Printed on January twelfth, 2026 by Bob Ciura

Month-to-month dividend shares may be a sexy funding choice for these searching for steady revenue.

Month-to-month dividends permit traders to obtain extra frequent funds than shares which pay quarterly or semi-annual dividend payouts.

In consequence, month-to-month dividend shares may also help to cowl residing bills, or complement different sources of revenue.

There are over 80 month-to-month dividend shares that presently supply a month-to-month dividend fee.

You possibly can obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter, like dividend yield and payout ratio) by clicking on the hyperlink beneath:

Shares with low P/E ratios can supply enticing returns if their valuation multiples broaden.

And when a low P/E inventory additionally has a excessive dividend yield, traders get ‘paid to attend’ for the valuation a number of to extend.

The ten month-to-month dividend shares beneath have excessive yields, and are undervalued. This might result in outsized returns within the years forward.

These 10 haven’t been vetted for dividend security. As a substitute, they’re merely the ten most undervalued month-to-month dividend shares within the Positive Evaluation Analysis Database.

The shares are sorted by annual valuation returns, in ascending order.

Desk of Contents

Undervalued Month-to-month Dividend Inventory #10: Agree Realty (ADC)

- Annual Valuation Return: 1.9%

- Whole Annual Anticipated Return: 9.7%

Agree Realty is an built-in actual property funding belief (REIT) targeted on possession, acquisition, improvement, and retail property administration.

Agree has developed over 40 group procuring facilities all through the Midwestern and Southeastern United States. On the finish of December 2024, the corporate owned and operated 2,370 properties situated in 50 states, containing roughly 48.8 million sq. toes of gross leasable area.

The corporate’s enterprise goal is to spend money on and actively handle a diversified portfolio of retail properties web leased to trade tenants.

On October twenty first, 2025, Agree Realty Corp. reported third quarter outcomes for Fiscal 12 months (FY)2025. The corporate reported sturdy third-quarter outcomes for 2025, with EPS of $0.47, beating estimates by $0.01, and income of $183.22 million, up 18.7% year-over-year.

Internet revenue per share rose 7.9% to $0.45, whereas Core FFO and AFFO per share elevated 8.4% and seven.2% to $1.09 and $1.10, respectively.

The corporate declared a month-to-month dividend of $0.256 per share, representing a 2.4% improve from the prior yr, and raised full-year 2025 AFFO steerage to $4.31–$4.33 per share.

ADC has elevated its dividend for 13 consecutive years.

Click on right here to obtain our most up-to-date Positive Evaluation report on ADC (preview of web page 1 of three proven beneath):

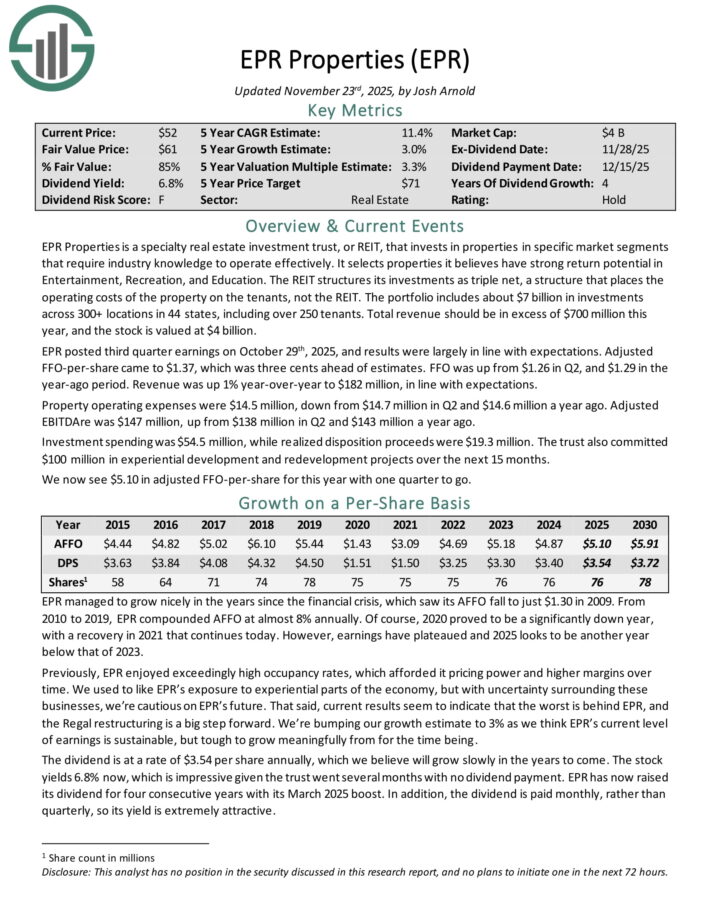

Undervalued Month-to-month Dividend Inventory #9: EPR Properties (EPR)

- Annual Valuation Return: 3.1%

- Whole Annual Anticipated Return: 11.2%

EPR Properties is a specialty actual property funding belief, or REIT, that invests in properties in particular market segments that require trade information to function successfully.

It selects properties it believes have sturdy return potential in Leisure, Recreation, and Training. The REIT constructions its investments as triple web, a construction that locations the working prices of the property on the tenants, not the REIT.

The portfolio consists of about $7 billion in investments throughout 300+ areas in 44 states, together with over 250 tenants. Whole income must be in extra of $700 million this yr.

EPR posted third quarter earnings on October twenty ninth, 2025, and outcomes had been largely in step with expectations. Adjusted FFO-per-share got here to $1.37, which was three cents forward of estimates.

FFO was up from $1.26 in Q2, and $1.29 within the year-ago interval. Income was up 1% year-over-year to $182 million, in step with expectations.

Property working bills had been $14.5 million, down from $14.7 million in Q2 and $14.6 million a yr in the past. Adjusted EBITDAre was $147 million, up from $138 million in Q2 and $143 million a yr in the past.

Funding spending was $54.5 million, whereas realized disposition proceeds had been $19.3 million. The belief additionally dedicated $100 million in experiential improvement and redevelopment initiatives over the subsequent 15 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on EPR (preview of web page 1 of three proven beneath):

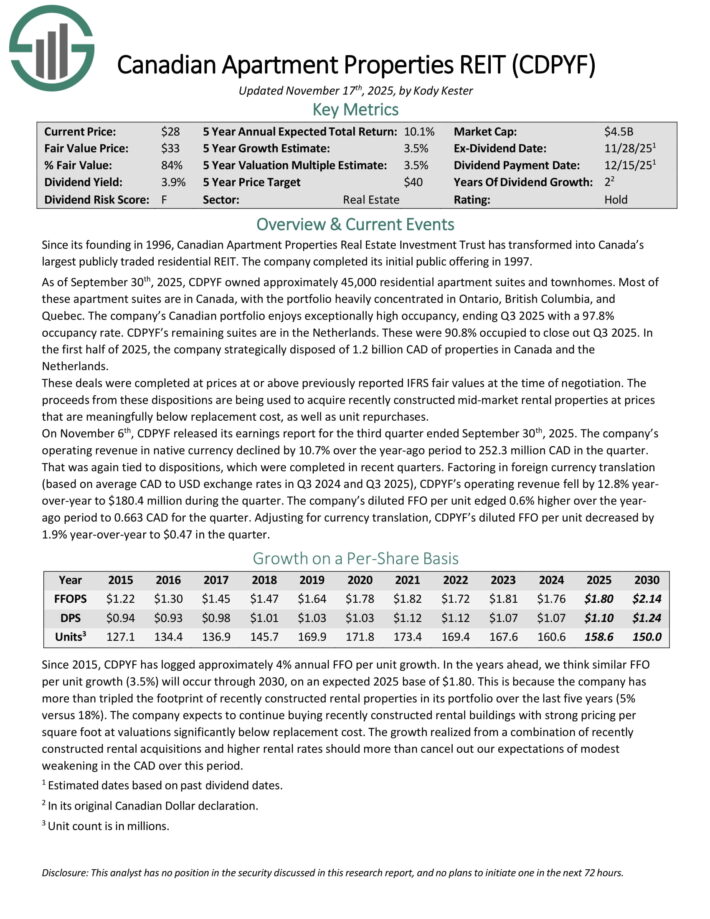

Undervalued Month-to-month Dividend Inventory #8: Canadian Condo Properties REIT (CDPYF)

- Annual Valuation Return: 3.2%

- Whole Annual Anticipated Return: 9.8%

Canadian Condo Properties Actual Property Funding Belief is Canada’s largest publicly traded residential REIT. The corporate accomplished its preliminary public providing in 1997.

As of September thirtieth, 2025, CDPYF owned roughly 45,000 residential residence suites and townhomes. Most of those residence suites are in Canada, with the portfolio closely concentrated in Ontario, British Columbia, and

Quebec.

The corporate’s Canadian portfolio enjoys exceptionally excessive occupancy, ending Q3 2025 with a 97.8% occupancy charge. CDPYF’s remaining suites are within the Netherlands. These had been 90.8% occupied to shut out Q3 2025.

Within the first half of 2025, the corporate strategically disposed of 1.2 billion CAD of properties in Canada and the Netherlands.

These offers had been accomplished at costs at or above beforehand reported IFRS honest values on the time of negotiation. The proceeds from these inclinations are getting used to amass lately constructed mid-market rental properties at costs which are meaningfully beneath substitute price, in addition to unit repurchases.

On November sixth, CDPYF launched its earnings report for the third quarter. The corporate’s working income in native foreign money declined by 10.7% over the year-ago interval to 252.3 million CAD within the quarter.

Diluted FFO per unit edged 0.6% larger over the year-ago interval to 0.663 CAD for the quarter. Adjusting for foreign money translation, CDPYF’s diluted FFO per unit decreased by 1.9% year-over-year to $0.47 within the quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on CDPYF (preview of web page 1 of three proven beneath):

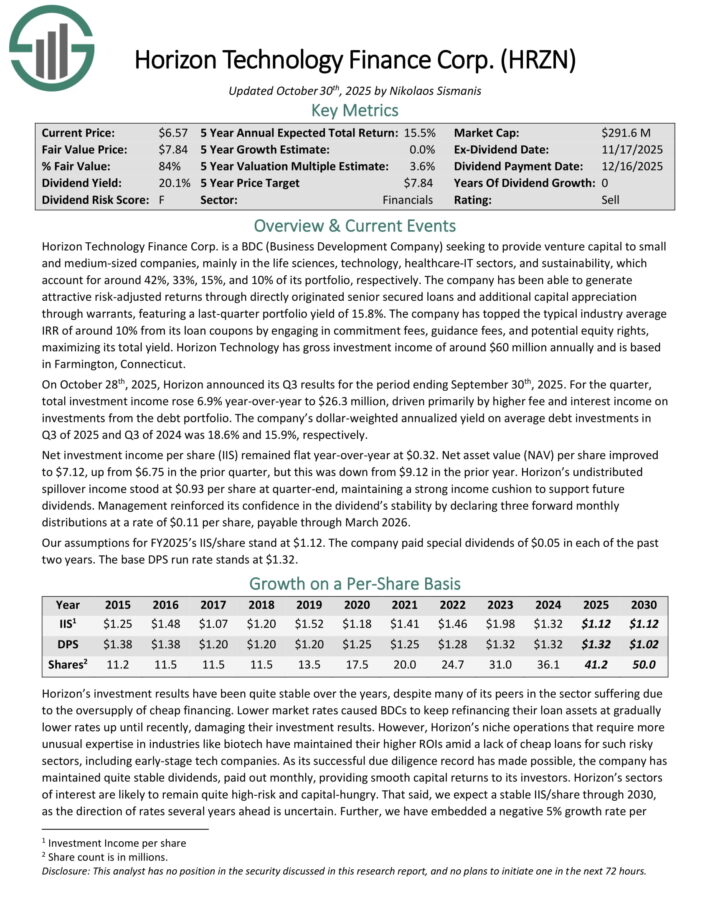

Undervalued Month-to-month Dividend Inventory #7: Horizon Expertise Finance Corp. (HRZN)

- Annual Valuation Return: 3.2%

- Whole Annual Anticipated Return: 15.1%

Horizon Expertise Finance Corp. is a BDC that gives enterprise capital to small and medium–sized corporations within the know-how, life sciences, and healthcare–IT sectors.

The corporate has generated enticing threat–adjusted returns via immediately originated senior secured loans and extra capital appreciation via warrants.

On October twenty eighth, 2025, Horizon introduced its Q3 outcomes. For the quarter, whole funding revenue rose 6.9% year-over-year to $26.3 million, pushed primarily by larger charge and curiosity revenue on investments from the debt portfolio.

The corporate’s dollar-weighted annualized yield on common debt investments in Q3 of 2025 and Q3 of 2024 was 18.6% and 15.9%, respectively.

Internet funding revenue per share (IIS) remained flat year-over-year at $0.32. Internet asset worth (NAV) per share improved to $7.12, up from $6.75 within the prior quarter, however this was down from $9.12 within the prior yr.

Horizon’s undistributed spillover revenue stood at $0.93 per share at quarter-end, sustaining a powerful revenue cushion to help future dividends.

Click on right here to obtain our most up-to-date Positive Evaluation report on HRZN (preview of web page 1 of three proven beneath):

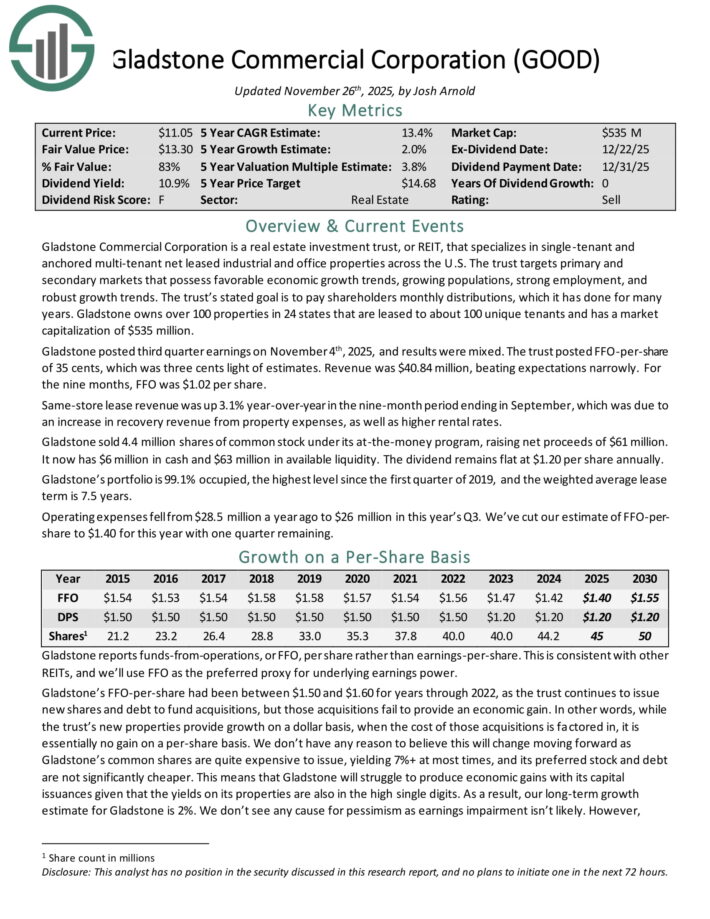

Undervalued Month-to-month Dividend Inventory #6: Gladstone Business Corp. (GOOD)

- Annual Valuation Return: 3.5%

- Whole Annual Anticipated Return: 13.1%

Gladstone Business Company is an actual property funding belief, or REIT, that focuses on single-tenant and anchored multi-tenant web leased industrial and workplace properties throughout the U.S.

The belief targets main and secondary markets that possess favorable financial development developments, rising populations, sturdy employment, and strong development developments.

The belief’s said objective is to pay shareholders month-to-month distributions, which it has performed for greater than 17 consecutive years. Gladstone owns over 100 properties in 24 states which are leased to about 100 distinctive tenants.

Gladstone posted third quarter earnings on November 4th, 2025, and outcomes had been blended. The belief posted FFO-per-share of 35 cents, which was three cents gentle of estimates. Income was $40.84 million, beating expectations narrowly. For the 9 months, FFO was $1.02 per share.

Identical-store lease income was up 3.1% year-over-year within the nine-month interval ending in September, which was attributable to a rise in restoration income from property bills, in addition to larger rental charges.

Gladstone offered 4.4 million shares of frequent inventory beneath its at-the-money program, elevating web proceeds of $61 million. It now has $6 million in money and $63 million in out there liquidity.

The dividend stays flat at $1.20 per share yearly. Gladstone’s portfolio is 99.1% occupied, the very best stage because the first quarter of 2019, and the weighted common lease time period is 7.5 years.

Click on right here to obtain our most up-to-date Positive Evaluation report on GOOD (preview of web page 1 of three proven beneath):

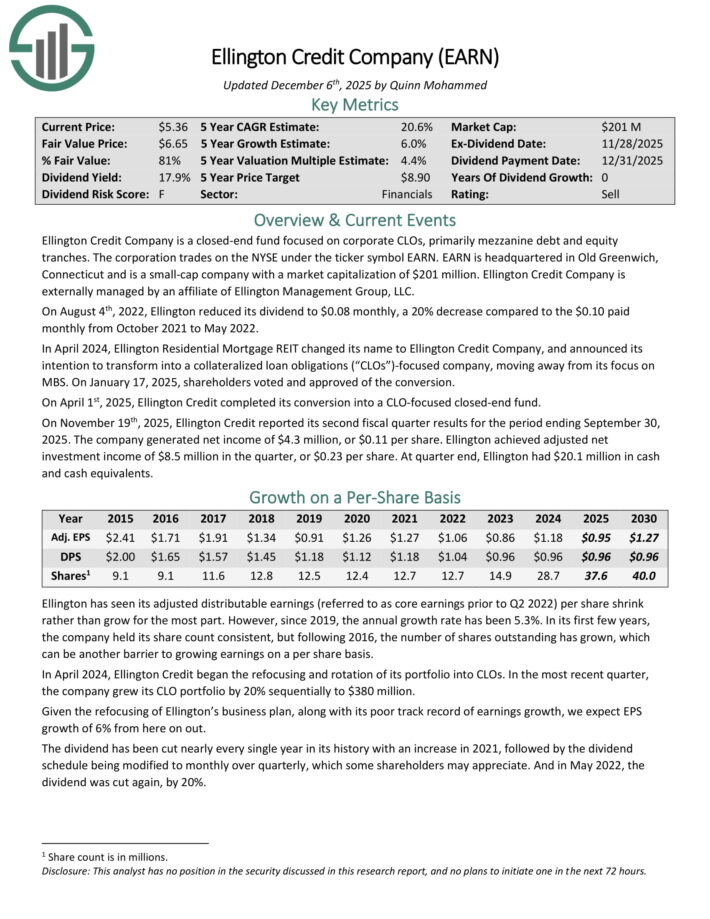

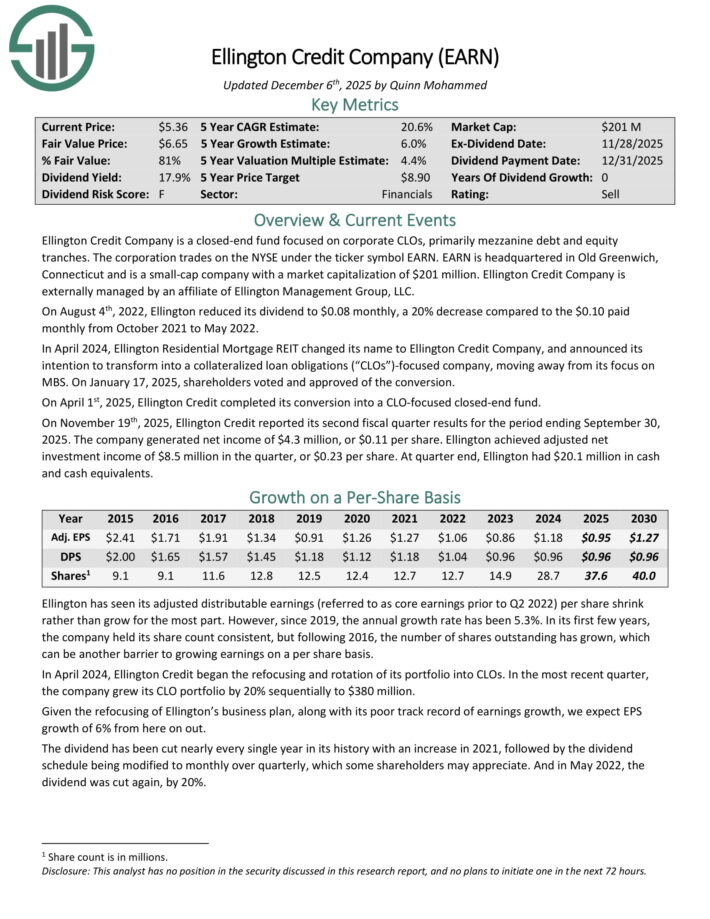

Undervalued Month-to-month Dividend Inventory #5: Ellington Credit score Co. (EARN)

- Annual Valuation Return: 3.7%

- Whole Annual Anticipated Return: 19.8%

Ellington Credit score Co. acquires, invests in, and manages residential mortgage and actual property associated belongings. Ellington focuses totally on residential mortgage-backed securities, particularly these backed by a U.S. Authorities company or U.S. authorities–sponsored enterprise.

Company MBS are created and backed by authorities businesses or enterprises, whereas non-agency MBS are not assured by the federal government.

On November nineteenth, 2025, Ellington Credit score reported its second fiscal quarter outcomes for the interval ending September 30, 2025. The corporate generated web revenue of $4.3 million, or $0.11 per share.

Ellington achieved adjusted web funding revenue of $8.5 million within the quarter, or $0.23 per share. At quarter finish, Ellington had $20.1 million in money and money equivalents.

Click on right here to obtain our most up-to-date Positive Evaluation report on EARN (preview of web page 1 of three proven beneath):

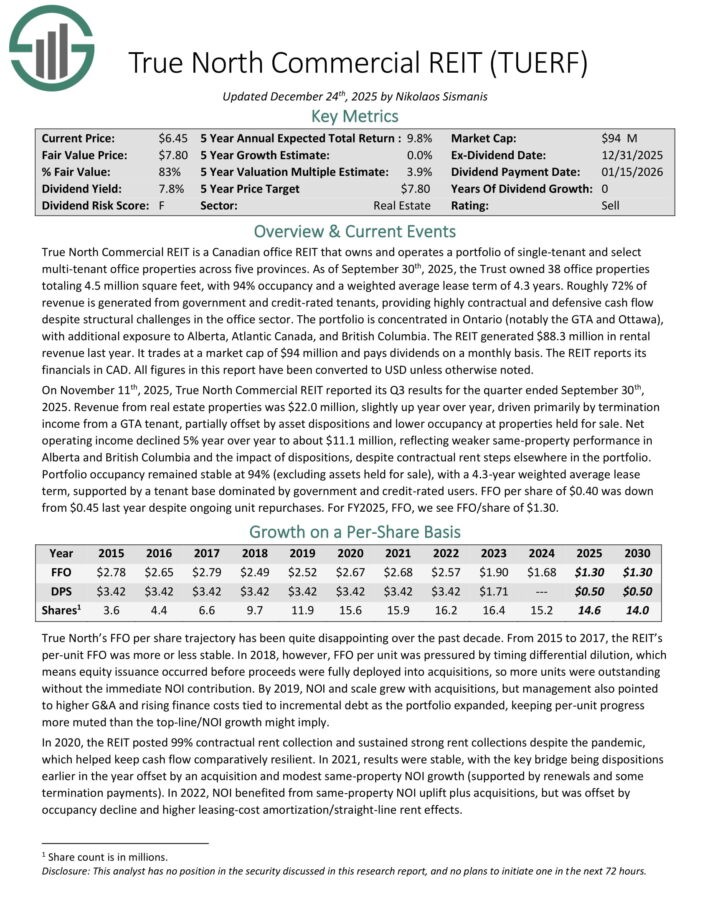

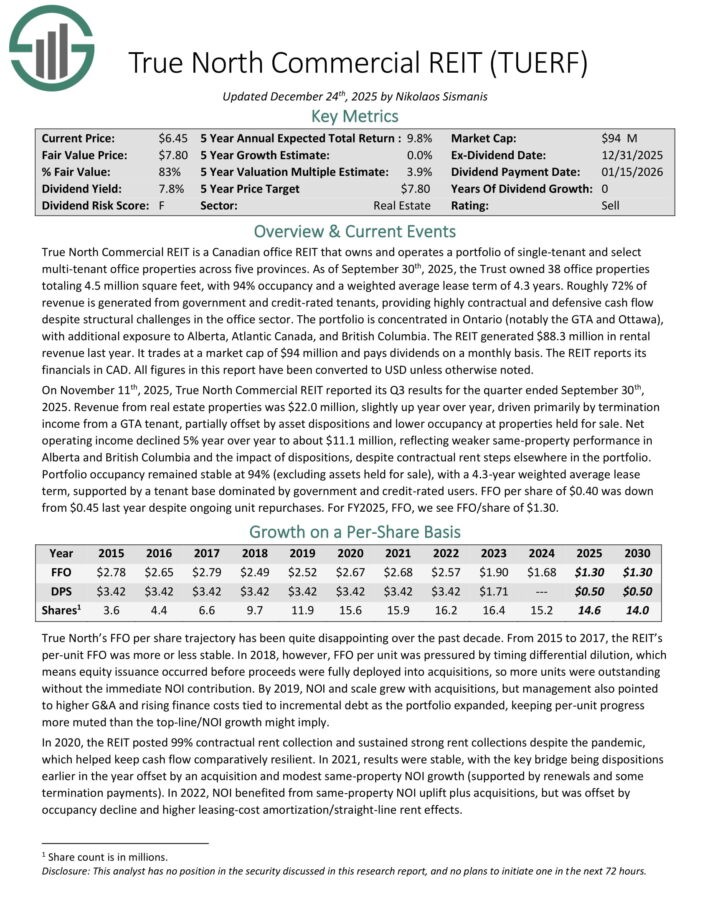

Undervalued Month-to-month Dividend Inventory #4: True North Business REIT (TUERF)

- Annual Valuation Return: 3.8%

- Whole Annual Anticipated Return: 9.7%

True North Business REIT is a Canadian workplace REIT that owns and operates a portfolio of single-tenant and choose multi-tenant workplace properties throughout 5 provinces.

As of September thirtieth, 2025, the Belief owned 38 workplace properties totaling 4.5 million sq. toes, with 94% occupancy and a weighted common lease time period of 4.3 years.

Roughly 72% of income is generated from authorities and credit-rated tenants, offering extremely contractual and defensive money circulation regardless of structural challenges within the workplace sector.

The portfolio is concentrated in Ontario (notably the GTA and Ottawa), with extra publicity to Alberta, Atlantic Canada, and British Columbia. The REIT generated $88.3 million in rental income final yr.

On November eleventh, 2025, True North Business REIT reported its Q3 outcomes. Income from actual property properties was $22.0 million, barely up yr over yr.

Development was pushed primarily by termination revenue from a GTA tenant, partially offset by asset inclinations and decrease occupancy at properties held on the market.

Internet working revenue declined 5% yr over yr to about $11.1 million, reflecting weaker same-property efficiency in Alberta and British Columbia and the influence of inclinations, regardless of contractual hire steps elsewhere within the portfolio.

Portfolio occupancy remained steady at 94% (excluding belongings held on the market), with a 4.3-year weighted common lease time period, supported by a tenant base dominated by authorities and credit-rated customers.

FFO per share of $0.40 was down from $0.45 final yr regardless of ongoing unit repurchases.

Click on right here to obtain our most up-to-date Positive Evaluation report on TUERF (preview of web page 1 of three proven beneath):

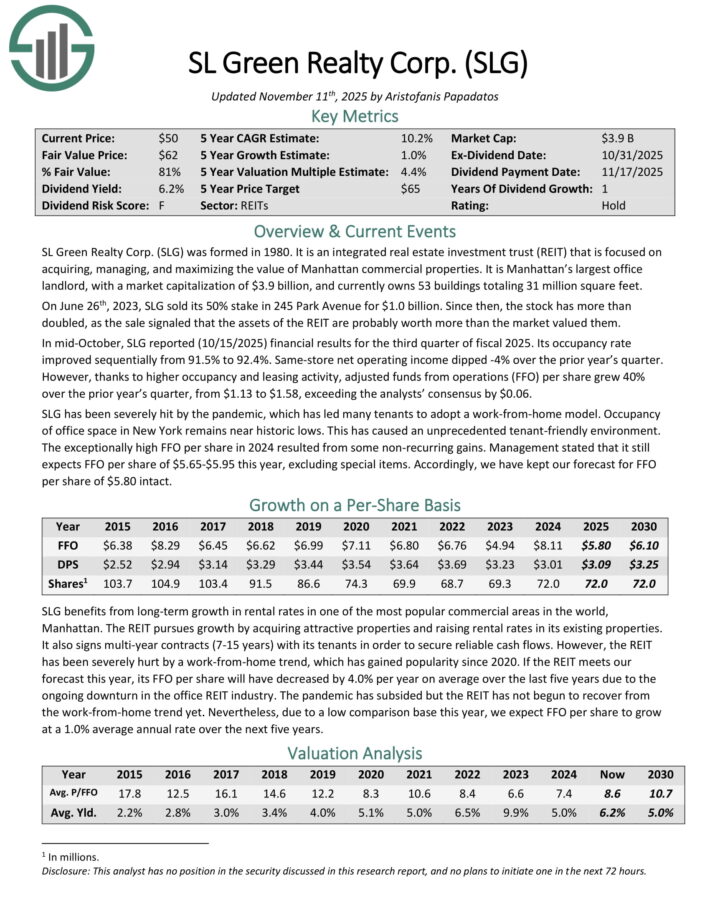

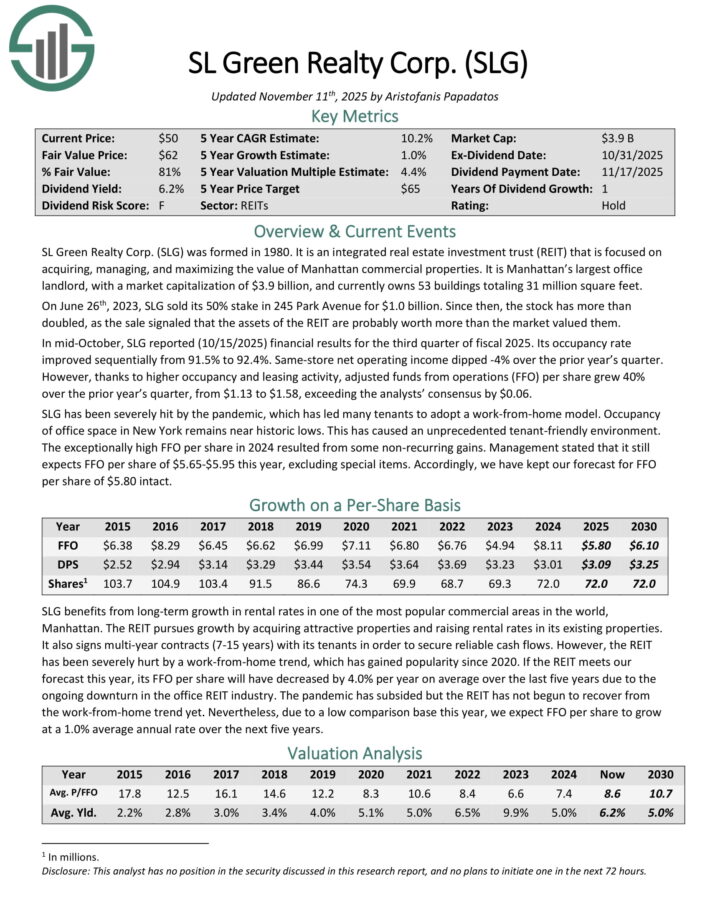

Undervalued Month-to-month Dividend Inventory #3: SL Inexperienced Realty (SLG)

- Annual Valuation Return: 4.7%

- Whole Annual Anticipated Return: 10.5%

SL Inexperienced Realty was shaped in 1980. It’s an built-in actual property funding belief (REIT) that’s targeted on buying, managing, and maximizing the worth of Manhattan industrial properties.

It’s Manhattan’s largest workplace landlord, and presently owns 53 buildings totaling 31 million sq. toes.

In mid-October, SLG reported (10/15/2025) monetary outcomes for the third quarter of fiscal 2025. Its occupancy charge improved sequentially from 91.5% to 92.4%. Identical-store web working revenue dipped -4% over the prior yr’s quarter.

Nevertheless, due to larger occupancy and leasing exercise, adjusted funds from operations (FFO) per share grew 40% over the prior yr’s quarter, from $1.13 to $1.58, exceeding the analysts’ consensus by $0.06.

SLG has been severely hit by the pandemic, which has led many tenants to undertake a work-from-home mannequin. Occupancy of workplace area in New York stays close to historic lows. This has precipitated an unprecedented tenant-friendly setting.

The exceptionally excessive FFO per share in 2024 resulted from some non-recurring positive aspects. Administration said that it nonetheless expects FFO per share of $5.65-$5.95 this yr, excluding particular objects.

Click on right here to obtain our most up-to-date Positive Evaluation report on SLG (preview of web page 1 of three proven beneath):

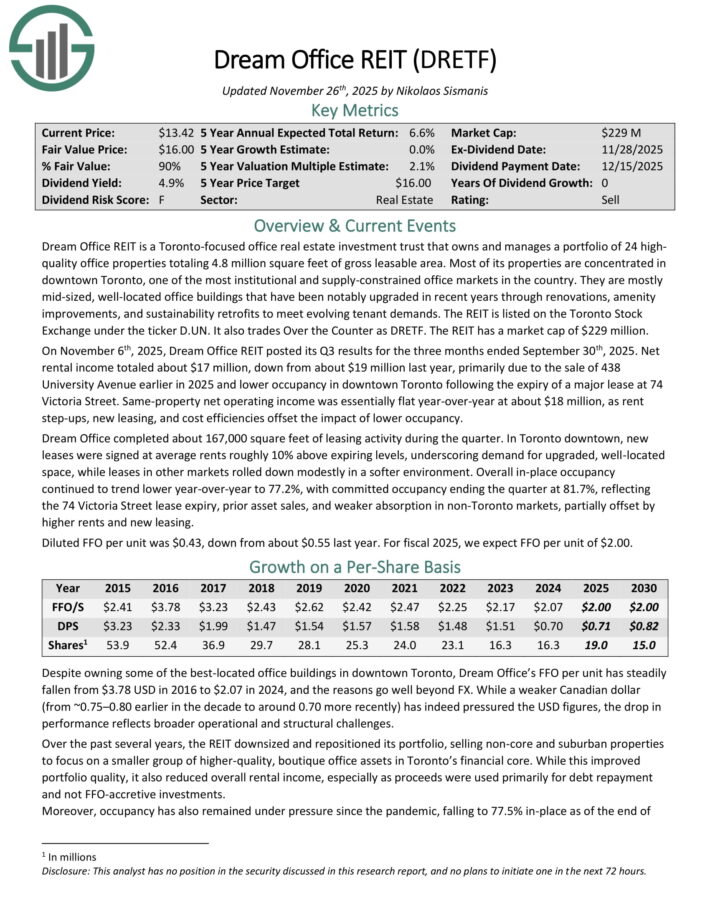

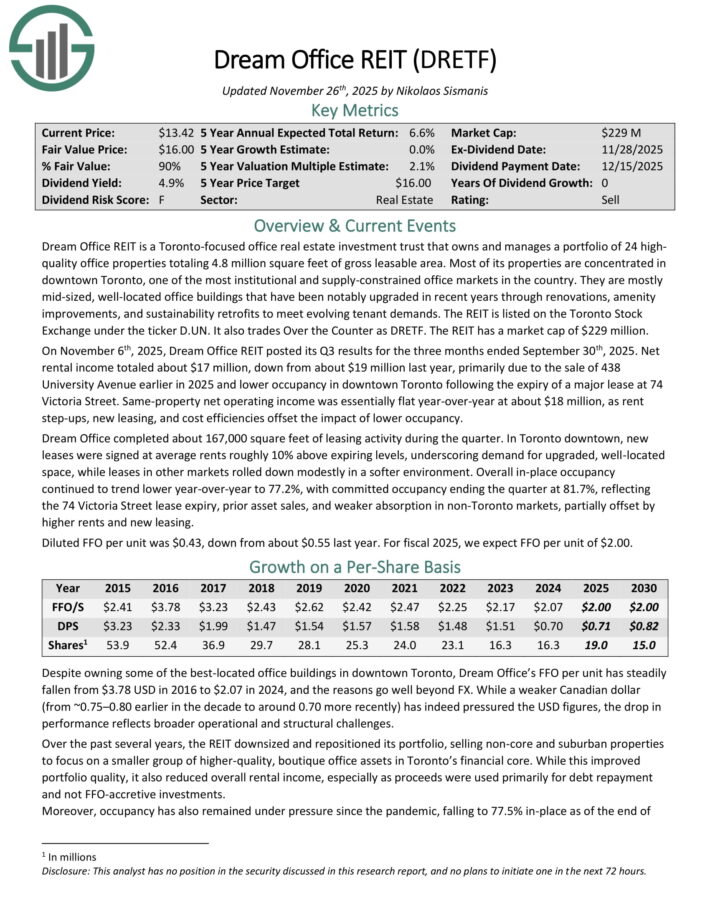

Undervalued Month-to-month Dividend Inventory #2: Dream Workplace REIT (DRETF)

- Annual Valuation Return: 5.3%

- Whole Annual Anticipated Return: 10.0%

Dream Workplace REIT is a Toronto-focused workplace actual property funding belief that owns and manages a portfolio of 24 high-quality workplace properties totaling 4.8 million sq. toes of gross leaseable space.

Most of its properties are concentrated in downtown Toronto, some of the institutional and supply-constrained workplace markets within the nation.

The REIT is listed on the Toronto Inventory Trade beneath the ticker D.UN. It additionally trades Over the Counter as DRETF.

On November sixth, 2025, Dream Workplace REIT posted its Q3 outcomes for the three months ended September thirtieth, 2025. Internet rental revenue totaled about $17 million, down from about $19 million final yr.

This was primarily as a result of sale of 438 College Avenue earlier in 2025 and decrease occupancy in downtown Toronto following the expiry of a serious lease at 74 Victoria Road.

Identical-property web working revenue was primarily flat year-over-year at about $18 million, as hire step-ups, new leasing, and price efficiencies offset the influence of decrease occupancy.

Dream Workplace accomplished about 167,000 sq. toes of leasing exercise through the quarter. In Toronto downtown, new leases had been signed at common rents roughly 10% above expiring ranges.

Diluted FFO per unit was $0.43, down from about $0.55 final yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on DRETF (preview of web page 1 of three proven beneath):

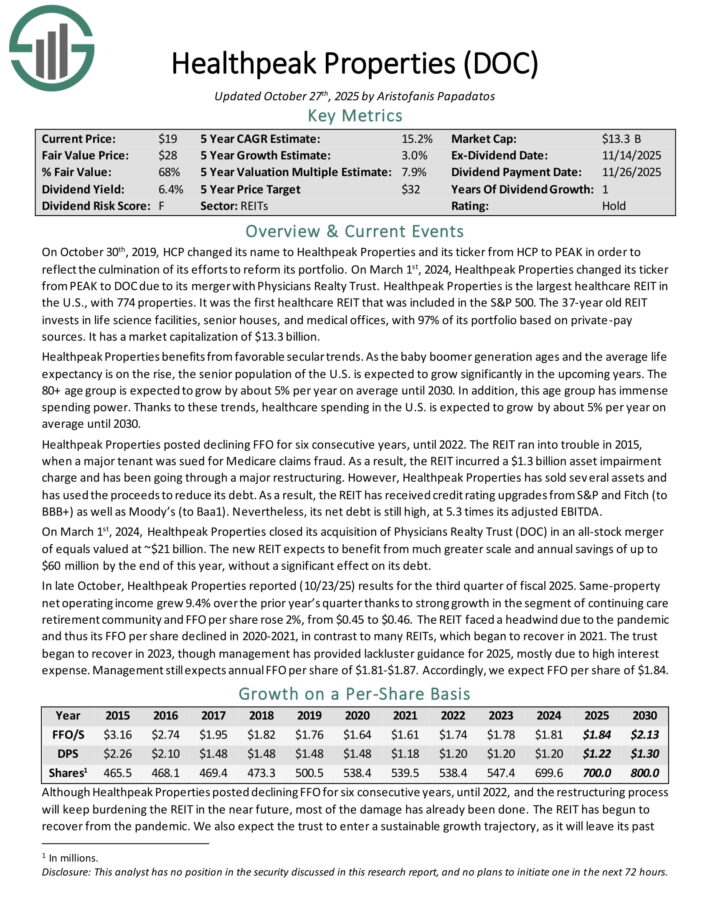

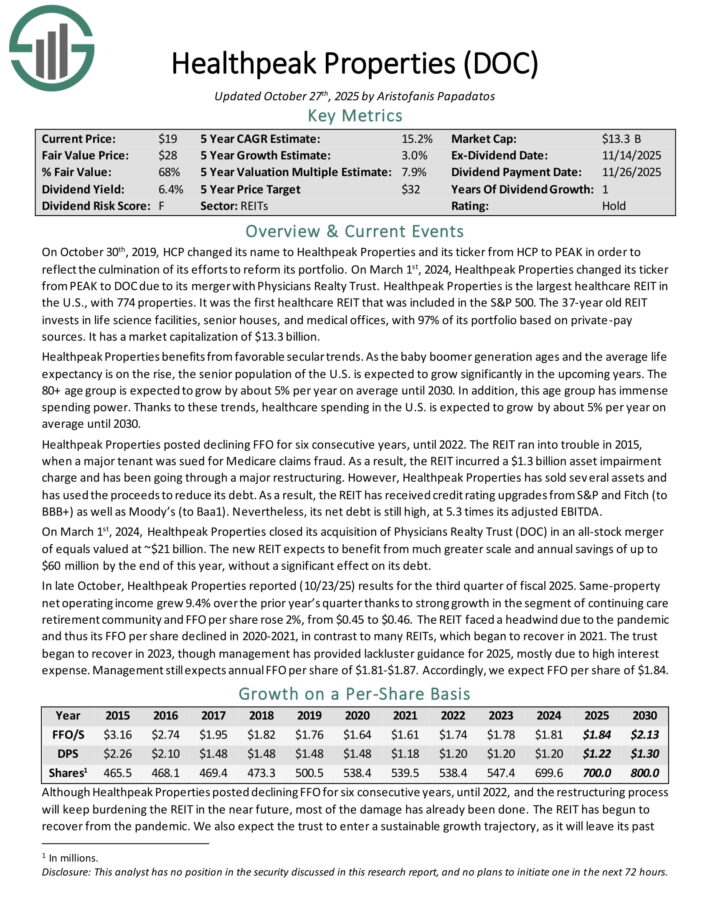

Undervalued Month-to-month Dividend Inventory #1: Healthpeak Properties (DOC)

- Annual Valuation Return: 10.5%

- Whole Annual Anticipated Return: 17.9%

Healthpeak Properties is the most important healthcare REIT within the U.S., with 774 properties. It was the primary healthcare REIT that was included within the S&P 500.

The REIT invests in life science services, senior homes, and medical places of work, with 97% of its portfolio primarily based on private-pay sources.

In late October, Healthpeak Properties reported (10/23/25) outcomes for the third quarter of fiscal 2025. Identical-property web working revenue grew 9.4% over the prior yr’s quarter due to sturdy development within the phase of continuous care retirement group and FFO per share rose 2%, from $0.45 to $0.46.

Administration nonetheless expects annual FFO per share of $1.81-$1.87.

The payout ratio is standing at a virtually 10-year low whereas the REIT didn’t have any debt maturities in 2025. The REIT has begun to recuperate from the pandemic. We additionally anticipate the belief to enter a sustainable development trajectory.

Click on right here to obtain our most up-to-date Positive Evaluation report on DOC (preview of web page 1 of three proven beneath):

Further Studying

Don’t miss the sources beneath for extra month-to-month dividend inventory investing analysis.

And see the sources beneath for extra compelling funding concepts for dividend development shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].