevertheless, given the 13-year excessive costs of oil and gasoline, we anticipate Exxon to put up a lot greater earnings within the upcoming quarters and thus we anticipate Exxon to put up all-time excessive earnings per share of about $10.10 this yr. In distinction to earlier rallies of the oil value, producers have boosted their manufacturing conservatively, fearing that the rally will show short-lived as a result of secular shift of most international locations from fossil fuels to wash power sources. So long as producers stay cautious, the oil value is more likely to stay excessive.

Exxon has two thrilling development tasks in place proper now. The Permian Basin can be a serious development driver, because the oil big has about 10 billion barrels of oil equal within the space and expects to achieve manufacturing of greater than 1.0 million barrels per day within the space by 2024.

Guyana, one of the thrilling development tasks within the power sector, can be one other main development driver. Since 2019, Exxon Mobil has made a number of main deep-water discoveries in Guyana and has an enviable ~90% success charge.

Supply: Investor Presentation

Because of the discoveries Exxon has achieved offshore Guyana, it has greater than tripled its estimated reserves within the space, from 3.2 billion barrels in early 2018 to almost 11.0 billion barrels now.

However, Exxon has withdrawn its earlier steering for ~25% development of manufacturing till 2025. With a purpose to protect funds, it has reduce its capital bills and thus it now expects flat output till at the least 2025. Because the oil big has not grown its manufacturing since 2008, the brand new steering is actually disappointing.

So long as the costs of oil and gasoline stay excessive, Exxon will maintain posting extreme earnings however the inventory will in all probability come beneath strain every time the subsequent downcycle exhibits up. That is very true given the 65% rally of the inventory this yr, to a brand new all-time excessive.

Given the excessive comparability base shaped by the anticipated all-time excessive earnings per share of $10.10 of Exxon this yr, we anticipate a 9% common annual decline of earnings per share over the subsequent 5 years. However, Exxon is at present buying and selling at a price-to-earnings ratio of 10.4, which is decrease than our honest worth estimate of 13.

If the inventory reaches our honest valuation degree in 5 years, it can get pleasure from a 4.6% annualized enlargement of its earnings a number of. Given additionally its 3.4% dividend yield, we anticipate the inventory to supply a -1.0% common annual return over the subsequent 5 years.

Massive Oil Supermajor #6: Chevron (CVX)

Chevron is the second-largest U.S.-based oil firm, behind Exxon Mobil. And like Exxon, Chevron is on the checklist of Dividend Aristocrats.

In 2018, 2019 and 2021, Chevron generated 78%, 78% and 84% of its earnings from its upstream phase, respectively. As well as, Chevron produces oil and pure gasoline at a 61/39 ratio however a portion of its gasoline output is priced primarily based on the oil value. Because of this, about 75% of the manufacturing of Chevron is priced primarily based on the oil value.

In late April, Chevron reported (4/29/22) monetary outcomes for the primary quarter of 2022. The oil main diminished its manufacturing by 2% over final yr’s quarter however drastically benefited from the rally of oil and gasoline costs to 13-year highs. Because of this, it grew its adjusted earnings per share 31% sequentially, from $2.56 to $3.36, an almost all-time excessive.

Chevron outperformed Exxon by a large margin, because the latter posted primarily flat earnings resulting from losses from value hedges. As we don’t anticipate the sanctions of western international locations on Russia to be withdrawn anytime quickly, we anticipate oil and gasoline costs to stay extreme this yr and thus we anticipate Chevron to put up report earnings per share of $16.40 this yr.

Chevron grew its output by 5% in 2017, 7% in 2018, 4% in 2019, however only one% in 2020 and 0.5% in 2021 as a result of pandemic. Chevron has now returned to development mode because of its sustained development within the Permian Basin and in Australia. The corporate has greater than doubled the worth of its property within the Permian within the final three years because of new discoveries and technological advances.

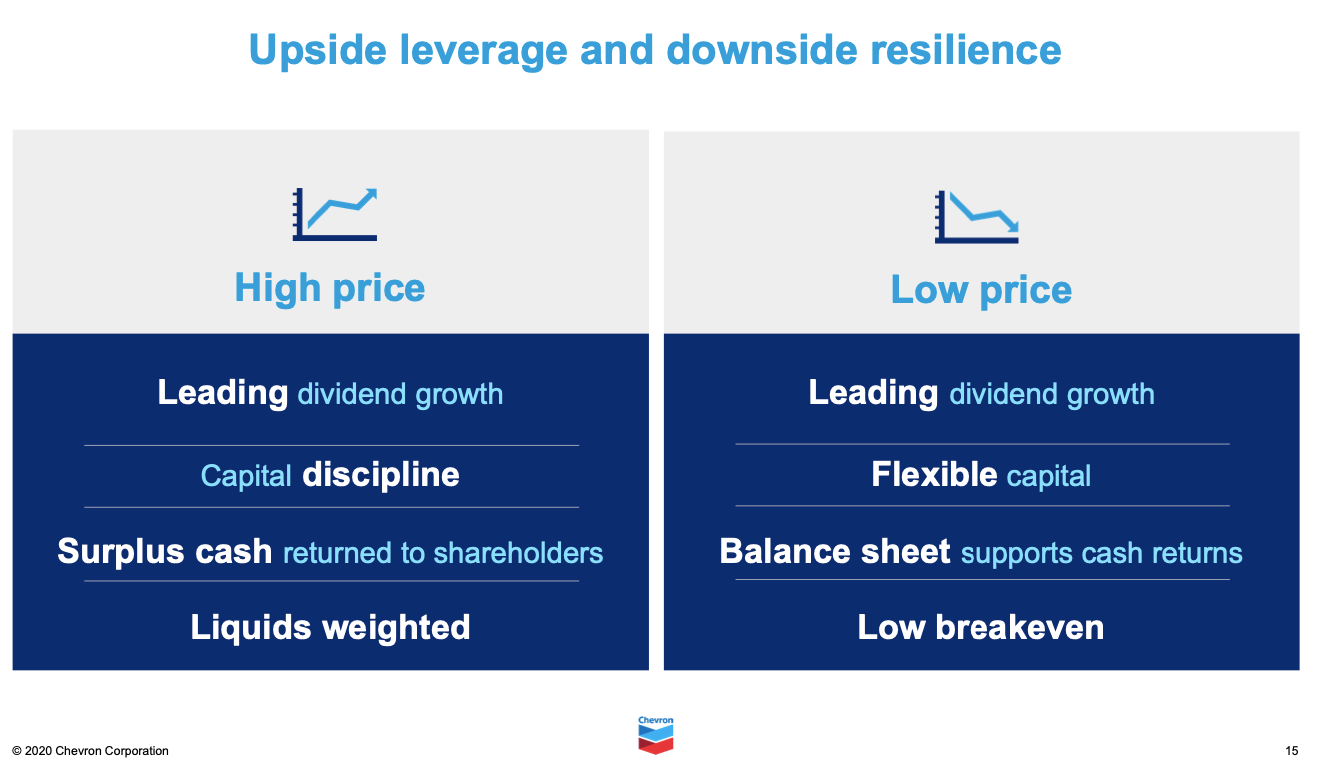

Furthermore, Chevron discovered its lesson from the earlier downturn of the power sector, in 2014-2016, and now invests most of its funds in tasks that start delivering money flows inside two years. As well as, because of the excessive grading of its asset portfolio, Chevron can fund its dividend even at a WTI value round $45, which corresponds to a Brent value round $50 beneath regular circumstances.

Supply: Investor Presentation

Subsequently, the dividend of Chevron has a large margin of security. However, as a result of 67% rally of the inventory within the final 12 months, to a brand new all-time excessive, the inventory is at present providing a 10-year low dividend yield of three.1%.

Given the excessive comparability base shaped by the anticipated all-time excessive earnings per share of $16.40 of Chevron this yr, we anticipate a ten% common annual decline of earnings per share over the subsequent 5 years. However, Chevron is at present buying and selling at a price-to-earnings ratio of 11.0, which is decrease than our honest worth estimate of 14.

If the inventory reaches our honest valuation degree in 5 years, it can get pleasure from a 4.9% annualized enlargement of its earnings a number of. Given additionally its 3.1% dividend yield, we anticipate the inventory to supply a -1.9% common annual return over the subsequent 5 years.

Ultimate Ideas

The oil majors are thriving because of the rally of the costs of oil and gasoline to 13-year highs this yr. Because the western international locations will not be more likely to withdraw their sanctions on Russia anytime quickly, the short-term outlook is undoubtedly vivid for the oil majors.

The present growth additionally has one other particular attribute. Throughout previous rallies of commodity costs, oil producers used to spice up their manufacturing at a quick tempo to benefit from the excessive costs. On this method, they drastically elevated international oil provide and thus they gave rise to a subsequent downturn.

Nevertheless, this isn’t the case within the present growth of the power sector. Regardless of the 13-year excessive costs, most firms are unable to extend their output as a result of lack of investments in new development tasks lately amid the pandemic. Oil producers are additionally reluctant to spend nice quantities on new development tasks, fearing that the secular shift of the world from fossil fuels to wash power sources will render such investments unprofitable sooner or later. Subsequently, the present growth of the power sector might last more than standard.

Nevertheless, it’s unreasonable to anticipate the growth to final for a few years. Because of the excessive costs of oil and gasoline, most international locations are investing in renewable power tasks at a report tempo. This development will take its toll on the oil business in some unspecified time in the future sooner or later. Subsequently, buyers ought to be particularly cautious of their decisions amongst oil shares.

TotalEnergies appears to be probably the most enticing oil main proper now, although it was rather more enticing a couple of weeks in the past. This exemplary oil main has the very best anticipated return whereas it has additionally proved to be by far probably the most resilient oil main to downturns.

Associated: The Greatest Oil Refiner: Analyzing The Massive 4 U.S. Oil Refiner Shares

Additional Studying

The next Certain Dividend databases include probably the most dependable dividend shares in our funding universe:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].