In the event you’re like most traders, you’re asking the incorrect questions.

I used to be chatting with a bunch of advisors a few decade in the past in La Jolla and a query arose. I’ll paraphrase:

“Meb, thanks for the speak. We get a gentle stream of salespeople and consultants in right here hawking their varied asset allocation fashions. Frankly, it may be overwhelming. Some will ship us a 50-page report, all to clarify a strategic shift from 50% equities to 40%. I wish to do proper by my purchasers, however I’ve a tough time studying all the assorted analysis items and fashions, not to mention reconciling their variations. Any ideas?”

The advisor adopted up by emailing me this abstract of all the institutional asset allocation fashions by the Goldmans, Morgan Stanleys, and Deutsche Banks of the world. And as you’ll see, they’re HIGHLY completely different. Morgan Stanley stated solely 25% in US shares, whereas Silvercrest stated 54%! Brown Advisory stated 10% in rising markets and JPMorgan 0%.

So what’s an advisor to do? What’s the best asset allocation mannequin?

Seems, that’s really, that’s the incorrect query.

The proper beginning query is, “Do asset allocation variations even matter?”

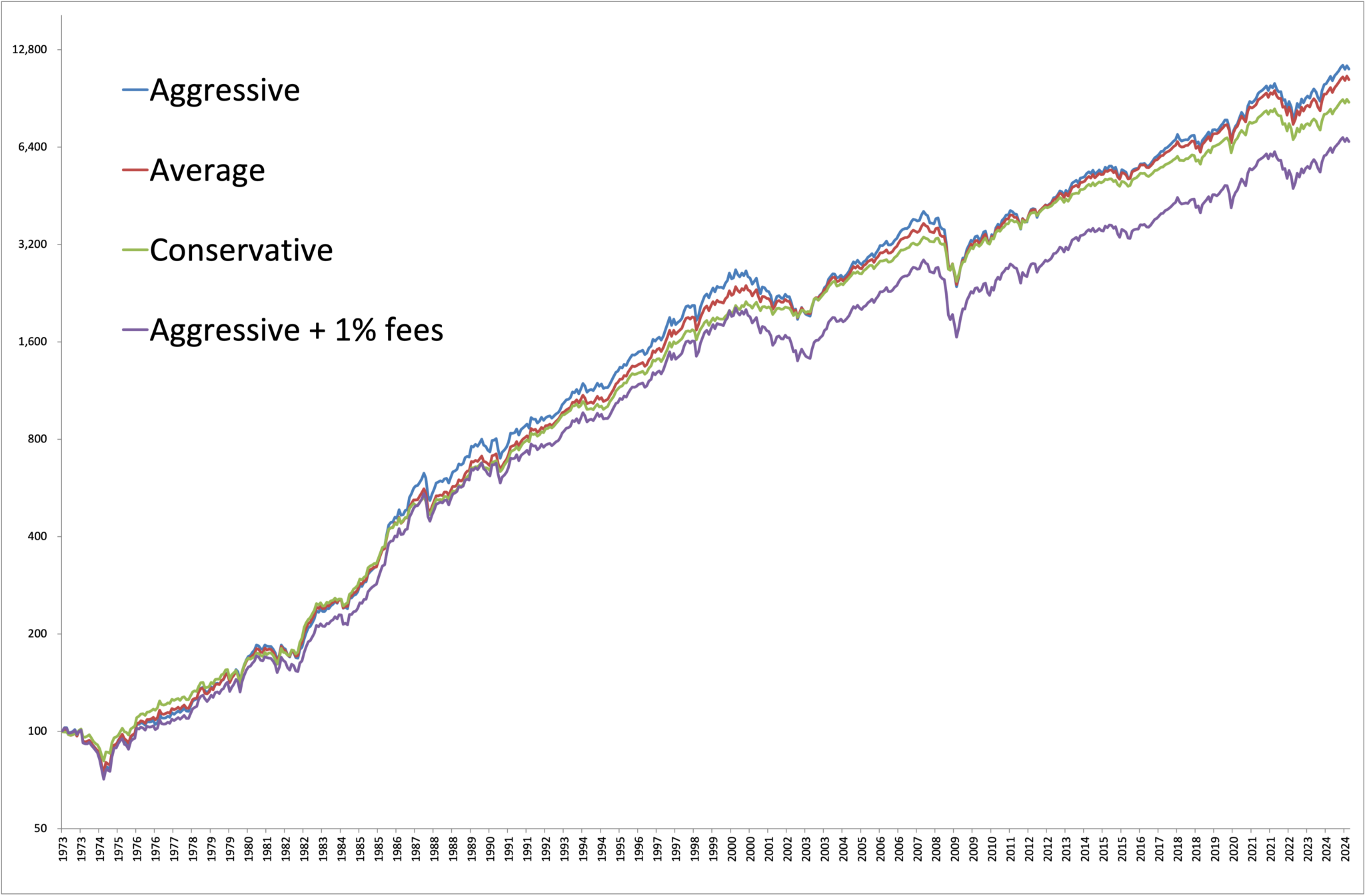

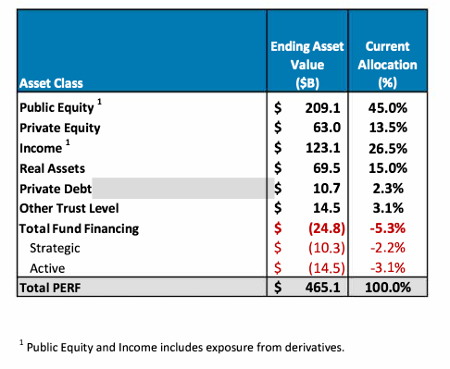

Within the abstract article that the advisor despatched me, there’s a hyperlink to an information desk displaying the asset allocations of 40 of the nation’s main wealth administration teams. I teased out all the info from the desk to look at three allocations:

The allocation with essentially the most quantity in shares (Deutsche Financial institution at 74%).

The common of all 40.

The allocation with the least quantity in shares (Northern Belief at 35%).

We used public market equivilants for the personal methods. Beneath is the fairness curve for every. Except you’ve hawk-like imaginative and prescient, you’ll probably have a tough time distinguishing between the curves, and that is for essentially the most completely different. The opposite 40+ corporations reside someplace within the center!!

Beneath are the returns for every allocation over all the 1973-2024 interval.

Most aggressive (DB): 9.48% replace

Common: 9.32%

Least aggressive (AT): 8.98%

There you’ve it – the distinction between essentially the most and least aggressive portfolios is a whopping 0.50% a yr. Now, how a lot do you suppose all of those establishments cost for his or her companies? What number of tens of millions and billions in consulting charges are wasted fretting over asset allocation fashions?

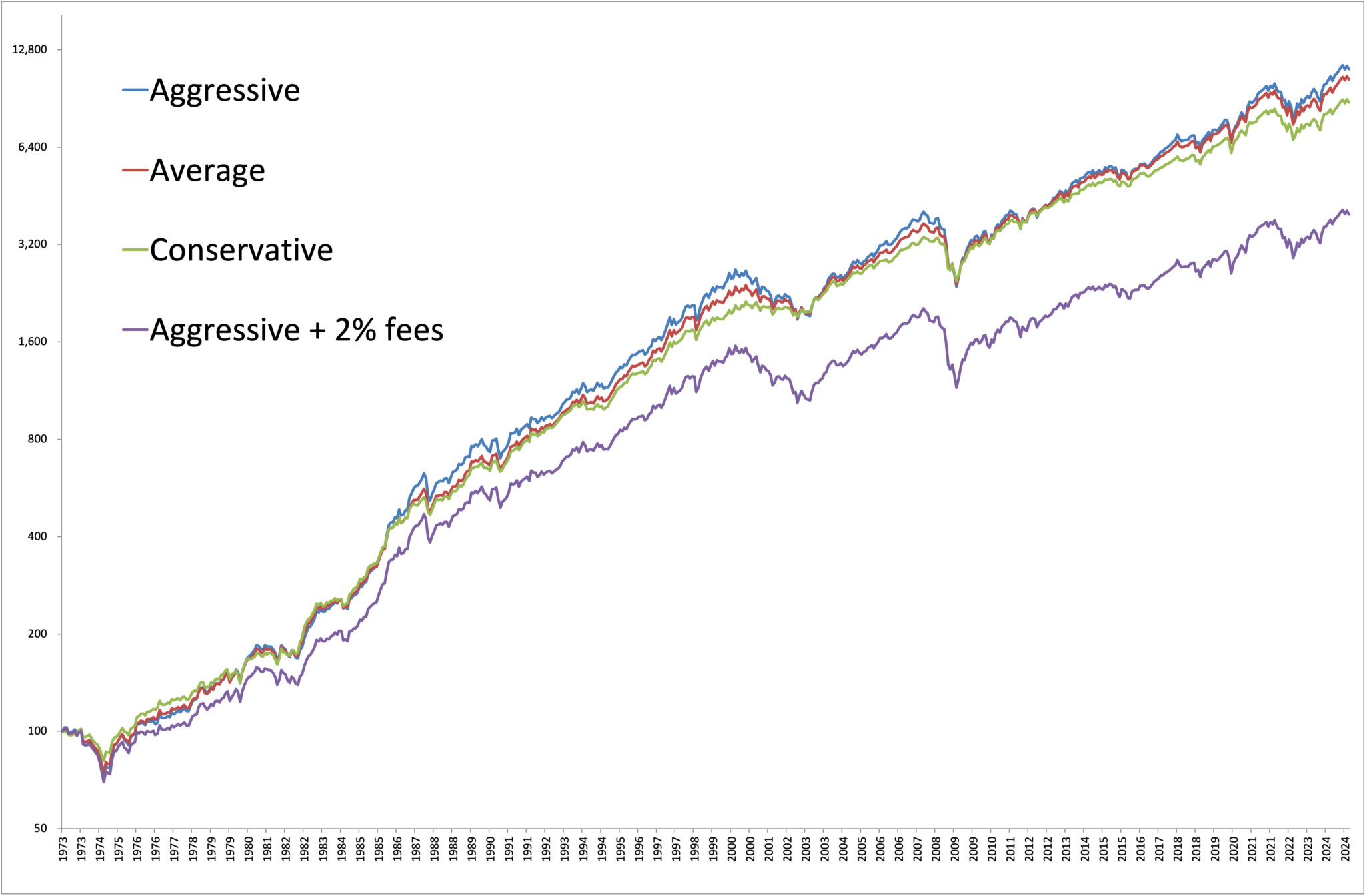

Let’s strive another experiment…

Overlay a easy 1% administration price on essentially the most aggressive portfolio and look once more on the returns. Just by paying this gentle price (that’s decrease than the typical mutual fund, by the best way) you’ve turned the best returning allocation into the bottom returning allocation – rendering all the asset allocation determination completely irrelevant.

And if you happen to allocate to the typical advisor with a mean price (1%) that invests within the common mutual fund, properly, you understand the conclusion.

So all these questions that stress you out…

“Is it a superb time for gold?”

“What in regards to the subsequent Fed transfer – ought to I lighten my fairness positions beforehand?”

“Is the UK going to depart the EU, and what ought to that imply for my allocation to overseas investments?”

Allow them to go.

In the event you had billions of {dollars} underneath administration and entry to the very best traders on the earth, you’d suppose you’d be capable to beat a primary 60/40 index. Seems most establishments can’t.

In the event you’re an expert cash supervisor, go spend your time on worth added actions like property planning, insurance coverage, tax harvesting, prospecting, common time together with your purchasers or household, and even golf.

:max_bytes(150000):strip_icc()/health-broccoli-vs-brussel-sprouts-template-1_720-c310b4225b194326b0f2e80f1478c02b.jpg)