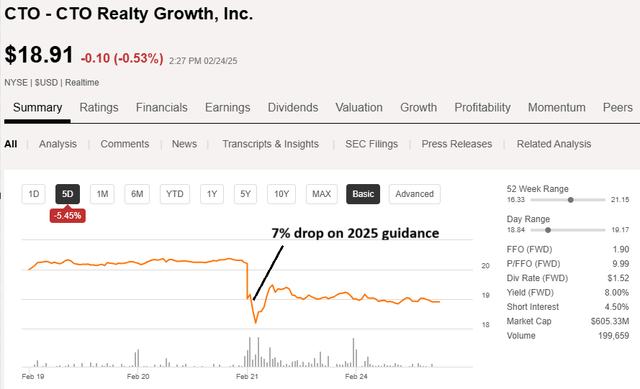

CTO Realty Development, Inc. (NYSE:CTO) has turn into extremely opportunistic because the inventory dropped 7% on glorious earnings. This text will element why the drop occurred and present that as we dig in additional, the underlying knowledge and fundamentals portend a powerful future for CTO.

The drop – headline quantity weak spot

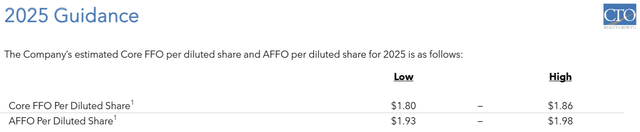

Consensus estimates referred to as for CTO to earn $2.01 of AFFO/share in 2025.

S&P International Market Intelligence

Regardless of sturdy earnings within the fourth quarter of 2024, CTO issued 2025 AFFO steerage at $1.93 to $1.98.

CTO

That is a 6 cent miss on the midpoint and represents unfavorable progress in 2025.

REITs are overwhelmingly traded on AFFO/share and AFFO/share progress. As such, a miss of this magnitude was not obtained effectively, with the inventory buying and selling down 7% on the report.

SA

The algorithms that may execute trades inside moments of a report hitting the information are glorious at detecting beats or misses on headline numbers, so the value drop was rapid.

These algorithms, nevertheless, aren’t pretty much as good at analyzing the underlying fundamentals.

The basics inform a distinct story – one in every of power and progress.

Past the headlines

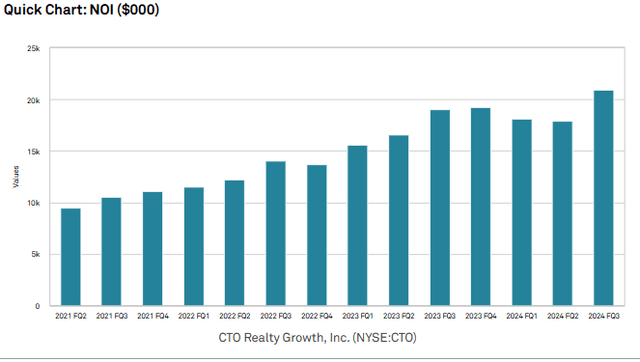

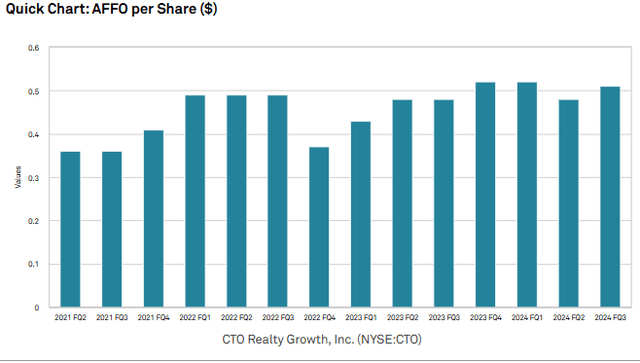

CTO has been rising properly, with will increase in web working earnings flowing by means of to stable AFFO/share good points.

S&P International Market Intelligence

S&P International Market Intelligence

Whereas the charts above are up and to the proper, there are some lumps on account of timing.

Retail leases take some time to begin. Permits should be obtained. Shops should be reconfigured. Tenants want to maneuver in.

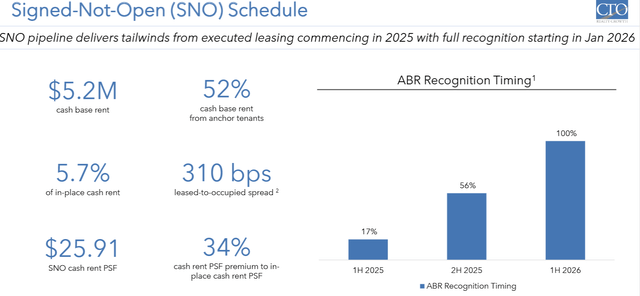

Thus, there’s usually a three-to-12-month hole between lease signing and graduation. CTO presently has $5.2 million annual base lease in contracts which might be signed however not but open, in any other case often known as SNO leases.

CTO

As there are 31.84 million shares excellent, SNO leases signify 16 cents per share in AFFO accretion. These 16 cents per share will begin to kick in all through 2025, however primarily hit earnings in 2026 and past. Since solely 17% of it’s within the first half of 2025, weighted common earnings for the yr will largely not embody the SNO leases.

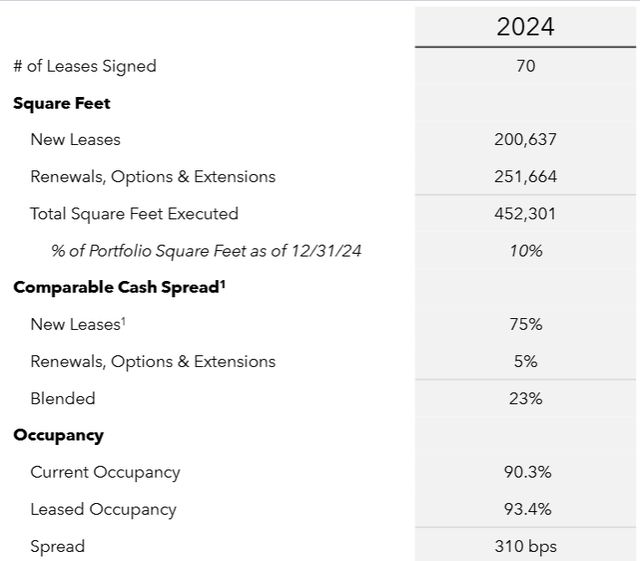

This SNO lease timing concern has been current with CTO for some time. It tends to roll. In 2024, many previously SNO leases commenced whereas new leases had been signed. Particularly, 70 leases had been signed in 2024 encompassing 452K sq. toes.

CTO

Notably, new leases had been signed at 75% greater lease than expiring leases. Blended leasing spreads had been pulled down by renewal choices which allowed tenants to increase their leases at a median roll-up of simply 5%. Total spreads got here in at 23%-plus.

Remember that such renewal choices are a relic of a time when retail lease negotiations had been tenant-favored. Following the Monetary Disaster, retail actual property was oversupplied, so landlords simply wanted tenants to maintain their house open. This allowed tenants to barter favorable phrases similar to renewal choices at solely minor roll-ups.

At present, retail actual property is undersupplied, so negotiations are extra landlord-favored. Tenants usually don’t get renewal choices of this sort anymore. So going ahead, the next proportion of leases must be signed on the full markup to market rental charges.

Past the everyday SNO leasing, 2025 options one other substantial timing concern: the alternative of bankrupt tenants.

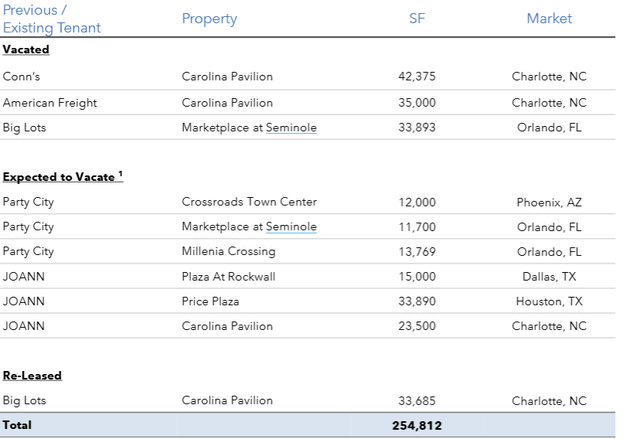

CTO misplaced the next tenants to chapter:

CTO

In a latest article, we mentioned extensively how the chapter of retail tenants is definitely favorable for landlords within the current setting so long as the properties concerned are effectively positioned.

The essential concept is that rental charges on present leases are effectively under market charges such that chapter of the tenant affords a chance to re-lease on the a lot greater market fee effectively upfront of the preliminary lease’s expiry.

John Albright, CTO’s CEO, mentioned the tenant bankruptcies on the 4Q24 earnings name:

“Transferring to lately introduced retailer bankruptcies. Given that every one of our impacted leases had been for areas with meaningfully under market rents and embedded worth, now we have been proactive in working to shortly regain them. Late within the fourth quarter, we efficiently labored by means of the courtroom course of and regained 4 areas that had been occupied by our two Massive Tons, one Conn’s, and an American Freight. Moreover, we are actually engaged on agreements to get possession of our three Get together Metropolis areas and three JOANN areas early in 2025. Notably, we have already got LOIs or are negotiating leases with tenants for a majority of those areas.”

Somewhat than making an attempt to power the bankrupt tenants to honor the leases and pay lease, CTO is kicking them out as quick as they will to have the ability to lease the house to new tenants. New leases on this house are prone to be about 50% greater lease per foot. Albright continues:

“Primarily based on present lease negotiations, we presently estimate that potential re-leasing unfold for these areas could possibly be between 40% and 60%. Whereas we’re making fast progress on leases with new tenants, it merely takes time for tenants to acquire permits, full their build-out and open. Accordingly, we anticipate lease from new tenants to begin throughout 2026.”

The previous leases of bankrupt tenants listed above paid $2.8 million ABR. That represents about 9 cents per share in misplaced income. Since these properties are to be vacant for almost all of 2025, this resulted within the mild 2025 steerage.

I feel the market is seeing this as misplaced income. I see it as a timing concern.

Primarily based on negotiations, CTO anticipates signing alternative tenants for these areas at $4.0-$4.5 million ABR. So, upon stabilization, CTO’s ABR must be about $1.2 to $1.7 million greater than it was with these tenants in place.

CTO steerage assumes the properties are recaptured from tenants within the first quarter, so it is counting virtually no lease from former tenants of those properties in 2025. Steerage assumes new leases begin in 2026, so it’s assuming no lease from future tenants in 2025.

Stabilized run-rate AFFO/share (beats consensus by 13 cents)

There are two vital parts of earnings that must be current in 2026 and past however not 2025.

- SNO leases – $5.2 million ABR.

- Substitute tenants for kicked-out tenants $4.25 million ABR.

Together, that means that stabilized ABR must be $9.45 million greater than 2025 ABR. That is 29 cents per share.

As such, we calculated CTO’s stabilized run fee AFFO/share at $2.24. That is effectively above 2026 consensus estimates of $2.11.

The upper stabilized AFFO is enabled by CTO’s stellar leasing exercise in 2024 and the continuing leasing exercise at market charges.

Why are market rents so excessive for CTO’s properties?

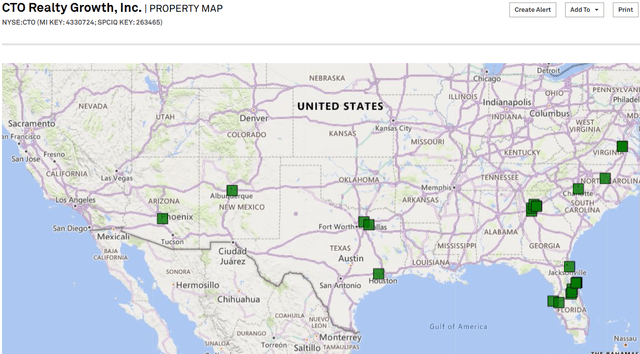

CTO’s procuring facilities are in Atlanta, Phoenix, Dallas, Tampa, Daytona Seaside and different high-growth Sunbelt markets.

S&P International Market Intelligence

For different sorts of actual property, these markets are excessive progress and excessive provide.

Multifamily rents, for instance, are anticipated to come back in roughly flat in 2025 for these markets as a result of the fast job and inhabitants progress is being balanced out by a big wave of newly constructed flats. The identical could possibly be stated for industrial properties.

Procuring facilities profit from the identical demand drivers of inhabitants and job progress, however have uniquely low provide. There was just about no new web provide of procuring facilities within the U.S. since 2009.

As such, the sector has greater demand with minimal provide progress leading to greater occupancy and better rental charges.

CTO’s five-mile catchment areas common 203,000 individuals and $143,000 common family earnings. Retailers need entry to densely populated affluence, so that they’re paying premiums to find in CTO’s facilities.

Keen to attend

Given the timing of lease commencements, it’ll probably take till mid-2026 for CTO’s run fee AFFO/share to hit $2.24.

With a market worth of $18.85 that is a particularly low cost valuation, and with an 8% dividend yield, I am pleased to attend for the contracted ABR to kick in. Simply as CTO bought off when the headline AFFO got here in weak, I think the value will rise when AFFO grows on lease graduation.