[ad_1]

“It’s been an ideal period for investors: A climate of fear is their best friend.”

That quote comes from Warren Buffett’s Berkshire Hathaway.

Specifically from the firm’s annual report … back in 2009.

The report came just months after the end of a massive stock market crash.

It contained some timeless advice:

Those who invest only when commentators are upbeat end up paying a heavy price for meaningless reassurance. In the end, what counts in investing is what you pay for a business … and what that business earns in the succeeding decade or two.

Buffett even went so far as to pen a rare New York Times Op-Ed titled “Buy American. I am.”

In the article, he told the world he was buying American stocks, and he wasn’t waiting for the market to bottom out.

Just over a year later, Buffett famously bought America’s largest rail company — Burlington Northern.

At the time, it was Berkshire’s biggest deal. It paid off $8.8 billion in profits last year alone.

Buffett wasn’t the only one going all-in amid the crash either.

John Paulson became an investing legend when he made $15 billion shorting the housing bubble.

Then, starting in 2009, he made billions more by betting big as bank shares bounced back.

JPMorgan CEO Jamie Dimon earned much of his $1.8 billion net worth by investing in shares of his own bank after the crash. His bank’s shares more than tripled from that year’s lows.

I realize that these success stories may be the last thing you want to hear right now.

The S&P 500 is down 22% so far this year.

University of Michigan’s Consumer Sentiment Index is at its lowest level in history:

Meanwhile, rising rates have wreaked havoc on the bond market. 2022 saw the worst global sell-off in over 70 years.

Scary stuff.

But at the same time, we’re reaching a critical turning point in this bear market…

One that almost no one is talking about.

Because today — October 19, 2022 — marks the 289th day of this bear market.

Coincidentally, that’s exactly how long bear markets last (on average).

So historically speaking, we’re likely much closer to the end of this decline than the beginning.

What’s more — and I know this sounds contrarian…

Sentiment often sets new lows shortly before the market bounces back.

In other words … it’s always darkest before the dawn. As cliché as that sounds.

And things tend to turn around much faster than most investors expect.

Following bear markets, stocks return an average of 42% in the first year.

The last three bear market recoveries have been even more explosive — delivering an average gain of over 32% in the first three months alone!

Like Warren Buffett quipped: “If you wait for the robins, spring will be over.”

So instead of waiting for robins or stock market bottoms, I’m going to show you which stocks will lead the next recovery…

I’ll also tell you which stocks won’t be “coming back” to their previous highs — and why.

It all starts with…

The Most Valuable Thing About Bear Markets

Since the Great Depression, we’ve witnessed 26 bear markets.

During each of those, we’ve seen a consistent pattern in how stocks perform.

Namely, small-cap value stocks are nearly always the best bet.

Just take a look at the years that followed seven of the biggest bear markets of the last century:

As you can see, small-cap value stocks almost always outperform in the years that follow bear markets.

The same is true for recessions.

That’s important because most economists now expect we’ll face a recession in 2023.

In 9 out of the last 10 recessions, small-cap stocks have outperformed — delivering an average return of 17% during the second half of each recession and 27.5% a year later.

That means time is of the essence.

To quote Anchor Capital: “We believe recessionary environments are favorable times to contemplate investment in small-cap stocks, as history indicates small caps tend to outperform larger caps before an economic recession ends.”

We saw plenty of examples of this play out during the early 2020 recession.

Take Yeti Holdings, for example. It makes some of the world’s coolest coolers and tumblers.

Early 2020 saw Yeti’s share price drop by 50%.

Then in late March, just as worldwide lockdowns kicked in, Yeti’s share prices took off. By November of last year, Yeti was up over 560%.

Another small-cap stock called SiTime sank to $16 in March of 2020. By February of the next year, share prices went up to $140.

Likewise with Bill.com, which dipped down to $30 … before rocketing to $334 a year and a half later.

Of course, that’s not to say all small caps are created equal.

The Critical Ingredient for Small-Cap Success

As you can see, small-cap stocks are often the biggest victims of bear market fear.

They’re also the most likely to lead the charge as markets recover.

But while some of today’s most beaten-down stocks deserve to be priced far higher — some could stand to be beaten down a little more.

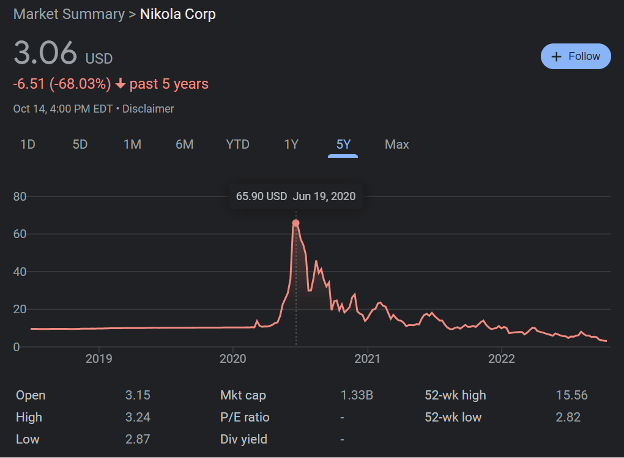

Take Nikola, for example.

This electric truck battery manufacturer was a darling of EV investors.

After going public in June of 2020, shares rocketed up 500%. Industry insiders talked about the company becoming the next Tesla.

The company just had one problem…

It didn’t have any revenue.

And while share prices were soaring, Nikola was also burning through cash. A billion dollars, to be precise.

Once all this came to light, investors realized the company would need to raise more capital. Nikola’s shares tanked soon after.

Shares are now down over 95% from their high. And they’re not even worth $3.

If you haven’t guessed it yet, the one critical component for small-cap success: money.

The best small caps right now are the ones making money.

Or those with revenue coming in the near future.

Without one or the other, small caps will have trouble performing in these markets.

I know. There are plenty of exciting companies with promising technology out there. But in today’s environment, small caps need to show investors the cash.

Thinking in these terms can help when it comes to…

Spotting a Small-Cap Land Mine in Your Portfolio

According to CFA and Goldman Sachs alum John Morrison: “Small companies with high stock prices that lose money or generate little profit may be holding back your small-cap portfolio.”

Morrison pointed out that the five biggest detractors from the Russell 2000’s return all posted negative profits compared to the year prior.

All five also sold at price-to-book ratios in the top quarter of the market.

Once again, they’re not necessarily bad investments.

They’re just bad for this market. Even as the broad market soared to new highs in 2021, small-cap stocks with low profitability bombed.

And things only got worse for those stocks in 2022.

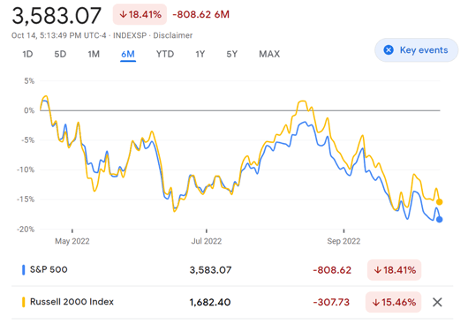

But on the whole, small caps are still outperforming — even with the markets looking their bleakest.

Over the last six months, the Russell 2000 has edged out the S&P 500:

And once markets hit bottom, we can expect this trend to continue.

Which leaves us with just one question…

Should You Buy Small-Cap Stocks Right Now?

I’ll keep it simple: The answer is yes.

And I can think of five reasons small caps should be in your portfolio today:

- Unrivaled upside: As you’ve already seen, small caps can deliver faster and more consistent returns during recovery periods — and even before markets hit bottom.

- Perfect for rebuilding portfolios: Small caps’ rapid earning potential means they can deliver outstanding returns within a five- to 10-year time frame.

- More immune to global turmoil: Big companies like Apple and Microsoft have globe-spanning deals that can be affected by trade wars and foreign relations. Small caps deal with much smaller, often all-American, markets.

- Value matters: You can’t dispute the sheer value in small caps right now. The Russell 2000’s price-to-earnings ratio is down over 85% in the last year. Dollar for dollar, small-cap value is in an amazing place right now.

- Almost everyone started small: Today’s biggest mega-cap stocks started out as small companies. It’s true that not all small-cap stocks succeed. But it’s a fact that some go on to become massive international companies.

All of that is just scratching the surface too.

If you’d like to know more about small-cap investing, sign up for my “Bear Market Fortunes” webinar — premiering tomorrow, October 20.

The event is completely free for subscribers of Winning Investor Daily.

Sign up today, and I’ll send you an email when we go live tomorrow!

Which Stocks (if Any) Are You Buying in This Market?

Are you buying into any stocks to lower your average, or are you holding out to see how the rest of 2022 plays out?

I’m interested to hear your thoughts on this market, and what you’re doing to make the most of a tough year. Just shoot me an email at [email protected].

I’ll review some of the best responses in this Saturday’s issue of RAD!

Regards,

Ian King

Editor, Strategic Fortunes

[ad_2]

Source link