CristinaNixau/iStock Editorial through Getty Photographs

Frasers Group (OTCPK:SDIPF) is a high quality firm buying and selling at a major low cost to its historic averages and the sector. The corporate is well-positioned to benefit from any restoration within the UK financial system with its important and luxurious merchandise lineup. We provoke protection with a purchase ranking.

The Firm

Frasers Group is without doubt one of the UK’s most outstanding and numerous sports activities and style retailers. With a market cap of $4.7bn, its major retailer manufacturers embody Sports activities Direct, Home Of Fraser, GAME, and Evans Cycles. In addition they personal clothes and sports activities manufacturers, together with Jack Wills, Slazenger and Gieves & Hawkes.

Sports activities Direct purchased the Home of Fraser division retailer chain for £90m ($120m) in 2018 simply because it went into administration. The then CEO of Sports activities Direct, Mike Ashley had stated he deliberate to show the Home of Fraser chain into the “Harrods of the Excessive Avenue”.

Mike Ashley opened his first sports activities store in 1982 and has constructed a major multi-billion retail chain. He stepped again from energetic administration in 2022 however nonetheless retains a 73% share of the corporate. The corporate has an energetic share repurchase program, and despite the fact that the variety of shares Mr. Ashley holds has decreased, his holding within the firm has elevated from roughly 64% since 2014. This generally is a deterrent for potential buyers, and we want to see Mike Ashley hand over extra management of the corporate. This can be about to vary as the corporate introduced it’s looking for shareholder approval to accumulate 67.5m or 15% of excellent shares not directly held by Mr. Ashley. This values the shares at roughly $730m (£556m). Because the shares can be canceled, this would cut back the controlling curiosity of Mr. Ashley’s holdings to roughly 68.5%. We like this development, nonetheless, we want to see extra shares supplied to retail buyers or block gross sales to institutional buyers.

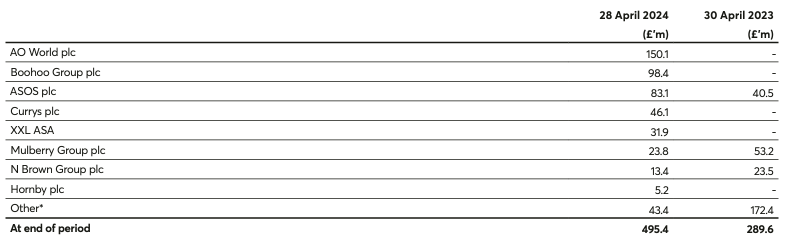

The group has important holdings in numerous different retail and style corporations.

Fraser Group’s Lengthy-Time period Funding Truthful Worth As of 28 April 2024 (Firm Annual Report)

The corporate continues to strategically make investments and enhance its holding in among the above corporations and to accumulate different smaller belongings. On 10 April, they agreed to accumulate Twin Sport, a Dutch sports activities retailer with 17 shops. In addition they just lately acquired Frenchgate, a shopping mall in South Yorkshire for $39m (£29.5m). They’ve additionally elevated their holdings in Hugo Boss, valued at $545m (£415m, €490m). This brings the whole investments in different corporations to over £1bn ($1.3bn).

The corporate stories operations in three segments. The most important is UK Sports activities, which consists of UK-based sports activities retail and wholesale operations, GAME UK, and all online-related operations. As of the 12 months ending April 2024, It accounts for 51.7% of whole revenues. Premium Way of life accounts for 21.7% of revenues. Internation (non-UK) retail accounts for 1 / 4 of their revenues.

Monetary Evaluation

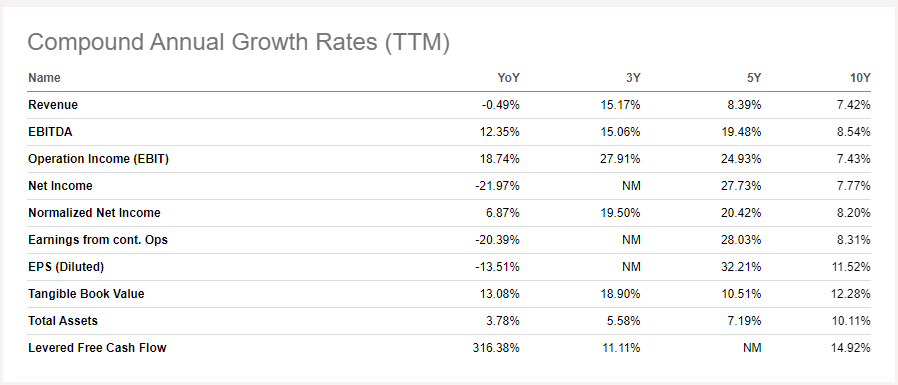

Income progress has been wholesome at 7.4% 10-year CAGR and a extra spectacular 15% over the previous 3 years. The corporate has completed properly to face up to the price of residing disaster within the UK the place revenues stalled in FY24.

Fraser Group Progress Profile (Looking for Alpha)

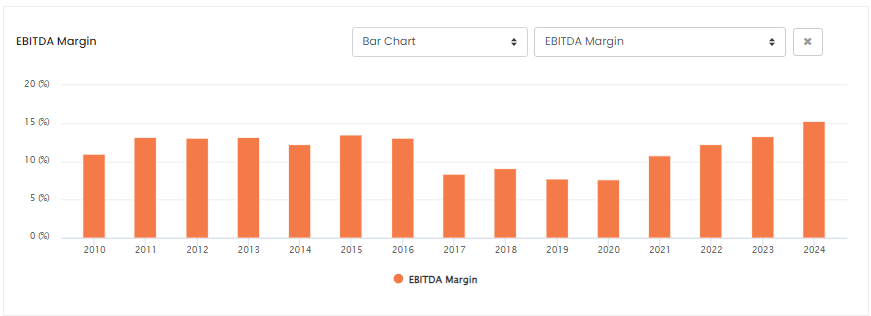

Margins proceed to extend from the lows of 2020 and EBITDA margins are at an all-time excessive of 15%.

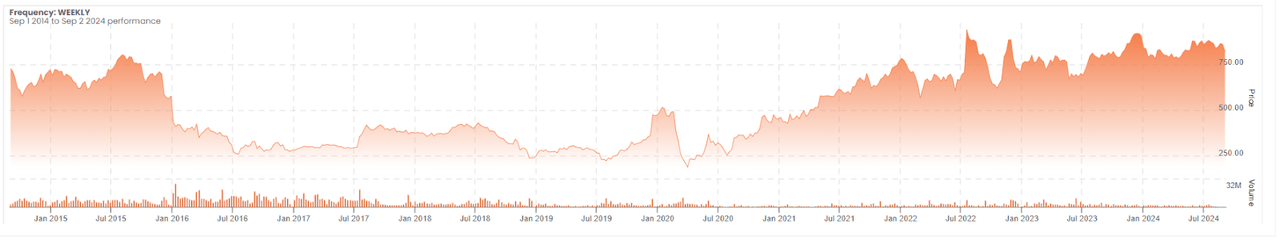

Fraser Group EBITDA Margins (ROCGA Analysis) Fraser Group Share Value Efficiency (ROCGA Analysis)

Despite the fact that they managed to develop revenues, as margins deteriorated, by the top of 2017 the corporate misplaced 70% of its worth from its peak in 2016. With enhancing margins and considerably larger income progress, the share costs have recovered over the previous few years.

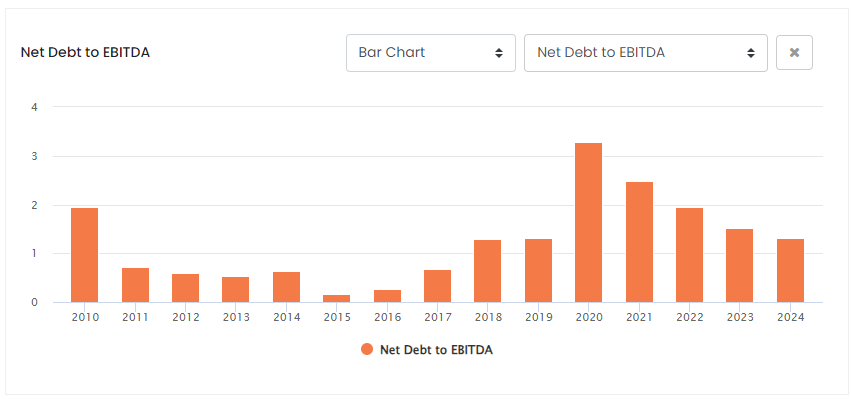

Fraser Group Web Debt to EBITDA (ROCGA Analysis)

The corporate steadiness sheet additionally strengthened with web debt to EBITDA decrease for FY24 from a peak of over 3X to roughly 1.3x. FY24 debt elevated barely from £1,430 to £1,453m, but when we consider its funding properties, monetary belongings, and money & equivalents, web debt improved from FY23 of £701 to £248.

FY24 noticed revenues decline barely with anticipated weak point within the discretionary market corresponding to in GAME UK, demand for luxurious items, and a few deliberate Home of Fraser retailer closures. The lack of income in these markets was offset by robust efficiency within the core Sports activities Direct enterprise. Bettering product combine within the necessities market by catering to the extra cost-conscious clients, strengthening model relationships, and fewer of the decrease margin gross sales from GAME Group noticed margins enhance. Adjusted earnings earlier than tax elevated 13.1% in FY24 and adjusted EPS was up 34% to £0.96 ($1.3).

The group is engaged on an Elevation Technique that encompasses constructing stronger relationships with model companions, increasing present manufacturers, opening new shops to learn communities, specializing in bodily and on-line retailer experiences, progress and integration of strategic mergers and acquisitions, strategic investments, and strengthening governance, compliance, and threat administration.

With the mixing and synergies of its bolt-on acquisitions, and its warehouse automation program additional enhancing effectivity, the corporate is assured of robust monetary efficiency. For FY25 they count on a mid-point enhance in adjusted earnings earlier than tax of 10%, within the vary of £575m-£625m ($755m to $620). Assuming the tax burden doesn’t change, we estimate EPS to be roughly 10% larger at £1.05.

The UK is predicted to recuperate with a GDP progress of 1% for FY24 and rise additional to its long-term common of 1.9% in FY25. Frasers has consolidated and positioned itself to benefit from the restoration. We count on progress from its well-entrenched core manufacturers and restoration within the luxurious market. Consensus estimates income progress of roughly 4.5% for FY25 and our estimate for EPS is £1.05.

Frasers is already exhibiting progress within the worldwide market, the place revenues grew 3.3% in FY24. That is anticipated to enhance as its acquisition of MySale in Australia and Twin Sport, its Dutch sports activities retailer begins to register full-year revenues.

Sporting items and style retail function in very aggressive environments. Rivals embody related retail shops, corresponding to JD Sports activities (OTCPK:JDSPY) within the UK or DICK’s Sporting Items (DKS) within the US, and in addition normal retailers. Normal retailers can compete by promoting related product strains or considerably cheaper store-owned manufacturers. There’s additionally threat from on-line retailers and the risk from manufacturers eager to promote direct-to-consumers, successfully skipping the center man. An instance of DTC is Skechers (SKX). SKK has elevated its DTC income from 2018’s 11% of revenues to roughly half in its newest quarter.

The UK financial system is rising once more, and shopper confidence is returning to regular. If this stalls, shopper’s discretionary spending on sporting and style items will sluggish. Additionally, there may be at all times the danger of miscalculating and predicting sporting style and buying patterns.

Valuation

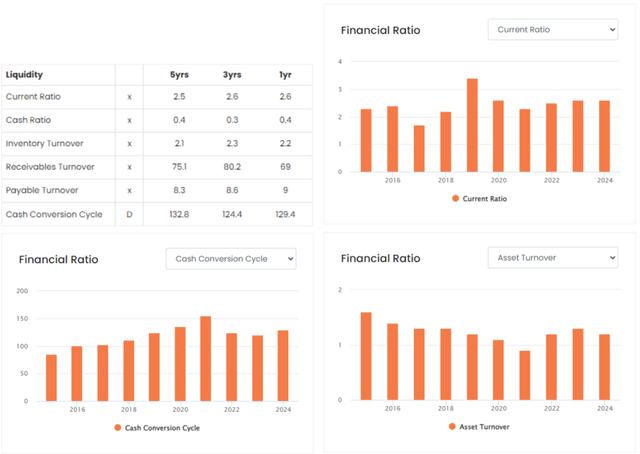

Fraser is a high-quality firm exhibiting decreasing leverage (Web debt to EBITDA chart above), enhancing present ratios, higher working capital administration, larger margins, enhancements in asset turnover ratios, and better returns. Total, Fraser scores properly on high quality.

Frasers High quality Snapshot (ROCGA Analysis)

If we evaluate FY24 numbers with the 5-year averages, we discover the present ratio is a bit more wholesome at 2.6x in comparison with 2.5x, the money conversion cycle was rising and had reached a peak of 155 days in 2021, however has now come all the way down to 129 days. In 2022, the corporate broke the declining development in asset turnover and these have improved. Asset turnover is calculated by dividing revenues by belongings. Increased asset turnover signifies the corporate is producing extra revenues per capital invested.

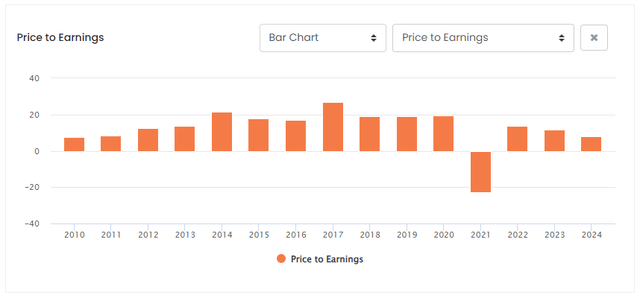

A high-quality firm buying and selling on single-digit PE ratios might be a very good funding alternative. Frasers is buying and selling at roughly £8.15 on the London Shares Alternate, its major itemizing, and we estimated the FY25 EPS of roughly £1.05, giving us a PE ratio of seven.8x.

Frasers Historic PE Ratio (ROCGA Analysis)

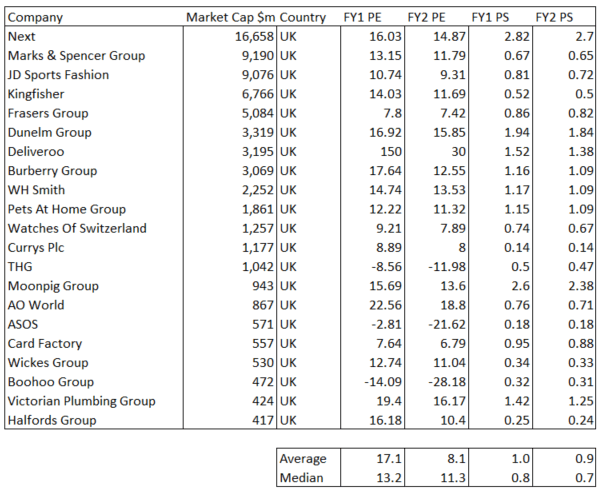

Aside from the losses in 2021, The present FY24 PE ratio is the bottom in comparison with the previous 10 years. Revenues are forecast to begin rising once more at an identical charge to the sector’s averages. Earnings progress, nonetheless, is predicted to be larger at 10%, in comparison with the sector’s 4%. The Non-GAAP FWD PE for the sector is 15.5x and a median of 13.2x for the UK shopper discretionary retail. Given the corporate’s progress profile, it needs to be buying and selling at the very least at par with the sector valuation multiples.

UK shopper discretionary retail (ROCGA Analysis & Writer)

On the record above the closest peer throughout the UK is JD Sports activities. Despite the fact that it’s buying and selling on larger PE ratios than Frasers, it’s nonetheless buying and selling at a reduction to the sector averages. DKS, an identical firm to Frasers with related forecast earnings and income progress, and margins profile is buying and selling at a considerably larger Non-GAAP FY25 PE of 14.99x.

With earnings progress anticipated to be stronger than the sector averages, with PE considerably decrease, a recovering UK financial system, and shopper confidence returning, we count on Frasers to be buying and selling on larger multiples quickly. We provoke with a purchase ranking.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.