By James Davey and Paul Sandle

LONDON (Reuters) – Britain’s huge retailers, together with Tesco (OTC:), Sainsbury (LON:)’s, M&S and Subsequent (LON:), say they’re stepping up their drive for effectivity via automation and different measures, to restrict the affect of rising prices on the costs they cost their prospects.

Because the UK financial system struggles to develop, the brand new Labour authorities’s resolution is a hike in employer taxes to lift cash for funding in infrastructure and public companies, which has prompted criticism from the enterprise neighborhood.

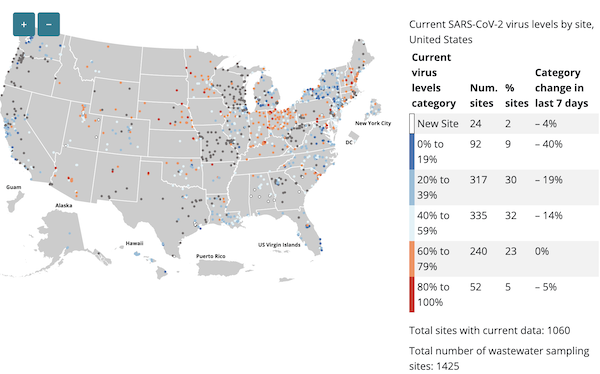

Retailers have stated the elevated social safety funds, an increase within the nationwide minimal wage, packaging levies and better enterprise charges – all coming in April – will price the sector 7 billion kilos ($8.6 billion) a yr.

Considerations of the broader financial affect despatched retail share costs sharply decrease this week and drove up authorities borrowing prices.

Within the retail sector, bigger gamers have extra scope to adapt and are cushioned by earlier wholesome earnings, however analysts have stated smaller gamers may discover themselves beneath extreme stress.

Clothes retailer Subsequent stated it confronted a 67 million kilos improve in wage prices in its yr to end-January 2026, however nonetheless forecast revenue progress.

It reckons it will possibly offset the upper wage invoice with measures together with a 1% improve in costs that it stated was “unwelcome, however nonetheless decrease than UK common inflation”. It might probably additionally improve operational efficiencies in its warehouses, distribution community and shops, the corporate stated.

CEO Simon Wolfson stated extra automation was inevitable throughout the sector.

“With any mechanisation mission you are at all times taking a look at a pay-back on it – you are saying ‘what is the saving versus the price of the mechanisation, or AI or software program’,” he advised Reuters.

“If the value of the mechanisation would not go up, however the value of the labour it saves does go up, it may imply that extra initiatives will be justified.”

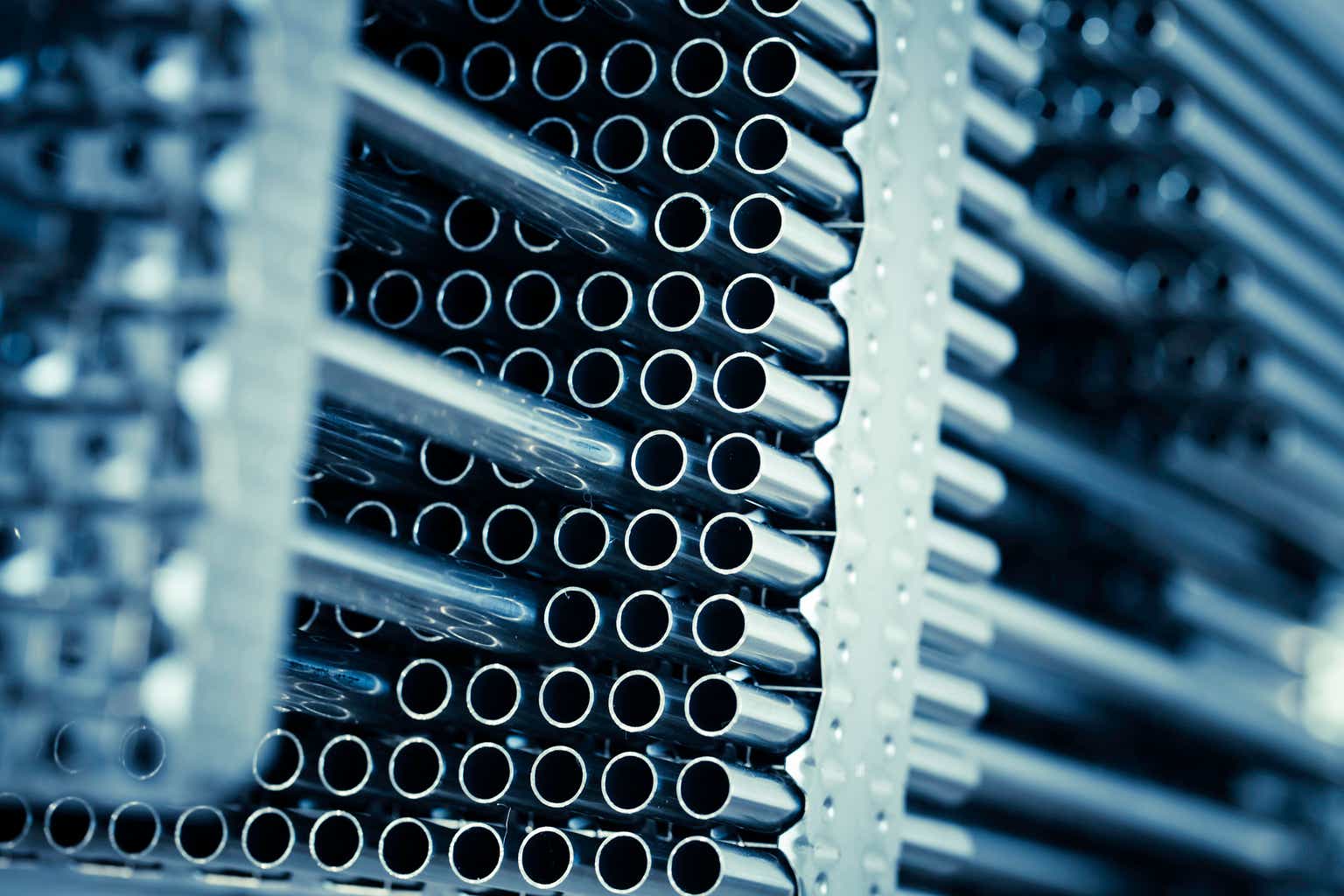

MORE ROBOTS?

Baker and food-to-go chain Greggs (LON:) final yr opened a extremely automated manufacturing line at its Newcastle, northeast England, website, that means it will possibly make as much as 4 million extra steak bakes and different merchandise every week from its present 10 million.

Tesco, Britain’s greatest grocery store, can also be rising automation and can open a robotic chilled distribution centre in Aylesford, southeast England, this yr.

No. 2 grocer Sainsbury’s is encouraging extra customers to make use of its SmartShop handheld self-scanning expertise.

Although Tesco faces a 250 million pound annual hit from the hike in employer nationwide insurance coverage contributions alone, CEO Ken Murphy stated it will cope.

Having navigated the COVID pandemic, provide chain disruption and commodity and power inflation, he stated Tesco was used to coping with rising prices by discovering financial savings elsewhere.

Finance chief Imran Nawaz stated Tesco’s “Save to Make investments” programme was on monitor to ship 500 million kilos of effectivity financial savings in its yr to February 2025, having delivered 640 million kilos in 2023/24.

“As we glance forward it is clear it may be one other yr the place we’ll have to do a stellar job,” Nawaz stated, singling out financial savings from higher shopping for by Tesco’s procurement organisation, in logistics, in freight, and in reducing waste.

Sainsbury’s, dealing with an extra 140 million kilos nationwide insurance coverage headwind, is equally concentrating on 1 billion kilos of price financial savings by March 2027.

Clothes and meals retailer M&S, dealing with 120 million kilos of additional wage prices, stated it aimed to move on “as little as attainable” to customers.

One of many greatest names on the British excessive road, the 141-year-old retailer is in the midst of a profitable turnaround programme and believes it will possibly proceed to grind out additional financial savings, modernising its distribution and provide chain.

“My abstract is: huge job, however tons in our management and we have got to be ruthlessly targeted on prices in these subsequent 12 months,” CEO Stuart Machin stated.

“We discuss so much about quantity progress, as a result of the extra we promote, the extra that offsets a few of these price pressures.”

However for a lot of smaller gamers elevating costs is the one possibility.

A British Chambers of Commerce survey of 4,800 companies, largely with fewer than 250 workers, discovered 55% deliberate value will increase – doubtlessly hampering the battle to comprise inflation and develop the financial system.

And for some, extra drastic motion could also be required.

British low cost retailer Shoe Zone has stated the extra prices of the price range meant some shops had develop into unviable and can be closed.

($1 = 0.8149 kilos)