Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

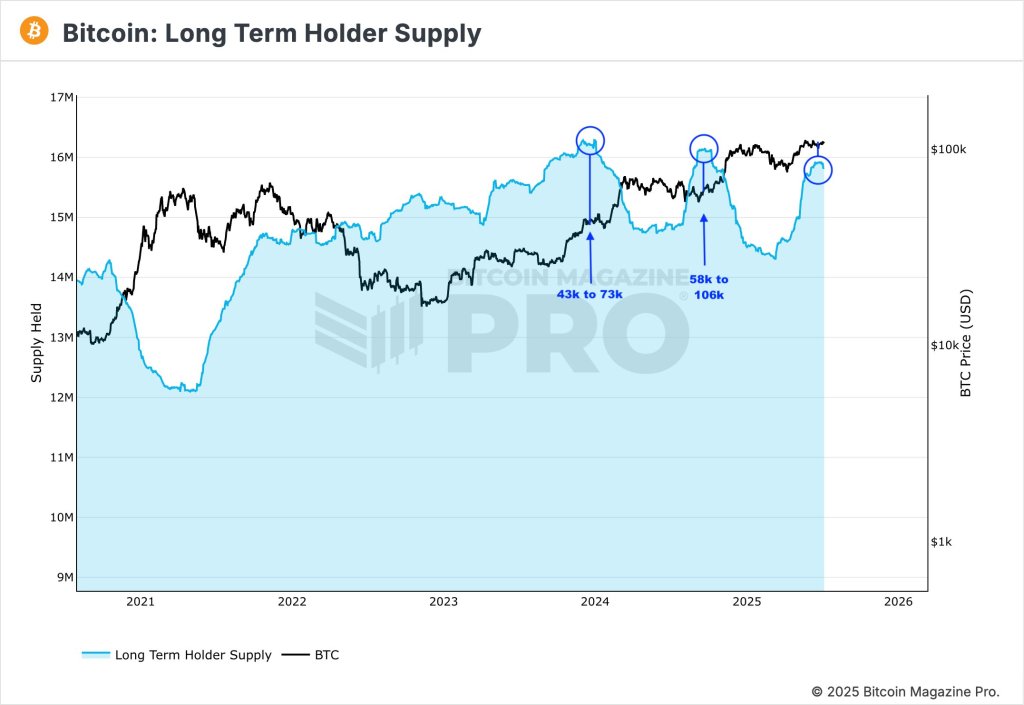

The Bitcoin market seems to be coiling for a significant transfer, in line with outstanding crypto analyst CrediBull Crypto (@CredibleCrypto), who highlighted right this moment through X that over 80% of all Bitcoin in existence is at present being held by long-term traders—ranges of provide constraint beforehand seen solely at main inflection factors in Bitcoin’s worth historical past.

Why No One’s Promoting Bitcoin

In his publish, CrediBull famous, “The one 2 instances in Bitcoin’s 15 12 months historical past that this % was larger was at 43k earlier than a $30,000 impulse to 73k and at 58k earlier than a $50,000 impulse to 105k+.” Drawing on this historic precedent, he concluded that the market is poised for one more large leg up: “When nearly all of $BTC complete circulating provide is cornered by ‘diamond arms’, worth strikes up aggressively on the trace of any ‘new’ demand.”

With “extra” provide now redistributed to long-term holders and institutional entities reminiscent of Bitcoin treasury corporations more and more taking the lead, the analyst sees a transparent sign: “The following impulse IS IMMINENT. This subsequent one may even seemingly be even larger than the final two ($50,000+). Who’s prepared for 150k+ Bitcoin?”

Associated Studying

The optimism shouldn’t be with no technical underpinning. In a earlier publish, CrediBull addressed the present market construction and his personal Elliott Wave-based state of affairs planning: “My authentic depend/thought shared a number of days in the past had us rejecting at vary highs above 110k and seeing a pullback all the way down to the BLUE zone at 102k-ish earlier than transferring sideways for a number of extra weeks earlier than the following impulse begins.”Nevertheless, the analyst acknowledged a major different chance: “I do nonetheless assume this state of affairs is possible, I additionally acknowledge that there’s a non-zero likelihood that the following impulse up has already begun (most bullish state of affairs depicted).”

Given the value motion and construction, CrediBull argued that the risk-reward profile not favors bearish positioning. “In both case, draw back is comparatively restricted on Bitcoin from present ranges imo and so focus must be on figuring out potential lengthy opps on Bitcoin quite than seeking to brief clear energy.”

Associated Studying

He punctuated the purpose with a rhetorical jab: “Why is it now unlawful to brief Bitcoin? As a result of there’s a non-zero likelihood that the following impulse up has already begun.”

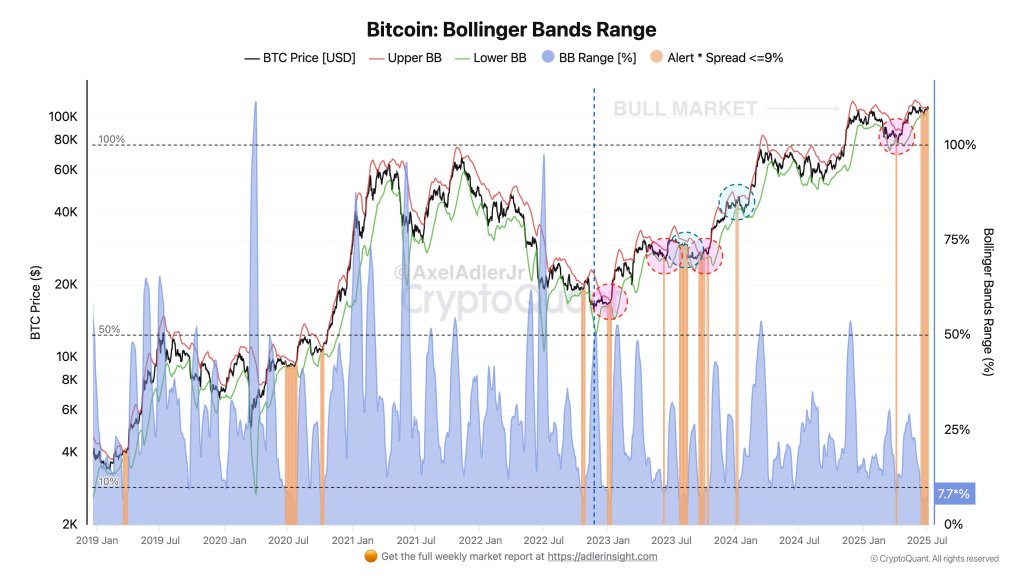

Including a layer of technical affirmation, analyst Axel Adler Jr supplied a concurrent sign from volatility metrics. Adler pointed to a major Bollinger Bands squeeze underway, writing: “The vary between the higher and decrease boundaries has fallen to 7.7%—one of many lowest values all through your complete bull cycle.”

Such compressions in volatility traditionally precede massive directional strikes. Adler defined, “The lower in volatility signifies power accumulation out there; the value is prepared for a rally, and in an upward development surroundings, the probabilities of an upward breakout are considerably larger.”

Within the present cycle, Adler has recognized six episodes of such squeezes. 4 have been instantly adopted by robust worth appreciation, whereas the remaining two noticed transient corrections earlier than persevering with upward. The takeaway: “Primarily based on this expertise, the present squeeze more than likely foreshadows one other upward impulse, though a small consolidation earlier than the transfer can be not dominated out.”

With long-term holders now controlling an amazing share of provide, bullish technical compression in play, and institutional adoption persevering with to soak up circulating cash, the surroundings CrediBull describes echoes previous moments of explosive upside. Whereas nothing is assured, the mix of on-chain metrics and technical indicators recommend Bitcoin’s subsequent chapter might already be starting—quietly, beneath the floor.

At press time, BTC traded at $108,738.

Featured picture created with DALL.E, chart from TradingView.com