Printed on March twentieth, 2025 by Bob Ciura

Many consumers have a wish to ‘beat the market’.

This looks like a wonderful objective. In any case, the market is ‘merely widespread’, so it should make sense to on the very least beat widespread.

Nonetheless in its place of specializing in an arbitrary benchmark or compounding purpose (‘I must compound at 20% yearly’ for instance), I think about it makes additional sense to focus on the rationale you is perhaps investing.

Broadly, that’s to turn into worthwhile. Nonetheless additional significantly, the aim of dividend progress investing is to assemble a rising passive income stream.

And the underlying operate there could also be to have a rising passive income stream that exceeds your payments – so you’ll have true, lasting financial freedom.

The securities you select in your dividend progress portfolio to have the ability to receive lasting financial freedom by rising passive income really matter.

That’s the place dividend progress shares can be found in–additional significantly, blue chip shares which have elevated their dividends for on the very least 10 consecutive years.

You’ll be capable of receive our free blue chip shares itemizing with important financial metrics akin to dividend yields and price-to-earnings ratios, by clicking on the hyperlink beneath:

There are presently higher than 500 securities in our blue chip shares itemizing.

Blue-chip shares are established, financially sturdy, and persistently worthwhile publicly traded companies.

Their energy makes them fascinating investments for comparatively safe, reliable dividends and capital appreciation versus a lot much less established shares.

Instead of chasing returns, consumers can start establishing long-term passive income by dividend progress shares.

The following 10 blue chip shares have elevated their dividends for on the very least 10 years, and have Dividend Menace Scores of ‘C’ or greater throughout the Constructive Analysis Evaluation Database, plus one of the best dividend progress.

The ten blue chip shares are sorted by dividend progress cost.

Desk of Contents

The desk of contents beneath permits for simple navigation.

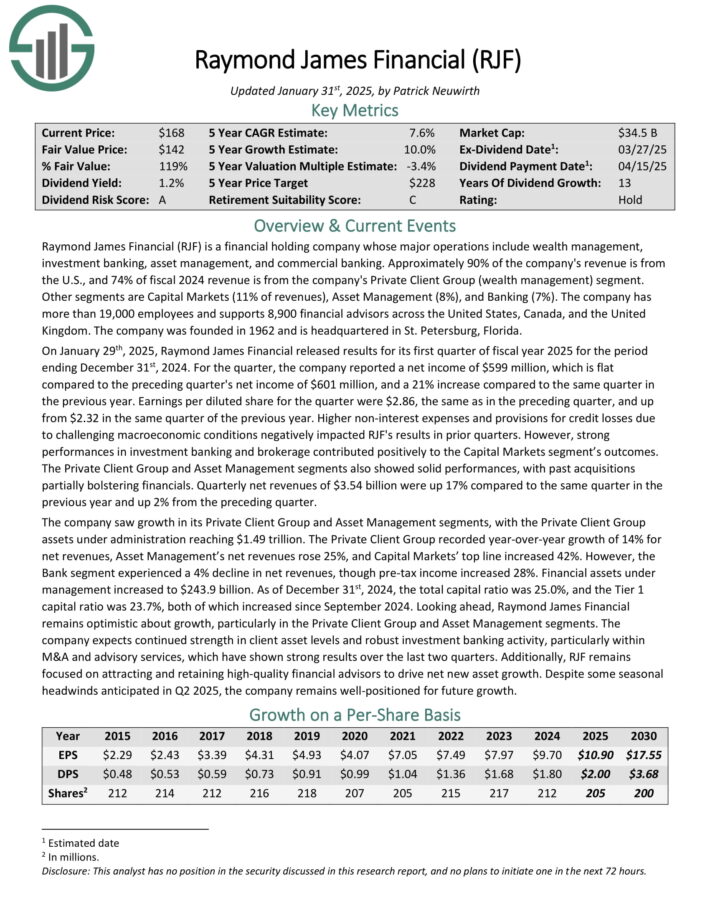

Blue Chip #10: Raymond James Financial (RJF)

- Dividend Historic previous: 13 years of consecutive will improve

- Dividend Growth: 13.0%

Raymond James Financial (RJF) is a financial holding agency whose most important operations embrace wealth administration, funding banking, asset administration, and industrial banking. Roughly 90% of the company’s earnings is from the U.S., and 74% of fiscal 2024 earnings is from the company’s Private Shopper Group (wealth administration) part.

Completely different segments are Capital Markets (11% of revenues), Asset Administration (8%), and Banking (7%). The company has higher than 19,000 employees and helps 8,900 financial advisors all through the US, Canada, and the UK.

On January twenty ninth, 2025, Raymond James Financial launched outcomes for its first quarter of fiscal yr 2025 for the interval ending December thirty first, 2024.

For the quarter, the company reported a web income of $599 million, which is flat as compared with the earlier quarter’s web income of $601 million, and a 21% improve as compared with the an identical quarter throughout the earlier yr.

Earnings per diluted share for the quarter have been $2.86, the an identical as throughout the earlier quarter, and up from $2.32 within the an identical quarter of the sooner yr. Sturdy performances in funding banking and brokerage contributed positively to the Capital Markets part’s outcomes.

Click on on proper right here to acquire our newest Constructive Analysis report on RJF (preview of internet web page 1 of three confirmed beneath):

Blue Chip #9: Intuit Inc. (INTU)

- Dividend Historic previous: 13 years of consecutive will improve

- Dividend Growth: 13%

Intuit is a cloud-based accounting and tax preparation software program program large, headquartered in Mountain View, California. Its merchandise current financial administration, compliance, and suppliers for patrons, small firms, self-employed employees, and accounting professionals worldwide.

Its hottest platforms embrace QuickBooks, TurboTax, Mint, and TSheets. Cumulatively they serve higher than 100 million purchasers. The company recorded $16.3 billion in revenues ultimate yr and is headquartered in Mountain View, California.

On February twenty fifth, 2025, Intuit printed its fiscal Q2 outcomes for the interval ending January thirty first, 2025. This was one different steady quarter, with “World Enterprise Choices Group” revenues up 19% year-over-year.

Significantly, QuickBooks On-line Accounting revenues grew 22% year-over-year, pushed by purchaser progress, higher environment friendly prices, and mix-shift.

Adjusted EPS for the quarter grew by 26% to $3.32 as compared with FQ2 2024.

Administration reiterated its earnings and nonGAAP EPS steering for FY2025. Revenues are anticipated to be in a diffusion of $18.160 billion to $18.347 billion, implying a progress cost between 12% and 13% from ultimate yr.

Adjusted EPS is anticipated to be between $19.16 and $19.36. This implies a year-over-year progress of 18% to 19%.

Click on on proper right here to acquire our newest Constructive Analysis report on INTU (preview of internet web page 1 of three confirmed beneath):

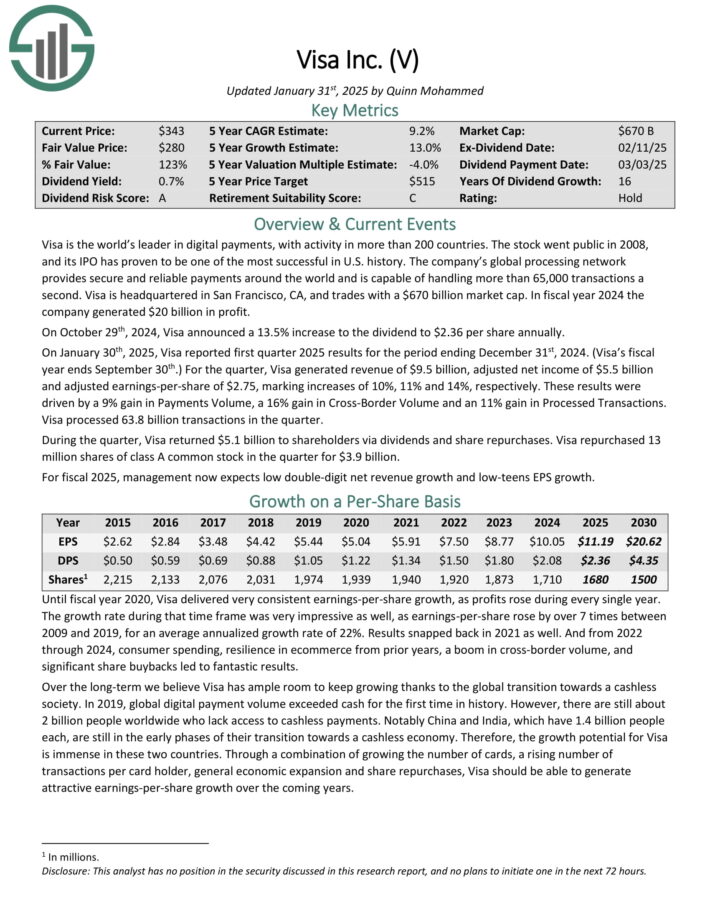

Blue Chip #8: Visa Inc. (V)

- Dividend Historic previous: 16 years of consecutive will improve

- Dividend Growth: 13%

Visa is the world’s chief in digital funds, with train in extra than 200 worldwide places. The company’s world processing neighborhood provides secure and reliable funds world extensive and is ready to coping with higher than 65,000 transactions a second.

On January thirtieth, 2025, Visa reported first quarter 2025 outcomes for the interval ending December thirty first, 2024. (Visa’s fiscal yr ends September thirtieth.)

For the quarter, Visa generated earnings of $9.5 billion, adjusted web income of $5.5 billion and adjusted earnings-per-share of $2.75, marking will improve of 10%, 11% and 14%, respectively.

These outcomes have been pushed by a 9% purchase in Funds Amount, a 16% purchase in Cross-Border Amount and an 11% purchase in Processed Transactions. Visa processed 63.8 billion transactions throughout the quarter.

Click on on proper right here to acquire our newest Constructive Analysis report on Visa (preview of internet web page 1 of three confirmed beneath):

Blue Chip #7: Apple Inc. (AAPL)

- Dividend Historic previous: 12 years of consecutive will improve

- Dividend Growth: 13.9%

Apple is a know-how agency that designs, manufactures, and sells merchandise akin to iPhones, iPads, Mac, Apple Watch and Apple TV. Apple moreover has a suppliers enterprise that sells music, apps, and subscriptions.

On January thirtieth, 2025, Apple reported financial outcomes for the first quarter of fiscal yr 2025 (Apple’s fiscal yr ends the ultimate Saturday in September).

Full product sales grew 4% over the prior yr’s quarter, to a model new file of $124.3 billion, because of sustained progress in iPhone, iPad and Wearables all through all areas.

Earnings-per-share grew 10%, from $2.18 to $2.40, and exceeded the analysts’ consensus by $0.05. Notably, Apple has missed the analysts’ estimates solely as quickly as throughout the ultimate 25 quarters.

Going forward, Apple’s earnings progress might be pushed by a lot of elements. One in every of these is the persevering with cycle of iPhone releases, which creates lumpy outcomes. In the long run, Apple should be able to develop its iPhone product sales, albeit in an irregular vogue.

Click on on proper right here to acquire our newest Constructive Analysis report on AAPL (preview of internet web page 1 of three confirmed beneath):

Blue Chip #6: UnitedHealth Group (UNH)

- Dividend Historic previous: 15 years of consecutive will improve

- Dividend Growth: 14%

UnitedHealth dates once more to 1974 when Structure Med was primarily based by a gaggle of properly being care professionals trying to find strategies to broaden healthcare selections for patrons.

The company has two most important reporting segments: UnitedHealth and Optum. The earlier provides world healthcare benefits to individuals, employers, and Medicare/Medicaid beneficiaries. The Optum part is a suppliers enterprise that seeks to lower healthcare costs and optimize outcomes for its purchasers.

UnitedHealth posted fourth quarter and full-year earnings on January sixteenth, 2025, and outcomes confirmed a unusual miss on the best line. Even when shares have been properly off their highs earlier to the report, the stock declined anyway as the company dissatisfied consumers for the first time shortly.

Adjusted earnings-per-share obtained right here to $6.81, which was seven cents ahead of estimates. Nonetheless, earnings was up solely 6.8% to $100.8 billion, missing by practically a billion {{dollars}}.

UnitedHealthcare seen earnings of $74.1 billion via the quarter, missing consensus by $1.3 billion. OptumRx posted $35.8 billion of earnings, up 15% year-over-year and beating estimates. OptumHealth seen 5% progress year-over-year to $25.7 billion, moreover beating estimates.

The company’s medical care ratio was 85.5% in 2024, a deterioration of about 230 basis components year-over-year. This was attributable to elevated Medicare funding reductions and member mix, primarily. The company issued steering for this yr of $29.50 to $30.00 in adjusted earnings-per-share.

Click on on proper right here to acquire our newest Constructive Analysis report on UNH (preview of internet web page 1 of three confirmed beneath):

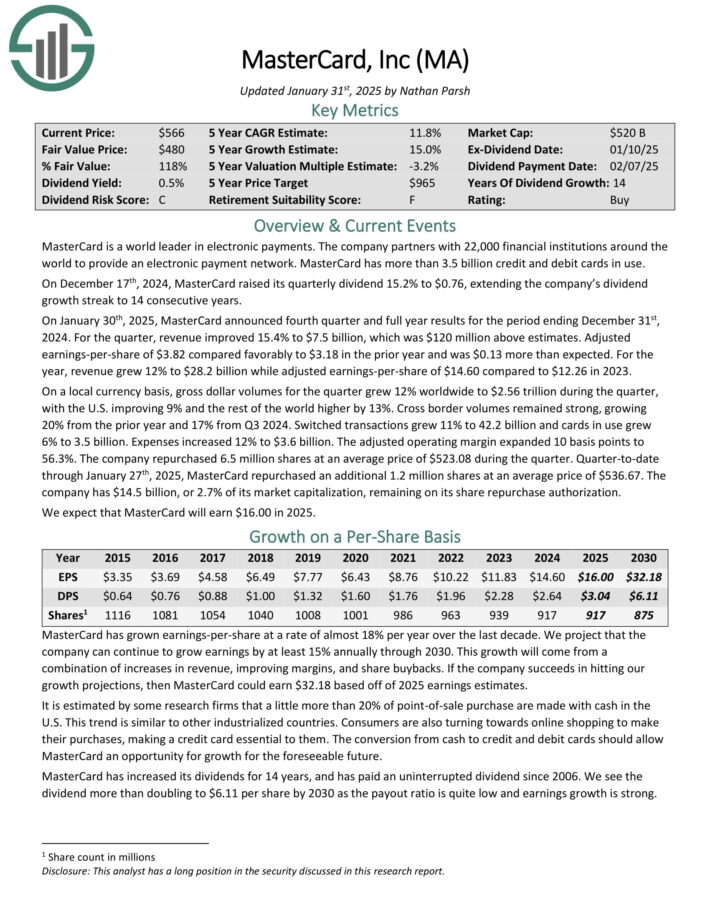

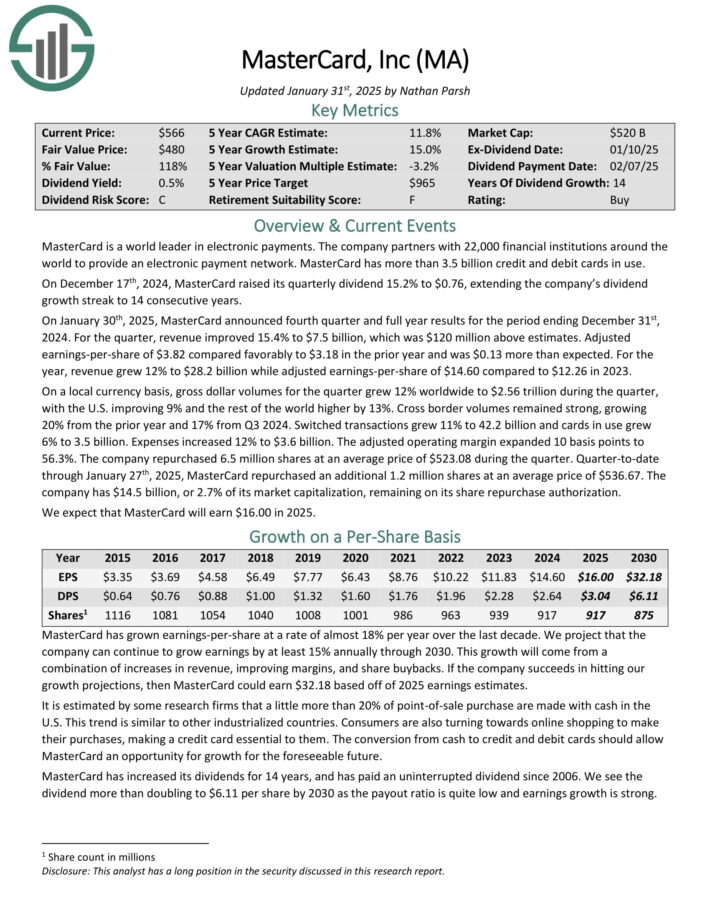

Blue Chip #5: Mastercard Inc. (MA)

- Dividend Historic previous: 14 years of consecutive will improve

- Dividend Growth: 15%

MasterCard is a world chief in digital funds. The company companions with 25,000 financial institutions world extensive to supply an digital value neighborhood. MasterCard has higher than 3.1 billion credit score rating and debit enjoying playing cards in use.

On January thirtieth, 2025, MasterCard launched fourth quarter and full yr outcomes for the interval ending December thirty first, 2024.

For the quarter, earnings improved 15.4% to $7.5 billion, which was $120 million above estimates. Adjusted earnings-per-share of $3.82 in distinction favorably to $3.18 throughout the prior yr and was $0.13 higher than anticipated.

For the yr, earnings grew 12% to $28.2 billion whereas adjusted earnings-per-share of $14.60 as compared with $12.26 in 2023.

On a neighborhood foreign exchange basis, gross buck volumes for the quarter grew 12% worldwide to $2.56 trillion via the quarter, with the U.S. bettering 9% and the rest of the world higher by 13%.

Cross border volumes remained sturdy, rising 20% from the prior yr and 17% from Q3 2024.

Click on on proper right here to acquire our newest Constructive Analysis report on Mastercard (preview of internet web page 1 of three confirmed beneath):

Blue Chip #4: Zoetis Inc. (ZTS)

- Dividend Historic previous: 11 years of consecutive will improve

- Dividend Growth: 15%

Zoetis is a drug agency that focuses on animal properly being, along with discovering, creating, manufacturing, and commercialising medicines, vaccines, and diagnostic merchandise.

Biodevices, genetic exams, and precision livestock farming complement the company’s selections. The Vaccine part is the largest earnings producing part, with 22% of the entire earnings, whereas the US generates 54% of the earnings.

On February thirteenth, 2025, Zoetis Inc. reported sturdy financial outcomes for the fourth quarter of 2024, with earnings reaching $2.3 billion, a 5% improve from the sooner yr and up 6% on an operational basis. The company expert progress in every its U.S. and Worldwide segments, pushed primarily by sturdy demand for companion animal merchandise.

Throughout the U.S. part, earnings was $1.3 billion, reflecting a 4% improve as compared with This fall 2023. Product sales of companion animal merchandise grew by 7%, fueled by continued sturdy demand for Simparica Trio, dermatology merchandise akin to Apoquel and Cytopoint, and monoclonal antibody therapies for osteoarthritis ache.

Growth was partially offset by the affect of the preliminary stocking of Librela and Apoquel Chewable merchandise all through their prior-year launches. Livestock product product sales declined by 8%, primarily because of divestiture of the medicated feed additive portfolio and positive water-soluble merchandise.

Click on on proper right here to acquire our newest Constructive Analysis report on ZTS (preview of internet web page 1 of three confirmed beneath):

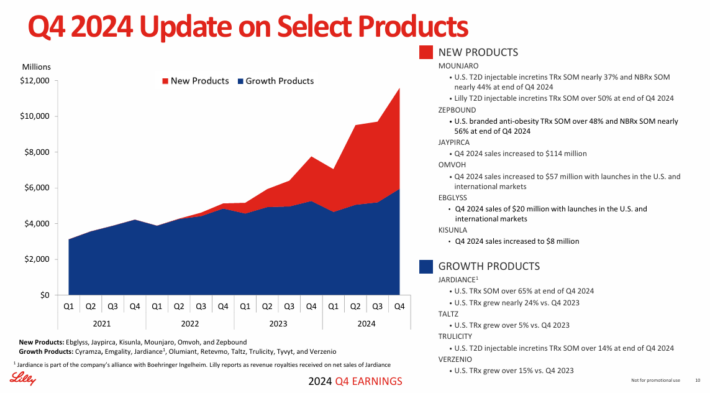

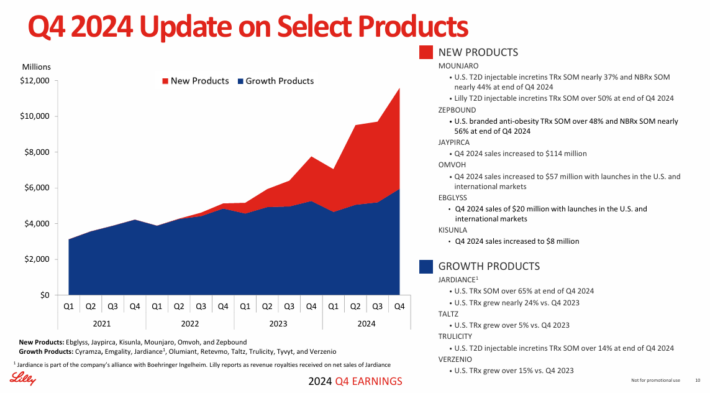

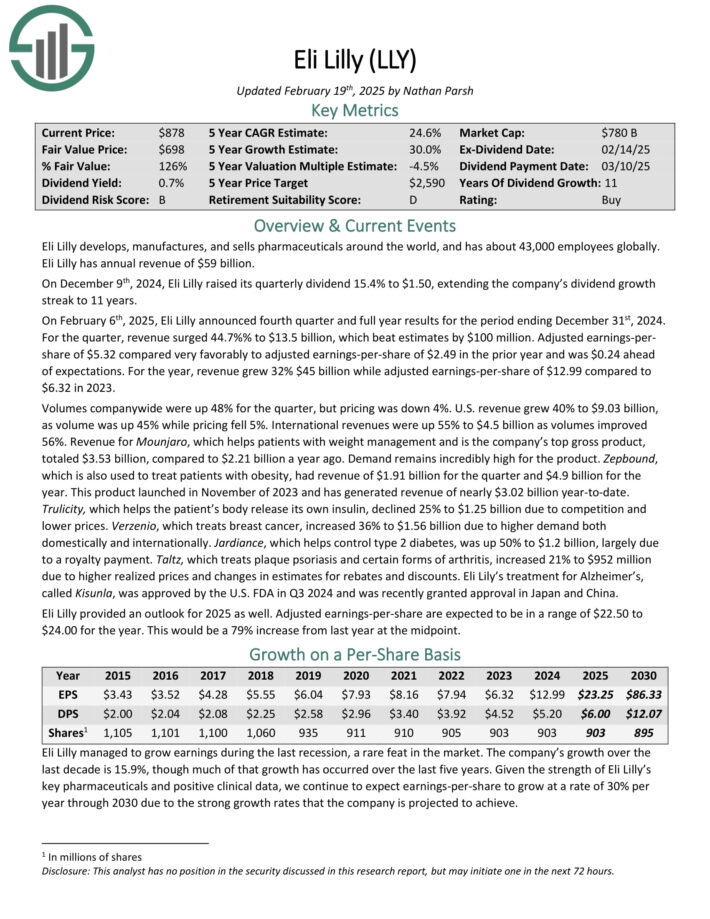

Blue Chip #3: Eli Lilly & Co. (LLY)

- Dividend Historic previous: 11 years of consecutive will improve

- Dividend Growth: 15%

Eli Lilly develops, manufactures, and sells prescription drugs world extensive, and has about 43,000 employees globally. Eli Lilly has annual earnings of $59 billion.

On December ninth, 2024, Eli Lilly raised its quarterly dividend 15.4% to $1.50, extending the company’s dividend progress streak to 11 years.

On February sixth, 2025, Eli Lilly launched fourth quarter and full yr outcomes for the interval ending December thirty first, 2024. For the quarter, earnings surged 44.7%% to $13.5 billion, which beat estimates by $100 million.

Provide: Investor Presentation

Adjusted earnings-per-share of $5.32 in distinction very favorably to adjusted earnings-per-share of $2.49 throughout the prior yr and was $0.24 ahead of expectations.

For the yr, earnings grew 32% $45 billion whereas adjusted earnings-per-share of $12.99 as compared with $6.32 in 2023. Volumes company-wide have been up 48% for the quarter, nevertheless pricing was down 4%.

U.S. earnings grew 40% to $9.03 billion, as amount was up 45% whereas pricing fell 5%. Worldwide revenues have been up 55% to $4.5 billion as volumes improved 56%.

Revenue for Mounjaro, which helps victims with weight administration and is the company’s excessive gross product, totaled $3.53 billion, as compared with $2.21 billion a yr up to now.

Demand stays extraordinarily extreme for the product. Zepbound, which can be utilized to take care of victims with weight issues, had earnings of $1.91 billion for the quarter and $4.9 billion for the yr.

Click on on proper right here to acquire our newest Constructive Analysis report on LLY (preview of internet web page 1 of three confirmed beneath):

Blue Chip #2: Comfort Strategies USA (FIX)

- Dividend Historic previous: 13 years of consecutive will improve

- Dividend Growth: 15%

Comfort Strategies USA provides mechanical and electrical contracting suppliers all through the U.S. The company focuses on HVAC, plumbing, piping, controls, and electrical system installations and suppliers, working 47 gadgets with 178 locations in 136 cities.

Serving primarily industrial, industrial, and institutional markets, Comfort Strategies USA works in sectors like manufacturing, healthcare, education, and authorities.

The company generated $7.0 billion in revenues ultimate yr, with 56.7% of it coming from new facility installations and 43.3% coming from suppliers for present buildings. On February twentieth, 2025, Comfort Strategies raised its dividend by 14.3% to a quarterly cost of $0.40.

On the an identical day, the company posted its This fall and full-year outcomes for the interval ending December thirty first, 2024. Revenue for the interval was $1.87 billion, up 37.5% as compared with ultimate yr.

The rise included sturdy same-store train progress and contributions from acquisitions. The identical-store earnings progress was largely pushed by continued energy in market conditions, considerably in data amenities and chip crops.

The mechanical part recorded earnings progress of over 40% year-over-year, fueled by sturdy pure progress in constructing and suppliers. {{The electrical}} part moreover maintained steady effectivity, reflecting sustained demand. EPS elevated by about 60% to $4.09.

For the entire yr, the company reported EPS of $14.64, exceeding prior estimates. The company’s backlog remained sturdy, reaching $5.99 billion on the end of December.

Click on on proper right here to acquire our newest Constructive Analysis report on FIX (preview of internet web page 1 of three confirmed beneath):

Extreme Yield Blue Chip #1: Badger Meter Inc. (BMI)

- Dividend Historic previous: 32 years of consecutive will improve

- Dividend Growth: 15%

Badger Meter was primarily based in 1905 in Milwaukee, WI. It manufactures and markets meters and valves which is perhaps used to measure and administration the circulation of liquids, akin to water, oil and diversified chemical substances.

Its merchandise are moreover used to handle the circulation of air and totally different gases. Badger Meter generates ~$827 million in annual revenues.

On January thirty first, 2025, Badger Meter launched fourth quarter and full yr earnings outcomes for the interval ending December thirty first, 2025. For the quarter, earnings improved 12.5% to $205.2 million, which topped estimates by $2.45 million.

Earnings-per-share of $1.04 in distinction favorably to earnings-per-share of $0.84 throughout the prior yr and was $0.04 higher than anticipated. For the yr, earnings grew 18% to a model new file $826.6 million. Earnings-per-share totaled $4.23, which was a model new file and was up from $3.14 in 2023.

The utility water enterprise as quickly as as soon as extra grew 14% for the quarter. As with prior durations, this progress was led by an increase in demand for ORION Cellular endpoint, E-Sequence Ultrasonic meters, and BEACON Software program program as a Service.

Click on on proper right here to acquire our newest Constructive Analysis report on BMI (preview of internet web page 1 of three confirmed beneath):

Additional Finding out

In case you might be fascinated by discovering totally different high-yield securities, the following Constructive Dividend sources may be useful:

Extreme-Yield Specific particular person Security Evaluation

Completely different Constructive Dividend Sources

Thanks for finding out this textual content. Please ship any recommendations, corrections, or inquiries to [email protected].

rn

rn

Source link ","creator":{"@kind":"Particular person","title":"Index Investing Information","url":"https://indexinvestingnews.com/creator/projects666/","sameAs":["https://indexinvestingnews.com"]},"articleSection":["Investing"],"picture":{"@kind":"ImageObject","url":"https://www.suredividend.com/wp-content/uploads/2022/11/Blue-Chip-Shares-e1667696058583.png","width":0,"peak":0},"writer":{"@kind":"Group","title":"","url":"https://indexinvestingnews.com","brand":{"@kind":"ImageObject","url":""},"sameAs":["https://www.facebook.com/Index-Investing-News-102075432474739","https://twitter.com/IndexInvesting_"]}}

Source link