Monty Rakusen

Hear underneath or on the go on Apple Podcasts and Spotify.

ASML unintentionally releases numbers a day early and bookings prompts selling (0:16) Goldman, BofA and Citi excessive forecasts. (1:38) Walgreens to close 1,200 outlets. (3:10)

That’s an abridged transcript of the podcast.

Our excessive story so far. Semiconductor shares are slumping, pushing the overall stock market into purple after chip-equipment agency ASML (NASDAQ:ASML) sandbagged retailers, releasing earnings a day ahead of schedule — and the numbers had been unhealthy.

For the 12 months 2025, ASML lowered the web product sales forecast to €30 billion to €35 billion (midpoint of €32.5 billion); beforehand, the company anticipated about €30 billion to €40 billion (estimate of €35.94 billion).

Internet bookings fell 53% Q/Q to €2.63 billion euros, a far cry from the consensus of €5.4 billion.

ASML’s CEO says: “Whereas there proceed to be sturdy developments and upside potential in AI, totally different market segments are taking longer to recuperate. It now appears the restoration is further gradual than beforehand anticipated. That’s anticipated to proceed in 2025, which is leading to purchaser cautiousness.”

ASML is plunging better than 10%, with the important thing chip ETFs (SMH) (SOXX) falling spherical 4%. Chip giants Nvidia (NVDA), AMD (AMDN), and Broadcom (AVGO) are all down.

In search of to further outcomes, a flood of numbers hit sooner than the opening bell, with financials dominating.

Every principal agency issuing outcomes premarket beat on the best and bottom traces. That’s pretty a streak, nevertheless the question is whether or not or not that’s as a result of robust effectivity or lowered expectations.

Citi (C), Monetary establishment of America (BAC), and Goldman Sachs (GS) all weighed in.

Citi topped consensus, helped by lower payments, and the company expects to reach its full-year revenue and expense targets.

Steering for 2024 payments, excluding the FDIC specific analysis and civil money penalties, was unchanged at $53.5-$53.8 billion vs. $54.1 billion Seen Alpha consensus. The company expects a full-year retail corporations frequent web credit score rating loss cost at probably near the extreme end of 5.75%-6.25%.

Whereas Monetary establishment of America’s (BAC) earnings declined from every the sooner and year-ago quarters, they topped the consensus, bolstered by web earnings constructive elements in its World Markets and World Wealth and Funding Administration corporations.

Goldman topped forecasts by a big margin as web curiosity earnings elevated.

World Banking & Markets revenue included sturdy effectivity in equities and report quarterly web revenue in Fixed Income, Foreign exchange & Commodities financing. Asset & Wealth Administration revenue benefited from report quarterly administration and totally different prices.

Johnson & Johnson (JNJ) as beneath stress, though, as a result of it lowered its full-year earnings outlook no matter posting a better-than-expected Q3.

J&J reduce its adjusted operational earnings guidance for 2024 to $9.91 per share from $10.05 on the midpoint, noting that the have an effect on from its present acquisition of cardiac system maker V-Wave better than offset the improved quarterly effectivity. Nonetheless the agency raised its full-year operational product sales guidance to $89.6 billion throughout the midpoint compared with $89.4 billion beforehand.

And whereas Walgreens (WBA) sailed earlier consensus estimates, the principle focus was on retailer closures.

The pharmacy chain said it plans to close roughly 1,200 outlets over the next three years, which includes 500 in fiscal 2025 alone. Walgreens, which operates 8,700 outlets throughout the U.S., said these closures could be “immediately accretive” to its adjusted earnings and free cash motion.

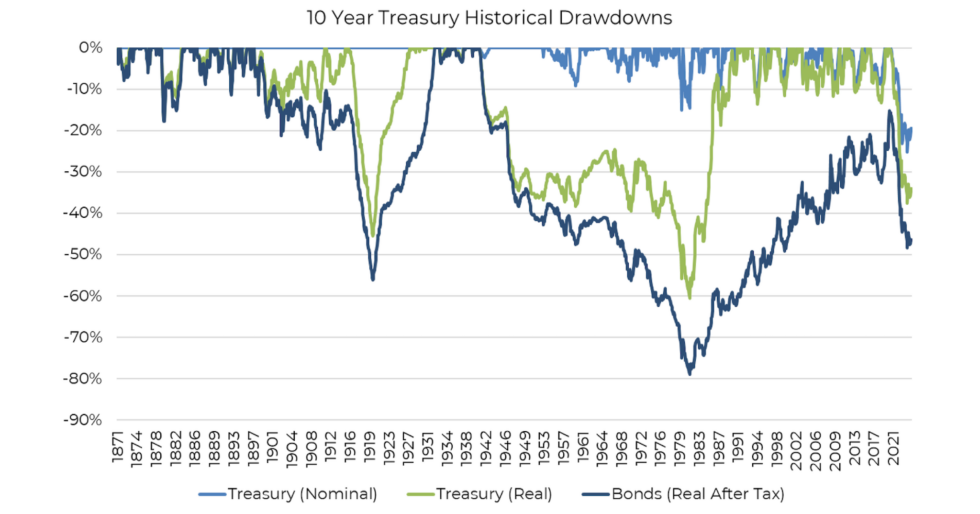

Elsewhere in instantly’s shopping for and promoting, longer prices had been lower following some weak manufacturing info. The ten-year Treasury yield (US10Y) is once more all the best way right down to 4.05%.

The October Empire State Manufacturing index retreated 23 elements to -11.9 compared with the consensus for a drop to 2.7.

Pantheon macroeconomist Samuel Tombs says the index tends to undershoot in October due to points with seasonal adjustment, nevertheless supplies: “October’s learning was the underside for the time of the 12 months since 2015, tentatively suggesting that circumstances throughout the manufacturing sector are deteriorating.”

The decline in yields took some steam out of the present dollar rally (DXY).

Wanting barely further intently, FX analyst Bundle Juckes of Societe Generale says: “By now, I anticipate everybody appears to be used to the notion that the FX market is in thrall to the doorway end of cost curves. Nonetheless that doesn’t cease me from being amazed on the way the short-term strikes in relative charges of curiosity are echoed in commerce prices.”

“In late September, the market was nearly pricing in 4% fed funds by the tip of this 12 months. Now it’s completely priced out one 25-bp reduce and is having second concepts about one different,” he supplies.

In several info of bear in mind, neutral members of the Medical Properties Perception (MPW) board launched findings of an neutral investigation into allegations made by transient sellers after the Boston Globe and OCCRP resurfaced many of the an identical allegations in tales printed on Oct. 9, 2024.

The investigation found no proof that Medical Properties “gratuitously” overpays its operator-tenants for precise property; no proof of improper round-tripping; and no proof of improper recognition of “uncollectible” lease by the use of GAAP-mandated straight-line revenue recognition.

It moreover concluded that neither Medical Properties nor Manolete Nicely being has an possession curiosity in any Malta property or hospital. In addition to, no proof was found that administration manipulated acquisitions or totally different metrics to satisfy compensation targets.

And throughout the Wall Avenue Evaluation Nook, Roth MKM named 16 software program program shares in your consideration.

Chief Market Technician JC O’Hara says software program program has been “quietly starting to get away on absolutely the stage and slowly start to boost on the relative stage.”

He recognized that the breakout throughout the iShares Expanded Tech-Software program program Sector ETFs (IGV) is strong and by no means overbought.

Among the many many bullish names, Datadog (DDOG) and Varonis Packages (VRNS) “have long-established bearish-to-bullish reversal patterns nevertheless won’t be once more to their former highs,” he says.

Datadog has about 40% upside to its outdated extreme, and Varonis Packages has about 25% upside to its outdated extreme.

Totally different names embrace Dropbox (DBX), DocuSign (DOCU) and HubSpot (HUBS).