Anastasiia Makarevich

As is almost a yearly tradition, many Seeking Alpha authors will dutifully present their lists of stocks for 2023. Growth stocks, dividend stocks, real estate investment trusts (“REITs”), you can find a list of your interests on about any topic. At the beginning of 2022, I presented my list of investments to avoid, which you can read here. Since this article was very well read, I think it is interesting to check whether my predictions came true.

In this article, I will take a look at the results of these predictions: how many of the 7 were right, and how many were wrong? In a future article, I will follow this up with predictions for which stocks to avoid in 2023.

2022: the benchmark

To investigate how well (or poorly) I did with my predictions, I will use the S&P 500 (SP500) as a benchmark and see whether I was right or wrong with my predictions. But let us first recap what we did and didn’t know at the start of 2022. First, inflation was already up and energy and raw materials costs were already increasing. But Russia had not invaded Ukraine yet, and covid still seemed likely to remain a worldwide problem for the foreseeable future. The markets already started showing some cracks, but we did not know that 2022 would become a year during which a new bear market would start.

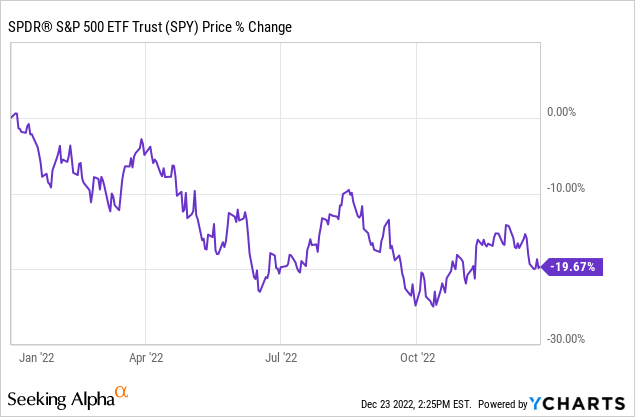

Graph 1: Price development of the S&P 500 in 2022 (Source: YCharts)

As you can see, the S&P 500 is down almost 20% during the year 2022. Of course, this can still change during the last week, but usually, these last weeks of the year do not feature many extreme stock market movements. So let us take a look at my predictions one-by-one and analyze whether I was right or wrong.

#1: Meta Platforms (META)

I considered Meta to both be a risky investment and one which would likely underperform the market in 2022 with their large bets on the metaverse and their potentially stagnating add revenues.

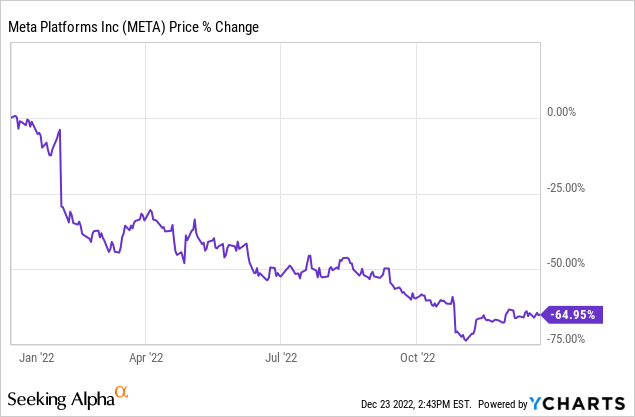

Graph 2: Share price development of Meta in 2022 (Source: YCharts)

Meta is down almost 65% percent this calendar year, greatly underperforming the S&P 500. In hindsight, the slump in share price of Meta was likely also partially caused by the privacy changes of Apple (AAPL), which led to an advertising revenue drop at Meta. The metaverse and the (lack of) trust of investors that this will quickly lead to additional revenues might be another factor. Large risks remain, but since Meta already dropped so much during 2022 and the stock seems cheap right now, I do not think that Meta will return on my upcoming 2023 list of investments to avoid. But for 2022, this call was completely RIGHT.

#2: Meme stocks AMC Entertainment Holdings, Inc. (AMC) and GameStop Corp. (GME)

People staying home due to Covid, cash handouts by the government, the success of broker Robinhood (HOOD), and a Reddit (REDDIT) army of investors were all factors leading up to meme stocks rising by unprecedented levels in 2021. I predicted that 2022 would feature a return to normalcy for these stocks.

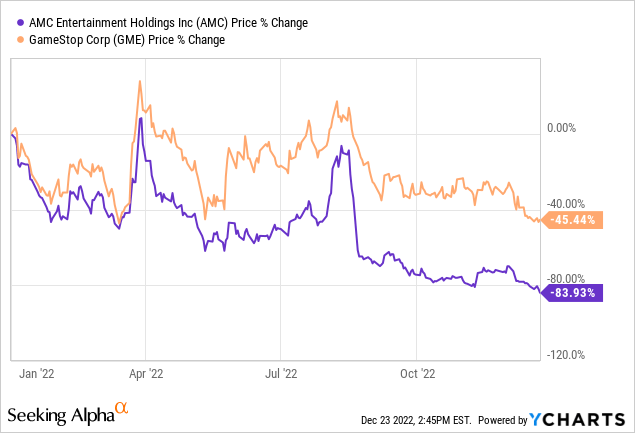

Graph 3: Share price development of AMC and Gamestop in 2022 (Source: YCharts)

Both AMC and Gamestop returned to more logical levels of valuation during 2022, though this did not go in a linear way to say the least, when you look at their graphs. In the end, AMC is down a staggering 84% this year, while Gamestop did better with minus 45%. RIGHT

#3: Tesla, Inc. (TSLA) and other EV producers

At the start of 2022, Tesla had a market capitalization of more than $1 trillion and a price-to-sales ratio of more than 25. I believed this valuation was clearly unsustainable, especially when compared to the market capitalization of other (non-EV) carmakers. I also expected other EV producers to underperform, and specifically mentioned Rivian (RIVN), Lucid Motors (LCID), BYD (OTCPK:BYDDF), and NIO (NIO) in my article, so these are the stocks to analyze.

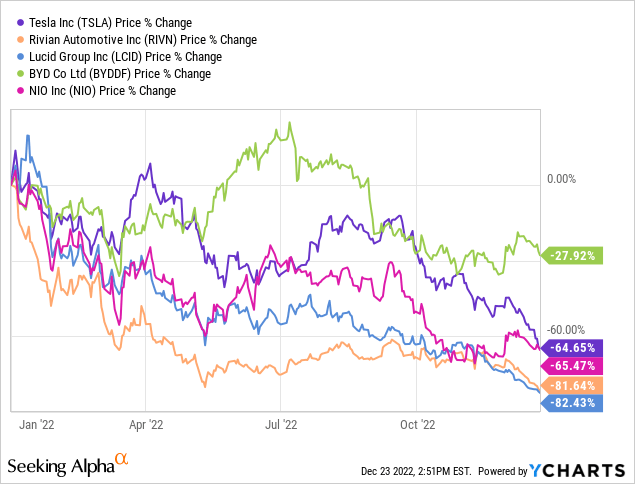

Graph 4: Share price development of Tesla, Rivian, Lucid Motors, BYD and NIO in 2022 (Source: YCharts)

As you can see, all of them are down more than the S&P 500, with most of them down more than 60%, BYD being the single exception. I am not convinced that the slump in shares of EV companies has come to a halt, so I will have to investigate whether to include Tesla or other EV producers on my investments-to-avoid list for 2023. RIGHT

#4: Office REITs

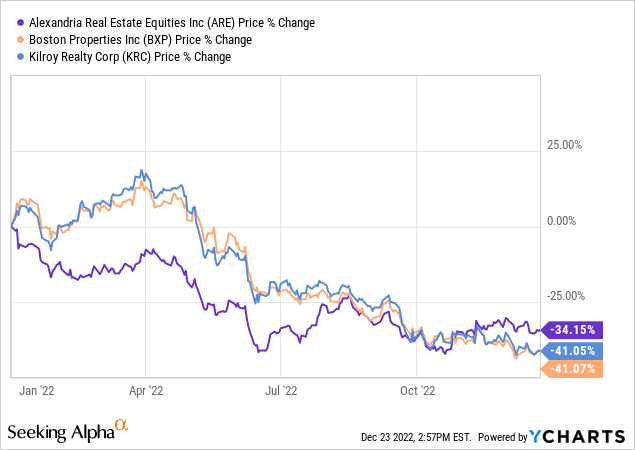

I believed that during the aftermath of Covid, employees would keep working from home, and that office REITs would suffer as a result of this. I did not specifically mention company names when I predicted that office REITs would underperform the market, so it is a bit tricky to investigate whether I was right or wrong with my call. Let us take a look at three of the largest office REITs: Alexandria Real Estate (ARE), Boston Properties (BXP), and Kilroy Realty (KRC).

Graph 5: Share price development of Alexandria Real Estate, Boston Properties and Kilroy Realty in 2022 (Source: YCharts)

As you can see, these three large office REITs all performed worse than the S&P 500. But to be completely honest, they likely did not perform badly because of the aftermath of Covid and employees working from home. In fact, most employees (including myself) regularly started going to the office again in 2022. It is much more likely that rising interest rates had a negative effect on the performance of office REITs. So my reasoning was incorrect, but the outcome was still spot-on. So I’m counting this one, but I will certainly not recommend these as an investment to avoid in 2023. RIGHT

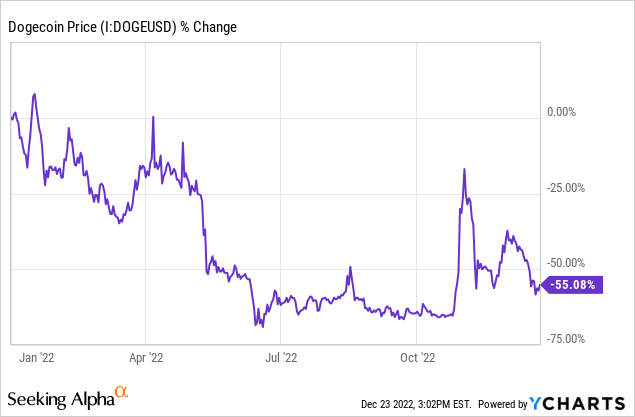

#5: Dogecoin (DOGE-USD) and Shiba Inu (SHIB-USD)

I argued that some cryptocurrencies, while being very popular, provided no improvements in technology but were nevertheless very popular in 2021. Dogecoin and Shiba Inu traded like meme coins, and I expected their price to underperform the markets in 2022.

Graph 6: Price development of Dogecoin in 2022 (Source: YCharts)

Dogecoin was down 55% in 2022. YCharts does not provide charts of Shiba Inu, but its year-to-date performance was even worse than Dogecoin at -75%. Dogecoin still has a market capitalization of more than $10B, and Shiba Inu more than $4B, so I believe these cryptos remain serious candidates for my list of investments to avoid in 2023. RIGHT

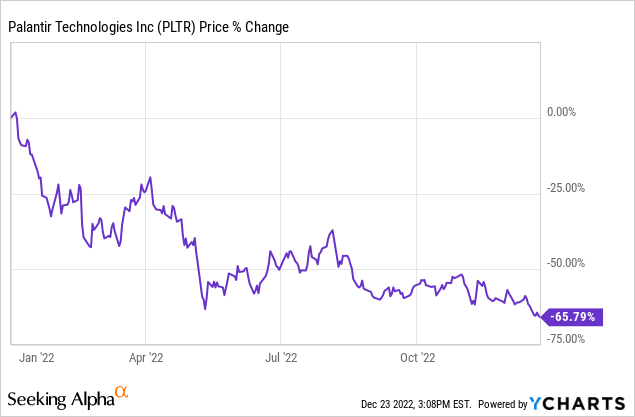

#6: Palantir Technologies Inc. (PLTR)

I listed Palantir specifically because it was a much-discussed battleground stock on Seeking Alpha. The stock had already dropped a lot before the start of 2022, but I believed it was still much too expensive with a valuation of more than 23x sales.

Graph 7: Share price development of Palantir in 2022 (Source: YCharts)

To be honest, I could have picked other overvalued growth stocks as well and still be right, but I believed Palantir was a more bold option because it had already started its decline at the start of 2021 having hit a share price of around $40. Right now, it trades just above $6, after having declined more than 65% in 2022. RIGHT

#7: Cash

I argued that, due to inflation, it would not be a good idea to keep a large part of your portfolio in cash during 2022. Well, as we can see, our benchmark the S&P 500 is down more than 20 percent compared to cash, so cash actually outperformed in a major way. Of course, it depends on which currency you’re picking, but when using the U.S. Dollar or the Euro, cash has been a strong market-beating investment in 2022. My prediction about cash was completely WRONG.

Overview and recap

| S&P 500 | -20% | Benchmark |

| Meta | -65% | RIGHT |

| AMC and Gamestop | -84% and -45% | RIGHT |

| Tesla, Rivian, BYD, NIO and Lucid Motors | -28% to -82% | RIGHT |

| Office REITs | -34% to -41% | RIGHT |

| Palantir | -66% | RIGHT |

| Cash | 0% | WRONG |

So for 2022, 6 out of my 7 predictions about stocks or assets underperforming the market were right. Only cash outperformed the market. I consider this to be partially a lucky shot; if the stock markets would have been up this year, results could have been different. Especially the office REITs and the stocks which I mainly chose because of their overvaluation such as the EV producers and Palantir might have done better in such a situation.

In my next article, I will try to repeat this feat. The rules will stay the same: I will predict 7 investments which I believe are likely to underperform the market in 2023 and compare them with the performance of the S&P 500 in 2023. Stay tuned!

In hindsight, these predictions look very easy to make, but at the time they were not. Of course, everyone knew at the time that meme stocks, Palantir and EV producers were quite expensive, but predicting if and when they would drop was not an easy task. I believe that there exist fewer obvious cases of overvaluation right now than there were one year ago, so the task of predicting next year’s losers is probably more difficult than it was last year.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.