Revealed on May twenty first, 2025 by Bob Ciura

There are good causes for merchants to non-public worldwide shares, harking back to diversification. Many corporations that perform exterior the U.S. have entry to geographic markets which may outperform the U.S. throughout the event of a house monetary downturn.

In any case, there are risks to purchasing worldwide shares, harking back to foreign exchange risk.

Nonetheless, earnings merchants looking for top of the range dividend shares shouldn’t on a regular basis ignore worldwide shares. Definitely, there are quite a few top quality worldwide shares which have compiled spectacular dividend growth histories.

Income merchants are in all probability accustomed to the Dividend Aristocrats, which can be a lot of the highest-quality shares to buy and keep for the long term.

You presumably can get hold of the whole Dividend Aristocrats guidelines, along with important metrics like dividend yields and price-to-earnings ratios, by clicking on the hyperlink beneath:

Disclaimer: Sure Dividend shouldn’t be affiliated with S&P Worldwide in any method. S&P Worldwide owns and maintains The Dividend Aristocrats Index. The data on this text and downloadable spreadsheet depends on Sure Dividend’s private overview, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and completely different sources, and is meant to help specific particular person merchants greater understand this ETF and the index upon which it’s primarily based. Not one of many information on this text or spreadsheet is official data from S&P Worldwide. Search the recommendation of S&P Worldwide for official information.

The guidelines of Dividend Aristocrats is diversified all through a lot of sectors, along with shopper objects, financials, industrials, and healthcare. Nevertheless it isn’t diversified geographically to include worldwide shares.

With this in ideas, this article will concentrate on 10 worldwide dividend growth shares which have raised their dividends for over 25 consecutive years, of their dwelling currencies.

Desk of Contents

The desk of contents beneath permits for easy navigation. The shares are listed by 5-year annual anticipated returns, in ascending order.

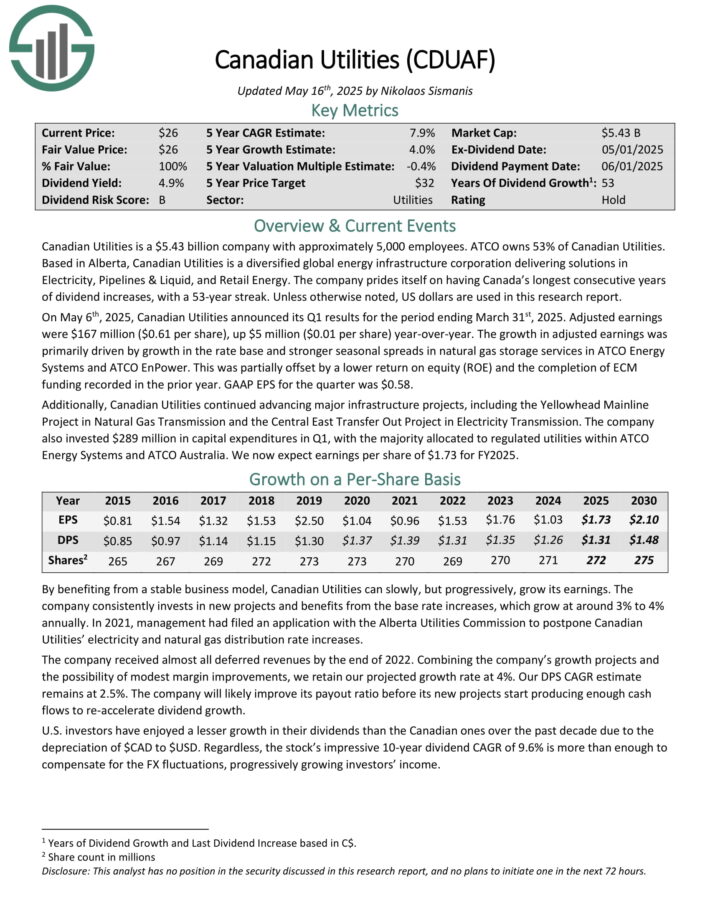

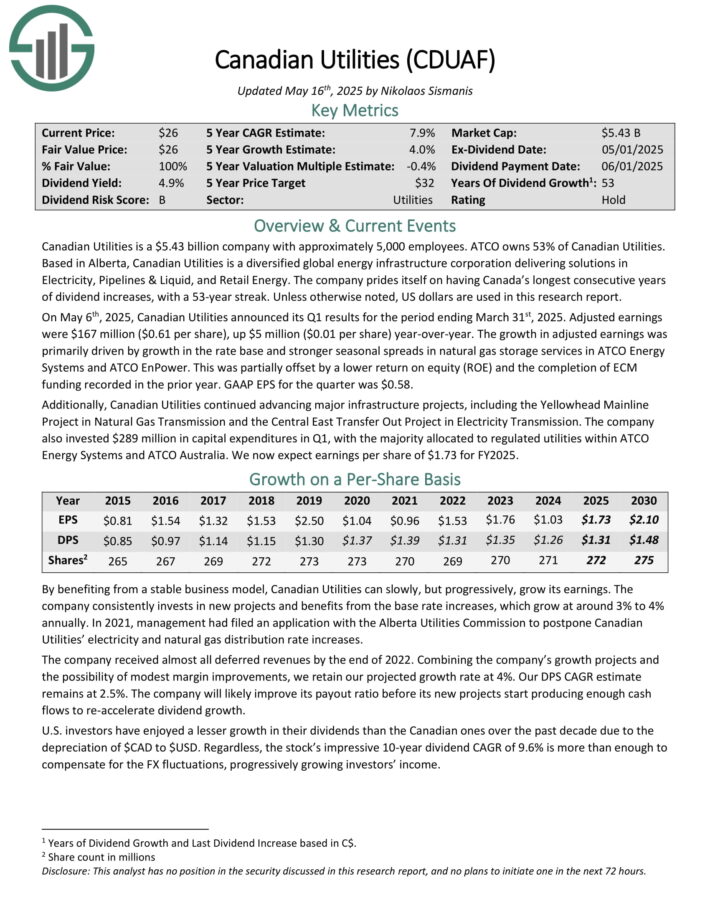

Worldwide Dividend Aristocrat #10: Canadian Utilities Ltd. (CDUAF)

- Consecutive Years Of Dividend Will enhance: 53

- Annual Anticipated Returns: 7.5%

Canadian Utilities is a utility agency with roughly 5,000 workers. ATCO owns 53% of Canadian Utilities. Primarily based in Alberta, Canadian Utilities is a diversified world energy infrastructure firm delivering choices in Electrical vitality, Pipelines & Liquid, and Retail Vitality.

The company prides itself on having Canada’s longest consecutive years of dividend will enhance, with a 53-year streak. Besides in some other case well-known, US {{dollars}} are used on this evaluation report.

On May sixth, 2025, Canadian Utilities launched its Q1 outcomes. Adjusted earnings have been $167 million ($0.61 per share), up $5 million ($0.01 per share) year-over-year.

The enlargement in adjusted earnings was primarily pushed by growth throughout the worth base and stronger seasonal spreads in pure gasoline storage suppliers in ATCO Vitality Strategies and ATCO EnPower. This was partially offset by a lower return on equity (ROE) and the completion of ECM funding recorded throughout the prior 12 months. GAAP EPS for the quarter was $0.58.

Furthermore, Canadian Utilities continued advancing major infrastructure duties, along with the Yellowhead Mainline Mission in Pure Gasoline Transmission and the Central East Change Out Mission in Electrical vitality Transmission.

Click on on proper right here to acquire our most modern Sure Analysis report on CDUAF (preview of net web page 1 of three confirmed beneath):

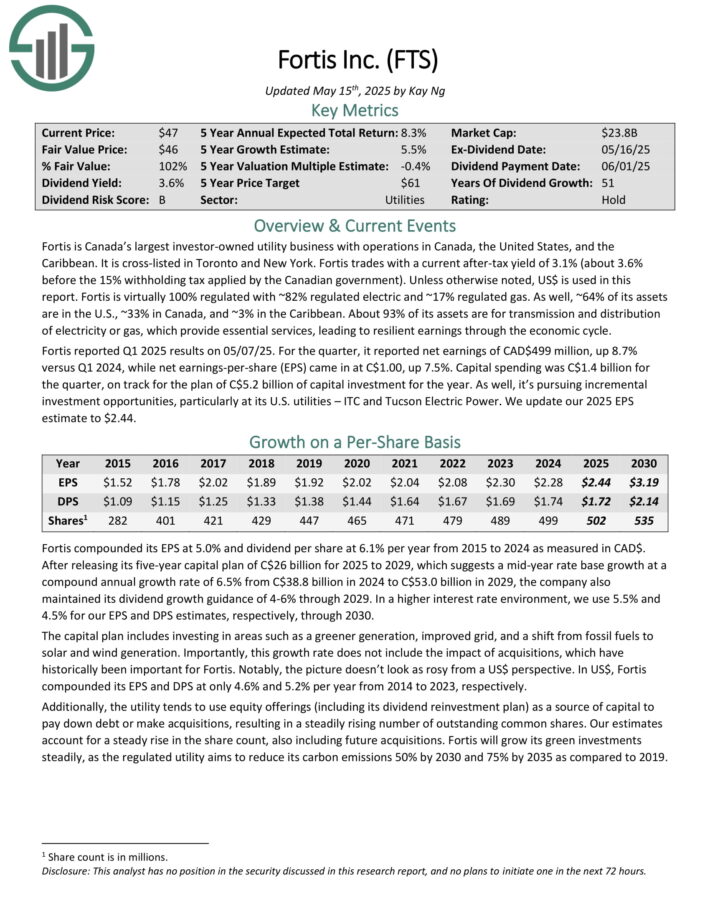

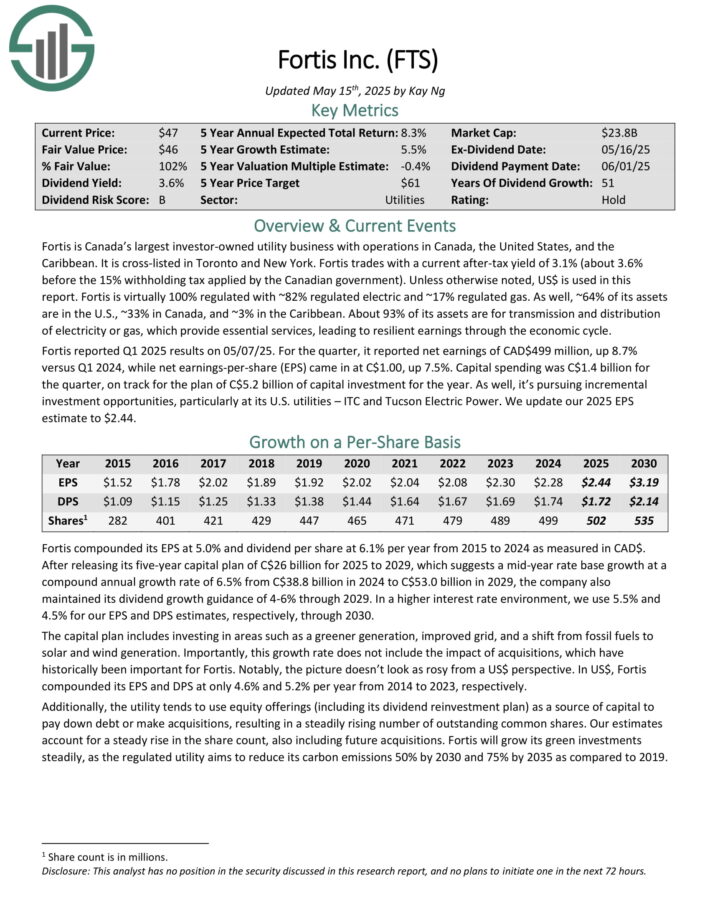

Worldwide Dividend Aristocrat #9: Fortis Inc. (FTS)

- Consecutive Years Of Dividend Will enhance: 51

- Annual Anticipated Returns: 7.9%

Fortis is Canada’s largest investor-owned utility enterprise with operations in Canada, the US, and the Caribbean. It’s cross-listed in Toronto and New York.

Fortis is nearly 100% regulated with ~82% regulated electrical and ~17% regulated gasoline. As correctly, ~64% of its property are throughout the U.S., ~33% in Canada, and ~3% throughout the Caribbean. About 93% of its property are for transmission and distribution {of electrical} vitality or gasoline, which supply necessary suppliers, leading to resilient earnings by the monetary cycle.

Fortis reported Q1 2025 outcomes on 05/07/25. For the quarter, it reported web earnings of CAD$499 million, up 8.7% versus Q1 2024, whereas web earnings-per-share (EPS) bought right here in at C$1.00, up 7.5%.

Capital spending was C$1.4 billion for the quarter, on monitor for the plan of C$5.2 billion of capital funding for the 12 months.

After releasing its five-year capital plan of C$26 billion for 2025 to 2029, which suggests a mid-year worth base growth at a compound annual growth worth of 6.5% from C$38.8 billion in 2024 to C$53.0 billion in 2029, the company moreover maintained its dividend growth steering of 4-6% by 2029.

The capital plan incorporates investing in areas harking back to a greener know-how, improved grid, and a shift from fossil fuels to picture voltaic and wind know-how.

Click on on proper right here to acquire our most modern Sure Analysis report on FTS (preview of net web page 1 of three confirmed beneath):

Worldwide Dividend Aristocrat #8: Canadian Nationwide Railway (CNI)

- Consecutive Years Of Dividend Will enhance: 30

- Annual Anticipated Returns: 7.9%

Canadian Nationwide Railway is an important railway operator in Canada. The company has a neighborhood of roughly 20,000 route miles and connects three coasts: the Atlantic, the Pacific and the Gulf of Mexico. It handles over $200 billion worth of merchandise yearly and carries over 300 million tons of cargo.

On January thirtieth, 2025, Canadian Nationwide Railway elevated its dividend 5% for the March thirty first, 2025 value date.

On May 1st, 2025, Canadian Nationwide Railway reported first quarter outcomes. For the quarter, earnings grew 2.3% to $3.18 billion, which was $25 million better than anticipated. Adjusted earnings-per share of $1.40 in distinction favorably to $1.26 throughout the prior 12 months and was $0.12 above estimates.

For the quarter, Canadian Nationwide Railway’s working ratio improved 20 basis components to 63.4%. Earnings ton miles improved 1% from the prior 12 months whereas carloads declined 2.2%.

Earnings outcomes have been mixed for lots of the agency’s specific particular person product courses. Using fastened foreign exchange, Coal (+9%), Grain and Fertilizers (+7%), and Petroleum and Chemical compounds (+3%) have been all bigger for the interval.

Click on on proper right here to acquire our most modern Sure Analysis report on CNI (preview of net web page 1 of three confirmed beneath):

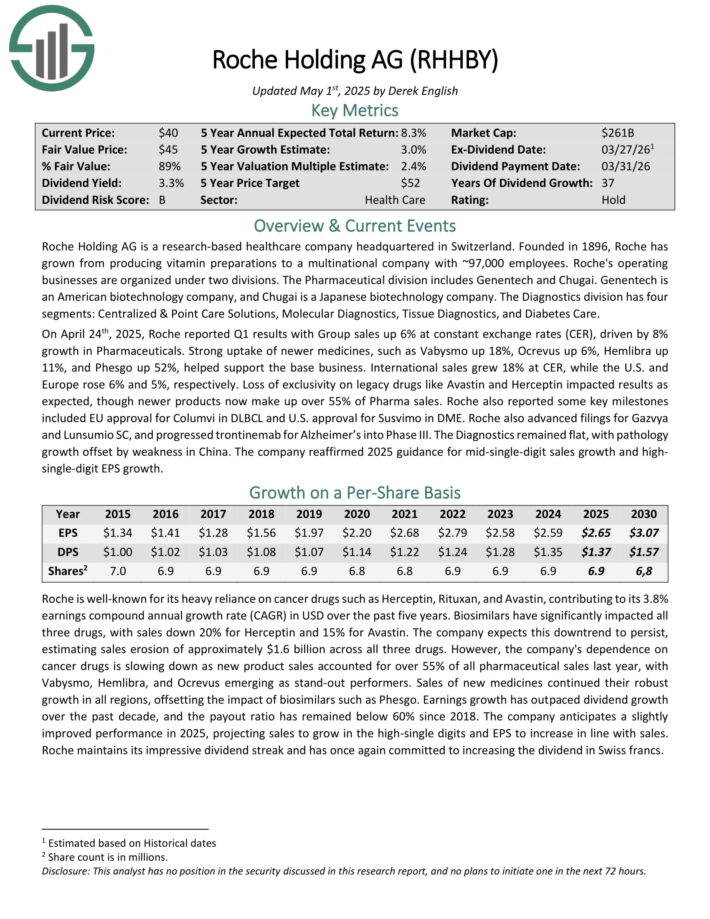

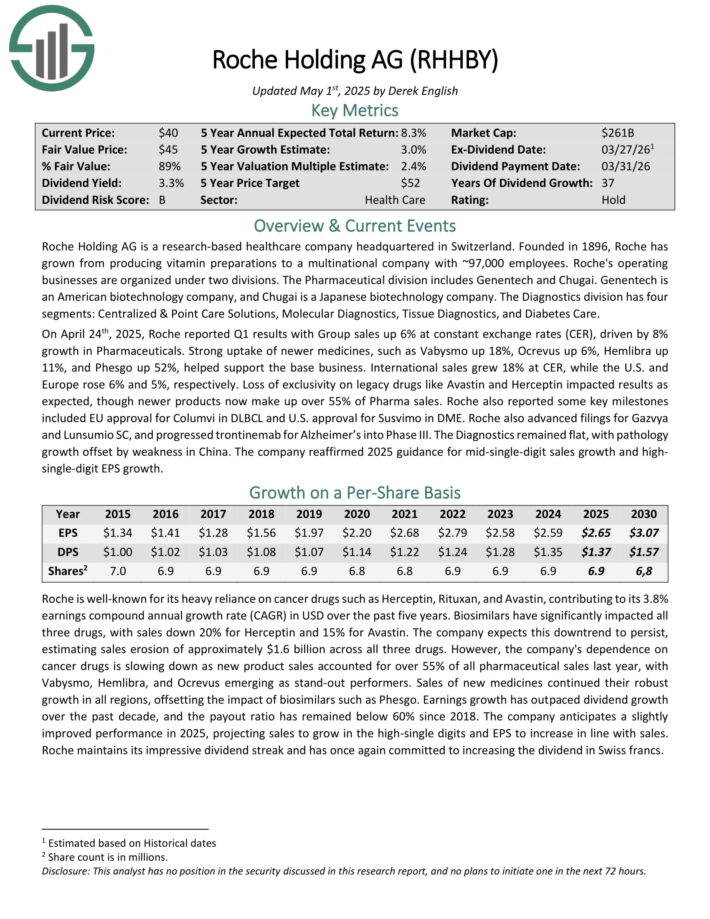

Worldwide Dividend Aristocrat #7: Roche Holding AG (RHHBY)

- Consecutive Years Of Dividend Will enhance: 37

- Annual Anticipated Returns: 8.4%

Roche Holding AG is a research-based healthcare agency headquartered in Switzerland. Primarily based in 1896, Roche has grown from producing vitamin preparations to a multinational agency with ~97,000 workers. Roche’s working corporations are organized beneath two divisions.

The Pharmaceutical division incorporates Genentech and Chugai. Genentech is an American biotechnology agency, and Chugai is a Japanese biotechnology agency. The Diagnostics division has 4 segments: Centralized & Degree Care Choices, Molecular Diagnostics, Tissue Diagnostics, and Diabetes Care.

On April twenty fourth, 2025, Roche reported Q1 outcomes with Group product sales up 6% at fastened commerce expenses (CER), pushed by 8% growth in Prescribed drugs. Sturdy uptake of newer medicines, harking back to Vabysmo up 18%, Ocrevus up 6%, Hemlibra up 11%, and Phesgo up 52%, helped help the underside enterprise.

Worldwide product sales grew 18% at CER, whereas the U.S. and Europe rose 6% and 5%, respectively. Lack of exclusivity on legacy treatment like Avastin and Herceptin impacted outcomes as anticipated, though newer merchandise now make up over 55% of Pharma product sales.

Roche moreover reported some key milestones included EU approval for Columvi in DLBCL and U.S. approval for Susvimo in DME. Roche moreover superior filings for Gazvya and Lunsumio SC, and progressed trontinemab for Alzheimer’s into Half III.

Click on on proper right here to acquire our most modern Sure Analysis report on RHHBY (preview of net web page 1 of three confirmed beneath):

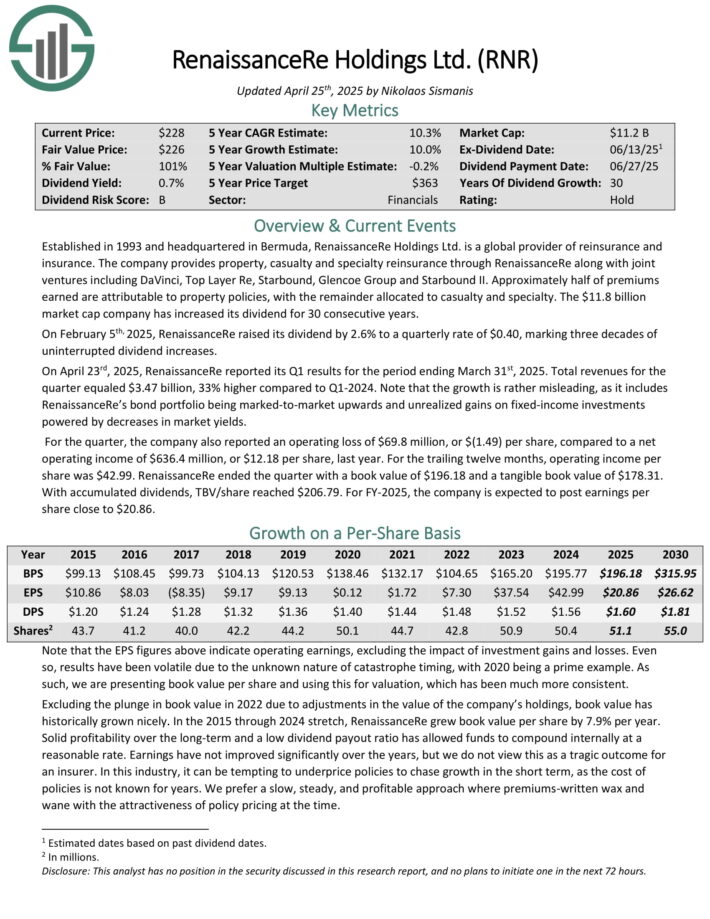

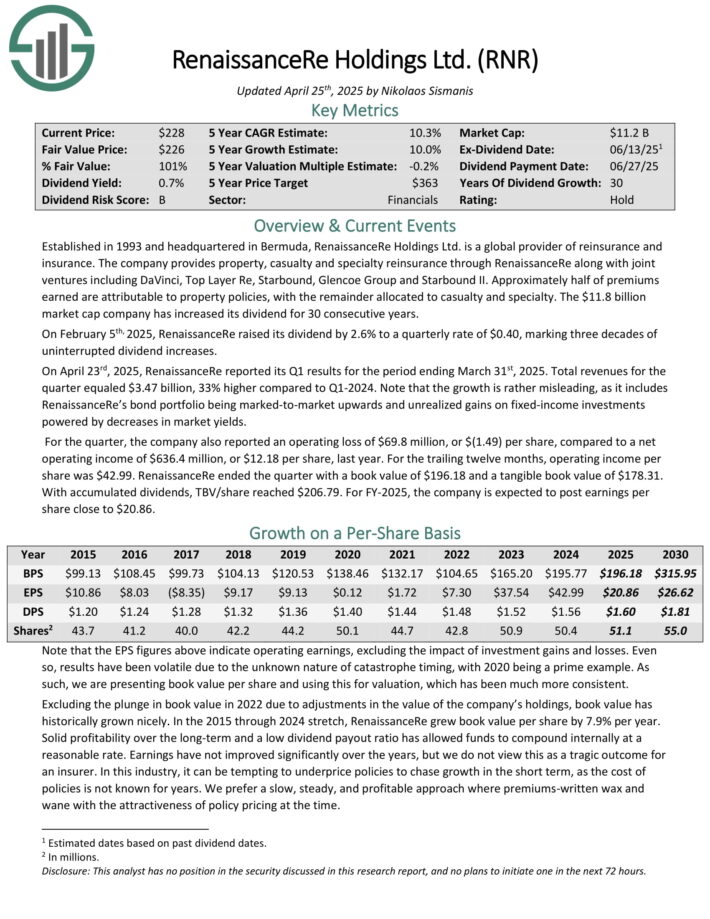

Worldwide Dividend Aristocrat #6: RenaissanceRe Holdings Ltd. (RNR)

- Consecutive Years Of Dividend Will enhance: 30

- Annual Anticipated Returns: 8.7%

Established in 1993 and headquartered in Bermuda, RenaissanceRe Holdings Ltd. is a worldwide provider of reinsurance and insurance coverage protection.

The company provides property, casualty and specialty reinsurance by RenaissanceRe along with joint ventures along with DaVinci, Excessive Layer Re, Starbound, Glencoe Group and Starbound II.

Roughly half of premiums earned are attributable to property insurance coverage insurance policies, with the remaining allotted to casualty and specialty.

On February fifth, 2025, RenaissanceRe raised its dividend by 2.6% to a quarterly worth of $0.40, marking three a very long time of uninterrupted dividend will enhance.

On April twenty third, 2025, RenaissanceRe reported its Q1 outcomes for the interval ending March thirty first, 2025. Complete revenues for the quarter equaled $3.47 billion, 33% bigger as compared with Q1-2024.

Phrase that the enlargement is sort of misleading, as a result of it incorporates RenaissanceRe’s bond portfolio being marked-to-market upwards and unrealized constructive components on fixed-income investments powered by decreases in market yields.

For the quarter, the company moreover reported an working lack of $69.8 million, or $(1.49) per share, as compared with a web working earnings of $636.4 million, or $12.18 per share, remaining 12 months.

Click on on proper right here to acquire our most modern Sure Analysis report on RNR (preview of net web page 1 of three confirmed beneath):

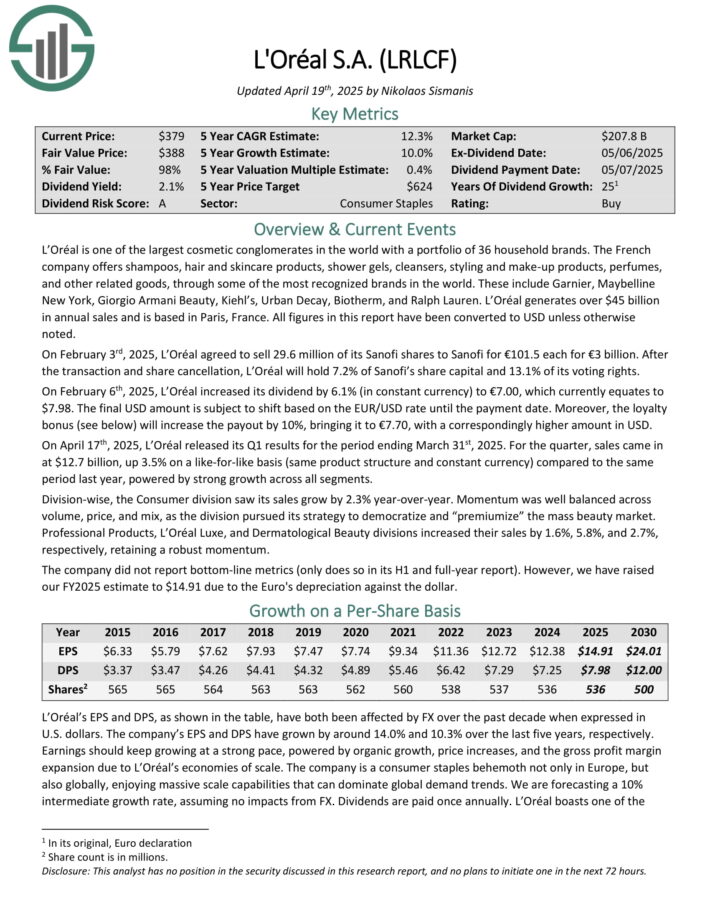

Worldwide Dividend Aristocrat #5: L’Oreal (LRLCF)

- Consecutive Years Of Dividend Will enhance: 25

- Annual Anticipated Returns: 10.1%

L’Oréal is among the many largest magnificence conglomerates on the earth with a portfolio of 36 household producers. The French agency presents shampoos, hair and skincare merchandise, bathe gels, cleansers, styling and make-up merchandise, perfumes, and completely different related objects, by a lot of essentially the most acknowledged producers on the earth.

These embody Garnier, Maybelline New York, Giorgio Armani Magnificence, Kiehl’s, Metropolis Decay, Biotherm, and Ralph Lauren. L’Oréal generates over $45 billion in annual product sales and depends in Paris, France. All figures on this report have been remodeled to USD till in some other case well-known.

On February third, 2025, L’Oréal agreed to advertise 29.6 million of its Sanofi shares to Sanofi for €101.5 each for €3 billion. After the transaction and share cancellation, L’Oréal will keep 7.2% of Sanofi’s share capital and 13.1% of its voting rights. On February sixth, 2025, L’Oréal elevated its dividend by 6.1% (in fastened foreign exchange) to €7.00.

On April seventeenth, 2025, L’Oréal launched its Q1 outcomes for the interval ending March thirty first, 2025. For the quarter, product sales bought right here in at $12.7 billion, up 3.5% on a like-for-like basis (comparable product development and stuck foreign exchange) as compared with the equivalent interval remaining 12 months, powered by sturdy growth all through all segments.

Click on on proper right here to acquire our most modern Sure Analysis report on LRLCF (preview of net web page 1 of three confirmed beneath):

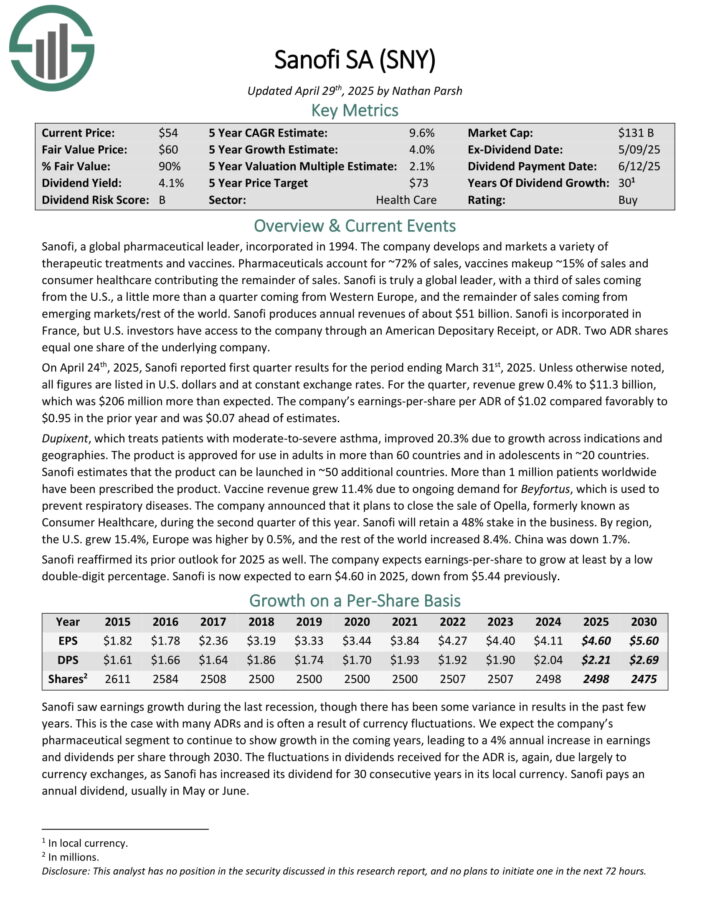

Worldwide Dividend Aristocrat #4: Sanofi (SNY)

- Consecutive Years Of Dividend Will enhance: 30

- Annual Anticipated Returns: 10.1%

Sanofi is a worldwide pharmaceutical agency that develops and markets various therapeutic therapies and vaccines. Prescribed drugs account for ~72% of product sales, vaccines make-up ~15% of product sales and shopper healthcare contributing the remainder of product sales.

Sanofi produces annual revenues of about $51 billion. It’s included in France, nevertheless U.S. merchants have entry to the company by an American Depositary Receipt, or ADR. Two ADR shares equal one share of the underlying agency.

On April twenty fourth, 2025, Sanofi reported first quarter outcomes for the interval ending March thirty first, 2025. Besides in some other case well-known, all figures are listed in U.S. {{dollars}} and at fastened commerce expenses.

For the quarter, earnings grew 0.4% to $11.3 billion, which was $206 million better than anticipated. The company’s earnings-per-share per ADR of $1.02 in distinction favorably to $0.95 throughout the prior 12 months and was $0.07 ahead of estimates.

Dupixent, which treats victims with moderate-to-severe bronchial bronchial asthma, improved 20.3% due to growth all through indications and geographies. The product is permitted for use in adults in further than 60 nations and in adolescents in ~20 nations. Sanofi estimates that the product might be launched in ~50 additional nations.

Vaccine earnings grew 11.4% due to ongoing demand for Beyfortus, which is used to forestall respiratory illnesses.

Click on on proper right here to acquire our most modern Sure Analysis report on SNY (preview of net web page 1 of three confirmed beneath):

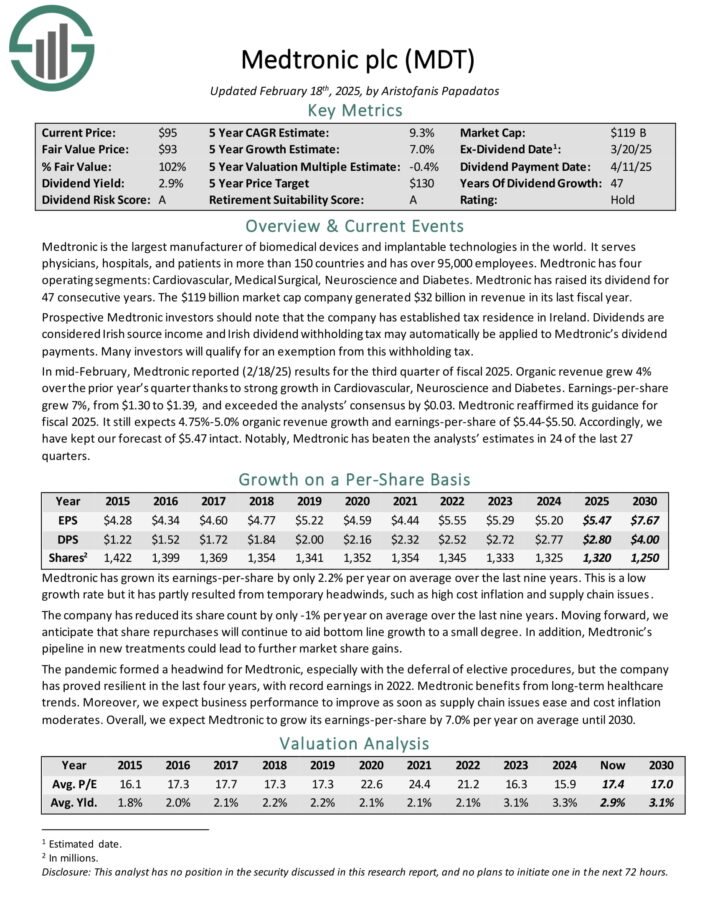

Worldwide Dividend Aristocrat #3: Medtronic plc (MDT)

- Consecutive Years Of Dividend Will enhance: 47

- Annual Anticipated Returns: 11.2%

Medtronic is an important producer of biomedical devices and implantable utilized sciences on the earth. It serves physicians, hospitals, and victims in further than 150 nations and has over 95,000 workers.

Medtronic has 4 working segments: Cardiovascular, Medical Surgical, Neuroscience and Diabetes. Medtronic has raised its dividend for 47 consecutive years. The company generated $32 billion in earnings in its remaining fiscal 12 months.

Potential Medtronic merchants ought to watch that the company has established tax residence in Ireland. Dividends are considered Irish provide earnings and Irish dividend withholding tax may routinely be utilized to Medtronic’s dividend funds. Many merchants will qualify for an exemption from this withholding tax.

In mid-February, Medtronic reported (2/18/25) outcomes for the third quarter of fiscal 2025. Pure earnings grew 4% over the prior 12 months’s quarter resulting from sturdy growth in Cardiovascular, Neuroscience and Diabetes.

Earnings-per-share grew 7%, from $1.30 to $1.39, and exceeded the analysts’ consensus by $0.03. Medtronic reaffirmed its steering for fiscal 2025. It nonetheless expects 4.75%-5.0% pure earnings growth and earnings-per-share of $5.44-$5.50.

Click on on proper right here to acquire our most modern Sure Analysis report on MDT (preview of net web page 1 of three confirmed beneath):

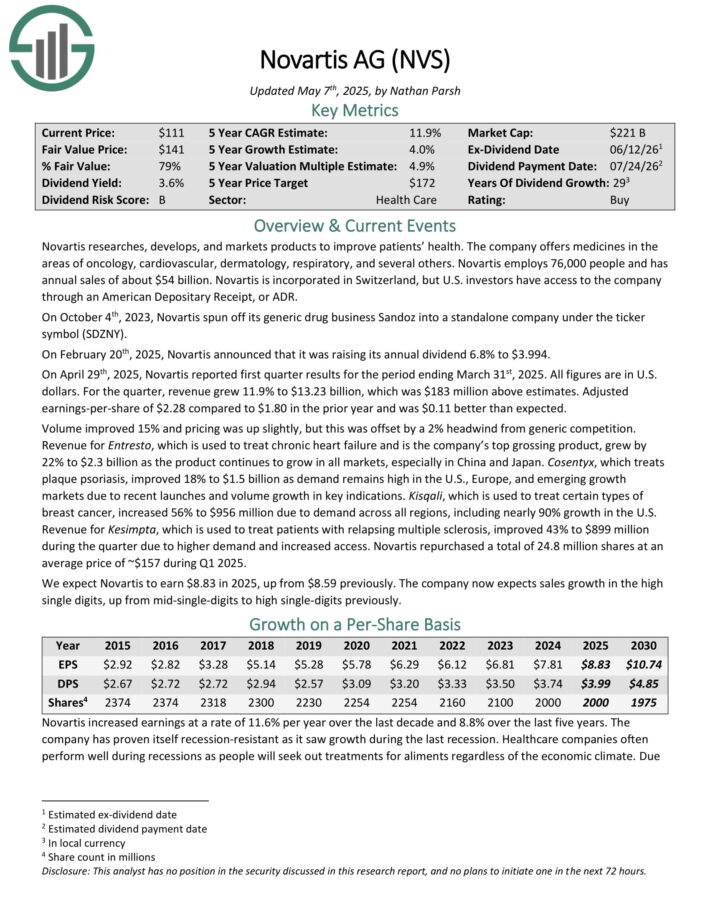

Worldwide Dividend Aristocrat #2: Novartis AG (NVS)

- Consecutive Years Of Dividend Will enhance: 29

- Annual Anticipated Returns: 11.5%

Novartis researches, develops, and markets merchandise to reinforce victims’ nicely being. The company presents medicines throughout the areas of oncology, cardiovascular, dermatology, respiratory, and several other different others. Novartis employs 76,000 people and has annual product sales of about $54 billion.

Novartis is included in Switzerland, nevertheless U.S. merchants have entry to the company by an American Depositary Receipt, or ADR.

On February twentieth, 2025, Novartis launched that it was elevating its annual dividend 6.8% to $3.994.

On April twenty ninth, 2025, Novartis reported first quarter outcomes. All figures are in U.S. {{dollars}}. For the quarter, earnings grew 11.9% to $13.23 billion, which was $183 million above estimates. Adjusted earnings-per-share of $2.28 as compared with $1.80 throughout the prior 12 months and was $0.11 greater than anticipated.

Amount improved 15% and pricing was up barely, nevertheless this was offset by a 2% headwind from generic opponents. Earnings for Entresto, which is used to take care of continuous coronary coronary heart failure and is the company’s excessive grossing product, grew by 22% to $2.3 billion as a result of the product continues to develop in all markets, notably in China and Japan.

Cosentyx, which treats plaque psoriasis, improved 18% to $1.5 billion as demand stays extreme throughout the U.S., Europe, and rising growth markets due to newest launches and amount growth in key indications..

Click on on proper right here to acquire our most modern Sure Analysis report on NVS (preview of net web page 1 of three confirmed beneath):

Worldwide Dividend Aristocrat #1: Novo Nordisk (NVO)

- Consecutive Years Of Dividend Will enhance: 29

- Annual Anticipated Returns: 18.8%

Novo Nordisk A/S ADR is an enormous world pharmaceutical agency headquartered in Denmark. The company focuses on two core enterprise segments: Diabetes & Weight issues Care and Unusual Diseases.

The Diabetes & Weight issues Care part manufactures insulin, related provide strategies, oral anti-diabetic merchandise, and merchandise to take care of weight issues. The Unusual Diseases part manufactures merchandise for hemophilia and completely different continuous illnesses. Novo Nordisk derives ~92% of earnings from diabetes and weight issues.

Novo Nordisk reported wonderful Q1 2025 outcomes on May seventh, 2025. Agency-wide product sales have been up 19% in Danish kroner to and diluted earnings per share (“EPS”) rose 15% on a year-over-year basis.

Diabetes & Weight issues product sales elevated 21% pushed by will enhance in Ozempic and Rybelsus (GLP-1), Wegovy (weight issues), long-acting insulin, and fast-acting insulin, offset by lower product sales for premix insulin, Saxenda (weight issues), Victoza (GLP-1), and flat human insulin.

The Unusual Sickness part product sales rose 5% attributable to rising unusual blood and endocrine issues treatment. The company is growing its blockbuster GLP-1 and weight issues treatment to completely different indications and dosing sizes.

The company lowered its outlook to 13 – 21% product sales growth and 16%- 24% working income growth in 2025.

Click on on proper right here to acquire our most modern Sure Analysis report on NVO (preview of net web page 1 of three confirmed beneath):

Additional Learning

The following Sure Dividend databases embrace primarily essentially the most reliable dividend growers in our funding universe:

In case you’re trying to find shares with distinctive dividend traits, ponder the subsequent Sure Dividend databases:

Thanks for learning this textual content. Please ship any solutions, corrections, or inquiries to [email protected].

rn

rn

Source link ","creator":{"@sort":"Particular person","title":"Index Investing Information","url":"https://indexinvestingnews.com/creator/projects666/","sameAs":["https://indexinvestingnews.com"]},"articleSection":["Investing"],"picture":{"@sort":"ImageObject","url":"https://www.suredividend.com/wp-content/uploads/2022/10/Dividend-Aristocrats-Picture-150x150.png","width":0,"top":0},"writer":{"@sort":"Group","title":"","url":"https://indexinvestingnews.com","emblem":{"@sort":"ImageObject","url":""},"sameAs":["https://www.facebook.com/Index-Investing-News-102075432474739","https://twitter.com/IndexInvesting_"]}}

Source link

:max_bytes(150000):strip_icc()/Health-GettyImages-1500717013-55fe4215d03a41e7b6de916b9afe1f37.jpg)