This investor constructed a multimillion-dollar precise property portfolio with low-money-down loans and little cash-to-close. On account of his good “rinse and repeat” method, he’s quickly scaled from zero to 13 rental fashions in merely 4 years, all whereas accumulating a whole bunch of {{dollars}} of cash stream a month. He would have not at all been ready to get to this place if he hadn’t adopted a way many merchants are too scared to try.

Mike Johnson knew one of many easiest methods to take better career risks was to have a backup plan. The final phrase passive income plan? Rental properties. Nevertheless he didn’t want to put 20% to 25% down on each property he bought, so he started the place many merchants do—residence hacking. 4 years later, he’s continued his repeatable residence hacking method, shopping for a model new property yearly, dwelling in a single unit, and renting out the others.

This has allowed Mike to assemble a portfolio worth $3.4 million in merely 4 years whereas searching for in B+ or A-class neighborhoods and taking residence a healthful amount of cash stream. Nevertheless he has dealt alongside together with his truthful proportion of issues—squatters, non-paying tenants, and loads of purple paint. Mike nonetheless says investing has been an infinite win for him, and chances are you’ll repeat his comparable method!

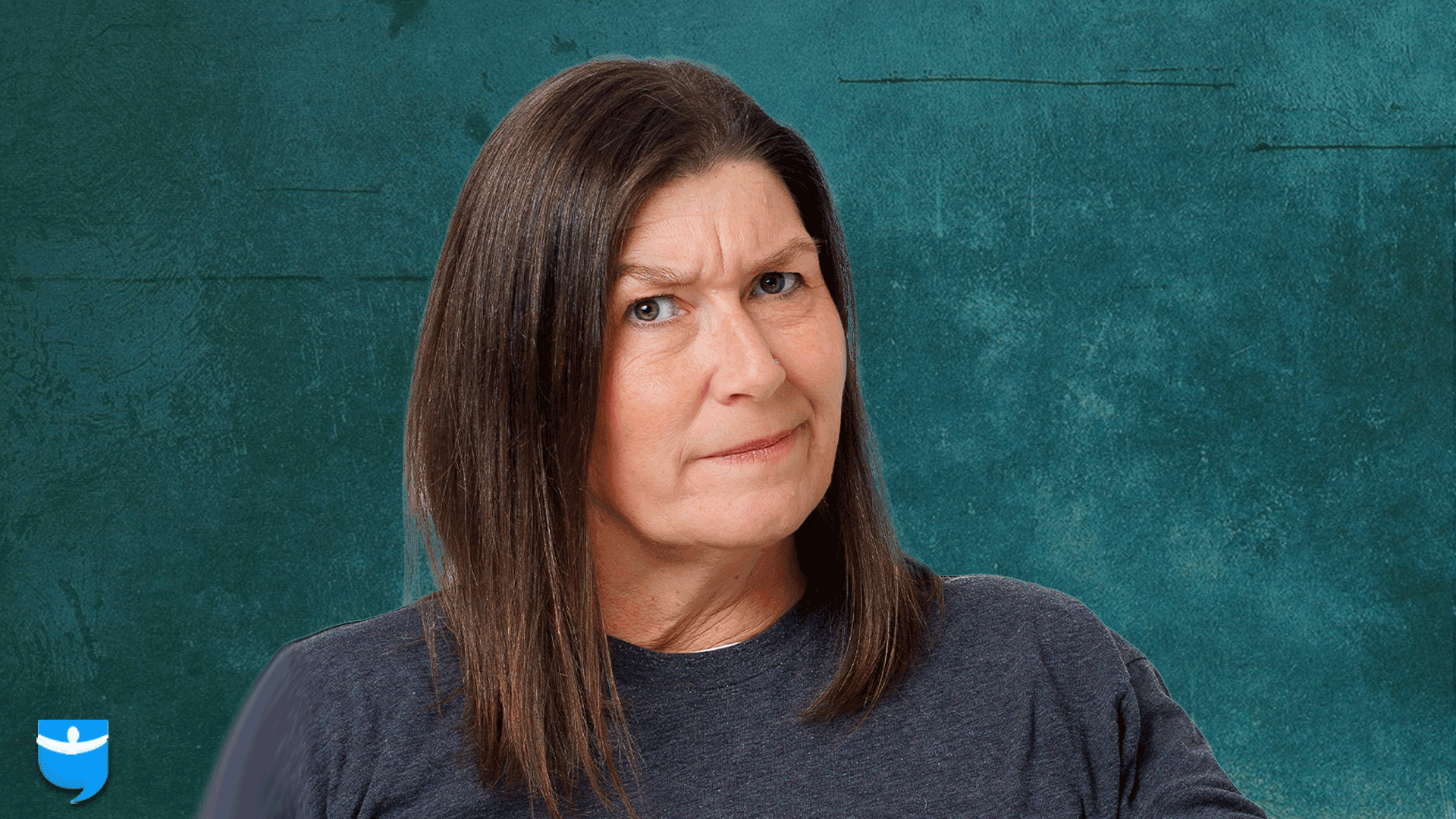

Dave Meyer:

This investor bought a property worth one and a half million {{dollars}} in a tremendous neighborhood in a major US metropolis with solely $35,000 cash in 2024. It’s actually doable. Hey mates, welcome once more to the BiggerPockets podcast. I’m Dave Meyer, head of precise property investing proper right here at BiggerPockets. And proper this second on the current we’re talking with Mike Johnson, an investor in Chicago. Mike started his investing journey with a $13,000 down payment on a duplex in 2021, and he has residence hacked his strategy into 13 fashions in merely 4 years now. He’s dwelling in a single amongst Chicago’s most fascinating neighborhoods with a whole bunch of {{dollars}} in month-to-month cashflow and the potential for tens of hundreds of thousands in appreciation over the next couple of years. And Mike isn’t doing one thing that the overwhelming majority of people can’t do. He’s found presents within the market, he’s putting down as little as doable. He’s completed comparatively hands-off renovation and now he’s sitting on this unimaginable portfolio. Merely a couple of years later, Mike proper this second goes to tell us how his deep analysis of investing selections has led to precise property throughout the first place. How certainly one of many additional extreme draw back tenants I’ve ever heard of led to a free rehab for him and why he’s a fan of the terribly prolonged shut. So proper right here we go. That’s me talking with investor Mike Johnson. Mike, welcome to the podcast. Thanks for being proper right here.

Mike Johnson:

Good to fulfill you Dave. Thanks for having me. Excited to be proper right here.

Dave Meyer:

Yeah, so give us a bit little little bit of background. What have been you doing when you first obtained into precise property and the best way manner again was that?

Mike Johnson:

So I obtained into precise property 4 years up to now all through Covid in 2020, and I was a medical machine product sales rep that purchased models throughout the working room. In order quickly as Covid occurred, now we have been restricted entry to hospitals, which was a major part of my day. Mockingly. This was concerning the equivalent time the place I had no pupil debt anymore and I had this nest egg that was setting up. So naturally I started looking at funding autos on the place do I park my money for top-of-the-line return long term? And that’s after I stumbled upon precise property and sort of started edging my strategy to my first deal.

Dave Meyer:

Good. Congrats on paying off your pupil debt, by the best way through which. That’s on a regular basis a extraordinarily good feeling and an important step on anyone’s early retirement or financial freedom journey.

Mike Johnson:

Yeah.

Dave Meyer:

So inform me a bit bit regarding the types of investments you’re keen about on account of I consider people rise up to now the place you’ve received a bit little little bit of capital, it’s a tremendous place to be. You would possibly choose to enter flipping, you are able to do long-term leases, short-term leases. What appealed to you first about precise property?

Mike Johnson:

I do know when some people spend cash on precise property, they use it as a way to an end to get out the every single day grind, cease their W2 and kind try this full time. I’ve the type reverse technique to that the place I have the benefit of my W2 job. So I’m a long-term buy andhold investor. I’ve completed 4 residence hacks primarily at this stage in my funding journey. In order a lot as 13 fashions all through 4 buildings. And for me it’s truly merely to assemble that passive income and it offers me security in my W2 job so that I can take additional career risks with positions to get new experiences which is able to entail a pay decrease. Whereas if I didn’t have this as a fallback, presumably I is perhaps a lot much less inclined to taking these risks in my W2, the place long-term I consider that’s going to pay dividends for bigger diploma roles that require that you simply’ve received some diversified experiences. And so it’s actually helped progress me in my W2 career and it’s a pleasing side hustle. It’s your particular person enterprise, it’s yours, and it’s pleasing to see it develop.

Dave Meyer:

So set the seed. The place do you reside and is that the place you chose to take a place as properly?

Mike Johnson:

It’s. So I was born and raised in Wisconsin, small metropolis of 5,000 people, nevertheless I moved to Chicago about seven and a half years up to now. So I’ve been proper right here ever since I took the medical machine product sales job. Nevertheless apparently enough, my first deal was actually in Milwaukee. We’ll sort of get into the reason why I chosen Milwaukee Market, nevertheless then the alternative three presents have been in Chicago the place I for the time being reside.

Dave Meyer:

Alright, yeah, let’s get into it. I indicate must you take heed to the current, Henry has, I actually just like the time interval he dubbed of Lake Affect cashflow, which is just that anyplace throughout the Good Lakes space, the Midwest there’s extreme potential for cashflow. I consider Chicago falls into that, nevertheless Milwaukee is on a regular basis sort of a sort of standouts. After getting a take a look at lists of places that do provide cashflow, Milwaukee’s on a regular basis up there. So is that why you targeted it?

Mike Johnson:

It’s. So for me, actually, as quickly as I obtained into the BiggerPockets podcast, the books did the free webinars on recommendations on the way to underwrite after I sort of took that in. I appeared on the markets, correct, a duplex two to 4 unit in Chicago versus Milwaukee, dramatic distinction throughout the cash that it’s good to make investments. So for me, in my geography, for my medical machine product sales job, I coated Milwaukee, loads of rural Illinois and components of Chicago. So I’d technically switch and dwell in Milwaukee and nonetheless do my day job, nevertheless I’d’ve to take a place far a lot much less cash. And so for me, Milwaukee is probably going one of the carefully concentrated duplex cities throughout the nation. And so there’s loads of selections. And so that’s why I decided that if there’s any fires that I’ve to position out particularly particular person for some trigger I’d drive there and be there in an hour 20. So merely having that comfort of my first funding property, that’s sort of the entire the reason why I chosen Milwaukee.

Dave Meyer:

Oh, cool. And did you residence hack? Did you actually dwell there?

Mike Johnson:

So I did a ten% down proprietor occupancy mortgage. And it’s sort of humorous. So correct spherical after we closed, my geography modified from, they took away all my Wisconsin they often gave me Iowa. So I known as my lender on account of I known as my lender and I said, Hey, I obtained to easily be reliable with you. Proper right here’s my geography and when it’s shifting throughout the new fiscal 12 months, I can’t switch Milwaukee, nevertheless what do I do? And he merely said, as long as you alter your insurance coverage protection, he’s like, you had intent after we closed to dwell there, we’re okay with it, nevertheless clearly affirm with us, write us a letter telling us what occurred. And I had the documentation correct with my GI changes yearly, and so I not at all ended up transferring into that property, nevertheless I did do a ten% down proprietor occupancy mortgage. So that was November of 2020 and the duplex was 128,000 in Milwaukee. To offer some context,

Dave Meyer:

All correct, good. 128 grand, you set 10% down. So I assume with closing costs and all of the items, someplace spherical 17, 18, presumably as a lot as 20 grand was sort of like what you needed to get into that deal.

Mike Johnson:

Yeah, 19,000 is definitely what I put into the deal itself had a 2.8% worth. So actually everybody is aware of that the fees have been very low at the moment.

Dave Meyer:

Do you take note what it took to carry that? What was your month-to-month expense all in?

Mike Johnson:

So my PIT, I indicate correct now’s it’s 9 22, so principal insurance coverage protection, taxes and curiosity, the setting up’s bringing in 1700 a month.

Dave Meyer:

Wow, that’s superior.

Mike Johnson:

There’s a nice unfold on there, and I’ve had the equivalent tenants all 4 years.

Dave Meyer:

Wow.

Mike Johnson:

Zero vacancy. They’re glad to dwell there. The fashions have been currently redone after I bought the place, and so it’s been very low increase to sort of hold that property.

Dave Meyer:

That’s great. Wow. Very cool. I merely want to re-emphasize what Mike merely said to everyone listening is that Mike was ready to get into his first duplex for under $20,000 full. And naturally prices have modified, nevertheless such a way the place you’re getting an proprietor occupant mortgage with 10% down, even when that went as a lot as two 50, presumably it’s goes from 19 grand to 25 grand, nevertheless merely demonstrates that a whole lot of these lower money down selections are nonetheless obtainable. I actually like listening to that your PITI is under a thousand {{dollars}}. That three digit month-to-month payment is a unusual issue. Possibly pretty exhausting to look out these days. Keep onto that for costly life.

Mike Johnson:

Yeah, nothing’s truly come close to that sense that, but it surely certainly was a tremendous first step into precise property investing and no regrets with the first property the least bit up so far.

Dave Meyer:

Why do you suppose that you simply simply’ve had tenants for 4 years? Is there one thing you in all probability did throughout the screening, one thing that you simply simply appeared for that you simply simply attribute that success to? On account of as everybody is aware of, vacancy kills zeal.

Mike Johnson:

So for me, firstly, certain, I’m the proprietor, nevertheless I try to easily be a human. So I’ve conversations with them. If there’s any factors, I merely say, merely textual content material me immediately. They didn’t have a superb property administration agency managing the setting up sooner than. So I launched myself and I merely sort of converse to ’em and say, Hey, is there one thing that you simply simply primarily want fixed correct off the bat? Can we take care of that? After which anytime there’s an issue, I get it taken care of immediately. So that they perception me. There’s open communication. And so within the case of resigning the lease, I’ve elevated lease two to 4 years, nevertheless I on a regular basis current comps. I on a regular basis give them under market lease, nevertheless then they’ve justification of, alright, if I switch, I’m going to pay additional per thirty days after which it’s transferring costs. They usually additionally’ve merely decided to stay yearly. And so it’s labored out. It’s merely humorous on account of usually when you’re looking at entering into precise property investing, you suppose that there’s all these specific points it’s good to do. It’s merely you do the equivalent points many instances. You’re an ideal specific particular person, you take care of factors after they occur, and most of the events over time, the funding’s going to work out merely great.

Dave Meyer:

I actually like your technique to this. I actually really feel sort of the equivalent strategy. I’m merely don’t overthink this. Merely be an ideal human being, underwrite presents, it’s going to work out, be affected particular person. I consider persistence is one different large one which some people have an issue with, nevertheless hopefully listening to this podcast, preaching to you, precise property’s a protracted recreation. Merely be affected particular person. It’s going to work out. All correct. We do ought to take a quick break, nevertheless we’ll be once more with Mike correct after this. Hey everyone. Welcome once more to the BiggerPockets podcast. I’m proper right here with investor Mike Johnson. All correct. So that was your first deal. What received right here subsequent for you?

Mike Johnson:

Actually, I closed on the next residence hack in Chicago and Northside of city. This was my FHA mortgage that I used. So three and 5% down, it was a $750,000 4 unit brick setting up, which is good.

Dave Meyer:

Oh wow.

Mike Johnson:

I obtained a 2.75% worth on this setting up, and the cash I invested who acquired the setting up was solely 27,000.

Dave Meyer:

Oh, okay. I was about to say that you simply simply truly might want to have gone up in out-of-pocket payments because you paid 19 grand out of pocket for the first one. For individuals who put 25% down on a $750,000, you’re talking one factor nearer to 200 grand. How did you pull that one off?

Mike Johnson:

Yeah, so this one inherently with the three.5% down, you’re not putting loads of cash into the deal for a $750,000 4 unit, nevertheless I on a regular basis try to maximise vendor credit score. So presumably they’re eager to do the repairs beforehand. Optimistic, you’re capped out, I think about for a two to 4 fashions, a 3% of the acquisition value is how so much vendor credit score rating you’ll be able to do. So I on a regular basis try and advise that, try to maximise that. That will convey your cash to close as little as doable, and that helps push up your return metrics. So I on a regular basis try to do that. I don’t know if that’s widespread in every state, nevertheless proper right here in Illinois we pay taxes and arrears for property tax. So if I shut six months into the 12 months, you get six months of the prorated tax amount at closing. So must you pay 20,000 in annual taxes, you’re going to get $10,000 credit score rating and likewise you don’t actually actually really feel that until you promote the setting up. So that you simply get all some great benefits of lower money down. Oh, that’s superior. Time value of money and getting return on that money all just because they haven’t paid the current 12 months’s tax bill. And so that you just take care of that so that all these points combined ended up me bringing solely $27,000 to the desk. And there’s some very fascinating tales with this setting up, and I had some rehabs I moreover did alongside the best way through which. Nevertheless yeah, all in all, it’s performing properly 12 months to

Dave Meyer:

Date. Is that certainly one of many causes you chose to spend cash on Chicago barely than Milwaukee? Or have been you merely dwelling there? Why swap markets?

Mike Johnson:

So for me, it’s comfortable with precise property investing at this stage. I sort of obtained my ft moist in Milwaukee. I understand this. I’ve had some tenant interactions. It’s not the first time anymore. And so now I consider for me, I don’t like to do out-state investing. I like to do it in my yard residence. Hacking money is finite. So for me, I solely have a whole lot of it. So I want to maximize and my money. And even after I did the FHA mortgage, I on a regular basis try and go to the utmost mortgage prohibit for these. So the setting up that I’ve, the fashions are massive. They’re 4 mattress, two bathtub, 18 a complete lot for a ft. Cool. So a bit bit harder to place tenants, nevertheless chances are you’ll ration bigger rents. And so for a 4 unit, you you’re maximizing the rental income. And the reason why I chosen Chicago or just the Midwest usually is I on a regular basis sort of use an analogy with the stock market.

So that you’ve received the tech shares must you spend cash on Colorado, California, a couple of of those presumably sexier states, appreciation wise, I take into account that as a tech stock. You’re going to get loads of appreciation, nevertheless cashflow is hard. Throughout the Midwest, I actually really feel choose it’s a bit of bit of every. It’s like a dividend stock, a bit little little bit of cashflow, presumably fairly a bit, but it surely certainly’s Chicago, you’re paying additional for the property, nevertheless you get a combination, you get a bit little little bit of appreciation. I’ve had cashflow in all my properties, and so I’ve had success proper right here and I dwell proper right here, so if there’s any factors, I’ve eyes on the property, I’ve the entire contacts for maintenance repairs, and it makes it a reasonably seamless transition from one property to the next.

Dave Meyer:

What about tenants? Have you ever ever had comparable means to retain tenants within the equivalent strategy we did in Milwaukee?

Mike Johnson:

Consideration-grabbing enough. So ran into some factors at closing, and this was a troublesome lesson realized, nevertheless primarily for this setting up, I did my remaining walkthrough the day sooner than closing, and the best floor tenants have been all transferring out, correct? There’s barely one thing throughout the unit. The seller’s brokers, there as soon as extra, I see them bodily transferring points out. I think about top-of-the-line in people good to go. They did the repairs they said they’ve been going to do. Fast forward, I shut the next day I come once more and the door is locked, like, properly, this door shouldn’t be locked. So I tried to open it and I see a little bit of paper on the door and it’s a signed eviction moratorium. So all through covid you couldn’t evict. And prolonged story fast, it wasn’t even certainly one of many tenants that was on the lease. It was a person that was paying them a few {dollars} a month to crash on their couch. He’s who ended up squatting throughout the unit.

Dave Meyer:

And

Mike Johnson:

It took me 9 months to endure eviction courtroom. I really misplaced the case, by the best way through which. Did all of the items by the books. I misplaced the case expert tenant. And moral story is he ended up vacating on his private accord, thank the Lord. Nevertheless he completely vandalized the unit. He painted all of the items purple, hardwood flooring, tiles, cabinets, residence tools what broken residence home windows, crazy vandalism. And at this stage I’m like, I’m merely glad to get the unit once more, nevertheless I haven’t gotten any rental income for 9 months. And now I see all the unit’s trash. And like I mentioned, it’s a 1800 sq. foot, 4 mattress, two bathtub unit, so it’s not like a two one rehab. It’s all of the items. So that was a stupendous experience, but it surely certainly was coated by insurance coverage protection.

Dave Meyer:

Oh my God. Correctly, I’m sorry to hearken to that. I’ve a pair questions. I do suppose when people think about investing in precise property and get nervous about it, it’s exactly this that folk get nervous about. So can you merely inform us a bit bit how this occurred? Did you’re employed along with this specific particular person at any stage and converse to them about what their intentions have been or how did this entire unfortunate state of affairs unfold?

Mike Johnson:

Yeah, so I indicate, trying again, don’t ever shut till you affirm the tenants are out, correct? That’s a troublesome lesson realized trying again is 2020. Nevertheless as quickly as we obtained to the aim the place anybody’s dwelling throughout the unit, I don’t know who it’s at this stage, I in the end attain out to the sooner proprietor of the setting up and I said, Hey, do you’ve received any idea? Can you attain out to the tenants and see who’s presumably nonetheless staying there? Do you’ve received any insights? And it was by actually the seller and the seller’s agent the place I found that it was anybody that was paying the sooner tenants to crash there primarily. And so I found his title, I obtained his contact data, and so I made contact, and naturally you want to try and treatment points with out involving an authorized skilled. So I tried offering him cash to maneuver. I tried to look out him sponsored housing. I talked to people in Chicago and is there anyplace that we’ll assist sort of relocate him? I even equipped money to the sooner tenants to see if I’d pay them to have them switch in with them for only a few months. He wasn’t keen about any of this. And that’s after I sort of decided that I’m going to ought to go the approved

Dave Meyer:

Route. And so that you’ve been merely going forwards and backwards with him being like, what about this? What about this? And he was equivalent to, nah, I’m cool. I’m staying proper right here.

Mike Johnson:

Yeah. I even equipped to say, Hey, chances are you’ll’t afford to dwell proper right here alone, correct? It’s a 4 mattress room unit, nevertheless what can you afford? And so I even equipped, I’ll place tenants throughout the totally different bedrooms as a approach to hold there, you don’t must maneuver, chances are you’ll afford it. After which it’s rented by the mattress room. I’m getting the entire rental income. And I believed that was presumably an ideal decision, merely wasn’t . He led me alongside to make it appear to be he was enthusiastic about it, nevertheless I found on the end of the day, this isn’t the first time this man’s completed this. It’s humorous how they’ll afford a extraordinarily good authorized skilled, nevertheless they’ll’t afford any of the lease. So from what

Dave Meyer:

I’m listening to, you’ve gotten been clearly type of the sufferer on this state of affairs. How did you lose that case?

Mike Johnson:

So accepting money was the first mistake. He said, Hey, I can afford to pay you partially correct now, I accepted the partial payment, nevertheless the second you accept money from him, it’s not a squadron. He’s a paid tenant, correct? Irrespective of within the occasion that they’re paid in full or not. Primarily I did all of the items with serving him the uncover given the courtroom date, et cetera, proper. Did all of the items appropriately. The rationale why I misplaced the case is on account of he had an ideal authorized skilled that launched up case laws.

Dave Meyer:

That’s powerful.

Mike Johnson:

Lastly in my ideas, I’m like, properly, that’s vandalism. It’s not going coated under my protection. Nevertheless as a result of it was so unhealthy, clearly it was additional than merely placed on and tear. So that they ended up defending your full rehab, which was spherical $55,000. Now the unit, I nearly modified all of the items. So now I’m getting $750 additional a month in lease. I get increased tenants on account of it’s completely rehabbed. And other people tenants have been there for two years now. And so it was a crazy experience. It labored out in the long term, nevertheless not realizing if it was going to work out, that was most likely one of many hectic events in my life, to be reliable.

Dave Meyer:

I’m sorry to hearken to that. That’s crazy. Correctly, I’m glad it labored out long term. I on a regular basis ask people this on account of inevitably every precise property investor has, presumably to not this extreme, nevertheless a story the place they misplaced money, one factor unfortunate occurred, it was a ache throughout the butt, and oftentimes it happens earlier in your career, nonetheless learning like this. So have been you ever considering giving up or type of thrown throughout the towel?

Mike Johnson:

It crossed my ideas on account of as quickly as I misplaced the eviction case, that’s the place it sort of started to sinking that this might presumably be one different 9 months. And with Covid, no particular person truly knew at this stage what it was and the best way prolonged it was going to remaining, how infectious points have been. And so in my ideas, I’m like, if this drags on one different 9 months, I indicate, I’m paying out of pocket for stuff. Nevertheless retrospect, it’s my most worthwhile setting up now at this stage the place the PITI suppose is 5,300 a month, and it’s bringing in 91 50 a month.

Dave Meyer:

Oh my God. 91 50.

Mike Johnson:

Superb unfold.

Dave Meyer:

Okay. That’s

Mike Johnson:

Superior. And I rehabbed the one totally different unit the place I put $50,000 into our unit. So one 12 months I didn’t buy a property, and so I, nothing penciled out. So I spent 50,000 on a rehab for certainly one of many fashions, nevertheless now I’ve all newly rehab fashions, sluggish repairs, good tenants, and the unfold could be very good. Okay, wow.

Dave Meyer:

Correctly, you talked about at first of the episode that you simply simply had 4 presents. We’ve talked about two at Duplex in Milwaukee, and subsequent we talked about your fourplex in Chicago. We do ought to take a quick break, nevertheless I want to hear about what you’ve been as a lot as additional currently correct after this. Hey everyone. Welcome once more to the BiggerPockets podcast. I’m proper right here with investor Mike Johnson talking about his portfolio between Milwaukee and Chicago. We’ve talked about two of the presents so far, nevertheless the third one, what did you do after that 4 unit with the unfortunate squatter state of affairs?

Mike Johnson:

So at this stage, I had the bug and I’m into precise property investing and gained a house hack. As soon as extra, I’m starting to take a look at completely totally different neighborhoods. And so I end up landing on a 3 unit property in a west side neighborhood of Chicago. So this one wasn’t a brick setting up, nevertheless ultimately ended up doing a ten% down mortgage proprietor occupancy. I moved into the best floor unit and I obtained a 3.87% worth. Good. So prices are starting to go up at this stage, correct? Nonetheless aggressive market. And for this deal, I ended up putting about $51,000 into this

Dave Meyer:

Deal.

Mike Johnson:

So by far primarily essentially the most I’ve put proper right into a deal at this stage, nevertheless I increased understand underwriting sort of the little ideas you’ll be able to do to attenuate cash to close. And so that was deal amount three.

Dave Meyer:

Good. Okay. And it labored out hopefully. No squatters.

Mike Johnson:

No squatters, nevertheless I’ll let you already know there’s been tenant a factors. No. Oh

Dave Meyer:

Gosh.

Mike Johnson:

I had a litigious tenant restore some accidents. Whoa.

Dave Meyer:

And

Mike Johnson:

It was making threats. And so at the moment I said, I’m not properly outfitted and fitted to this. I don’t want to make any errors. And so I merely decided, I employed a property administration agency that’s well-known throughout the Chicago land area. Him and his workers has completed a tremendous job, they often have attorneys, they’ve people which will be going to do points the fitting strategy and doc points. And so ever since they took over, the connection is good. There’s no factors. Nevertheless I consider they see a private landlord they often suppose that they sort of profit from the state of affairs, and I was dwelling throughout the unit so they could obtain entry to me at any stage they see me. And so one issue that I merely wished to do is just separate myself from the tenants. I don’t want to work collectively and I don’t want to say or do one thing incorrectly that’s going to impact me throughout the courtroom of laws in Chicago. And so I can nonetheless self-manage the alternative properties, as soon as extra, have good tenants, very low vacancy. And so it doesn’t truly require so much work on my half, nevertheless very glad that I offloaded this one property.

Dave Meyer:

So the reason the alternative ones though is because you’re not dwelling there and it’s equivalent to you’ve received type of that bodily separation from tenants that makes you increased ready to deal with.

Mike Johnson:

Correct? I’m not pretty in a position to forego the seven, 8% of gross income. And I’ve moreover, I used to do the entire showings myself, nevertheless now I benefit from an agent. So I don’t pay property administration, nevertheless I’ll pay an agent to do the showings for me. So my portfolio is definitely very, very hands-off a pair hours a month presumably. Nevertheless I’ve contractors that I perception, plumbers, maintenance people. So that search is over to start out with. You’re on the lookout for a reliable specific particular person, and that’s hectic. Nevertheless now that I’ve a workers, it’s very low stress, and so I’m eager to pay a bit bit additional the cashflow. And so I’m glad to pay the worth to be fingers off and focus my consideration elsewhere.

Dave Meyer:

That’s good. I indicate, I merely want everyone to hearken to how this merely methodical technique Mike is taking can assemble a portfolio that’s large thrilling. I indicate, no offense by this mike, nevertheless you’re not doing one thing large flashy. No. It’s akin to you’d bought a duplex, you positioned good tenants, you don’t have any vacancy, you bought a fourplex, you dealt with loads of the headache. Now you’re producing great cashflow, but yet one more one the place you be taught to adapt and barely than dealing it together with your self, you’re type of offloading the stuff you don’t want to do. And now that’s going to cashflow. And that’s over the course of what, three or 4 years at this stage?

Mike Johnson:

Yeah. I indicate, in decrease than 4 years, I acquired, I consider it’s valued at 3.4 million in properties and yeah, I consider it was in three years, in 9 months. So it’s not like this took me a really very long time to do. And to your stage, it’s rinse and repeat the equivalent residence hacking methodology, and as you obtain experience and prices go up, my latest deal was only a few months up to now and I had a 6.5% worth, nevertheless I nonetheless was ready to close in a class neighborhood. And so it’s merely sort of humorous following the funding journey. It’s like, okay, COVID charges of curiosity, all of the items, pencils, after which as prices go up, I’ve nonetheless managed to make points work and I haven’t completed one thing. To your stage, truly open air the sphere,

Dave Meyer:

I merely want to stage out to everyone that a whole lot of these presents that Mike’s doing do nonetheless work proper this second. The numbers might be a bit completely totally different. I don’t know must you’re going to make the equivalent exact diploma of cashflow, nevertheless must you’re attempting to inherently merely improve your financial place, a whole lot of these residence hacking strategies the place you progress from one to the alternative, that’s solely a time examined issue that works in nearly every form of funding environment. Merely a couple of weeks up to now on the current, now we have been chatting with an investor who started doing this in 2005 and did it by the 2010s all through a totally completely totally different form of environment. That’s merely a sort of types of approaches to precise property investing that works whatever the place you’re coming from. So merely want to encourage people, even must you’re pondering, Hey, yeah, these have been low fee of curiosity environments, that that’s nonetheless one factor that’s doable. And it appears like Mike, chances are you’ll inform us about the best way it’s nonetheless doable with a deal you recently did inside the ultimate 12 months or so.

Mike Johnson:

Yeah, inside only a few months up to now, it closed on this one in August of 2024. This deal was a bit bit completely totally different. This was a $1.5 million 4 unit brick setting up, three fashions throughout the entrance with the brick coach residence throughout the once more, but it surely certainly’s in Wicker Park, which should you already know one thing about Chicago, it’s a superb neighborhood. So it’s an A class neighborhood, superb buildings, very walkable. And I benefit from the model new Fannie Freddie 5% down mortgage, so very extraordinarily levered, nevertheless typical mortgage. And so I obtained a 6.5% worth, nevertheless this one I wanted to get very creative on account of I solely ended up putting $38,000 into this 1.5 million setting up, which is type it crazy whenever you focus on that. That’s decrease than I put in a setting up that I paid 6 94, which was the three unit. So for this one, as soon as extra, with 5% down, actually you’ve received that when extra, maximize vendor credit score. So 3% on about 1.5 is spherical $43,000 in vendor credit score. I obtained on excessive of that. I consider that’s one different well-liked precise property method that folk use, nevertheless I on a regular basis shut throughout the first or second of the month.

Dave Meyer:

Oh, I actually like this. Certain,

Mike Johnson:

On account of this setting up brings in nearly 13,000 a month in income. So whenever you’ve received two months and never utilizing a payment, you’ve received a $26,000 cushion for future repairs, one thing that presumably it’s good to do. And it’s lower cash to close. And easily the very last item was the tax preparation. Pricey setting up, pay loads of taxes shut the middle of the 12 months. So I obtained all that tax credit score rating as properly. That lowered my cash to close, which I solely wanted to convey, I consider $12,000 I consider to the closing desk. Nevertheless my all in with earnest money was 38 on this setting up.

Dave Meyer:

Wow. Unbelievable. That’s large cool. I merely wished to elucidate the issue you said about doing the closing on the first or second of the month. That’s merely such an easy strategy to assemble a cash reserve and reduce your payments. Nevertheless primarily, as soon as you are taking out a traditional mortgage, let’s say you shut on May 1st, you’re not going to pay for May. You’re moreover not going to pay for June. Your first payment is perhaps due July 1st, and that won’t sound like fairly a bit, nevertheless like Mike said, if he’s producing 13 grand a month in May and June, that’s $26,000 he has with out his largest expense, you’re nonetheless going to supply different payments. You’re going to most likely nonetheless have financing. And counting on the state of the setting up, chances are you’ll want some turnover costs or upgrades that you simply simply want to make, nevertheless you’re primarily taking that income that you simply simply’re merely sending to the monetary establishment and not at all going to see as soon as extra, and likewise you’re pushing it off for two months.

And naturally you’re nonetheless going to ought to pay that money once more. That’s how a mortgage works. Merely the mechanics of working a enterprise, it’s a truly fortunate strategy to do it. So anytime you’ve received the selection or some flexibility about when to close on a property, merely do it as earliest throughout the month that you can. First is good, second is good. Even the first week, you’re truly going to offer your self an enormous revenue there. Clearly when you shut, it’s the equivalent amount of capital, nevertheless you gained’t should, for example, set as so much aside for a cash reserve.

Mike Johnson:

And the tenants listed under are people which will be working professionals, good jobs, extreme income, and easily no factors. I indicate, so the tenant pool is good.

Dave Meyer:

I adore it. You deserve it, man. After two powerful ones with tenant circumstances that weren’t truly of your particular person making. Good to hearken to that you simply simply obtained a relatively calm one, but it surely certainly appears like truly this form of deal, you in all probability did loads of creative stuff and kudos to you for doing your entire evaluation. You realized the information. You realized among the many little hustles that you are able to do on each deal to type of reduce the sum of cash that you simply simply’re putting into it, nevertheless realistically, this form of deal, people would possibly try this deal. This, I consider serves as a model for people listening of a tremendous deal which you could execute on proper this second.

Mike Johnson:

100%. And there’s two good points too. So with an FHA, you’ve received the self-sufficiency test, which makes it truly exhausting usually to have enough rental income to cross that test and even do an FHA mortgage. The great issue about this 5% down Fannie Freddie mortgage is it’s double the velocity prohibit. So you can purchase twice as expensive of a property and there’s no self-sufficiency test. So rapidly chances are you’ll afford to buy in these A class neighborhoods the place I’m in, whereas an FHE mortgage would not at all cross proper right here on account of the buildings are just too expensive. So it actually opened up the neighborhoods that I was coming to on account of I consider a lot of folks don’t want to residence hack, they often’re like, I don’t want to dwell in that neighborhood, which it’s legit, it’s non-public alternative, nevertheless this new fanny, Freddie 5% down mortgage, it’s going to get you into the eight class neighborhoods in most cities. And so, yeah, I was ready to capitalize on that almost correct as that mortgage bundle deal received right here out. So presumably not as widespread data and there wasn’t as many people utilizing it however, but it surely certainly’s a tremendous alternative.

Dave Meyer:

That’s a tremendous tip. Yeah, I didn’t even perceive that They don’t have the self-sufficiency test. That’s a extraordinarily cool tip.

Mike Johnson:

Yeah, it’s very good.

Dave Meyer:

Superior. So what’s subsequent for you, Mike? It appears as should you’re type of doing this methodically. Are you merely going to take care of attempting to do these sort of small yearly, every two years?

Mike Johnson:

So the issue about me maximizing my leverage on these properties is my DTI is pretty capped out correct now.

So I’ll have to sit back it for a 12 months or so, nevertheless so one amongst two points. I consider I’ll do the dwell and flip method the place I buy a condominium sort of by the lake in Chicago, after which I dwell there two to five years, do a rehab, after which you’ll promote that inside 5 and by no means pay taxes on it. So nonetheless sort of use the tax profit methodology of precise property that I’m conscious of or look into presumably merely renting on account of this unit that I’m in rents for better than what I’d be eager to dwell in myself. This is usually a three mattress, two bathtub, and I’m alone, so I’ll most likely switch proper right into a smaller unit, lease this out, after which I’d presumably get proper right into a 5 plus multifamily and sort of start presumably scaling up a bit bit, performing some greater presents.

Dave Meyer:

Superior, man. Correctly, congratulations. And easily want to reiterate, that’s the occasion I on a regular basis give the place people say, is your most important residence an funding? Clearly, you’ve confirmed us, Mike, that certain, it might be you’ve managed to build up tens of hundreds of thousands of {{dollars}} worth of precise property merely by means of the usage of your most important residence and even going forward. I actually like your pondering on account of certain, ultimately in nearly every investor’s career, your debt to income ratio turns into an issue. You should cool off, and that’s okay. It’s utterly great. I’ve gone years with out searching for presents for sure. However as well as Mike, pondering of fantastic strategies to do it too. I actually like that you simply simply’re versatile enough to think about renting. I’ve moreover completed that. When you do the arithmetic, usually it merely is wise to lease or do a dwell and flip. That’s what I’m doing correct now. It’s merely one different good strategy to earn cash. Alright, I consider that’s all we obtained for proper this second. Mike, thanks so much for turning into a member of us. Congrats on your entire success and for navigating some pretty troublesome tenant circumstances. We respect you being proper right here.

Mike Johnson:

Thanks for having me. This was pleasing.

Dave Meyer:

It truly was. And everyone take note, we’re on a regular basis looking for additional merchants like Mike to perform on the current. For individuals who’d like to tell your precise property story to the BiggerPockets viewers, chances are you’ll apply at biggerpockets.com/customer. Thanks as soon as extra for listening. We’ll see you subsequent time.

Help us attain new listeners on iTunes by leaving us a rating and evaluation! It takes merely 30 seconds and instructions is perhaps found proper right here. Thanks! We truly respect it!

Inquisitive about learning additional about proper this second’s sponsors or becoming a BiggerPockets affiliate your self? E mail [email protected].