© Reuters. FILE PHOTO: Elon Musk arrives on the In America: An Anthology of Trend themed Met Gala on the Metropolitan Museum of Artwork in New York Metropolis, New York, U.S., Might 2, 2022. REUTERS/Andrew Kelly

(Reuters) – Elon Musk is aiming to extend Twitter (NYSE:)’s annual income to $26.4 billion by 2028, up from $5 billion final yr, the New York Instances reported on Friday, citing a pitch deck offered by the world’s richest man to traders.

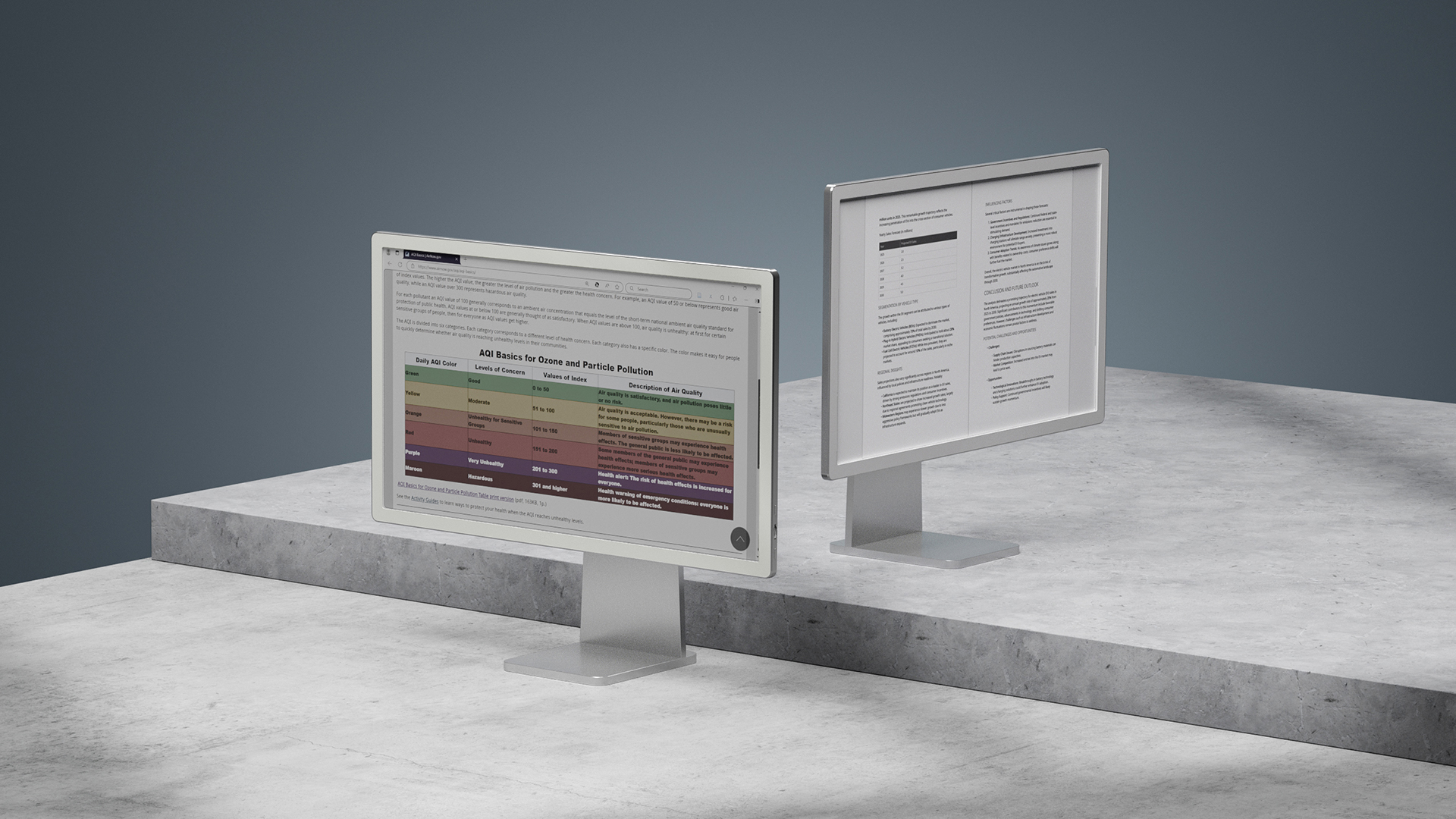

Promoting will fall to 45% of whole income underneath Musk, down from about 90% in 2020, producing $12 billion in income in 2028, whereas subscriptions are anticipated to tug in one other $10 billion, in keeping with the report.

The top of electric-vehicle maker Tesla (NASDAQ:) Inc additionally goals to extend Twitter’s money circulate to $3.2 billion in 2025 and $9.4 billion in 2028, the newspaper reported, citing the presentation.

Musk clinched a deal final month to purchase Twitter for $44 billion in money, in a transfer that can shift management of the social media platform populated by tens of millions of customers and world leaders to the Tesla Inc chief.

The billionaire has promised to revitalize the corporate and broaden the variety of customers by cracking down on spam bots and lowering the quantity of moderation to facilitate extra “free speech”.

After the closure of the deal, Musk is anticipated to change into Twitter’s short-term CEO, an individual acquainted with the matter informed Reuters on Thursday.

Amongst his different targets, Musk expects the social media firm to herald $15 million from a funds enterprise in 2023 that can develop to about $1.3 billion by 2028, the NYT cited the doc as saying.

Musk anticipates he can improve Twitter’s common income per consumer to $30.22 in 2028 from $24.83 final yr, it added. He additionally expects Twitter to have 11,072 workers by 2025, up from round 7,500.

Income from Twitter Blue, the corporate’s premium subscription service launched final yr, is anticipated to have 69 million customers by 2025, the NYT reported.

Musk, in a now deleted tweet final month, recommended a raft of modifications to the social media large’s Twitter Blue premium subscription service, together with slashing its value.

On Thursday, Musk listed a bunch of high-profile traders who’re prepared to supply funding of $7.14 billion for his Twitter bid, together with Oracle (NYSE:) co-founder Larry Ellison and Sequoia Capital.

Musk has elevated the financing dedication to $27.25 billion, which incorporates commitments from 19 traders, and diminished a margin mortgage from Morgan Stanley (NYSE:) tied to his Tesla inventory to $6.25 billion. He has already secured commitments for $13 billion in loans towards Twitter shares.

Musk couldn’t be reached for remark. Twitter didn’t instantly reply to a Reuters request for remark.