Hudson Pacific Properties (NYSE:HPP) screens as extraordinarily discounted, buying and selling at lower than 30% of Internet Asset Worth (NAV). Whereas it’s true that discounted valuation offers a margin of security, the magnitude of low cost is a little bit of an phantasm.

With a consensus NAV of $7.61 and the inventory buying and selling at $2.32, HPP seems to be buying and selling at about 30% of NAV. Nonetheless, the corporate as a complete is absolutely buying and selling at 88% of that very same consensus asset worth. Additional, an 18% decline in asset worth from the latest consensus NAV can be sufficient to take NAV of widespread shares to $0.

Let’s stroll by means of the mathematics:

Leverage amplifying look of low cost

A consensus of 6 Wall Avenue analysts spots HPP’s NAV at $7.61

S&P International Market Intelligence

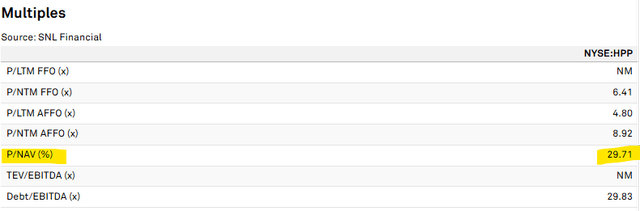

That NAV spots HPP at a value to NAV of 29.71% (utilizing intraday pricing on 5/5/25)

S&P International Market Intelligence

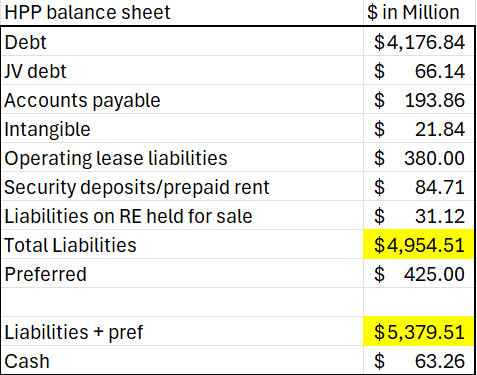

It needs to be famous, nevertheless, that NAV per share refers back to the fairness worth of widespread shares after accounting for all securities above them within the waterfall, which on this case is debt, present liabilities, and a most popular, HPP Most popular C (HPP.PR.C).

Per the 4Q24 supplemental, liabilities plus most popular complete $5.379 billion.

2MC

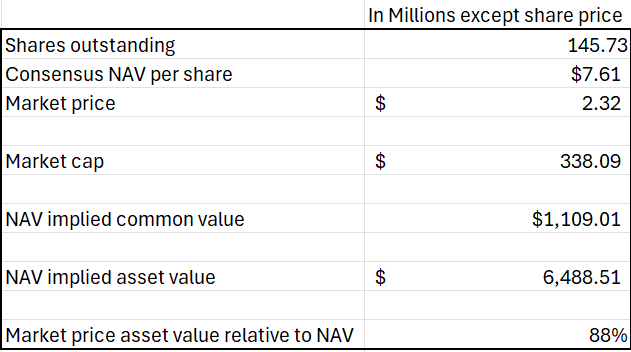

As such, the widespread inventory is a tiny portion of the general capital stack. At that $2.32 market value, the market capitalization of absolutely diluted widespread shares is $338 million.

2MC

The $7.61 NAV implies the widespread is value $1.109B, which suggests an total asset worth of $6.488B.

So by the inventory buying and selling “cheaply” at $2.32 and 30% of NAV, an investor shopping for it at this time is certainly getting a large low cost to NAV. Nonetheless, that low cost is simply on the widespread fairness slice. You might be basically getting the widespread for $338 million as a substitute of full value of $1.1B. That could be a low cost of $770.9 million.

Nonetheless, it nonetheless comes with the debt and most popular. Right here is the way it stacks up when wanting on the complete capital stack.

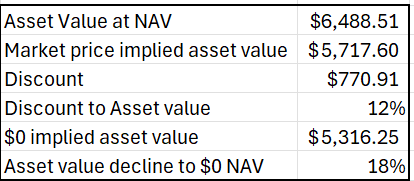

2MC

Regardless of buying and selling at 30% of NAV, the corporate total is buying and selling at $5.717 billion in comparison with Internet Asset Worth of $6.488 billion.

The true low cost from a complete capital stack perspective is a mere 12%.

Why does this matter?

It issues as a result of it impacts how delicate the worth of 1’s funding is to adjustments in asset worth.

On the floor, it’d look like when shopping for at 30% of NAV/share one might maintain 70% lack of asset worth and nonetheless come out complete. However that simply isn’t the way it works when leverage is factored in.

A lot of HPP’s capital stack is debt and most popular shares that an 18% decline in asset worth from the $7.61 per share NAV can be sufficient to utterly wipe out widespread shares. It could take NAV per share to $0.

That’s the take-home level: A big low cost to NAV doesn’t at all times imply a big margin of security.

NAV low cost relative to margin of security is expounded to how levered an organization is, and in instances like HPP, the place leverage is extraordinarily excessive, the margin of security is kind of small regardless of how low-cost the inventory appears to be like relative to NAV.

None of this makes HPP uninvestable. It simply shapes the character of what constitutes a viable thesis.

What would make an funding in HPP carry out properly?

If you’re in HPP as a result of it’s buying and selling so cheaply that’s in all probability not an excellent purpose. Even modest continued declines in fundamentals generally is a wipeout regardless of how massive of a reduction one will get when shopping for the inventory.

For this to work as an funding, one has to consider within the turnaround story. HPP’s workplace belongings must discover new sources of demand to stabilize occupancy and ultimately return to development.

It’s solely potential.

HPP has lovely belongings that — previous to the crash in workplace house — would have been thought-about trophy properties. If NOI rebounds, the worth positive aspects to traders may very well be monumental. If fundamentals are shifting in a optimistic course, the face worth 30% of NAV really works the way in which you hope it might. An investor would get a triple simply within the inventory value attending to NAV and the leverage would additionally work in an investor’s favor.

Leverage amplifies asset worth positive aspects in addition to losses. If workplace broadly begins performing higher, HPP’s asset worth positive aspects can be multiplied with respect to widespread inventory. Thus, there’s a bull case to be made right here. It simply rests firmly in a basic turnaround story and never in a price story.

My take

Whereas there are some inexperienced shoots in workplace, I’m nonetheless of the idea that workplace is considerably oversupplied. For my part, there can be extra ache earlier than the eventual upswing. Right now, I’m bearish on many of the workplace sector.