Key Takeaways

- The US Home handed President Trump’s spending invoice on Thursday; it is now heading to Trump for his signature.

- The laws contains tax cuts, elevated discretionary spending, and safety-net program reductions.

Share this text

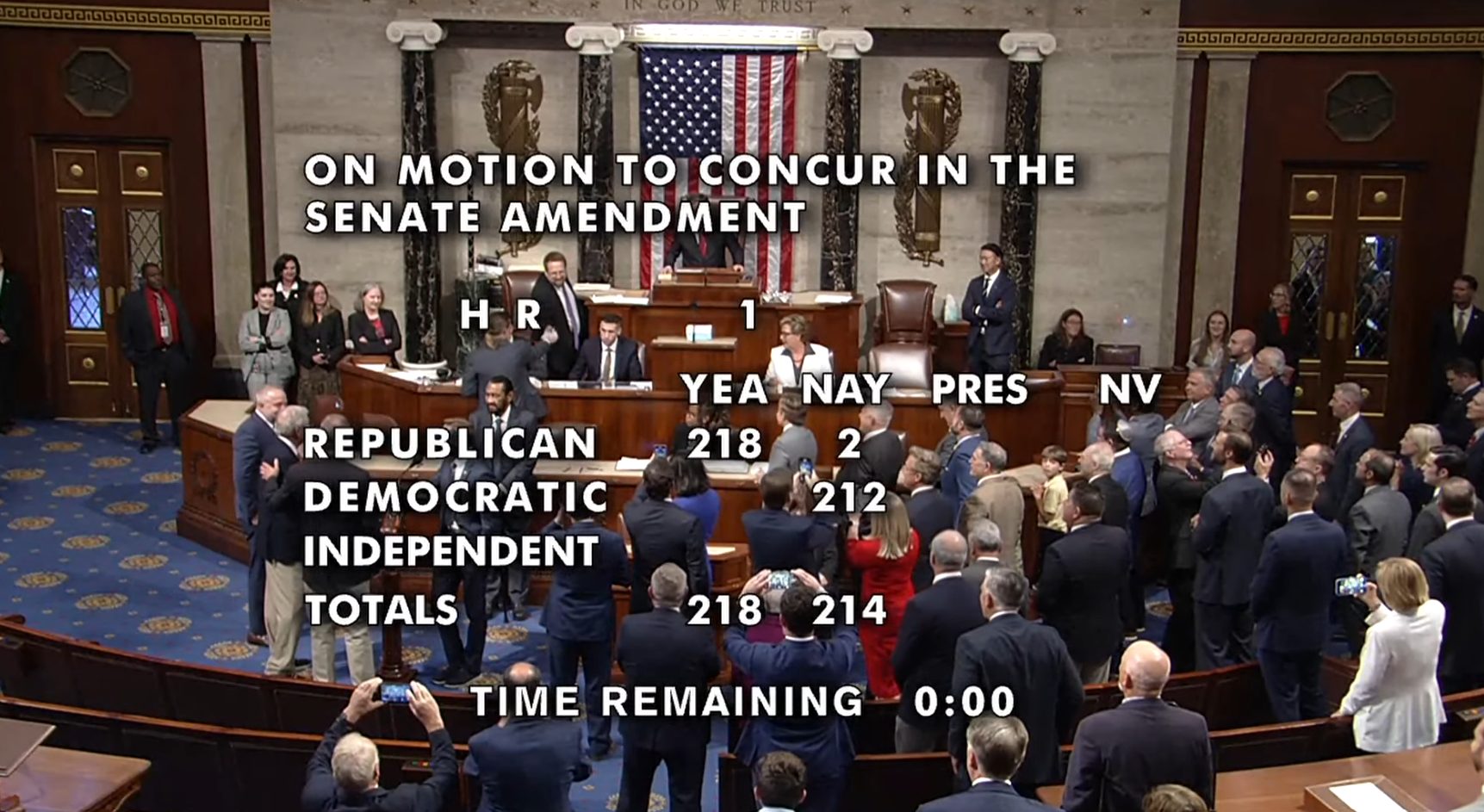

President Donald Trump’s flagship tax-and-spending laws, the “Large Lovely Invoice,” cleared Congress on July 3 after passing the Home of Representatives on a slender 218-214 vote.

Two Republican representatives, Brian Fitzpatrick of Pennsylvania and Thomas Massie of Kentucky, crossed occasion strains to vote with Democrats towards the measure, which had already cleared the Senate earlier this week.

The US Senate handed the invoice with out together with proposed crypto tax amendments aimed toward benefiting stakers, miners, and digital asset holders. Regardless of efforts by Senator Cynthia Lummis and different proponents, crypto-specific measures have been overlooked on account of time constraints through the invoice’s closing negotiations.

The laws contains tax reductions for people and companies, will increase in discretionary spending, and cuts to safety-net applications. Monetary analysts venture that the invoice may enhance the nationwide debt by $3.3 trillion over a decade.

Home Democratic Chief Hakeem Jeffries set a chamber report for the longest speech throughout his ground protest towards laws.

The invoice now heads to the White Home for President Trump’s signature.

Bitcoin dangers $90K retest as Trump’s invoice units the stage for liquidity squeeze

Arthur Hayes, co-founder of BitMEX and a distinguished crypto analyst, predicts that President Trump’s Large Lovely Invoice, which raises the US debt ceiling, may trigger a sizeable liquidity drain because the US Treasury refills its Treasury Normal Account (TGA).

This drain, estimated to be practically $500 billion, may briefly push Bitcoin’s value to retest the $90,000 to $95,000 vary.

Regardless of potential short-term volatility, Hayes stays constructive about Bitcoin’s long-term trajectory, suggesting {that a} easy market absorption of the bond issuance may preserve Bitcoin steady within the $100,000s.

Share this text