Incomel/iStock by way of Getty Pictures

Russia’s capability to invade international international locations is intently tied to its vitality exports. Russia produces round 11% of the world’s oil. Additionally it is the first provider of vitality to Europe, making up 27% of Europe’s crude oil imports and a staggering 41% of its pure fuel imports. Vitality dependence on Russia is exceptionally excessive in jap Europe, with Balkan international locations almost completely depending on Russian exports. The identical is partly true for Italy and Germany, the place round half of the pure fuel provides come from Russia.

In comparison with the U.S, Europe’s electrical grid is barely much less depending on pure fuel, which makes up simply over a 3rd of its complete electrical vitality sources. Some notable international locations comparable to Poland, Netherlands, Eire, and Italy derive over half of their electrical energy from pure fuel. Germany is within the technique of shutting down its remaining nuclear crops, that means its fossil gasoline demand will probably rise over the approaching 12 months.

Whereas Europe is extremely depending on Russia for vitality, Russia’s financial system is financially tied to Europe. Russia has a really excessive 7% present account-to-GDP ratio, with vitality commodity gross sales making up roughly half of its complete exports. A big and rising portion of Russia’s federal price range comes from oil and fuel gross sales. The nation additionally has a big $630B forex hoard, primarily made up of western currencies and over a fifth being gold. Russia has the fourth-largest complete worldwide forex reserve on the earth and an especially low authorities debt-to-GDP ratio. These forex reserves will likely be important since Russia has a excessive 9% inflation fee which is able to probably speed up given its latest forex, bond, and inventory market collapse.

Total, these figures display that Russia and Europe are extremely dependent upon one another. Much more, the selections a handful of people make over the approaching hours and days will probably have far-reaching penalties on the worldwide vitality market. I’ve been bullish on the vitality sector for a while, as final described in November in “XLE: Oil Stock Builds Could Be Adopted By Even Bigger Drawdowns.” The U.S. has seen continued oil drawdowns since, and the present unlucky state of affairs could dramatically worsen this subject over the approaching months. Let’s take a better look.

Will Europe Ban Russian Vitality?

The state of affairs with Russia is extremely kinetic and, at this level, is altering by the hour. That stated, Russia’s overwhelming acts of aggression towards Ukraine are already inflicting disruptions to the worldwide vitality market. On the onset of Russia’s invasion, oil costs shot up by double digits to over $100 per barrel however have since declined again to ~$90. This speedy reversal occurred because the NATO nation’s preliminary listing of sanctions towards Russia appeared to do little or no to focus on Russia’s vitality sector. E.U. leaders deliberate to ban expertise exports that Russia might use to improve refineries, whereas the U.S. stated it will limit Gazprom’s (OTCPK:OGZPY) capability to lift cash within the U.S.

In my opinion, the present sanctions towards Russia will do little or no to (justifiably) cripple Russia’s financial system. So long as Russia sells fossil fuels, its financial system will probably stay intact, primarily as a result of oil and fuel costs are extremely elevated. That stated, sanctions banning oil is probably not crucial as tanker charges on Russian crude oil routes have tripled because the invasion. I anticipate tanker charges will stay excessive as Russia has to this point shelled a minimum of three industrial cargo ships close to the Odesa port, and insurers have usually stopped protecting vessels within the important Black Sea area.

Whereas Europe has vitality sources that don’t contain Russia, the continent is already battling extraordinarily excessive electrical energy costs. Europe has far much less saved pure fuel than is seasonally typical. There’s some hope that U.S. liquified pure fuel (“LNG”) exports to Europe might offset losses from Russia, however solely round 1 / 4 of E.U fuel is imported by way of LNG. Like most international locations at the moment, the united stateshas abnormally low saved pure fuel, so it’s unlikely to fully-offset declines from Russia.

Regardless of the sturdy probability of making an vitality disaster, Western leaders seem to have elevated efforts to enact extra materials financial sanctions on Russia. On the time of writing, this contains the elimination of “choose banks” from the SWIFT messaging system and measures to make sure the Russian oligarchs lose entry to western monetary belongings. These measures will limit Russia’s capability to make the most of its hoard of international forex reserves and freeze important worldwide monetary transactions in Russia by chopping off SWIFT. Based on Russia, its suspension from SWIFT will end in no items (oil, fuel, and metals) flowing from Russia to Europe. Since non-European international locations use SWIFT, the ban might additionally considerably disrupt Russia’s commodity exports worldwide.

China does have its personal cross-border interbank cost system and has elevated infrastructure to export its commodities to China. In my opinion, tightening financial ties to China is a long-term resolution Russia is prone to pursue, however it can do little to cease short-term disruptions to the worldwide commodity provide. Contemplating the overwhelming international response towards Russia’s conduct, China could not want to preserve its financial friendship with Russia. The online consequence may very well be a considerable enhance in near-term worldwide oil and different commodity costs, although this depends upon whether or not or not different choices are created.

The Combat For Freedom Has Financial Prices

The financial penalties of banning Russia from SWIFT shouldn’t be understated. In my opinion, on the time of writing, international fairness and commodity markets have under-reacted considerably. As hedge fund supervisor Bill Ackman said:

I wouldn’t wish to hold cash in a financial institution that may’t entry the SWIFT system. As soon as a financial institution can’t switch or obtain funds from different banks, its solvency might be in danger. If I have been Russian, I might take my cash out now. Financial institution runs might start in Russia on Monday

Certainly, this financial institution run has already begun with giant queues of Russians at ATMs across the nation. On an identical notice, it needs to be identified that a big portion of Russian residents doesn’t help the invasion of Ukraine regardless of opposing propaganda efforts. I can solely think about that dissent will develop by a magnitude if the ruble sinks and Russian residents see their wealth quickly disappear. The potential for immense home disruptions inside Russia could ultimately trigger labor disruptions in its oil and fuel companies, doubtlessly exacerbating the worldwide vitality shock.

Whereas I purpose to give attention to the vitality market, traders would profit from contemplating the bigger perspective behind the continued disaster. A key purpose for Putin’s “frustration” that invading a sovereign nation was “harder than he anticipated” is that Ukrainian residents have made important efforts to withstand invading forces. I consider it’s truthful to say that many Ukrainians are placing the yearn for freedom over fears of loss. Equally, suppose the E.U. and different international locations & areas around the globe place the best of liberty over materials and financial motives. In that case, Putin (and firm) has zero capability to keep up management with out spurring an excessive home monetary disaster. U.S. and E.U. leaders are undoubtedly involved that sanctions will exacerbate the continued vitality disaster. Nonetheless, at this level, I’m keen to wager that People and Europeans are keen to pay extra for gasoline and electrical energy for the reason for freedom.

The place Might Oil Go?

On the time of writing, there seems to be a considerable shift away from the view that this will likely be just like the 2014 Crimea invasion, which had comparatively restricted international financial penalties exterior of Russia. The elevated acts of aggression from Russia and the a lot bigger worldwide response have, in my opinion, inspired western leaders to take extra aggressive steps in thwarting Russia, even on the probably price of unfavourable financial penalties for the west.

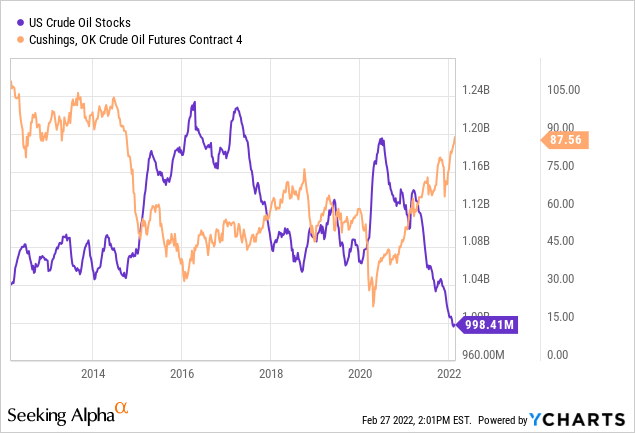

We should needless to say a lot of the globe has been in an vitality disaster since COVID lockdowns resulted in substantial manufacturing cuts. These cuts resulted in appreciable declines in complete reserves and better oil and fuel costs. See beneath:

The usEnergy Data Administration has forecasted that vitality manufacturing ought to meet provide by round Q2-Q3 of this 12 months, implying a possible finish to declines in U.S oil storage ranges. I’ve some doubts about this as a result of ongoing reductions in “drilled however uncompleted” nicely stock ranges backed by low CapEx spending on behalf of most U.S producers. As this provide of latest oil wells turns into restricted, much less worthwhile investments into newly drilled wells will likely be wanted to keep up complete oil manufacturing. OPEC’s issue sustaining manufacturing implies they’re experiencing related challenges in normalizing output ranges.

Actually, I might be bullish on crude oil costs even when Russia was not disrupting the globe. There’s some thought that OPEC will enhance manufacturing to make up for Russia’s export losses, however this might require monumental and well timed investments, contemplating Russia makes up such a big portion of worldwide oil and fuel exports. At any fee, OPEC has to this point been unable to lift manufacturing even to its capability ranges, so I extremely doubt any nation will handle to offset a decline in Russia’s exports.

It’s troublesome to say what the affect on oil costs will likely be. Complete Russian oil manufacturing is at the moment 11.2M BPD, whereas complete international manufacturing declines from 2019 to 2020 was 6.5M BPD. So, if Russia’s oil exports decline by 50%, the web impact can be much like that of COVID lockdowns. Nevertheless, the state of affairs is completely different since, at this level, I don’t anticipate demand to exogenously decline because it did with COVID. Thus, the speed of worldwide declines in oil storage might probably be extra intensive than they have been over the previous two years. Accordingly, I consider it’s truthful to say that if SWIFT measures trigger Russia to cease promoting fossil fuels, commodity costs might even see a bigger rise since 2020.

In my opinion, a $150-$200 value per barrel isn’t off the desk. This will likely appear excessive, however allow us to not overlook that oil was round $150 again in 2008 when the united statesdollar was extra worthwhile (from an inflation perspective), and the worldwide oil provide was far safer. After all, if Russia can not promote oil, it might want to shut down nicely manufacturing. As we have discovered since 2020, if you shut down an oil nicely, it takes a variety of money and time to show it again on. Thus, if Russia shuts down oil and fuel wells, it will probably result in a multi-year disruption in international fossil gasoline provides, that means oil could rise and stay costly for years.

Hedge Alternative With XLE

Oil and fuel corporations are maybe the one benefactors from this example. The SPDR U.S Vitality Sector ETF (XLE) has risen barely because the onset of the invasion, and I think it can enhance extra if oil crosses above the $100 line. Many of the smaller corporations within the fund have most of their operations in the USA and can thus profit from extra important exports at increased costs. The ETF’s increased market-cap holdings, comparable to Exxon Mobil (XOM), have some publicity to Russia and will likely be negatively impacted by sanctions. That stated, XLE usually has minimal publicity to Russia since most of its holdings give attention to manufacturing within the U.S.

XLE can also be an affordable fund regardless of an 18% estimated annual EPS progress. The ETF at the moment has a weighted-average price-to-cash circulate of 9X and a ahead “P/E” of solely 12X. Its dividend yield can also be comparatively excessive at 3.4%. I anticipate XLE’s holdings’ earnings to rise at a faster-than-expected tempo if oil will increase as excessive as I think. The overall earnings of many of those corporations might comparatively rapidly rise by 50-100% of crude and fuel rises by 50-100%, if not by extra as a result of revenue margin growth that normally comes with increased costs.

In any probability, this example could probably end in a big enhance in XLE’s worth. After all, a substantial shock in oil costs would negatively affect the U.S. and, mixed with different monetary disruptions, could quickly trigger a cloth decline in U.S monetary asset costs. That stated, the one sectors which I consider have upside potential are vitality and gold miners, with XLE being one of many extra well-rounded choices for vitality traders.

Since we can not know what is going to happen on this extremely kinetic state of affairs, XLE’s and oil’s upside isn’t assured. We stay in a time the place it’s maybe finest to not maximize beneficial properties however to place your self in a fashion that permits you to sleep higher at evening. To me, a place in XLE or different vitality shares isn’t a conventional “bullish hypothesis” however is as a substitute a strong technique of hedging towards at the moment’s quite a few draw back threat elements. Even when I look to purchase energy-producing shares, I might probably hold place sizing small and preserve ample money reserves, which might be deployed when asset costs higher mirror actuality.