Data updated daily

As the group of companies that produce goods that are used in construction and manufacturing, the industrial sector forms the backbone of the global economy.

It stands to reason that the sector likely holds many compelling dividend growth investment opportunities.

The industrial sector covers a wide swath of industries, including (among others):

We’ve compiled a list of all industrial stocks (along with important investing metrics) that you can download below:

Constituents for the industrial stocks list were derived from three major industrial sector exchange-traded funds:

- Industrial Select Sector SPDR Fund (XLI)

- iShares U.S. Industrials ETF (IYJ)

- iShares Global Industrials ETF (EXI)

Keep reading this article to learn more about the benefits of investing in industrial sector stocks.

How To Use The Industrial Stocks List To Find Investment Ideas

Having an Excel document containing the names, tickers, and financial data for all industrial stocks is very useful.

This document becomes even more powerful when combined with a fundamental working knowledge of Microsoft Excel.

With that in mind, this section will show you how to screen through stocks in the industrial stocks list.

The first screen we’ll implement is for dividend-paying industrial stocks with dividend yields above 4%.

Screen 1: High Yield Industrial Stocks

Step 1:Download the industrial stocks list.

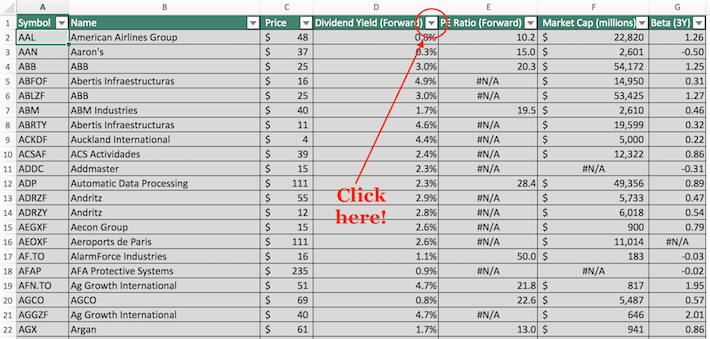

Step 2: Click on the filter icon at the top of the dividend yield column, as shown below.

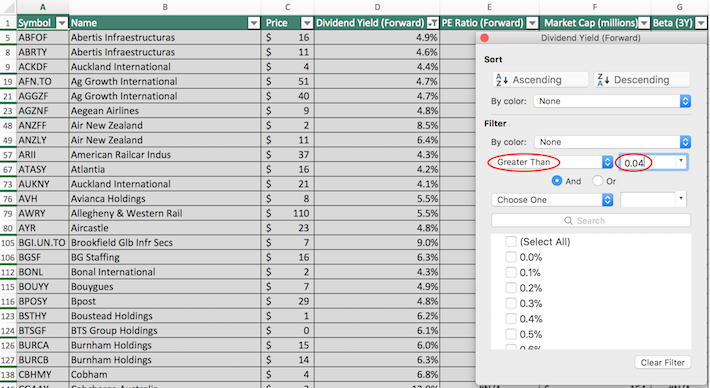

Step 3: Change the filter setting to “Greater Than” and input 0.04 into the field beside it, as shown below.

The remaining stocks in this Excel spreadsheet are dividend-paying industrial stocks with dividend yields above 4%.

The next screen that we’ll implement is for dividend-paying industrial stocks with price-to-earnings ratios below 20 and market capitalizations above $10 billion.

Screen 2: Low Price-to-Earnings Ratios, Large Market Capitalizations

Step 1:Download the industrial stocks list.

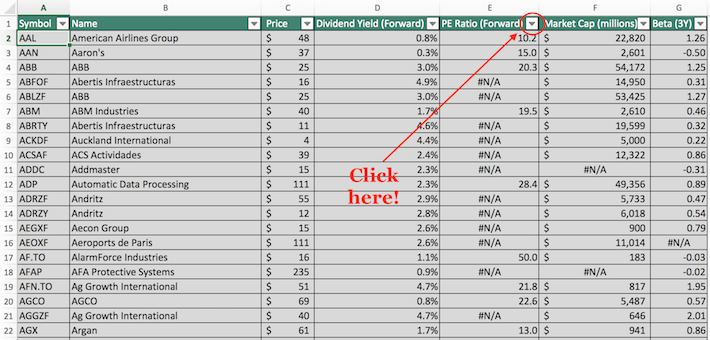

Step 2: Click on the filter icon at the top of the price-to-earnings ratio column, as shown below.

Step 3: Change the filter setting to “Less Than” and input 20 into the field beside it, as shown below. This will filter for dividend-paying industrial stocks with price-to-earnings ratios below 20.

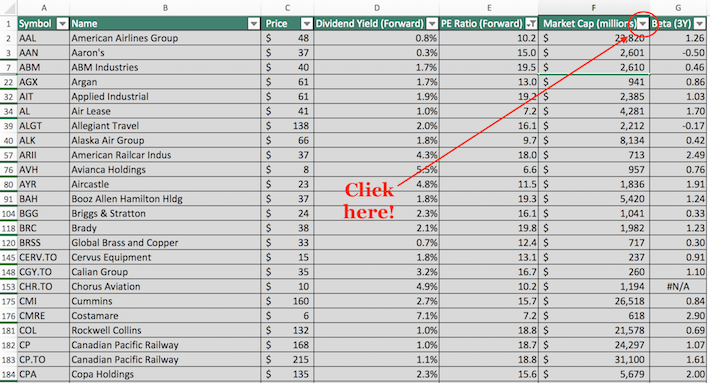

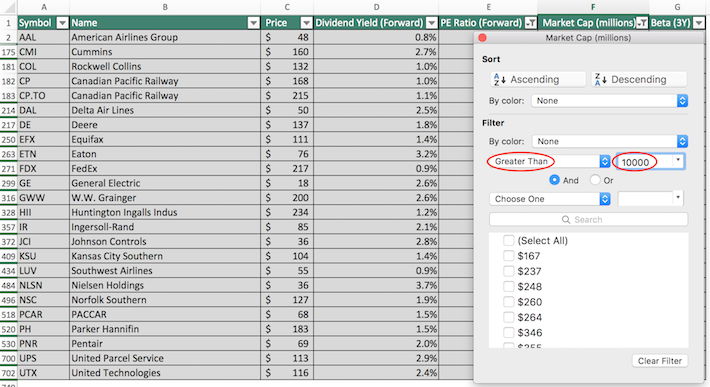

Step 4: Close out of this filter window by clicking the exit (not by clicking the “Clear Filter” button at the bottom of the window). Then, click on the filter icon at the top of the market capitalization column, as shown below.

Step 5: Change the filter setting to “Greater Than” and input 10000 into the field beside it. This will filter for dividend-paying industrial stocks with market capitalizations above $10 billion.

Note that since the spreadsheet measures market capitalization in millions of dollars, filtering for stocks with market capitalizations above “$10,000 million” is equivalent to filtering for stocks with market capitalizations above $10 billion.

The remaining stocks shown in this spreadsheet are dividend-paying industrial stocks with price-to-earnings ratios below 20 and market capitalizations above $10 billion.

You now have a solid understanding of how to use the industrial stocks list to find securities with certain financial characteristics.

The remainder of this article will discuss the merits of investing in the industrial sector in detail.

Why Invest In The Industrial Sector

The industrial sector is the section of the overall stock market that is concerned with manufacturing, producing, and distributing goods used in construction and manufacturing.

The sector also includes other industries like airlines, farming equipment, industrial machinery, lumber production, and metal fabrication.

Because of the nature of the businesses it contains, the performance of the industrial sector is primarily driven by the supply and demand for building construction – including residential, commercial, and industrial properties.

The sector’s performance also fluctuates in response to changes in the supply and demand of manufactured products.

So what does all of this mean for self-directed investors?

Well, it means that the industrial sector is more cyclical than, say, the healthcare sector or the consumer staples sector.

This is because when the economy contracts and consumer begin saving more and spending less, construction slows and industrial companies must produce fewer goods due to reduced sales.

Even many of the best industrial sector stocks experience cyclicality.

With that said, the industrial sector is broadly diversified. There are a number of different sub-sectors within the industrial sector.

As you can imagine, railroads tend to behave differently than airlines, which in turn tend to behave differently than metal fabrication companies.

This means that there is usually at least one area that is growing within the industrial sector. As an example, many oil and gas-related industrial companies are struggling right now due to low oil prices while aerospace and defense companies are performing very well.

There are also other subsectors of the industrial sector – such as waste management – that tend to perform well through a wide variety of economic environments.

Final Thoughts

The importance of the industrial sector to the global economy means that here are often compelling investment opportunities to be found there.

With that said, the industrial sector is certainly not the only place to find investment ideas.

If you’re willing to venture outside of the industrial sector, the following Sure Dividend databases contain some of the most high-quality dividend stocks in our investment universe:

If you’re looking for other sector-specific dividend stocks, the following Sure Dividend databases will be useful:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].