Printed on July sixteenth, 2025 by Bob Ciura

Investing legend Peter Lynch was one of the crucial well-known fund managers of all time. Because the supervisor of the Magellan Fund for Constancy Investments, Lynch produced annual returns of 29.2% from 1977-1990.

This efficiency made the Magellan fund the top-performing mutual fund on the earth, cementing Lynch as probably the greatest cash managers of all time.

Lynch additionally popularized the time period “Development-at-a-Affordable Worth” investing. Put merely, GARP investing is to attempt to discover undervalued shares that additionally supply long-term development potential.

That is pretty troublesome to place into observe, as many shares are undervalued, however have weak development prospects. In the meantime, one of the best development shares out there usually sport excessive valuations, and are not often undervalued.

Subsequently, shares that mix each are exhausting to seek out, and requires buyers to look far and broad. Maybe Lynch himself put it greatest:

I feel it was simply completely different corporations and I at all times thought for those who checked out 10 corporations, you’d discover one which’s attention-grabbing, for those who’d have a look at 20, you’d discover two, or for those who have a look at 100 you’ll discover 10. The person who turns over probably the most rocks wins the sport. I’ve additionally discovered this to be true in my private investing.

A very good place to start out searching for GARP shares is the blue chip shares checklist, a gaggle of shares which have raised their dividends for at the very least 10 years.

You’ll be able to obtain the checklist of over 500 blue chip shares now, by clicking on the hyperlink under:

This text will checklist the highest 10 blue chip shares which might be undervalued in response to their P/E ratios, with optimistic earnings development of at the very least 5% yearly anticipated for the long run.

Lastly, these 10 shares are primarily based within the U.S., and have the bottom price-to-earnings ratios. The checklist is sorted by their P/E ratio, in ascending order.

These 10 dividend shares qualify as growth-at-a-reasonable worth.

Desk of Contents

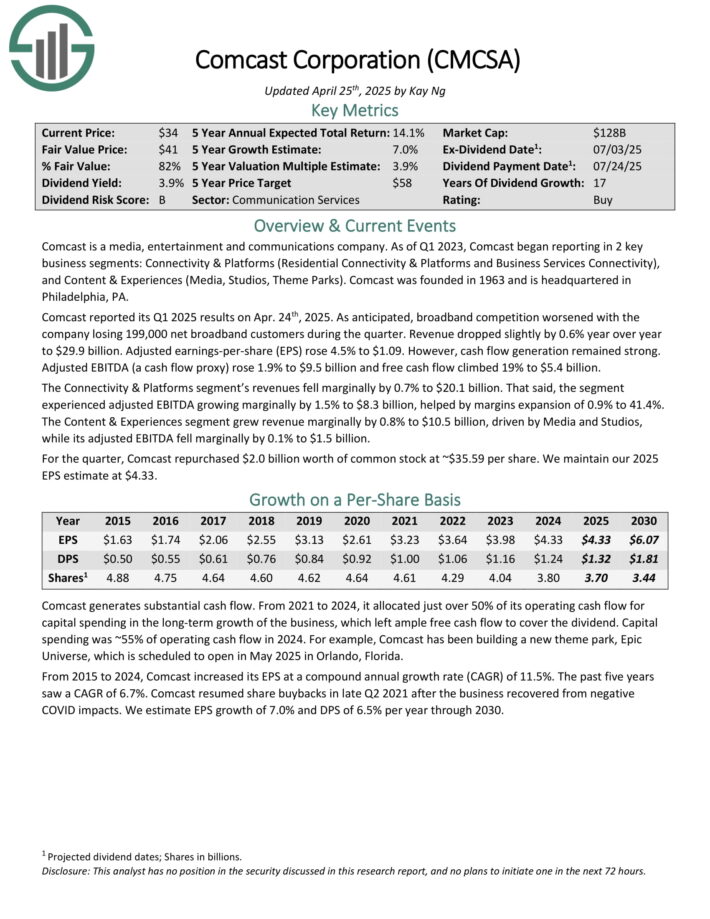

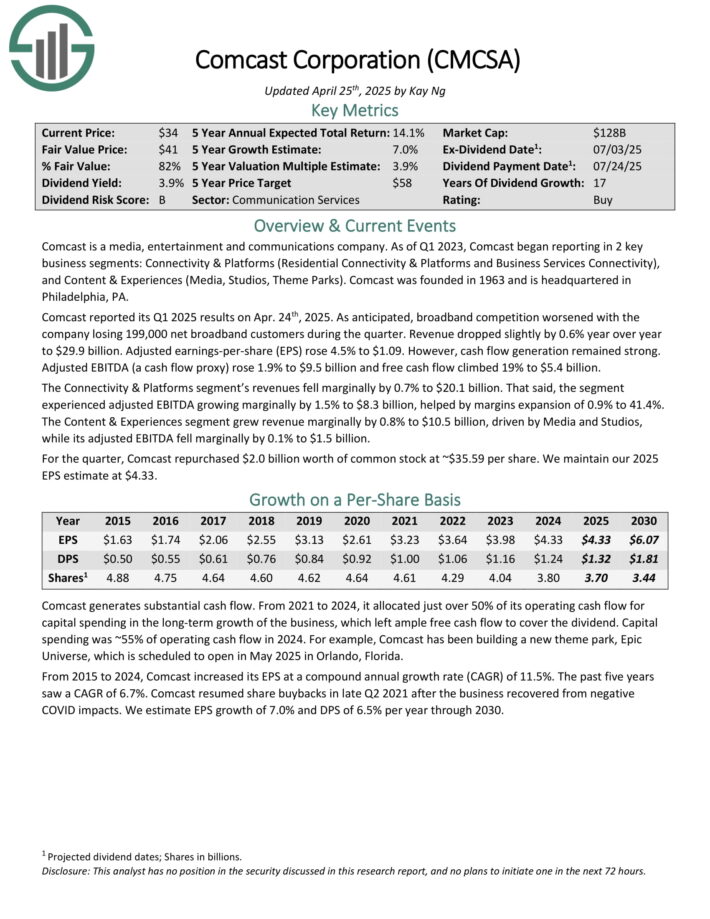

GARP Inventory #10: Comcast Corp. (CMCSA)

- 5-12 months Annual Anticipated EPS Development: 7.0%

- P/E Ratio: 8.1

Comcast is a media, leisure and communications firm. As of Q1 2023, Comcast started reporting in 2 key enterprise segments: Connectivity & Platforms (Residential Connectivity & Platforms and Enterprise Providers Connectivity), and Content material & Experiences (Media, Studios, Theme Parks).

Comcast reported its Q1 2025 outcomes on Apr. twenty fourth, 2025. As anticipated, broadband competitors worsened with the corporate shedding 199,000 web broadband clients throughout the quarter.

Income dropped barely by 0.6% year-over-year to $29.9 billion. Adjusted earnings-per-share (EPS) rose 4.5% to $1.09. Nevertheless, money move technology remained robust.

Adjusted EBITDA (a money move proxy) rose 1.9% to $9.5 billion and free money move climbed 19% to $5.4 billion. The Connectivity & Platforms phase’s revenues fell marginally by 0.7% to $20.1 billion. The phase skilled adjusted EBITDA rising marginally by 1.5% to $8.3 billion, helped by margins growth of 0.9% to 41.4%.

The Content material & Experiences phase grew income marginally by 0.8% to $10.5 billion, pushed by Media and Studios, whereas its adjusted EBITDA fell marginally by 0.1% to $1.5 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on CMCSA (preview of web page 1 of three proven under):

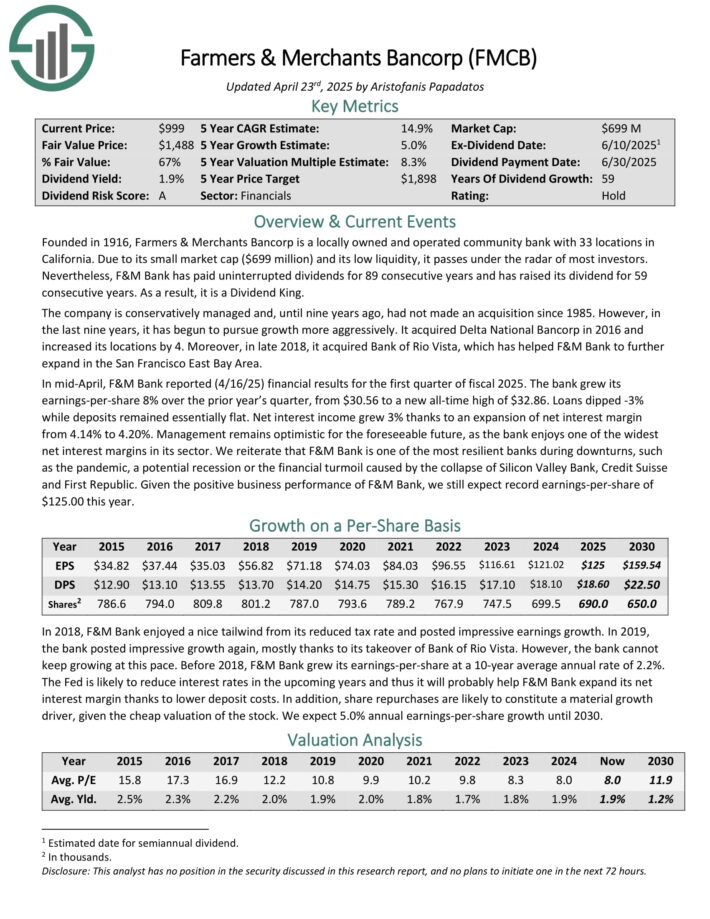

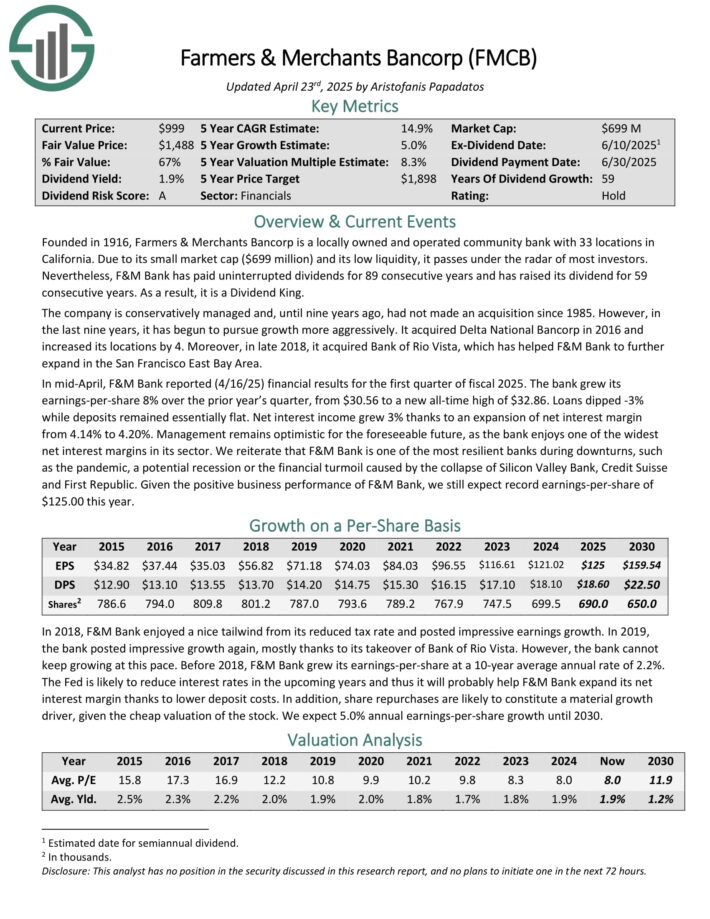

GARP Dividend Inventory #9: Farmers & Retailers Bancorp (FMCB)

- 5-12 months Annual Anticipated EPS Development: 5.0%

- P/E Ratio: 8.0

Farmers & Retailers Bancorp is a regionally owned and operated group financial institution with 32 places in California. On account of its small market cap and its low liquidity, it passes beneath the radar of most buyers.

F&M Financial institution has paid uninterrupted dividends for 89 consecutive years and has raised its dividend for 59 consecutive years.

In mid-April, F&M Financial institution reported (4/16/25) monetary outcomes for the primary quarter of fiscal 2025. The financial institution grew its earnings-per-share 8% over the prior yr’s quarter, from $30.56 to a brand new all-time excessive of $32.86.

Loans dipped -3% whereas deposits remained primarily flat. Internet curiosity revenue grew 3% because of an growth of web curiosity margin from 4.14% to 4.20%.

F&M Financial institution is a prudently managed financial institution, which has at all times focused a conservative capital ratio. The financial institution at the moment has a complete capital ratio of 15.2%, which ends up in the best regulatory classification of “effectively capitalized.”

Furthermore, its credit score high quality stays exceptionally robust, as there are extraordinarily few non-performing loans and leases in its portfolio.

Click on right here to obtain our most up-to-date Certain Evaluation report on FMCB (preview of web page 1 of three proven under):

GARP Dividend Inventory #8: Century Monetary (CYFL)

- 5-12 months Annual Anticipated EPS Development: 6.0%

- P/E Ratio: 8.0

Century Monetary Company is a financial institution holding firm primarily based in Coldwater, Michigan, that operates primarily by way of its wholly-owned subsidiary, Century Financial institution and Belief.

The financial institution gives a variety of economic providers, like conventional banking merchandise comparable to deposit accounts, industrial and client loans, residential mortgage loans, and wealth administration providers.

Additionally, the financial institution supplies specialised monetary providers, comparable to belief and funding administration, that are essential contributors to non-interest revenue.

Century Financial institution and Belief serves its native communities by way of a community of 11 banking places of work positioned throughout Department, St. Joseph, and Hillsdale Counties in Michigan, in addition to varied ATM places. On the finish of March, Century Monetary had deposits of $415.1 million.

On Might fifth, 2025, Century Monetary Company launched its Q1 outcomes for the interval ending March thirty first, 2025. For the quarter, web revenue reached $2.3 million, or $1.38 per share, up from $2.0 million or $1.18 per share final.

Internet curiosity revenue totaled $5.0 million, a rise from $4.7 million in Q1 2024, pushed by development in loans and a steady rate of interest setting.

Non-interest revenue grew to $1.35 million, up from $1.33 million a yr earlier, reflecting continued energy in belief and funding administration providers.

Click on right here to obtain our most up-to-date Certain Evaluation report on CYFL (preview of web page 1 of three proven under):

GARP Dividend Inventory #7: Benchmark Bankshares (BMBN)

- 5-12 months Annual Anticipated EPS Development: 6.0%

- P/E Ratio: 7.6

Benchmark Bankshares is a monetary holding firm that operates primarily by way of its wholly-owned subsidiary, Benchmark Neighborhood Financial institution.

Headquartered in Kenbridge, Virginia, the financial institution supplies quite a lot of conventional banking providers, together with deposit accounts, client and industrial loans, and mortgage banking.

The financial institution additionally gives wealth administration providers and operates a sturdy portfolio of enterprise options that embody credit score providers, service provider providers, and debit card processing.

Benchmark Neighborhood Financial institution operates 17 branches, with a geographical give attention to Southside Virginia and Northern North Carolina, together with key places in areas comparable to Kenbridge, South Hill, and Farmville in Virginia, and Wake Forest, North Carolina.

The financial institution has steadily grown its footprint, most lately increasing its providers in North Carolina by opening a full-service department in Wake Forest and changing its Mortgage Manufacturing Workplace (LPO) in Zebulon right into a full-service department.

On Might nineteenth, 2025, Benchmark introduced its Q1 2025 outcomes for the interval ending March thirty first, 2025. For the quarter, Benchmark posted web revenue of $4.6 million, or $1.03 per share, in comparison with $3.2 million, or $0.72 per share final yr.

Internet curiosity revenue rose 16.8% to $13.3 million, with the web curiosity margin (NIM) rising to 4.64% from 4.25%.

Click on right here to obtain our most up-to-date Certain Evaluation report on BMBN (preview of web page 1 of three proven under):

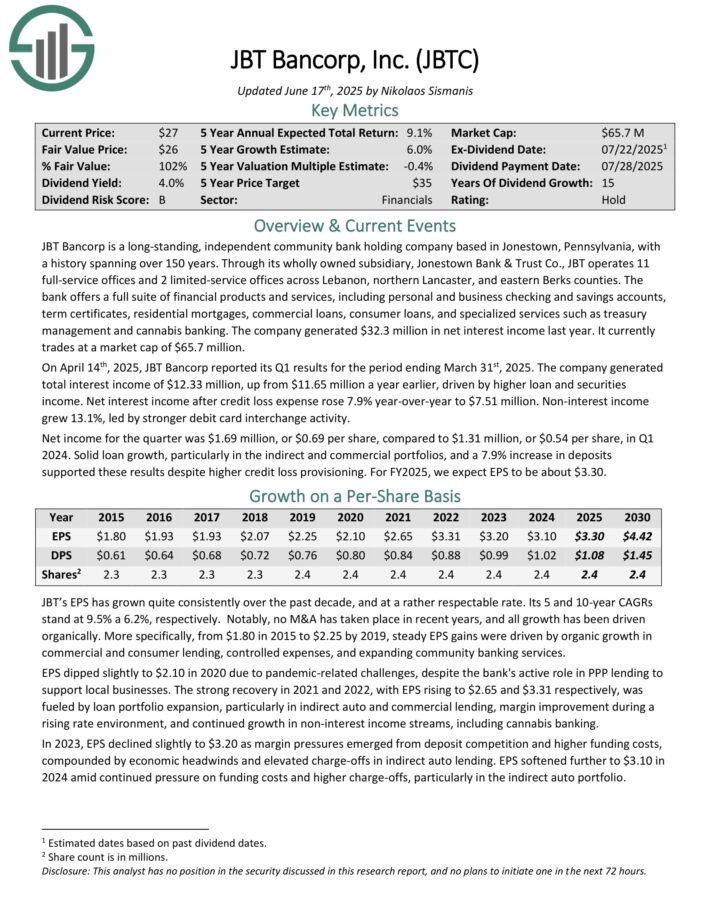

GARP Dividend Inventory #6: JBT Bancorp (JBTC)

- 5-12 months Annual Anticipated EPS Development: 6.0%

- P/E Ratio: 7.6

JBT Bancorp is a long-standing, unbiased group financial institution holding firm primarily based in Jonestown, Pennsylvania, with a historical past spanning over 150 years.

By means of its wholly owned subsidiary, Jonestown Financial institution & Belief Co., JBT operates 11 full-service places of work and a couple of limited-service places of work throughout Lebanon, northern Lancaster, and japanese Berks counties.

The financial institution gives a full suite of economic services and products, together with private and enterprise checking and financial savings accounts, time period certificates, residential mortgages, industrial loans, client loans, and specialised providers comparable to treasury administration and hashish banking.

The corporate generated $32.3 million in web curiosity revenue final yr.

On April 14th, 2025, JBT Bancorp reported its Q1 outcomes for the interval ending March thirty first, 2025. The corporate generated whole curiosity revenue of $12.33 million, up from $11.65 million a yr earlier, pushed by greater mortgage and securities revenue.

Internet curiosity revenue after credit score loss expense rose 7.9% year-over-year to $7.51 million. Non-interest revenue grew 13.1%, led by stronger debit card interchange exercise.

Internet revenue for the quarter was $1.69 million, or $0.69 per share, in comparison with $1.31 million, or $0.54 per share, in Q1 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on JBTC (preview of web page 1 of three proven under):

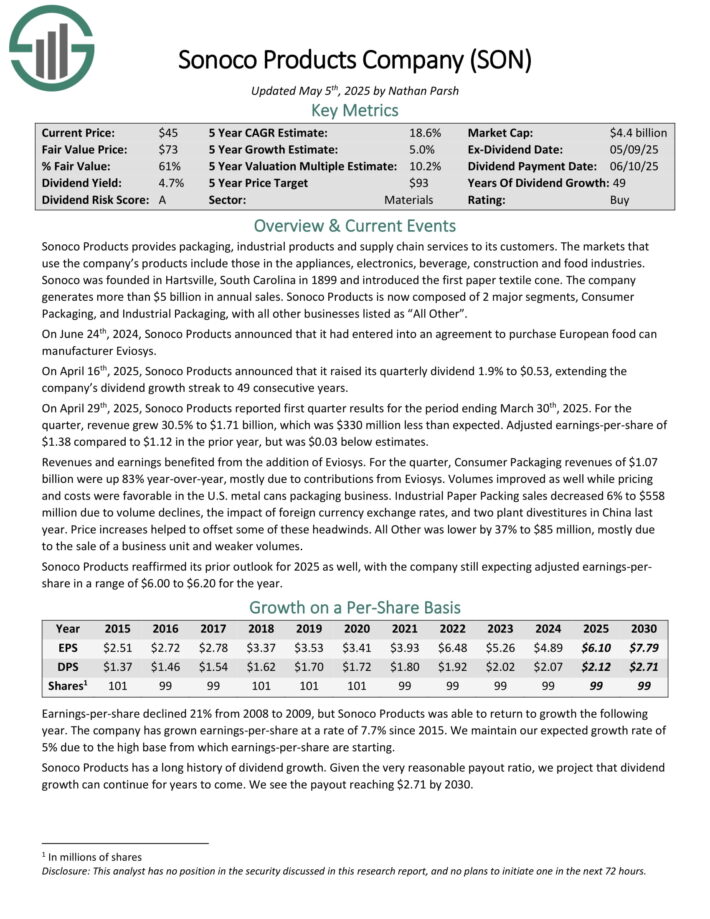

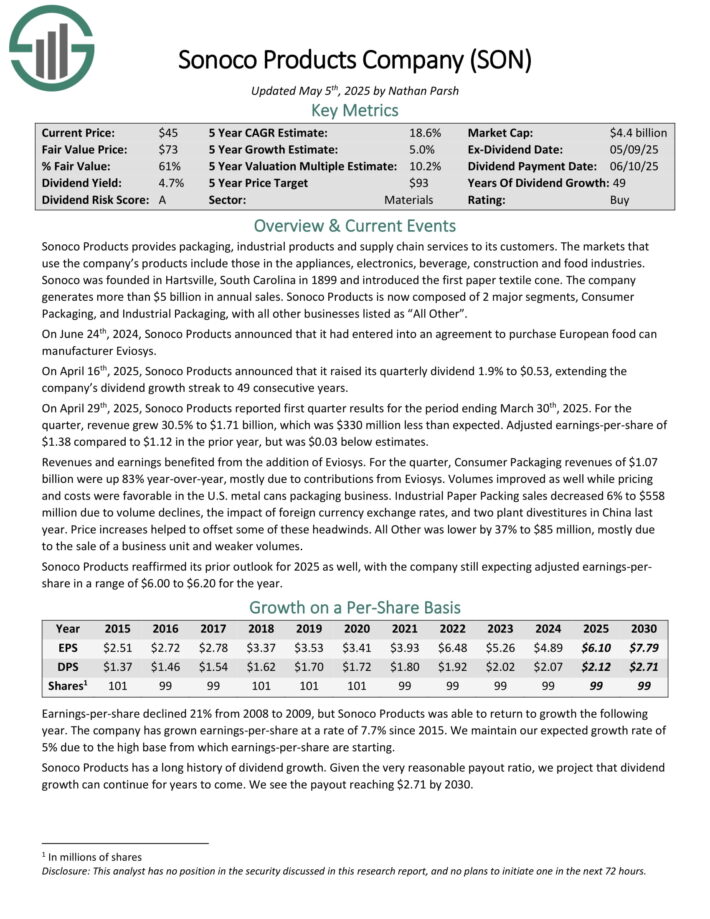

GARP Dividend Inventory #5: Sonoco Merchandise (SON)

- 5-12 months Annual Anticipated EPS Development: 5.0%

- P/E Ratio: 7.4

Sonoco Merchandise supplies packaging, industrial merchandise and provide chain providers to its clients. The markets that use the corporate’s merchandise embody these within the home equipment, electronics, beverage, development and meals industries.

The corporate generates over $5 billion in annual gross sales. Sonoco Merchandise is now composed of two main segments, Client Packaging, and Industrial Packaging, with all different companies listed as “All Different”.

On April sixteenth, 2025, Sonoco Merchandise raised its quarterly dividend 1.9% to $0.53, extending the corporate’s dividend development streak to 49 consecutive years.

On April twenty ninth, 2025, Sonoco Merchandise reported first quarter outcomes for the interval ending March thirtieth, 2025.

Supply: Investor Presentation

For the quarter, income grew 30.5% to $1.71 billion, which was $330 million lower than anticipated. Adjusted earnings-per-share of $1.38 in comparison with $1.12 within the prior yr, however was $0.03 under estimates.

Revenues and earnings benefited from the addition of Eviosys. For the quarter, Client Packaging revenues of $1.07 billion had been up 83% year-over-year, largely attributable to contributions from Eviosys.

Volumes improved as effectively whereas pricing and prices had been favorable within the U.S. steel cans packaging enterprise.

Click on right here to obtain our most up-to-date Certain Evaluation report on Sonoco (SON) (preview of web page 1 of three proven under):

GARP Dividend Inventory #4: Canandaigua Nationwide Company (CNND)

- 5-12 months Annual Anticipated EPS Development: 5.0%

- P/E Ratio: 7.4

Canandaigua Nationwide Company (CNC) is the mother or father firm of The Canandaigua Nationwide Financial institution & Belief Firm (CNB) and Canandaigua Nationwide Belief Firm of Florida (CNTF), providing a variety of economic providers, together with banking, lending, mortgage providers, belief, funding administration, and insurance coverage.

With 23 branches throughout its service areas, CNC is give attention to serving native communities by offering personalised monetary options to people, companies, and municipalities.

CNC emphasizes group banking, specializing in reinvesting within the native economic system by way of a various lending portfolio. As of December thirty first, 2024, CNC reported whole deposits of $4.0 billion.

In early March, Canandaigua Nationwide launched its full-year outcomes for the interval ending December thirty first, 2024. For the yr, whole curiosity revenue grew 13% to $248 million.

Complete curiosity bills grew 29% to $111 million. Internet curiosity revenue grew by 3% to $137 million. Complete different revenue (service prices on deposit accounts and belief and funding providers) elevated 6% to $54 million.

Complete different bills (Inc. salaries, occupancy, and advertising) grew 6% to $125 million. Internet revenue was $45 million, comparatively flat year-over-year. EPS was $24.15.

Click on right here to obtain our most up-to-date Certain Evaluation report on CNND (preview of web page 1 of three proven under):

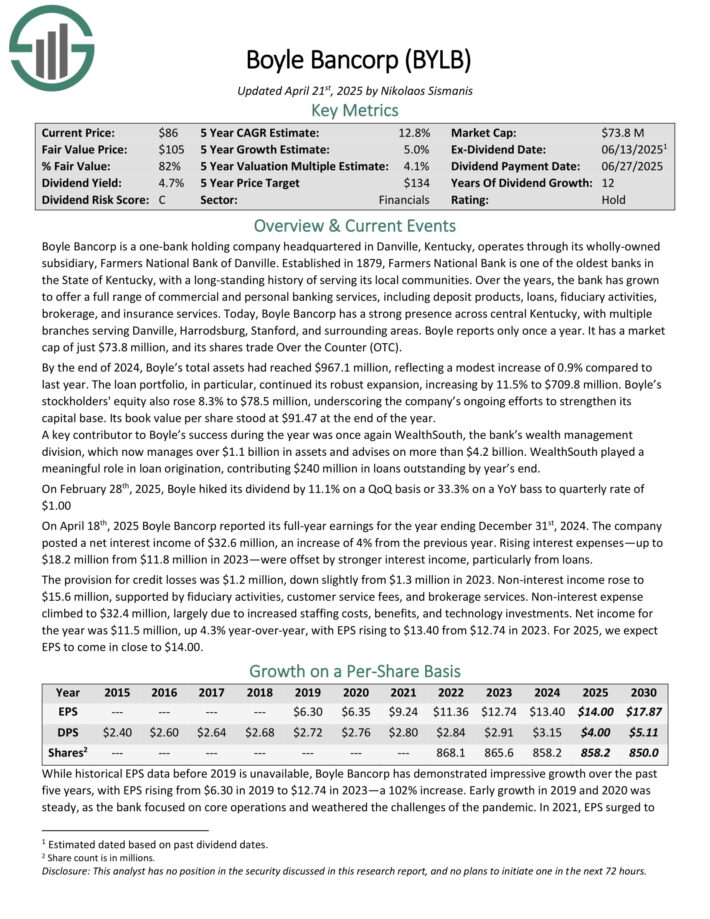

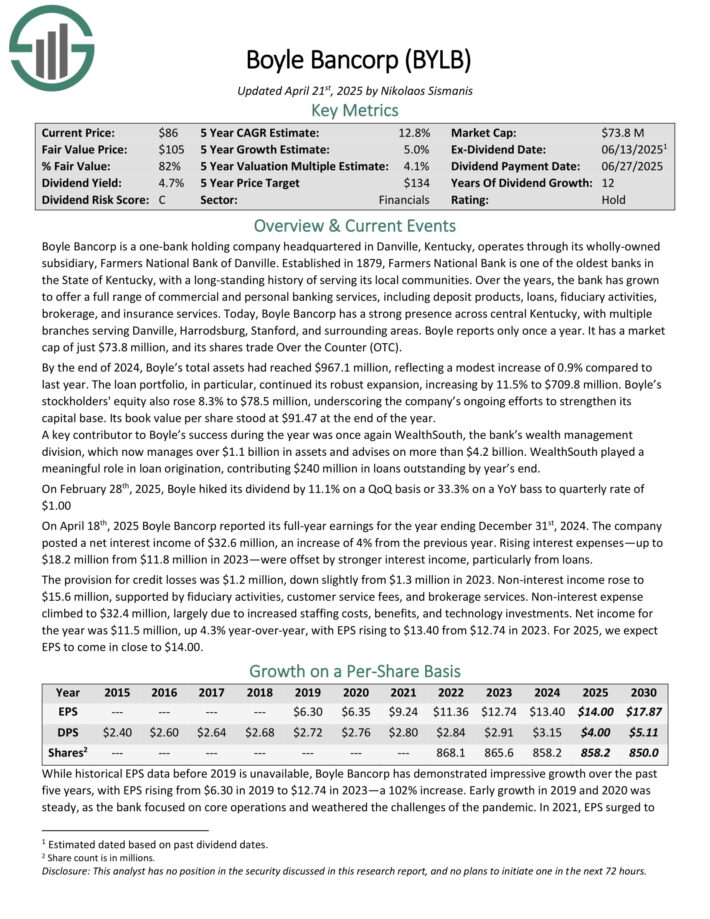

GARP Dividend Inventory #3: Boyle Bancorp (BYLB)

- 5-12 months Annual Anticipated EPS Development: 5.0%

- P/E Ratio: 6.4

Boyle Bancorp is a one-bank holding firm headquartered in Danville, Kentucky, operates by way of its wholly-owned subsidiary, Farmers Nationwide Financial institution of Danville.

Established in 1879, Farmers Nationwide Financial institution is without doubt one of the oldest banks within the State of Kentucky, with a long-standing historical past of serving its native communities.

By the top of 2024, Boyle’s whole belongings had reached $967.1 million, reflecting a modest enhance of 0.9% in comparison with final yr. The mortgage portfolio, particularly, continued its sturdy growth, growing by 11.5% to $709.8 million. Its e-book worth per share stood at $91.47 on the finish of the yr.

A key contributor to Boyle’s success throughout the yr was as soon as once more WealthSouth, the financial institution’s wealth administration division, which now manages over $1.1 billion in belongings and advises on greater than $4.2 billion. WealthSouth performed a significant function in mortgage origination, contributing $240 million in loans excellent by yr’s finish.

On February twenty eighth, 2025, Boyle hiked its dividend by 11.1% on a QoQ foundation or 33.3% on a YoY bass to quarterly price of $1.00.

On April 18th, 2025 Boyle Bancorp reported its full-year earnings for the yr ending December thirty first, 2024. The corporate posted a web curiosity revenue of $32.6 million, a rise of 4% from the earlier yr.

Rising curiosity bills—as much as $18.2 million from $11.8 million in 2023—had been offset by stronger curiosity revenue, significantly from loans.

Click on right here to obtain our most up-to-date Certain Evaluation report on BYLB (preview of web page 1 of three proven under):

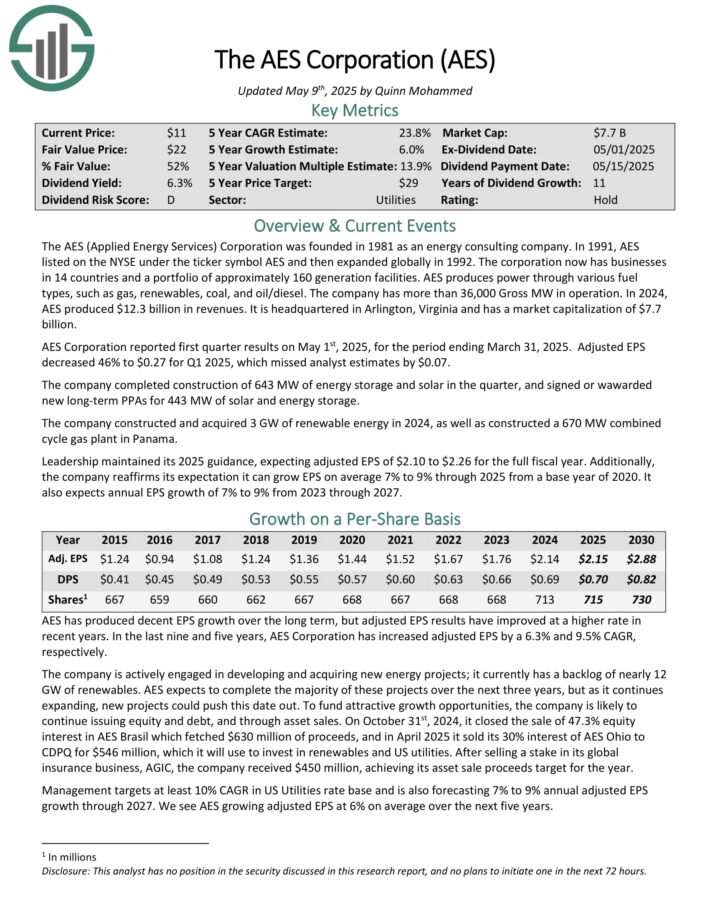

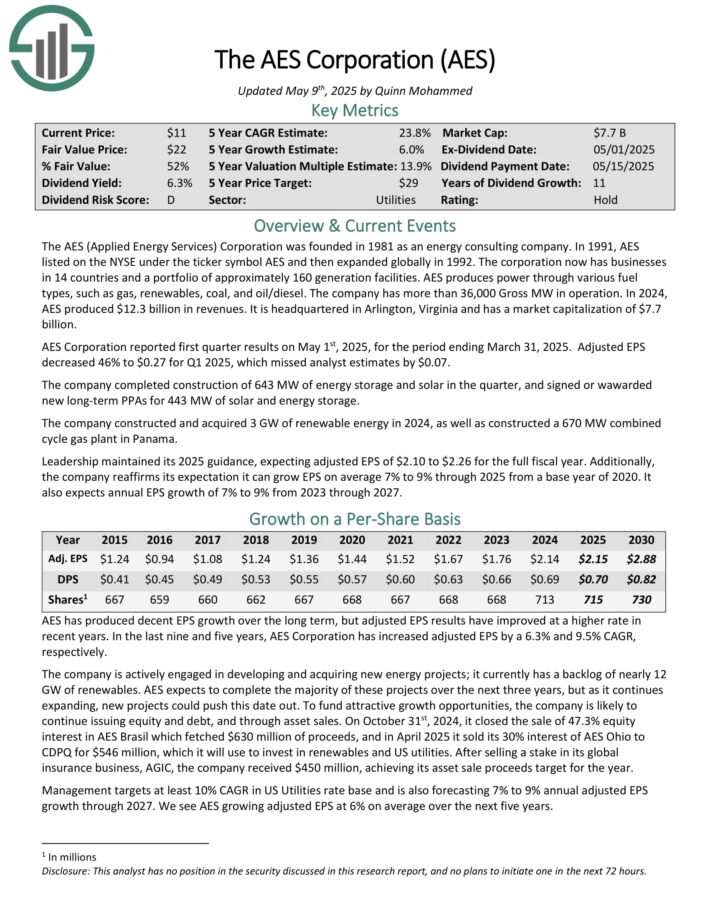

GARP Dividend Inventory #2: AES Corp. (AES)

- 5-12 months Annual Anticipated EPS Development: 6.0%

- P/E Ratio: 6.1

The AES (Utilized Power Providers) Company has companies in 14 international locations and a portfolio of roughly 160 technology services. AES produces energy by way of varied gasoline sorts, comparable to fuel, renewables, coal, and oil/diesel.

The corporate has greater than 36,000 Gross MW in operation. In 2024, AES produced $12.3 billion in revenues.

AES Company reported first quarter outcomes on Might 1st, 2025, for the interval ending March 31, 2025. Adjusted EPS decreased 46% to $0.27 for Q1 2025, which missed analyst estimates by $0.07.

The corporate accomplished development of 643 MW of power storage and photo voltaic within the quarter, and signed or wawarded new long-term PPAs for 443 MW of photo voltaic and power storage.

The corporate constructed and bought 3 GW of renewable power in 2024, in addition to constructed a 670 MW mixed cycle fuel plant in Panama. Management maintained its 2025 steering, anticipating adjusted EPS of $2.10 to $2.26 for the complete fiscal yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on AES (preview of web page 1 of three proven under):

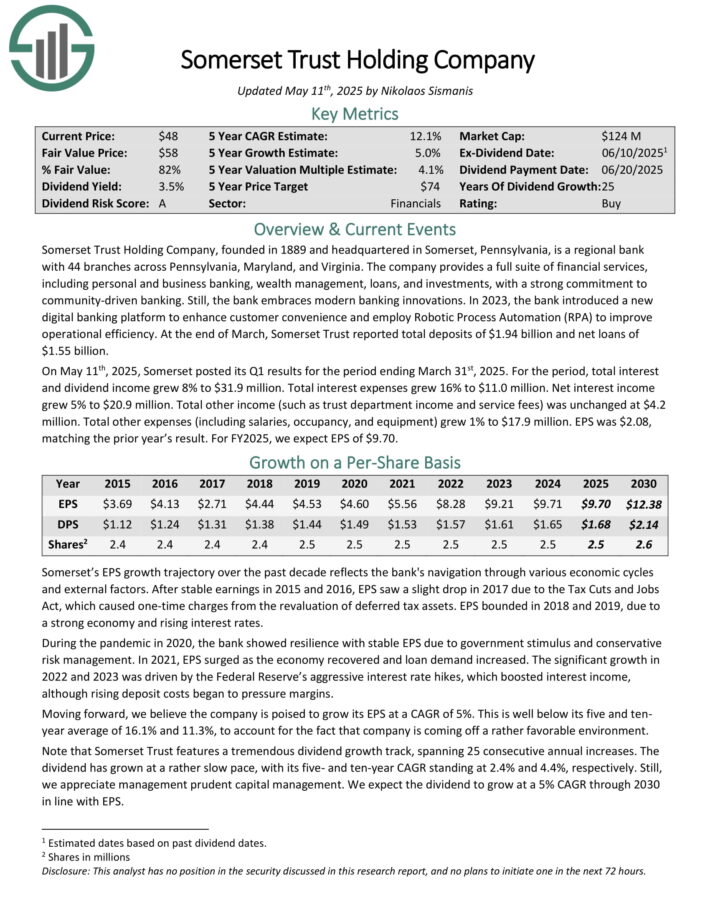

GARP Dividend Inventory #1: Somerset Belief Holding Firm (SOME)

- 5-12 months Annual Anticipated EPS Development: 5.0%

- P/E Ratio: 5.4

Somerset Belief Holding Firm, based in 1889 and headquartered in Somerset, Pennsylvania, is a regional financial institution with 44 branches throughout Pennsylvania, Maryland, and Virginia.

The corporate supplies a full suite of economic providers, together with private and enterprise banking, wealth administration, loans, and investments, with a robust dedication to community-driven banking. Nonetheless, the financial institution embraces trendy banking improvements.

On the finish of March, Somerset Belief reported whole deposits of $1.94 billion and web loans of $1.55 billion.

On Might eleventh, 2025, Somerset posted its Q1 outcomes for the interval ending March thirty first, 2025. For the interval, whole curiosity and dividend revenue grew 8% to $31.9 million. Complete curiosity bills grew 16% to $11.0 million. Internet curiosity revenue grew 5% to $20.9 million.

Complete different revenue (comparable to belief division revenue and repair charges) was unchanged at $4.2 million. Complete different bills (together with salaries, occupancy, and tools) grew 1% to $17.9 million. EPS was $2.08, matching the prior yr’s end result.

Click on right here to obtain our most up-to-date Certain Evaluation report on SOME (preview of web page 1 of three proven under):

Last Ideas

Blue chip shares are likely to have many or the entire following traits:

- Market leaders

- In style / well-known

- Giant-cap market capitalization

- Lengthy historical past of paying rising dividends

- Constant profitability even throughout recessions

That’s why they will make wonderful investments for the long-run. And their energy and reliability make them compelling investments for buyers of all expertise ranges, from inexperienced persons to consultants.

If you’re all in favour of discovering high-quality dividend development shares and/or different high-yield securities and revenue securities, the next Certain Dividend sources will probably be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].