SlavkoSereda/iStock through Getty Photos

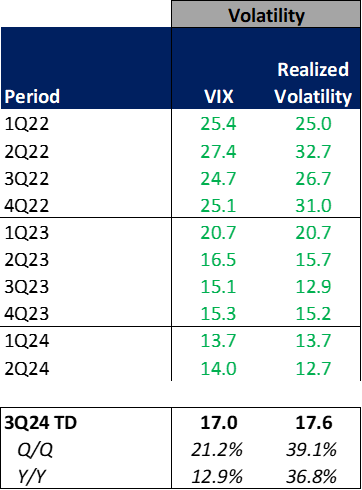

Volatility Metrics

Volatility, as measured by the VIX, is at the moment averaging 17.0 in 3QTD, up 13% from 16.5 in 3Q23 however and up 21% from 14.0 in 2Q24. Moreover, realized volatility, as measured by each day modifications within the closing worth of the S&P 500 is monitoring at 17.6 in 3QTD, up 37% from 12.9 in 3Q23 and up 39% from 12.7 in 2Q24.

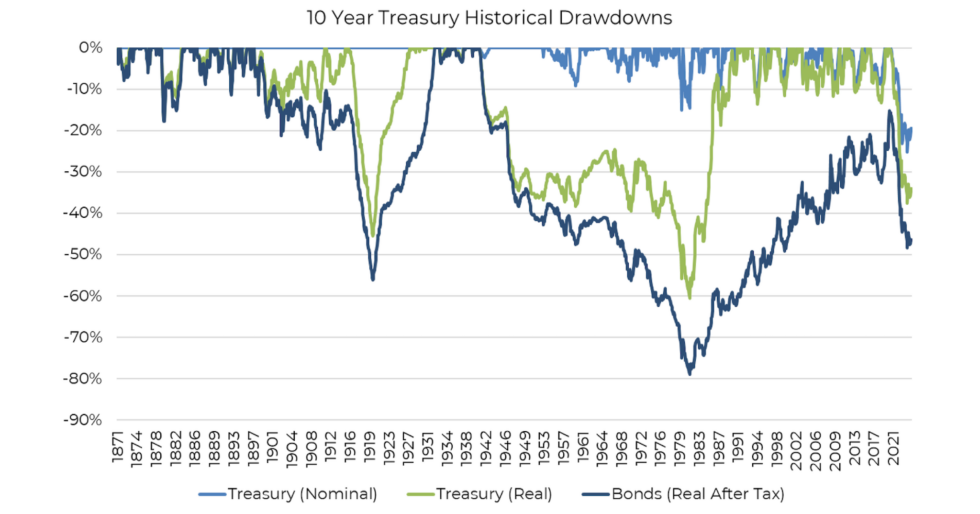

Yahoo Finance

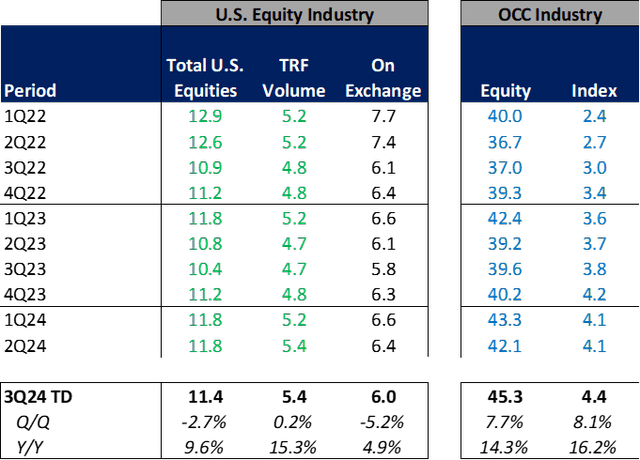

U.S. Equities, Fairness Choices, & Index Choices

In the meantime, whole U.S. fairness volumes are monitoring at 11.4 billion per day, up 10% from 10.4 billion in 3Q23 however down 3% from 11.8 billion in 2Q24. Moreover, whole business fairness possibility volumes are monitoring at 45 million per day, up 14% from 3Q23 and up 8% from 42.1 million in 2Q24. Business Index possibility volumes are at the moment averaging 4.4 million per day in 3Q24TD, up 16% vs. 3.8 million in 3Q23 and up 8% from 2Q24.

Cboe International Markets and OCC

Change Particular Volumes

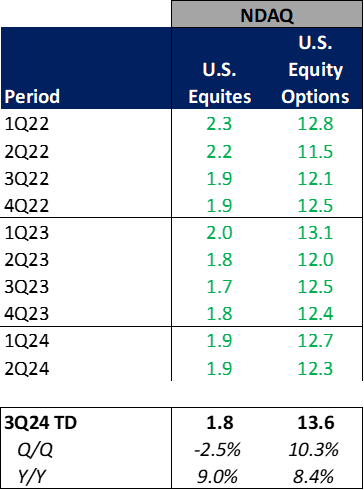

Nasdaq (NDAQ)

Nasdaq’s U.S. fairness quantity is averaging 1.8 billion per day in 3Q24TD, up 9% relative to 3Q23 however down 3% relative to 2Q24. Based mostly on QTD ADV, Nasdaq has misplaced 8 foundation factors of market share in U.S. equities relative to 3Q23 however picked up 4 foundation factors of market share relative to 2Q24. Moreover, Nasdaq’s U.S. fairness choices quantity is averaging 13.6 million contracts per day, up 8% relative to 3Q23 and up 10% relative to 2Q24. Based mostly on QTD ADV, Nasdaq has misplaced 164 foundation factors of market share in U.S. fairness choices relative to 3Q23 however picked up 72 foundation factors of market share relative to 2Q24.

Cboe International Markets and OCC

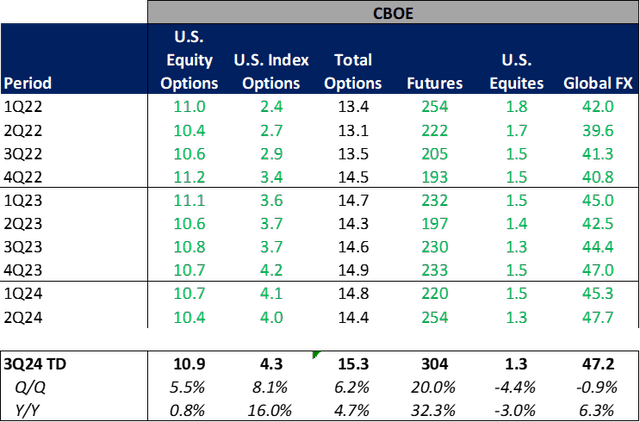

Cboe (CBOE)

Cboe’s U.S. fairness quantity is averaging 1.3 billion per day in 3Q24TD, down 3% relative to 3Q23 and down 4% relative to 2Q24. Based mostly on QTD ADV, Cboe has misplaced 146 foundation factors of market share in U.S. equities relative to 3Q23 and 20 foundation factors of market share relative to 2Q24. The Y/Y market share decline is smart, given Cboe talked about on its 4Q23 earnings name that it had carried out some pricing modifications in U.S. equities designed to extend income seize (on the potential expense of market share). Cboe’s U.S. fairness choices quantity is averaging 10.9 million contracts per day, up 1% relative to 3Q23 and up 6% relative to 2Q24. Based mostly on QTD ADV, Cboe has misplaced 324 foundation factors of market share in U.S. fairness choices relative to 3Q23 and 51 foundation factors of market share relative to 2Q24. In the meantime, Cboe’s index possibility volumes are averaging 4.3 million contracts per day in 3Q24TD, up 16% Y/Y and up 8% from 2Q24. Moreover, Cboe’s futures volumes are averaging 304k per day, up 32% from 3Q23 and up 20% from 2Q24 ranges whereas FX volumes are averaging $47.2 billion per day, up 6% from 3Q23 however down 1% from 2Q24.

Cboe International Markets and OCC

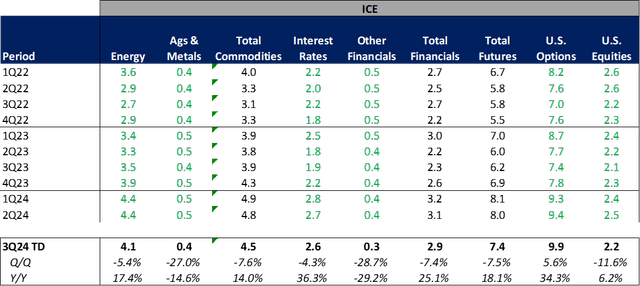

Intercontinental Change (ICE)

Intercontinental Change’s U.S. fairness quantity is averaging 2.2 billions per day in 3Q24TD, up 6% relative to 3Q23 however down 12% relative to 2Q24. Based mostly on QTD ADV, Intercontinental Change has misplaced 60 foundation factors of market share in U.S. equities relative to 3Q23 and has misplaced 194 foundation factors of market share relative to 2Q24. Moreover, Intercontinental Change’s U.S. fairness choices quantity is averaging 9.9 million contracts per day, up 34% relative to 3Q23 and up 6% relative to 2Q24. Based mostly on QTD ADV, Intercontinental Change has gained 326 foundation factors of market share in U.S. fairness choices relative to 3Q23 however misplaced 44 foundation factors of market share relative to 2Q24. By way of Intercontinental Change’s futures volumes, Power quantity is averaging 4.1 million contracts per day, up 17% Y/Y however down 5% relative to 2Q24, whereas Ags & Metals contracts are averaging 0.4 hundreds of thousands per day, down 15% vs. 3Q23 and down 27% relative to 2Q24, and Financials quantity is monitoring at 2.9 million contracts per day, up 25% Y/Y however down 7% relative to 2Q24 ranges.

Intercontinental Change, Cboe International Markets and OCC

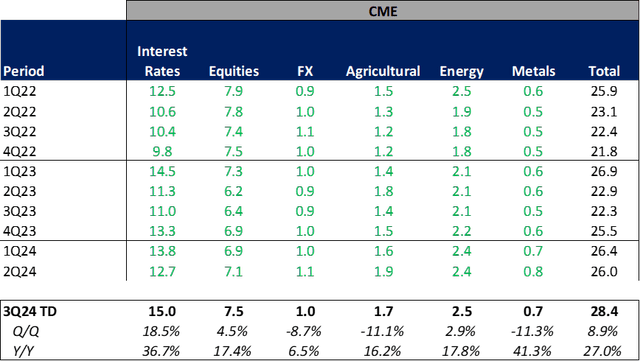

CME Group (CME)

CME Group’s whole futures and choices complicated quantity is averaging 28.4 million contracts per day in 3Q24TD, up 27% Y/Y and up 9% from 2Q24 ranges. By product line, Curiosity Charge futures and choices are averaging 15.0 million contracts per day, up 37% Y/Y and up 19% from 2Q24, Equities contracts are averaging 7.5 million contracts per day, up 17% Y/Y and up 5% from 2Q24, FX contracts are averaging 1.0 million per day, up 7% Y/Y however down 9% from 2Q24, Agricultural contracts are averaging 1.7 million per day, up 16% Y/Y however down 11% from 2Q24, Power contracts are averaging 2.5 million per day, up 18% Y/Y and up 3% from 2Q24 ranges, and Metals contracts are averaging 0.7 million per day, up 41% Y/Y however down 11% from 2Q24 ranges.

CME Group

What This Means For the Exchanges

By way of how the above interprets into revenues for the exchanges, CME Group’s efficiency in 3Q24TD has been the strongest relative to what the corporate reported within the prior yr interval, suggesting probably the most upside to 3Q24 transaction revenues on a Y/Y foundation. Cboe reveals the subsequent highest Y/Y potential enchancment in transaction associated income – pushed primarily by energy in index choices and futures volumes. Intercontinental Change reveals the third most upside relative to yr in the past transaction income outcomes – primarily pushed by outperformance Y/Y in Intercontinental Change’s vitality and monetary futures volumes. Nasdaq’s efficiency on transaction revenues appears to be like to be up solely barely vs. what they reported a yr in the past, based mostly on QTD volumes.

Based mostly on the QTD quantity data, I’d recommend shopping for CME Group on the anticipation of upward revisions to transaction income estimates, significantly given the current efficiency of CME relative to the opposite exchanges (CME group down 1% over the past 3 months vs. the opposite exchanges +14-18%). I’d additionally contemplate shopping for CBOE given the robust transaction income and potential for extra tailwinds given the extra risky surroundings of late (as talked about in my initiation observe on CBOE increased quantity and volatility environments have an outsized influence on CBOE’s earnings energy). Whereas ICE’s transaction revenues are more likely to be up meaningfully Y/Y, the inventory has reacted nicely not too long ago (+18% within the final 3 months – possible because of the potential for decrease rates of interest within the coming months/years, which ought to profit ICE’s mortgage enterprise (as talked about in my initiation observe on ICE), so I’d not recommend making modifications to my place right here based mostly on transaction volumes. I additionally wouldn’t recommend making modifications to my place on Nasdaq based mostly on QTD quantity data, as transaction revenues are more likely to stay comparatively unchanged Y/Y and the inventory has carried out fairly nicely in current months following robust 2Q24 earnings outcomes (as talked about in my newest observe on NDAQ).