LagartoFilm

Funding Thesis

The First Belief Development Energy ETF (NASDAQ:FTGS) supplies traders with large-cap equal-weighted publicity to 50 shares which have elevated earnings per share by over 21% yearly during the last three years. Buying and selling at 19.17x ahead earnings, it is a GARP investor’s dream, however there is a catch. In contrast to most development ETFs, analysts anticipate FTGS’s development charge to sluggish over the following 12 months, and this comparatively poor earnings momentum may turn into a short-term headwind. Subsequently, my recommendation at the moment is to keep away from it, however I nonetheless sit up for evaluating its technique and evaluating it with 4 options in additional element beneath.

FTGS Overview

Technique Dialogue

FTGS tracks the Development Energy Index, choosing 50 securities primarily based on money available, debt ratios, and income and money circulation development. The methodology doc is linked right here, however I’ve summarized the important thing screens beneath:

- Minimal $5 million three-month common day by day traded worth.

- Rank within the prime 500 by free-float market capitalization.

- Minimal $1 billion in money or short-term investments.

- Most 30% long-term debt to market cap ratio.

- Minimal 15% return on fairness.

Securities passing these screens obtain two ranks primarily based on three-year money circulation share development and three-year income share development, and the 2 ranks are mixed to acquire a single mixed rank. The highest 15 securities with the perfect mixed rank from every ICB business are chosen for the ultimate step, after which the 50 securities with the perfect mixed ranks are chosen. This course of is repeated quarterly, with reconstitution in impact following the third Friday in January, April, July, and October. Every safety receives an equal weight (2%) on these dates.

In my opinion, there’s additionally the potential for a couple of low-growth shares to sneak into the Index, because the money circulation and income development screens should solely be optimistic relative to a few years in the past. In bull markets, it is a straightforward goal to hit, and since all screens are backward-looking, there’s nothing stopping the Index from choosing shares whose development charges have topped out. On the plus facet, the Index ought to be effectively diversified because of the 30% max allocation per sector (15 shares per sector / 2% per inventory). That would give it a bonus over large-cap development ETFs that chubby the Know-how sector and lots of Magnificent Seven shares, however as we have witnessed within the final 12 months, betting towards them does not all the time work, particularly over the long term.

Efficiency Snapshot

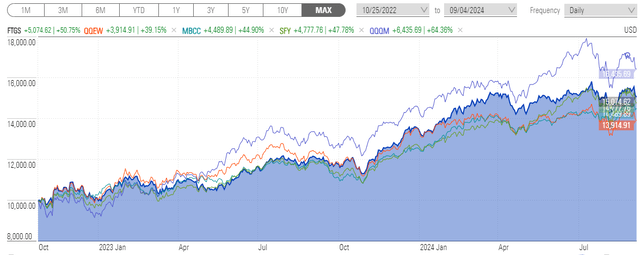

FTGS solely launched on October 25, 2022, and since that is near the time when mega-caps began to outperform considerably, its observe report is underwhelming in comparison with the Invesco Nasdaq 100 ETF (QQQM). By means of September 4, 2024, FTGS has lagged by 14% (50.75% vs. 64.36%).

Morningstar

Nonetheless, FTGS beat the First Belief NASDAQ-100 Equal Weighted ETF (QQEW) by 11.60%, which is maybe its closest competitor. FTGS additionally outperformed the Monarch Blue Chips Core ETF (MBCC), which can be equal-weighted and barely edged the Sofi Choose 500 ETF (SFY), which I’ve labeled as “development gentle” in earlier evaluations.

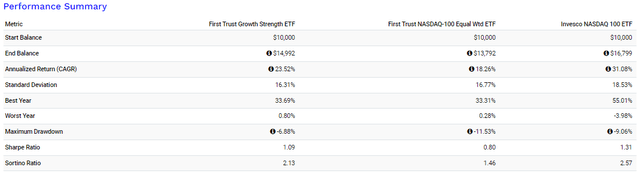

Portfolio Visualizer supplies some extra data on danger and returns. Since November 2022, FTGS has been much less risky, as measured by normal deviation, and had the bottom max drawdown. Additionally, it managed to realize 0.80% within the final two months of 2022, whereas QQQM declined by 3.98%. Had the ETF launched earlier, there is a good likelihood its returns could be far more aggressive with QQQM, which fell 32.52% in 2022.

Portfolio Visualizer

Discovering different large-cap development ETFs with higher observe data is comparatively simple. Nonetheless, a lot might be defined by the excellent efficiency of a choose few shares. For instance, the Roundhill Magnificent Seven ETF (MAGS) is up 43.49% during the last 12 months, and different prime performers, just like the Schwab U.S. Massive-Cap Development ETF (SCHG), allocate over 50% to those shares. Naturally, SCHG and comparable ETFs may turn into bottom-performing ETFs if these shares have been to say no, which is why I welcome better-diversified choices like FTGS.

FTGS Evaluation

Sector Allocations

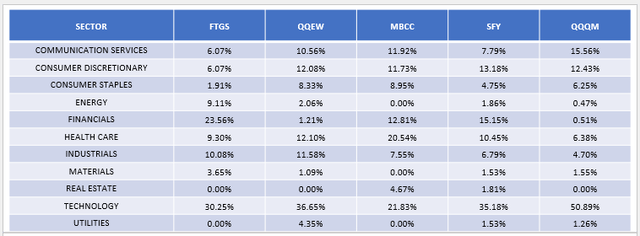

The next desk highlights the sector allocation variations between FTGS, QQEW, MBCC, SFY, and QQQM. At 30%, FTGS’s Know-how sector publicity is maxed out, with the distinction distributed primarily to Financials. In the meantime, QQEW and SFY have 35-37% allotted to Know-how, whereas QQQM is the outlier at 50.89%.

The Sunday Investor

Elementary Evaluation: High 25 Holdings

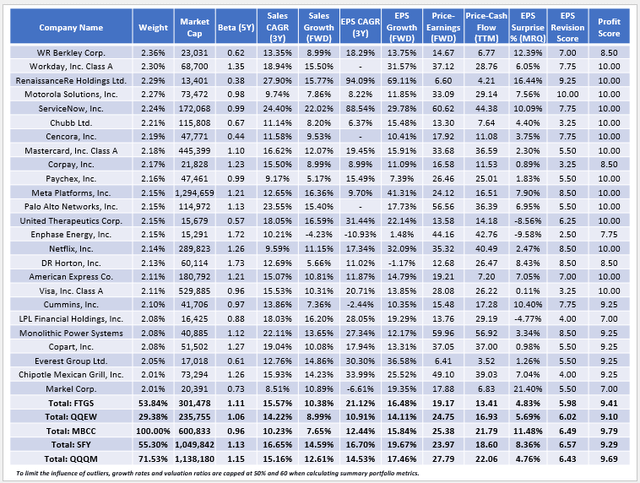

The following desk highlights chosen elementary metrics for FTGS’s prime 25 holdings, which complete 53.84% of the portfolio. My first statement is that FTGS contains a number of mid-cap funds like RenaissanceRe Holdings (RNR) and Enphase Vitality (ENPH). With market caps of round $15 billion or much less, I am shocked these shares have been eligible, nevertheless it does open the door to it functioning extra like an all-cap fund.

The Sunday Investor

FTGS is a high-quality fund, evidenced by a 9.41/10 revenue rating, which I derived from Searching for Alpha Issue Grades. I attribute this to the preliminary set of screens for debt and return on fairness. FTGS’s alternatives have additionally grown gross sales by 15.57% per 12 months during the last three years, a formidable however unsurprising discover, given how that is one of many components its Index makes use of to rank securities. I haven’t got money circulation development figures, however its alternatives have additionally grown earnings per share by an annualized 21.12% during the last three years, by far the biggest on this pattern. Many Monetary shares, together with Visa (V) and LPL Monetary Holdings (LPLA), contribute to those sturdy outcomes.

Nonetheless, the catch is that FTGS’s one-year estimated earnings per share development charge is sort of 5% decrease at 16.48%. Please observe, that is not regular for large-cap development ETFs, and the hole between the 2 figures is the third most among the many 69 funds I observe on this class. The one two ETFs with wider gaps are the Pacer US Money Cows Development ETF (BUL) and the Invesco S&P 500 GARP ETF (SPGP), which is predicted as a result of these ETFs truly use worth screens. In distinction, FTGS makes use of no worth screens, and whereas its 19.17x ahead P/E is sort of enticing from a growth-at-a-reasonable-price perspective, I am involved this may not be the case after future reconstitution. Primarily based on the Index methodology doc, there’s nothing stopping the Index from choosing excessive P/E shares with excessive historic earnings development charges however weak estimated development charges.

A part of FTGS’s anticipated development slowdown is attributed to comparatively weak earnings shock and earnings revision figures. Its alternatives delivered a 4.83% earnings shock final quarter and have a 5.98/10 EPS Revision Rating. In the meantime, the common figures for the class are 7.23% and 6.46/10, respectively, so FTGS is sort of a bit behind. Put otherwise, FTGS’s cheaper valuation is probably going the results of its alternatives delivering underwhelming outcomes, which supplied Wall Avenue analysts with little cause to improve earnings expectations. I place these statistics within the broader “sentiment” class, and sadly, FTGS ranks #65/69 on this issue amongst large-cap development ETFs.

Funding Suggestion

FTGS has delivered stable outcomes in comparison with equal-weight development options like QQEW and MBCC. As well as, it trades at simply 19.17x ahead earnings and options 21.12% three-year historic earnings per share development, which is unbelievable from a GARP perspective. Nonetheless, I am involved that FTGS’s enticing valuation is as a result of its development charge is slowing, and I am much more involved that that is an unintended consequence of a flawed technique. With frequent quarterly reconstitutions, I will not have to attend too lengthy to check this speculation, however out of an abundance of warning, I am limiting my score on FTGS to a impartial “maintain” for now. Thanks for studying, and I sit up for answering any questions within the feedback beneath.