JHVEPhoto

I used to be fallacious about Carvana Co. (NYSE:CVNA). Massive time. Again in 2022, I believed Carvana was a enterprise about to go bust, and in June 2023, I believed the optimistic adjusted EBITDA reported by the corporate was not as enticing because it appeared. Mr. Market has definitely humbled me, with CVNA replenish greater than 3,600% since my first bearish piece was printed in December 2022.

Across the identical time, my long-term pal Charaka Janitha Mahage, who at present works as a buyside analyst for one of many main non-public fairness corporations in Dubai, tried convincing me to put money into Carvana, however his efforts weren’t profitable as I believed Carvana was a ticking time bomb. Together with his funding resolution in Carvana proving to be a significant success, I sat down with Charaka during the last weekend to debate why he went in opposition to the grain in December 2022 and what he thinks about Carvana’s future. Though he doesn’t share his funding portfolio/choices publicly, he agreed to share his views with In search of Alpha readers upon my request, as I believed his perspective on Carvana would add immense worth to In search of Alpha readers. My perspective on Carvana has modified dramatically within the final 6 months as the corporate has delivered on most of its guarantees, and my current dialog with Charaka gave me much more confidence to consider in Carvana’s enterprise. Though I’m not planning to put money into CVNA on the present valuation, I’m upgrading CVNA from a promote ranking to a maintain ranking.

On the finish of this text, you will discover direct social media hyperlinks to comply with Charaka on LinkedIn and X, if you wish to attain out to the analyst instantly.

Why I Am No Longer A Bear

Earlier than I current a abstract of my dialogue with Charaka, let me briefly recap why I used to be bearish on Carvana again then and what modified my stance over the previous few months.

In my earlier Carvana articles, linked above, I held a bearish view of Carvana’s prospects as I believed the corporate would miss out on gentle on the finish of the tunnel due to some important causes.

- I believed the used automobile market would decelerate significantly in 2023, making it tough for Carvana and different used automobile sellers to see any progress.

- In 2022, whereas Carvana was grappling with liquidity points, I believed the corporate would run out of short-term liquidity to outlive earlier than its turnaround plan begins delivering outcomes.

- I believed Carvana would fail to materially enhance gross revenue per unit, on condition that its working bills had shot by means of the roof through the pandemic.

- I discovered Carvana’s progress at any value technique an enormous turnoff and believed the administration crew would fail to undertake a technique that might give attention to profitability.

All these assumptions proved to be off the mark, and Carvana’s monetary efficiency since 2023 has been one for the historical past books.

The U.S. used automobile market remained surprisingly robust in 2023 regardless of elevated rates of interest, as shoppers wished to keep away from the excessive costs of recent automobiles amid continued inflationary pressures. Round 36 million used vehicles have been bought final 12 months. This market power created a chance for Carvana to execute its turnaround technique to perfection, and the corporate grabbed this chance with each fingers.

My assumptions for Carvana’s liquidity points proved to be off the mark too, with the corporate surviving the preliminary onslaught by means of short-term funding and in a while bettering the stability sheet additional by means of a debt restructuring (extra on that later). The corporate’s huge turnaround from a profitability perspective was what caught me off guard probably the most. Even on the again of a decline in retail models bought from 412,296 in 2022 to 312,847 in 2023, Carvana recorded a web earnings of $450 million for 2023, marking the primary worthwhile 12 months for the corporate. The corporate additionally eradicated greater than $1 billion in working bills, delivering on the guarantees it gave buyers when chapter rumors have been haunting each the corporate and its shareholders.

One other notable change was the administration’s technique shift from a progress at any value mindset to a worthwhile progress mindset. By shifting priorities, Carvana has been capable of get pleasure from notable working efficiencies and improved monetary flexibility that might assist the corporate survive an business downturn.

Given how all my assumptions have been confirmed fallacious prior to now 18 months, it now not is sensible to stay bearish on CVNA. Findings from my dialog with Charaka additionally reinforce the truth that Carvana is a much better enterprise than I initially thought. Nonetheless, I do really feel that the prepare has left the station with CVNA inventory making a robust comeback, so I’ll stay on the sidelines now purely primarily based on valuation dangers.

The Abstract Of The Q&A Session

I’ve organized the next section as a Q&A bit to assist readers perceive his thought course of higher. The primary three questions focus on the thought course of that led him to uncover the funding alternative in Carvana, and the rest focuses on what the long run holds for the corporate, together with his 12-month goal worth for CVNA. Please notice that these solutions have been derived from his direct responses to my questions.

Q1: What key elements or indicators led you to suggest Carvana at $5 regardless of the widespread bearish sentiment on the time?

In answering this query, Charaka highlighted 4 important areas the place he disagreed with the market sentiment in December 2022.

- Carvana’s huge addressable market alternative.

- The long-term worth of Carvana’s infrastructure build-up.

- Carvana’s liquidity profile.

- The administration’s competency to scale back prices.

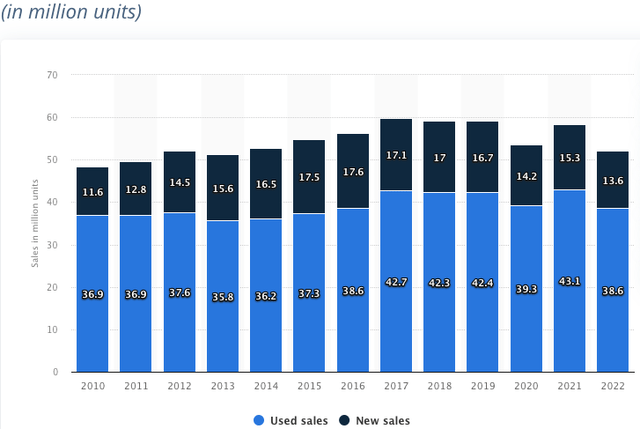

Carvana, which operates within the used automobile market in america, had a market share of simply over 1% in 2022. Based on Statista, used gentle car gross sales within the U.S. reached 38.6 million models in 2022 whereas Carvana bought simply 412,296 models in whole.

Exhibit 1: Used and new gentle car gross sales within the U.S.

Statista

Though conventional gamers who prioritized regional enterprise alternatives dominate the used car market as we speak, Charaka believes Carvana’s nationwide technique will allow the corporate to aggressively seize market share in the long run, resulting in strong income and earnings progress. This assumption performed a key function in his funding in CVNA in December 2022. Carvana, regardless of monetary struggles in 2022, has remained true to its infrastructure-expanding technique to energy this nationwide strategy. Based on Charaka, the market was under-appreciating the profitable long-term ROIs of this technique when he made his first funding within the firm.

He additionally believes that many buyers – together with yours really – miscalculated the liquidity danger dealing with the corporate again when chapter rumors have been ripe in 2022. He believes the market was lacking the provision of working capital loans and the potential for a debt restructuring. Not even a 12 months later, Carvana accomplished a debt restructuring, decreasing its debt burden by $1.3 billion and bettering the short-term liquidity profile meaningfully.

Charaka additionally believes that the market sentiment towards the competency of the administration crew, led by Ernest C. Garcia III, was too bearish in December 2022 as buyers missed Carvana’s potential to avoid wasting substantial prices by slashing advertising and marketing bills and different variable prices. That is one other space during which Carvana has excelled within the final 18 months.

Q2: How did you assess Carvana’s monetary stability and future progress prospects when the inventory was at such a low level?

Charaka’s evaluation of Carvana’s monetary stability revealed a chance the market was lacking on the time. Based on the analyst, Carvana was well-positioned to outlive at the very least a 12 months from December 2022 whereas the market was anticipating the chapter danger to materialize inside weeks. The corporate had entry to $750 million in money and short-term investments by the top of This fall 2022 and likewise had entry to short-term loans and high-quality actual property.

At a depressed inventory worth, Charaka thought he was getting a cut price as he believed within the firm’s potential to interrupt even at a a lot decrease unit base given the room for a considerable discount in prices. Provided that insiders have been controlling the enterprise on the time, he thought there was little incentive for the administration to decide on the trail of chapter as the primary selection, given the lengthy runway for progress.

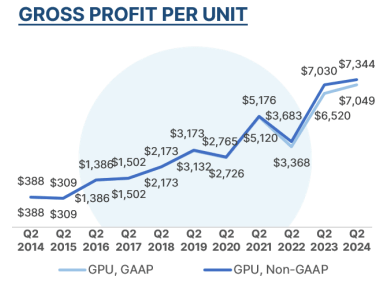

Carvana has delivered on most of those fronts, with the corporate seeing a notable rise in gross revenue per unit within the final 18 months, aided by a positive shift in spreads between wholesale and retail market costs and decrease reconditioning prices.

Exhibit 2: Carvana’s gross revenue per unit

Q2 2024 shareholder letter

Q3: Since your advice, Carvana inventory has surged. What do you consider have been the important thing drivers behind this outstanding restoration?

Many In search of Alpha readers are conscious of Carvana’s stellar restoration. Once I requested this query from Charaka, he highlighted three fascinating traits and developments that not solely clarify the resurgence of the corporate but additionally level to strong progress sooner or later.

- The execution of the administration crew to chop prices and present higher unit economics whereas shrinking the enterprise.

- The corporate’s entry to Adesa property, which ought to convey down logistics prices over time.

- The built-in enterprise mannequin, which generates higher unit economics, knowledge, and the power to write down higher loans over time.

This fall: Trying forward, what are your expectations for Carvana’s efficiency, and what ought to buyers be conscious of within the coming months?

Charaka, regardless of trimming his stake in Carvana within the final couple of months, stays invested within the firm with a portfolio allocation that exceeds 10%. Though he’s optimistic in regards to the long-term outlook for Carvana, he believes buyers ought to think about a number of dangers which can be looming on the horizon.

First, within the quick time period, there’s a danger of the unfold between wholesale and retail market costs shrinking, which can result in a discount in gross revenue per unit. The query he wants buyers to reply is whether or not Carvana is over-earning as a result of favorable macroeconomic circumstances. It might take real-world knowledge to evaluate this danger absolutely, so he recommends retaining an in depth eye on the macro circumstances and the way they affect Carvana to gauge a measure of the standard of the underlying enterprise.

Second, there’s a danger of a pointy slowdown for used vehicles, which might affect Carvana’s profitability and liquidity on condition that the corporate is increasing its stock base whereas its largest rivals are shrinking their stock ranges. Though there isn’t any fast liquidity danger, Carvana’s technique could backfire if the used automobile market slows down at a quicker tempo than anticipated.

There are some early indicators of cooling within the used automobile market. Based on Cox Automotive, the second half of this 12 months will see a slowdown in used automobile gross sales, with the majority of progress coming from much less worthwhile industrial gross sales moderately than extremely worthwhile retail gross sales. Talking to CNBC, Cox Automotive Chief Economist Jonathan Smoke stated:

Total, we’re anticipating some weak point within the coming few months. We mainly are making some assumptions that we will’t fairly maintain the tempo that we’ve been seeing. However we’re not anticipating a collapse both.

Stock ranges appear to be rising regularly and the interest-rate surroundings will not be conducive for automobile procuring both, elevating the chance of a slowdown in used automobile gross sales by the top of the 12 months.

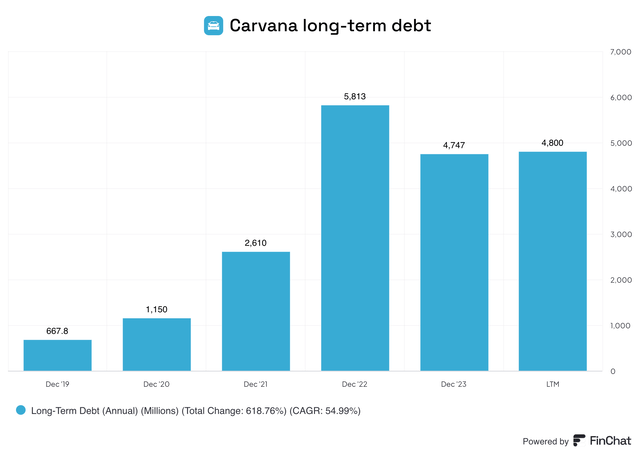

Third, buyers ought to consider how shortly Carvana can cut back its debt burden, decreasing its terminal danger for long-term shareholders. As illustrated beneath, the corporate has accomplished an inexpensive job of decreasing its debt burden since 2022 however stays extremely indebted with virtually $5 billion in long-term debt.

Exhibit 3: Carvana long-term debt

FinChat.io

Subsequent, the analyst believes buyers must be cautious of Carvana’s unit economics hitting a ceiling because the variety of models bought will increase. The corporate has expanded its capability to cater to round 3 million models as we speak, and the anticipated progress in models would possibly contribute to profitability to a lesser diploma if gross revenue per unit declines sharply. Such a growth is prone to reset the market valuation for Carvana, which highlights the near-term valuation danger confronted by buyers.

Q5: Do you could have a 12-month worth goal for Carvana inventory?

Charaka will not be including to his lengthy place as we speak regardless of believing that CVNA could commerce round $190 within the foreseeable future given the respectable prospects for the subsequent 12 months. He believes the corporate is effectively on monitor to generate $1 billion in EBITDA, however the firm appears pretty valued at a ahead EBITDA a number of of round 30. He believes an important determinant of CVNA inventory worth within the subsequent 12 months would be the macro surroundings dealing with the corporate.

Q6: Are you able to listing down the explanations behind your long-term bullish stance on Carvana?

- The vertically built-in enterprise mannequin, which improves operational effectivity, paving the way in which for enhanced buyer satisfaction and a differentiated aggressive providing.

- The corporate’s entry to invaluable buyer knowledge, which permits it to cater to buyer necessities higher than most of its rivals, as evidenced by the market share positive aspects Carvana has loved within the final 12 months.

- The substantial unutilized infrastructure, which permits the corporate to aggressively develop its market footprint when the time is correct.

Total, Charaka believes Carvana will likely be a really tough firm to compete with as soon as its capital construction is in a greater place.

Q7: What are the assets you suggest for Carvana buyers?

Along with In search of Alpha, which is residence to among the greatest investor-driven analysis on Carvana, Charaka recommends just a few different sources that might be useful for Carvana buyers.

- Main analysis on InPractice (interview transcripts with suppliers and market researchers, and so on.).

- The Different Alpha Publication.

- IndraStocks account on X.

- Investor letters printed by Saga Companions.

That wraps up the Q&A abstract. Though Charaka doesn’t share his funding analysis on Carvana publicly – he’s absolutely licensed to take action if he needs to – you’ll be able to attain out to him instantly or comply with him on LinkedIn and X for any questions concerning his stance on Carvana.

Takeaway

I used to be fallacious about Carvana, and even my very educated pal Charaka Mahage couldn’t change my opinion about investing in CVNA when the inventory was buying and selling at depressed costs in December 2022. Carvana has proved all my assumptions fallacious prior to now 18 months, forcing me to withdraw my bearish stance on the corporate. I’ll comply with the corporate intently to determine a possible entry level sooner or later and share my findings on In search of Alpha.