porcorex

Market uncertainty can be value investor’s best friend, as a boogeyman can scare many investors into selling. This can be especially meaningful for high yielding investments. For example, every 1% drop in the share price on a stock yielding 10% results in a 0.1% higher dividend yield, whereas the same percentage drop on a stock yielding 2% results in just a 0.02% rise in the yield.

This brings me to Stellus Capital Investment Corp. (NYSE:SCM), a high yielding BDC that pays investors monthly, helping shareholders to match monthly living expenses with a steady dividend check. SCM’s share price has fallen by a meaningful amount in recent weeks, and in this article, I highlight why this opens up a good opportunity to pick up some shares at a bargain.

Why SCM?

Stellus Capital is an externally-managed BDC that focuses on providing debt financing solutions to middle market companies in the U.S., with annual EBITDA in the $5-50M range. SCM went public 10 years ago and received its first and second SBIC licenses in 2014 and 2019. Since IPO, SCM has invested $8.1 billion across 300+ companies in 20 industries.

SCM has demonstrated favorable strong growth in its investment portfolio in recent years, with a 3-year CAGR of 14%, and achieving a 5-year return on equity of 9.6%. Importantly, it values direct relationships with its borrowers, as it focuses on originated loans versus broadly syndicated financings.

This means that SCM is typically the sole lender in the tranches in which it invests. Having a direct relationship with borrowers is also helpful, as building upon a relationship of trust can lead to follow-on venture debt financing rounds with existing borrowers. Moreover, substantially all investments are in portfolio companies backed by reputable private equity sponsors, implying a significant level of due diligence on the equity side in which SCM’s PE partners invest.

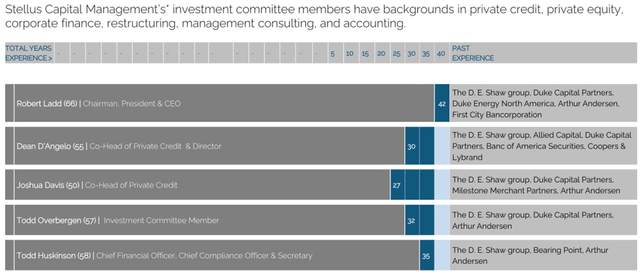

SCM is also led by a seasoned management team. As shown below, the management team collectively has over 100 years of experience, led by CEO and Chairman, Robert Ladd, who previously served at the D.E. Shaw Group and Duke Energy (DUK).

SCM Management (Investor Presentation)

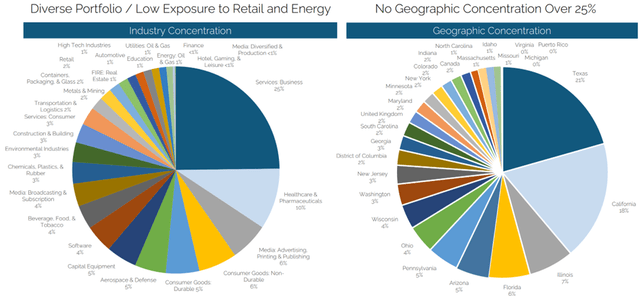

At present, SCM’s portfolio consists of 89 active investments diversified by geography and industry. It invests primarily in defensive industries with low exposure to cyclical industries like hospitality and energy, as shown below.

SCM Portfolio Mix (Investor Presentation)

Moreover, the vast majority (92%) of is debt portfolio is in the form of first lien debt, followed by second lien at 7%, and less than 1% exposure to unsecured debt. In addition, the majority of SCM’s investments are in the two lowest risk categories (RG1 and RG2), which make up 82% of the portfolio, with just 3% of investments in RG4 category, and 0% in the highest risk category of RG5.

One potential area for concern is 4 loans that are currently on non-accrual, representing 2.5% of portfolio fair value. However, these investment sit higher on the capital stack than equity investments from venture partners, and I would anticipate that SCM should be able to recover a good portion of its original investment.

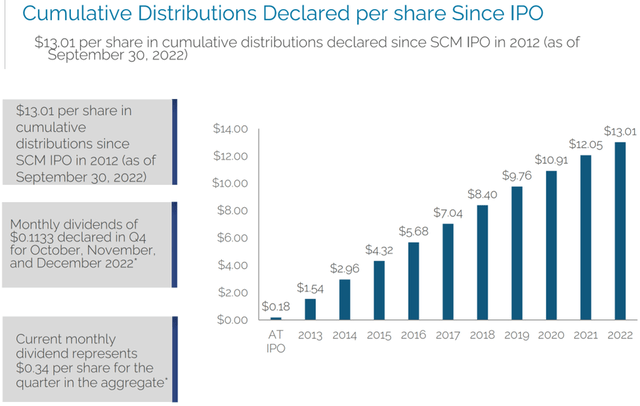

Meanwhile, SCM’s Core NII per share of $0.31 during the third quarter amply covers its $0.28 regular quarterly dividend (paid $0.933 per month). As shown below, SCM has paid $13.01 in cumulative dividends over the past decade.

SCM Cumulative Dividends (Investor Presentation)

SCM also stands to benefit from a rising rate environment, as 97% of its debt portfolio is in the form of floating rate loans. Management expects continued capacity pay both a regular and special dividend, resulting in a total 10.4% dividend yield. This is based on expectations of the current interest rate levels combined with potential additional gains in its equity investments, as noted during the recent conference call:

We expect that in January, we will combine the regular and additional dividends into a regular dividend of $0.34 per share for the quarter, which is a 21% increase in the regular dividend. Further, assuming that our benchmark pricing rates LIBOR and SOFR stay at their current levels, if not rising, we would likely look at raising the new regular dividend in January to a level above the $0.34 per share, more to come in January on that.

Relative to equity gains, notwithstanding a slowing economy, we continue to see the benefit of equity gain realizations. As noted earlier, we’ve had $4.7 million net realized gains this year through September 30 and expect more in the fourth quarter.

Lastly, I find SCM to be reasonably attractive at the current price of $13.10 with a price to book ratio of 0.92x. This translates to potential for double-digit total returns should SCM’s share price return to its book value. Analysts have a consensus Buy rating on SCM with an average price target of $14.08, sitting just $0.10 under book value.

SCM Price Target (Seeking Alpha)

Investor Takeaway

SCM is a high-yielding BDC with a diversified portfolio and seasoned management team. It has an attractive total dividend yield of 10.4%, along with potential for equity gains from its venture debt investments. At the current price of $13.10 and price to book ratio of 0.92x, SCM offers investors the potential for double-digit returns from both income and capital appreciation.