Key Takeaways

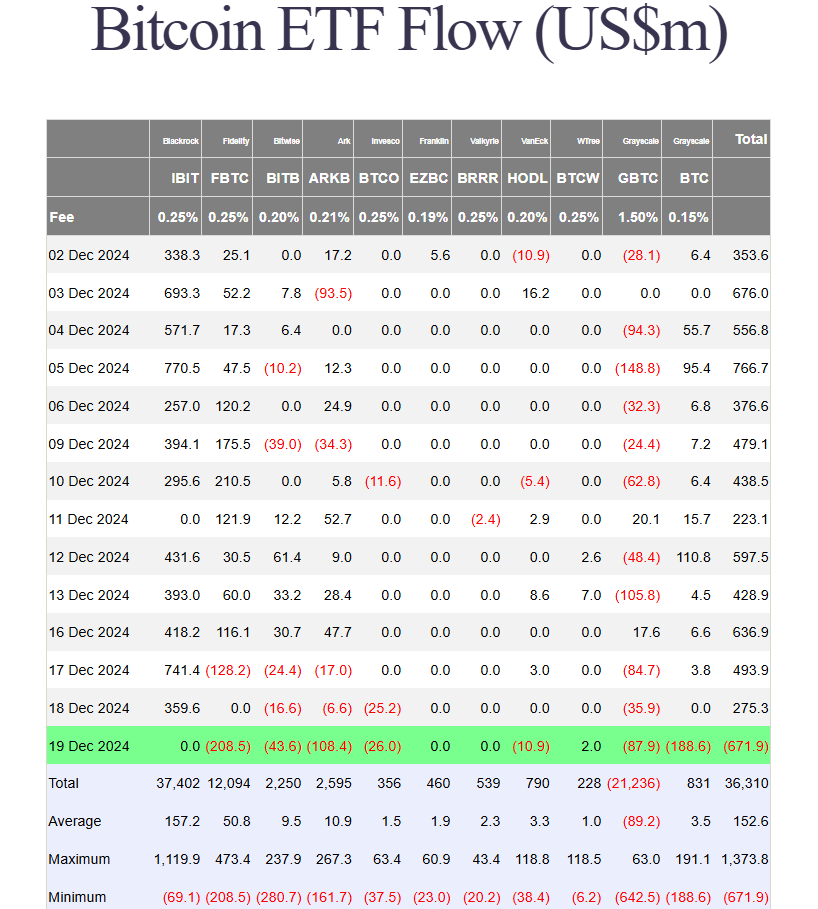

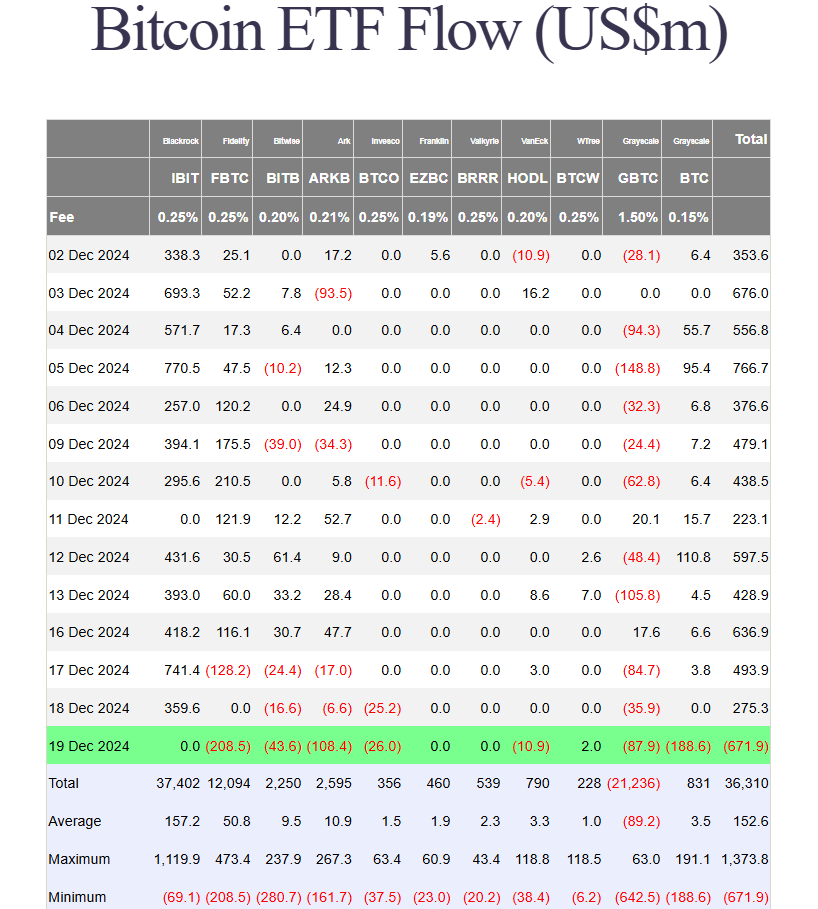

- US Bitcoin ETFs skilled historic outflows with buyers withdrawing $672 million in a day.

- Constancy’s Bitcoin Fund led the outflows, adopted by Grayscale and ARK Make investments ETFs.

Share this text

US spot Bitcoin ETFs suffered their largest-ever single-day outflow amid a pointy crypto market sell-off following the FOMC assembly. In accordance with Farside Traders knowledge, roughly $672 million exited these funds on Thursday, ending a interval of internet inflows that started in late November.

The huge withdrawal eclipsed the earlier document of practically $564 million set on Might 1, when the group of spot Bitcoin ETFs noticed practically $564 million in withdrawals after Bitcoin dropped 10% to $60,000 over per week.

Constancy’s Bitcoin Fund (FBTC) led the exodus with $208.5 million in outflows, whereas Grayscale’s Bitcoin Mini Belief (BTC) recorded its lowest level since launch with over $188 million in internet outflows.

ARK Make investments’s Bitcoin ETF (ARKB) and Grayscale’s Bitcoin Belief (GBTC) additionally noticed large withdrawals, with ARKB shedding $108 million and GBTC shedding practically $88 million. In the meantime, three competing ETFs managed by Bitwise, Invesco, and Valkyrie collectively misplaced $80 million.

BlackRock’s iShares Bitcoin Belief (IBIT), which logged $1.9 billion in internet inflows this week and was a serious contributor to the group’s latest robust efficiency, recorded zero flows for the day.

WisdomTree’s Bitcoin Fund (BTCW) was the only gainer, attracting $2 million in new investments.

Bitcoin’s worth fell under $96,000 throughout the market downturn and at present trades at round $97,000, down 4% over 24 hours, in line with CoinGecko knowledge. The steep decline throughout all property triggered $1 billion in leveraged liquidations on Thursday, Crypto Briefing reported.

The market turbulence adopted the Fed’s hawkish messaging after its fee reduce determination. The Fed applied a 25-basis-point fee discount on Wednesday however indicated fewer cuts in 2025.

Though worth volatility persists, the Crypto Concern and Greed Index nonetheless signifies greed sentiment at 74, down just one level from yesterday.

Share this text