avstraliavasin

Introduction

Equinor ASA (NYSE:EQNR) is known as the partly Norwegian state-owned oil agency. They’re recognized for his or her low carbon footprint and not too long ago essential perform in vitality security throughout the Europe. My thesis is based on the concept that oil demand will peak later than 2030, attributable to lower EV adoption cost throughout the transportation enterprise. If this happens to be true, then merchants holding oil companies will end up with an superior return, with a guess in opposition to the current investor sentiment and I take into account Equinor may presumably be an superior agency to place cash into, based mostly totally on its current price.

Furthermore, Equinor has really low price multiples compared with rivals and good capital allocation, which long-term merchants can revenue from. For simplicity features, this analysis will focus additional on Equinor’s oil sector.

What’s the earnings mix?

Equinor’s earnings mix is separated into 5 completely totally different areas:

- Exploration and manufacturing, Norway

- Exploration and manufacturing, Worldwide

- Exploration and manufacturing, USA

- Promoting and advertising, Midstream, and Processing

- Renewables

Approx. Adjusted Working income (Authors calculations)

E&P, Norway, is the precept contributor to Equinor’s working profitability, with barely higher than 76% of the working income, which is the precept provide of income for Equinor ASA.

On the current second, Equinor is shedding money on its Renewables division, with lower prices in Europe and inflation impacting its profitability. Nonetheless, Equinor has an opportunistic view on this sector and believes in long-term profitability for this sector in the long term based mostly totally on how so much they’re investing into renewables not too long ago.

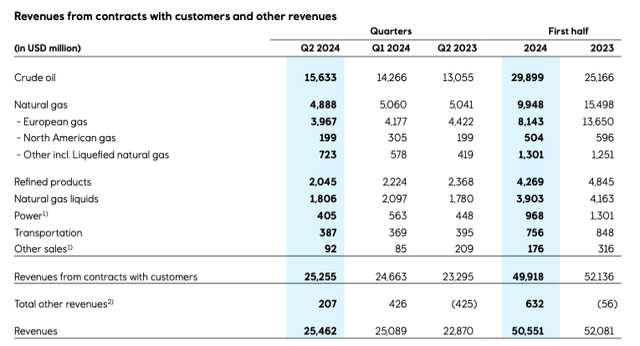

Revenue by commodity (Equinor Q2)

Crude oil is the heavy lifter, with barely higher than 60% of the earnings, and oil could be the foremost focus of this textual content.

The manufacturing numbers

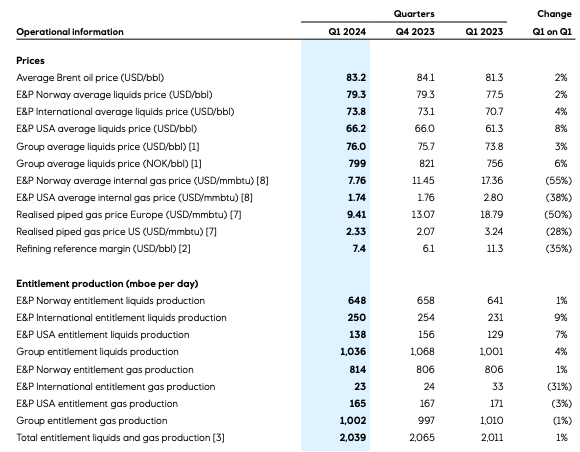

Equinor delivered a whole equity manufacturing of two mboe per day. The excellence between Equity manufacturing and Entitlement manufacturing is that equity is gross manufacturing, nonetheless entitlements are after deducting contractual and monetary obligations corresponding to royalties, manufacturing sharing agreements (PSAs), and taxes.

Operational information (Equinor Q1 2024)

Norway reached a median price of Brent oil of $83 per barrel, with a median of 648 mboe per day in manufacturing. The gasoline manufacturing from Norway is identical as 814 additional per day, with a median price of 9.41 USD/MMBtu. The ultimate 188 mboe per day was produced internationally, attaining a gasoline price of two.33 USD/MMbtu.

Progress

In response to Equnior, their plans are to develop their oil and gasoline division by 5% until 2026 after which preserve their 2 million barrels per day manufacturing by 2030. How will they do this? Key initiatives are the Linnorm discovery throughout the Norwegian Sea, the Breidablikk topic, and the Sparta topic throughout the Gulf of Mexico.

Their future plans are to develop their renewable division to higher than 80 TWh inside 2035. That may be a rise of higher than 10.000% from instantly’s 774 GWh of renewable manufacturing. How so much will this worth? Correctly, based mostly on Equinor, its plan is to make use of fifty% of its capital expenditures on its renewable division by 2030. Equinor has from 2021 to 2026 plans to take a place spherical $23 billion in renewable vitality initiatives. Specializing in offshore wind, picture voltaic, and totally different low-carbon choices.

IEA oil demand and supply outlook

IEA demand outlook signifies that peak oil demand will be in 2029. Impacted by extreme EV product sales, renewables and gasoline altering the demand for vitality manufacturing and enchancment in automobile effectivity will drive down the demand for oil. IEA signifies that EV product sales would possibly attain 40 million by 2030, and that may displace spherical 6 mb/d. It is going to resolve to a peak oil demand of 106.5 mb/d by 2029 as their base case.

IEA believes that present will improve by 6 mb/d until 2030 and end at 113 mb/d significantly above their predicted demand peak.

Goldman Sachs oil demand outlook

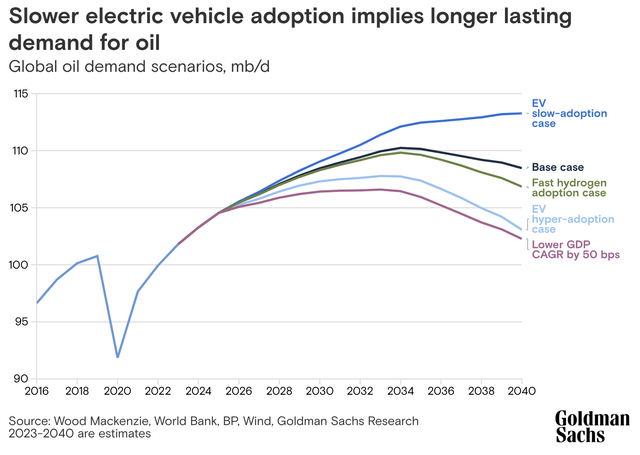

Goldman Sachs outlook suggests a later peak oil demand than totally different excellent forecasts. Goldman Sachs base case is that oil demand will peak in 2034 attributable to these two parts underneath.

Slower adoption of EV autos

Decreased Subsidies: The adoption of EVs in Europe has been decreased due to the cutback in subsidies.

Price Opponents: The extreme diploma of price opponents locations pressure on automaker earnings and, subsequently, limits investments in EVs.

Technical Factors and Infrastructure: Points relating to charging infrastructure and the affordability and resale price of EVs.

Protection Uncertainty: Political uncertainties in areas identical to the US and Europe are hampering the tempo of EV adoption.

Rising income and higher vitality demand

Rising markets: Rising markets are anticipated to increase the demand for oil throughout the subsequent couple of years, notably in Asia.

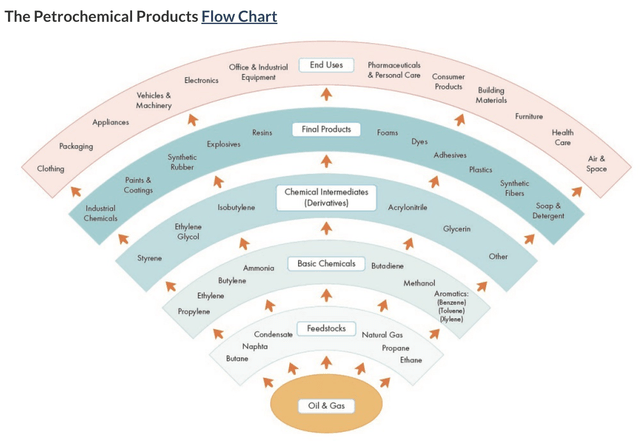

Petrochemicals (Canadian Vitality Regulator)

Petrochemicals: The demand for petrochemicals is offsetting the slower demand for gasoline merchandise. Petrochemicals are used for various completely totally different merchandise like cleansing cleaning soap and plastics. If the worldwide GDP per capita retains rising, then it ought to have an effect on the demand for petrochemical merchandise, which might be a day-to-day necessity.

Goldman Sachs has acknowledged completely totally different eventualities. The important thing danger to worldwide oil demand comes from the adoption of EV autos and renewable vitality sources. In response to Goldman Sachs analysts, in 2028, the adoption of EV autos will offset the demand for gasoline; that’s their base case. This means they take into account the peak gasoline demand will be in 2028, nonetheless totally different merchandise like diesel will proceed to rise until 2034 attributable to heavy-duty vans, based mostly on Goldman Sachs analysis.

Goldman Sachs completely totally different eventualities (Goldman Sachs)

The analysts at Goldman Sachs have acknowledged 5 completely totally different eventualities. Sluggish EV adoption might be probably the most bullish outlook, with a world oil demand of 113 mb/d and low GDP CAGR being most likely probably the most bearish state of affairs, with an anticipated oil demand of 102 mb/d.

OPEC

OPEC has confirmed dedication to the subsequent oil price throughout the remaining couple of years. Actively making an attempt to have an effect on the price of oil by means of using manufacturing cuts. I take into account OPEC has aimed to have a superb bigger price than $80 per bbl, nonetheless totally different non-OPEC worldwide areas have slowly elevated their present as prices keep comparatively safe. In 2023, the frequent annual oil price was $75 per barrel, and so far in 2024, the oil price has been $81 per barrel.

OPEC has already devoted to keep up manufacturing cuts all by means of this yr. Manufacturing cuts of 1.65 mill barrels a day, which every Saudi Arabia and Russia have been notably supportive of.

This may increasingly give us merchants some reinsurance that totally different extremely efficient forces are influencing the price of oil to keep up it at a extreme diploma, certainly one of many causes may presumably be {{that a}} bigger oil price is critical for Russia to finance their warfare.

Equinor’s perform in vitality security in Europe

Norway is now grow to be a significant participant in supplying pure gasoline to Europe, and Equinor is a major contributor proper right here. At current, Norway gives about 30% of Europe’s gasoline present. Equinor has actually signed a long-term contract to supply Germany with 10 billion cubic meters of pure gasoline yearly from 2024 to 2034. That’s about 1/3 of Germany’s industrial demand. We take into account that gasoline prices would possibly proceed to stay elevated as totally different alternate choices will take time. Renewables are every not very worthwhile in Europe in the meanwhile and takes time to assemble, moreover it appears identical to the Ukraine-Russia warfare just isn’t going to complete in a short time, sadly.

EU Pure Gasoline (Shopping for and promoting Economics)

Why have pure gasoline prices stayed elevated since 2022? Correctly, there’s a mix of disrupted present chains, expensive LNG, and infrastructural challenges with geopolitical stress.

Effectivity and capital building

As with each totally different oil and gasoline agency in the meanwhile, Equinor makes some big money. They’ve a return on equity of 21% and an internet margin of 9.14%. Financial effectively being will be reassuring, with debt a debt-to-equity ratio of 0.75 and an curiosity safety ratio of 31.70, which is larger than safe.

On the current oil price, Equinor is a extremely safe place to be. Furthermore, Equinor has an settlement with Germany to provide roughly 1/3 of their industrial gasoline present until 2034, which is one different safety measure.

Financial effectively being and dealing effectivity (Morningstar)

Valuation

Multiples

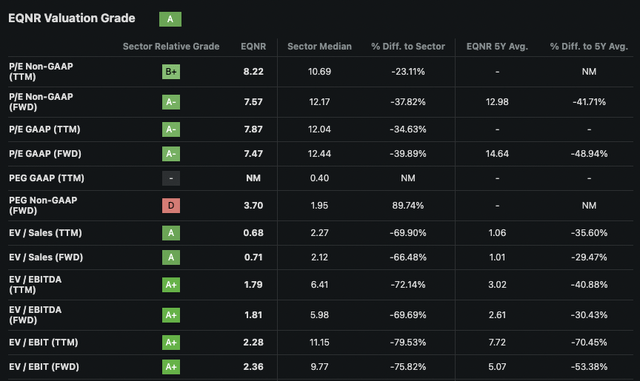

Starting with Equinor’s multiples, we’ll clearly see that Equinor is at a reasonably large low price compared with the sector median. Why is that this the case? This might presumably be attributable to Equinor’s lower future growth cost compared with the sector median, as Equinor is additional focused on rising its renewable division after 2030.

A lot of valuation (Looking for Alpha)

Nonetheless, I take into account Equinor appears too low price compared with the sector median. The standard distinction between the sectors is roughly 43% lower than the sector median.

DCF

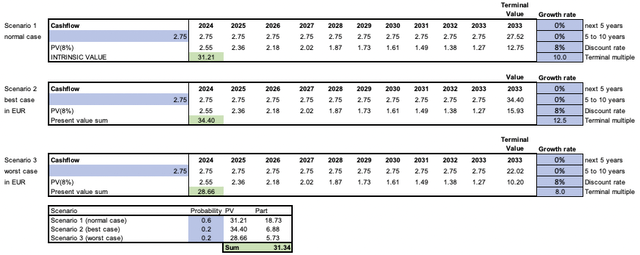

Doing a DCF analysis for Equinor is hard because of predicting future earnings for a commodity enterprise is principally unattainable, nonetheless the extent of this analysis is to ask your self in case you take into account that oil demand will proceed properly previous 2029 or not. Must you take into account this to be true, then I take into account chances are you’ll rely on an oil price of spherical $80 per bbl for the unforeseeable future.

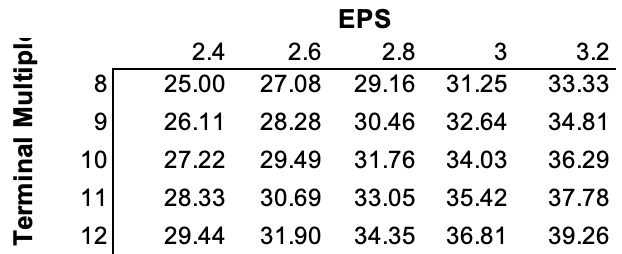

DCF sensitivity valuation (Authors calculations) Sensitivity analysis (Authors calculations)

The EPS estimate is based on the median of the ultimate eight quarters and with an 80% safety margin, so a quarterly EPS of $0.69. I used a WACC of 8% and calculated with 0% anticipated growth. Even with 0% anticipated growth, a sensible terminal plenty of of above ten, and an EPS of two.4, which equals a quarterly EPS of 0.6, we get a share price above $27 per share. That’s barely above the current price, even with 0% growth and an EPS margin of safety of 80%.

Moreover, attempting on the sensitivity analysis, we’ll see that instantly’s share price is relatively low price, even with lower EPS and terminal plenty of. A EPS of two.4 is a -27% dispersion of instantly’s main EPS. Furthermore, a WACC of 8% is almost 40% bigger than the frequent based mostly on my sources.

Historic main EPS and WACC (Looking for Alpha)

All of these eventualities are priced with 0% growth, this affords way more confidence that the market is pricing Equinor really low price instantly.

Dividend yield

The current dividend yield is barely above 11%, nonetheless that is because of Equinor’s extraordinary dividend, which has doubled the dividend yield the earlier years. It is going to end after 2024 once more to uncommon dividend; attributable to this truth we’ll rely on a dividend yield nearer to 5% at instantly’s price if uncommon dividend proceed like beforehand.

Buyback yield

In Q1, Equinor launched that they’re going to buy once more shares worth $6 billion in 2024, this is identical as spherical 8% if the price is spherical $26 per share, and buybacks worth of between $4 or $6 billion in 2025. In response to Equinor, they’ve spent $947 million the first half of 2024 on buybacks. This means an additional $5.053 billion is predicted the ultimate half of 2024 based mostly on their plan, it’s a 7% buyback yield until the highest of 2024 based mostly totally on a price of $26 per share.

Renewable initiatives

If we do a quick valuation comparability by between present companies like EDP who produces 26 GW and ReNew who produces 10 GW, we’ll try and estimate what the 12-16 GW may presumably be. EDP is valued at €15 billion and ReNew is valued at €2.1 billion. At first hand-sight, ReNew appears pretty low price if we merely consider manufacturing compared with price in opposition to EDP, which can be for various causes.

If we do a bear case of the valuation for Equinor’s renewable initiatives based mostly totally on EDP valuation, since that’s in a additional comparable market. We are going to estimate that Equinor’s renewables endeavor could also be valued at $6 billion. That’s presently equal to 3 {{dollars}} per share. Not a giant amount, nonetheless it’s an 8% improve from instantly’s price.

Conclusion

Equinor is projected to maintain up a safe oil and gasoline manufacturing outlook of two mboe/d until 2030. Concurrently, the company is able to significantly broaden its renewables division to satisfy its environmental targets, which is one factor merchants can revenue from the next couple of years. My calculations counsel the current price is relatively low price. In response to my sensitivity analysis, the current share price is principally low compared with the entire completely totally different state of affairs’s. On the current price, my calculations current that the current price doesn’t embody any growth from the renewables initiatives, which merchants will get completely free on the current price. Furthermore, Equinor’s multiples appear undervalued compared with the sector median, with a median low price of 43%.

Equinor’s current price offers a strategic entry degree to be taught from safe extreme oil prices. Patrons can anticipate a buyback yield barely above 7% and a dividend yield of 5% this yr, with a future dividend yield of 5% if oil prices keep safe.

This analysis hinges on the thought throughout the tempo {of electrical} automobile adoption. The IEA forecasts that EVs will symbolize over 60% of auto product sales by 2035 beneath the “Stated Insurance coverage insurance policies State of affairs.” Furthermore, the IEA predicts that by 2035, EVs, along with buses and vans, will make up over 50% of auto product sales throughout the US. I, along with others, uncover this speedy adoption state of affairs unlikely. I align additional with Goldman Sachs’ slower EV adoption state of affairs, which anticipates peak oil demand occurring after 2040.

In summary, in case you take into account that the adoption of EVs will progress additional slowly than the IEA initiatives and that Goldman Sachs’ late state of affairs is additional seemingly, this would possibly justify investing in Equinor. This notion stems from the expectation that oil demand will peak later. Lastly, it comes all the way in which all the way down to your perspective on what will be acceptable. Predicting oil demand is sort of unattainable, nonetheless one certainty stays: in case you anticipate a significantly later peak in oil demand and deal with to maintain up your composure all through doubtlessly turbulent durations, you’ll most probably make an distinctive return by betting in opposition to the market sentiment.