Printed on December twenty sixth, 2024 by Bob Ciura

Extreme-yield shares pay out dividends which might be significantly larger than market frequent dividends. As an illustration, the S&P 500’s current yield is barely ~1.3%.

Extreme-yield shares can be very helpful to shore up income after retirement. A $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

We now have now created a spreadsheet of shares (and thoroughly related REITs and MLPs, and so forth.) with dividend yields of 5% or further…

You’ll be capable of get hold of your free full itemizing of all extreme dividend shares with 5%+ yields (along with obligatory financial metrics equal to dividend yield and payout ratio) by clicking on the hyperlink beneath:

Extreme dividend shares are naturally attention-grabbing for income merchants equal to retirees. Extreme yield shares can current larger ranges of retirement income.

In spite of everything, merchants on a regular basis should do their evaluation, to make sure the underlying stock can keep its dividend payout.

This article will current a top level view of why dividend shares are attention-grabbing for retirees, along with a listing of 10 extreme yield shares for lasting retirement income.

Desk Of Contents

The desk of contents beneath provides for easy navigation of the article:

Why Buy Extreme Dividend Shares?

There are numerous good the explanation why income merchants can buy extreme dividend shares with yields above 5%.

First, dividends current an obligatory improve to a corporation’s full returns over time. Analysis current that going once more to 1960, 85% of the cumulative full return of the S&P 500 Index1 can be attributed to reinvested dividends and the ability of compounding

Shares that pay extreme dividends don’t should see their share prices develop as lots as a non-dividend-paying stock with a view to acquire the equivalent full return.

Second, dividend shares, and notably resilient dividend shares that proceed to pay dividends all through sturdy events, can offset market declines all through bear markets. Whereas their share prices could dip shortly, merchants will on the very least nonetheless revenue from a delicate income stream.

Third, when corporations have a monitor file of paying out dividends, that has a disciplining affect on administration.

As a consequence of this reality, the subsequent 10 extreme yield shares could current lasting retirement income. The ten shares beneath all have current yields above 5%, with Dividend Hazard Scores of A or B inside the Optimistic Analysis Evaluation Database.

This combination ends in a listing of 10 extreme yield shares that current sturdy income now, with a wonderful chance of sustaining their dividends in a recession.

Extreme Yield Stock For Lasting Retirement Income: UGI Corp (UGI)

UGI Firm is a gasoline and electrical utility that operates in Pennsylvania, together with an enormous energy distribution enterprise that serves your full US and totally different parts of the world.

It was primarily based in 1882 and has paid consecutive dividends since 1885. Its market capitalization is $6.2 billion. The company operates in 4 reporting segments: AmeriGas, UGI Worldwide, Midstream & Promoting and advertising, and UGI Utilities.

On November 22, 2024, UGI Firm reported file outcomes for fiscal 2024, reaching an all-time extreme adjusted diluted EPS of $3.06, pushed by sturdy execution of strategic priorities and effectivity enhancements.

The company realized a $75 million low cost in working payments ahead of schedule, reaching eternal worth monetary financial savings centered for fiscal 2025.

UGI moreover returned $320 million to shareholders through dividends, persevering with a 140-year streak of consecutive dividend funds and demonstrating a five-year EPS CAGR of 6%.

Key accomplishments included necessary investments in infrastructure, with $500 million allotted to utility enhancements and the completion of the Moody RNG endeavor, anticipated to supply 300 MMCF yearly.

Click on on proper right here to acquire our most modern Optimistic Analysis report on UGI (preview of net web page 1 of three confirmed beneath):

Extreme Yield Stock For Lasting Retirement Income: NNN REIT (NNN)

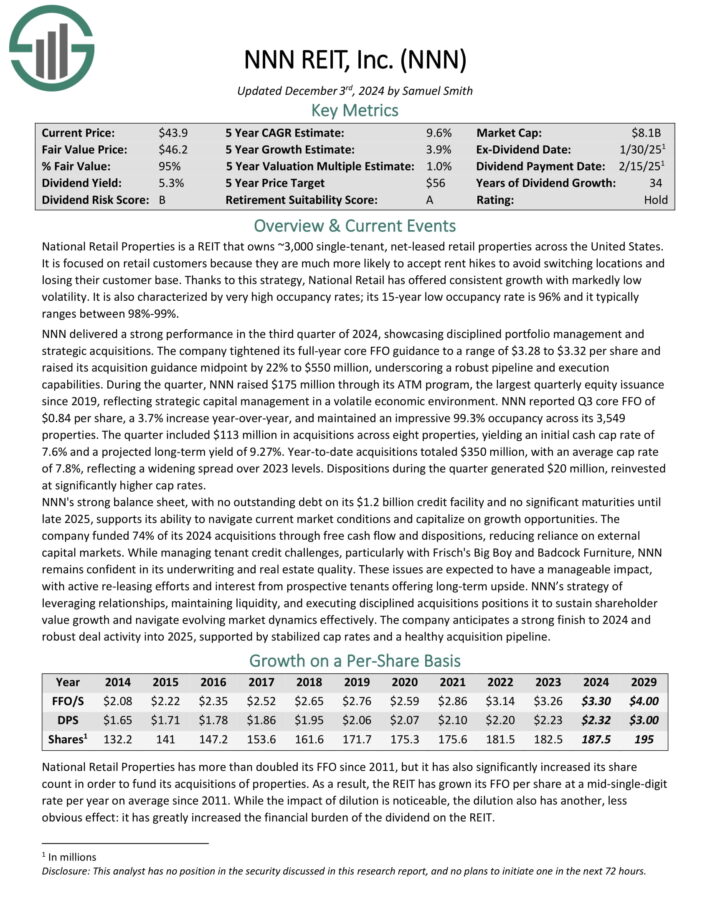

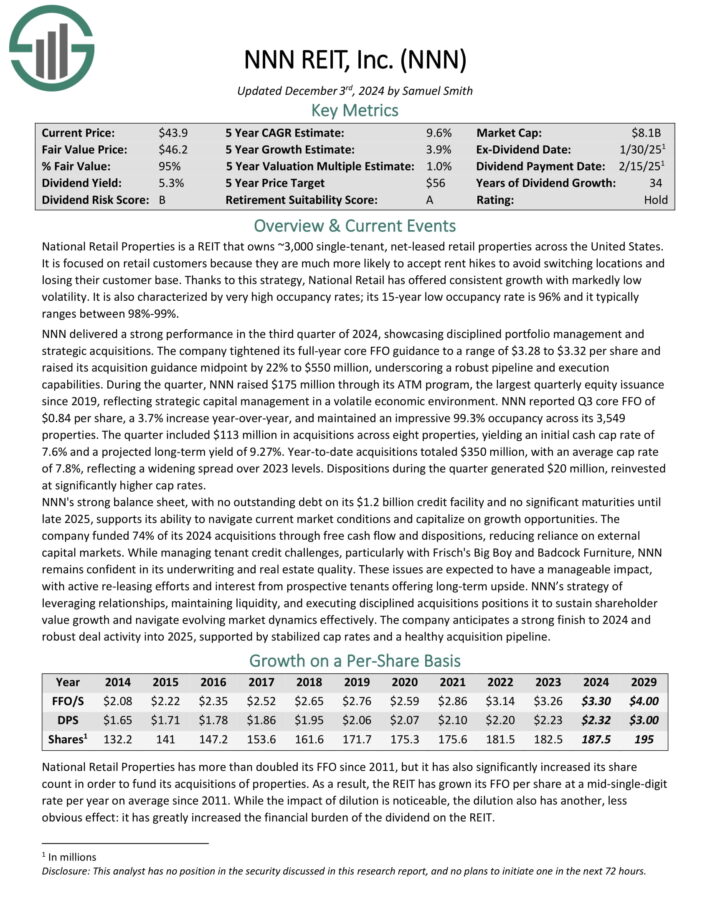

Nationwide Retail Properties is a REIT that owns ~3,000 single-tenant, net-leased retail properties all through the US.

It’s centered on retail prospects on account of they’re a lot further liable to accept rent hikes to avoid switching areas and dropping their purchaser base. Its 15-year low occupancy cost is 96% and it typically ranges between 98%-99%.

NNN delivered a robust effectivity inside the third quarter of 2024, showcasing disciplined portfolio administration and strategic acquisitions.

The company tightened its full-year core FFO steering to quite a lot of $3.28 to $3.32 per share and raised its acquisition steering midpoint by 22% to $550 million, underscoring a sturdy pipeline and execution capabilities.

NNN reported Q3 core FFO of $0.84 per share, a 3.7% improve year-over-year, and maintained a formidable 99.3% occupancy all through its 3,549 properties.

Click on on proper right here to acquire our most modern Optimistic Analysis report on NNN (preview of net web page 1 of three confirmed beneath):

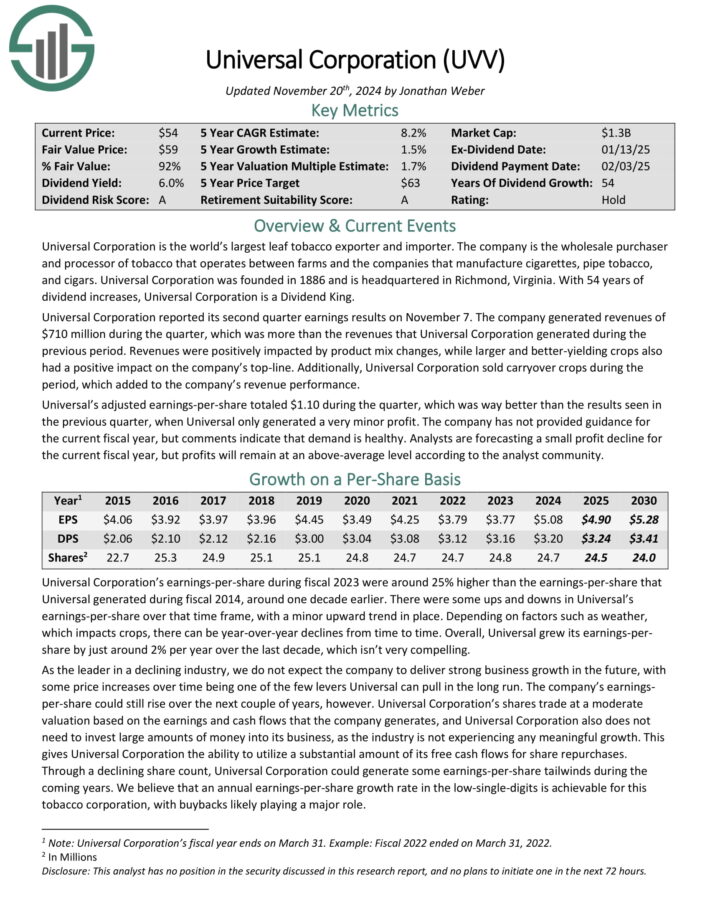

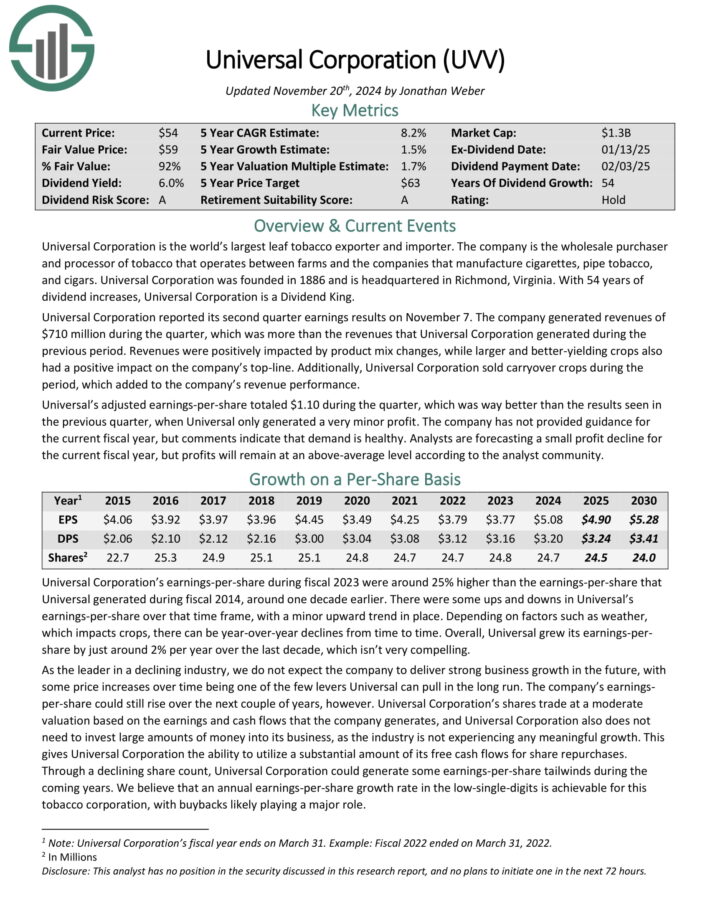

Extreme Yield Stock For Lasting Retirement Income: Widespread Corp. (UVV)

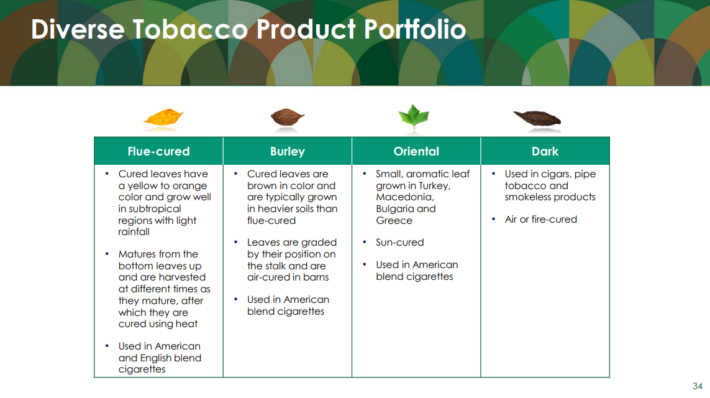

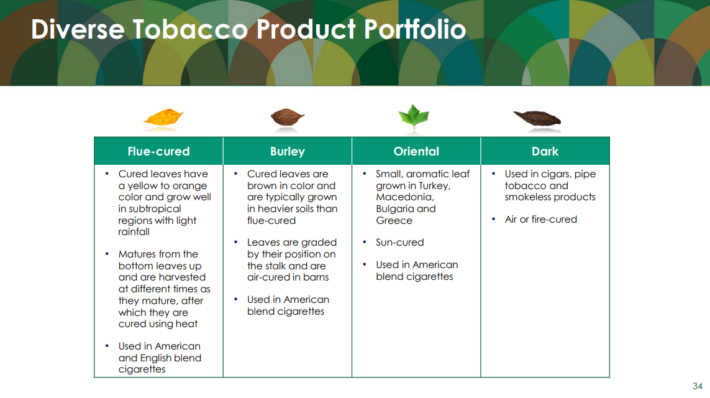

Widespread Firm is a market chief in supplying leaf tobacco and totally different plant-based inputs to consumer product producers.

The Tobacco Operations part buys and sells tobacco used to make cigarettes, cigars, pipe tobacco, and smokeless merchandise.

Widespread buys tobacco from its suppliers, processes it, and sells it to large tobacco corporations inside the US and internationally.

Provide: Investor Presentation

The Ingredient Operations deal primarily with greens and fruits nonetheless is significantly smaller than the tobacco operations. Widespread has been rising this enterprise through acquisitions starting in 2020.

Widespread Firm reported its second quarter earnings outcomes on November 7. The company generated revenues of $710 million by means of the quarter.

Furthermore, Widespread Firm purchased carryover crops by means of the interval, which added to the company’s earnings effectivity.

Click on on proper right here to acquire our most modern Optimistic Analysis report on Widespread (preview of net web page 1 of three confirmed beneath):

Extreme Yield Stock For Lasting Retirement Income: Realty Income (O)

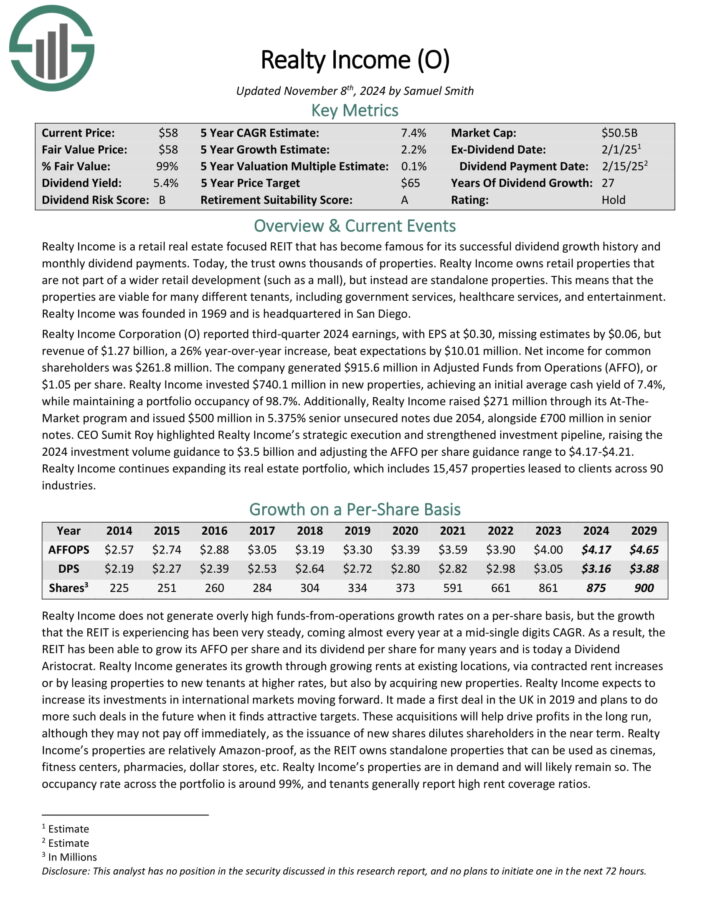

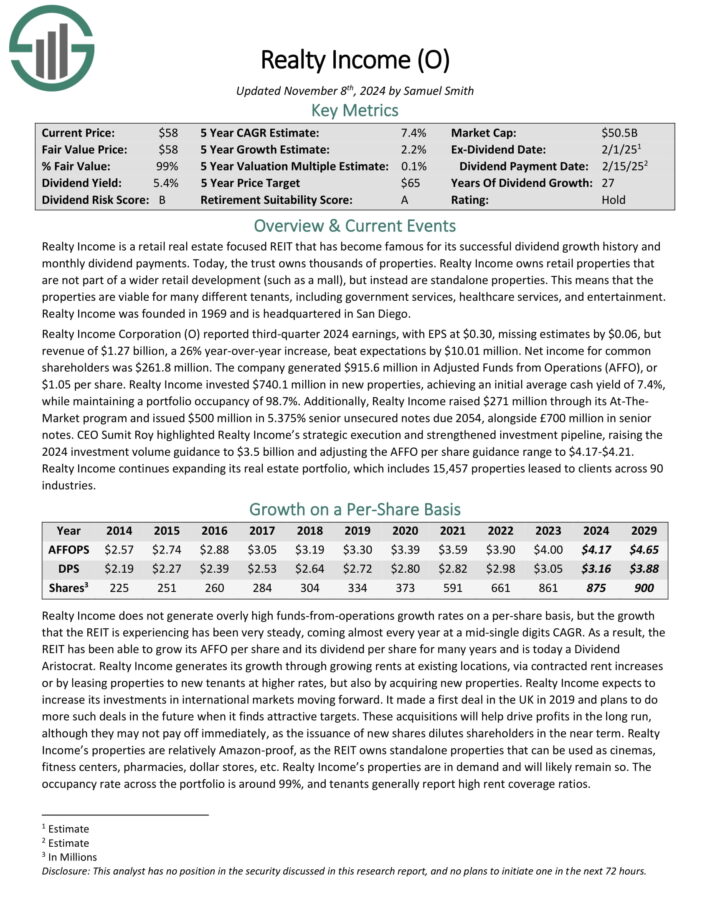

Realty Income is a retail precise property centered REIT that has develop to be well-known for its worthwhile dividend progress historic previous and month-to-month dividend funds.

Realty Income owns retail properties that aren’t part of a wider retail development (equal to a mall), nonetheless as an alternative are standalone properties. Which suggests the properties are viable for lots of completely totally different tenants, along with authorities corporations, healthcare corporations, and leisure.

Realty Income reported third-quarter 2024 earnings, with EPS at $0.30, missing estimates by $0.06, nonetheless earnings of $1.27 billion, a 26% year-over-year improve, beat expectations by $10.01 million. Internet income for frequent shareholders was $261.8 million.

The company generated $915.6 million in Adjusted Funds from Operations (AFFO), or $1.05 per share. Realty Income invested $740.1 million in new properties, reaching an preliminary frequent cash yield of seven.4%, whereas sustaining a portfolio occupancy of 98.7%.

Click on on proper right here to acquire our most modern Optimistic Analysis report on Realty Income (preview of net web page 1 of three confirmed beneath):

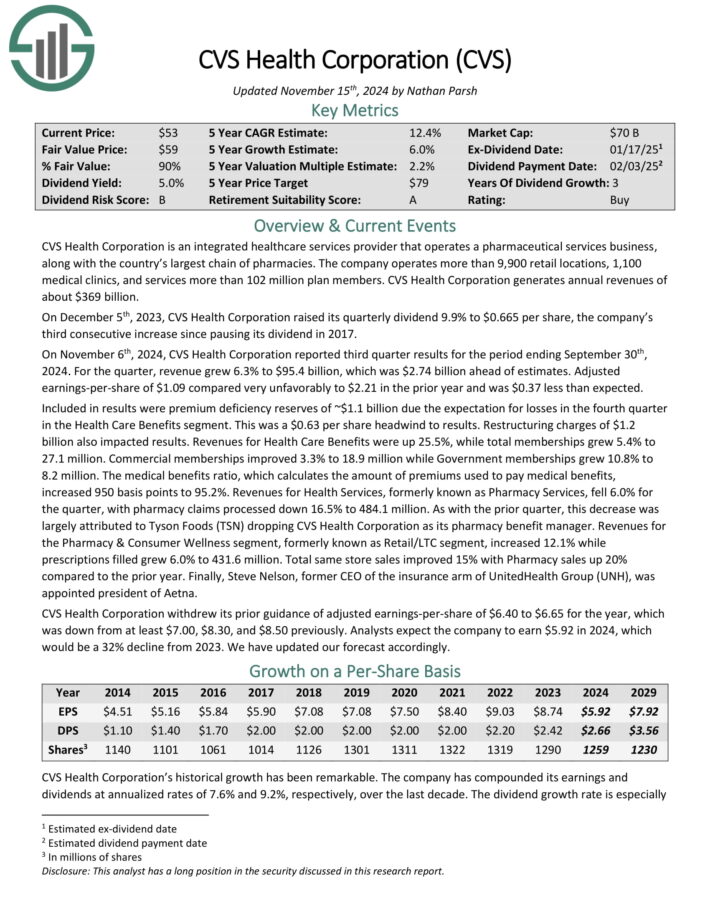

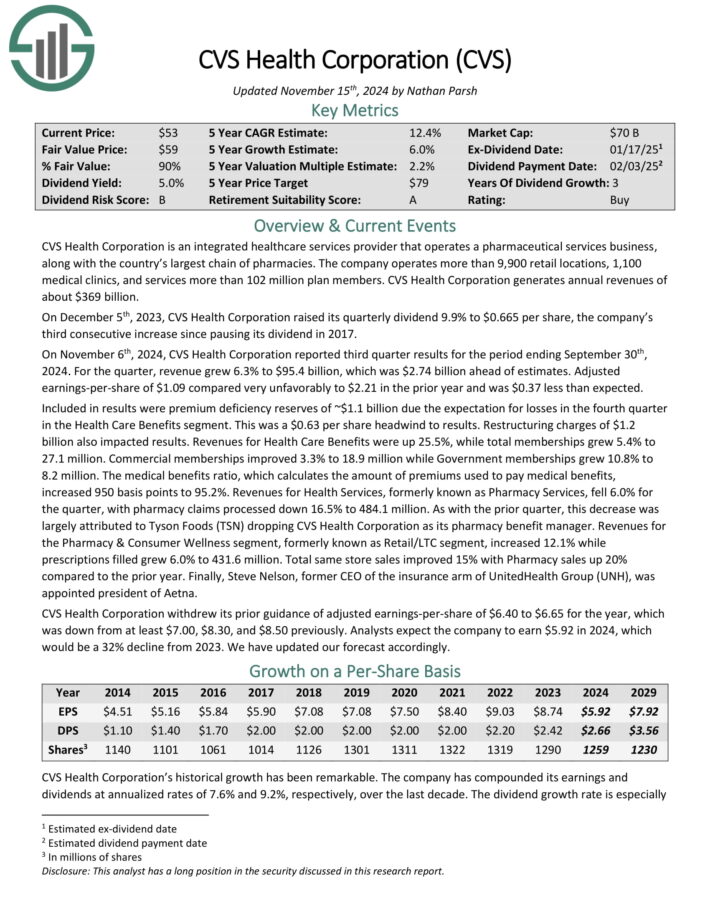

Extreme Yield Stock For Lasting Retirement Income: CVS Effectively being (CVS)

CVS Effectively being Firm is an built-in healthcare corporations provider that operates a pharmaceutical corporations enterprise, along with the nation’s largest chain of pharmacies.

The company operates larger than 9,900 retail areas, 1,100 medical clinics, and firms larger than 102 million plan members. CVS Effectively being Firm generates annual revenues of about $369 billion.

On November sixth, 2024, CVS Effectively being Firm reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, earnings grew 6.3% to $95.4 billion, which was $2.74 billion ahead of estimates. Adjusted earnings-per-share of $1.09 in distinction very unfavorably to $2.21 inside the prior yr and was $0.37 decrease than anticipated.

Included in outcomes have been premium deficiency reserves of ~$1.1 billion due the expectation for losses inside the fourth quarter inside the Effectively being Care Benefits part.

This was a $0.63 per share headwind to outcomes. Restructuring costs of $1.2 billion moreover impacted outcomes. Revenues for Effectively being Care Benefits have been up 25.5%, whereas full memberships grew 5.4% to 27.1 million.

Click on on proper right here to acquire our most modern Optimistic Analysis report on CVS (preview of net web page 1 of three confirmed beneath):

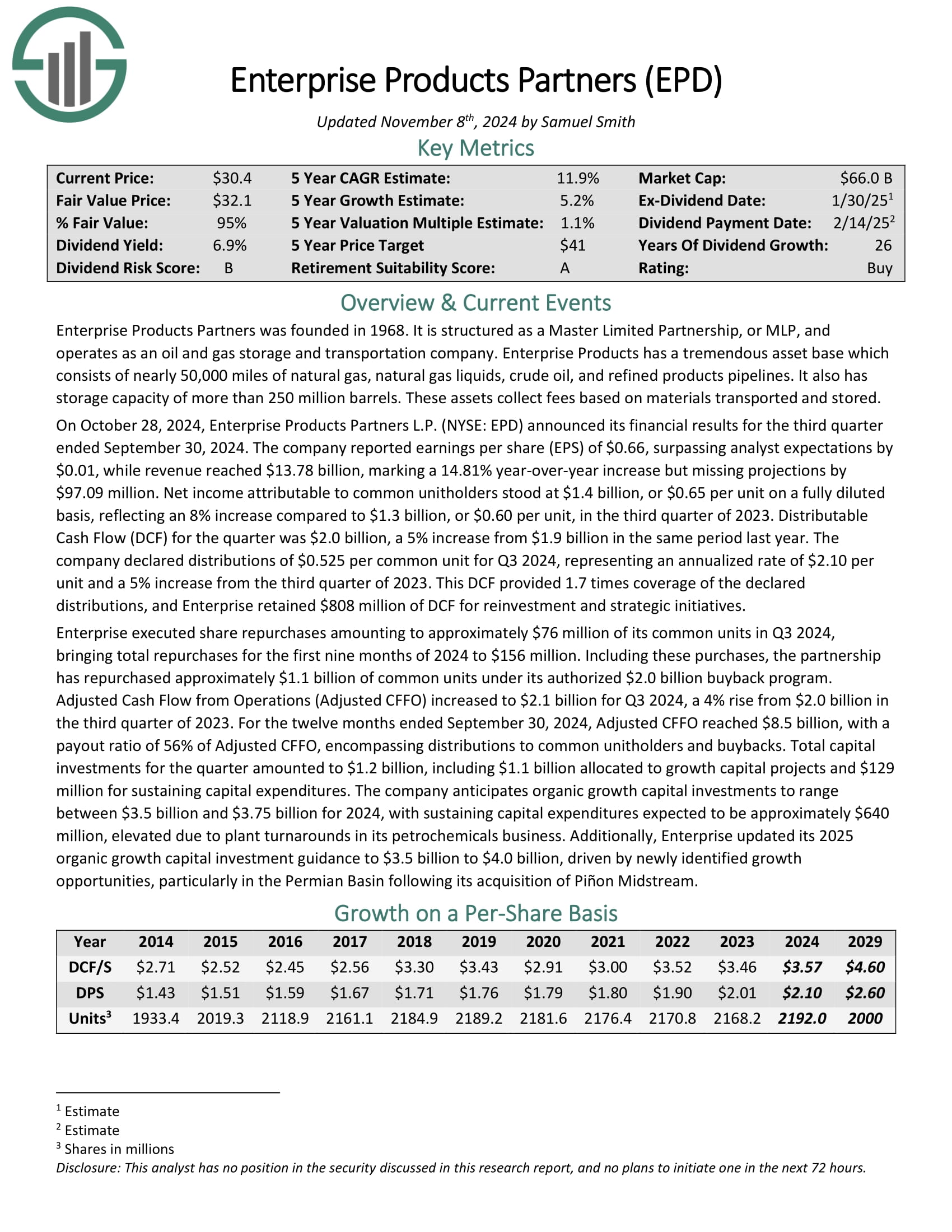

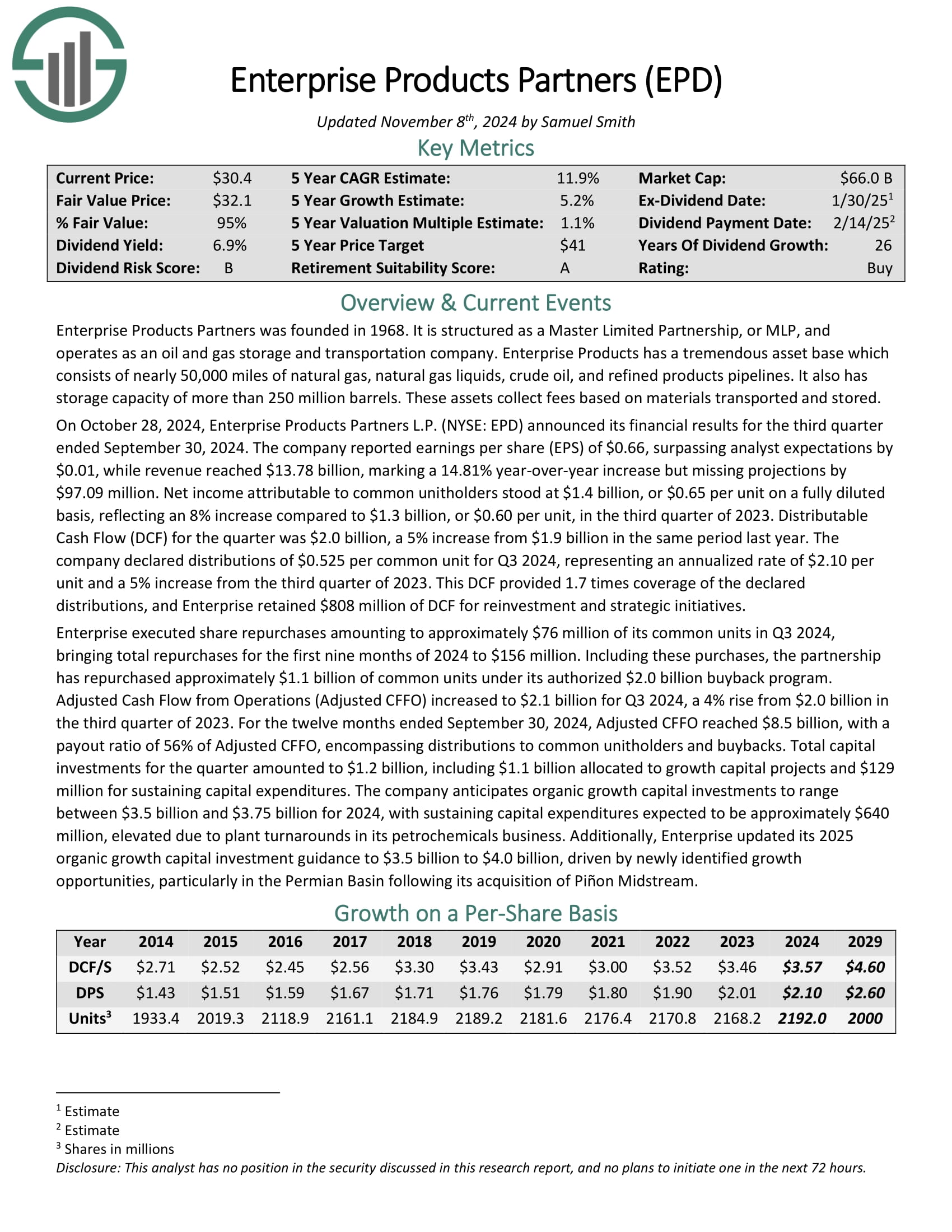

Extreme Yield Stock For Lasting Retirement Income: Enterprise Merchandise Companions (EPD)

Enterprise Merchandise Companions was primarily based in 1968. It’s structured as a Grasp Restricted Partnership, or MLP, and operates as an oil and gasoline storage and transportation agency.

Enterprise Merchandise has an enormous asset base which consists of larger than 50,000 miles of pure gasoline, pure gasoline liquids, crude oil, and refined merchandise pipelines.

It moreover has storage functionality of larger than 300 million barrels. These belongings purchase expenses based totally on volumes of provides transported and saved.

Provide: Investor Presentation

On October 28, 2024, Enterprise Merchandise Companions launched its financial outcomes for the third quarter ended September 30, 2024. Revenue reached $13.78 billion, marking a 14.81% year-over-year improve.

Distributable Cash Transfer (DCF) for the quarter was $2.0 billion, a 5% improve from $1.9 billion within the equivalent interval ultimate yr.

The company declared distributions of $0.525 per frequent unit for Q3 2024, representing an annualized cost of $2.10 per unit and a 5% improve from the third quarter of 2023. DCF supplied 1.7 events safety of the declared distributions.

Click on on proper right here to acquire our most modern Optimistic Analysis report on EPD (preview of net web page 1 of three confirmed beneath):

Extreme Yield Stock For Lasting Retirement Income: Sunoco LP (SUN)

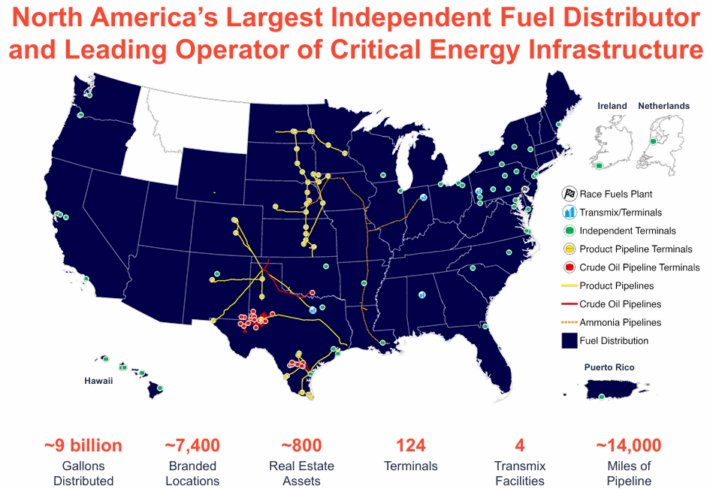

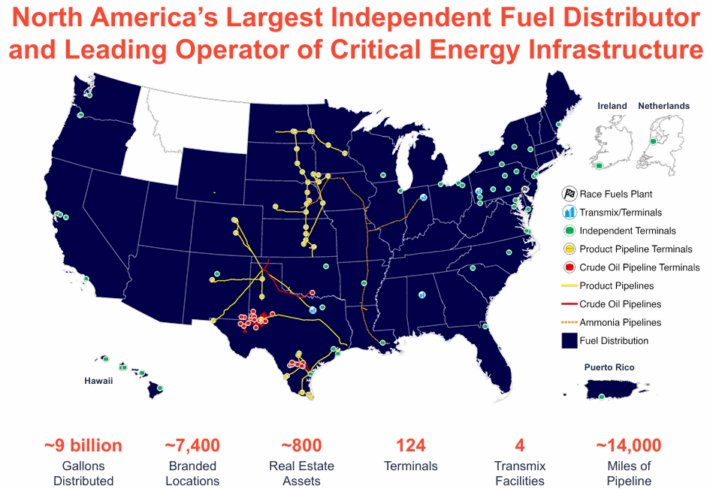

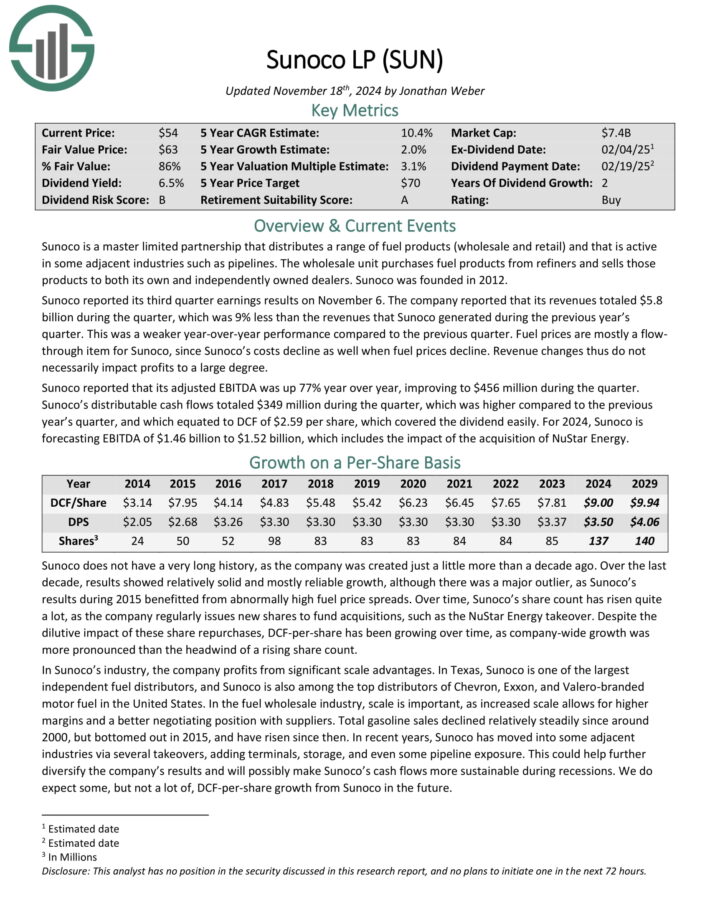

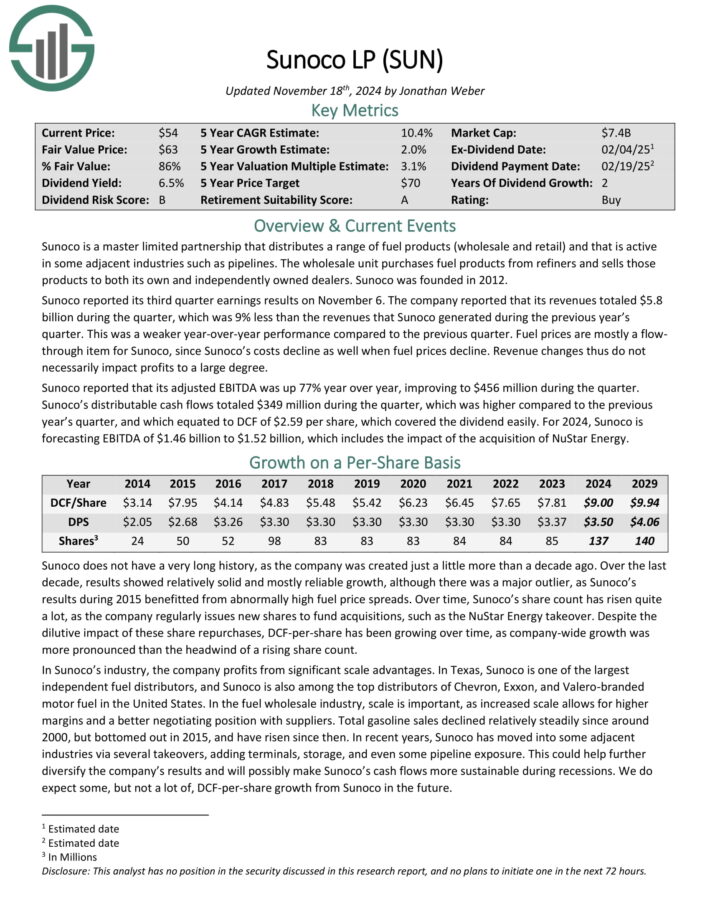

Sunoco is a grasp restricted partnership that distributes quite a lot of gasoline merchandise (wholesale and retail) and that’s energetic in some adjoining industries equal to pipelines.

The wholesale unit purchases gasoline merchandise from refiners and sells these merchandise to every its private and independently owned sellers.

Provide: Investor Presentation

Sunoco reported its third quarter earnings outcomes on November 6. The company reported that its revenues totaled $5.8 billion by means of the quarter, which was 9% decrease than the revenues that Sunoco generated by means of the sooner yr’s quarter.

Sunoco reported that its adjusted EBITDA was up 77% yr over yr, enhancing to $456 million by means of the quarter. Distributable cash flows totaled $349 million by means of the quarter, which was larger compared with the sooner yr’s quarter, and which equated to DCF of $2.59 per share, which coated the dividend merely.

For 2024, Sunoco is forecasting EBITDA of $1.46 billion to $1.52 billion, which contains the have an effect on of the acquisition of NuStar Energy.

Click on on proper right here to acquire our most modern Optimistic Analysis report on SUN (preview of net web page 1 of three confirmed beneath):

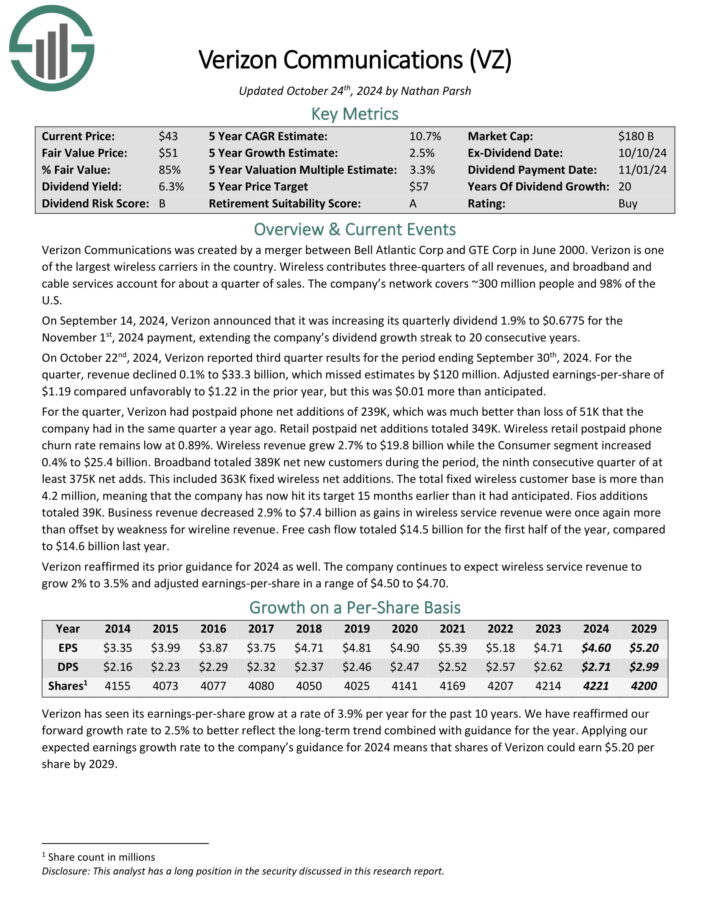

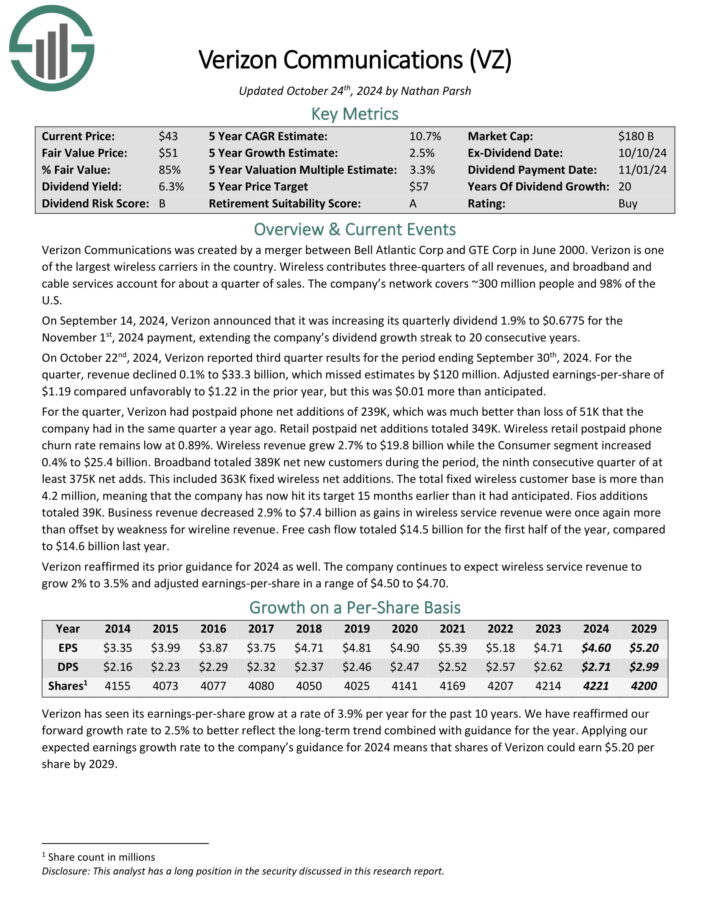

Extreme Yield Stock For Lasting Retirement Income: Verizon Communications (VZ)

Verizon is among the many largest wi-fi carriers inside the nation. Wi-fi contributes three-quarters of all revenues, and broadband and cable corporations account for a few quarter of product sales. The company’s neighborhood covers ~300 million people and 98% of the U.S.

On October twenty second, 2024, Verizon reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, earnings declined 0.1% to $33.3 billion, which missed estimates by $120 million.

Provide: Investor Presentation

Adjusted earnings-per-share of $1.19 in distinction unfavorably to $1.22 inside the prior yr, nonetheless this was $0.01 larger than anticipated.

For the quarter, Verizon had postpaid cellphone net additions of 239K, which was lots higher than lack of 51K that the company had within the equivalent quarter a yr prior to now. Retail postpaid net additions totaled 349K.

Wi-fi retail postpaid cellphone churn cost stays low at 0.89%. Wi-fi earnings grew 2.7% to $19.8 billion whereas the Consumer part elevated 0.4% to $25.4 billion.

Click on on proper right here to acquire our most modern Optimistic Analysis report on VZ (preview of net web page 1 of three confirmed beneath):

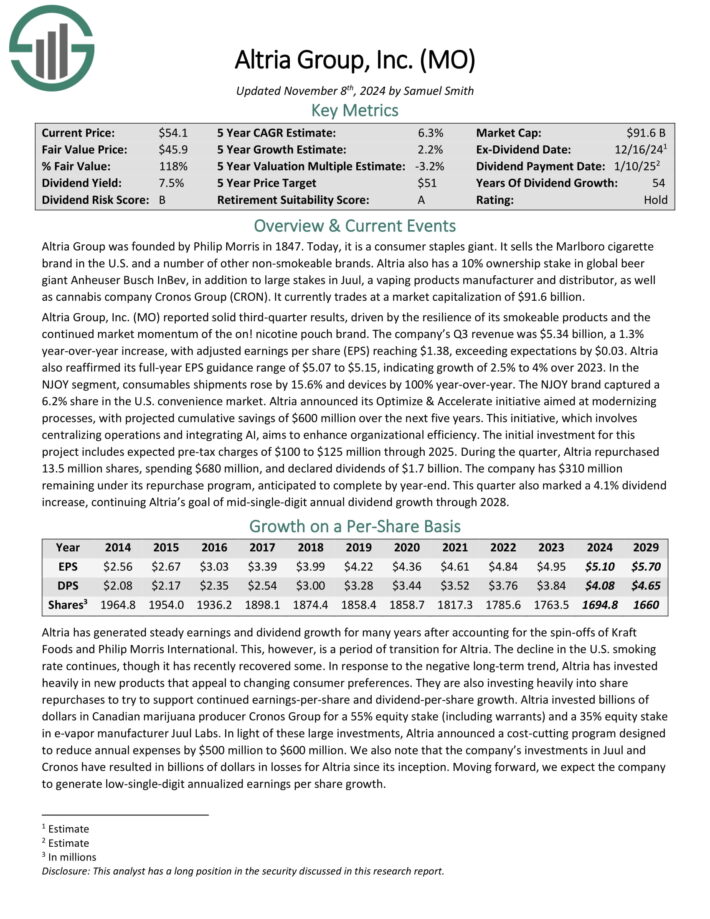

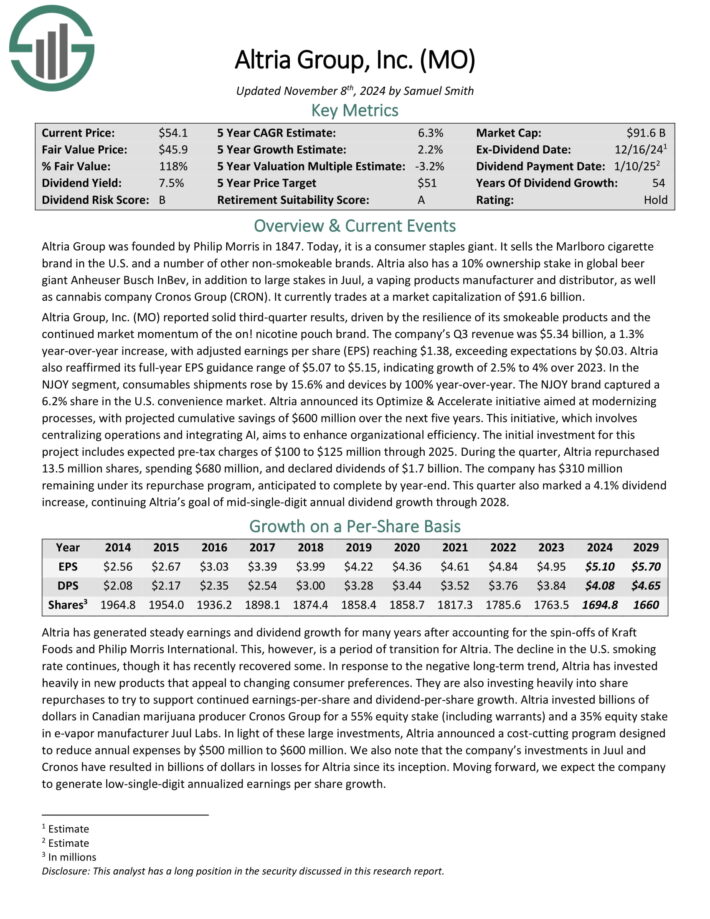

Extreme Yield Stock For Lasting Retirement Income: Altria Group (MO)

Altria is a tobacco stock that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and additional beneath a variety of producers, along with Marlboro, Skoal, and Copenhagen, amongst others.

The company moreover has a 35% funding stake in e-cigarette maker JUUL, and a 45% stake inside the cannabis agency Cronos Group (CRON).

Altria reported sturdy third-quarter outcomes, pushed by the resilience of its smokeable merchandise and the continued market momentum of the on! nicotine pouch mannequin.

Provide: Investor Presentation

The company’s Q3 earnings was $5.34 billion, a 1.3% year-over-year improve, with adjusted earnings per share (EPS) reaching $1.38, exceeding expectations by $0.03.

Altria moreover reaffirmed its full-year EPS steering differ of $5.07 to $5.15, indicating progress of two.5% to 4% over 2023.

In the midst of the quarter, Altria repurchased 13.5 million shares, spending $680 million, and declared dividends of $1.7 billion. The company has $310 million remaining beneath its repurchase program, anticipated to complete by year-end.

Click on on proper right here to acquire our most modern Optimistic Analysis report on Altria (preview of net web page 1 of three confirmed beneath):

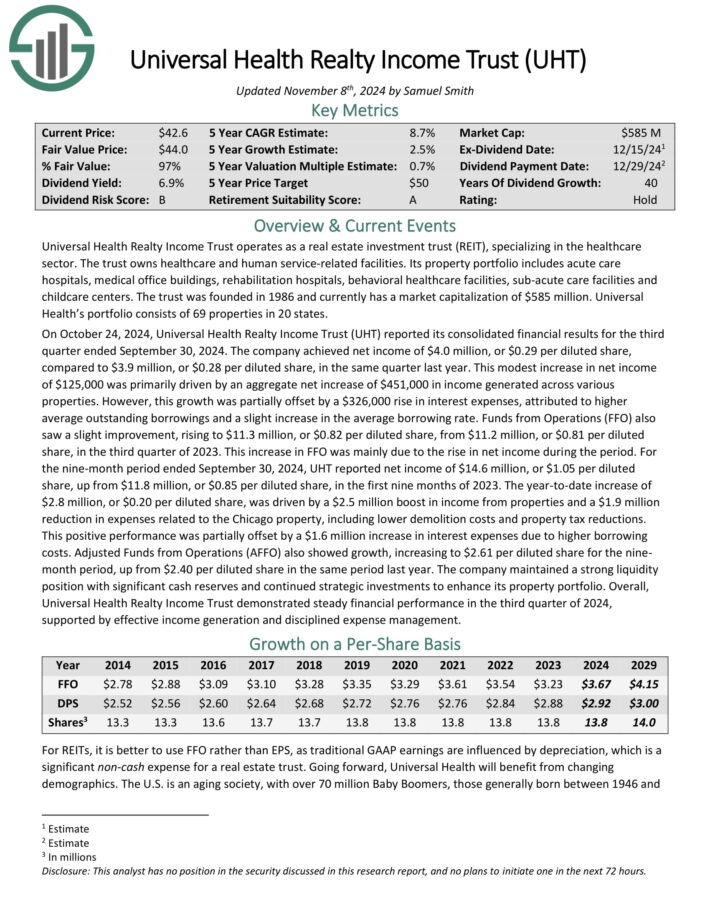

Extreme Yield Stock For Lasting Retirement Income: Widespread Effectively being Retirement Income Perception (UHT)

Widespread Effectively being Realty Income Perception operates as an precise property funding perception (REIT), specializing inside the healthcare sector. The assumption owns healthcare and human service-related facilities.

Its property portfolio consists of acute care hospitals, medical office buildings, rehabilitation hospitals, behavioral healthcare facilities, sub-acute care facilities and childcare services. Widespread Effectively being’s portfolio consists of 69 properties in 20 states.

On October 24, 2024, UHT reported its third quarter outcomes. Funds from Operations (FFO) observed a slight enchancment, rising to $11.3 million, or $0.82 per diluted share, from $11.2 million, or $0.81 per diluted share, inside the third quarter of 2023. This improve in FFO was primarily on account of rise in net income by means of the interval.

The company maintained a robust liquidity place with necessary cash reserves and continued strategic investments to spice up its property portfolio.

Click on on proper right here to acquire our most modern Optimistic Analysis report on UHT (preview of net web page 1 of three confirmed beneath):

Remaining Concepts

All of the above shares have sturdy enterprise fashions that generate extreme ranges of cash motion. In flip, extreme dividend shares can current extreme dividend payouts to shareholders.

With our highest Dividend Hazard Scores along with extreme current yields, the ten shares on this text may be attractive investments for income merchants, equal to retirees.

For those who’re centered on discovering high-quality dividend progress shares and/or totally different high-yield securities and income securities, the subsequent Optimistic Dividend sources may be useful:

Extreme-Yield Specific particular person Security Evaluation

Completely different Optimistic Dividend Property

Thanks for finding out this textual content. Please ship any ideas, corrections, or inquiries to [email protected].

rn

rn

Source link ","writer":{"@sort":"Individual","identify":"Index Investing Information","url":"https://indexinvestingnews.com/writer/projects666/","sameAs":["https://indexinvestingnews.com"]},"articleSection":["Investing"],"picture":{"@sort":"ImageObject","url":"https://www.suredividend.com/wp-content/uploads/2022/10/Excessive-Dividend-Picture.jpg","width":0,"top":0},"writer":{"@sort":"Group","identify":"","url":"https://indexinvestingnews.com","brand":{"@sort":"ImageObject","url":""},"sameAs":["https://www.facebook.com/Index-Investing-News-102075432474739","https://twitter.com/IndexInvesting_"]}}

Source link