File image: The German share value index DAX graph pictured on the inventory alternate in Frankfurt, Germany. The DAX index has emerged as one of many surprisingly greatest performers after a very long time. This displays renewed optimism in Germany’s economic system, which is present process a reset.

| Photograph Credit score:

STAFF

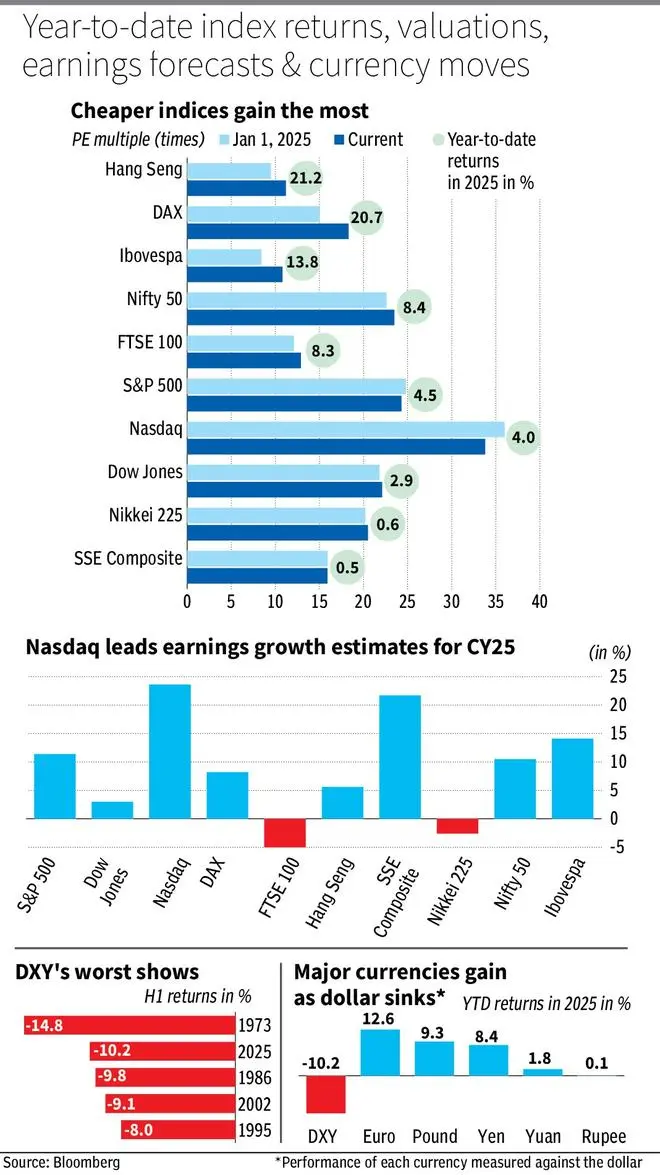

In the event you’d gone into hibernation on January 1 and simply woken up, you would possibly assume the worldwide markets, particularly the US, had had a easy trip in H1 of 2025. For instance, the two.9 per cent, 4.51 per cent and 4 per cent returns for Dow Jones, S&P 500 and Nasdaq Composite masks a few of the wildest gyrations the indices have seen in a six-month interval.

Within the first week of April, S&P 500 and Nasdaq noticed their third worst two-day efficiency in 20 years on the traces of the volatility witnessed throughout the world monetary disaster.

Amid these turbulences, some unlikely winners and losers throughout equities and currencies is the story of this 12 months’s H1.

US, Europe swap locations

Whereas AI, Magnificent Seven and US exceptionalism have been the euphoric themes on the daybreak of the 12 months, in actuality the 20.7 per cent returns for Germany’s Dax index makes it one of many surprisingly greatest performers after a very long time. This displays renewed optimism in Germany’s economic system, which is present process a reset. As a part of a €800-billion plan, the EU lifted the rule requiring member-nations to maintain finances deficits beneath 3 per cent of GDP.

Germany adopted swimsuit, with the Bundestag voting to reform the Schuldenbremse — a constitutional “debt brake” limiting the finances deficit to 0.35 per cent of GDP, enacted in 2009 after the worldwide monetary disaster. With this reform and plans to extend deficits and spend extra, German shares discovered favour like by no means earlier than. These actions have utterly boxed out tariff conflict associated issues.

Even after this out-performance, the Dax nonetheless stays one of many most cost-effective main index at a PE of 18.2 instances. So is the case with China’s Grasp Seng, which is the most effective performer YTD. It trades at a PE of 11.22 instances. In impact, the most cost effective main indices firstly of the 12 months — Ibovespa, Grasp Seng, FTSE 100 and Dax — are the most effective performers amongst world indices.

Relating to currencies, whereas the greenback stays the worldwide reserve foreign money, de-dollarisation appeared to realize traction. The greenback index (DXY) is down 10.2 per cent in H1 2025, its steepest six-month fall since June 1973, whereas the euro surprisingly had considered one of its greatest six months. Different main currencies have additionally appreciated in opposition to the greenback, in contrast to final 12 months when the greenback stood alone in power.

What lies forward

One of the exceptional options has been how a lot markets have rebounded from the lows. For instance, the Nasdaq Composite is up 32.78 per cent from the tariff conflict lows. India’s Nifty 50 is up by 16.1 per cent. However as in comparison with the beginning of the 12 months, the uncertainties are solely a lot larger whether or not it’s the tariff conflict, geopolitics, or slowdown within the US economic system submit the increase years following Covid.

So, hereon, quite a bit will depend upon how earnings development performs out. A few of the tariff conflict associated impacts might be first seen within the upcoming June quarter earnings.

The H2 of the 12 months will reveal two vital issues — whether or not markets have been too informal about tariff wars, and, extra importantly, whether or not the de-dollarisation course of is for actual or nonetheless a fantasy.

Printed on June 28, 2025