Revealed on December thirty first, 2024 by Bob Ciura

Extreme yield securities are thought-about primarily as income mills. Nevertheless a lot much less consideration is paid to their capability to compound income over time.

There are three drivers for compounding income from any funding:

- Reinvesting dividends

- Dividend growth on a per share basis

- The time over which the funding is held

Reinvesting dividends is significantly extremely efficient with high-yield securities. Elevated yields indicate which you might compound your income stream sooner by reinvesting dividends.

If all dividends from a 5.0% yielding stock are reinvested, you’ll compound your income stream at roughly 5.0% yearly.

And since extreme yield shares, on widespread, don’t have notably extreme growth prices, you probably can “create” income growth by reinvesting dividends until you need them for personal finance causes.

We hold an inventory of high-dividend shares with current yields above 5%. You’ll be capable to receive the extreme dividend shares guidelines by clicking on the hyperlink underneath:

There are a variety of extreme yield securities available on the market. Nevertheless it certainly’s non as widespread for a high-yield security to pay rising dividends on a per share basis over time.

When this happens, your income compounds, even when you don’t reinvest dividends.

Nevertheless within the occasion you do reinvest dividends, you get compounding benefits from every proudly proudly owning additional shares (by the use of reinvesting dividends), and receiving additional income from each share (from dividend growth on a per share basis).

Subsequently, discovering shares with a extreme current yield with dividend will improve, may very well be a extremely efficient combination.

The following 10 extreme yield dividend compounders have current yields above 5%, and Dividend Hazard Scores of ‘C’ or larger. The guidelines moreover excludes REITs, BDCs, and MLPs.

Desk of Contents

The ten extreme yield dividend compounders are ranked by 5-year dividend growth value, from lowest to highest.

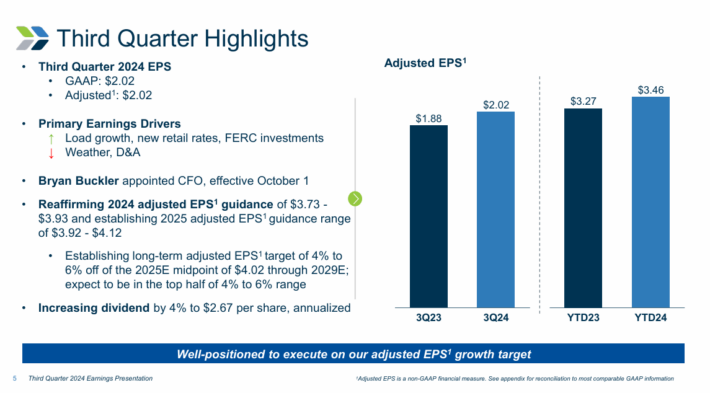

Extreme Yield Dividend Compounder #10: Evergy Inc. (EVRG)

- Dividend Yield: 4.3%

- Dividend Growth Cost: 5.0%

Evergy is {an electrical} utility holding agency included in 2017 and headquartered in Kansas Metropolis, Missouri.

By its subsidiaries Evergy Kansas, Evergy Metro and Evergy Missouri West, the company serves roughly 1.4 million residential purchasers, virtually 200,000 enterprise purchasers and 6,900 industrial purchasers and municipalities in Kansas and Missouri.

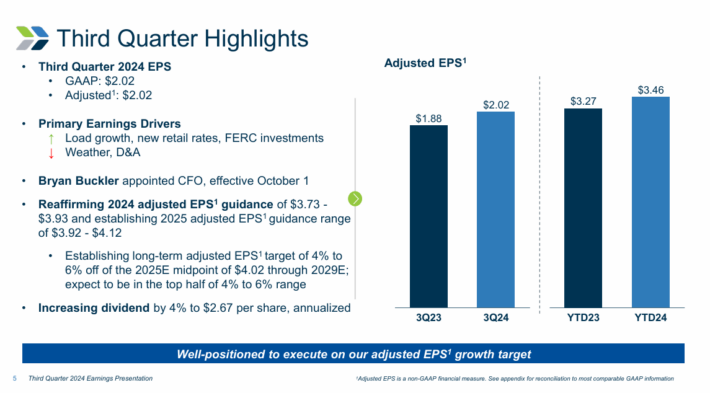

In early November, Evergy reported (11/7/24) financial outcomes for the third quarter of fiscal 2024. The company benefited from value hikes and higher weather-normalized demand, partly offset by cooler summer season season local weather and higher depreciation.

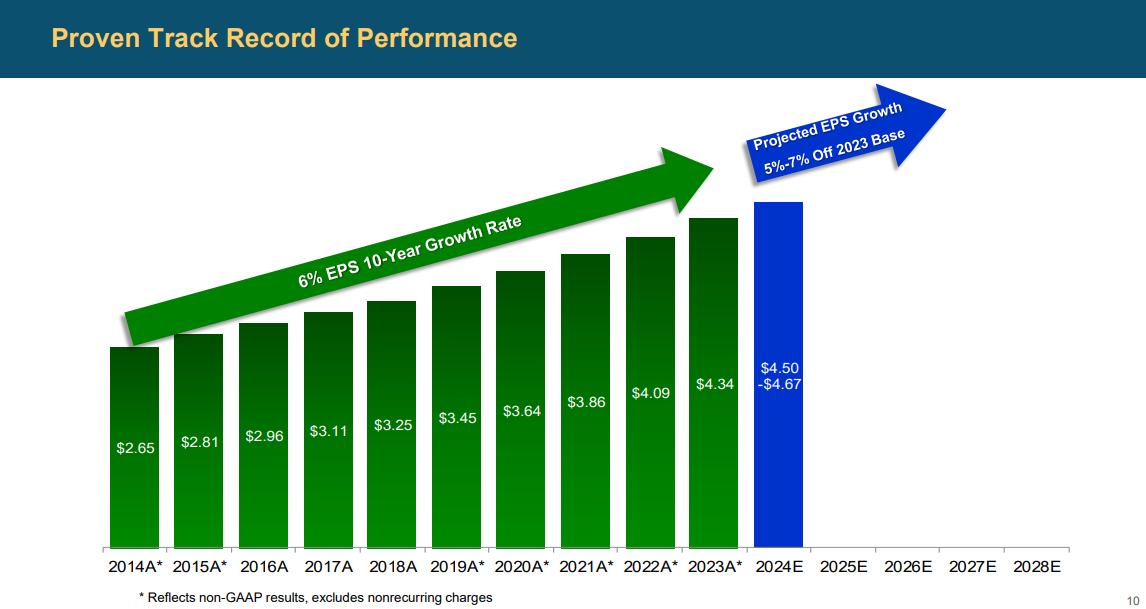

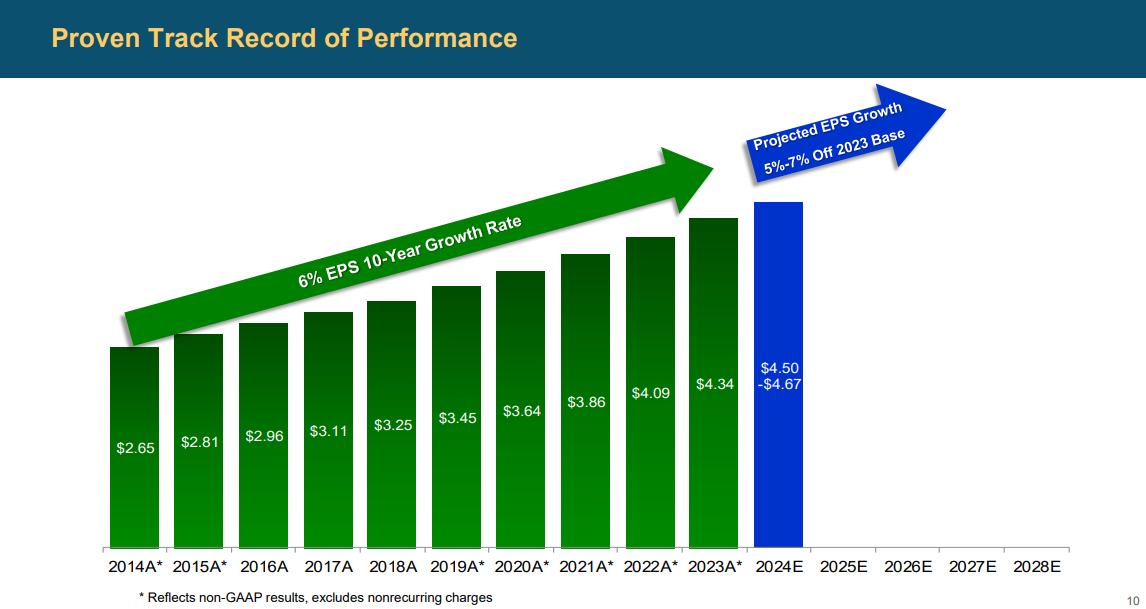

Provide: Investor Presentation

Adjusted earnings-per-share grew 7% year-over-year. Evergy reaffirmed its constructive steering for 2024. It expects adjusted earnings-per-share of $3.73-$3.93 and reiterated its long-term steering for 4%-6% adjusted earnings-per-share growth.

It moreover expects earnings-per-share of $3.92-$4.12 in 2025.

Click on on proper right here to acquire our most recent Optimistic Analysis report on Evergy Inc. (preview of internet web page 1 of three confirmed underneath):

Extreme Yield Dividend Compounder #9: Spire Inc. (SR)

- Dividend Yield: 6.2%

- Dividend Hazard Score: B

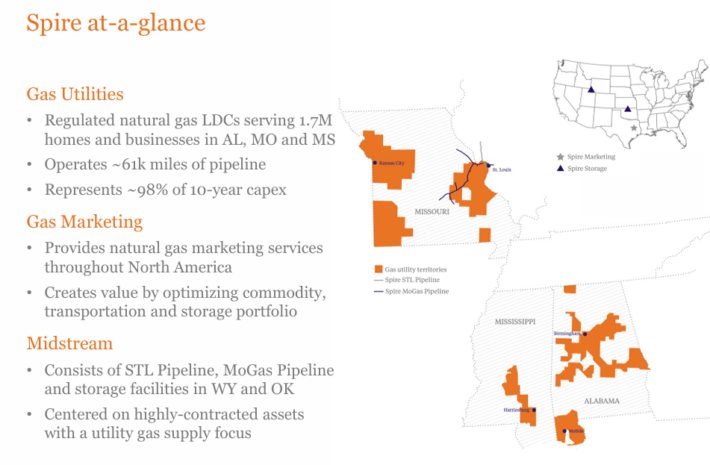

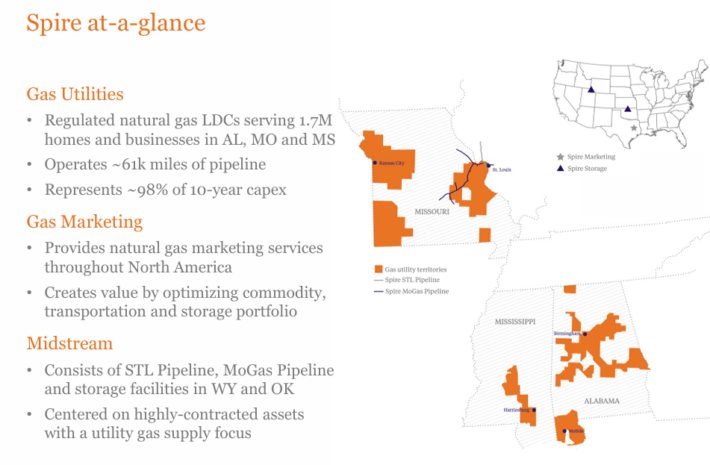

Spire Inc. is a public utility holding agency based totally in St. Louis, Missouri. The company offers pure gas service by the use of its regulated core utility operations whereas taking part in non-regulated actions that current enterprise options.

The company has 5 gas utilities, serving 1.7 million properties and corporations all through Alabama, Mississippi, and Missouri. This makes Spire the fifth largest publicly traded pure gas agency inside the nation.

Provide: Investor Presentation

The company generated $2.6 billion in product sales in Fiscal 12 months (FY)2024. Spire has been rising its dividends for 22 straight years.

On November twentieth., 2024, the company reported its FY2024 fourth quarter outcomes. The company reported an internet income of $250.9 million ($4.19 per share), up from $217.5 million ($3.85 per share) in fiscal 2023.

Adjusted earnings reached $247.4 million ($4.13 per share), enhancing from $228.1 million ($4.05 per share) the sooner 12 months.

The company reaffirmed its long-term adjusted earnings growth aim of 5–7% and provided fiscal 2025 earnings steering of $4.40 to $4.60 per share.

Click on on proper right here to acquire our most recent Optimistic Analysis report on SR (preview of internet web page 1 of three confirmed underneath):

Extreme Yield Dividend Compounder #8: Flowers Meals, Inc. (FLO)

- Dividend Yield: 4.7%

- Dividend Growth Cost: 5.1%

Flowers Meals opened its first bakery in 1919 and has since flip into one in all many largest producers of packaged bakery meals within the US, working 46 bakeries in 18 states.

Its well-known producers embrace Marvel Bread, Residence Pleasure, Nature’s Private, Dave’s Killer Bread, Tastykake and Canyon Bakehouse.

The company operates in two segments: Direct Retailer-Provide (DSD) and Warehouse Provide, with ~85% of the company’s product being delivered on to outlets.

Provide: Investor Presentation

Up to date breads, buns, rolls, and tortillas make up a number of three-fourths of the enterprise, with product sales channels for the company reduce up between Supermarkets, Mass Merchandisers, Foodservice, and Consolation Retailer.

On May twenty third, 2024, Flower Meals elevated its quarterly dividend 4.3% to $0.24, extending the company’s dividend growth streak to 22 consecutive years.

On November eighth, 2024, Flowers Meals reported third quarter outcomes for the interval ending October fifth, 2024. For the quarter, earnings of $1.19 billion was down 0.8% from the prior 12 months. Adjusted earnings-per-share equaled $0.33, up from $0.29 within the similar quarter remaining 12 months.

Flowers Meals provided an updated outlook for 2024 as correctly. For the 12 months, earnings is predicted in a variety of $5.116 billion to $5.147 billion. Adjusted earnings-per-share are anticipated to be in a variety of $1.24 to $1.28.

Click on on proper right here to acquire our most recent Optimistic Analysis report on FLO (preview of internet web page 1 of three confirmed underneath):

Extreme Yield Dividend Compounder #7: RGC Sources, Inc. (RGCO)

- Dividend Yield: 4.2%

- Dividend Growth Cost: 5.2%

RGC Sources, Inc. operates as a distributor and vendor of pure gas to industrial, enterprise, and residential purchasers by the use of its subsidiaries: Roanoke Gasoline, Midstream, and Diversified Vitality.

Residential purchasers are the company’s largest purchaser section, accounting for ~58% of the total revenues, adopted by enterprise purchasers at 34%.

The company operates in three segments: Gasoline Utility, the necessary factor earnings generator; Funding in Associates; and Mum or dad & Totally different. The company was based mostly in 1883 and generates barely under $100 million in annual earnings.

On November 14th, 2024, RGC Sources launched its This fall 2024 outcomes. The company posted non-GAAP EPS of $0.01, beating the market’s estimate by $0.02, and complete revenues of $13.10 million, which had been up 5.11% 12 months over 12 months.

The earnings growth was pushed by better contributions from the Mountain Valley Pipeline (MVP), primarily from Allowance for Funds Used All through Growth (AFUDC) sooner than the pipeline commenced operations in June 2024.

Click on on proper right here to acquire our most recent Optimistic Analysis report on RGCO (preview of internet web page 1 of three confirmed underneath):

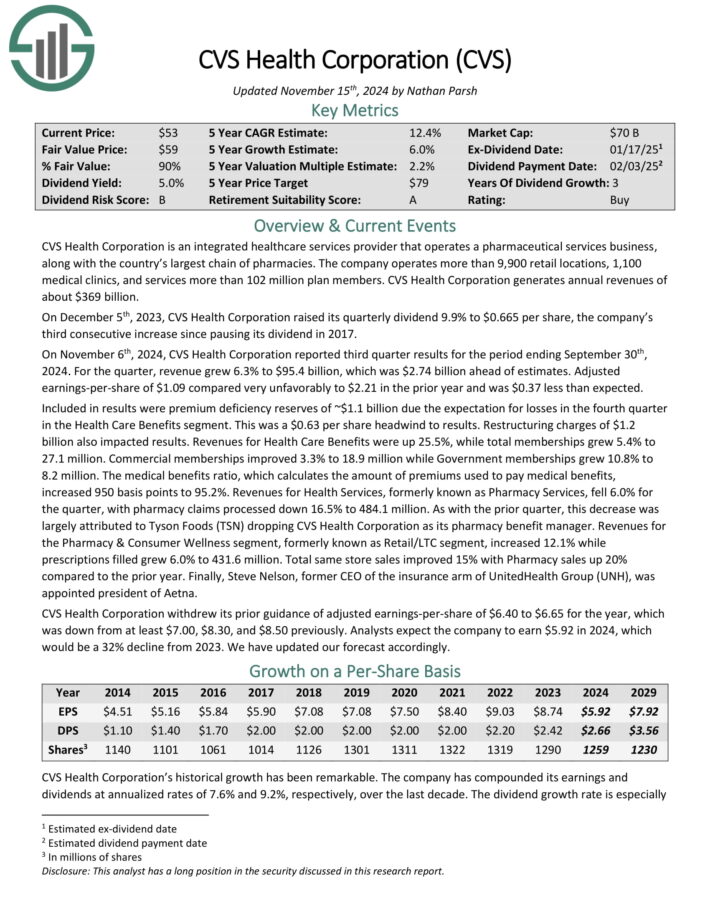

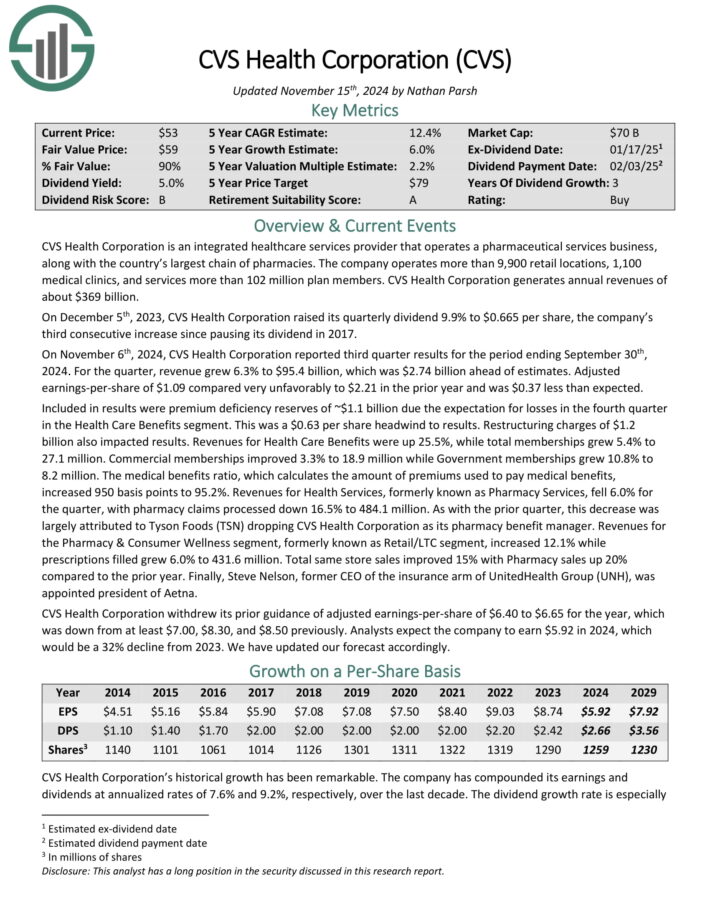

Extreme Yield Dividend Compounder #6: CVS Nicely being Corp. (CVS)

- Dividend Yield: 6.1%

- Dividend Growth Cost: 6.0%

CVS Nicely being Firm is an built-in healthcare corporations provider that operates a pharmaceutical corporations enterprise, along with the nation’s largest chain of pharmacies.

The company operates better than 9,900 retail areas, 1,100 medical clinics, and corporations better than 102 million plan members. CVS Nicely being Firm generates annual revenues of about $369 billion.

On November sixth, 2024, CVS Nicely being Firm reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, earnings grew 6.3% to $95.4 billion, which was $2.74 billion ahead of estimates. Adjusted earnings-per-share of $1.09 in distinction very unfavorably to $2.21 inside the prior 12 months and was $0.37 decrease than anticipated.

Included in outcomes had been premium deficiency reserves of ~$1.1 billion due the expectation for losses inside the fourth quarter inside the Nicely being Care Benefits section.

This was a $0.63 per share headwind to outcomes. Restructuring charges of $1.2 billion moreover impacted outcomes. Revenues for Nicely being Care Benefits had been up 25.5%, whereas complete memberships grew 5.4% to 27.1 million.

Click on on proper right here to acquire our most recent Optimistic Analysis report on CVS (preview of internet web page 1 of three confirmed underneath):

Extreme Yield Dividend Compounder #5: Eversource Vitality (ES)

- Dividend Yield: 5.0%

- Dividend Growth Cost: 6.0%

Eversource Vitality is a diversified holding agency with subsidiaries that current regulated electrical, gas, and water distribution service inside the Northeast U.S.

The company’s utilities serve better than 4 million purchasers after shopping for NStar’s Massachusetts utilities in 2012, Aquarion in 2017, and Columbia Gasoline in 2020.

Eversource has delivered common growth to shareholders for a number of years.

Provide: Investor Presentation

On November 4th, 2024, Eversource Vitality launched its third-quarter 2024 outcomes for the interval ending September thirtieth, 2024.

For the quarter, the company reported an internet lack of $(118.1) million, a sharp decline from earnings of $339.7 million within the similar quarter of ultimate 12 months, which shows the have an effect on of the company’s exit from offshore wind investments.

The company reported a loss per share of $(0.33), in distinction with earnings-per-share of $0.97 inside the prior 12 months. Earnings from the Electrical Transmission section elevated to $174.9 million, up from $160.3 million inside the prior 12 months, primarily ensuing from a greater diploma of funding in Eversource’s electrical transmission system.

Click on on proper right here to acquire our most recent Optimistic Analysis report on ES (preview of internet web page 1 of three confirmed underneath):

Extreme Yield Dividend Compounder #4: Portland Regular Electrical (POR)

- Dividend Yield: 4.6%

- Dividend Growth Cost: 6.0%

Portland Regular Electrical is {an electrical} utility based totally in Portland, Oregon, providing electrical vitality to better than 930,000 purchasers in 51 cities. The company owns or contracts better than 3.5 gigawatts of vitality period, between gas, coal, wind & photograph voltaic, and hydro.

On April nineteenth, 2024, Portland Regular Electrical launched a 5% improve inside the quarterly dividend to $0.50 per share.

Portland Regular reported third quarter 2024 outcomes on October twenty fifth, 2024. The company reported internet income of $94 million for the quarter, equal to $0.90 per diluted share on a GAAP basis, compared with $0.46 in Q3 2023.

Retail vitality deliveries rose 0.3% year-to-date compared with the similar prior 12 months interval, nevertheless wholesale vitality deliveries soared 45%. Consequently, complete vitality deliveries rose 11%.

Administration narrowed its 2024 full 12 months steering for adjusted earnings per share to $3.13 on the midpoint based totally on a group of assumptions, most notably a 2.5% improve in annual vitality deliveries.

Click on on proper right here to acquire our most recent Optimistic Analysis report on Portland Regular Electrical Agency (preview of internet web page 1 of three confirmed underneath):

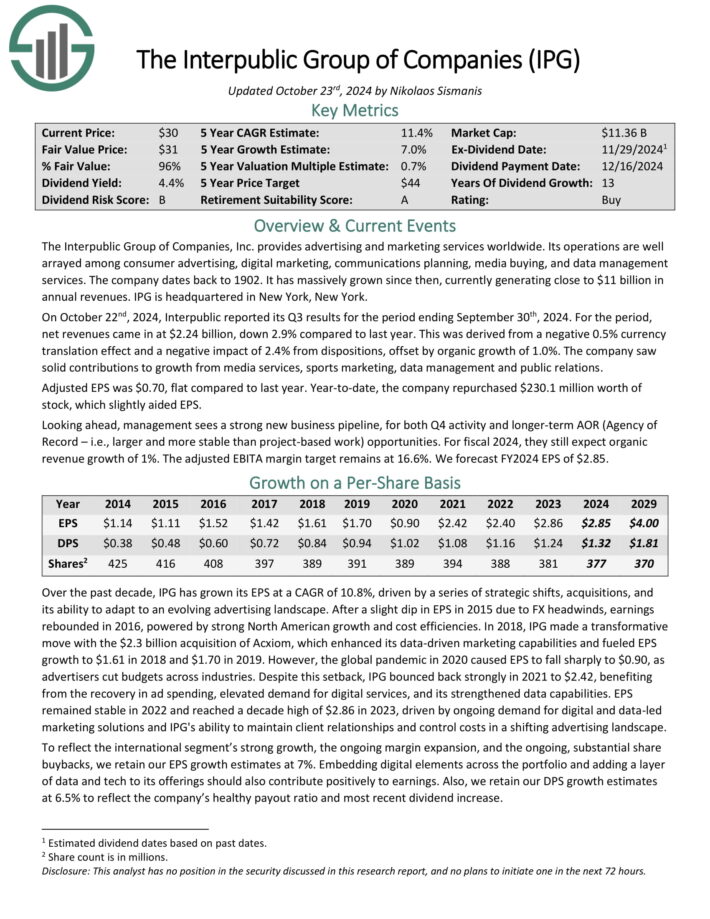

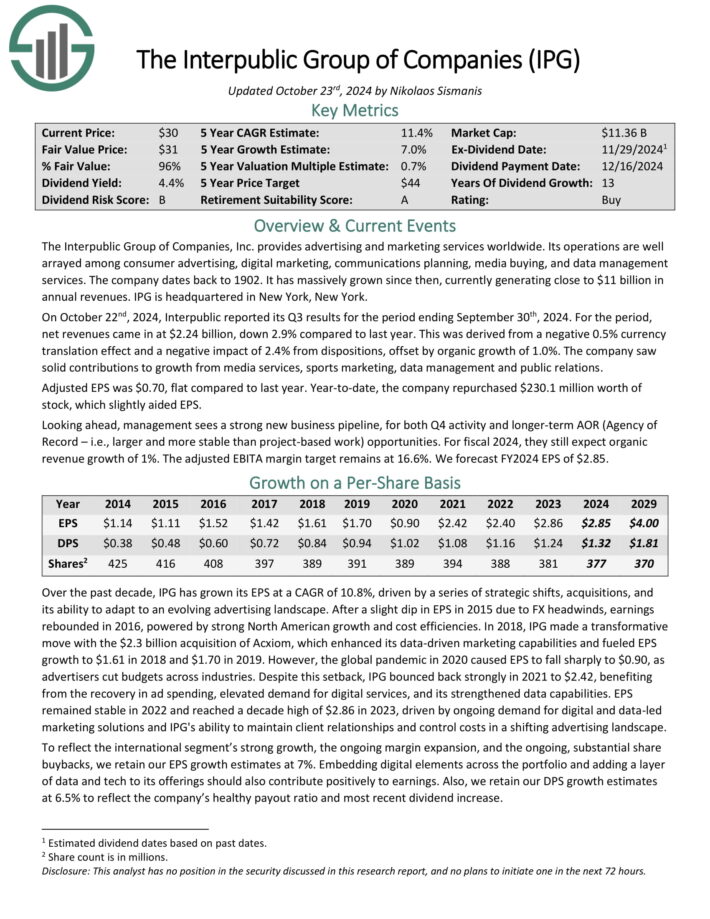

Extreme Yield Dividend Compounder #3: Interpublic Group of Cos. (IPG)

- Dividend Yield: 4.7%

- Dividend Growth Cost: 6.5%

The Interpublic Group of Corporations, Inc. offers selling and promoting and advertising corporations worldwide. Its operations are correctly arrayed amongst consumer selling, digital promoting and advertising, communications planning, media looking for, and data administration corporations.

On October twenty second, 2024, Interpublic reported its Q3 outcomes for the interval ending September thirtieth, 2024. For the interval, internet revenues obtained right here in at $2.24 billion, down 2.9% compared with remaining 12 months.

This was derived from a opposed 0.5% international cash translation affect and a opposed have an effect on of two.4% from tendencies, offset by pure growth of 1.0%.

The company seen sturdy contributions to growth from media corporations, sports activities actions promoting and advertising, data administration and public relations.

Adjusted EPS was $0.70, flat compared with remaining 12 months. 12 months-to-date, the company repurchased $230.1 million value of stock, which barely aided EPS.

Click on on proper right here to acquire our most recent Optimistic Analysis report on IPG (preview of internet web page 1 of three confirmed underneath):

Extreme Yield Dividend Compounder #2: FMC Corp. (FMC)

- Dividend Yield: 4.8%

- Dividend Growth Cost: 7.0%

FMC Firm is an agricultural sciences agency that offers crop security, plant effectively being, {{and professional}} pest and turf administration merchandise. By acquisitions, FMC is now one in all many 5 largest patented crop chemical firms.

The company markets its merchandise by the use of its private product sales group and via alliance companions, neutral distributors, and product sales representatives. It operates in North America, Latin America, Europe, the Middle East, Africa, and Asia.

On October twenty ninth, 2024, FMC Firm launched its third quarter outcomes for the interval ending September thirtieth, 2024.

For the quarter, the company reported earnings of $1.07 billion, up 9% versus the third quarter of 2023, and adjusted earnings per diluted share of $0.69, up 57% versus the similar quarter of the sooner 12 months.

Quarterly earnings growth was primarily pushed by a 17% improve in amount, notably sturdy in North America and Latin America, no matter coping with a 5% decline from value decreases ensuing from tough market circumstances and a 3% worldwide commerce headwind.

Click on on proper right here to acquire our most recent Optimistic Analysis report on FMC (preview of internet web page 1 of three confirmed underneath):

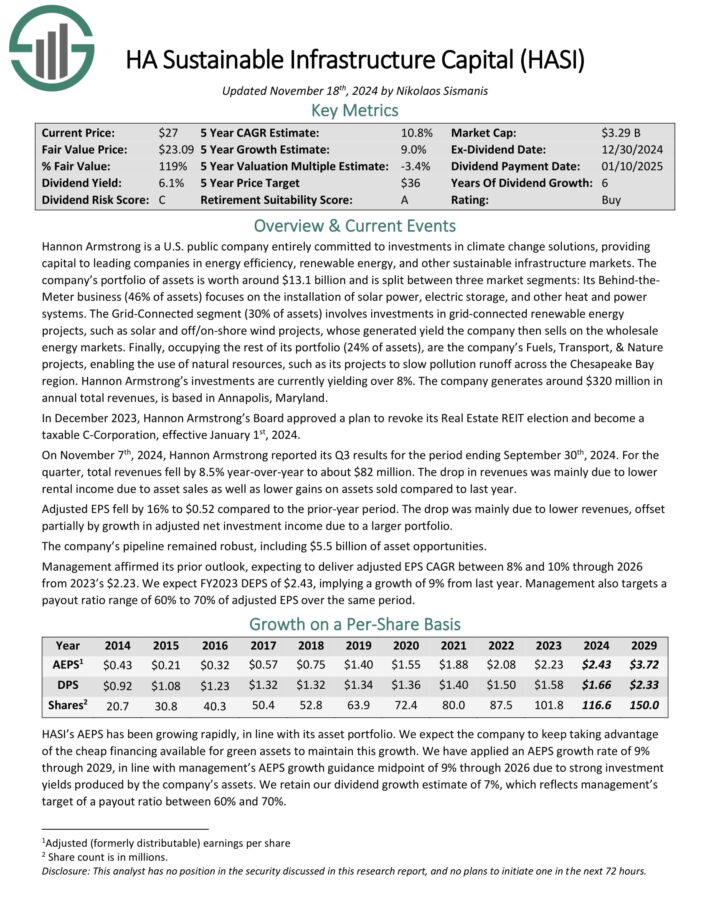

Extreme Yield Dividend Compounder #1: HA Sustainable Infrastructure Capital (HASI)

- Dividend Yield: 6.2%

- Dividend Growth Cost: 7.0%

Hannon Armstrong is a U.S. public agency that invests in native climate change choices, providing capital to fundamental firms in vitality effectivity, renewable vitality, and completely different sustainable infrastructure markets.

The company’s portfolio of belongings is value spherical $13.1 billion and is reduce up between three market segments: Its Behind the Meter enterprise (46% of belongings) focuses on the arrange of photo voltaic vitality, electrical storage, and completely different heat and vitality applications.

The Grid-Associated section (30% of belongings) consists of investments in grid-connected renewable vitality duties, equal to photograph voltaic and off/on-shore wind duties, whose generated yield the company then sells on the wholesale vitality markets.

Lastly, occupying the rest of its portfolio (24% of belongings), are the company’s Fuels, Transport, & Nature duties, enabling utilizing pure property, equal to its duties to gradual air air pollution runoff all through the Chesapeake Bay space.

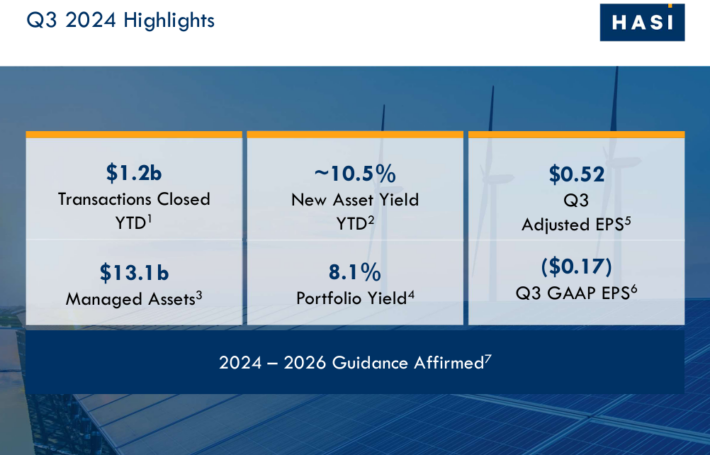

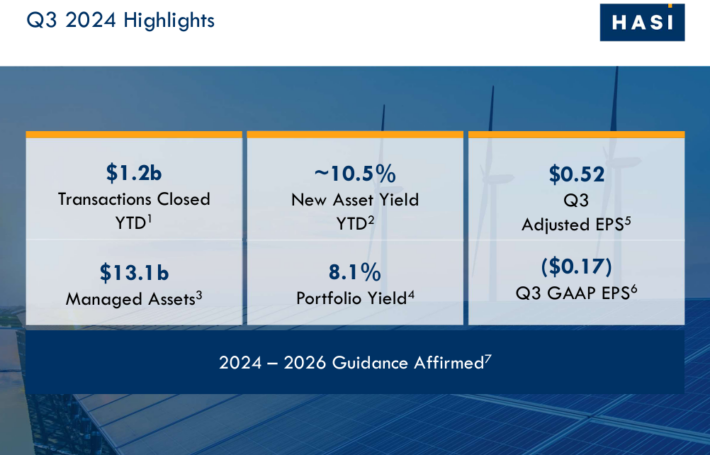

Provide: Investor Presentation

On November seventh, 2024, Hannon Armstrong reported its Q3 outcomes for the interval ending September thirtieth, 2024. For the quarter, complete revenues fell by 8.5% year-over-year to about $82 million.

The drop in revenues was primarily ensuing from lower rental income ensuing from asset product sales along with lower useful properties on belongings provided compared with remaining 12 months.

Adjusted EPS fell by 16% to $0.52 compared with the prior-year interval. The drop was primarily ensuing from lower revenues, offset partially by growth in adjusted internet funding income ensuing from a much bigger portfolio.

The company’s pipeline remained sturdy, along with $5.5 billion of asset options. Administration affirmed its prior outlook, anticipating to ship adjusted EPS CAGR between 8% and 10% by the use of 2026.

Click on on proper right here to acquire our most recent Optimistic Analysis report on HASI (preview of internet web page 1 of three confirmed underneath):

Additional Learning

Consumers should proceed to look at each stock to make sure their fundamentals and growth keep on observe, notably amongst shares with terribly extreme dividend yields.

See the property underneath to generate additional compelling funding ideas for dividend growth shares and/or high-yield funding securities.

Thanks for learning this textual content. Please ship any recommendations, corrections, or inquiries to [email protected].

rn

rn

Source link ","creator":{"@sort":"Particular person","title":"Index Investing Information","url":"https://indexinvestingnews.com/creator/projects666/","sameAs":["https://indexinvestingnews.com"]},"articleSection":["Investing"],"picture":{"@sort":"ImageObject","url":"https://www.suredividend.com/wp-content/uploads/2022/10/Excessive-Dividend-Picture.jpg","width":0,"peak":0},"writer":{"@sort":"Group","title":"","url":"https://indexinvestingnews.com","brand":{"@sort":"ImageObject","url":""},"sameAs":["https://www.facebook.com/Index-Investing-News-102075432474739","https://twitter.com/IndexInvesting_"]}}

Source link