Updated on October 17th, 2022 by Bob Ciura

Income investors might be tempted to buy stocks with the highest dividend yields. But this is often a mistake, as extreme high-yielding stocks are often in dubious financial condition. While high yields are important, we believe it is equally important to focus on quality.

One way to measure the quality of a dividend stock is by its dividend history. We believe stocks with established histories of dividend growth, are more likely to continue growing their dividends moving forward. This is why we focus on groups of stocks with long histories of increasing their dividends, such as the Dividend Aristocrats.

Meanwhile, investors should also look over the list of Dividend Contenders, which have raised their dividends for 10-24 years.

With this in mind, we created a downloadable list of 348 Dividend Contenders. You can download your free copy of the Dividend Contenders list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

This article will discuss an overview of Dividend Contenders, and why investors should consider quality dividend growth stocks. Additional information regarding dividend stocks in our coverage universe can be found in the Sure Analysis Research Database.

Table of Contents

You can instantly jump to any specific section of the article by clicking on the links below:

Overview of Dividend Contenders

The requirement to become a Dividend Contender is fairly straightforward: 10-24 consecutive years of dividend growth. While 10-24 years may not seem like the longest track record, and indeed there are stocks with much longer streaks of annual dividend hikes, it is nevertheless a positive indicator.

After all, there are a number of companies that have never paid a dividend. Or, even among companies that do pay dividends, many have not been able to raise their dividends consistently due to a lack of underlying business growth.

Many companies cannot pay dividends, or raise dividend payouts from year to year, because their business models do not generate enough profits or cash flow.

Cyclical companies also have trouble joining lists of long-running dividend growth stocks, because their profits collapse during recessions.

Automakers and oil stocks are good examples of highly cyclical companies that will often freeze or cut their dividends during recessions.

In recessions, corporate profits typically decline, particularly within industries that are closely tied to consumer spending. In 2020-2021, companies across multiple industries suspended or eliminated their dividend payouts due to the impact of the coronavirus pandemic on the global economy.

That said, there were many companies that maintained their dividends over the past two years, and even continued to raise them, despite the pandemic.

The highest-quality dividend growth stocks that continued to increase their dividends, once again proved the staying power and durable competitive advantages of their business models.

This is why income investors looking for safe dividends and reliable dividend growth, should focus on companies with established histories of successfully growing their dividends, even during recessions.

Example Of A High-Quality Dividend Contender: Qualcomm Inc. (QCOM)

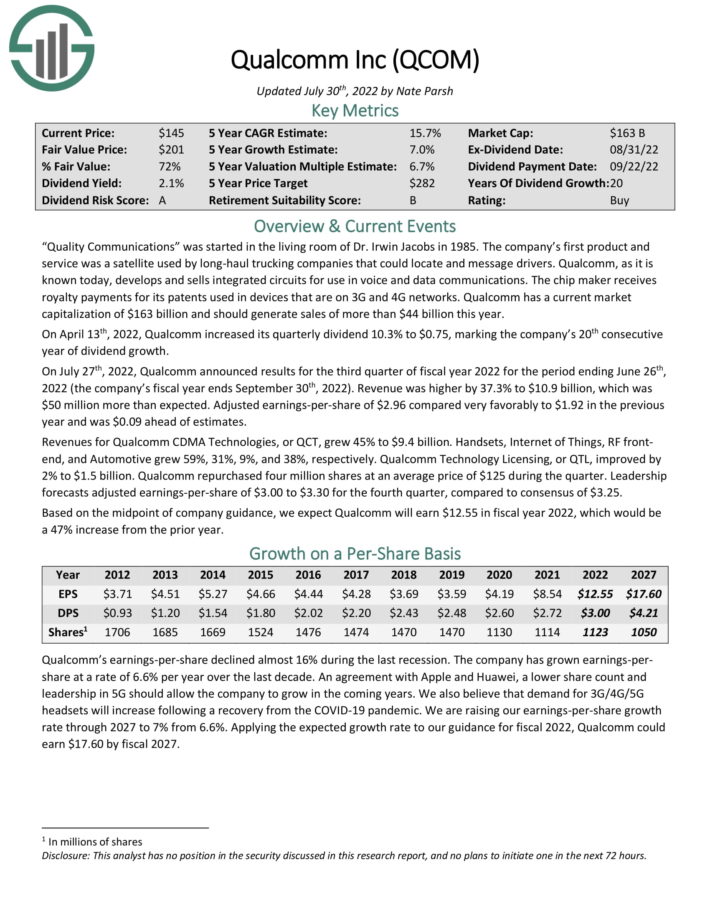

Qualcomm develops and sells integrated circuits for use in voice and data communications. The chip maker receives royalty payments for its patents used in devices that are on 3G and 4G networks.

Qualcomm is a large-cap stock with a current market capitalization above $120 billion. The company should generate sales of more than $44 billion this year.

On April 13th, 2022, Qualcomm increased its quarterly dividend 10.3% to $0.75, marking the company’s 20th consecutive year of dividend growth.

In the fiscal 2022 third quarter, revenue was higher by 37.3% to $10.9 billion, and was $50 million more than expected. Adjusted earnings-per-share of $2.96 compared very favorably to $1.92 in the previous year and was $0.09 ahead of estimates.

Revenues for Qualcomm CDMA Technologies, or QCT, grew 45% to $9.4 billion.

Source: Investor Presentation

Handsets, Internet of Things, RF frontend, and Automotive grew 59%, 31%, 9%, and 38%, respectively. Qualcomm Technology Licensing, or QTL, improved by 2% to $1.5 billion. Qualcomm repurchased four million shares at an average price of $125 during the quarter.

Leadership forecasts adjusted earnings-per-share of $3.00 to $3.30 for the fourth quarter, compared to consensus of $3.25. Based on the midpoint of company guidance, we expect Qualcomm will earn $12.55 in fiscal year 2022, which would be a 47% increase from 2021.

Click here to download our most recent Sure Analysis report on QCOM (preview of page 1 of 3 shown below):

Final Thoughts

Investors on the hunt for stocks with a high likelihood of increasing their dividends each year reliably, should focus on stocks with the longest histories of dividend growth.

For a company to raise its dividend for at least 10 years, it must have durable competitive advantages, steady profitability even during times of economic downturns, and a positive future growth outlook.

This will provide them with the ability to raise their dividends going forward. As a result, high-quality Dividend Contenders like Qualcomm are attractive for long-term dividend growth investors.

If you are interested in finding high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].