Revealed on June 4th, 2025 by Bob Ciura

Because the group of firms that produce items which might be utilized in building and manufacturing, the economic sector kinds the spine of the worldwide economic system.

The commercial sector covers a large swath of industries, together with (amongst others):

The commercial sector is the part of the general inventory market that’s involved with manufacturing, producing, and distributing items utilized in building and manufacturing.

The sector additionally consists of different industries like airways, farming tools, industrial equipment, lumber manufacturing, and steel fabrication.

We’ve compiled an inventory of practically 80 industrial shares (together with essential investing metrics) which you could obtain under:

A stunning variety of Dividend Kings, a gaggle of shares with not less than 50 years of dividend will increase, come from the Industrials sector.

In reality, of the 55 shares that at the moment comprise the Dividend Kings, 12 are Industrials. Due to this fact, it’s clear that there are a selection of high quality dividend development shares from the Industrials sector.

This text will record the 12 Dividend Kings from the Industrials sector.

Desk of Contents

You’ll be able to immediately bounce to any particular part of the article by clicking on the hyperlinks under:

Industrials Dividend King #12: Automated Knowledge Processing (ADP)

- Dividend Development Streak: 50 years

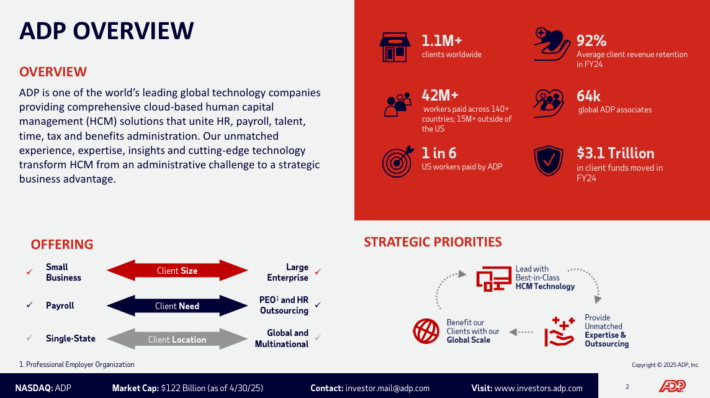

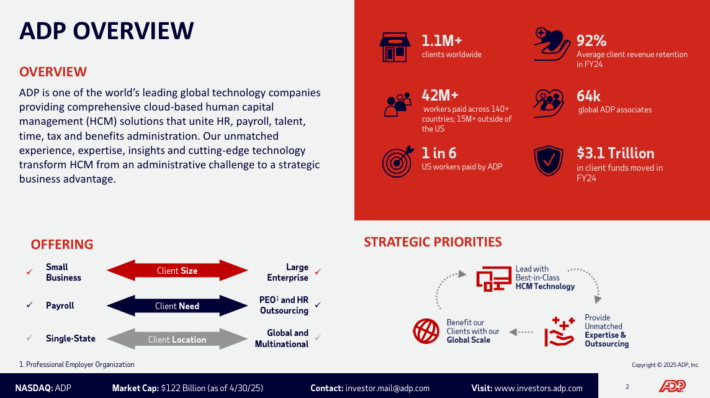

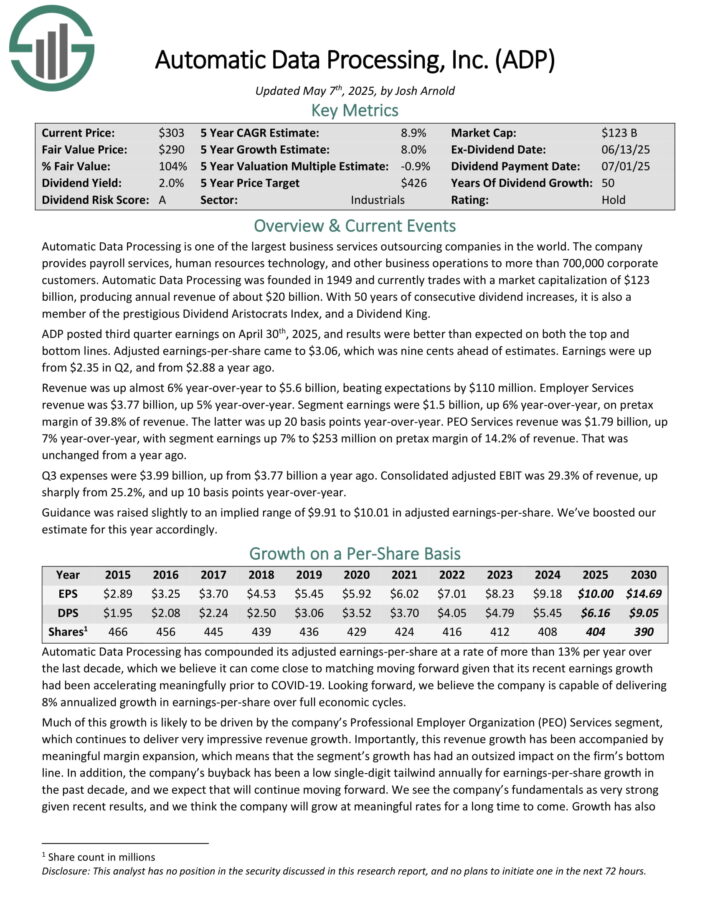

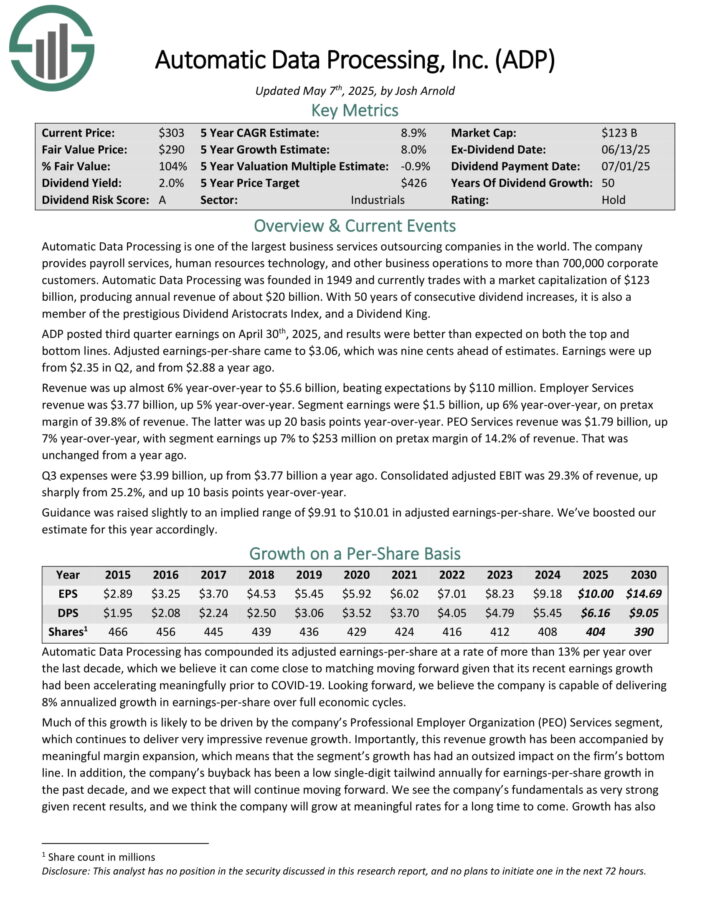

Automated Knowledge Processing is likely one of the largest enterprise providers outsourcing firms on the earth. The corporate offers payroll providers, human sources expertise, and different enterprise operations to greater than 700,000 company prospects. Automated Knowledge Processing produces annual income of about $20 billion.

Supply: Investor Presentation

ADP posted third quarter earnings on April thirtieth, 2025, and outcomes have been higher than anticipated on each the highest and backside traces. Adjusted earnings-per-share got here to $3.06, which was 9 cents forward of estimates. Earnings have been up from $2.35 in Q2, and from $2.88 a yr in the past.

Income was up nearly 6% year-over-year to $5.6 billion, beating expectations by $110 million. Employer Companies income was $3.77 billion, up 5% year-over-year. Phase earnings have been $1.5 billion, up 6% year-over-year, on pretax margin of 39.8% of income. The latter was up 20 foundation factors year-over-year.

PEO Companies income was $1.79 billion, up 7% year-over-year, with phase earnings up 7% to $253 million on pretax margin of 14.2% of income. That was unchanged from a yr in the past.

Click on right here to obtain our most up-to-date Certain Evaluation report on ADP (preview of web page 1 of three proven under):

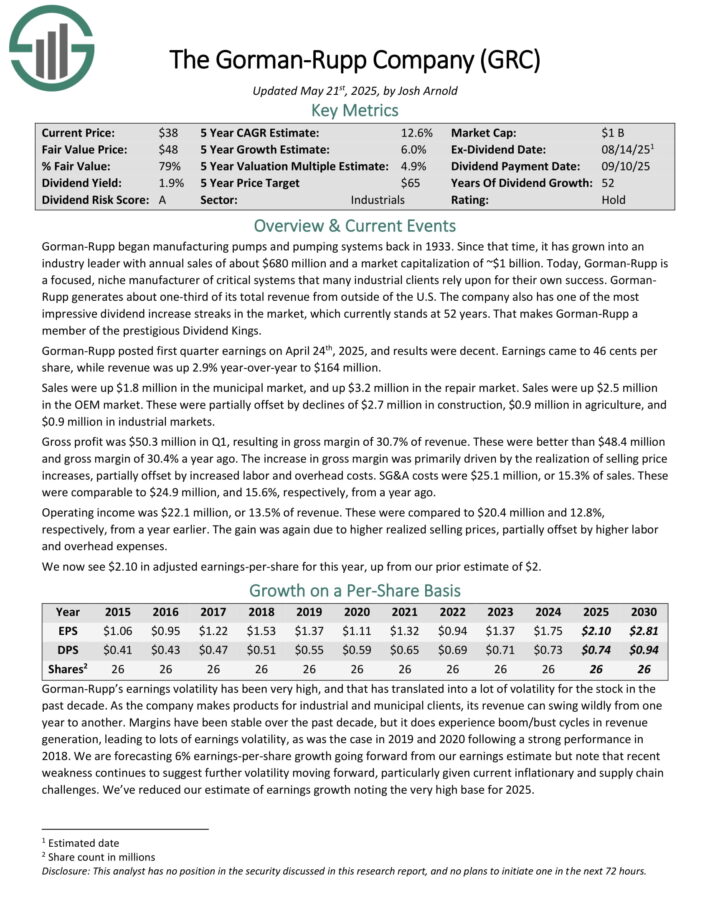

Industrials Dividend King #11: Gorman-Rupp Co. (GRC)

- Dividend Development Streak: 52 years

Gorman-Rupp started manufacturing pumps and pumping methods again in 1933. Since that point, it has grown into an business chief with annual gross sales of about $680 million.

Gorman-Rupp is a targeted, area of interest producer of essential methods that many industrial shoppers depend upon for their very own success. Gorman-Rupp generates about one-third of its complete income from outdoors of the U.S.

Gorman-Rupp posted first quarter earnings on April twenty fourth, 2025. Earnings got here to 46 cents per share, whereas income was up 2.9% year-over-year to $164 million.

Gross sales have been up $1.8 million within the municipal market, and up $3.2 million within the restore market. Gross sales have been up $2.5 million within the OEM market. These have been partially offset by declines of $2.7 million in building, $0.9 million in agriculture, and $0.9 million in industrial markets.

Gross revenue was $50.3 million in Q1, leading to gross margin of 30.7% of income. These have been higher than $48.4 million and gross margin of 30.4% a yr in the past.

The rise in gross margin was primarily pushed by the belief of promoting value will increase, partially offset by elevated labor and overhead prices.

Click on right here to obtain our most up-to-date Certain Evaluation report on GRC (preview of web page 1 of three proven under):

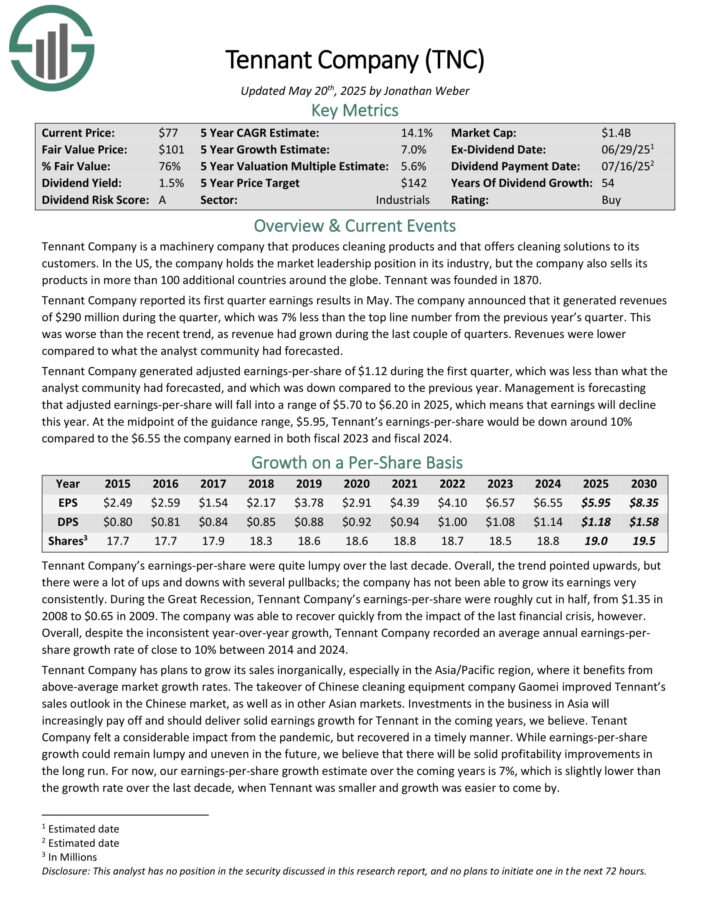

Industrials Dividend King #10: Tennant Co. (TNC)

- Dividend Development Streak: 53 years

Tennant Firm is a equipment firm that produces cleansing merchandise and that provides cleansing options to its prospects. Within the US, the corporate holds the market management place in its business, however the firm additionally sells its merchandise in additional than 100 further nations across the globe. Tennant was based in 1870.

Tennant Firm reported its first quarter earnings ends in Might. The corporate introduced that it generated revenues of $290 million in the course of the quarter, which was 7% lower than the highest line quantity from the earlier yr’s quarter.

This was worse than the current pattern, as income had grown over the last couple of quarters. Revenues have been decrease in comparison with what the analyst neighborhood had forecast.

Tennant Firm generated adjusted earnings-per-share of $1.12 in the course of the first quarter, which was lower than what the analyst neighborhood had forecast, and was down in comparison with the earlier yr.

Administration is forecasting that adjusted earnings-per-share will fall into a spread of $5.70 to $6.20 in 2025, which signifies that earnings will decline this yr. On the midpoint of the steerage vary, $5.95, Tennant’s earnings-per-share can be down round 10%.

Click on right here to obtain our most up-to-date Certain Evaluation report on TNC (preview of web page 1 of three proven under):

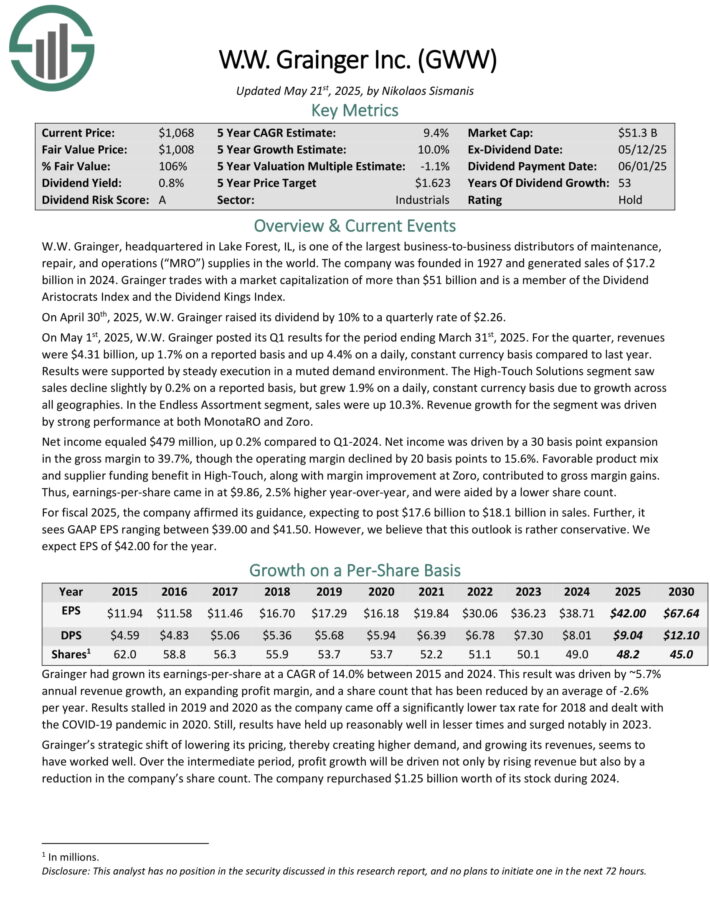

Industrials Dividend King #9: W.W. Grainger (GWW)

- Dividend Development Streak: 54 years

W.W. Grainger, headquartered in Lake Forest, IL, is likely one of the largest business-to-business distributors of upkeep, restore, and operations (“MRO”) provides on the earth. The corporate was based in 1927 and generated gross sales of $17.2 billion in 2024.

On April thirtieth, 2025, W.W. Grainger raised its dividend by 10% to a quarterly price of $2.26.

On Might 1st, 2025, W.W. Grainger posted its Q1 outcomes for the interval ending March thirty first, 2025. For the quarter, revenues have been $4.31 billion, up 1.7% on a reported foundation and up 4.4% on a day by day, fixed foreign money foundation in comparison with final yr.

Internet earnings equaled $479 million, up 0.2% in comparison with Q1-2024. Internet earnings was pushed by a 30 foundation level enlargement within the gross margin to 39.7%, although the working margin declined by 20 foundation factors to fifteen.6%.

Favorable product combine and provider funding profit in Excessive-Contact, together with margin enchancment at Zoro, contributed to gross margin positive factors. Earnings-per-share got here in at $9.86, 2.5% increased year-over-year, and have been aided by a decrease share rely.

Click on right here to obtain our most up-to-date Certain Evaluation report on GWW (preview of web page 1 of three proven under):

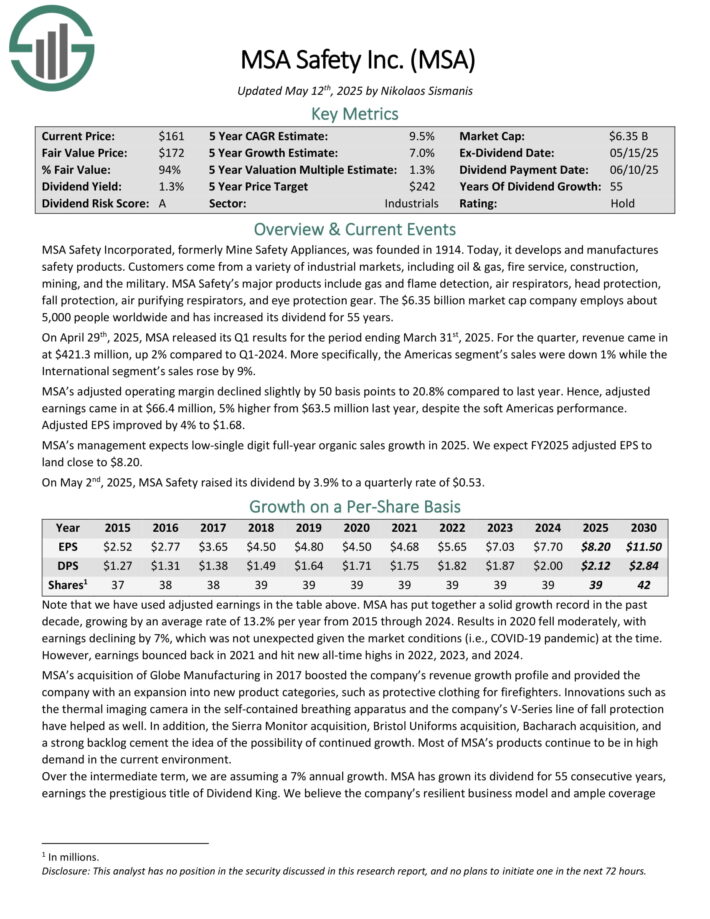

Industrials Dividend King #8: MSA Security (MSA)

- Dividend Development Streak: 55 years

MSA Security Included, previously Mine Security Home equipment, was based in 1914. At the moment, it develops and manufactures security merchandise.

Clients come from a wide range of industrial markets, together with oil & gasoline, hearth service, building, mining, and the army.

MSA Security’s main merchandise embody gasoline and flame detection, air respirators, head safety, fall safety, air purifying respirators, and eye safety gear.

On April twenty ninth, 2025, MSA launched its Q1 outcomes. For the quarter, income got here in at $421.3 million, up 2% in comparison with Q1-2024.

Extra particularly, the Americas phase’s gross sales have been down 1% whereas the Worldwide phase’s gross sales rose by 9%.

MSA’s adjusted working margin declined barely by 50 foundation factors to twenty.8% in comparison with final yr. Adjusted EPS improved by 4% to $1.68.

Click on right here to obtain our most up-to-date Certain Evaluation report on MSA (preview of web page 1 of three proven under):

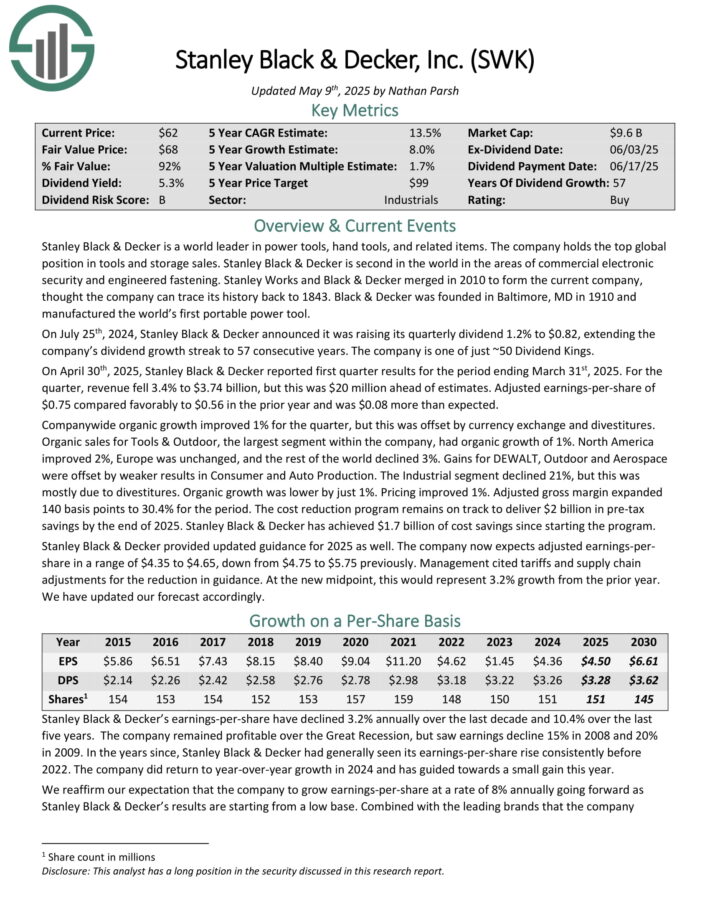

Industrials Dividend King #7: Stanley Black & Decker (SWK)

- Dividend Development Streak: 57 years

Stanley Black & Decker is a world chief in energy instruments, hand instruments, and associated gadgets. The corporate holds the highest world place in instruments and storage gross sales. Stanley Black & Decker is second on the earth within the areas of business digital safety and engineered fastening.

On April thirtieth, 2025, Stanley Black & Decker reported first quarter outcomes for the interval ending March thirty first, 2025. For the quarter, income fell 3.4% to $3.74 billion, however this was $20 million forward of estimates. Adjusted earnings-per-share of $0.75 in contrast favorably to $0.56 within the prior yr and was $0.08 greater than anticipated.

Firm-wide natural development improved 1% for the quarter, however this was offset by foreign money trade and divestitures. Natural gross sales for Instruments & Outside, the biggest phase throughout the firm, had natural development of 1%.

North America improved 2%, Europe was unchanged, and the remainder of the world declined 3%. Beneficial properties for DEWALT, Outside and Aerospace have been offset by weaker ends in Client and Auto Manufacturing.

Click on right here to obtain our most up-to-date Certain Evaluation report on SWK (preview of web page 1 of three proven under):

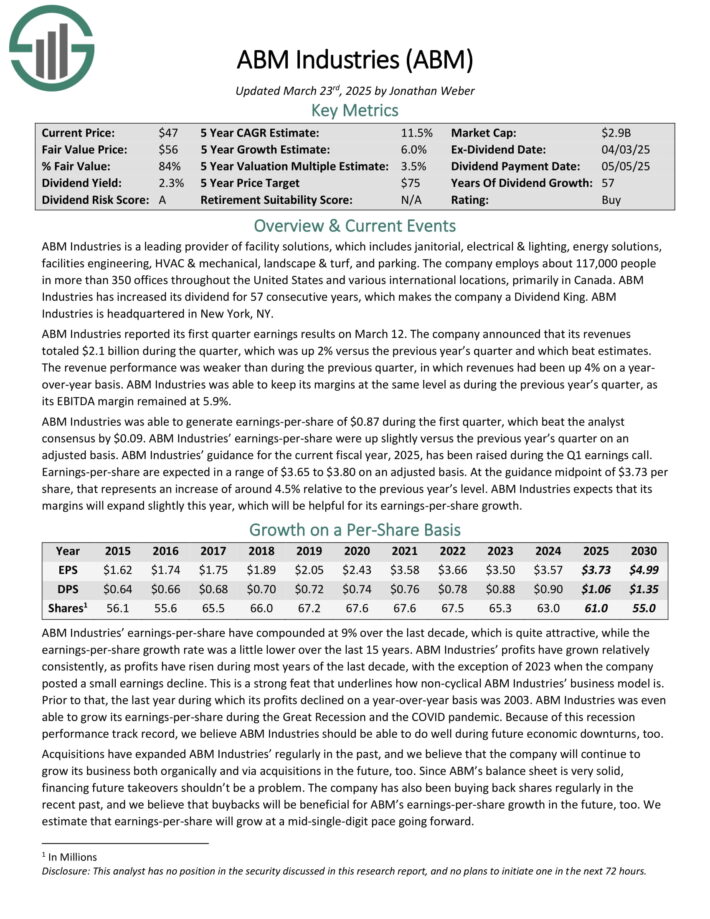

Industrials Dividend King #6: ABM Industries (ABM)

- Dividend Development Streak: 57 years

ABM Industries is a number one supplier of facility options, which incorporates janitorial, electrical & lighting, vitality options, services engineering, HVAC & mechanical, panorama & turf, and parking.

The corporate employs about 124,000 folks in additional than 350 workplaces all through america and varied worldwide areas, primarily in Canada.

Supply: Investor Presentation

ABM Industries reported its first quarter earnings outcomes on March 12. The corporate introduced that its revenues totaled $2.1 billion in the course of the quarter, which was up 2% versus the earlier yr’s quarter and which beat estimates.

The income efficiency was weaker than in the course of the earlier quarter, by which revenues had been up 4% on a year-over-year foundation. ABM Industries was in a position to preserve its margins on the identical stage as in the course of the earlier yr’s quarter, as its EBITDA margin remained at 5.9%.

ABM Industries was in a position to generate earnings-per-share of $0.87 in the course of the first quarter, which beat the analyst consensus by $0.09. ABM Industries’ earnings-per-share have been up barely versus the earlier yr’s quarter on an adjusted foundation.

Click on right here to obtain our most up-to-date Certain Evaluation report on ABM (preview of web page 1 of three proven under):

Industrials Dividend King #5: Illinois Device Works (ITW)

- Dividend Development Streak: 61 years

Illinois Device Works is a diversified multi-industrial producer with seven distinctive working segments: Automotive, Meals Gear, Take a look at & Measurement, Welding, Polymers & Fluids, Building Merchandise and Specialty Merchandise.

Final yr the corporate generated $15.9 billion in income. The corporate is geographically diversified, with greater than half of its income generated outdoors of america.

On April thirtieth, 2025, Illinois Device Works reported first quarter 2025 outcomes for the interval ending March thirty first, 2025. For the quarter, income got here in at $3.8 billion, shrinking 3.4% year-over-year. Gross sales declined 3.7% within the Automotive OEM phase, the biggest out of the corporate’s seven segments.

In reality, each single one in all ITW’s segments skilled income declines year-over-year. Meals Gear, Take a look at & Measurement and Electronics, Welding, Polymers & Fluids, Building Merchandise and Specialty Merchandise all noticed income decline -0.7%, -6.3%, -0.9%, -0.8%, -9.2%, and -1.0% respectively.

Internet earnings equaled $700 million or $2.38 per share in comparison with $819 million or $2.73 per share in Q1 2024. Within the first quarter, ITW repurchased $375 million of its shares. Illinois Device Works reaffirmed its 2025 steerage, nonetheless anticipating full-year GAAP EPS to be $10.15 to $10.55.

Click on right here to obtain our most up-to-date Certain Evaluation report on ITW (preview of web page 1 of three proven under):

Industrials Dividend King #4: Nordson Corp. (NDSN)

- Dividend Development Streak: 61 years

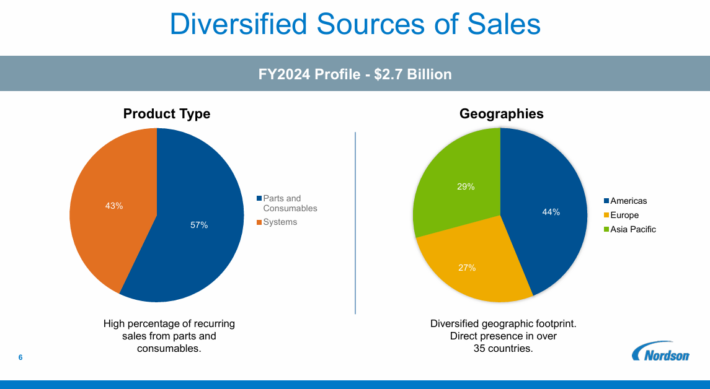

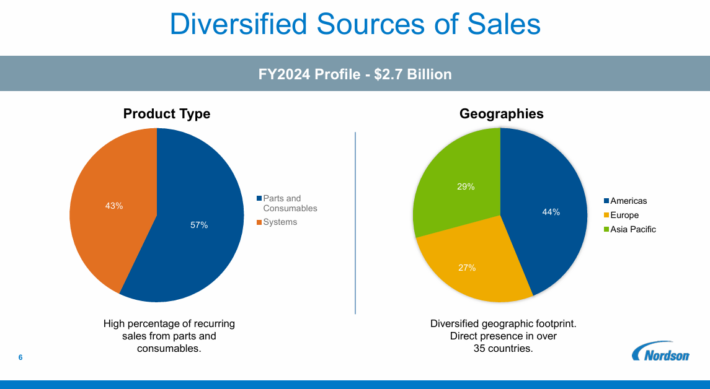

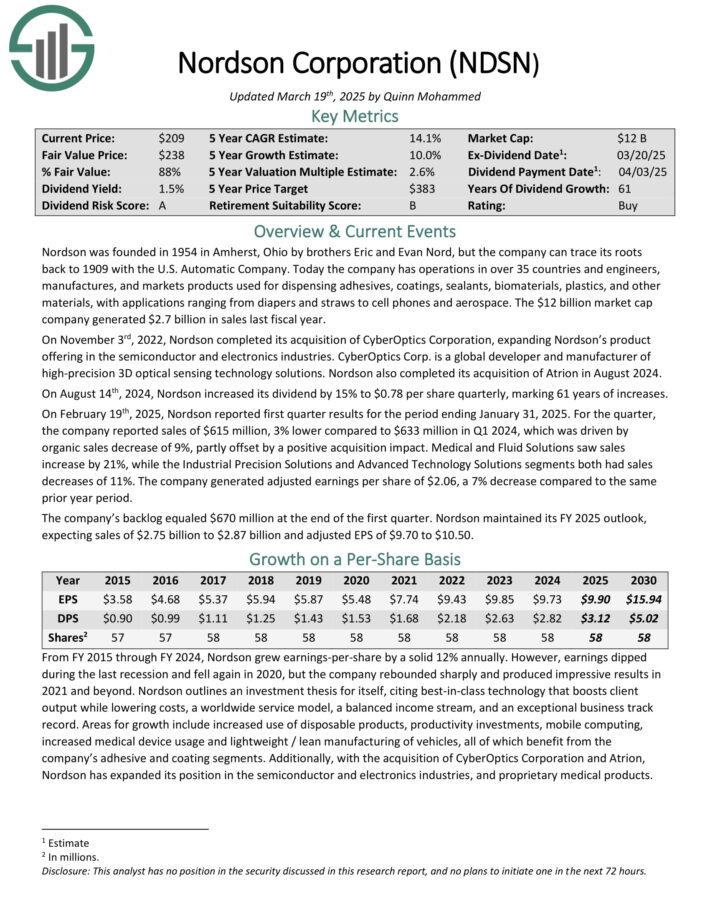

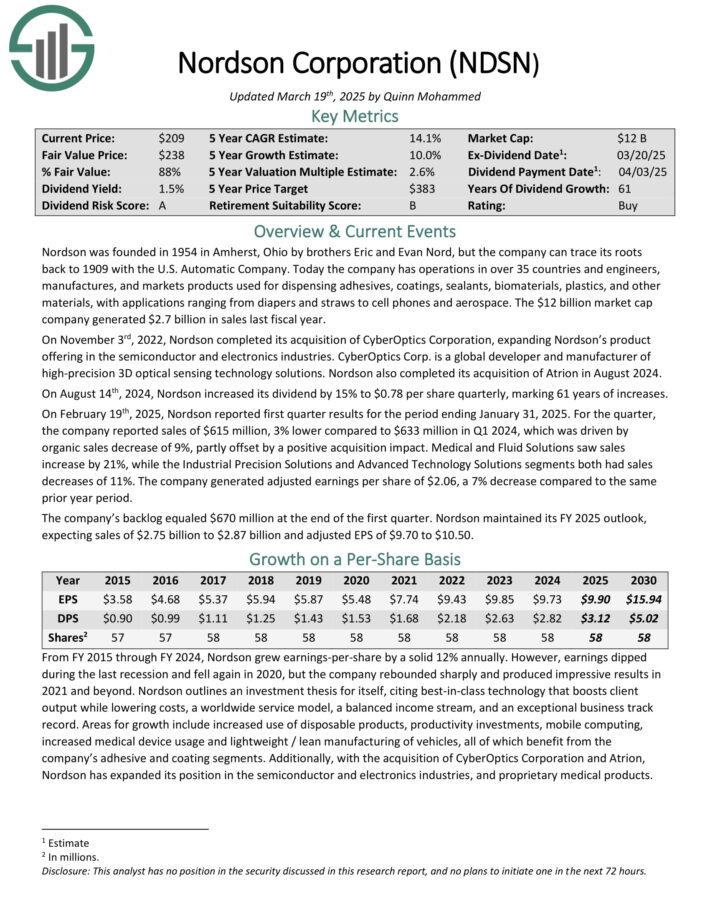

Nordson was based in 1954 in Amherst, Ohio by brothers Eric and Evan Nord, however the firm can hint its roots again to 1909 with the U.S. Automated Firm.

At the moment the corporate has operations in over 35 nations and engineers, manufactures, and markets merchandise used for shelling out adhesives, coatings, sealants, biomaterials, plastics, and different supplies, with functions starting from diapers and straws to cell telephones and aerospace.

Supply: Investor Presentation

On February nineteenth, 2025, Nordson reported first quarter outcomes for the interval ending January 31, 2025. For the quarter, the corporate reported gross sales of $615 million, 3% decrease in comparison with $633 million in Q1 2024, which was pushed by natural gross sales lower of 9%, partly offset by a optimistic acquisition impression.

Medical and Fluid Options noticed gross sales enhance by 21%, whereas the Industrial Precision Options and Superior Expertise Options segments each had gross sales decreases of 11%. The corporate generated adjusted earnings per share of $2.06, a 7% lower in comparison with the identical prior yr interval.

Click on right here to obtain our most up-to-date Certain Evaluation report on NDSN (preview of web page 1 of three proven under):

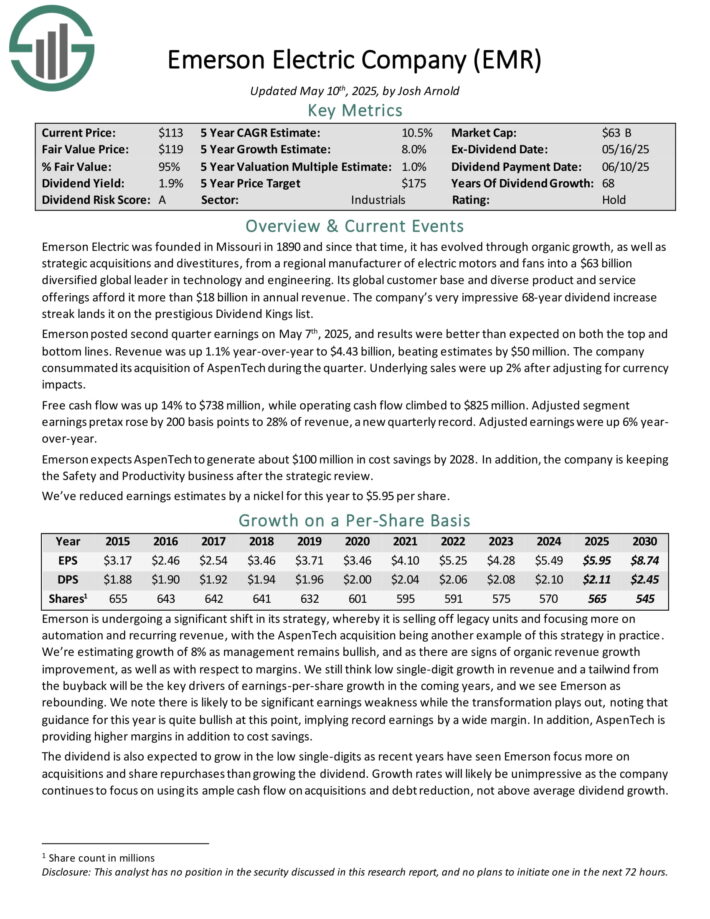

Longest Dividend Development Streak #3: Emerson Electrical Co. (EMR)

- Dividend Development Streak: 68 years

Emerson Electrical was based in Missouri in 1890 and since that point, it has advanced by way of natural development, in addition to strategic acquisitions and divestitures, from a regional producer of electrical motors and followers right into a diversified world chief in expertise and engineering.

Its world buyer base and numerous product and repair choices afford it greater than $18 billion in annual income.

Emerson posted second quarter earnings on Might seventh, 2025, and outcomes have been higher than anticipated on each the highest and backside traces. Income was up 1.1% year-over-year to $4.43 billion, beating estimates by $50 million.

The corporate consummated its acquisition of AspenTech in the course of the quarter. Underlying gross sales have been up 2% after adjusting for foreign money impacts.

Free money circulation was up 14% to $738 million, whereas working money circulation climbed to $825 million. Adjusted phase earnings pretax rose by 200 foundation factors to twenty-eight% of income, a brand new quarterly document. Adjusted earnings have been up 6% year-over-year.

Emerson expects AspenTech to generate about $100 million in price financial savings by 2028. As well as, the corporate is holding the Security and Productiveness enterprise after the strategic evaluate.

Click on right here to obtain our most up-to-date Certain Evaluation report on EMR (preview of web page 1 of three proven under):

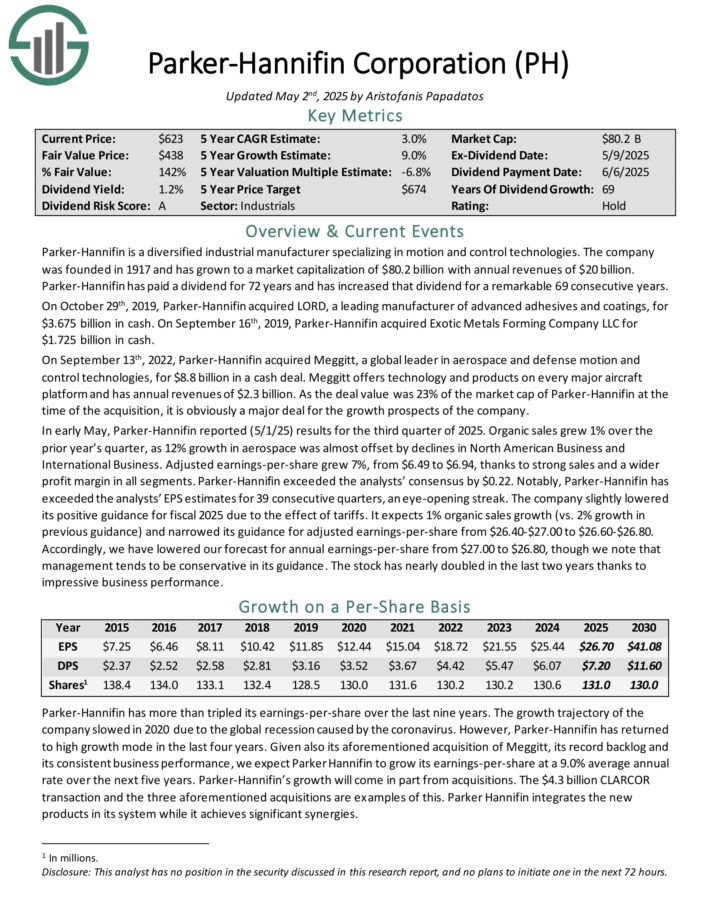

Longest Dividend Development Streak #2: Parker-Hannifin Corp. (PH)

- Dividend Development Streak: 69 years

Parker-Hannifin is a diversified industrial producer specializing in movement and management applied sciences. The corporate generates annual revenues of $20 billion.

Parker-Hannifin has elevated the dividend for 69 consecutive years.

Supply: Investor Presentation

In early Might, Parker-Hannifin reported (5/1/25) outcomes for the third quarter of 2025. Natural gross sales grew 1% over the prior yr’s quarter, as 12% development in aerospace was nearly offset by declines in North American Enterprise and Worldwide Enterprise.

Adjusted earnings-per-share grew 7%, from $6.49 to $6.94, due to sturdy gross sales and a wider revenue margin in all segments.

Parker-Hannifin exceeded the analysts’ consensus by $0.22. Notably, Parker-Hannifin has exceeded the analysts’ EPS estimates for 39 consecutive quarters.

Click on right here to obtain our most up-to-date Certain Evaluation report on Parker-Hannifin (preview of web page 1 of three proven under):

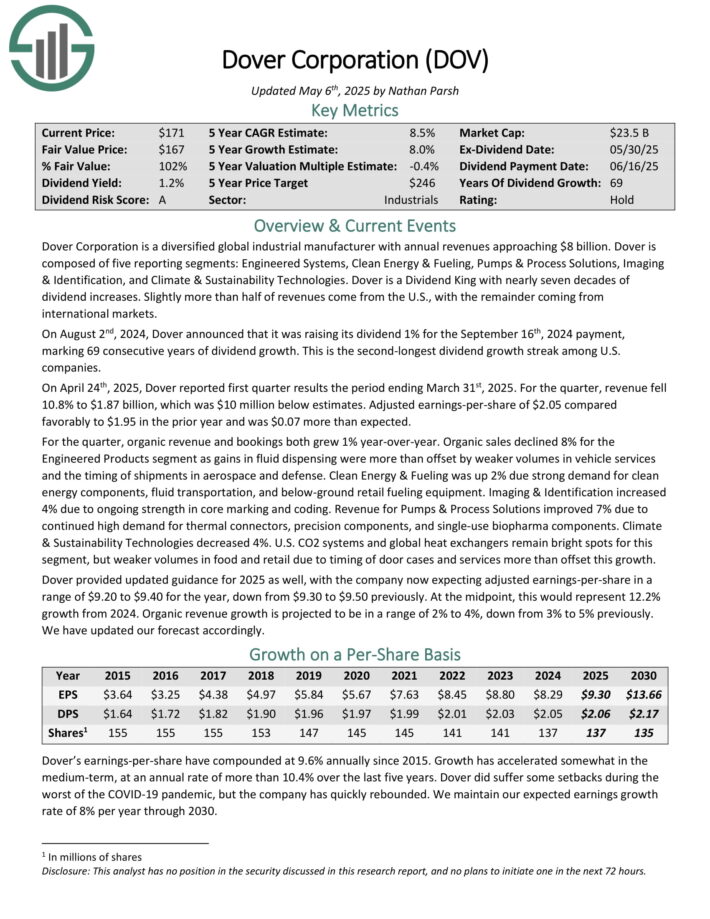

Longest Dividend Development Streak #1: Dover Corp. (DOV)

- Dividend Development Streak: 69 years

Dover Company is a diversified world industrial producer with annual revenues approaching $8 billion.

Dover consists of 5 reporting segments: Engineered Techniques, Clear Vitality & Fueling, Pumps & Course of Options, Imaging & Identification, and Local weather & Sustainability Applied sciences.

On April twenty fourth, 2025, Dover reported first quarter outcomes the interval ending March thirty first, 2025. For the quarter, income fell 10.8% to $1.87 billion, which was $10 million under estimates.

Adjusted earnings-per-share of $2.05 in contrast favorably to $1.95 within the prior yr and was $0.07 greater than anticipated.

For the quarter, natural income and bookings each grew 1% year-over-year. Natural gross sales declined 8% for the Engineered Merchandise phase as positive factors in fluid shelling out have been greater than offset by weaker volumes in automobile providers and the timing of shipments in aerospace and protection.

Dover supplied up to date steerage for 2025 as nicely, with the corporate now anticipating adjusted earnings-per-share in a spread of $9.20 to $9.40 for the yr. On the midpoint, this may symbolize 12.2% development from 2024. Natural income development is projected to be in a spread of two% to 4%.

Click on right here to obtain our most up-to-date Certain Evaluation report on DOV (preview of web page 1 of three proven under):

Further Studying

Certain Dividend maintains quite a lot of different lists of high quality dividend development shares:

In case you’re on the lookout for different sector-specific dividend shares, the next Certain Dividend databases will probably be helpful:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].