Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

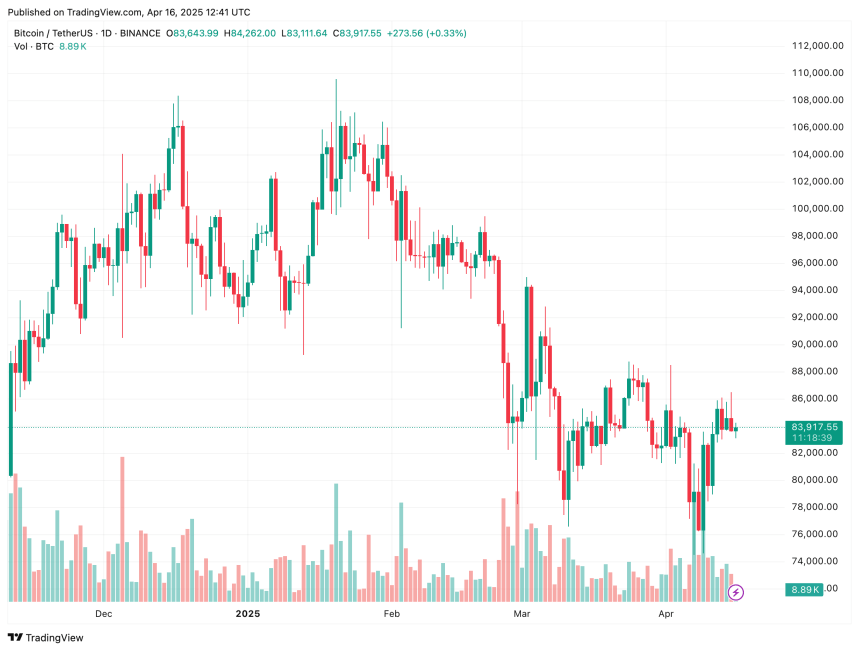

In accordance with a current CryptoQuant Quicktake publish, whereas Bitcoin (BTC) has seen a gentle rise in value from November 2024 to February 2025, sentiment within the cryptocurrency’s futures market has not proven a corresponding uptick.

Bitcoin Futures Sentiment Index Alerts Warning

Bitcoin’s value surged from roughly $74,000 in November 2024 to a peak of $101,000 by early February 2025. Nevertheless, following US President Donald Trump’s tariff bulletins, risk-on belongings – together with BTC -have skilled a big pullback.

Associated Studying

After hitting a possible native backside of $74,508 earlier this month on April 6, the apex cryptocurrency has recovered a few of its current losses. The highest digital asset is buying and selling within the mid $80,000 vary on the time of writing.

Regardless of this restoration, BTC’s futures sentiment has continued to say no since February. At the same time as the value holds close to native highs, sentiment within the futures market has notably cooled.

CryptoQuant contributor abramchart highlighted this divergence, noting that it may point out rising warning or profit-taking conduct regardless of the continuing bullish development. The analyst commented:

This means a cooling curiosity or elevated concern within the futures market, presumably as a result of macroeconomic uncertainty, regulatory issues, or anticipated corrections.

A have a look at the BTC futures sentiment index reveals a resistance zone round 0.8 and a help degree close to 0.2. The index is presently hovering round 0.4, pointing to a predominantly bearish sentiment throughout futures markets.

Equally, Bitcoin’s common value has steadily declined from its early 2025 highs. It’s now ranging between $70,000 and $80,000, signalling potential market indecision amid heightened tariff tensions.

In accordance with abramchart, if futures sentiment stays low, BTC may face prolonged value consolidation and even downward stress within the close to time period. Nevertheless, any rising bullish catalyst may shortly shift the sentiment and renew upward momentum.

Is BTC Shut To A Momentum Shift?

Some analysts consider Bitcoin could also be nearing a breakout. After consolidating within the mid-$80,000s for a number of weeks, on-chain metrics recommend BTC could also be undervalued at present ranges. Indicators corresponding to BTC trade reserves and the Stablecoin Provide Ratio help this view.

Associated Studying

As well as, momentum indicators like Bitcoin’s weekly Relative Power Index have begun to interrupt out of a long-standing downward trendline – elevating hopes for a possible bullish rally again towards $100,000.

Nevertheless, a number of dangers nonetheless stay. The current look of a ‘dying cross’ on BTC’s value chart – mixed with persistent macroeconomic issues associated to commerce tariffs – may nonetheless weigh closely on market sentiment. At press time, BTC trades at $83,917, down 1.8% over the previous 24 hours.

Featured picture from Unsplash, Charts from CryptoQuant and TradingView.com