[ad_1]

Up to date on September sixth, 2022 by Bob Ciura

Spreadsheet information up to date every day

What are excessive dividend shares?

They’re shares that pay out a dividend considerably in extra of market common dividends. The S&P 500 presently has a dividend yield of simply 1.4%.

The excessive dividend shares on this article all have dividend yields of 5% or extra.

Excessive-yield shares may be very useful to shore up earnings after retirement. A $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

We have now created a spreadsheet of shares (and carefully associated REITs and MLPs, and so forth.) with dividend yields of 5% or extra…

You possibly can obtain your free full record of all securities with 5%+ yields (together with vital monetary metrics corresponding to dividend yield and payout ratio) by clicking on the hyperlink under:

Not all high-yield shares make equally good investments…

This text examines the 7 highest yielding securities within the Positive Evaluation Analysis Database with Dividend Danger Scores of C or higher, with a minimal yield of 5%.

Notes: We replace this text close to the start of every month so you’ll want to bookmark this web page for subsequent month. The spreadsheet makes use of the Wilshire 5000 because the universe of securities from which to pick, plus a couple of extra securities we display for five%+ dividend yields.

With yields of 5% and better, these securities all provide excessive dividends (or distributions). And with Dividend Danger Scores of C or higher, they don’t undergo from the standard extreme riskiness of really high-yielding securities.

In different phrases, these are comparatively protected, excessive dividend shares so that you can contemplate including to your retirement or pre-retirement earnings portfolio.

Desk Of Contents

All excessive dividend shares on this record have dividend yields above 5%, making them very interesting in an atmosphere of low rates of interest.

Individually, a most of three shares had been allowed for any single market sector to make sure diversification. Lastly, all of the shares are based mostly in america.

The 7 excessive dividend shares with Dividend Danger scores of C or higher are listed so as by dividend yield, from lowest to highest.

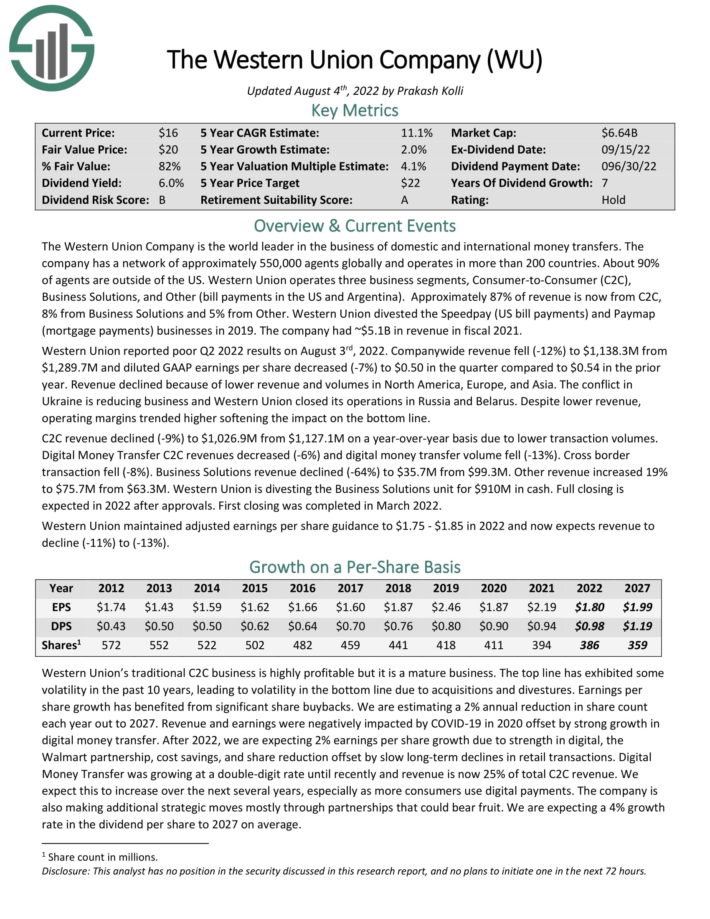

Excessive Dividend Inventory #7: Western Union (WU)

- Dividend Yield: 6.7%

- Dividend Danger Rating: B

The Western Union Firm is the world chief within the enterprise of home and worldwide cash transfers. The corporate has a community of roughly 550,000 brokers globally and operates in additional than 200 international locations. About 90% of brokers are exterior of the US. Western Union operates three enterprise segments, Shopper-to-Shopper (C2C), Enterprise Options, and Different (invoice funds within the US and Argentina). Roughly 87% of income is now from C2C, 8% from Enterprise Options and 5% from Different. The corporate had ~$5.1B in income in fiscal 2021.

Western Union reported poor Q2 2022 outcomes on August third, 2022. Firm-wide income fell (-12%) to $1,138.3M from $1,289.7M and diluted GAAP earnings per share decreased (-7%) to $0.50 within the quarter in comparison with $0.54 within the prior yr. Income declined due to decrease income and volumes in North America, Europe, and Asia. The battle in Ukraine is lowering enterprise and Western Union closed its operations in Russia and Belarus.

Supply: Investor Presentation

Regardless of decrease income, working margins trended larger softening the influence on the underside line. C2C income declined (-9%) to $1,026.9M from $1,127.1M on a year-over-year foundation as a consequence of decrease transaction volumes. Digital Cash Switch C2C revenues decreased (-6%) and digital cash switch quantity fell (-13%). Cross border transaction fell (-8%). Enterprise Options income declined (-64%) to $35.7M from $99.3M. Different income elevated 19% to $75.7M from $63.3M.

Western Union maintained adjusted earnings per share steerage to $1.75 – $1.85 in 2022 and now expects income to say no (-11%) to (-13%).

Click on right here to obtain our most up-to-date Positive Evaluation report on WU (preview of web page 1 of three proven under):

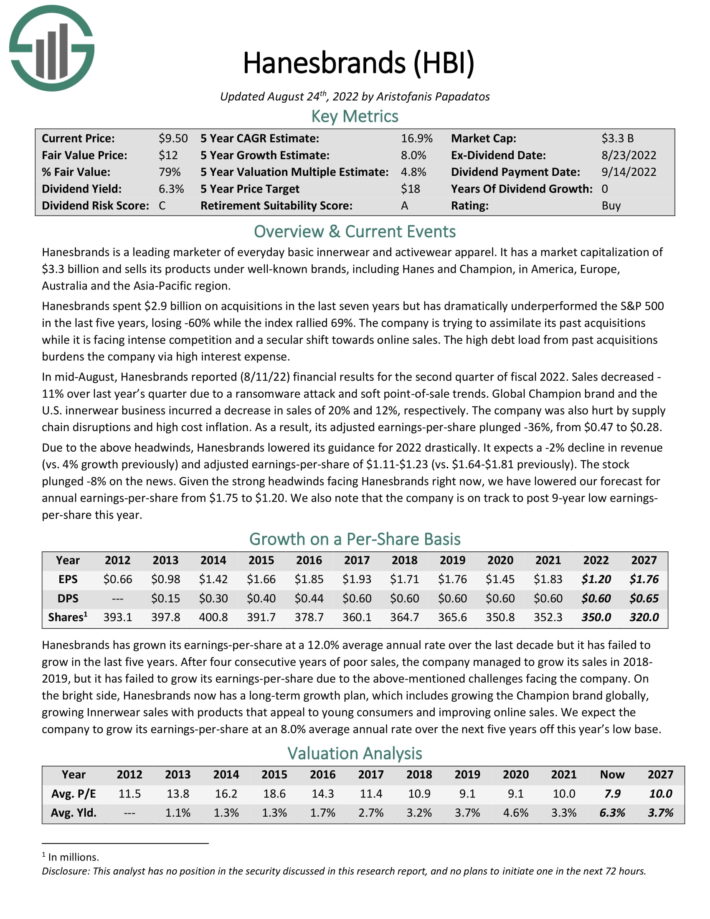

Excessive Dividend Inventory #6: Hanesbrands, Inc. (HBI)

- Dividend Yield: 7.0%

- Dividend Danger Rating: C

Hanesbrands is a number one marketer of on a regular basis fundamental innerwear and activewear attire. It sells its merchandise beneath well-known manufacturers, together with Hanes and Champion, in America, Europe, Australia and the Asia-Pacific area.

In mid-August, Hanesbrands reported (8/11/22) monetary outcomes for the second quarter of fiscal 2022. Gross sales decreased by 11% over final yr’s quarter as a consequence of a ransomware assault and delicate point-of-sale developments. World Champion model and the U.S. innerwear enterprise incurred a lower in gross sales of 20% and 12%, respectively. The corporate was additionally damage by provide chain disruptions and excessive value inflation. Consequently, its adjusted earnings-per-share plunged -36%, from $0.47 to $0.28.

As a result of above headwinds, Hanesbrands lowered its steerage for 2022 drastically. It expects a -2% decline in income (vs. 4% development beforehand) and adjusted earnings-per-share of $1.11-$1.23 (vs. $1.64-$1.81 beforehand).

Click on right here to obtain our most up-to-date Positive Evaluation report on HBI (preview of web page 1 of three proven under):

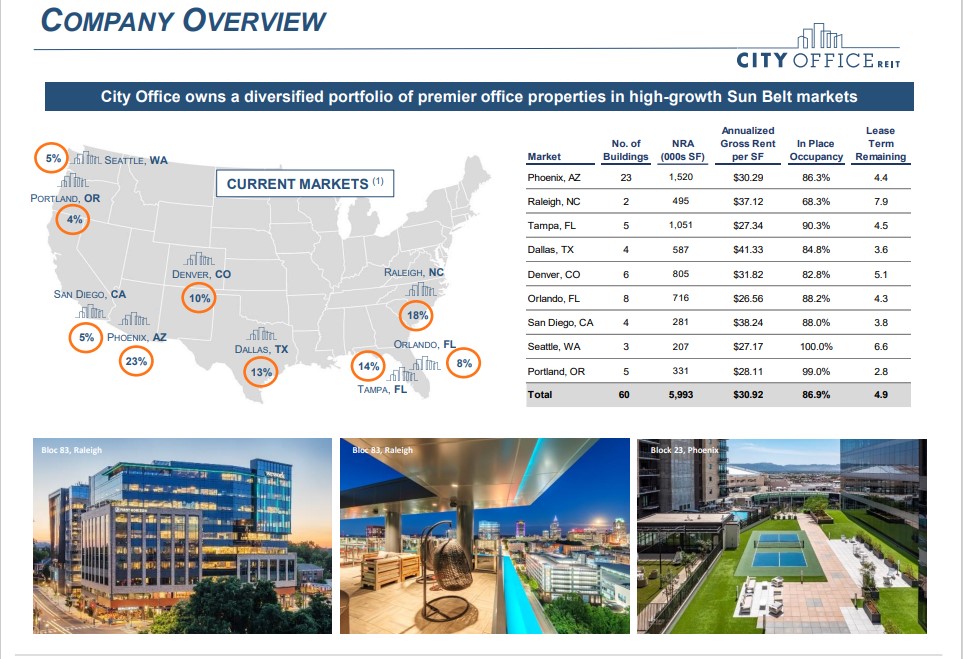

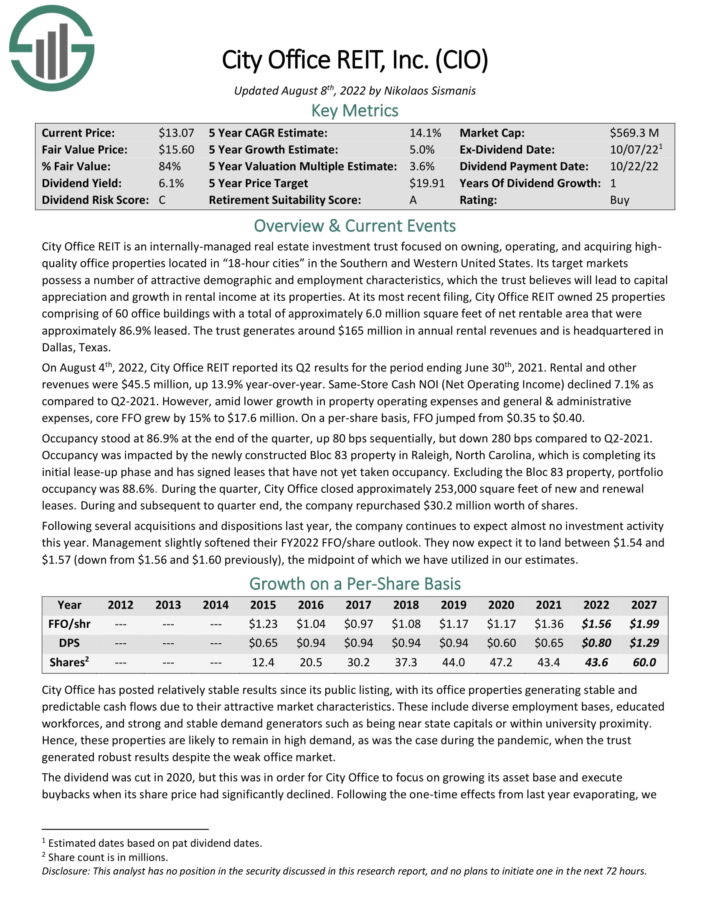

Excessive Dividend Inventory #5: Metropolis Workplace REIT (CIO)

- Dividend Yield: 7.0%

- Dividend Danger Rating: C

Metropolis Workplace REIT is an internally-managed actual property funding belief centered on proudly owning, working, and buying highquality workplace properties positioned in “18-hour cities” within the Southern and Western United States. Its goal markets possess quite a few engaging demographic and employment traits, which the belief believes will result in capital appreciation and development in rental earnings at its properties.

Supply: Investor Presentation

On August 4th, CIO reported quarterly income of $45.5 million, which beat by $1 million and represented a 14% year-over-year improve. Core FFO of $0.40 beat by a penny. Adjusted FFO got here to $0.18 per share. Identical-store money NOI declined 7% for the quarter.

Following a number of acquisitions and tendencies final yr, the corporate continues to anticipate nearly no funding exercise this yr. Administration additionally continues to anticipate FY2022 FFO/share between $1.54 and $1.57, the midpoint of which we’ve utilized in our estimates. It represents a 16% improve in comparison with final yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on CIO (preview of web page 1 of three proven under):

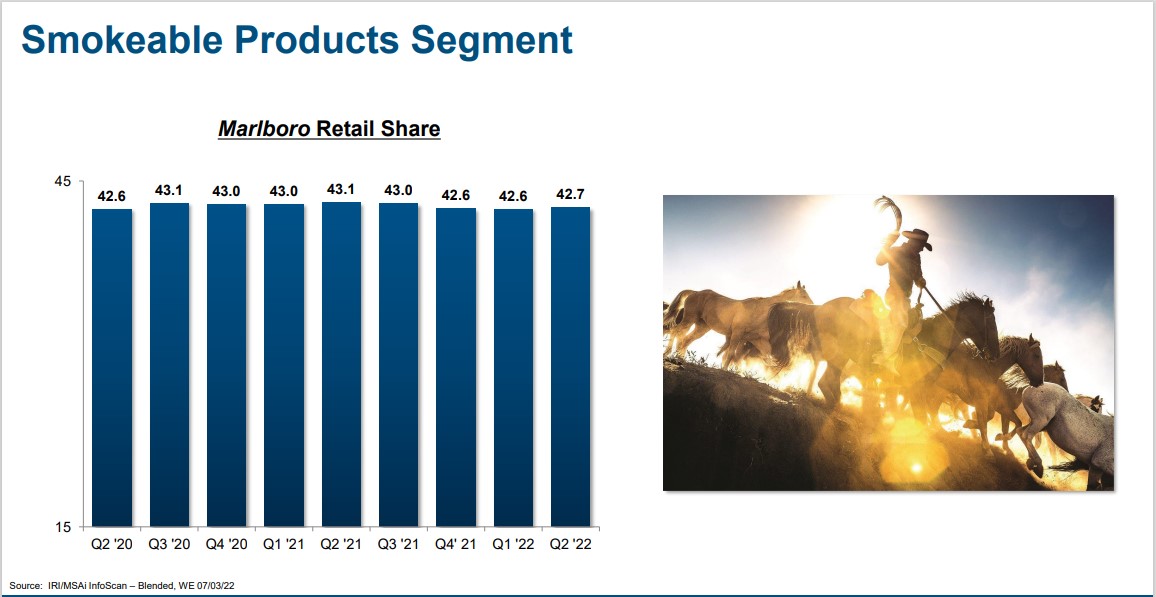

Excessive Dividend Inventory #4: Magellan Midstream Companions LP (MMP)

- Dividend Yield: 8.1%

- Dividend Danger Rating: C

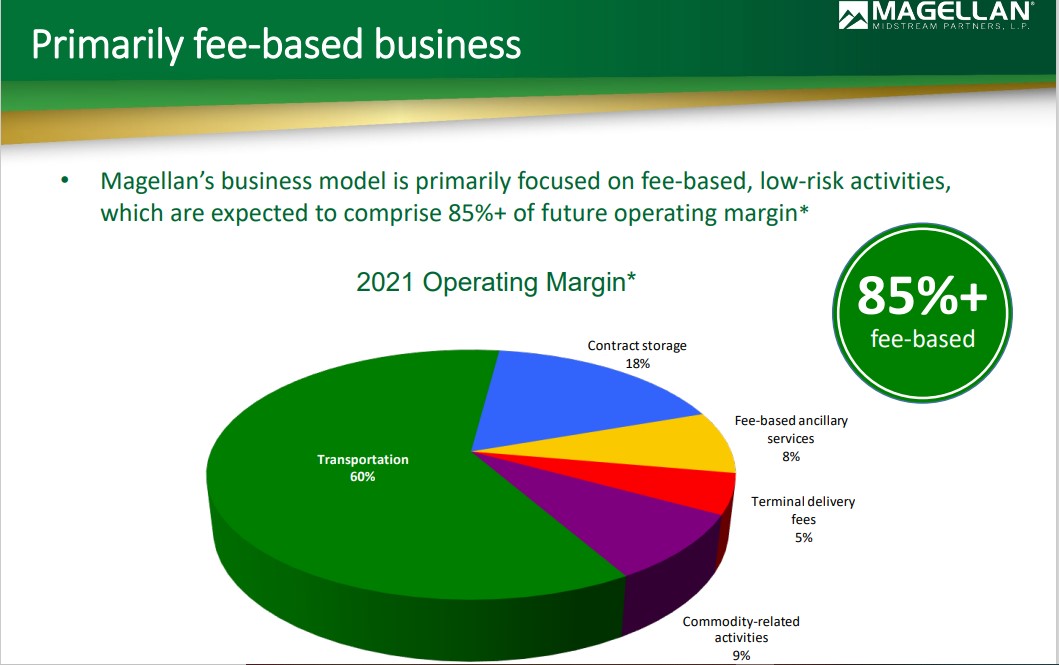

Magellan Midstream Companions is a Grasp Restricted Partnership, or MLP. Magellan has the longest pipeline system of refined merchandise, which is linked to almost half of the overall U.S. refining capability.

This section generates ~65% of its whole working earnings whereas the transportation and storage of crude oil generates ~35% of its working earnings. MMP has a fee-based mannequin; solely ~9% of its working earnings relies on commodity costs.

Supply: Investor Presentation

In early August, MMP reported (7/28/22) monetary outcomes for the second quarter of fiscal 2022. Adjusted earnings-per-share of $1.94 beat analyst estimates by $0.95 per share. Income of $789 million for the quarter additionally beat, by $90 million, and rose 21% year-over-year. The corporate expects free money stream of round $1.45 billion for 2022, and roughly $578 million of extra free money stream after distributions.

The corporate has a optimistic development outlook, as a consequence of its lineup of development initiatives underway. The corporate invested has greater than $500 million of potential development initiatives into consideration. As well as, share repurchases could represent one other vital development driver.

Click on right here to obtain our most up-to-date Positive Evaluation report on MMP (preview of web page 1 of three proven under):

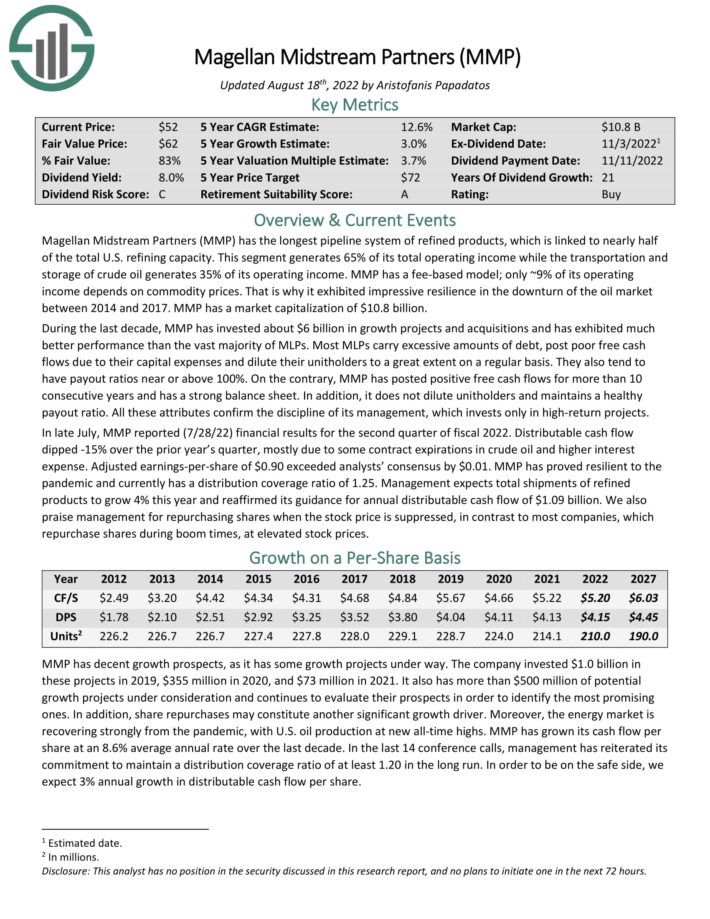

Excessive Dividend Inventory #3: Sunoco LP (SUN)

- Dividend Yield: 8.3%

- Dividend Danger Rating: B

Sunoco is a Grasp Restricted Partnership that distributes gas merchandise by way of its wholesale and retail enterprise models. The wholesale unit purchases gas merchandise from refiners and sells these merchandise to each its personal and independently-owned sellers.

The retail unit operates shops the place gas merchandise in addition to different merchandise corresponding to comfort merchandise and meals are bought to clients.

Associated: The High 20 Highest Yielding MLPs Now

Supply: Investor Presentation

Sunoco reported its second quarter earnings outcomes on August 4th. Income of $7.82 billion rose 78% year-over-year, and beat analyst estimates by $2.19 billion. Earnings-per-share of $1.20 beat by $0.14 per share. The corporate reported adjusted EBITDA of $214 million and distributable money stream of $159 million as adjusted. Sunoco maintained a quarterly distribution of 1.83x, with a quarter-end leverage ratio of 4.17x.

For 2022, Sunoco is forecasting EBITDA of round $795 million to $835 million, representing development of round 10% versus 2021.

Click on right here to obtain our most up-to-date Positive Evaluation report on Sunoco (preview of web page 1 of three proven under):

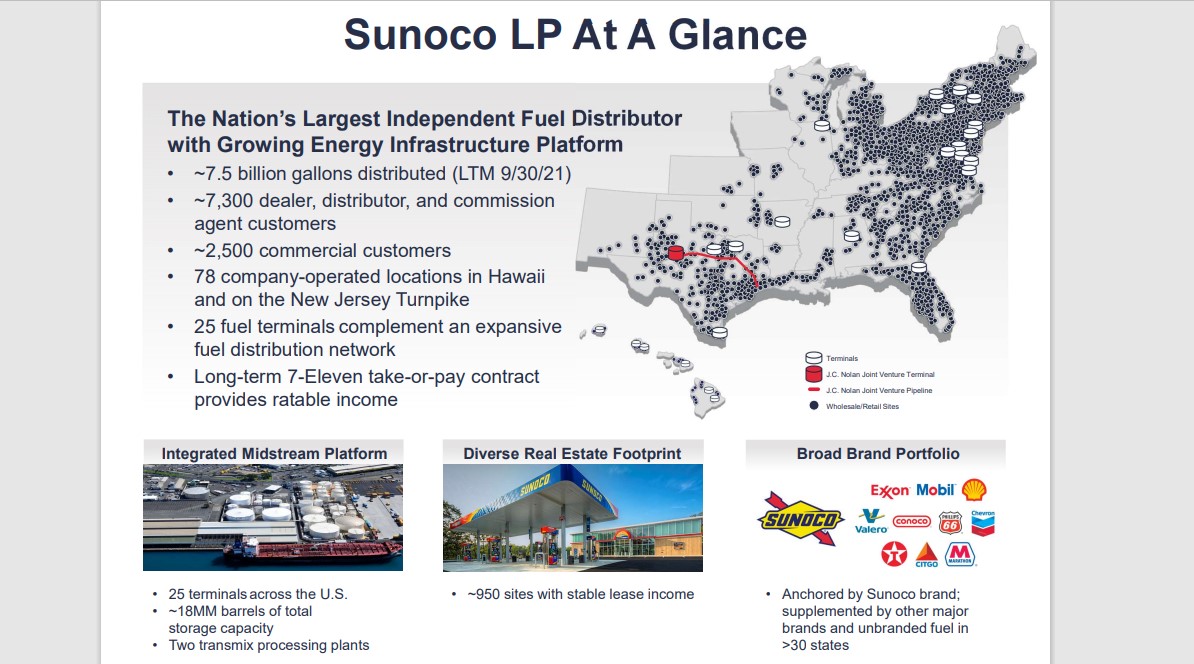

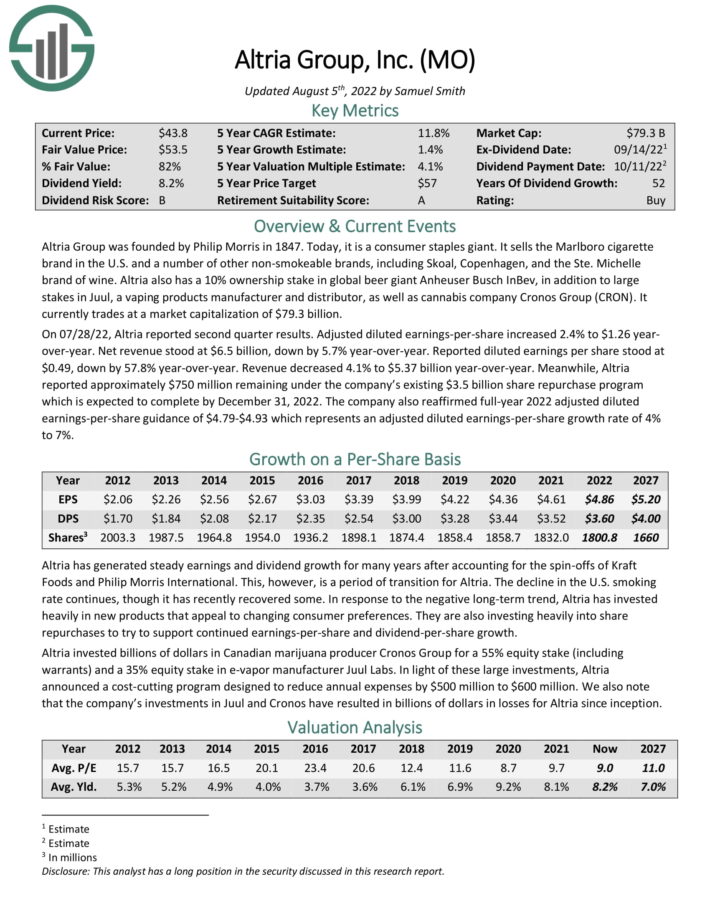

Excessive Dividend Inventory #2: Altria Group (MO)

- Dividend Yield: 8.4%

- Dividend Danger Rating: B

Altria Group was based by Philip Morris in 1847. In the present day, it’s a shopper staples large. It sells the Marlboro cigarette model within the U.S. and quite a few different non-smokeable manufacturers, together with Skoal and Copenhagen.

The flagship model continues to be Marlboro, which instructions over 40% retail market share within the U.S.

Supply: Investor Presentation

Altria additionally has a 10% possession stake in world beer large Anheuser-Busch InBev, along with giant stakes in Juul, a vaping merchandise producer and distributor, in addition to hashish firm Cronos Group (CRON).

On 7/28/22, Altria reported second quarter FY22 outcomes. Income of $5.37 billion declined by 4% and missed estimates by $50 million. Adjusted earnings-per-share of $1.26 beat estimates by a penny.

The corporate additionally reaffirmed full-year 2022 adjusted diluted earnings-per-share steerage of $4.79-$4.93. The vary represents 4%-7% development for the complete yr.

Altria has elevated its dividend for over 50 years, putting it on the unique Dividend Kings record. It’s also a Dividend Champion.

Click on right here to obtain our most up-to-date Positive Evaluation report on Altria Group (preview of web page 1 of three proven under):

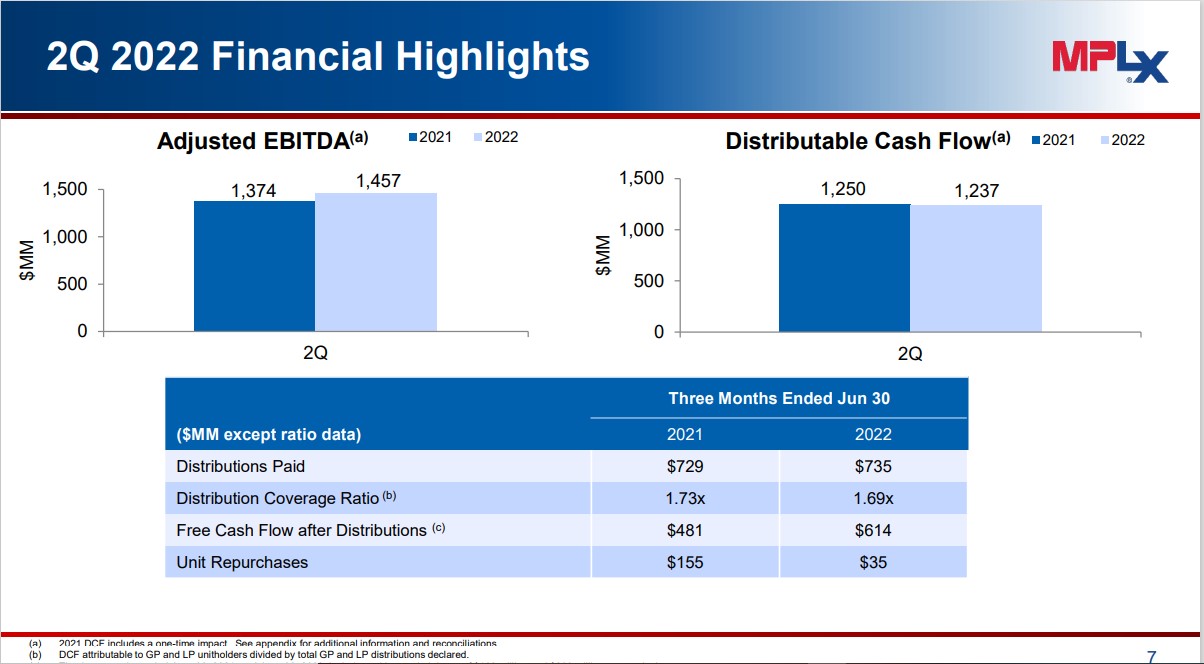

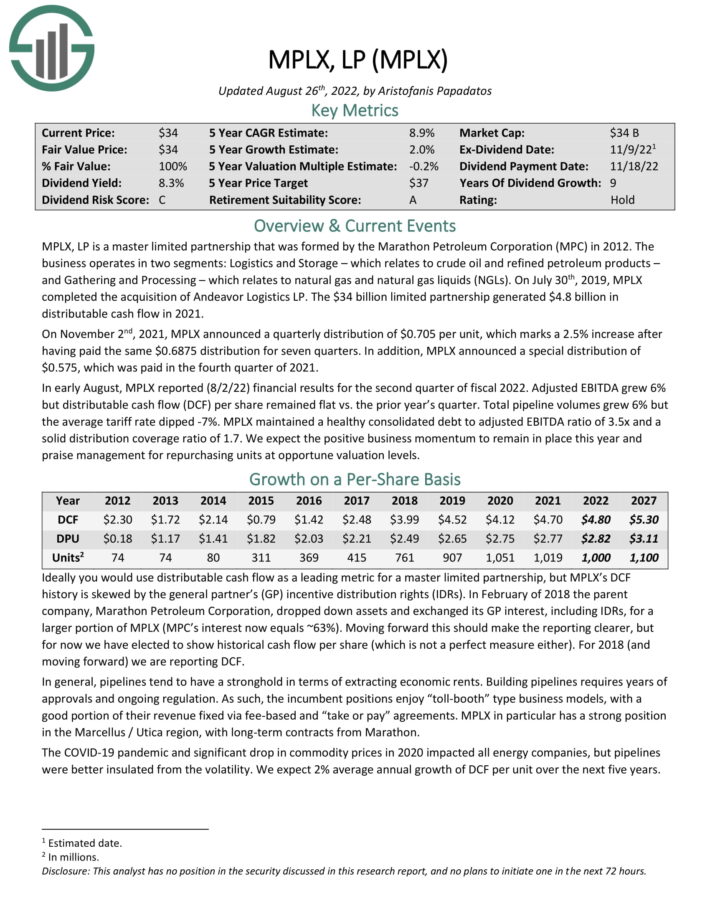

Excessive Dividend Inventory #1: MPLX LP (MPLX)

- Dividend Yield: 8.7%

- Dividend Danger Rating: C

MPLX LP is a Grasp Restricted Partnership that was shaped by the Marathon Petroleum Company (MPC) in 2012.

The enterprise operates in two segments: Logistics and Storage – which pertains to crude oil and refined petroleum merchandise – and Gathering and Processing – which pertains to pure gasoline and pure gasoline liquids (NGLs). In 2019, MPLX acquired Andeavor Logistics LP.

You possibly can see highlights of the corporate’s second-quarter report within the picture under:

Supply: Investor Presentation

In early August, MPLX reported (8/2/22) monetary outcomes for the second quarter of fiscal 2022. Income of $2.94 billion rose 22% year-over-year and beat analyst estimates by $350 million. In the meantime, earnings-per-share of $0.83 beat by a penny. Development capital spending for 2022 is anticipated to come back in at $700 million, whereas MPLX additionally declared a further unit repurchase program of as much as $1 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on MPLX (preview of web page 1 of three proven under):

The Excessive Dividend 50

You possibly can see evaluation on the 50 highest-yielding shares under, excluding worldwide securities, royalty trusts, REITs, and MLPs.

The Excessive Dividend 50 are listed so as of their dividend yields as of March 14th, 2022. The most recent Positive Evaluation Analysis Database report for every safety is included as properly.

- Artisan Companions Asset Administration (APAM) | [See newest Sure Analysis report]

- Lumen Applied sciences (LUMN) | [See newest Sure Analysis report]

- Antero Midstream (AM) | [See newest Sure Analysis report]

- By way of Renewables (VIA) | [See newest Sure Analysis report]

- Vector Group (VGR) | [See newest Sure Analysis report]

- B&G Meals (BGS) | [See newest Sure Analysis report]

- Altria Group (MO) | [See newest Sure Analysis report]

- New York Neighborhood Bancorp (NYCB) | [See newest Sure Analysis report]

- ONEOK Inc. (OKE) | [See newest Sure Analysis report]

- Southern Copper Company (SCCO) | [See newest Sure Analysis report]

- Common Corp. (UVV) | [See newest Sure Analysis report]

- Western Union (WU) | [See newest Sure Analysis report]

- Northwest Bancshares (NWBI) | [See newest Sure Analysis report]

- Philip Morris Worldwide (PM) | [See newest Sure Analysis report]

- Blackstone Group (BX) | [See newest Sure Analysis report]

- Xerox Holdings (XRX) | [See newest Sure Analysis report]

- Worldwide Enterprise Machines (IBM) | [See newest Sure Analysis report]

- Foot Locker (FL) | [See newest Sure Analysis report]

- Gilead Sciences (GILD) | [See newest Sure Analysis report]

- M.D.C. Holdings (MDC) | [See newest Sure Analysis report]

- Viatris Inc. (VTRS) | [See newest Sure Analysis report]

- Verizon Communications (VZ) | [See newest Sure Analysis report]

- AT&T Inc. (T) | [See newest Sure Analysis report]

- Mercury Basic (MCY) | [See newest Sure Analysis report]

- Phillips 66 (PSX) | [See newest Sure Analysis report]

- Leggett & Platt (LEG) | [See newest Sure Analysis report]

- Pinnacle West Capital (PNW) | [See newest Sure Analysis report]

- Dow Inc. (DOW) | [See newest Sure Analysis report]

- PetMed Categorical (PETS) | [See newest Sure Analysis report]

- Cracker Barrel Outdated Nation Retailer (CBRL) | [See newest Sure Analysis report]

- Prudential Monetary (PRU) | [See newest Sure Analysis report]

- Unum Group (UNM) | [See newest Sure Analysis report]

- Worldwide Paper (IP) | [See newest Sure Analysis report]

- Edison Worldwide (EIX) | [See newest Sure Analysis report]

- Valero Vitality (VLO) | [See newest Sure Analysis report]

- Franklin Sources (BEN) | [See newest Sure Analysis report]

- Hole, Inc. (GPS) | [See newest Sure Analysis report]

- Newell Manufacturers (NWL) | [See newest Sure Analysis report]

- ExxonMobil Company (XOM) | [See newest Sure Analysis report]

- OGE Vitality (OGE) | [See newest Sure Analysis report]

- Kraft-Heinz (KHC) | [See newest Sure Analysis report]

- H&R Block (HRB) | [See newest Sure Analysis report]

- Weyco Group (WEYS) | [See newest Sure Analysis report]

- Kontoor Manufacturers (KTB) | [See newest Sure Analysis report]

- 3M Firm (MMM) | [See newest Sure Analysis report]

- TrustCo Financial institution Corp. (TRST) | [See newest Sure Analysis report]

- Huntington Bancshares Inc. (HBAN) | [See newest Sure Analysis report]

- Spire Inc. (SR) | [See newest Sure Analysis report]

- United Bankshares Inc. (UBSI) | [See newest Sure Analysis report]

- Washington Belief Bancorp (WASH) | [See newest Sure Analysis report]

Ultimate Ideas

The 7 excessive dividend shares analyzed above all have dividend yields of 5% or larger. And importantly, these securities usually have higher danger profiles than the typical high-yield safety.

That stated, a dividend is rarely assured, and excessive dividend shares are doubtlessly liable to dividend reductions or suspensions if a recession happens within the close to future.

Buyers ought to proceed to observe every inventory to ensure their fundamentals and development stay on observe, notably amongst shares with extraordinarily excessive dividend yields.

Moreover, the next Positive Dividend databases include essentially the most dependable dividend shares in our funding universe:

You possibly can obtain the free spreadsheet under for extra high-yield funding concepts.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link