Updated on November 18th, 2022 by Bob Ciura

Bill Gates is the fourth-richest person in the world, behind only Jeff Bezos, Elon Musk, and Bernard Arnault. His net worth of ~$129 billion is a massive amount of money. Not surprisingly, the Bill & Melinda Gates Foundation has a huge investment portfolio above $17 billion according to a recent 13F filing.

That kind of wealth is something the vast majority of us can only dream of. However, there is one similarity between the everyday investor and the wealthiest person on the planet.

We’re all looking for good stocks to buy and hold for the long-term. That is why it is useful to review the stock holdings of the Bill & Melinda Gates Foundation.

You can download our full list of all 21 Gates Foundation stocks (along with important metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

The Bill & Melinda Gates Foundation owns several highly profitable companies, with sustainable competitive advantages. Many of the stocks also pay dividends to shareholders, and grow their dividend payouts over time.

This article will discuss the 19 stocks held by the Bill & Melinda Gates Foundation.

Table of Contents

You can skip to the analysis for each of the Gates Foundation’s 21 stock holdings, with the table of contents below. Stocks are listed in order of the portfolio’s largest positions to smallest positions.

- Microsoft (MSFT)

- Berkshire Hathaway (BRK.B)

- Canadian National Railway (CNI)

- Waste Management (WM)

- Caterpillar Inc. (CAT)

- Deere & Company (DE)

- Ecolab (ECL)

- Coca-Cola FEMSA, S.A.B. de C.V. (KOF)

- Walmart (WMT)

- Waste Connections (WCN)

- FedEx Corp. (FDX)

- Crown Castle International (CCI)

- Coupang, Inc. (CPNG)

- Schrodinger, Inc. (SDGR)

- United Parcel Service, Inc. (UPS)

- Kraft Heinz (KHC)

- Madison Square Garden Sports Corp. (MSGS)

- Weber Inc. (WEBR)

- On Holding AG (ON)

- Carvana Co. (CVNA)

- Vroom, Inc. (VRM)

You can also watch video analysis of Gates’ stock holdings below:

#1—Microsoft

Dividend Yield: 1.0%

Percentage of Bill Gates’ Portfolio: 27.9%

Microsoft Corporation, founded in 1975 and headquartered in Redmond, WA, develops, manufactures and sells both software and hardware to businesses and consumers. Microsoft is a mega-cap stock with a market capitalization of $1.8 trillion.

Its offerings include operating systems, business software, software development tools, video games and gaming hardware, and cloud services.

In late October, Microsoft reported financial results for the first quarter of fiscal 2023. The company grew its revenue by 11% year-over-year. Sales of Azure, Microsoft’s high-growth cloud platform, grew 35%. However, adjusted earnings-per-share decreased by -13%, from $2.71 to $2.35, mostly due to a strong dollar, which reduced earnings from international markets, as well as production shutdowns in China and weak trends in the PC market.

Microsoft has a wide moat in the operating system & Office business units and a strong market position in cloud computing. It is unlikely that the company will lose market share with its older, established products, whereas cloud computing is such a high-growth industry that there is enough room for growth for multiple companies. Microsoft has a renowned brand and a global presence, which provides competitive advantages.

Click here to download our most recent Sure Analysis report on Microsoft (preview of page 1 of 3 shown below):

#2—Berkshire Hathaway

Dividend Yield: N/A (Berkshire Hathaway does not currently pay a dividend)

Percentage of Bill Gates’ Portfolio: 23.32%

Berkshire Hathaway stock is the largest individual holding of the Gates Foundation’s investment portfolio, and it is easy to see why. It’s safe to say the money is in good hands. Berkshire, under the stewardship of Warren Buffett, grew from a struggling textile manufacturer, into one of the largest conglomerates in the world.

Today, Berkshire is a global giant. It owns and operates dozens of businesses, with a hand in nearly every major industry including insurance, railroads, energy, finance, manufacturing, and retailing. It has a market capitalization above $600 billion.

Berkshire can be thought of in five parts: wholly owned insurance subsidiaries like GEICO, General Re and Berkshire Reinsurance; wholly-owned non-insurance subsidiaries like Dairy Queen, BNSF Railway, Duracell, Fruit of the Loom, NetJets, Precision Cast Parts and See’s Candies; shared control businesses like Kraft Heinz (KHC) and Pilot Flying J; marketable publicly-traded securities including significant stakes in companies like American Express (AXP), Apple (AAPL), Bank of America (BAC), Coca-Cola (KO) and Wells Fargo (WFC); and finally the company’s cash position.

In Berkshire’s annual letters to shareholders, Buffett typically evaluates the company’s performance in terms of book value. Book value is an accounting metric that measures a company’s assets minus its liabilities. The resulting difference is a company’s book value. This is a proxy for the intrinsic value of a firm, which Buffett believes to be the most important financial metric.

Berkshire doesn’t pay a dividend to shareholders. Buffett and his partner Charlie Munger have always contended that they can create wealth at a higher rate than the dividend would provide to shareholders.

While Berkshire stock may not be attractive for investors who want dividend income, there are few companies that have a track record nearly as great as Berkshire’s.

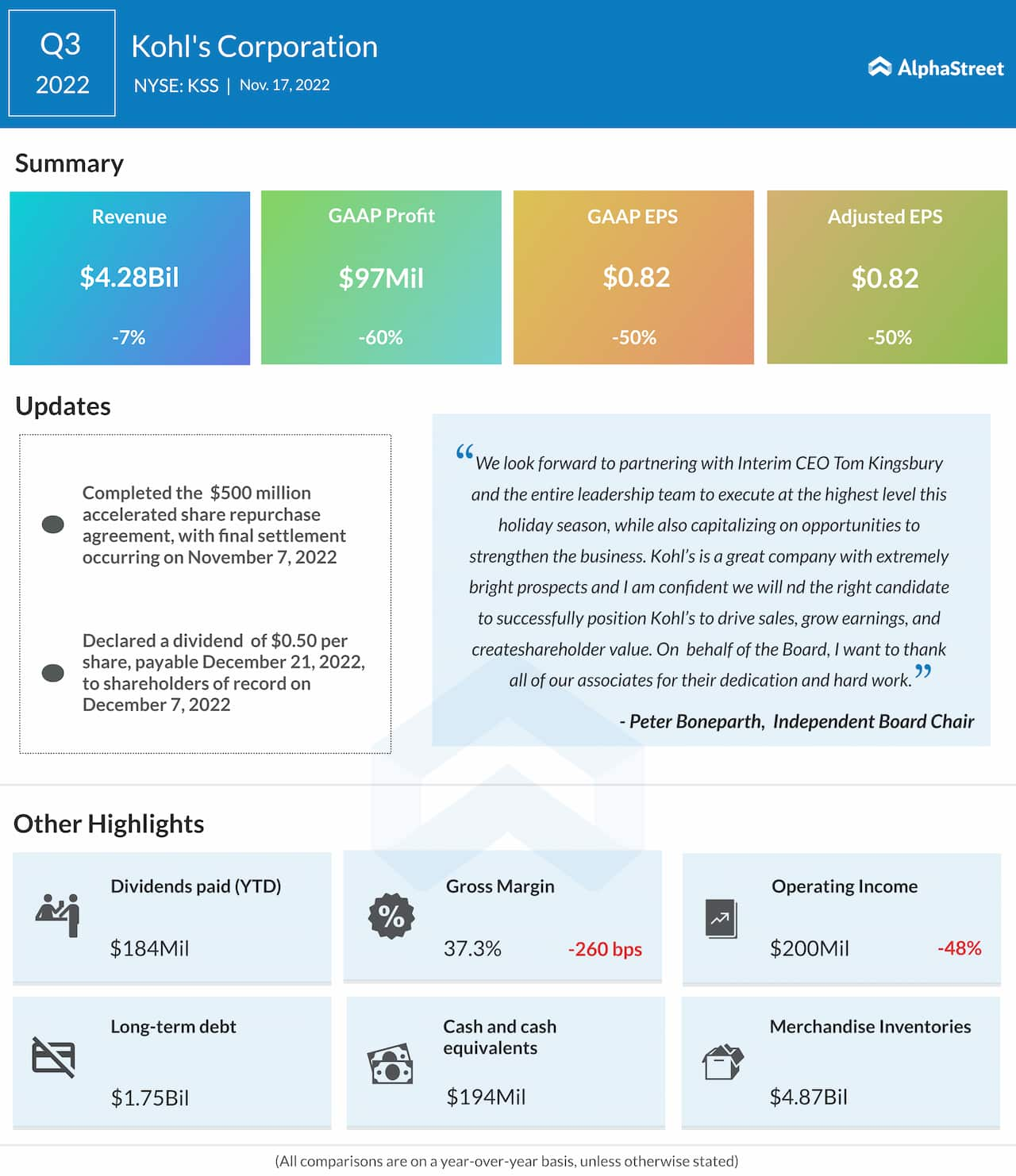

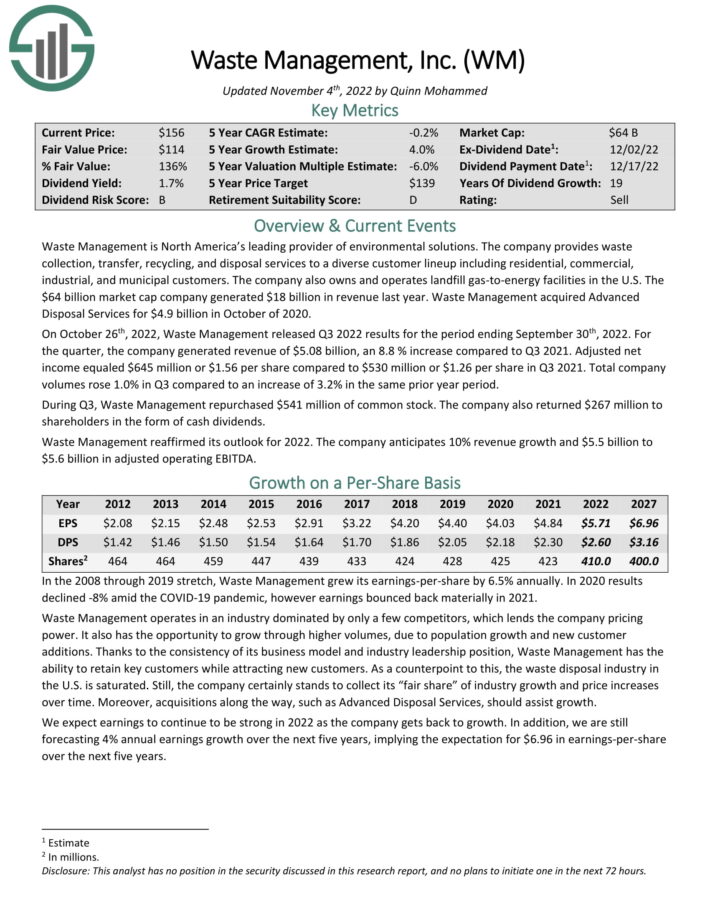

#3—Canadian National Railway

Dividend Yield: 1.4%

Percentage of Bill Gates’ Portfolio: 19.57%

Canadian National Railway is the only transcontinental railroad in North America. It has a network of approximately 20,000 route miles and connects three coasts: the Atlantic, the Pacific and the Gulf of Mexico. It handles over $200 billion worth of goods annually and carries over 300 million tons of cargo.

On October 25th, 2022, Canadian National Railway announced third quarter results for the period ending September 30th, 2022. Revenue grew 14.3% to $3.32 billion, beating estimates by $147.1 million. Adjusted earnings-per-share of $1.57 compared to $1.23 in the prior year and was $0.09 higher than expected.

Canadian National Railway’s operating ratio improved 550 basis points to 57.2% year-over-year and was considerably better than the 66.6% and 59.3% figure that the company had in the first and second quarter of the year, respectively. Revenue ton miles (RTM) increased 5% to 58.5 billion.

Click here to download our most recent Sure Analysis report on Canadian National Railway (preview of page 1 of 3 shown below):

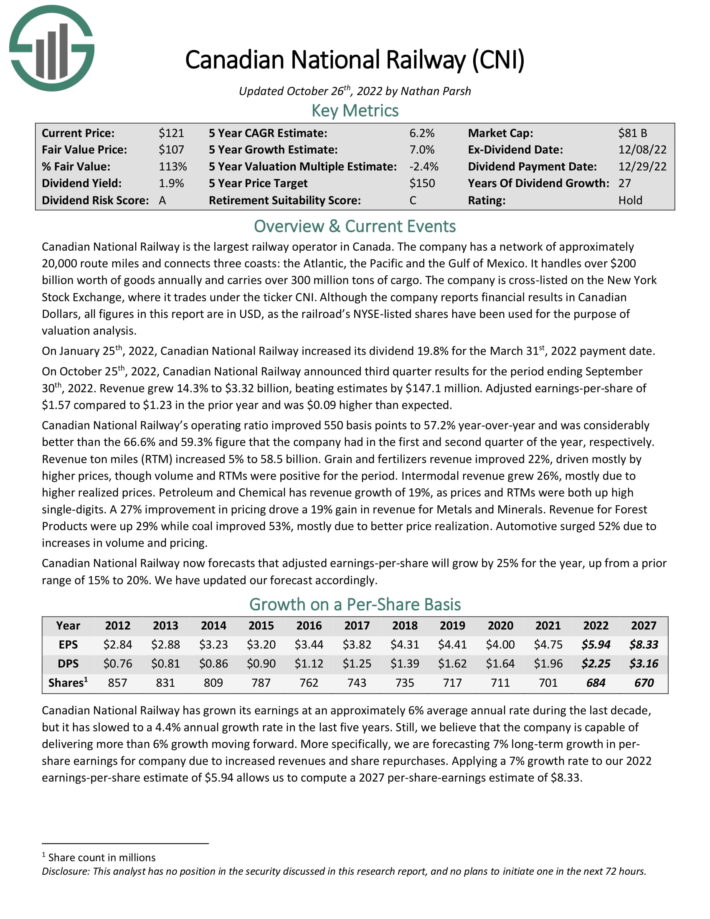

#4—Waste Management

Dividend Yield: 1.6%

Percentage of Bill Gates’ Portfolio: 16.34%

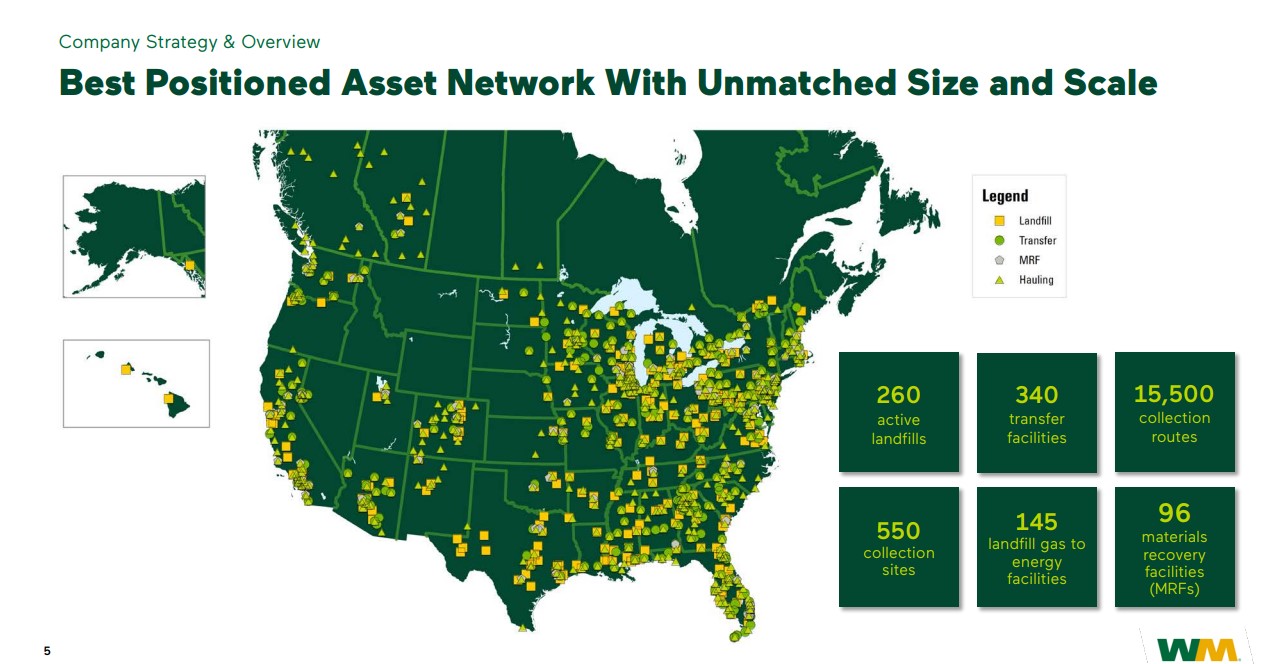

Waste Management is the embodiment of a company with a wide economic “moat”, a term popularized by Warren Buffett to describe a strong competitive advantage that protects a company from the full ravages of market competition. Waste Management operates in waste removal and recycling services. This is a highly-concentrated industry, with only a few companies controlling the majority of the market.

Source: Investor Presentation

On October 26th, 2022, Waste Management released Q3 2022 results for the period ending September 30th, 2022. For the quarter, the company generated revenue of $5.08 billion, an 8.8 % increase compared to Q3 2021. Adjusted net income equaled $645 million or $1.56 per share compared to $530 million or $1.26 per share in Q3 2021. Total company volumes rose 1.0% in Q3 compared to an increase of 3.2% in the same prior year period.

During Q3, Waste Management repurchased $541 million of common stock. The company also returned $267 million to shareholders in the form of cash dividends.

Click here to download our most recent Sure Analysis report on Waste Management (preview of page 1 of 3 shown below):

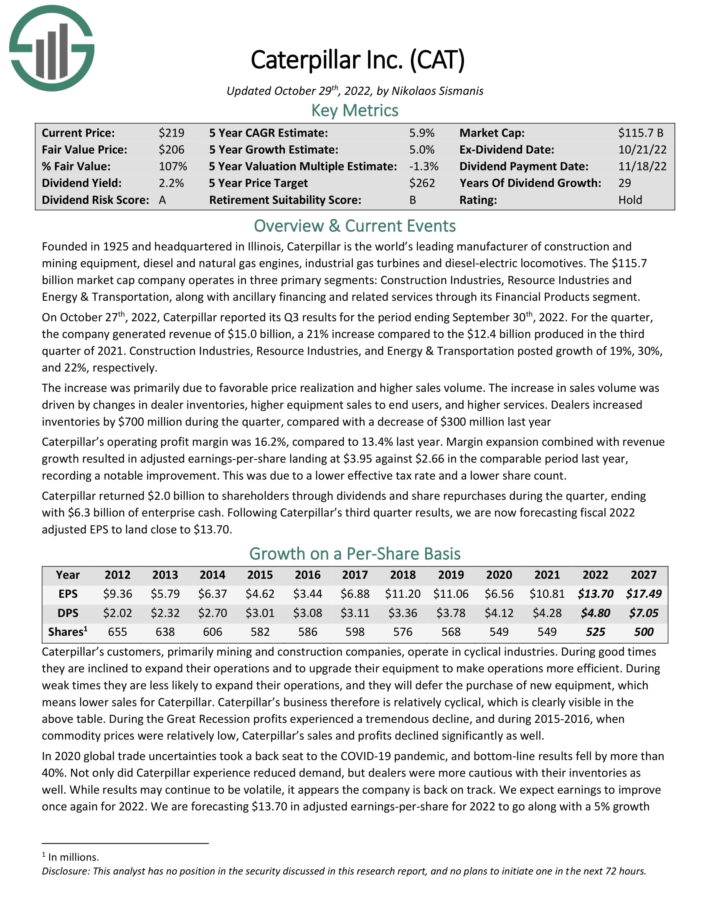

#5—Caterpillar

Dividend Yield: 2.0%

Percentage of Bill Gates’ Portfolio: 5.12%

Caterpillar is the global leader in heavy machinery. It has a strong brand with a dominant industry position. Caterpillar manufactures and markets heavy machinery, mostly for the construction and mining sectors.

The company operates in three primary segments: Construction Industries, Resource Industries and Energy & Transportation, along with ancillary financing and related services through its Financial Products segment.

Source: Investor Presentation

On October 27th, 2022, Caterpillar reported its Q3 results for the period ending September 30th, 2022. For the quarter, the company generated revenue of $15.0 billion, a 21% increase compared to the $12.4 billion produced in the third quarter of 2021. Construction Industries, Resource Industries, and Energy & Transportation posted growth of 19%, 30%, and 22%, respectively.

The increase was primarily due to favorable price realization and higher sales volume. The increase in sales volume was driven by changes in dealer inventories, higher equipment sales to end users, and higher services.

Click here to download our most recent Sure Analysis report on Caterpillar (preview of page 1 of 3 shown below):

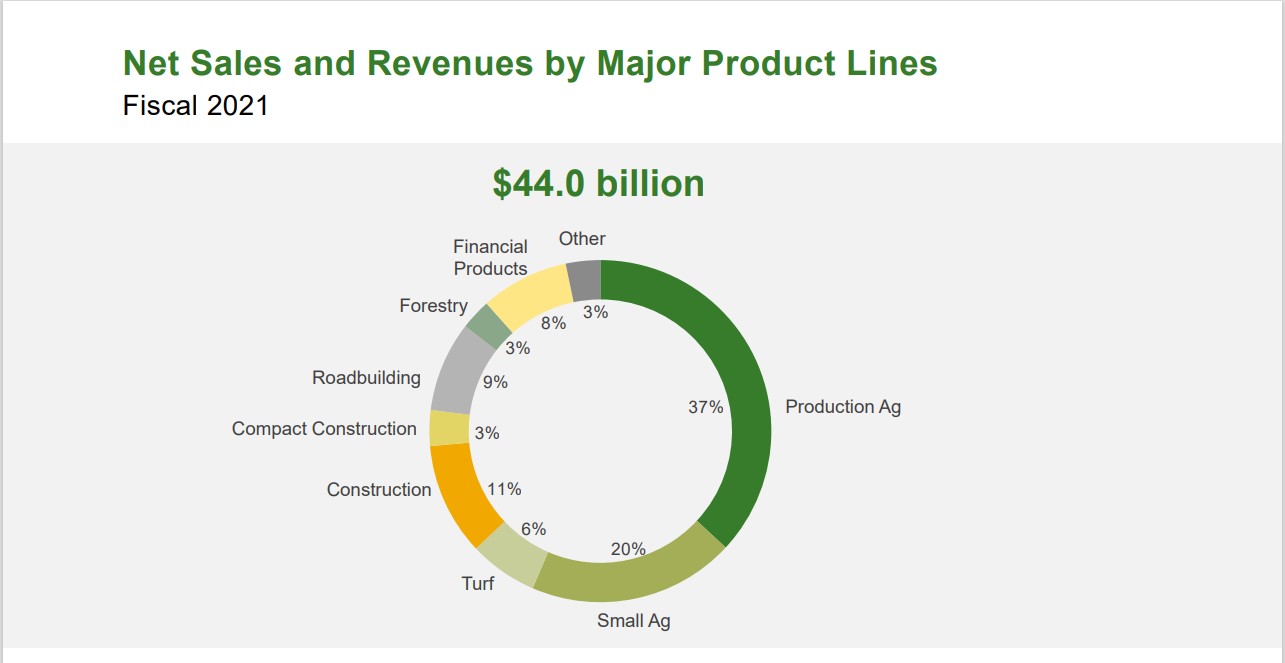

#6—Deere & Company (DE)

Dividend Yield: 1.1%

Percentage of Bill Gates’ Portfolio: 4.69%

Deere & Company is the largest manufacturer of farm equipment in the world. The company also makes equipment used in construction, forestry & turf care, produces engines and provides financial solutions to its customers. Deere was founded in 1837.

Source: Investor Presentation

In mid-August, Deere reported (8/19/22) financial results for the third quarter of fiscal 2022. The company grew its sales 25% over the prior year’s quarter thanks to high production growth. Sales grew across the board with the Production & Precision Ag, Small Ag & Turf and Construction & Forestry segments posting gains of 43%, 16%, and 8%, respectively.

Deere also grew its earnings-per-share 16%, from $5.32 to $6.16, but missed the analysts’ consensus by $0.53 due to high cost inflation and supply chain issues. Moreover, Deere narrowed its guidance for its annual earnings in 2022, from $7.0-$7.4 billion to $7.0-$7.2 billion. Nevertheless, Deere is doing its best to meet the exceptionally strong demand it enjoys for its products right now.

Click here to download our most recent Sure Analysis report on Deere (preview of page 1 of 3 shown below):

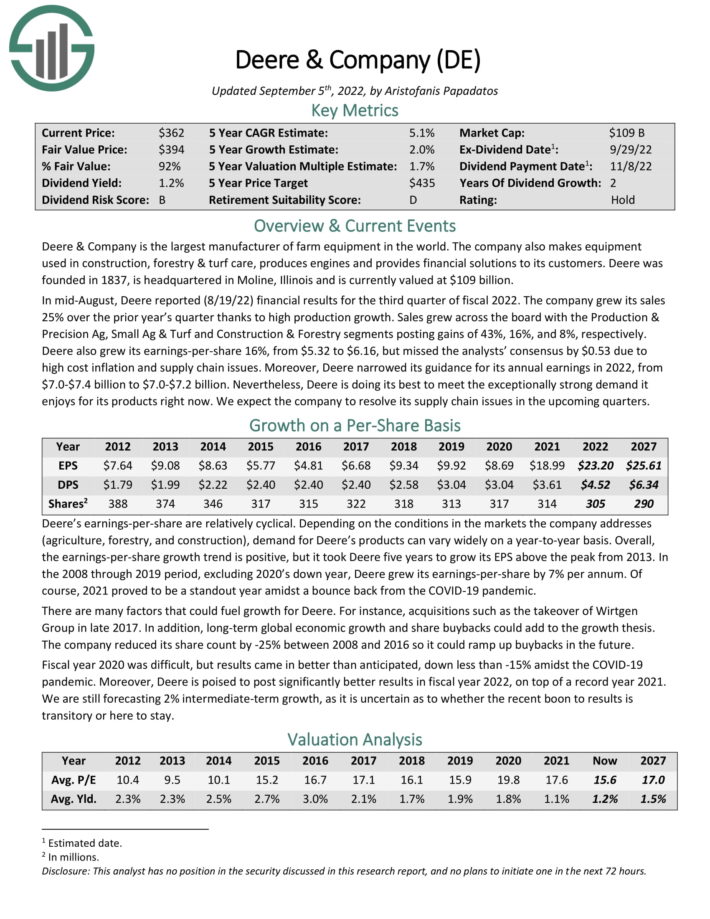

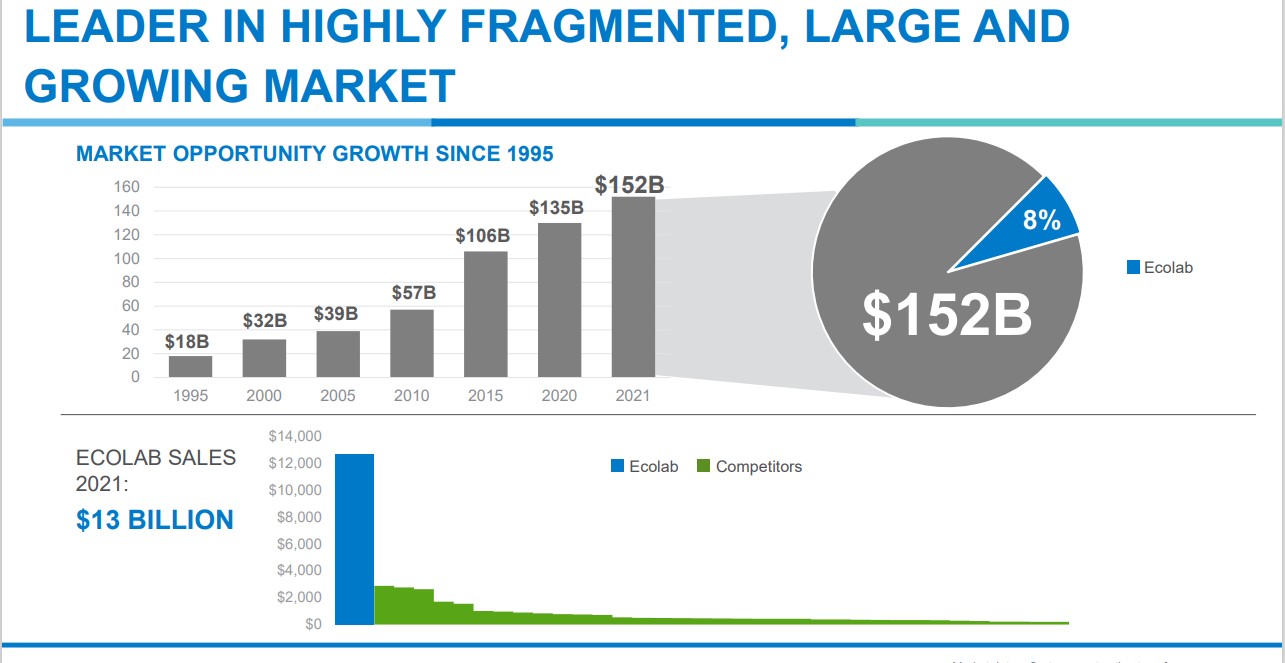

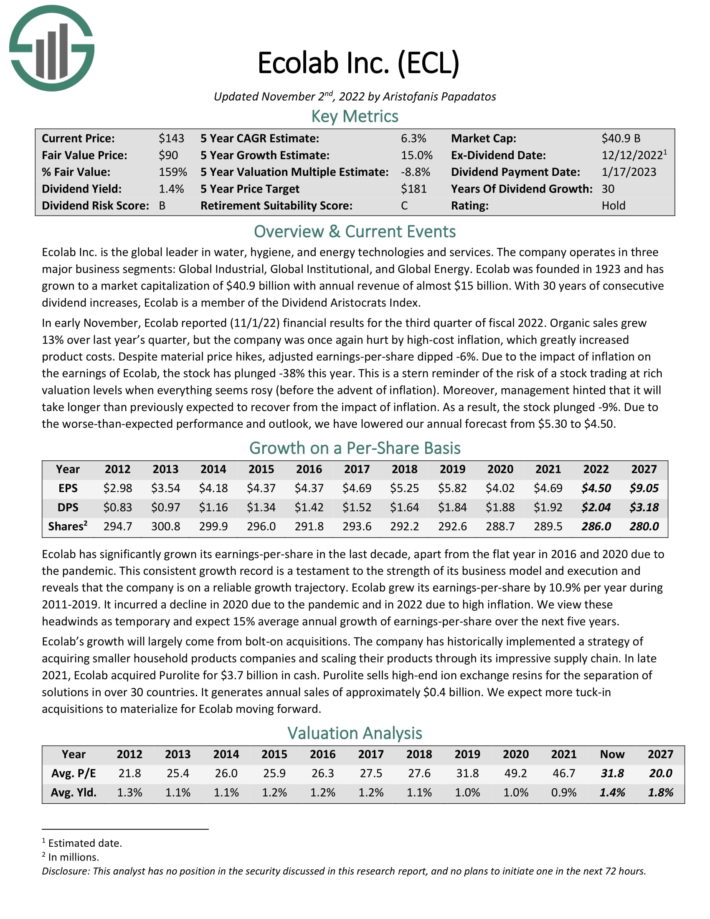

#7—Ecolab

Dividend Yield: 1.4%

Percentage of Bill Gates’ Portfolio: 2.19%

Ecolab was created in 1923, when its founder Merritt J. Osborn invented a new cleaning product called “Absorbit”. This product cleaned carpets without the need for businesses to shut down operations to conduct carpet cleaning. Osborn created a company revolving around the product, called Economics Laboratory, or Ecolab.

Source: Investor Presentation

Today, Ecolab is the industry leader and generates annual sales of roughly $13 billion. Ecolab operates three major business segments: Global Industrial, Global Institutional, and Global Energy, each of roughly equal size. The business is diversified in terms of operating segments, and also geography.

In early November, Ecolab reported (11/1/22) financial results for the third quarter of fiscal 2022. Organic sales grew 13% over last year’s quarter, but the company was once again hurt by high-cost inflation, which greatly increased product costs. Despite material price hikes, adjusted earnings-per-share dipped -6%.

Click here to download our most recent Sure Analysis report on Ecolab (preview of page 1 of 3 shown below):

#8—Coca-Cola FEMSA SAB

Dividend Yield: 3.9%

Percentage of Bill Gates’ Portfolio: 1.24%

Coca-Cola FEMSA produces, markets, and distributes Coca-Cola (KO) beverages. It offers the full line of sparkling and still beverages. It sells its products through distribution centers and retailers in Mexico, Guatemala, Nicaragua, Costa Rica, Panama, Colombia, Venezuela, Brazil, Argentina, and the Philippines.

Coca-Cola FEMSA is the largest franchise bottler in the world. The stock is an excellent way to gain exposure to two very attractive emerging markets: Latin America and South Asia.

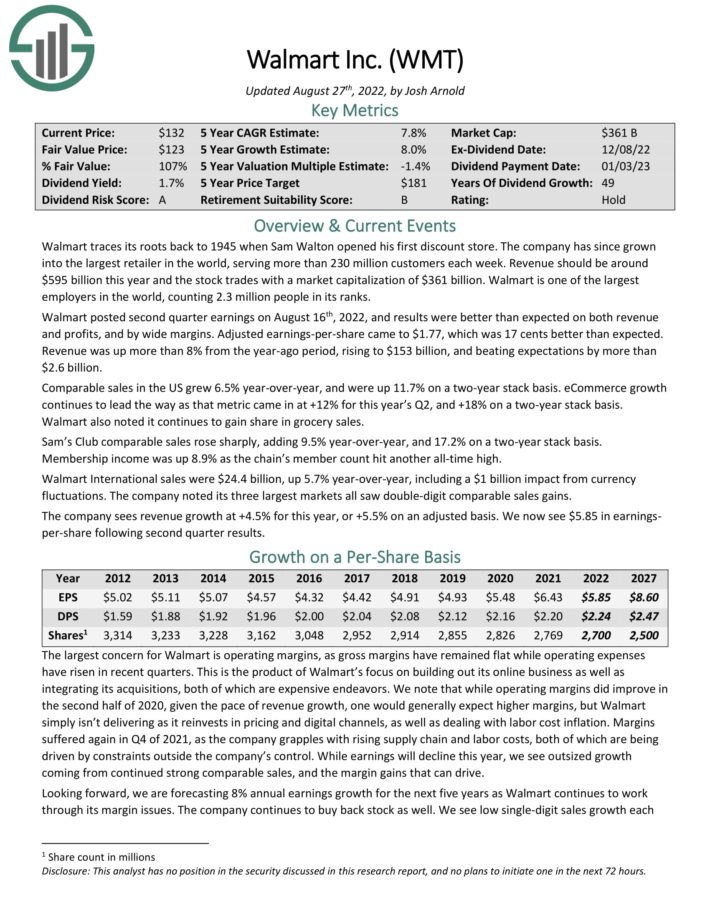

#9—Walmart Inc.

Dividend Yield: 1.5%

Percentage of Bill Gates’ Portfolio: 1.23%

Walmart is another great example of a company with durable competitive advantages. It is the largest retailer in the U.S., with annual revenue above $600 billion. The company came to dominate the retail industry by keeping a laser-like focus on reducing costs everywhere, particularly in supply chain and distribution.

Consumers tend to scale down to discount retail when times are tight, which is why Walmart continued to grow, even during the Great Recession. As a result, Walmart is arguably the most recession-resistant stock in the Gates Foundation’s portfolio.

This allows Walmart the ability to raise its dividend each year like clockwork, even during recessions. Walmart has raised its dividend for over 40 years in a row.

Its long history of dividend growth qualifies Walmart as a Dividend Aristocrat, a group of companies in the S&P 500 that have raised dividends for at least 25 consecutive years.

Click here to download our most recent Sure Analysis report on Walmart (preview of page 1 of 3 shown below):

#10—Waste Connections

Dividend Yield: 0.7%

Percentage of Bill Gates’ Portfolio: 0.85%

Waste Connections is a waste collection, transfer, disposal, and resource recovery business in the U.S. and Canada. It offers various recycling services, including solid waste, as well as fluids used in the oil and gas drilling industry, helping to increase the sustainability of those sectors.

The company was founded in 1997 and is based in Canada, with $7.2 billion in annual revenue, and a market cap of $33 billion.

Source: Investor presentation

As we can see, Waste Connections has robust ESG targets for the long-term, as it is looking to increase its own sustainability, as well as those of its customers.

Waste Connections has boosted its dividend for six consecutive years, but the strong performance of the stock means the yield is low at just 0.7%. However, we see strong dividend growth prospects for the stock in the years to come.

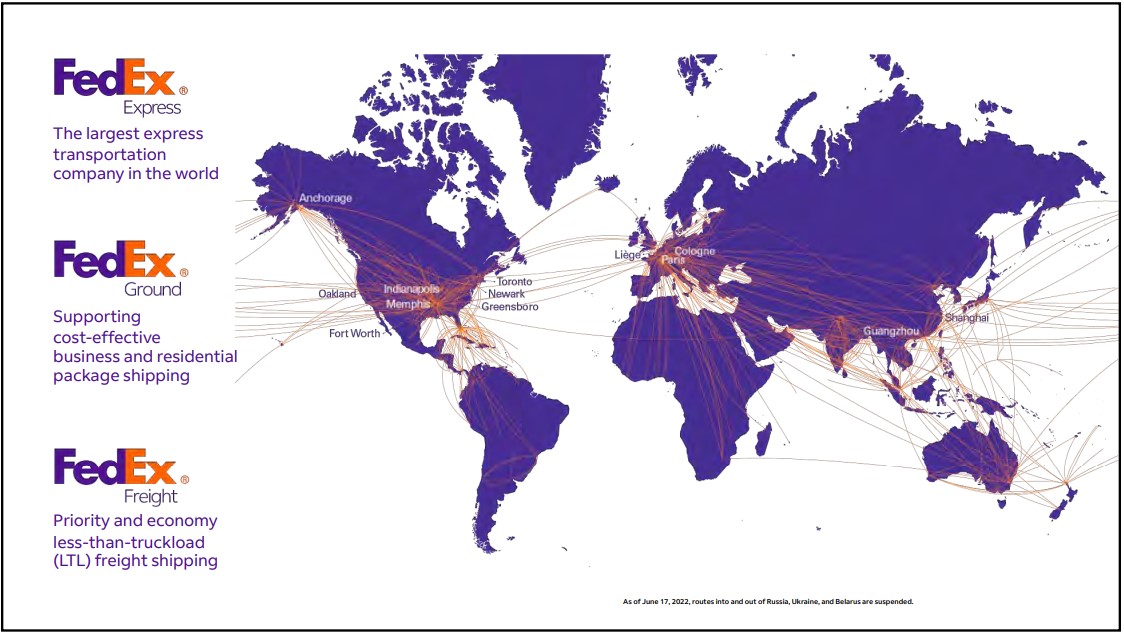

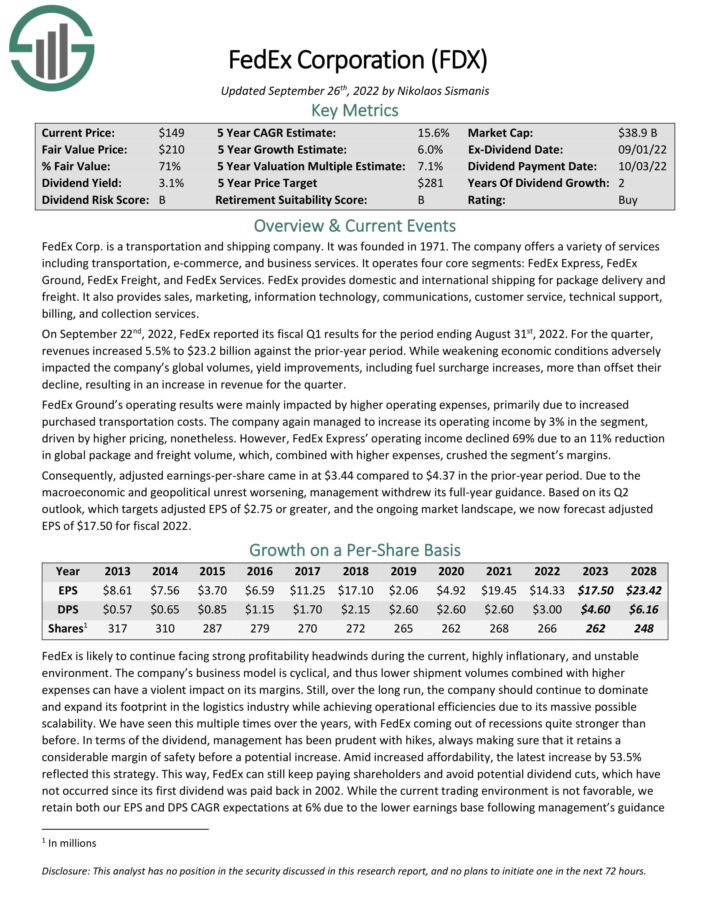

#11—FedEx

Dividend Yield: 2.2%

Percentage of Bill Gates’ Portfolio: 0.79%

FedEx Corp. is a transportation and shipping company. The company offers a variety of services including transportation, e-commerce, and business services. It operates four core segments: FedEx Express, FedEx Ground, FedEx Freight, and FedEx Services.

Source: Investor Presentation

On September 22nd, 2022, FedEx reported its fiscal Q1 results for the period ending August 31st, 2022. For the quarter, revenues increased 5.5% to $23.2 billion against the prior-year period. While weakening economic conditions adversely impacted the company’s global volumes, yield improvements, including fuel surcharge increases, more than offset their decline, resulting in an increase in revenue for the quarter.

FedEx Ground’s operating results were mainly impacted by higher operating expenses, primarily due to increased purchased transportation costs. The company again managed to increase its operating income by 3% in the segment, driven by higher pricing, nonetheless. However, FedEx Express’ operating income declined 69% due to an 11% reduction in global package and freight volume, which, combined with higher expenses, crushed the segment’s margins. Consequently, adjusted earnings-per-share came in at $3.44 compared to $4.37 in the prior-year period.

Click here to download our most recent Sure Analysis report on FedEx (preview of page 1 of 3 shown below):

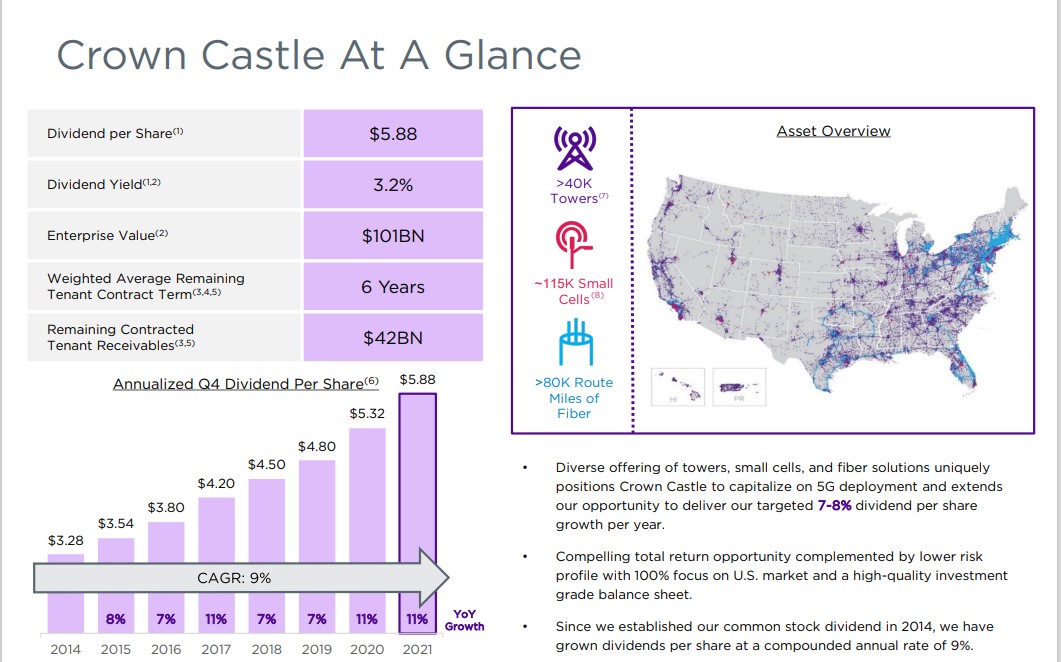

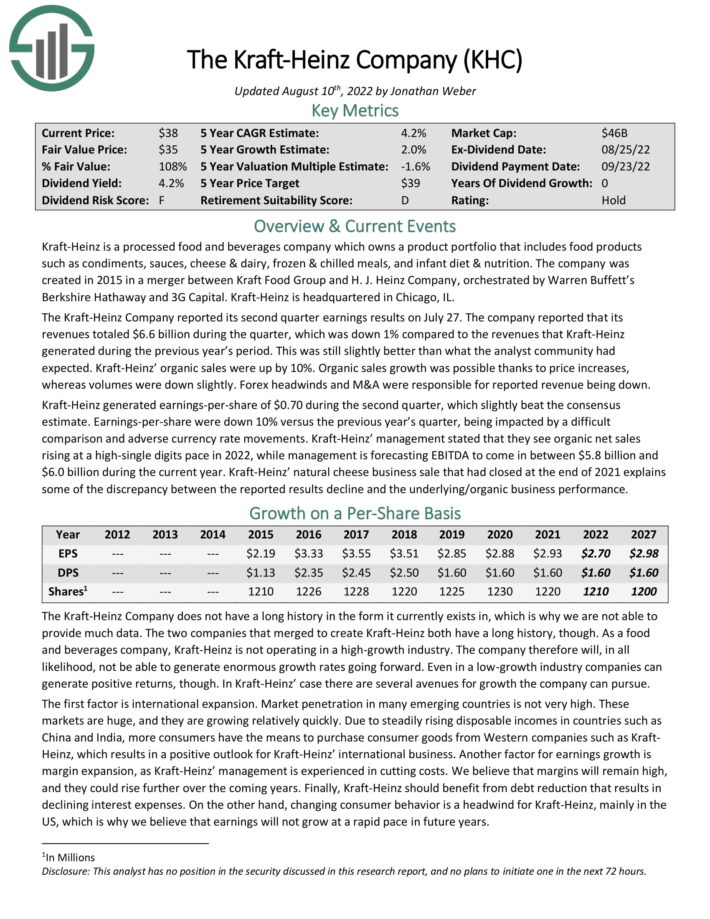

#12—Crown Castle International

Dividend Yield: 4.3%

Percentage of Bill Gates’ Portfolio: 0.56%

Crown Castle International is structured as a real estate investment trust, or REIT. You can see our full REIT list here.

Crown Castle owns cell phone towers with small cells where larger towers are not feasible, and fiber connections for data transmission. The trust owns, operates and leases more than 40,000 cell towers and 75,000 route miles of fiber across every major US market, helping it to support data infrastructure across the country.

Source: Investor Presentation

Crown Castle reported third quarter earnings on October 19th, 2022, and results were mixed. The REIT missed expectations on the bottom line, coming in with $1.85 earnings-per-share, missing expectations by six cents. However, that was still higher from $1.77 in the year-ago period. Revenue was up 8% to $1.75 billion, beating estimates to $20 million.

The REIT said customers continue to upgrade their tower networks, and that they expect another year of growth in 2023, with organic revenue growth for next year set to be 5%. Adjusted EBITDA rose from $976 million to $1.1 billion year-over-year, mostly due to growth in site rental revenues, and higher services contribution. The REIT boosted its dividend by 6.5% to $6.26 per share on an annualized basis, making eight consecutive years of dividend increases for Crown Castle.

Click here to download our most recent Sure Analysis report on Crown Castle International (preview of page 1 of 3 shown below):

#13—Coupang, Inc.

Dividend Yield: N/A

Percentage of Bill Gates’ Portfolio: 0.49%

Coupang is an e-commerce platform through its mobile apps and websites primarily in South Korea. It sells various products and services in the categories of home goods, apparel, beauty products, fresh food and groceries, sporting goods, electronics, consumables, and more.

#14—Schrodinger Inc.

Dividend Yield: N/A

Percentage of Bill Gates’ Portfolio: 0.44%

Schrodinger, Inc. is a health care technology company. It operates a computational platform that aims to accelerate drug delivery, both for external clients and the company’s own internal drug programs. Schrodinger conducted its initial public offering in February 2020. The stock currently has a market capitalization above $2 billion.

Schrodinger has exciting growth potential, due to the success of its drug delivery platform and its large and diversified customer base.

Schrodinger has a long runway of growth, because of the high degree of value that its products and services provide to customers. Designing drugs is extremely difficult work which is complex, lengthy, capital-intensive, and prone to high failure rates. This means many customers will continue to outsource this work to Schrodinger.

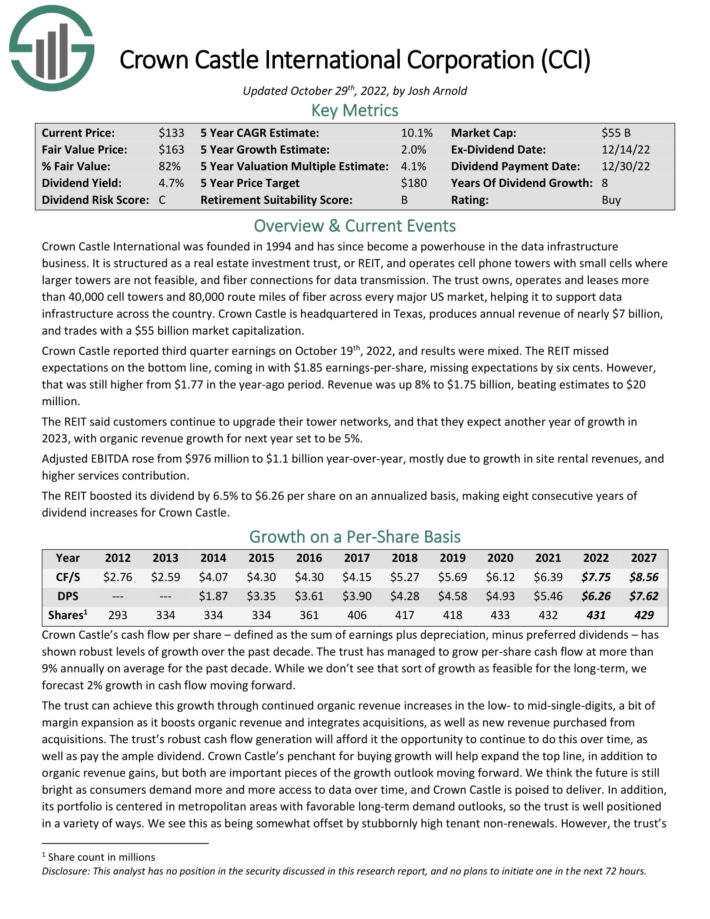

#15—United Parcel Service

Dividend Yield: 3.9%

Percentage of Bill Gates’ Portfolio: 0.39%

United Parcel Service is a logistics and package delivery company that offers services including transportation, distribution, ground freight, ocean freight, insurance and financing. Its operations are split into three segments: U.S. Domestic Package, International Package, and Supply Chain & Freight.

The company’s continued growth in the face of potential global economic headwinds, is due largely to its competitive advantages. UPS is the largest logistics/package delivery company in the U.S.

Source: Investor Presentation

It operates in a near duopoly, as its only major competitor to date is FedEx. To be sure, Amazon (AMZN) is expanding its own logistics business, but it still remains a customer of UPS as well.

On October 25th, 2022, UPS reported third quarter 2022 results for the period ending September 30th, 2022. For the quarter, the company generated revenue of $24.2 billion, a 4.2% increase compared to Q3 2021. The U.S. Domestic segment (making up 64% of sales) saw an 8.2% gain, while the International posted gains of 1.7% and Supply Chain & Freight segments decreased 6.3% respectively. Adjusted net income equaled $2.99 per share, up 10.3% year-over-year.

UPS also reaffirmed its 2022 outlook, anticipating revenue of about $102 billion, a 13.7% operating margin, about $5.2 billion in dividend payments and $3 billion in share repurchases.

Click here to download our most recent Sure Analysis report on UPS (preview of page 1 of 3 shown below):

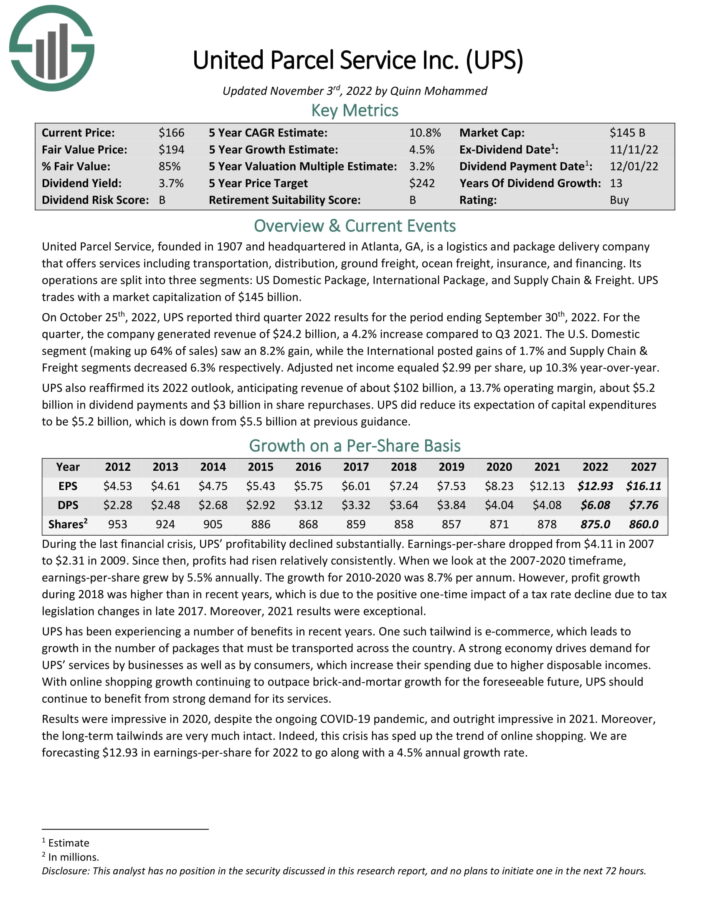

#16—Kraft Heinz (KHC)

Dividend Yield: 4.2%

Percentage of Bill Gates’ Portfolio: 0.28%

Kraft–Heinz is a processed food and beverages company which owns a product portfolio that includes food products such as condiments, sauces, cheese & dairy, frozen & chilled meals, and infant diet & nutrition. The company was created in 2015 in a merger between Kraft Food Group and H. J. Heinz Company, orchestrated by Berkshire Hathaway and 3G Capital.

The Kraft-Heinz Company reported its second quarter earnings results on July 27. The company reported that its revenues totaled $6.6 billion during the quarter, which was down 1% compared to the revenues that Kraft-Heinz generated during the previous year’s period. This was still slightly better than what the analyst community had expected.

Organic sales were up by 10%, driven by price increases, whereas volumes were down slightly. Forex headwinds and M&A were responsible for reported revenue being down. Kraft-Heinz generated earnings-per-share of $0.70 during the second quarter, which slightly beat the consensus estimate. Earnings-per-share were down 10% versus the previous year’s quarter, being impacted by a difficult comparison and adverse currency rate movements.

Click here to download our most recent Sure Analysis report on Kraft-Heinz (preview of page 1 of 3 shown below):

#17—Madison Square Garden Sports Corp.

Dividend Yield: N/A

Percentage of Bill Gates’ Portfolio: 0.26%

Madison Square Garden Sports Corp. is a diversified sports company. It owns multiple sports franchises including the New York Knicks and the New York Rangers. It also owns development league teams such as the Hartford Wolf Pack and the Westchester Knicks of the NBA G League. It also owns e-sports properties including Knicks Gaming and a controlling interest in Counter Logic Gaming (CLG).

#18—Weber Inc.

Dividend Yield: 1.0%

Percentage of Bill Gates’ Portfolio: 0.05%

Weber manufactures and distributes outdoor cooking products, accessories, consumables, and services in the U.S. and internationally. Its products include charcoal and gas grills, smokers, pellet and electric grills, and more.

#19—On Holding AG

Dividend Yield: N/A

Percentage of Bill Gates’ Portfolio: 0.03%

On Holding is based in Switzerland and it develops and distributes sports products worldwide. It offers its products through independent retailers and distributors, online, and stores.

#20—Carvana Co.

Dividend Yield: N/A

Percentage of Bill Gates’ Portfolio: 0.01%

Carvana is an e-commerce platform for buying and selling used cars in the United States. The company’s platform allows customers to research, inspect, obtain financing for and purchase vehicles from their desktop or mobile devices.

#21—Vroom, Inc. (VRM)

Dividend Yield: N/A

Percentage of Bill Gates’ Portfolio: 0.01%

Vroom operates as an e-commerce used automotive retailer in the United States. It operates an end-to-end e-commerce platform for buying, selling, transporting, and delivering vehicles.

Additional Resources

See the articles below for analysis on other major investment firms/asset managers/gurus:

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].