The market cap of all stablecoins has fallen from $168 billion firstly of October to round $166 billion as Bitcoin surpassed $70,000 as soon as once more.

Stablecoins, the liquidity of the crypto business, decline as buyers commerce them for different belongings reminiscent of Bitcoin. Whereas extra stablecoins can enter the ecosystem via fiat deposits to exchanges, this influx seems to be outpaced by the flight to non-stablecoin belongings.

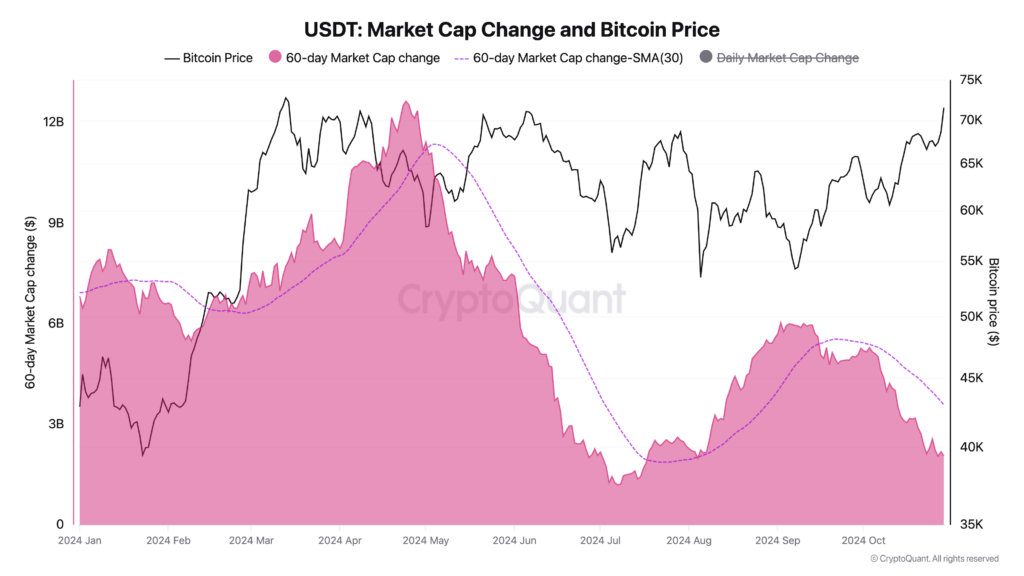

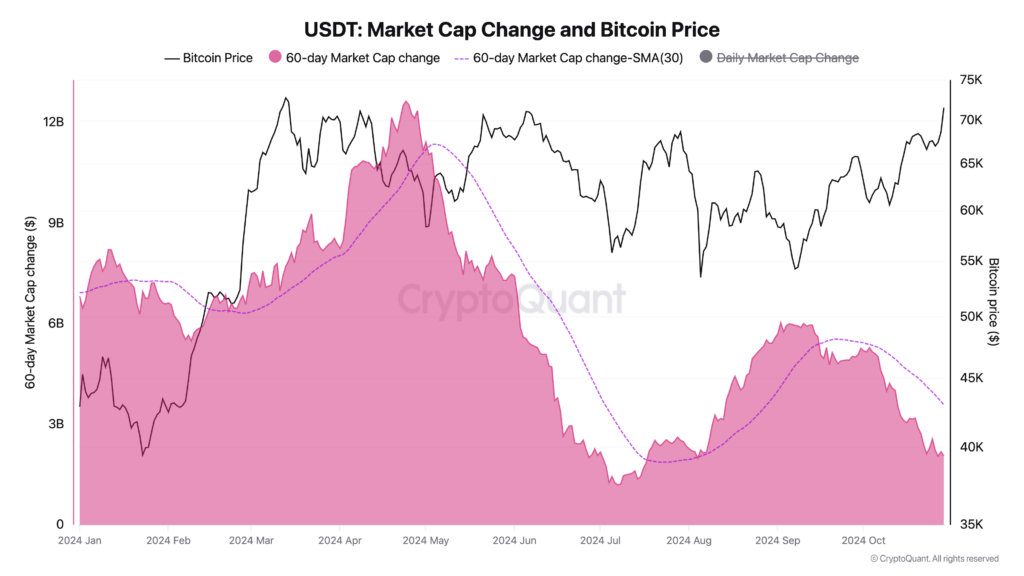

The biggest stablecoin by market cap, Tether, stands at $120 billion, having surged from $90 billion firstly of 2024. Nonetheless, the speed of this improve has slowed dramatically for the reason that starting of the month. The 60-day change in market cap has fallen under $3 billion for the primary time since August after a peak of over $12 billion in late April.

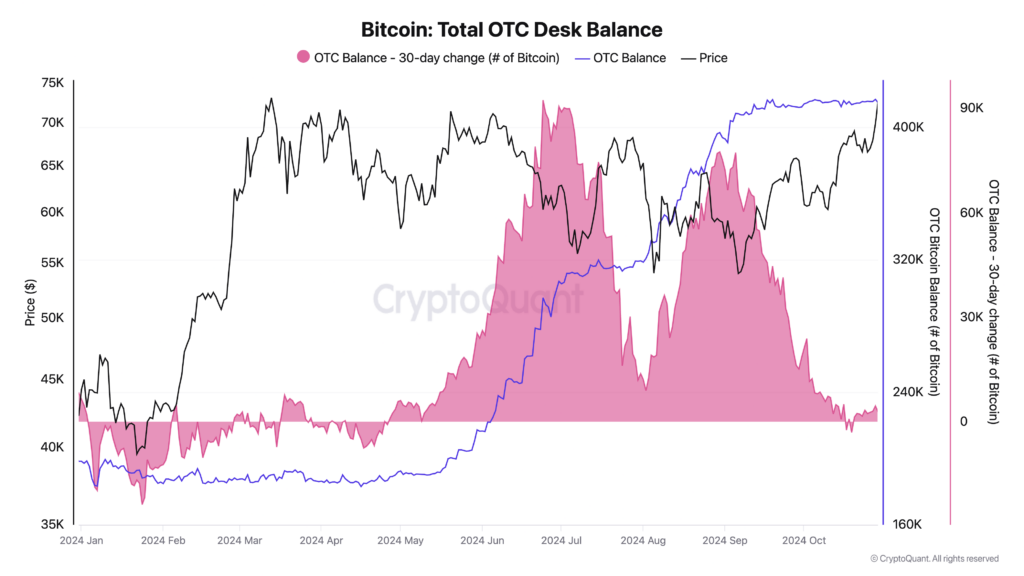

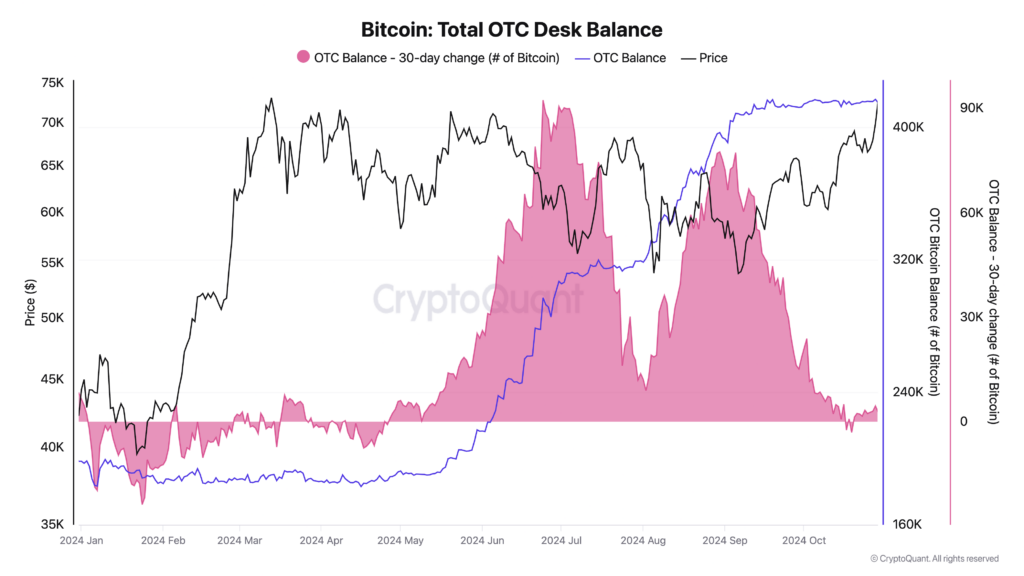

Along with a discount in each stablecoin balances and the speed of improve in Tether’s market cap, the expansion fee for OTC Bitcoin balances has additionally decreased. OTC balances reached an all-time excessive in September however have remained comparatively steady since.

With over $160 billion in stablecoins, there may be nonetheless loads of liquidity available in the market to probably gasoline a sustained bull run towards or past the all-time excessive.

![Top 15 Bitcoin Cycling Betting Sites for the 2025 Tour de France [Bonuses, Odds & Features Compared] Top 15 Bitcoin Cycling Betting Sites for the 2025 Tour de France [Bonuses, Odds & Features Compared]](https://static.news.bitcoin.com/wp-content/uploads/2025/07/best-tour-de-france-betting-sites-july-2025.png)