Revealed on Might 14th, 2025 by Bob Ciura

We’ve just one promote rule within the Certain Passive Revenue E-newsletter.

That one rule is to promote when a inventory breaks its streak of consecutive annual dividend will increase. This happens when a inventory does any of the next:

- Fails to extend its dividend (flat year-over-year-dividends)

- Reduces its dividend (declining year-over-year dividends)

- Eliminates its dividend

This implies dividend coverage totally dictates after we promote.

The last word purpose of the Certain Passive Revenue E-newsletter, and dividend development investing typically, is to understand dividend development over time (because the title implies).

As long as dividends are growing, we wish to purchase and maintain endlessly. Having further promoting standards can intervene with the long-term dividend compounding of any earlier purchase.

For that reason, we suggest dividend development buyers deal with shares with lengthy histories of accelerating dividends annually.

A main instance is the Dividend Aristocrats, a choose group of 69 S&P 500 shares with 25+ years of consecutive dividend will increase.

There are at present 69 Dividend Aristocrats. You possibly can obtain an Excel spreadsheet of all 69 Dividend Aristocrats (with metrics that matter akin to dividend yields and price-to-earnings ratios) by clicking the hyperlink under:

Disclaimer: Certain Dividend just isn’t affiliated with S&P International in any manner. S&P International owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet relies on Certain Dividend’s personal evaluate, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person buyers higher perceive this ETF and the index upon which it’s based mostly. Not one of the data on this article or spreadsheet is official information from S&P International. Seek the advice of S&P International for official data.

However when a inventory fails to generate dividend development, it isn’t doing what we bought it for.

For a dividend development investor, promoting a inventory that isn’t rising its dividend is rather a lot like disposing of a fridge that doesn’t preserve meals chilly – in both case, the rationale you acquire is not legitimate.

This text will focus on 10 dividend shares that will have engaging yields, however don’t have dividend development–that means buyers centered solely on rising earnings ought to take into account promoting.

The record is sorted by present yield, from lowest to highest.

Desk of Contents

You possibly can immediately leap to any particular part of the article by utilizing the hyperlinks under:

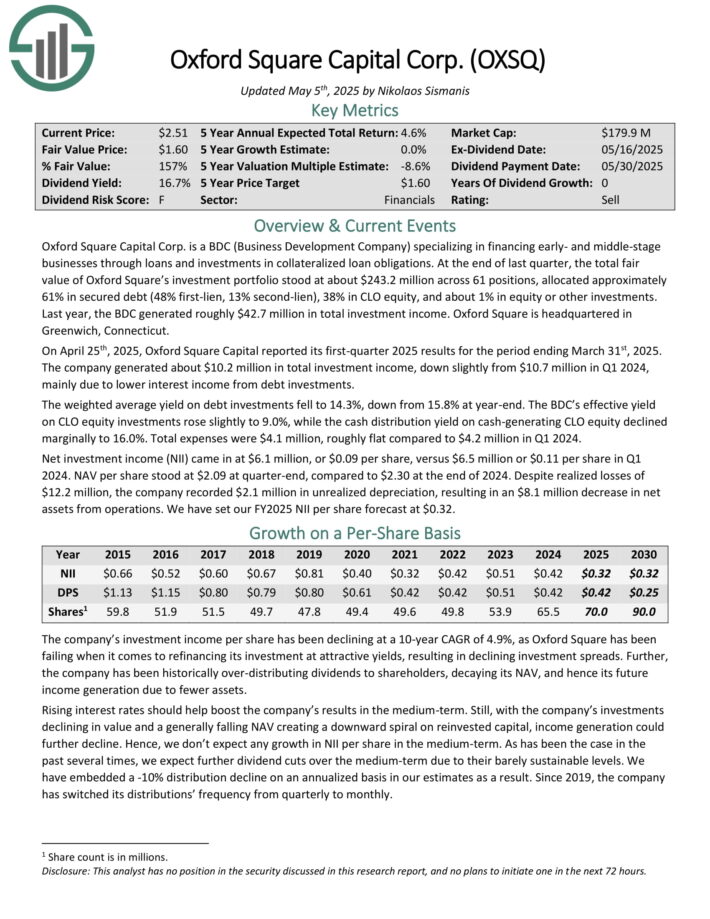

Excessive Dividend Inventory To Think about Promoting #10: Oxford Sq. Capital (OXSQ)

Oxford Sq. Capital Corp. is a BDC (Enterprise Improvement Firm) specializing in financing early- and middle-stage companies by means of loans and investments in collateralized mortgage obligations.

On the finish of final quarter, the whole honest worth of Oxford Sq.’s funding portfolio stood at about $243.2 million throughout 61 positions, allotted roughly 61% in secured debt (48% first-lien, 13% second-lien), 38% in CLO fairness, and about 1% in fairness or different investments. Final yr, the BDC generated roughly $42.7 million in complete funding earnings.

On April twenty fifth, 2025, Oxford Sq. Capital reported its first-quarter 2025 outcomes for the interval ending March thirty first, 2025. The corporate generated about $10.2 million in complete funding earnings, down barely from $10.7 million in Q1 2024, primarily resulting from decrease curiosity earnings from debt investments.

The weighted common yield on debt investments fell to 14.3%, down from 15.8% at year-end. The BDC’s efficient yield on CLO fairness investments rose barely to 9.0%, whereas the money distribution yield on cash-generating CLO fairness declined marginally to 16.0%. Whole bills have been $4.1 million, roughly flat in comparison with $4.2 million in Q1 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on OXSQ (preview of web page 1 of three proven under):

Excessive Dividend Inventory To Think about Promoting #9: Xerox Company (XRX)

Xerox Company traces its lineage again to 1906 when The Haloid Photographic Firm started manufacturing photographic paper and gear. By means of a collection of mergers and spinoffs, the Xerox we all know at this time was fashioned.

Xerox spun off its enterprise processing unit in 2017 (now known as Conduent) and now focuses on design, improvement, and gross sales of doc administration techniques.

In February, the corporate lower its quarterly dividend by 50%.

Xerox reported first quarter monetary outcomes on Might 1st. Quarterly income of $1.46 billion missed estimates by $60 million. Adjusted earnings-per-share of -$0.06 per share missed analyst estimates by $0.03 per share.

Click on right here to obtain our most up-to-date Certain Evaluation report on XRX (preview of web page 1 of three proven under):

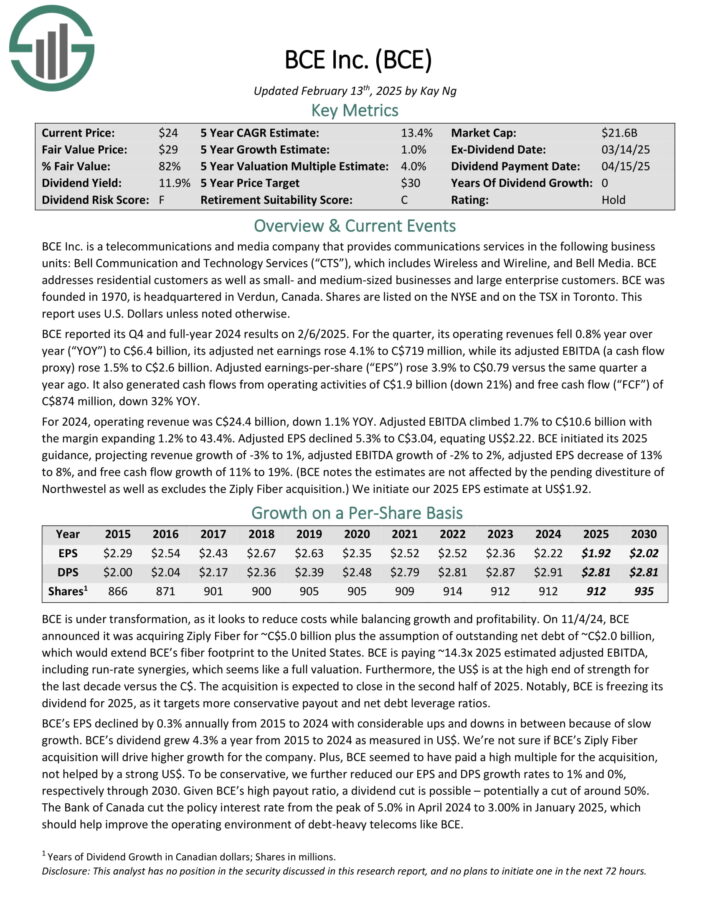

Excessive Dividend Inventory To Think about Promoting #8: BCE Inc. (BCE)

BCE Inc. is a telecommunications and media firm that gives communications companies within the following enterprise models: Bell Communication and Expertise Companies (“CTS”), which incorporates Wi-fi and Wireline, and Bell Media.

BCE addresses residential prospects in addition to small- and medium-sized companies and huge enterprise prospects. BCE was based in 1970, is headquartered in Verdun, Canada. Shares are listed on the NYSE and on the TSX in Toronto.

BCE reported its This fall and full-year 2024 outcomes on 2/6/2025. For the quarter, its working revenues fell 0.8% yr over yr (“YOY”) to C$6.4 billion, its adjusted internet earnings rose 4.1% to C$719 million, whereas its adjusted EBITDA (a money move proxy) rose 1.5% to C$2.6 billion.

Adjusted earnings-per-share (“EPS”) rose 3.9% to C$0.79 versus the identical quarter a yr in the past. It additionally generated money flows from working actions of C$1.9 billion (down 21%) and free money move (“FCF”) of C$874 million, down 32% YOY.

For 2024, working income was C$24.4 billion, down 1.1% YOY. Adjusted EBITDA climbed 1.7% to C$10.6 billion with the margin increasing 1.2% to 43.4%. Adjusted EPS declined 5.3%.

In Might, BCE lower its dividend by 56%.

Click on right here to obtain our most up-to-date Certain Evaluation report on BCE (preview of web page 1 of three proven under):

Excessive Dividend Inventory To Think about Promoting #7: Prospect Capital (PSEC)

Prospect Capital Company is a Enterprise Improvement Firm, or BDC, that gives personal debt and personal fairness to center–market firms within the U.S.

The corporate focuses on direct lending to proprietor–operated firms, in addition to sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional fairness investments.

Prospect posted second quarter earnings on February tenth, 2025, and outcomes have been considerably weak. Internet funding earnings per-share acme to twenty cents, whereas complete funding earnings fell from $211 million to $185 million year-over-year.

NII per-share fell from 21 cents in Q1, and 24 cents from the year-ago interval. Whole curiosity earnings was $169 million for the quarter, down from $185 million within the prior quarter, and $195 million a yr in the past. It additionally missed estimates by about $2 million.

Whole originations have been $135 million, down sharply from $291 million within the earlier quarter. Whole funds and gross sales have been $383 million, up from $282 million in Q1.

Click on right here to obtain our most up-to-date Certain Evaluation report on PSEC (preview of web page 1 of three proven under):

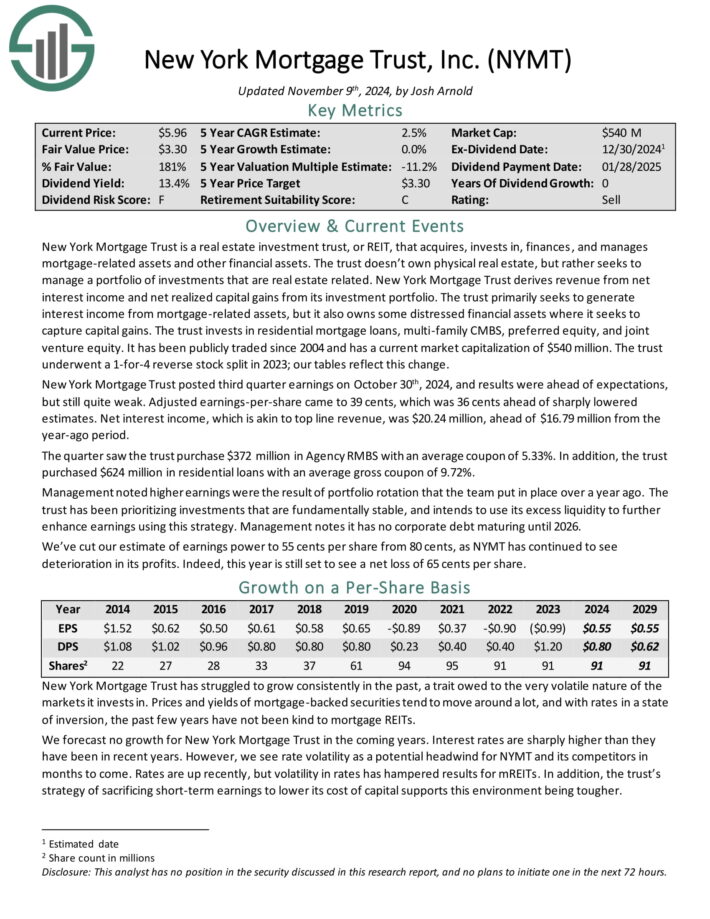

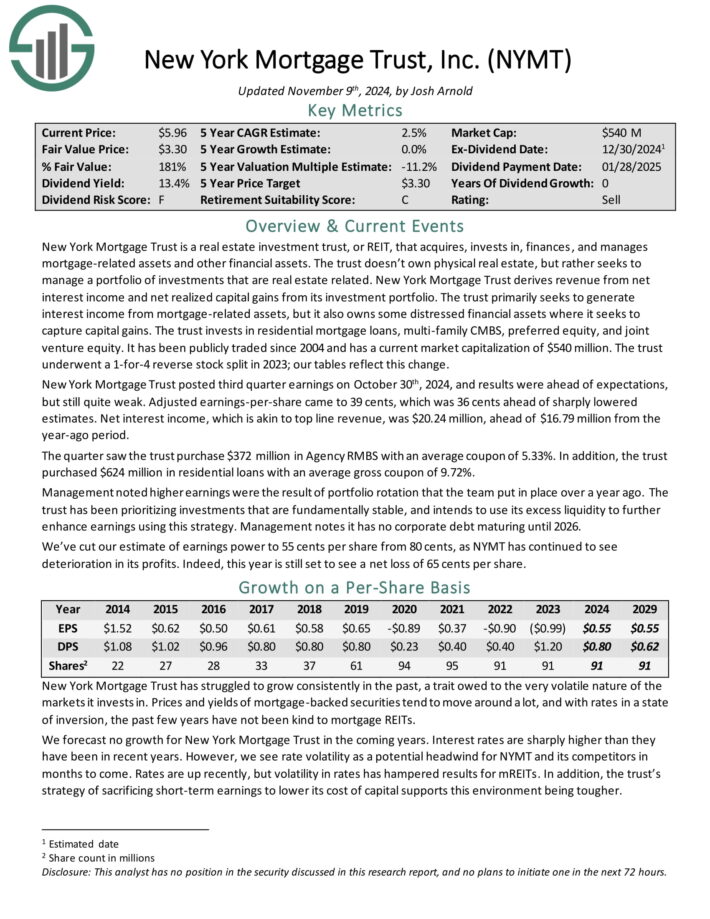

Excessive Dividend Inventory To Think about Promoting #6: New York Mortgage Belief (NYMT)

New York Mortgage Belief acquires, invests in, funds, and manages mortgage-related belongings and different monetary belongings. The belief doesn’t personal bodily actual property, however somewhat seeks to handle a portfolio of investments which are actual property associated.

The belief invests in residential mortgage loans, multi household CMBS, most well-liked fairness, and three way partnership fairness.

New York Mortgage Belief posted third quarter earnings on October thirtieth, 2024, and outcomes have been forward of expectations, however nonetheless fairly weak.

Adjusted earnings-per-share got here to 39 cents, which was 36 cents forward of sharply lowered estimates. Internet curiosity earnings, which is akin to prime line income, was $20.24 million, forward of $16.79 million from the year-ago interval.

The quarter noticed the belief buy $372 million in Company RMBS with a median coupon of 5.33%. As well as, the belief bought $624 million in residential loans with a median gross coupon of 9.72%.

Click on right here to obtain our most up-to-date Certain Evaluation report on NYMT (preview of web page 1 of three proven under):

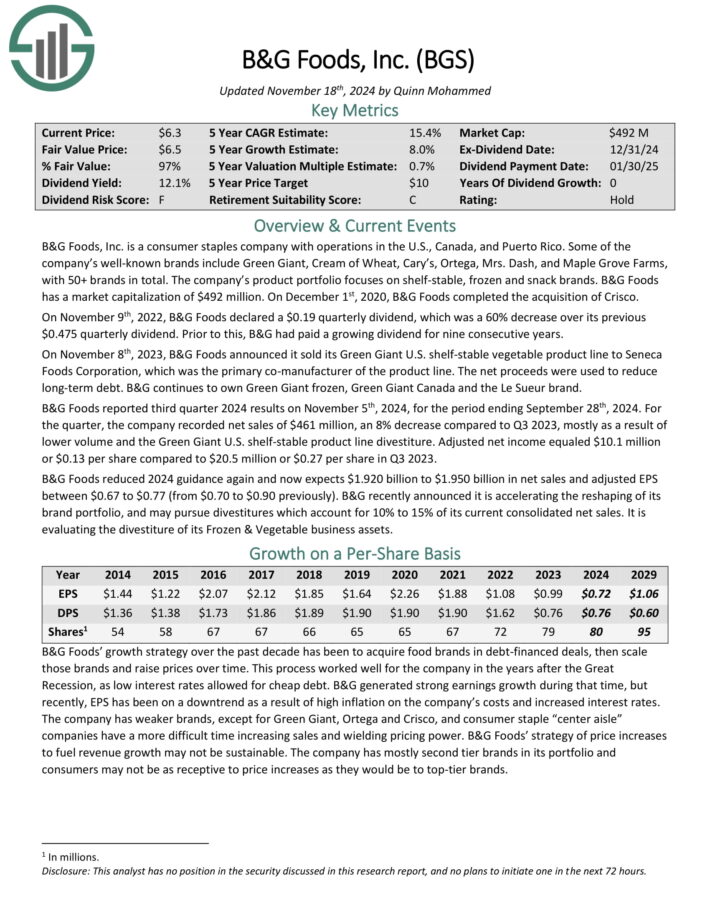

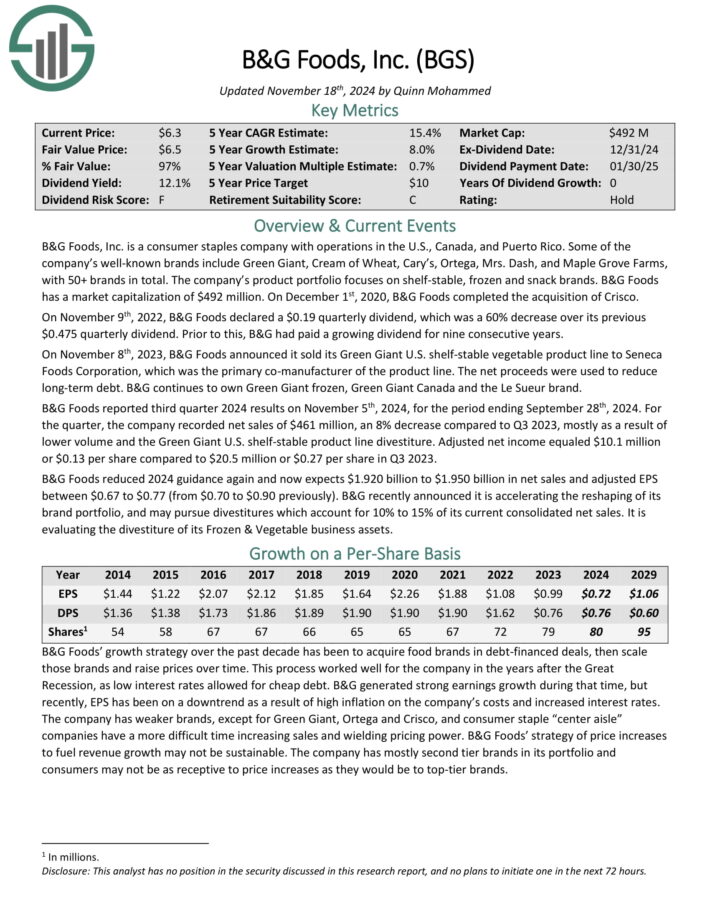

Excessive Dividend Inventory To Think about Promoting #5: B&G Meals, Inc. (BGS)

B&G Meals, Inc. is a shopper staples firm with operations within the U.S., Canada, and Puerto Rico. A number of the firm’s well-known manufacturers embrace Inexperienced Big, Cream of Wheat, Cary’s, Ortega, Mrs. Sprint, and Maple Grove Farms, with 50+ manufacturers in complete.

It product portfolio focuses on shelf-stable, frozen and snack manufacturers. On December 1st, 2020, B&G Meals accomplished the acquisition of Crisco.

B&G Meals reported first-quarter monetary outcomes on Might seventh. For the quarter, the corporate recorded internet gross sales of $425 million, which missed analyst estimates by $10.4 million. Adjusted earnings-per-share of $0.04 missed estimates, which known as for $0.08 per share.

The corporate revised full-year steering, now anticipating 2025 income of $1.86 billion to $1.91 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on BGS (preview of web page 1 of three proven under):

Excessive Dividend Inventory To Think about Promoting #4: ARMOUR Residential REIT (ARR)

ARMOUR Residential invests in residential mortgage-backed securities that embrace U.S. Authorities-sponsored entities (GSE) akin to Fannie Mae and Freddie Mac.

It additionally contains Ginnie Mae, the Authorities Nationwide Mortgage Administration’s issued or assured securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate residence loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, cash market devices, and non-GSE or authorities agency-backed securities are examples of different varieties of investments.

Within the fourth quarter of 2024, ARMOUR Residential REIT, Inc. reported a GAAP internet lack of $49.4 million, or $0.83 per frequent share. Regardless of this, the corporate achieved distributable earnings of $46.5 million, equating to $0.78 per frequent share, which fell wanting the anticipated $0.97. Internet curiosity earnings for the quarter was $12.7 million.

Throughout this era, ARMOUR raised roughly $136.2 million by means of the issuance of about 7.2 million shares through an on the market providing program. The corporate maintained its month-to-month frequent inventory dividend at $0.24 per share, totaling $0.72 for the quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on ARMOUR Residential REIT Inc (ARR) (preview of web page 1 of three proven under):

Excessive Dividend Inventory To Think about Promoting #3: Kohl’s Company (KSS)

Kohl’s traces its roots again to a single retailer: Kohl’s Division Retailer in 1962. Since then, it has grown into a frontrunner within the house – providing girls’s, males’s and youngsters’s attire, housewares, equipment, and footwear in additional than 1,100 shops in 49 states. The corporate ought to generate roughly $16 billion in gross sales this yr.

From 2007 by means of 2018, Kohl’s was capable of develop earnings-per-share by about 4.7% yearly. Nevertheless, it ought to be famous that this was pushed by the corporate’s intensive share repurchase program. Over that interval the share depend was practically halved, a discount fee of -5.6% per yr.

With the share repurchase program having been paused, we don’t see that as a tailwind in the meanwhile. Fears of struggling margins have confirmed to be proper, because the previous few years have seen declining profitability. We observe that 2021’s earnings has the potential to be the highest for a while.

In March, Kohl’s lower its quarterly dividend by 75%.

Click on right here to obtain our most up-to-date Certain Evaluation report on KSS (preview of web page 1 of three proven under):

Excessive Dividend Inventory To Think about Promoting #2: Orchid Island Capital (ORC)

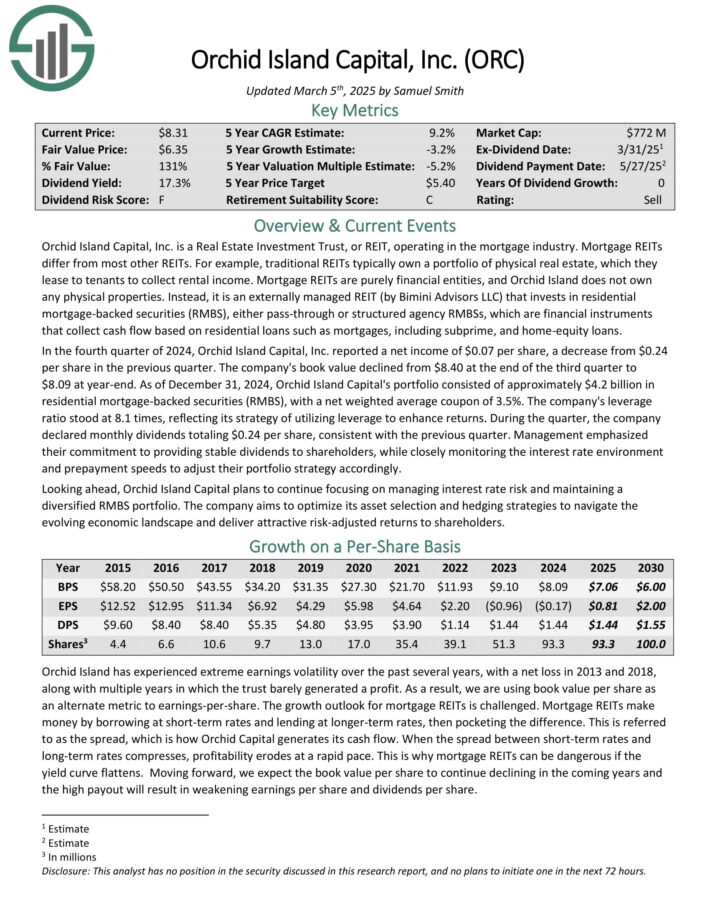

Orchid Island Capital is a mortgage REIT that’s externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), together with pass-through and structured company RMBSs.

These monetary devices generate money move based mostly on residential loans akin to mortgages, subprime, and home-equity loans.

Within the fourth quarter of 2024, Orchid Island Capital, Inc. reported a internet earnings of $0.07 per share, a lower from $0.24 per share within the earlier quarter. The corporate’s e-book worth declined from $8.40 on the finish of the third quarter to $8.09 at year-end.

As of December 31, 2024, Orchid Island Capital’s portfolio consisted of roughly $4.2 billion in residential mortgage-backed securities (RMBS), with a internet weighted common coupon of three.5%. The corporate’s leverage ratio stood at 8.1 instances, reflecting its technique of using leverage to reinforce returns.

Click on right here to obtain our most up-to-date Certain Evaluation report on Orchid Island Capital, Inc. (ORC) (preview of web page 1 of three proven under):

Excessive Dividend Inventory To Think about Promoting #1: Icahn Enterprises LP (IEP)

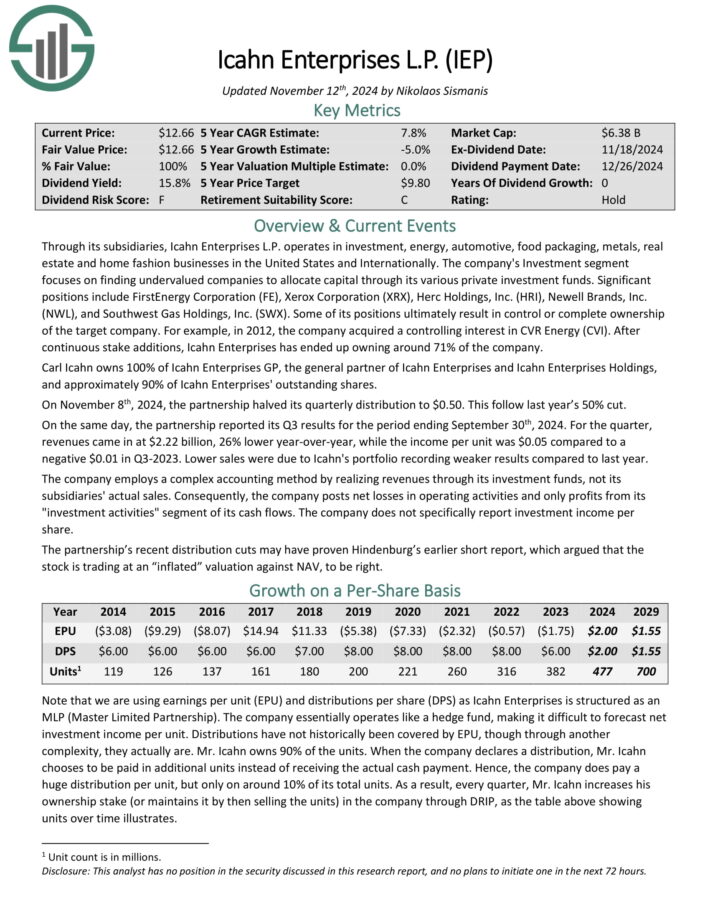

By means of its subsidiaries, Icahn Enterprises L.P. operates in funding, power, automotive, meals packaging, metals, actual property and residential trend companies in america and Internationally.

The corporate’s Funding section focuses on discovering undervalued firms to allocate capital by means of its varied personal funding funds.

Vital positions embrace FirstEnergy Company (FE), Xerox Company (XRX), Herc Holdings, Inc. (HRI), Newell Manufacturers, Inc. (NWL), and Southwest Gasoline Holdings, Inc. (SWX).

On November eighth, 2024, the partnership halved its quarterly distribution to $0.50. This comply with final yr’s 50% lower. On the identical day, the partnership reported its Q3 outcomes for the interval ending September thirtieth, 2024.

For the quarter, revenues got here in at $2.22 billion, 26% decrease year-over-year, whereas the earnings per unit was $0.05 in comparison with a adverse $0.01 in Q3-2023. Decrease gross sales have been resulting from Icahn’s portfolio recording weaker outcomes in comparison with final yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on IEP (preview of web page 1 of three proven under):

Last Ideas & Further Studying

Excessive dividend shares are naturally interesting on the floor, resulting from their excessive dividend yields.

However earnings buyers want to ensure they don’t fall right into a dividend ‘entice’, that means buying a inventory solely resulting from its excessive yield, solely to see the corporate lower or eradicate the dividend payout.

Revenue buyers on the lookout for development ought to take into account promoting the ten dividend shares on this article, as a result of they haven’t displayed any dividend development. In lots of circumstances, these shares have already lower their dividends, violating one of many three guidelines of the Certain Passive Revenue publication.

If you’re eager about discovering high-quality dividend development shares and/or different high-yield securities and earnings securities, the next Certain Dividend assets shall be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].