The unique supposed objective of derivatives when it was apparently first launched round 1800s was to handle danger. However it has since advanced right into a hypothesis device that has satirically elevated the chance within the system akin to tail wagging the canine. Historical past is replete with situations of monetary crises getting accentuated by the extreme use of hedging instruments as the principle buying and selling technique, such because the Black Monday, the October 1987 US crash or the 2007 international market meltdown.

To this extent whereas globally hypothesis has been at beforehand unseen ranges post-Covid, SEBI’s measures together with the latest actions in opposition to Jane Road are a lot welcome.

In a market the place there is no such thing as a dearth of volatility, the ratio of Futures & Choices (F&O)-to-cash turnover has now fallen to its lowest ranges in three years (BSE and NSE mixed). This may be attributed to SEBI measures applied since final 12 months. This may be considered as a constructive, though at 285 instances, the ratio implies hypothesis stays rampant not less than on a relative foundation when in comparison with pre-Covid ranges.

Buying and selling frenzy

In the course of the increase years of 2021-2023, this ratio surged, pushed by a retail buying and selling frenzy. Nevertheless, in combination retail merchants have had a torrid time shedding out to establishments, particularly FIIs, as indicated by information revealed by SEBI within the final two years.

Whether or not a few of these income had been inside the guidelines is now in query within the mild of SEBI’s latest ban on Jane Road for alleged market manipulation. The larger query is what’s driving this retail frenzy?

Is it insufficient understanding that bare F&O buying and selling is a zero-sum sport, which includes wealth switch fairly than wealth creation? Or is it an dependancy that’s arduous to kick?

What ever the explanation, it’s clear that systemic measures are required to curb reckless hypothesis, akin to the Nudge concept propounded by Nobel laureate Richard Thaler.

Silver lining

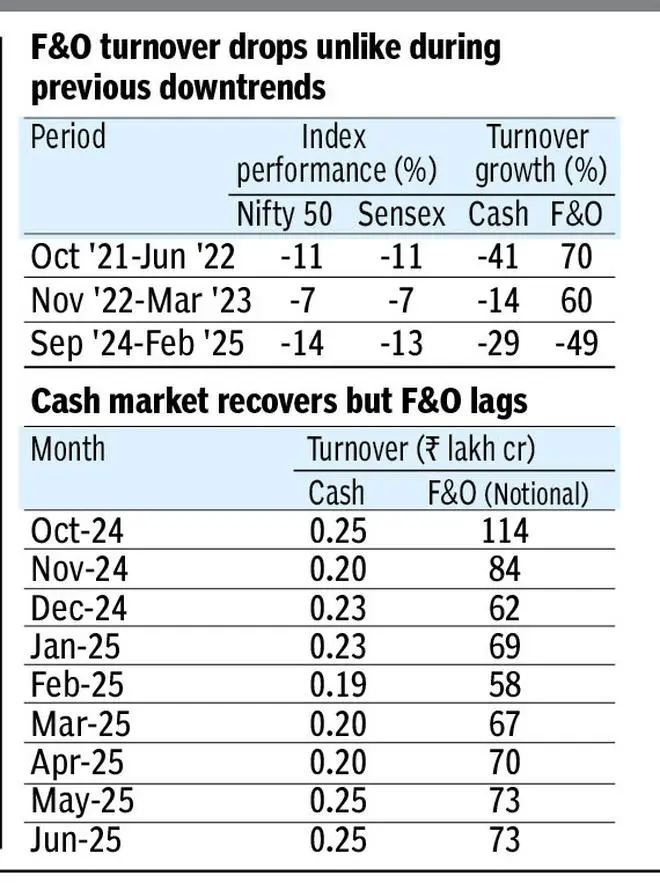

The F&O-to-cash-trading quantity, at 285 instances in June is nicely under the height of 487 instances in October 2023. Whereas it has continued to stay risky since, the pattern clearly seems to be down. This marks a major shift, one largely influenced by SEBI’s regulatory measures to clamp down on extreme buying and selling volumes and speculative exercise.

Measures just like the discount in weekly choices and the rise in contract values for index derivatives, launched in late 2024, are displaying their influence. This has led to a 36 per cent drop in cumulative F&O turnover (together with NSE and BSE) from the time the measures had been launched in November 2024 to June 2025, as tighter situations pressure merchants to regulate.

Evaluating the final three downtrends, there may be proof that the SEBI measures has discouraged F&O exercise to a notable extent. In the course of the October 2021-June 2022 and November 2022-March 2023 downcycles, the fairness turnover decreased (refer desk) however the derivatives turnover noticed a major enhance as F&O contracts permit individuals to monetise throughout a bear market, too.

Nevertheless, through the newest downtrend, between September 2024 and February 2025, the turnover within the F&O section, too, dropped.

Because the market has been on a restoration over the past 4 months, there was a rise in turnover in each the segments. Nevertheless, whereas the fairness turnover in June returned to ranges seen in October final 12 months, the F&O turnover has elevated marginally.

Going forward, it’s extremely doubtless that money market development will likely be larger than that of the derivatives section as measures like larger lot measurement, extra margin necessities and availability of weekly choices solely on one index per change will restrict participation.

Towards the grain

Although the cumulative turnover in F&O has diminished within the first half of 2025, volumes within the BSE have seen an uptick.

In H1 of calendar 2025, BSE’s turnover elevated by 45 per cent to ₹150-lakh crore in comparison with the identical interval final 12 months. However NSE’s turnover dipped 44 per cent to ₹259-lakh crore through the interval into account. Consequently, BSE’s share within the derivatives section improved to 37 per cent in H1 in comparison with 22 per cent in 2024 full 12 months. That is due to the discount of accessible weekly choices, which is more likely to have impacted NSE essentially the most.

Revealed on July 5, 2025