For those who haven’t observed, there actually hasn’t been a greater time to promote a property.

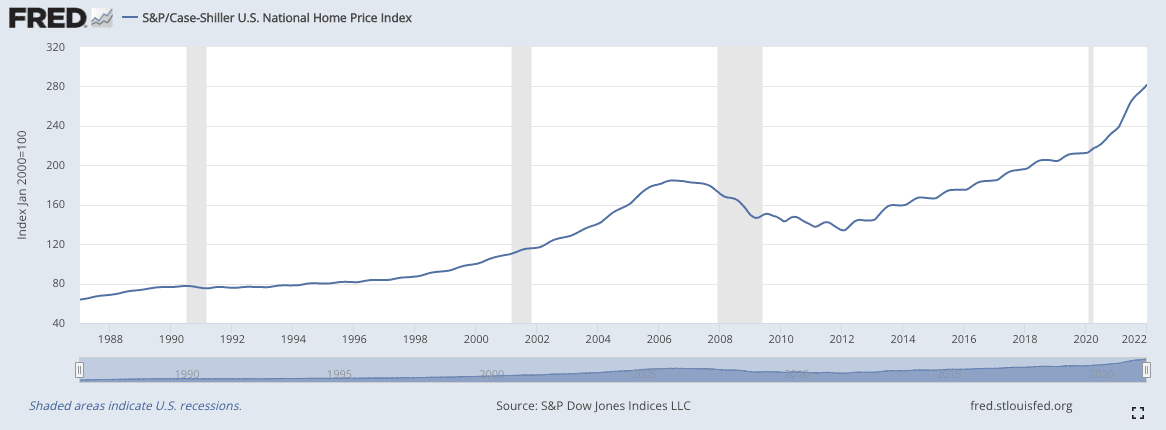

The Case-Shiller Index rounds out to about 282 factors as of late January, and median residence costs rose 15.9% year-over-year in February.

Add in the truth that sellers are receiving a number of affords inside just a few days after itemizing and you’ve got all the correct components to start out a bidding struggle, enhance the worth of your property, and stroll away with greater than you possibly can think about.

However, there is a matter. Taxes.

It’s nice seeing the worth tag of your property enhance, however that additionally means your tax invoice will likely be considerably increased. If you wish to benefit from the appreciation your present funding has earned however don’t need to get hit with the corresponding tax invoice; you may need to think about a few of these 1031 trade methods the highest traders are utilizing to navigate the vendor’s market.

Why use a 1031 trade?

With a 1031 trade, you may shelter your positive factors from being taxed by following up the sale with one other actual property funding of equal or larger worth. For those who comply with the foundations set by the IRS, your actual property investments can develop tax-deferred.

The problem of utilizing a 1031 trade in a vendor’s market

Nowadays, essentially the most difficult a part of executing a 1031 trade is discovering the substitute property inside 45 days of closing the sale on the previous property.

As we mentioned earlier, sellers are having fun with the luxurious of bidding wars and sky-high costs. Investing in right this moment’s market is rather more difficult. Offers are laborious to seek out, and you’ll’t assure that the property you need will fall into your fingers.

The excellent news is that after discovered and positioned below contract, the IRS grants a further 135 days to finalize the acquisition earlier than the 1031 trade is now not eligible.

1031 trade methods

One of the best ways to execute these 1031 trade methods is to have a plan earlier than the property you’re promoting is positioned below contract. It’s the time of closing that determines 1031 trade eligibility, so that you’ll have to know your out there routes earlier than this date.

You don’t have to have the ball rolling on a second property whereas your present is below contract. Not everyone seems to be comfy going after the substitute property earlier than their unique sale closes—even with contingencies. Ensure to find out your threat tolerance and solely take motion that permits you to sleep at evening.

The 4 1031 trade methods we’re going to speak about are based mostly on the place you’re at the moment at within the gross sales timeline. These are:

- For those who haven’t listed your property but

- For those who’re already below contract

- For those who’ve already closed

- Use a reverse trade

Dreading tax season?

Undecided easy methods to maximize deductions to your actual property enterprise? In The Guide on Tax Methods for the Savvy Actual Property Investor, CPAs Amanda Han and Matthew MacFarland share the sensible data it is advisable to not solely do your taxes this yr—however to additionally put together an ongoing technique that can make your subsequent tax season that a lot simpler.

For those who haven’t listed your property but

The primary technique is to barter the closing of your sale in a method that retains you within the driver’s seat. If you could find a pleasant purchaser, that is the best technique to do a 1031 trade.

A purchaser keen to attend so that you can conclude your property search is the best-case situation, however should you can’t discover somebody keen to attend, it is advisable to analysis just a few issues.

First, discover information in your market and look at the common days on market (DOM). This quantity will let you understand how lengthy it’s important to discover one other property and even the leverage you’ve over promoting your personal.

You may supply this information by means of Zillow, Redfin, or Realtor.com. Or, get in contact with a trusted native actual property agent in your space who can present extremely correct information utilizing the a number of itemizing service (MLS).

You would additionally ask different actual property traders what their previous month has appeared like in your space.

Primarily based on what you discover out, listed here are the next choices you’ve:

- Delaying placing your property in the marketplace till after you discover a substitute.

- Negotiate an prolonged sale date with the choice to speed up.

- Add a contingency clause to the provide that makes the sale depending on you discovering an appropriate substitute inside a sure period of time.

- Add the choice to increase closing by 15-30 days or extra.

For those who’re already below contract

If you’re already below contract to promote your property, you may nonetheless take motion to satisfy your 45-day identification deadline.

The objective is to start making affords as quickly as attainable. The problem in a vendor’s market is that patrons have little to no leverage. For those who can’t meet the vendor’s phrases, they will merely select one other provide. So that you’ll should be sensible.

You might have just a few paths to take right here:

- Think about making affords contingent in your sale (the percentages of this working is extraordinarily low in a vendor’s market, however it’s price making an attempt on a few properties).

- Ask for an prolonged closing (I recommend two weeks after your sale is scheduled. A few of our traders are experiencing lender delays on their gross sales that disrupt tight closings).

- Attempt to get an inspection, due diligence, or financing clause that expires every week or two after your sale is scheduled to shut.

- Think about a tiered earnest cash provide to get one of many above methods to work. Particularly, provide a strong earnest cash deposit at signing with one other bigger earnest cash deposit after your sale closes. Make these refundable or non-refundable relying in your threat tolerance and what the scenario warrants.

For those who’ve already closed the sale

This isn’t the very best situation to be in, however not all hope is misplaced. Keep in mind, you continue to have 45 days post-closing to discover a substitute property to execute a 1031 trade.

However, it is advisable to be quick and environment friendly in on the lookout for new properties.

For those who’ve exhausted your choices and spoken to each connection you’ve who may learn about a brand new deal coming to market, from the native agent to the plumber who all the time fixes the leaky taps, you may need to think about increasing your vary.

The very first thing is to contemplate dipping into markets outdoors of your personal. For those who haven’t been already, you may additionally need to take a look at properties that you just may not usually spend money on.

For example, should you’re a short-term rental investor however can’t snag a deal, maybe you must dip into the multifamily market?

Lastly, possibly it’s time to look into fractional property possession constructions like a Delaware Statutory Belief or a syndicated tenant in frequent challenge. When carried out proper, a majority of these investments can show to be profitable and supply a 1031 trade outlet.

Use a reverse trade

When you’ve got discovered the proper substitute property however can’t get the sale of your unique property lined up prematurely, a “reverse” trade could also be a superb match.

A reverse trade is a extra complicated trade construction with an extended lead time, particular financing necessities, and the next price ticket. That being mentioned, should you find an awesome alternative, the trade will defer a big quantity of tax.

A reverse trade is smart in a vendor’s market as sizzling because the one we’re in now should you can pull it off.

Closing ideas

Whereas actually not the popular choice, you will need to emphasize that there is no such thing as a penalty for beginning a 1031 trade and never finishing it.

For those who can’t discover a appropriate substitute, it could be higher to let your trade die and pay the taxes reasonably than make a foul funding. In the long term, you’ll remorse the unhealthy funding extra.

When you’ve got some other 1031 trade methods, depart a remark under to share them with the BiggerPockets neighborhood!