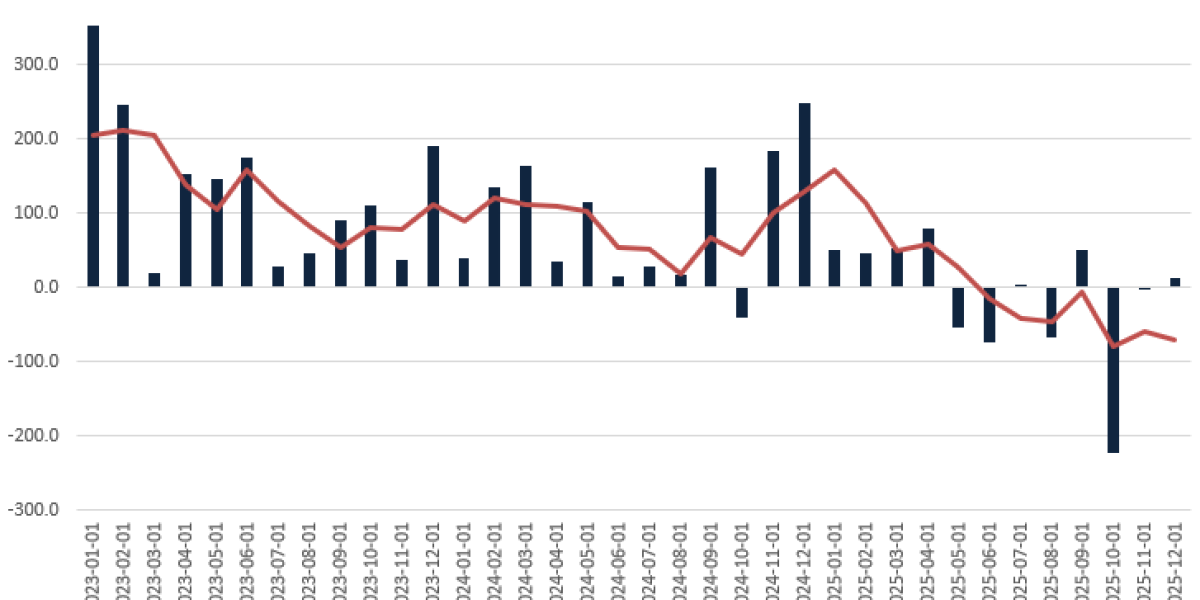

As we get down toward the end of the year, hedge funds and large-scale individual investors have a habit of shedding their losing positions, swallowing the losses now to offset them against capital gains taxes on their profitable holdings. The trades are called tax-loss harvesting, and they open up an interesting opportunity for the daring retail investor.

The opportunity comes due to a statistical quirk of trading history noted by Savita Subramanian, Bank of America’s head of US equity strategy. She points out “a higher potential for a bigger subsequent bounce in these stocks following the selling.”

These stocks, that have lead the losers through the year, tend to outperform from November through January. In fact, according to Subramanian’s analysis, in years when the S&P 500 has seen a negative return through October, the tax-loss harvesting stocks have outperformed the markets during November to January 100% of the time, by an average of 8.2%. The S&P 500 is down 23% so far this year.

Against this backdrop, Subramanian has identified 159 buy-rated stocks that fit the bill. Using TipRanks’ database, we narrowed down the list to 2 names that boast Strong Buy ratings from the rest of the Street. Let’s take a closer look.

Aptiv PLC (APTV)

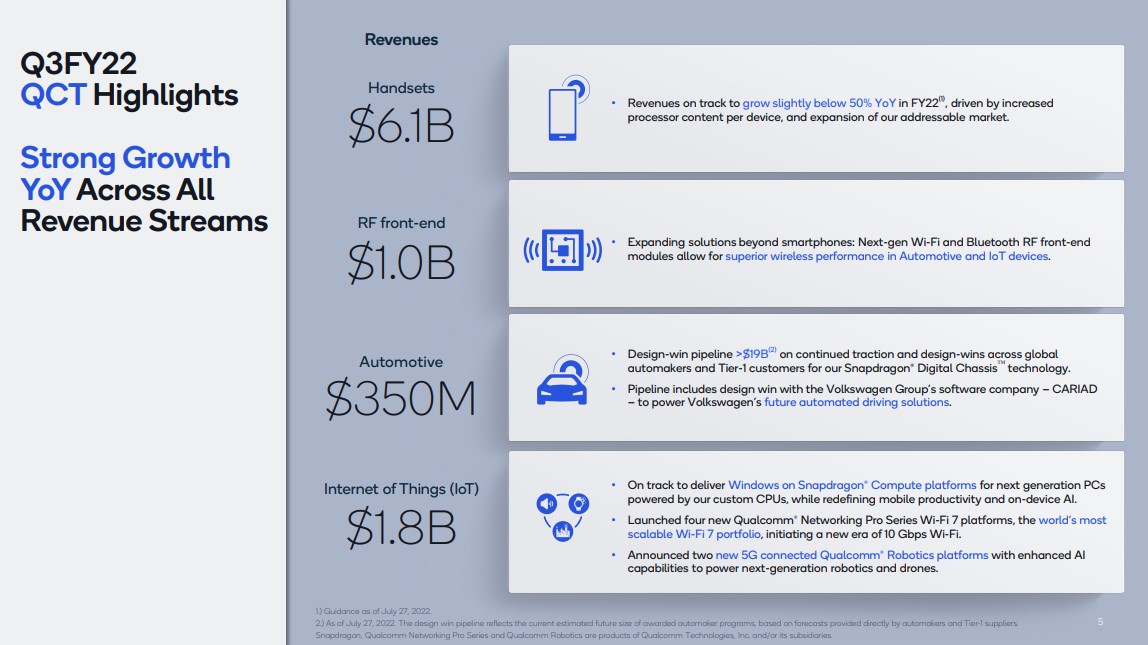

The first stock we’ll look at is Aptiv, an automotive technology company formed when Delphi, one of Detroit’s biggest names in the powertrain supply chain, divested itself of the powertrain and aftermarket auto parts business segments in 2017. The sold-off segments became a division of the transmission giant Borg Warner, while the remainder of the company rebranded as Aptiv and change its focus to automotive tech platforms, including on-road computing and network, and the software packages to enable connected and/or autonomous vehicles. Aptiv’s range of automotive solutions now includes software architecture for connection systems, electrical distribution, vehicle electrification, and smart vehicle capabilities.

While Aptiv traces its roots to Detroit, and the ‘Motor City’s’ legendary auto industry, the company now works in 46 countries and boasts 12 technical centers and 127 manufacturing facilities around the world.

Quarterly revenues since the end of 2020 have been stable at or near $4 billion. The most recent quarterly report, for 2Q22, showed a top line of $4.1 billion, up from $3.8 billion, or 7% year-over-year. However, earnings per diluted share came in at 22 cents, down sharply from the year-ago result of 60 cents EPS.

Like many others, Aptiv hasn’t had a great year, with shares falling 48% since the start of 2022. But things aren’t as bad as they may seem, argues Berenberg Bank analyst Jared Maymon, who sees a clear path forward for Aptiv.

“In our view, Aptiv’s investments in high-voltage electrification, active safety, and user experience are beginning to pay off as OEMs produce more electric vehicles; as a result, we believe APTV is well-positioned to capture meaningful share of an expanded TAM in the long run… In our view, APTV’s Signal & Power Solutions (SPS) content per vehicle (CPV) is rising from ~$500 in internal combustion engine vehicles (ICE) to ~$1,100 in EV’s, which should lead to annual growth over market (GoM) of 4%-6% through 2026E,” Maymon opined.

These comments are clearly bullish, and Maymon uses them to hold up his Buy rating on the stock. His price target, now set at $130, suggests a one-year gain of 54% is in the offing for Aptiv. (To watch Maymon’s track record, click here)

Overall, there are 13 recent analyst reviews for APTV shares, and they break down to 11 Buys and just 2 Holds, for a Strong Buy consensus rating. The stock has a trading price of $85.27 and its $136.67 average price target implies ~60% upside in the next 12 months. (See APTV stock forecast on TipRanks)

EPAM Systems, Inc. (EPAM)

From automotive systems, we’ll now switch our focus to custom software and system design, engineering, and consulting services. EPAM boasts that it can reimagine any company through a ‘digital lens,’ and that it has partnered with over 160 tech firms around the world to deliver cutting edge solutions. EPAM operated in 50 countries, claims more than 280 of the Forbes 2000 firms among its customer base.

This software firm was heading ever upward since its 2012 public debut. It posted more than $2 billion in annual revenue for the first time in 2019, saw that grow to $2.65 billion in 2020, and saw it jump again to $3.76 billion in 2021. The firm took a major hit, however, earlier this year, when Russia invaded Ukraine. EPAM is based in the US and Belarus, and at the end of 2021 it was employing more than 12,000 workers in Ukraine. Shares in EPAM fell sharply after the Russian invasion, and have not yet recovered. EPAM stock is down 49% for this year so far.

Even though the stock is down, EPAM has continued to post strong revenues. In 1Q22, the company showed a top line of $1.17 billion, and that was up to $1.195 billion for 2Q22. Year-over-year, the 2Q revenues were up 35%. Earnings results were mixed, however. The GAAP EPS showed a drop of 83% y/y, to 32 cents per diluted share, while the non-GAAP earnings were up 16% y/y, from $2.05 per diluted share to $2.38. The company does have deep pockets, however; even after burning 10% of its cash holdings in 1H22, EPAM still reported having $1.29 billion in cash and liquid assets available at the end of the second quarter.

All of this has caught the attention of 5-star analyst James Faucette of Morgan Stanley, who remains bullish on the IT firm despite freely acknowledging the risks it faces with so much exposure to the conflict in Eastern Europe.

“Despite the challenging operating environment, demand continues to be robust for EPAM’s services, driven largely by the secular trends we’ve seen over the last year, with project work around modernization of applications, movement to the cloud, data analytics, and platform engineering, among others,” Faucette noted.

“We remain constructive on EPAM’s execution abilities around recruiting and delivery, as well as the company’s ability to deliver compounding growth going forward. We continue to believe that EPAM is among the best-positioned IT Services companies to benefit from digital transformation spending given its 100% digital exposure, agile development-focused nearshore workforce, and disciplined acquisition-focused capital allocation strategy,” the analyst added.

Looking forward, Faucette rates EPAM shares an Overweight (i.e. Buy), and sets a $480 price target that implies a 42% upside over the course of the coming year. (To watch Faucette’s track record, click here)

The Morgan Stanley view on EPAM is no outlier; all 11 of the recent analyst reviews are positive, for a unanimous Strong Buy analyst consensus. The average price target of $470, with the trading price of $338.29, gives a one-year upside potential of ~39%. (See EPAM stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.