Current uncertainty over modifications in U.S. tariff coverage are at the moment weighing on the worth of the U.S. Greenback relative to different main currencies. The so-called “Trump tariffs” have additionally raised issues that, long-term, these tariffs might threaten the U.S. Greenback’s reserve forex standing.

But whereas President Trump’s tariff coverage modifications are a attainable long-term damaging for the U.S. Greenback and its dominance, this could possibly be countered by ongoing modifications to U.S. cryptocurrency coverage and laws.

A minimum of, per the President’s personal statements on his efforts to assist the expansion of the crypto {industry}, made weeks previous to final month’s “Liberation Day” tariff hike announcement. Though there’s been little out of the White Home concerning crypto since speak about tariffs took heart stage, one other wave of change for the crypto house could also be simply across the nook.

That’s the view of Binance CEO Richard Teng, who not too long ago spoke on the matter, and its potential affect on the {industry}. Specifically, the following wave of proposed laws might assist speed up institutional adoption of Bitcoin and different cryptocurrency belongings, which can in flip have a constructive affect on costs.

Teng’s Current Remarks Give Credence to Optimistic View

Trump could not have been obscure on the subject of latest cryptocurrency-related coverage modifications and laws pushed by his administration, however the above-mentioned dialog on this matter by Teng could give credence to an optimistic view on the additional institutional adoption of Bitcoin and different cryptos.

Whereas attending the Token2049 convention late final month, Teng was interviewed by UAE-based publication The Nationwide. Within the interview, the Binance CEO mentioned how he has not too long ago met with U.S. regulators and different key authorities officers. Following these conferences Teng explains his outlook and timeline, “The brand new efforts and optimism may be very actual within the US. So, I imagine the US goes to return out with very enlightened, pro-industry and sensible laws that assist the {industry} but in addition manages the danger on the similar time. So that you’re in all probability going to see a few of the new laws coming by means of by August this yr.

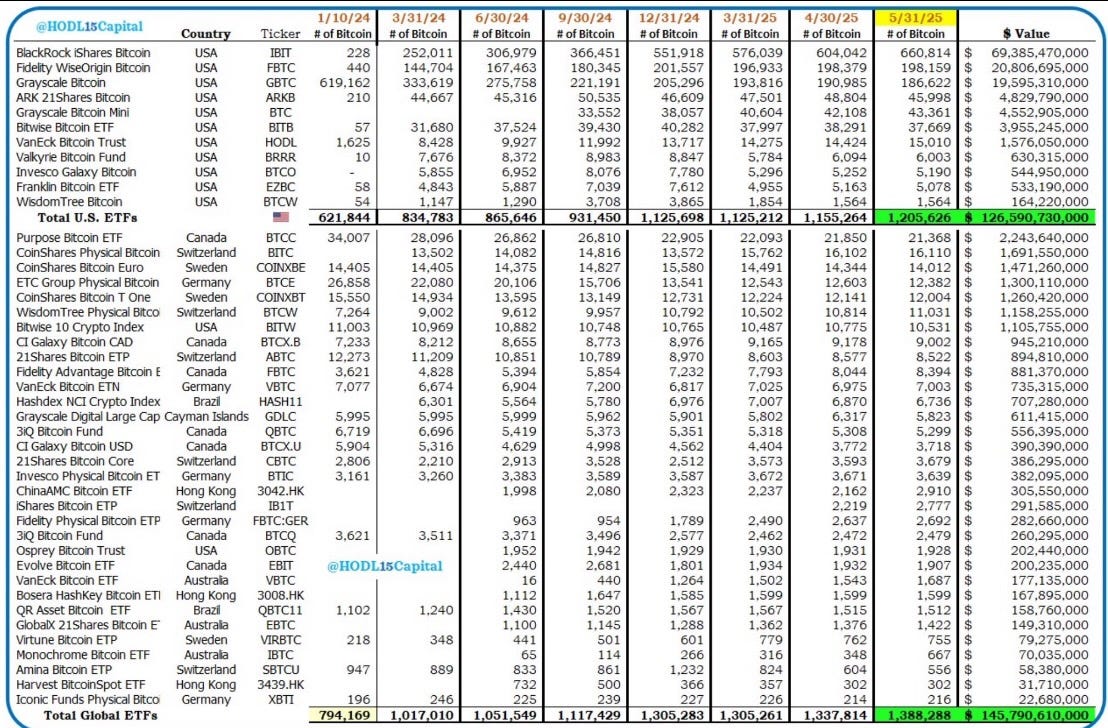

Prior pro-growth regulatory modifications, such because the approval of spot Bitcoin exchange-traded funds (ETFs), have led to an embracing of crypto by main monetary establishments like BlackRock. With this, Teng believes that subsequent clear-cut regulatory implementations will end in an extra wave of institutional adoption.

In flip, the constructive affect of buyers starting from household workplaces to main banks “making an attempt to get energetic into the house” might function a long-term constructive that can counter the short-term worry and uncertainty at the moment weighing on the house.

Professional-Crypto Agenda Nonetheless Prime of Thoughts for The Trump Administration

Once more, tariffs could also be on the high of the Trump administration’s forex agenda, however it’s not as if crypto has absolutely fallen onto the again burner. Based mostly on the President’s March statements on the subject of cryptocurrency regulatory modifications, it’s clear {that a} pro-crypto agenda stays high of thoughts amongst Trump and his administration.

Through a pre-recorded video performed on the Digital Asset Summit 2025 in New York on March 20, Trump shared his imaginative and prescient for America’s position in cultivating the additional development of crypto and the blockchain economic system. Talking glowingly of crypto {industry} leaders, the President said that the {industry} stood to “enhance our banking and fee system.”

In flip, this could “promote higher privateness, security, safety, and wealth” for all People, resulting in “an explosion of financial development.” Trump additionally touched on stablecoins, particularly how stablecoins pegged to the U.S. Greenback might assist “broaden the dominance” of the world’s major reserve forex.

Touting his personal efforts to make this imaginative and prescient a actuality, the president famous how his administration has ended the “final administration’s regulatory warfare on crypto and Bitcoin,” mentioning the collection of pro-growth coverage modifications his administration has applied since January. Whereas Trump didn’t present a lot element about upcoming modifications in U.S. cryptocurrency laws and coverage in his speech, such sweeping change stays on the horizon.

The Backside Line

In terms of Trump’s March statements on America’s position in the way forward for crypto, it could be greatest to take some parts of it with a grain of salt, however different parts at face worth. Solely time will inform whether or not stablecoins might function a constructive for the U.S. Greenback dominance, particularly as tariff modifications, if saved in place, speed up a shift from American hegemony, to a extra multipolar world.

Nevertheless, making an allowance for Richard Teng’s latest remarks, the Trump administration is ready to unleash one other game-changer for crypto later this yr, as pro-growth regulatory modifications spur one other main inflow of institutional capital into Bitcoin and different cryptocurrency belongings.

Current uncertainty over modifications in U.S. tariff coverage are at the moment weighing on the worth of the U.S. Greenback relative to different main currencies. The so-called “Trump tariffs” have additionally raised issues that, long-term, these tariffs might threaten the U.S. Greenback’s reserve forex standing.

But whereas President Trump’s tariff coverage modifications are a attainable long-term damaging for the U.S. Greenback and its dominance, this could possibly be countered by ongoing modifications to U.S. cryptocurrency coverage and laws.

A minimum of, per the President’s personal statements on his efforts to assist the expansion of the crypto {industry}, made weeks previous to final month’s “Liberation Day” tariff hike announcement. Though there’s been little out of the White Home concerning crypto since speak about tariffs took heart stage, one other wave of change for the crypto house could also be simply across the nook.

That’s the view of Binance CEO Richard Teng, who not too long ago spoke on the matter, and its potential affect on the {industry}. Specifically, the following wave of proposed laws might assist speed up institutional adoption of Bitcoin and different cryptocurrency belongings, which can in flip have a constructive affect on costs.

Teng’s Current Remarks Give Credence to Optimistic View

Trump could not have been obscure on the subject of latest cryptocurrency-related coverage modifications and laws pushed by his administration, however the above-mentioned dialog on this matter by Teng could give credence to an optimistic view on the additional institutional adoption of Bitcoin and different cryptos.

Whereas attending the Token2049 convention late final month, Teng was interviewed by UAE-based publication The Nationwide. Within the interview, the Binance CEO mentioned how he has not too long ago met with U.S. regulators and different key authorities officers. Following these conferences Teng explains his outlook and timeline, “The brand new efforts and optimism may be very actual within the US. So, I imagine the US goes to return out with very enlightened, pro-industry and sensible laws that assist the {industry} but in addition manages the danger on the similar time. So that you’re in all probability going to see a few of the new laws coming by means of by August this yr.

Prior pro-growth regulatory modifications, such because the approval of spot Bitcoin exchange-traded funds (ETFs), have led to an embracing of crypto by main monetary establishments like BlackRock. With this, Teng believes that subsequent clear-cut regulatory implementations will end in an extra wave of institutional adoption.

In flip, the constructive affect of buyers starting from household workplaces to main banks “making an attempt to get energetic into the house” might function a long-term constructive that can counter the short-term worry and uncertainty at the moment weighing on the house.

Professional-Crypto Agenda Nonetheless Prime of Thoughts for The Trump Administration

Once more, tariffs could also be on the high of the Trump administration’s forex agenda, however it’s not as if crypto has absolutely fallen onto the again burner. Based mostly on the President’s March statements on the subject of cryptocurrency regulatory modifications, it’s clear {that a} pro-crypto agenda stays high of thoughts amongst Trump and his administration.

Through a pre-recorded video performed on the Digital Asset Summit 2025 in New York on March 20, Trump shared his imaginative and prescient for America’s position in cultivating the additional development of crypto and the blockchain economic system. Talking glowingly of crypto {industry} leaders, the President said that the {industry} stood to “enhance our banking and fee system.”

In flip, this could “promote higher privateness, security, safety, and wealth” for all People, resulting in “an explosion of financial development.” Trump additionally touched on stablecoins, particularly how stablecoins pegged to the U.S. Greenback might assist “broaden the dominance” of the world’s major reserve forex.

Touting his personal efforts to make this imaginative and prescient a actuality, the president famous how his administration has ended the “final administration’s regulatory warfare on crypto and Bitcoin,” mentioning the collection of pro-growth coverage modifications his administration has applied since January. Whereas Trump didn’t present a lot element about upcoming modifications in U.S. cryptocurrency laws and coverage in his speech, such sweeping change stays on the horizon.

The Backside Line

In terms of Trump’s March statements on America’s position in the way forward for crypto, it could be greatest to take some parts of it with a grain of salt, however different parts at face worth. Solely time will inform whether or not stablecoins might function a constructive for the U.S. Greenback dominance, particularly as tariff modifications, if saved in place, speed up a shift from American hegemony, to a extra multipolar world.

Nevertheless, making an allowance for Richard Teng’s latest remarks, the Trump administration is ready to unleash one other game-changer for crypto later this yr, as pro-growth regulatory modifications spur one other main inflow of institutional capital into Bitcoin and different cryptocurrency belongings.