Tesla maintains its remaining Bitcoin holdings regardless of latest pockets transfers that triggered hypothesis of a possible sell-off, in keeping with blockchain analytics platform Arkham Intelligence.

In an Oct. 23 publish on X (previously Twitter), Arkham Intelligence clarified:

“We imagine that the Tesla pockets actions that we reported on final week have been pockets rotations with the Bitcoin nonetheless owned by Tesla.”

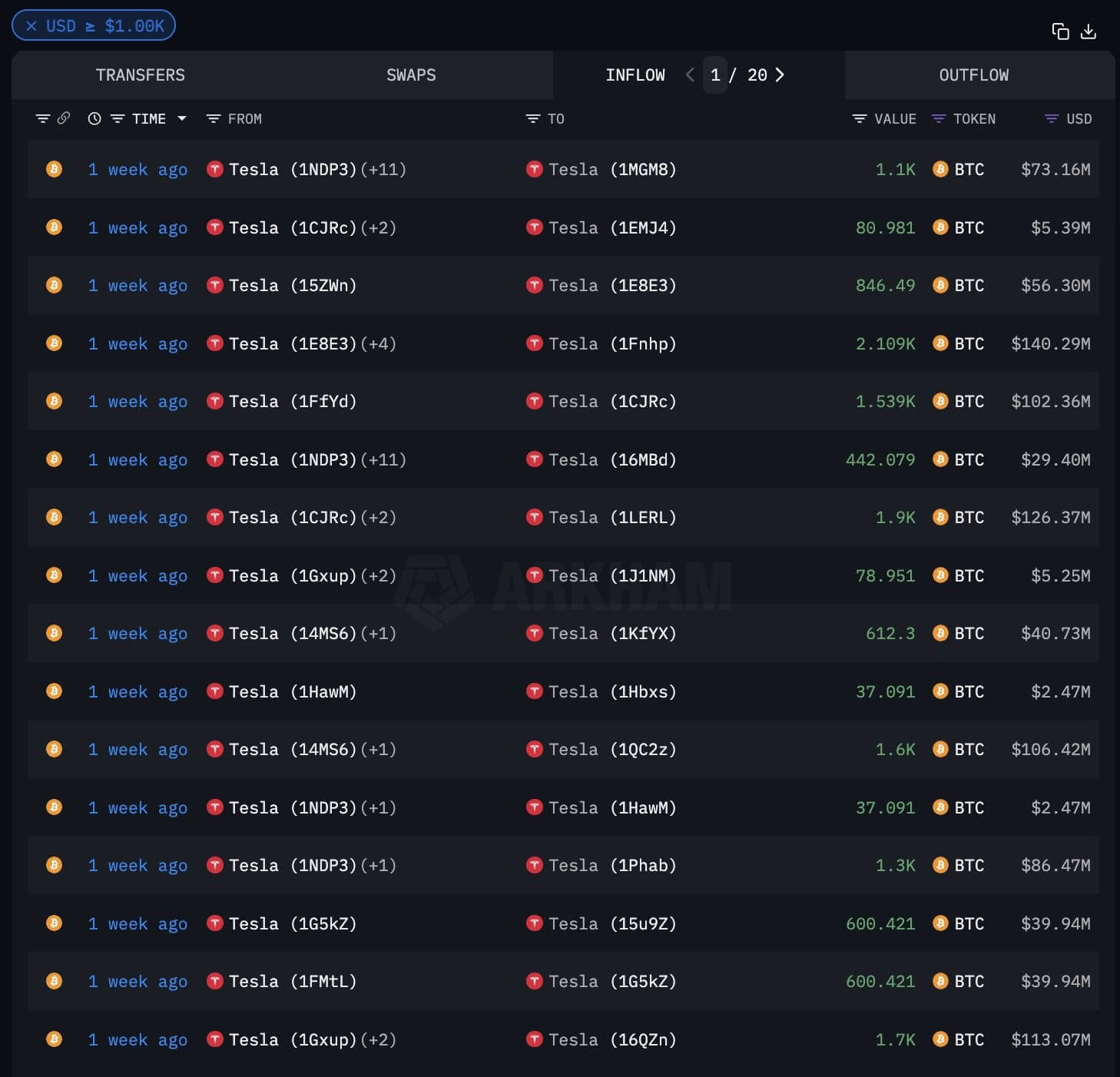

Arkham famous that the switch concerned sending Bitcoin to seven completely different wallets, every containing between 1,100 and a pair of,200 BTC. Previous to the ultimate switch, take a look at transactions have been carried out on all wallets, and all however one now maintain round-numbered Bitcoin balances.

On-chain knowledge reveals that 5 wallets include Bitcoin valued at over $100 million every—particularly, $142 million, $128 million, $121 million, $114 million, and $107.8 million. The remaining two wallets maintain $87.6 million and $74.1 million, respectively.

This replace follows Tesla’s sudden switch of its remaining 11,509 BTC—valued at round $768 million on the time—final week. The transfer sparked rumors of a possible sale, as Tesla had beforehand liquidated Bitcoin holdings.

In February 2021, the corporate offered 4,320 BTC shortly after investing $1.5 billion to evaluate its market liquidity. Tesla executed one other main sale in June 2022, offloading 29,160 BTC.

Since then, nonetheless, the corporate has maintained its Bitcoin holdings. Arkham Intelligence speculated that the latest transfers is likely to be associated to a Bitcoin-backed mortgage. It acknowledged:

“Some have speculated that that is motion to a custodian, for instance to safe a mortgage in opposition to the BTC.”

As of press time, Tesla has not issued an official rationalization for the transfers. Nonetheless, the truth that Bitcoin stays untouched within the new wallets has alleviated rapid issues a couple of market sell-off.

Market analysts are actually seeking to Tesla’s upcoming Q3 earnings report for additional perception into the corporate’s latest actions.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25799625/247465_Barbie_Phone_AJohnson_0004.jpg)