Revealed on February twentieth, 2025 by Bob Ciura

Spreadsheet info updated daily

The Dividend Aristocrats are a select group of 69 S&P 500 shares with 25+ years of consecutive dividend will enhance.

The requirements to be a Dividend Aristocrat are:

- Be throughout the S&P 500

- Have 25+ consecutive years of dividend will enhance

- Meet positive minimal measurement & liquidity requirements

There are in the meanwhile 69 Dividend Aristocrats.

You’ll have the ability to receive an Excel spreadsheet of all 69 Dividend Aristocrats (with metrics that matter just like dividend yields and price-to-earnings ratios) by clicking the hyperlink beneath:

Disclaimer: Sure Dividend is simply not affiliated with S&P World in any method. S&P World owns and maintains The Dividend Aristocrats Index. The information on this text and downloadable spreadsheet depends on Sure Dividend’s private overview, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and totally different sources, and is meant to help specific particular person patrons increased understand this ETF and the index upon which it’s based totally. Not one of many information on this text or spreadsheet is official info from S&P World. Search the recommendation of S&P World for official information.

Nonetheless, even Dividend Aristocrats can fall from grace. As an illustration, Walgreens Boots Alliance (WBA) was far from the Dividend Aristocrats guidelines in 2024.

The company slashed its dividend due to a pronounced enterprise downturn throughout the brick-and-mortar pharmacy retail commerce, amid elevated aggressive threats from on-line pharmacies.

This was after Walgreens Boots Alliance had maintained a 40+ yr streak of consecutive dividend will enhance.

Whereas dividend cuts from Dividend Aristocrats are shocking, they’ve occurred–and can happen as soon as extra. To be clear, the following 3 Dividend Aristocrats normally usually are not in the meanwhile in jeopardy of slicing their dividends.

Their dividend payouts are supported with ample underlying earnings (for now). If their earnings keep regular or proceed to develop, they’ve on the very least an sincere change of steady their dividend growth.

Nevertheless, the three Dividend Aristocrats beneath are going by means of primary challenges to numerous ranges, and in the meanwhile receive our lowest Dividend Hazard Scores of C, D, or F.

This article will current an in depth analysis on the three Dividend Aristocrats most in peril of a future dividend decrease.

Desk of Contents

Purple Flag Dividend Aristocrat For 2025: Fastenal Co. (FAST)

- Dividend Hazard Score: C

- Dividend Yield: 2.3%

Fastenal began in 1967 when Bob Kierlin and 4 associates pooled collectively $30,000 to open the first retailer. The distinctive intent was to dispense nuts and bolts by means of merchandising machine, nonetheless that idea purchased off the underside after 20 years.

The company went public in 1987 and proper now provides fasteners, devices and gives to its purchasers by means of 1,597 public branches, 2,031 full of life Onsite locations and over 126,900 managed inventory devices.

In mid-January, Fastenal reported (1/17/25) outcomes for the fourth quarter of fiscal 2024. It grew its internet product sales 4% over the prior yr’s quarter as a consequence of growth in Onsite locations whereas prices remained flat. Earnings-per-share remained flat at $0.46, missing the analysts’ consensus by $0.02.

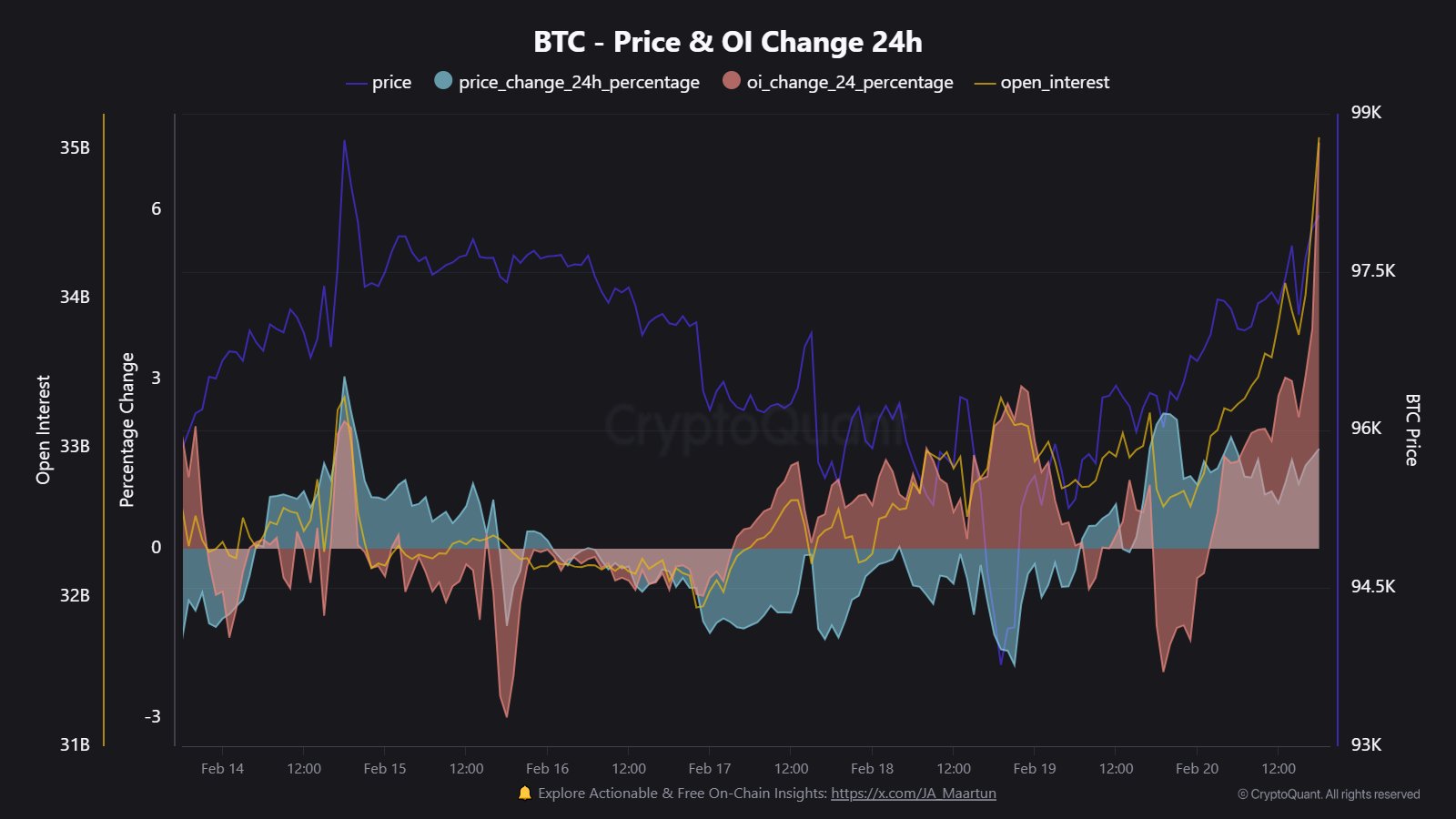

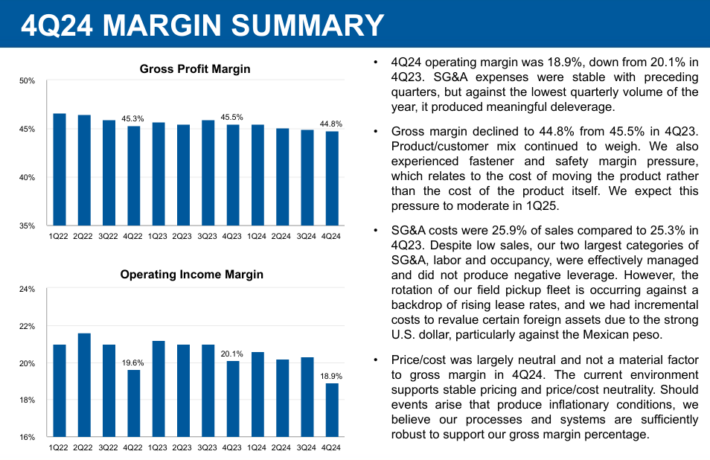

One objective for stagnant earnings is that the company’s margins have steadily declined over the earlier two years.

Provide: Investor Presentation

Fastenal’s earnings-per-share are anticipated to increase in 2025, nonetheless the agency’s dividend payout has elevated faster than its earnings in current occasions.

Consequently, the payout ratio is predicted to attain 80% in 2025. It’s a dangerously extreme diploma that doesn’t go away rather a lot financial wiggle room. If earnings unexpectedly declined, due to a recession or one other excuse, the dividend payout could very properly be in peril.

Click on on proper right here to acquire our most modern Sure Analysis report on FAST (preview of internet web page 1 of three confirmed beneath):

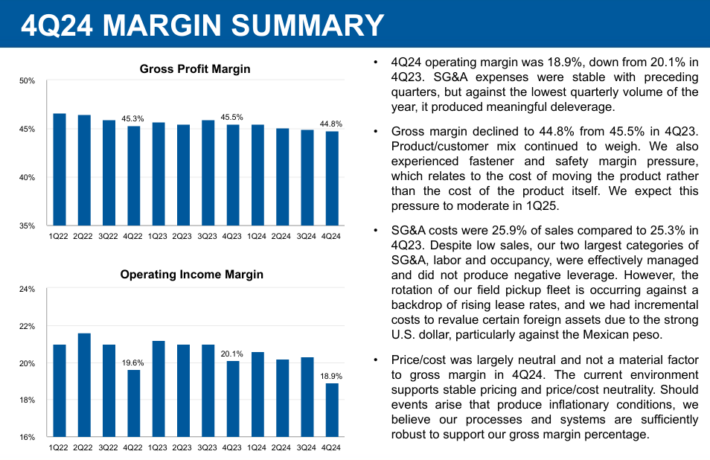

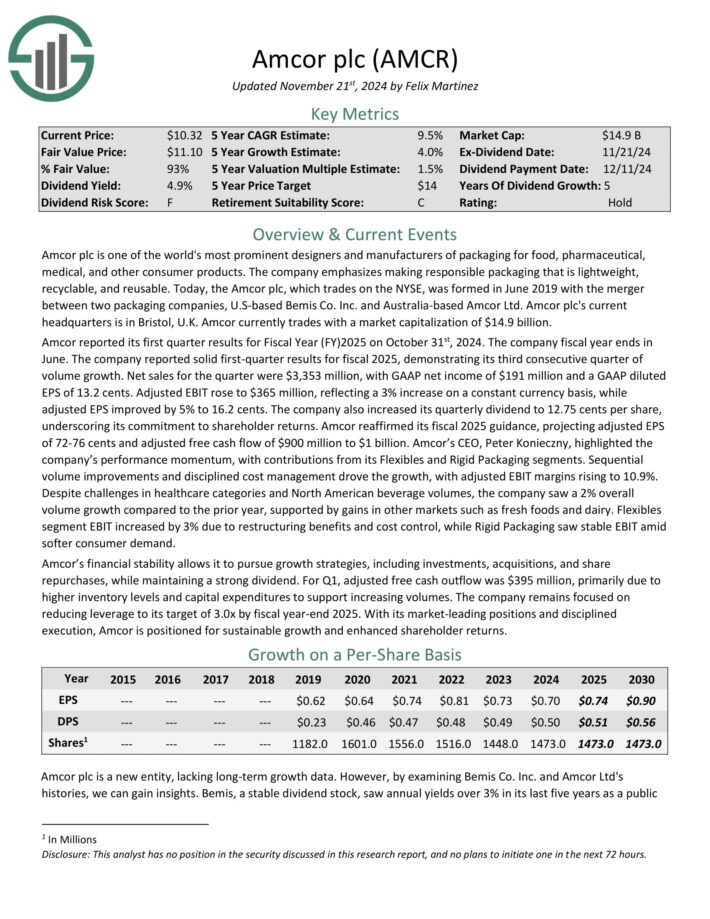

Purple Flag Dividend Aristocrat For 2025: Amcor plc (AMCR)

- Dividend Hazard Score: F

- Dividend Yield: 5.0%

Amcor plc is probably going one of many world’s most distinguished designers and producers of packaging for meals, pharmaceutical, medical, and totally different shopper merchandise. The company emphasizes making accountable packaging that’s lightweight, recyclable, and reusable.

At current, the Amcor plc, which trades on the NYSE, was formed in June 2019 with the merger between two packaging firms, U.S-based Bemis Co. Inc. and Australia-based Amcor Ltd. Amcor plc’s current headquarters is in Bristol, U.Okay.

The current dividend yield is partaking compared with the broader market, nonetheless the payout ratio is extreme at virtually 70% anticipated for 2025.

As a packaging producer, Amcor is particularly uncovered to the worldwide monetary system. It could possibly be troublesome for the company to maintain its dividend in a steep recession consequently. AMCR stock receives our lowest Dividend Hazard Score of ‘F’.

Click on on proper right here to acquire our most modern Sure Analysis report on AMCR (preview of internet web page 1 of three confirmed beneath):

Purple Flag Dividend Aristocrat For 2025: Franklin Sources (BEN)

- Dividend Hazard Score: C

- Dividend Yield: 6.1%

Franklin Sources is an funding administration agency. It was based mostly in 1947. At current, Franklin Sources manages the Franklin and Templeton households of mutual funds.

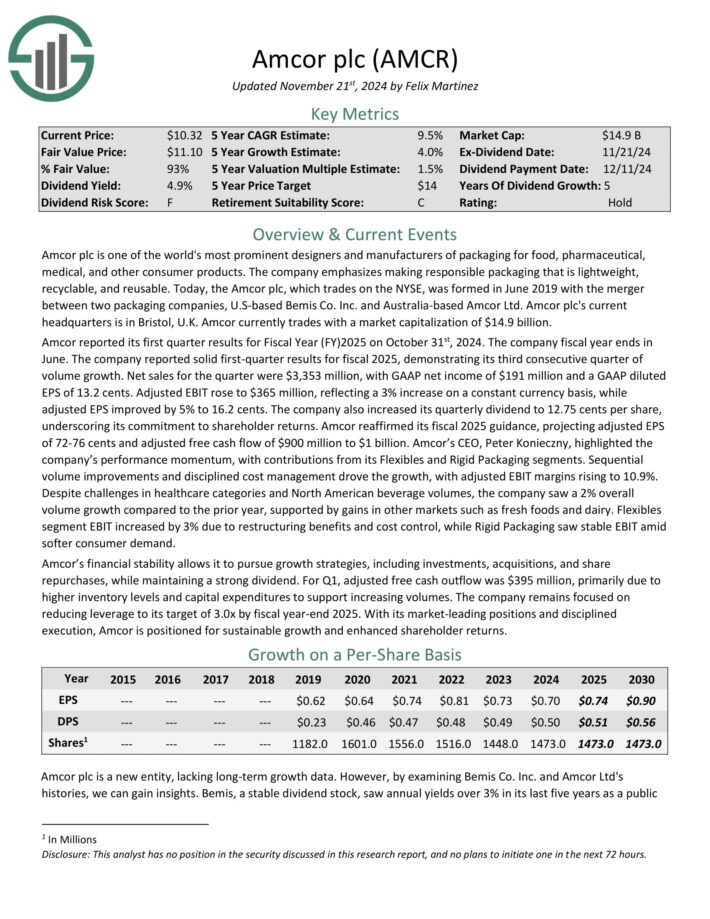

On January thirty first, 2025, Franklin Sources reported internet earnings of $163.6 million, or $0.29 per diluted share, for the first fiscal quarter ending December 31, 2024.

This marked a serious enchancment from the sooner quarter’s internet lack of $84.7 million, though EPS remained lower than the $251.3 million internet earnings recorded within the an identical quarter last yr.

Provide: Investor presentation

The previous couple of years have been troublesome for Franklin Sources. Franklin Sources was gradual to adapt to the altering setting throughout the asset administration commerce.

The explosive growth in exchange-traded funds and indexing investing surprised typical mutual funds.

ETFs have develop into very popular with patrons due largely to their lower costs than typical mutual funds. In response, the asset administration commerce has wanted to decrease costs and commissions or hazard shedding client property.

Earnings-per-share are anticipated to say no in 2025 consequently. The company nonetheless maintains a manageable payout ratio of 51% anticipated for 2025, however when EPS continues to say no, the dividend payout could very properly be in peril down the freeway.

Click on on proper right here to acquire our most modern Sure Analysis report on BEN (preview of internet web page 1 of three confirmed beneath):

Final Concepts

The Dividend Aristocrats are among the many many best dividend growth shares obtainable available in the market.

And whereas most Dividend Aristocrats will proceed to elevate their dividends yearly, there could very properly be some that end up slicing their payouts.

Whereas it’s unusual, patrons have seen a lot of Dividend Aristocrats decrease their dividends over the earlier a lot of years, along with Walgreens Boots Alliance, 3M Agency (MMM), V.F. Corp. (VFC), and AT&T Inc. (T).

Whereas the three Dividend Aristocrats launched proper right here have been worthwhile elevating their dividends yearly to date, all of them face numerous ranges of challenges to their underlying firms.

For that cause, earnings patrons should view the three pink flag Dividend Aristocrats on this text cautiously going forward.

Further Learning

Furthermore, the following Sure Dividend databases embody in all probability probably the most reliable dividend growers in our funding universe:

In case you occur to’re looking for shares with distinctive dividend traits, take note of the following Sure Dividend databases:

Thanks for learning this textual content. Please ship any options, corrections, or inquiries to [email protected].

rn

rn

Source link ","creator":{"@sort":"Particular person","identify":"Index Investing Information","url":"https://indexinvestingnews.com/creator/projects666/","sameAs":["https://indexinvestingnews.com"]},"articleSection":["Investing"],"picture":{"@sort":"ImageObject","url":"https://www.suredividend.com/wp-content/uploads/2022/10/Dividend-Aristocrats-Picture-150x150.png","width":0,"peak":0},"writer":{"@sort":"Group","identify":"","url":"https://indexinvestingnews.com","emblem":{"@sort":"ImageObject","url":""},"sameAs":["https://www.facebook.com/Index-Investing-News-102075432474739","https://twitter.com/IndexInvesting_"]}}

Source link