GlobalStock/iStock through Getty Photographs

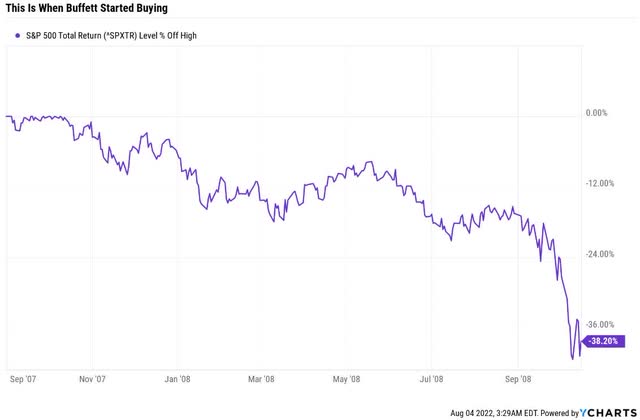

Many people are desirous to “be grasping when others are fearful.” Or no less than we are saying we’re. Who does not need to rating a Buffett-like blue-chip discount when the market is promoting off a blind panic?

YCharts

Quite a bit of individuals, and never simply those that are terrified the market will carry on falling decrease. I’ve just lately heard from some Dividend Kings members who’re 10% to 62% in money as a result of it appears simply so apparent that shares need to fall decrease.

Why? There are such a lot of causes.

- the 2-10 yield curve is now 44 foundation factors inverted, probably the most since August 2000

- meaning the bond market is probably the most assured in 22 years {that a} recession is coming comparatively quickly

- the Fed is mountaineering on the quickest fee in 40 years

- some analysts (like Cambridge’s Mohamed A. El-Erian) suppose the Fed will hike 75 factors three extra instances by the tip of the 12 months (4.5%)

- the Fed has by no means succeeded in attaining a gentle touchdown when inflation began above 5% (it is 9.1% now)

- the financial information says a recession MIGHT start in 4.5 to five months

- the typical recessionary bear market backside is -36% since 1960

- the blue-chip consensus is that if we get a recession, shares backside at -30% to -53%, relying on its severity

- that is doubtlessly 18% to 45% decrease than now

However are you aware what? It is doable that we would nonetheless keep away from a recession and that June sixteenth’s -24% low on the S&P 500 was the last word backside.

How on earth is that doable? As Citigroup factors out, there’s nonetheless a street to a gentle touchdown for the Fed.

- the job market is so sturdy that buyers have loads of cash to spend

- gasoline costs have fallen 20% from their peak, and client sentiment is prone to rise in consequence

- provide chains are steadily de-tangling themselves, and commodity costs are falling quickly

- the Fed mountaineering to 4% and even 5% is not any assure of a recession

- within the Nineties, we had charges as excessive as 6% with a booming financial system

And even IF we get a recession, Goldman and Citi nonetheless suppose the June sixteenth backside may need been as little as shares fall. How on earth is that doable?

Ben Carlson

As a result of within the 1953 recession, shares fell solely 15%, not a bear market.

Within the 1957 recessionary bear market, shares fell 21%, simply as they did within the 2018 bear market with no recession.

Within the 1960 recession, shares fell about what they’ve up to now.

Within the 1980 recession, they fell 17%, lower than in 2011’s and 2018’s non-recession bear markets.

In 1990 the market narrowly prevented a bear market totally.

Does it make logical sense for shares to have bottomed on June 16? To many traders, it does not appear so. It appears so apparent that shares simply need to fall much more than it might sound reckless and even downright silly to be shopping for shares proper now.

The principle objective of the inventory market is to make fools of as many males as doable.” – Bernard Baruch

When everybody agrees on the identical factor on Wall Road, usually the other occurs.

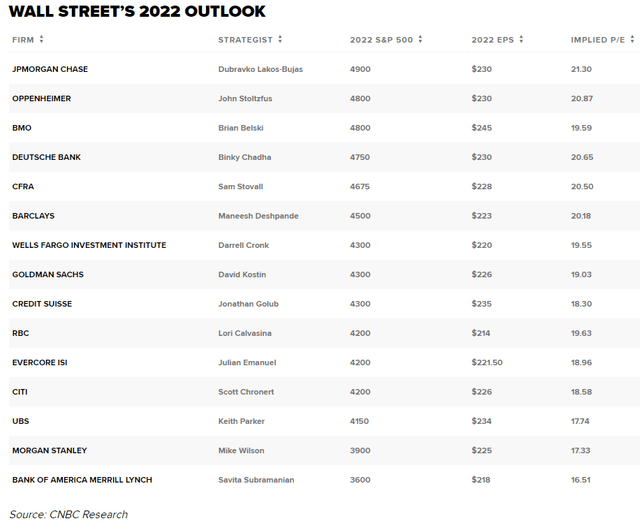

Does that imply that the present rally is destined to proceed? Doubtlessly all the way in which to new file highs? JPMorgan believes so, with a 4,900 worth goal on the S&P for the tip of the 12 months.

- new file highs this 12 months

- the bear market lasting lower than a 12 months

- and doubtlessly adopted by a 2023 bear market

CNBC

However what if neither excessive is true? What if the job market is simply too sturdy for the Fed to cease tightening however not weak sufficient for us to fall right into a recession? What if shares simply commerce sideways for a 12 months, biking up or down a bit however by no means hitting new highs or lows?

Sounds loopy proper? However on this Pandemic, we have seen numerous loopy issues that after had been thought inconceivable.

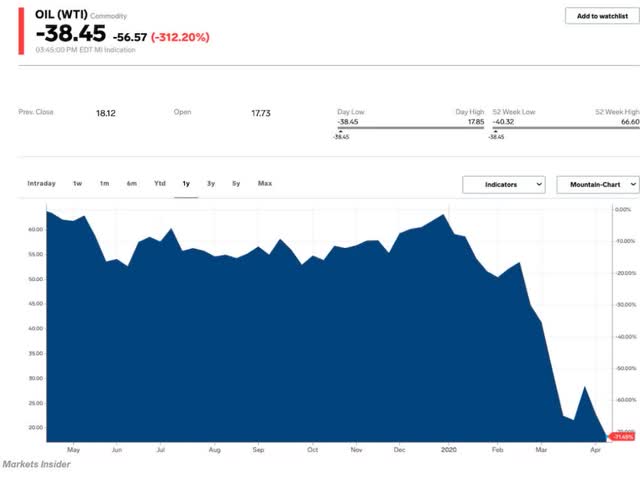

Enterprise Insider

On April 20, 2020, oil hit -$38 per barrel for a single day. So is it loopy to imagine there may be no less than an opportunity that shares do not make anybody appear like a genius within the subsequent 12 months?

Is it implausible to suppose the market would possibly frustrate the bulls AND the bears?

In that case, there will probably be no winners... besides for:

- long-term traders who ignore this loopy noise and simply maintain

- dollar-cost averagers

- dividend re-investors

- particular person blue-chip discount hunters

It does not take a recessionary bear market low for excellent dividend blue-chips to commerce at loopy low valuations.

So let me present you why you would possibly need to think about at this time PulteGroup (PHM) and Lincoln Nationwide (LNC) are two unbelievable bear market blue-chip bargains.

Each are quickly rising firms, and each commerce at beneath 5X earnings at this time, pricing in deeply unfavorable progress.

This creates the chance for Buffett-like return potential from blue-chip bargains hiding in plain sight.

- together with the potential for 50% CAGR returns via 2024

- and a quadruple inside 5 years

Lincoln Nationwide: One Of The Finest Insurance coverage Firms You have By no means Heard Of

Additional Studying:

- Lincoln Nationwide: A Buffett-Model Anti-Bubble Hidden Gem

- a complete have a look at LNC’s funding thesis, progress outlook, danger profile, valuation, and complete return potential

Causes To Doubtlessly Purchase LNC In the present day

- 87% high quality low-risk 12/13 Tremendous SWAN (sleep nicely at evening) insurance coverage firm

- the 121st highest high quality firm on the Grasp Checklist (76th percentile)

- 90% dividend security rating

- 12-year dividend progress streak (yearly for the reason that Nice Monetary Disaster)

- 3.9% very protected yield

- 0.5% common recession dividend minimize danger

- 1.5% extreme recession dividend minimize danger

- 28% traditionally undervalued (potential very sturdy purchase)

- Honest Worth: $80.24

- 5.5X ahead earnings vs. 8.5X to 9.5X historic (Anti-bubble blue-chip priced for -6% progress)

- A- unfavorable outlook credit standing = 2.5% 30-year chapter danger

- seventieth trade percentile danger administration consensus = good

- 7% to 17% CAGR margin-of-error progress consensus vary

- 12.3% CAGR median progress consensus

- 5-year consensus complete return potential: 20% to 29% CAGR

- base-case 5-year consensus return potential: % CAGR (X greater than the S&P consensus)

- consensus 12-month complete return forecast: 30%

- Basically Justified 12-Month Returns: 76% CAGR

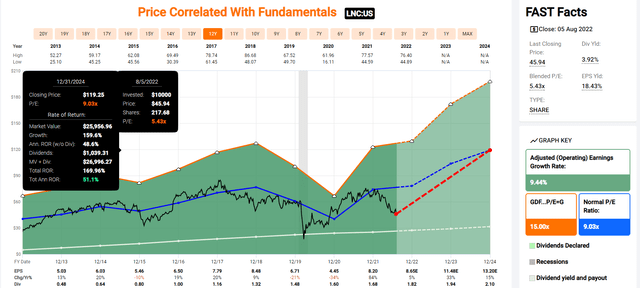

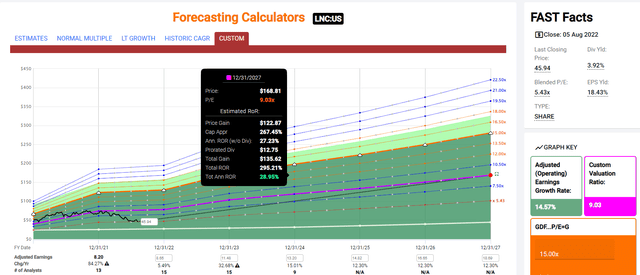

LNC 2024 Consensus Whole Return Potential

(Supply: FAST Graphs, FactSet)

If LNC grows as anticipated and returns to its historic 9X earnings, it may triple by 2024 and ship 51% annual complete returns.

LNC 2027 Consensus Whole Return Potential

(Supply: FAST Graphs, FactSet)

If LNC grows as anticipated via 2027 and returns to its historic 9X earnings, it may quadruple and ship 29% annual returns.

- Buffett-like returns from a blue-chip discount hiding in plain sight

Why is LNC such an unbelievable discount?

FAST Graphs, FactSet

As a result of it is priced as if we had been in a extreme recession, the one instances it is traded at such a low P/E is through the Pandemic, the GFC, and the 2011 bear market, a recession scare that started with the market buying and selling at 13X earnings.

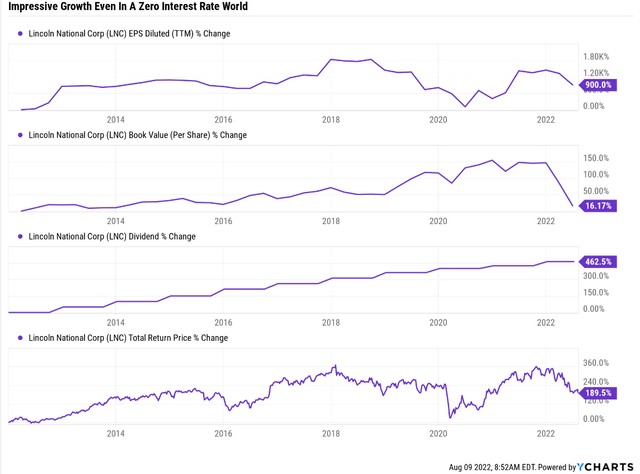

Will not falling rates of interest damage insurance coverage firms’ means to develop earnings?

YCharts

A-rated insurance coverage firms like LNC have come out of a decade of stricter laws and rates of interest that had been the bottom in human historical past.

LNC managed to develop its earnings 900% during the last decade and its dividend by virtually 6X.

And that was within the worst doable rate of interest setting within the historical past of the insurance coverage trade.

Moody’s expects 10-year treasury yields to normalize to 4% over time, which might be a boon to the insurance coverage trade.

- their value of capital is principally insurance coverage float, i.e. “free”

- and long-term yields decide the web yields on their funding portfolios

- rising charges = pure revenue for insurance coverage firms

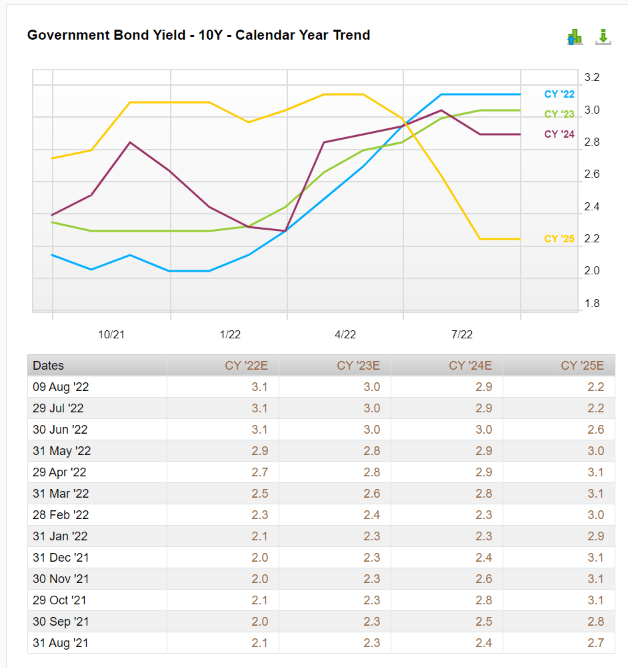

What if Moody’s is mistaken and 10-year yields do not return to 4%?

FactSet Analysis Terminal

The FactSet blue-chip economist consensus is for 10-year yields to crash in 2025, presumably because of progress considerations and elevated bond demand from retirees.

Nevertheless, if charges merely normalize to the two% to three% vary we noticed within the 2010s, as economists count on, then LNC will nonetheless have the ability to continue to grow at its 8% to 9% post-GFC fee.

For an organization priced at 5.5X earnings, actually a few of the lowest valuations in its historical past, LNC is a really compelling high-yield worth proposition.

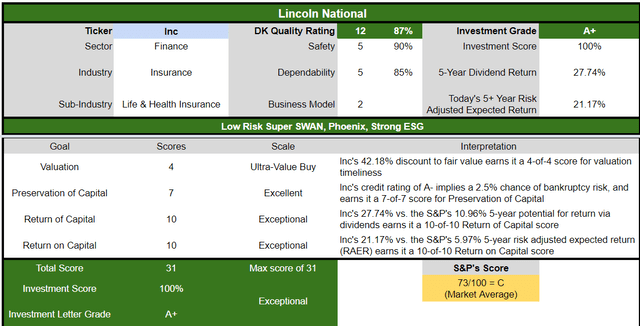

LNC Funding Determination Rating

DK

(Supply: DK Automated Funding Determination Software)

LNC is an distinctive, high-yield month-to-month blue-chip possibility for anybody snug with its danger profile.

- 42% low cost vs. 5% market premium = 47% higher valuation

- 3.9% yield vs. 1.6% yield

- 70% higher consensus long-term return potential

- 3.5X higher risk-adjusted anticipated return over the following 5 years

- 2.5X greater consensus dividends over the following 5 years

And what if long-term charges do come down considerably within the coming years? Then guess what’s prone to profit? Residence builders.

PulteGroup: Double-Digit Progress That is Loopy, Silly, Low-cost

Additional Studying:

- PulteGroup Is A Desk Pounding Sturdy Purchase

- a complete have a look at LNC’s funding thesis, progress outlook, danger profile, valuation, and complete return potential

Causes To Doubtlessly Purchase PHM In the present day

- 78% high quality medium-risk 12/13 Tremendous SWAN (sleep nicely at evening) house builder

- 84% dividend security rating

- 2-year dividend progress streak

- 1.4% very protected yield

- 0.5% common recession dividend minimize danger

- 1.85% extreme recession dividend minimize danger

- 35% traditionally undervalued (potential very sturdy purchase)

- Honest Worth: $67.16

- 4.5X ahead earnings vs. 10.5X to 11.5X historic (Anti-bubble blue-chip priced for -9% progress)

- 4.3X cash-adjusted trough earnings (factoring within the recession)

- BBB- steady outlook credit standing = 11% 30-year chapter danger

- 56th trade percentile danger administration consensus = common

- 8% to 13% CAGR margin-of-error progress consensus vary

- 11% CAGR median progress consensus

- 5-year consensus complete return potential: 24% to 30% CAGR

- base-case 5-year consensus return potential: % CAGR (X greater than the S&P consensus)

- consensus 12-month complete return forecast: 22%

- Basically Justified 12-Month Returns: 57% CAGR

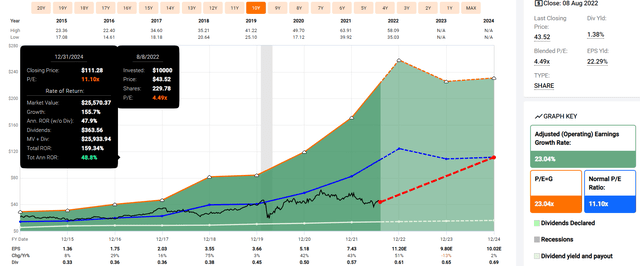

PHM 2024 Consensus Whole Return Potential

FAST Graphs, FactSet

If PHM grows as anticipated and returns to its historic P/E a number of, it may virtually triple by 2024 and ship 49% annual complete returns.

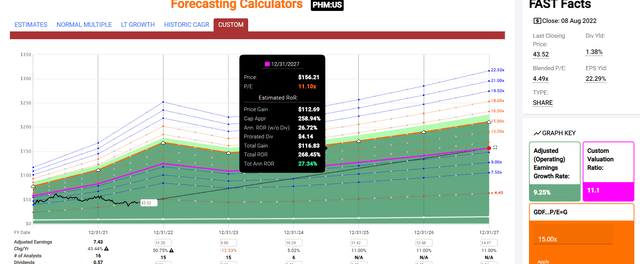

PHM 2027 Consensus Whole Return Potential

FAST Graphs, FactSet

If PHM grows as anticipated via 2027 and returns to its historic P/E, it may virtually quadruple and ship 27% annual returns.

- Buffett-like returns from a blue-chip discount hiding in plain sight

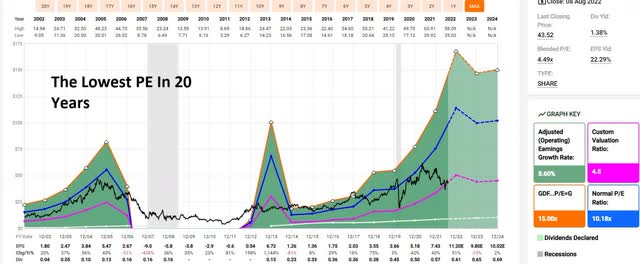

Why is Pulte such a possible Buffett-style anti-bubble “fats pitch?”

FAST Graphs, FactSet

As a result of it is buying and selling at a decrease P/E than through the Pandemic crash and at the most effective P/E in 20 years. Is the housing market lifeless? Possibly within the quick time period, however the long-term demographics are distinctive.

Morgan Stanley thinks that housing will see a 10-year to 20-year secular mega-boom, and this is why.

-

There are 150 million Millennials and Gen Zers vs. 75 million boomers

-

And over the following 20 years, they are going to virtually all be beginning households and reaching peak earnings

The Census Bureau estimates that the US wants 1.5 million new housing begins every year to maintain up with the inhabitants demand. However for the reason that Nice Recession, from 2007 via 2020, we have had fewer housing begins than this. To be exact, a complete provide shortfall of between 3 million and 5 million properties.

Have you learnt what this implies? If house builders elevated functionality by 33% to 2 million per 12 months, it may take as much as 10 years to shut the provision hole.

What does this doubtlessly imply for Pulte?

- $1.8 billion in consensus buybacks in 2022 and 2023: 10% of current shares

A continued provide scarcity for as the following few years, if not the following decade.

And naturally, let’s not overlook that long-term charges are anticipated to fall considerably within the coming years (2.2% consensus in 2025).

Pulte is the last word blue-chip coiled spring and is actually buying and selling at the most effective P/E in twenty years.

Over the long run, analysts count on PHM to ship 12.5% CAGR long-term returns.

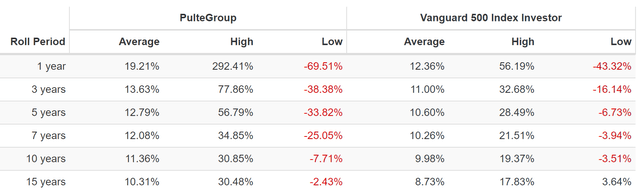

PulteGroup Rolling Returns Since 1985

(Supply: Portfolio Visualizer Premium)

That is just like its common rolling returns during the last 37 years.

However from bear market lows? Like we’re in now? PHM is able to 31% annual returns for the following 10 to fifteen years.

- 57X return potential over 15 years

You do not want crypto to attain life-changing, mind-blowing good points – you simply want the last word coiled spring blue-chip discount.

Backside Line: Whether or not The Market Trades Up, Down, or Sideways, These 2 Dividend Blue-Chips Are Doubtlessly Set To Soar And Too Low-cost To Ignore

Is the bear market over? Most economists do not suppose so – traditionally, the worst is but to return.

Day by day Shot

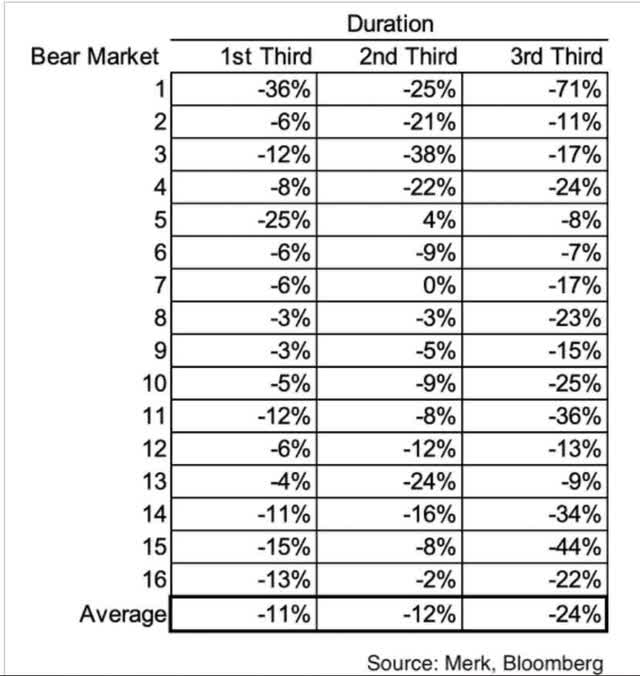

60% of historic bear market downturns are typically within the last third of a bear market.

That is why it is essential to be ready for something, whether or not shares commerce up, down, or sideways.

If we get a recession and shares fall one other 20% to 40%? Then every little thing will go on sale.

If we keep away from recession and June 16 proves to be the last word low? Nicely then LNC and PHM are nonetheless buying and selling at valuations you solely ever see in extreme recessionary bear market lows.

It is at all times and without end a market of shares, not a inventory market. One thing nice is at all times on sale, and within the case of LNC and PHM, they are not simply on sale; they’re face slapping, desk pounding, doubtlessly nice buys.

I’ve no real interest in worth traps or cigar butts. A dying enterprise is of no curiosity to me even at 2X earnings. However 5X earnings for world-class companies like these rising at double-digits? Now that is one thing I can get enthusiastic about.

The distinction between nice deep worth investing and the following bankrupt piece of trash is pure fundamentals, margin of security, and prudent risk-management.

For anybody snug with LNC and PHM’s danger profiles, these are two unbelievable dividend blue-chips doubtlessly set to quadruple inside 5 years.