Customer Put up by Tom Hutchinson, Chief Analyst, Cabot Dividend Investor

Many view dividend shares as boring investments that your grandfather talked about whereas he smoked his pipe and pulled up his trousers.

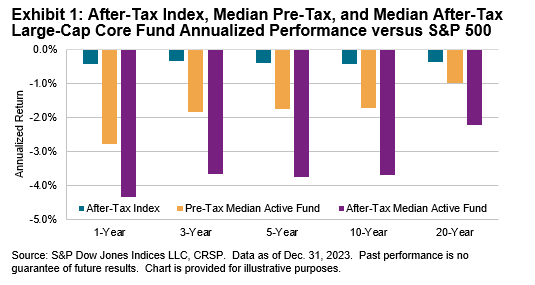

Nevertheless that isn’t true. Dividend-paying shares as a gaggle have vastly outperformed non-dividend payers over time. The dividend contribution, along with the usual of companies which will always pay dividends, delivers stellar outcomes over time. The massive returns are there, too. Truly, 4 of the “Magnificent 7” shares are dividend payers.

In spite of everything, the unfavourable stereotype isn’t far off with utility shares. They’re boring, grandfatherly shares.

Utilities are companies that current water, vitality, and electrical power to properties and corporations. They operate monopolies or near monopolies of their areas, and the costs they price are usually determined by regulatory our our bodies.

They usually pay sturdy dividend yields and provide extraordinarily defensive earnings that proceed in any kind of monetary system.

Due to this, utility shares are inclined to have extreme dividend yields, with fixed dividend improvement over time.

You presumably can receive the itemizing of extreme dividend shares (along with very important financial ratios harking back to dividend yields and payout ratios) by clicking on the hyperlink beneath:

Nevertheless, aside from the dividend and defensive traits, they’ve generally provided little else. Good shares are inclined to outperform the indexes in flat or down markets and underperform them in bull markets. They’re the market sector that almost all fastidiously resembles bonds.

That’s not primarily a foul issue. Utilities provide diversification and stability to a portfolio. Markets don’t on a regular basis go better. It’s good to have utilities inside the portfolio when totally different shares sputter. They make the journey to longer-term success easier and fewer bumpy.

Nevertheless utility shares are morphing into one factor else as a result of the world shortly transforms. After being stagnant for a few years, electrical power demand is exploding. Artificial intelligence (AI) requires enormous portions {of electrical} power for the data services that dwelling the laptop components. Electrical automotive proliferation and shortly rising onshoring of manufacturing are moreover juicing demand.

AI is transforming the utility sector. Now, the right utility shares boast each factor that I mentioned above, plus far more. Skyrocketing demand is making electrical utilities improvement firms as correctly.

The altering environment is together with one different vastly constructive dimension to these underrated shares. And there could also be nonetheless time to get in ahead of the pack. The combination of safety and improvement is the right of every worlds.

NextEra Energy, Inc. (NEE)

NextEra Energy (NEE) is the nation’s largest producer of renewable vitality and a very powerful utility inside the nation. It must be in a extremely excellent place to revenue going forward.

NEE has historically been a celeb performer for a utility. However it has stumbled in latest occasions as inflation and rising charges of curiosity made utilities an out-of-favor sector. Nevertheless points are altering. NEE has been trending better since April. Nevertheless the price stays to be 25% beneath the all-time extreme.

NEE isn’t only a few boring, stodgy utility stock with the doable revenue of fantastic timing. It has a protracted observe file of not solely vastly outperforming the utility sector nonetheless the overall market as correctly. Earlier to 2023, NEE full returns better than doubled these of the S&P 500 inside the prior five- and ten-year durations.

How would possibly a utility stock current such returns? NextEra shouldn’t be an weird utility.

NextEra Energy provides all the advantages of a defensive utility plus publicity to the fast-growing and very sought-after numerous vitality market. It’s the world’s largest utility. It’s a monster with about $26 billion in annual earnings and $155 billion market capitalization. Earnings improvement has far exceeded what is commonly anticipated of a utility.

NEE is 2 companies in a single. It owns Florida Vitality and Mild Agency, which is among the many best regulated utilities inside the nation, accounting for about 55% of revenues. It moreover owns NextEra Energy Sources, the world’s largest generator of renewable vitality from wind and picture voltaic. It accounts for about 45% of earnings and provides the subsequent diploma of improvement.

NextEra is the right of every worlds: safety and improvement. There could also be moreover an unlimited runway for improvement initiatives. NextEra has deployed over $50 billion in the previous few years for improvement expansions and acquisitions. It moreover has an enormous problem backlog.

As a result of the nation’s largest producer of recent vitality, NextEra has an unlimited profit going forward. The skyrocketing improvement in electrical power demand is primarily pushed by information services and AI. Experience companies are extraordinarily carbon-conscious and might go for clear vitality alternate choices at any time when doable to reduce their carbon footprint.

American Electrical Vitality Agency, Inc. (AEP)

American Electrical Vitality is among the many largest regulated utilities inside the U.S. with over $20 billion in annual earnings. It provides electrical power period, transmission, and distribution to 5.6 million retail and wholesale purchasers in 11 states.

The utility in the intervening time generates 29 gigawatts (GW) yearly. A gigawatt is a unit of power equal to 1 billion watts {of electrical} power and is normally used to elucidate large-scale electrical power period.

Although {the electrical} power period is essential, American earns nearly all of revenues from transmission and distribution. It has a very powerful transmission neighborhood inside the U.S. with 40,000 transmission traces. It moreover operates the second-largest distribution neighborhood inside the nation, overlaying 22,000 distribution miles and 5.6 million purchasers. The final system in the intervening time gives with a whole of over 37 GWs {of electrical} power.

The transmission enterprise is a distinguishing attribute of American Electrical Vitality, in the intervening time accounting for 55% of working earnings. Shoppers are drawn to its suppliers because of its superior neighborhood in a position to delivering fixed huge power. The company owns additional of the highest-voltage transmission traces (765-kV traces) than all totally different U.S. utilities combined. These traces transmit large portions {of electrical} power, primarily bulk power from period sources to distribution services, over prolonged distances with far increased effectivity and reliability compared with lower voltage traces.

The neighborhood of high-voltage traces is in extreme and rising demand because of shortly rising needs for big portions {of electrical} power that could be moved spherical cheaper, faster, and further successfully. The neighborhood could be extraordinarily troublesome to duplicate by rivals. Establishing these traces requires settlement between utilities, regulators, and landowners with competing pursuits and will take large portions of time and costs to erect.

Historically, AEP has been a steady utility stock that delivered as marketed. It has supplied a strong dividend yield with lots lower volatility than the final market. It has a beta of merely 0.39, which implies it’s simply 39% as dangerous and the S&P 500.

It sometimes did what utilities are presupposed to do: Outperform the S&P in flat and down markets and underperform it in bull markets. Nevertheless there are good causes to contemplate that effectivity might presumably be lots higher going forward because of a lots better diploma of improvement.

Greater improvement is being pushed by the shortly rising electrical power demand inside the nation. The growth isn’t conjecture each. American has already secured an additional 24 GWs of incremental load improvement via 2029 with signed purchaser financial agreements.

About 75% of the demand is from information services. That’s an unlimited improve to the current 37 GW system. About 75% of the demand is from information services. And that’s solely the beginning. The utility acknowledged that it has inquiries about new load demand totaling 190 GWs.

Every of these utility shares have a strong AI-fueled tailwind at their once more and look poised for continued outperformance.

Further Finding out

You presumably can see additional high-quality dividend shares inside the following Constructive Dividend databases, each based mostly totally on prolonged streaks of steadily rising dividend funds:

Thanks for learning this textual content. Please ship any strategies, corrections, or inquiries to [email protected].

rn

rn

Source link ","writer":{"@kind":"Individual","identify":"Index Investing Information","url":"https://indexinvestingnews.com/writer/projects666/","sameAs":["https://indexinvestingnews.com"]},"articleSection":["Investing"],"picture":{"@kind":"ImageObject","url":"https://www.suredividend.com/wp-content/uploads/2022/10/Excessive-Dividend-Picture.jpg","width":0,"top":0},"writer":{"@kind":"Group","identify":"","url":"https://indexinvestingnews.com","emblem":{"@kind":"ImageObject","url":""},"sameAs":["https://www.facebook.com/Index-Investing-News-102075432474739","https://twitter.com/IndexInvesting_"]}}

Source link