Key Takeaways

- Spot bitcoin ETF volumes doubled through the market crash.

- Morgan Stanley to start out recommending bitcoin ETFs to qualifying purchasers.

Share this text

![]()

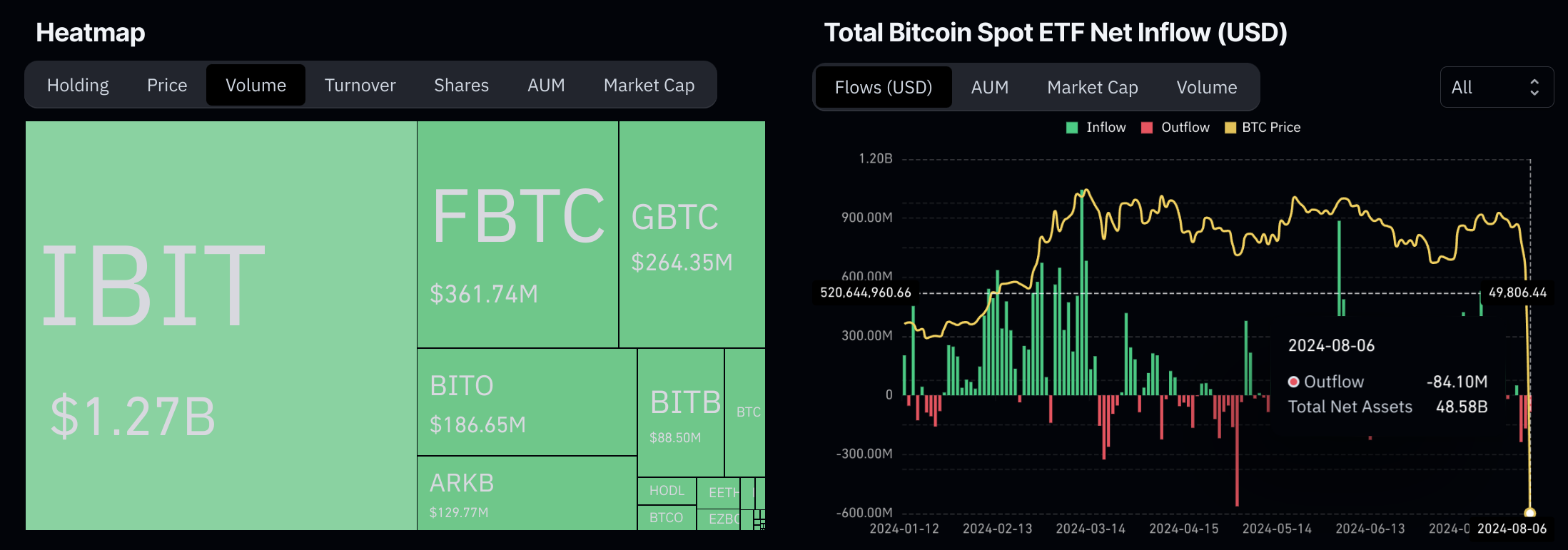

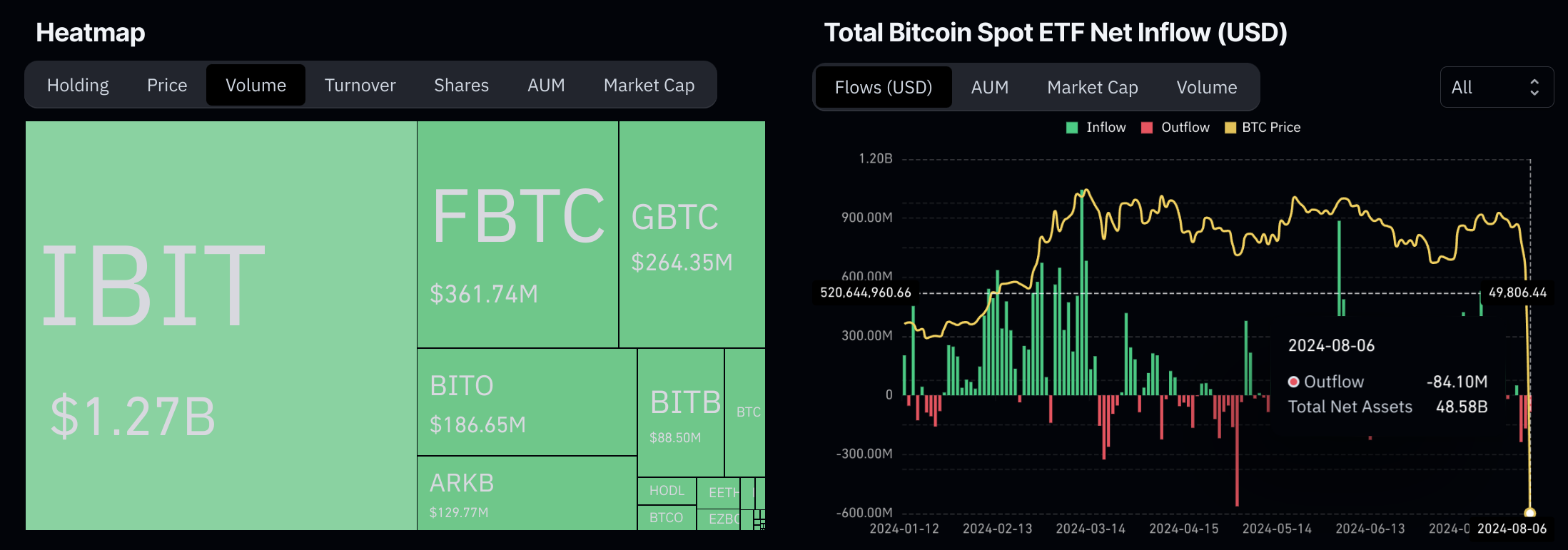

Buying and selling quantity for Bitcoin exchange-traded funds surged to $5.7 billion on August 6, surging from the prior 48 hours as crypto markets skilled heightened volatility. Outflows have since calmed down at $84.1 million, in response to information from Coinglass, with web property remaining on the $48 billion threshold.

The spike in ETF buying and selling coincided with an 8% drop in Bitcoin’s value since August 4. Ethereum noticed a fair steeper 21% decline after main funds like Leap Buying and selling and Paradigm reportedly bought a whole lot of thousands and thousands of {dollars} value of ETH. Alex Thorn, head of analysis at Galaxy Digital, reported that Bitcoin ETF buying and selling quantity exceeded $1.3 billion inside simply 20 minutes of market open. The iShares Bitcoin Belief led exercise with over $1.27 billion in quantity.

Rebound after six-month low

Bitcoin and Ethereum costs are rebounding after hitting six-month lows on Monday, with Bitcoin dipping under $50,000 and Ethereum experiencing its largest single-day drop in three years. The sell-off coincided with a broader market downturn affecting international shares.

Regardless of the market turbulence, web circulate information from CoinGlass signifies that almost all ETF holders maintained their positions. Analysts imagine the sell-off was exacerbated by broader macroeconomic considerations, together with weak US employment information and volatility throughout asset lessons. For context, the S&P 500 index has fallen over 5% since August 1.

JPMorgan Chase analysts report that spot Bitcoin ETF buying and selling volumes greater than doubled on Monday to over $5.2 billion, surpassing the January debut. Spot Ethereum ETFs noticed inflows exceeding $49 million throughout all funds.

Elevated asset allocation anticipated

Bernstein analysts spotlight that in contrast to earlier cycles, Bitcoin ETFs now present a extremely liquid funding avenue, buying and selling round $2 billion day by day. They anticipate elevated asset allocation to Bitcoin as extra wirehouses approve these merchandise within the coming months.

The surge in Bitcoin ETF quantity suggests some buyers seen the value dip as a shopping for alternative. Nevertheless, market construction stays fragile in response to Markus Thielen of 10x Analysis, who expects new crypto funding to sluggish till situations stabilize.

“It’s unlikely that vital gamers will make investments amid excessive volatility and unpredictable costs,” Thielen stated. “Many nonetheless have to exit positions and deleverage their portfolios,” explaining their evaluation.

The doubling of Bitcoin ETF quantity highlights how rapidly institutional capital can circulate out and in of crypto markets during times of volatility. It additionally demonstrates the rising significance of ETFs as a automobile for Bitcoin publicity amongst conventional buyers.

Share this text

![]()

![]()