After a powerful run within the first half of the 12 months, know-how shares have come underneath strain just lately. Current inventory worth developments counsel buyers are taking a extra cautious stance on the financial system whereas the mania round synthetic intelligence (AI) has additionally eased. Even high-flying Nvidia has been affected, with the inventory buying and selling down practically 20% over the previous six months.

However this current sell-off additionally presents some alternatives.

Let’s take a look at three tech shares (that are not named Nvidia) that buyers ought to take into account shopping for amid this newest market adjustment.

1. Taiwan Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing (NYSE: TSM), or TSMC for brief, is the main semiconductor fabrication contractor on the planet. As we speak, many semiconductor firms do not produce their very own chips. As a substitute, they outsource the method to firms specializing in chip manufacturing.

Whereas outsourced manufacturing might not sound like an thrilling enterprise, do not be fooled — this can be a extremely complicated course of that’s dominated by the businesses that may do it finest. In reality, the contract manufacturing unit of Intel, which was created in 2021 to compete with TSMC, just lately suffered a big setback after chip designer Broadcom stated checks it carried out confirmed that Intel’s latest course of was not prepared for high-volume manufacturing.

On the identical time, TSMC has been main the best way in technological improvements, with the corporate set to introduce 2-nanometer manufacturing know-how subsequent 12 months. The smaller the chip density, the higher the efficiency and consumption energy. With demand for AI chips turning into insatiable, the corporate has been rising its capability and constructing new fabrication amenities.

Given the excessive demand for its providers, TSMC can be set to boost costs on its extra superior applied sciences. Morgan Stanley analysts estimate it is going to elevate costs this 12 months by 10% for AI semiconductors and chip-on-wafer-on-substrate (CoWoS), 6% for high-performance computing, and three% for smartphones.

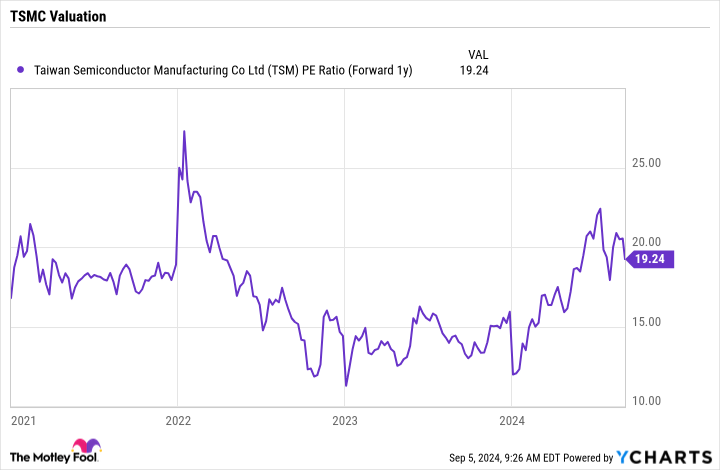

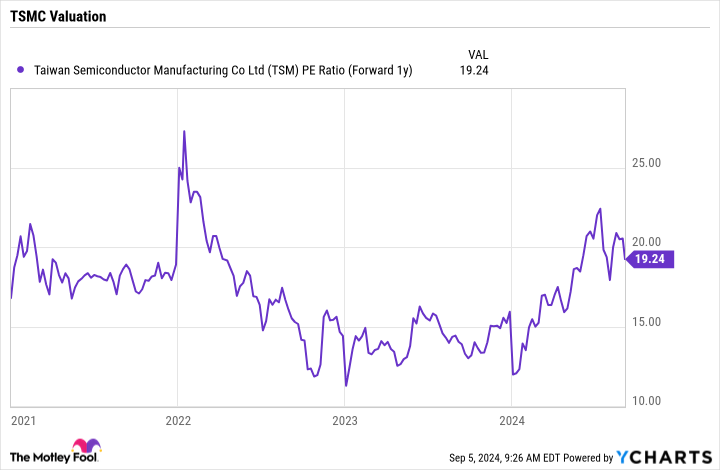

Buying and selling at a ahead price-to-earnings (P/E) ratio of about 19 based mostly on subsequent 12 months’s analyst estimates, the inventory continues to be attractively valued, particularly given the expansion prospects in entrance of it.

2. ASML

Whereas TSMC makes the chips for semiconductor firms, ASML (NASDAQ: ASML) makes the extremely specialised tools utilized by firms like TSMC to fabricate these chips. As TSMC and others increase their manufacturing to satisfy the rising demand for AI chips, they are going to want extra tools to provide these chips.

Not surprisingly, the semiconductor tools manufacturing enterprise may be lumpy, as these are very costly items of kit. These machines have a typical life cycle of about seven years earlier than they must be changed or refurbished.

In the meantime, 2024 is a little bit of a transitional 12 months for ASML because it introduces its latest know-how: a excessive numerical aperture excessive ultraviolet lithography system, or excessive NA EUV. The corporate says the brand new machines will improve chip manufacturing productiveness whereas decreasing manufacturing prices and bettering chip performance.

The corporate has shipped two of its excessive NA EUV programs up to now, with one working qualification wafers. With a price ticket of $380 million per unit, these new programs are dear and may assist drive income for ASML subsequent 12 months and past as chip producers transfer to the latest know-how to assist meet demand for AI chips. That, mixed with the variety of new fabs set to come back on-line over the following few years, bodes effectively for ASML’s long-term prospects.

At a previous analyst day, ASML administration set targets to develop income to between 30 billion to 40 billion euros ($33.3 billion to $44.4 billion) in 2025 and to 44 billion to 60 billion ($48.8 billion to $66.6 billion) by 2030. The corporate produced 27.6 billion euros ($30.6 billion) in income final 12 months, and it expects comparable income this 12 months.

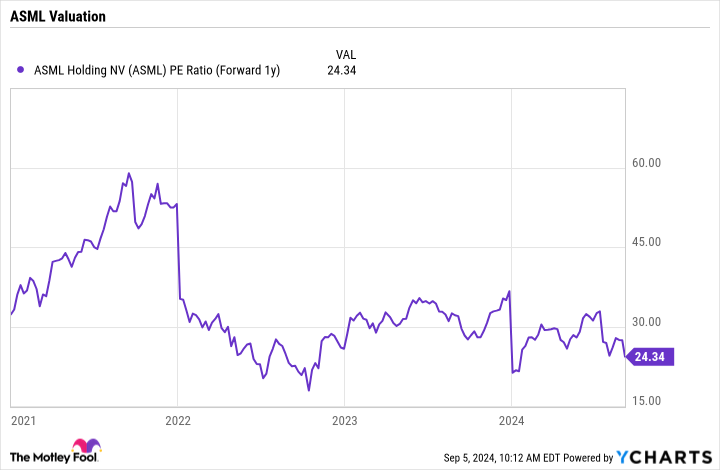

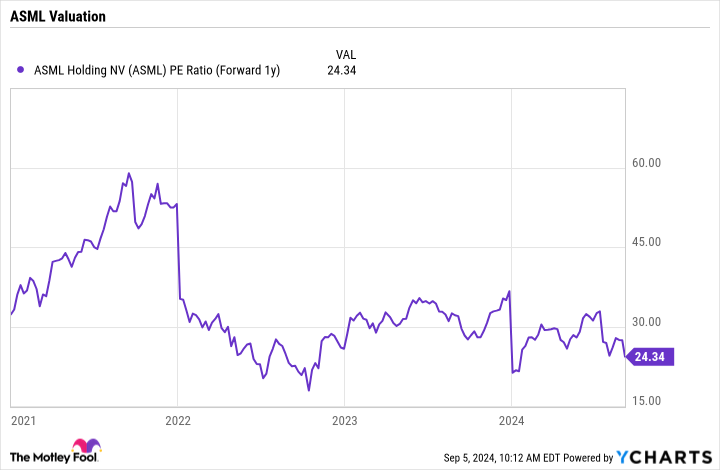

Buying and selling at a ahead P/E of simply over 24 instances based mostly on 2025 analyst estimates, ASML’s inventory seems enticing, given the expansion inflection in entrance of it.

3. Arm Holdings

Arm Holdings (NASDAQ: ARM) is the main semiconductor firm for central processor items (CPUs), which are sometimes described because the mind for units. The corporate has a dominant place within the smartphone market, with its know-how in nearly all smartphones across the globe.

In the meantime, Arm is taking purpose on the private pc (PC) market as effectively. The corporate’s know-how is presently in all Apple computer systems and laptops, however its purpose now’s to be in 50% of Home windows-based PCs within the subsequent 5 years. Whereas not as giant of a market as smartphones, that is nonetheless a pleasant alternative for the corporate. Arm has additionally been making strong inroads within the automotive market. It reported year-over-year income development of 28% within the sector in Q2.

Arm advantages from AI as effectively. Final quarter, Arm famous that it noticed elevated licensing within the AI knowledge heart as a result of want for personalisation, whereas it collaborated on an excellent chip with Nvidia that mixes an Arm-based CPU with an Nvidia graphics processing unit (GPU). Its know-how can be the idea for CPU knowledge heart chips from Amazon and Alphabet.

Whereas semiconductor firms like Nvidia and Broadcom design their very own chips, Arm employs a special mannequin during which it licenses its know-how to different firms to permit them to design their very own chips based mostly on its know-how. Via its licenses, it collects royalties on the variety of chips shipped which have included its know-how. This income stream might final years and even a long time.

Extra just lately, the corporate has been shifting prospects to a subscription mannequin, the place they will get a wider vary of use of its mental property. Whether or not by way of royalties or subscriptions, Arm has a really high-margin, largely recurring income stream.

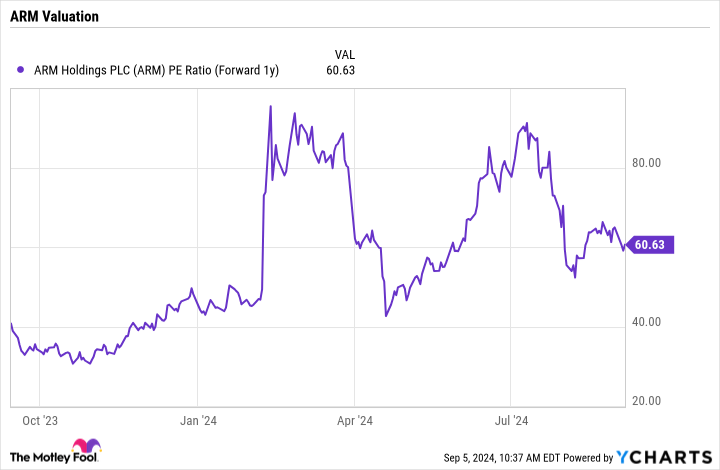

Primarily based on 2025 analyst estimates, Arm inventory trades at a ahead P/E of simply over 60.5 instances. Whereas that isn’t low cost on the floor, it is down from increased ranges, and Arm has one of the crucial enticing and long-tail enterprise fashions within the semiconductor house.

Do you have to make investments $1,000 in Arm Holdings proper now?

Before you purchase inventory in Arm Holdings, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Arm Holdings wasn’t one in all them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $630,099!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of September 3, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Geoffrey Seiler has positions in Alphabet. The Motley Idiot has positions in and recommends ASML, Alphabet, Amazon, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Broadcom and Intel and recommends the next choices: brief November 2024 $24 calls on Intel. The Motley Idiot has a disclosure coverage.

3 Shares Outdoors of Nvidia to Purchase Amid the Tech Promote-Off was initially printed by The Motley Idiot