Revealed on November fifth, 2025 by Bob Ciura

There’s an outdated saying, extensively attributed to the Greek thinker Heraclitus, that the one fixed in life is change. Which means that most issues in life are in a relentless state of transformation, and that change is an inevitable a part of human existence.

As investing mirrors life in some ways, the inventory market displays this similarity. When buying particular person shares, traders have to be keenly conscious of the merchandise an organization sells, the aggressive threats it faces, and the way change might disrupt the corporate or a whole business.

Technological change can threaten an organization’s enterprise mannequin. Nonetheless, for traders, there may be super worth in buying shares of firms that promote merchandise which stay constant over time.

This method considerably reduces the chances that developments in expertise will erode an organization’s aggressive benefits.

In flip, sturdy aggressive benefits permit an organization to pay dividends to shareholders every year, whereas persistently elevating its dividend over time.

The Dividend Kings are a choose group of 56 shares which have elevated their dividends for not less than 50 consecutive years.

We created a full record of all 56 Dividend Kings.

You may obtain the complete record, together with necessary monetary metrics equivalent to dividend yields and price-to-earnings ratios, by clicking on the hyperlink beneath:

Warren Buffett has lengthy been a proponent of investing in firms which have a “huge enterprise moat,” as he places it. One in all our favourite Buffett quotes is:

Our method could be very a lot benefiting from lack of change relatively than from change. With Wrigley chewing gum, it’s the dearth of change that appeals to me.

He was referring to Berkshire Hathaway’s funding in Wrigley gum, which displays his funding philosophy of favoring companies with secure, predictable traits over these topic to speedy change.

Corporations with sturdy enterprise fashions create well-established merchandise that will expertise much less volatility in comparison with these in quickly altering industries.

Their income streams and revenue margins are usually extra constant, making them extra interesting to traders searching for regular dividends.

This text will focus on 10 prime dividend shares that profit from lack of change.

Desk of Contents

The desk of contents beneath permits for straightforward navigation. The shares are sorted by their dividend enhance streaks, from lowest to highest.

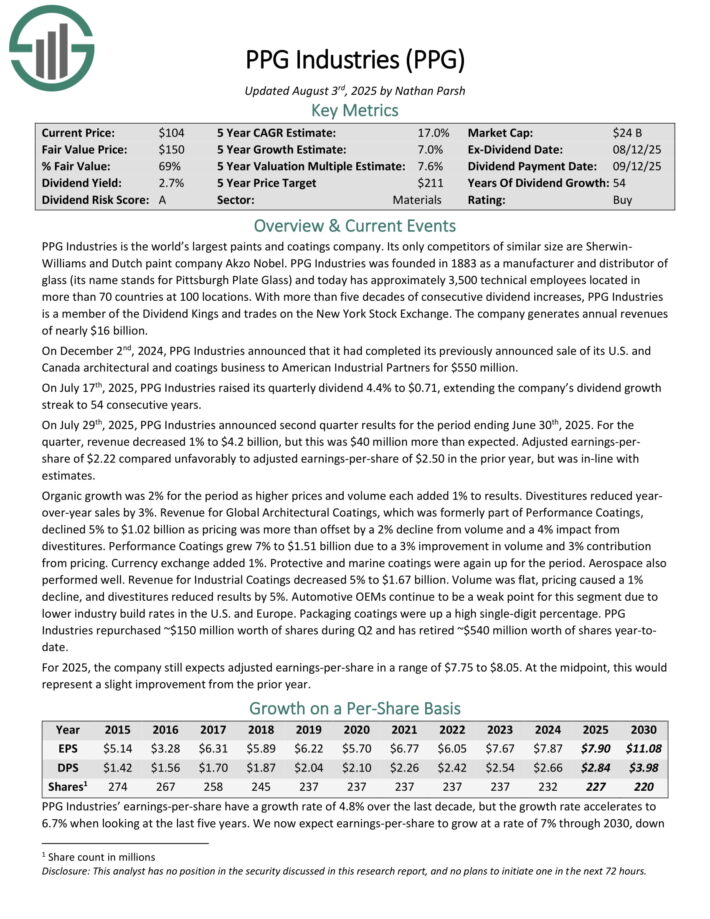

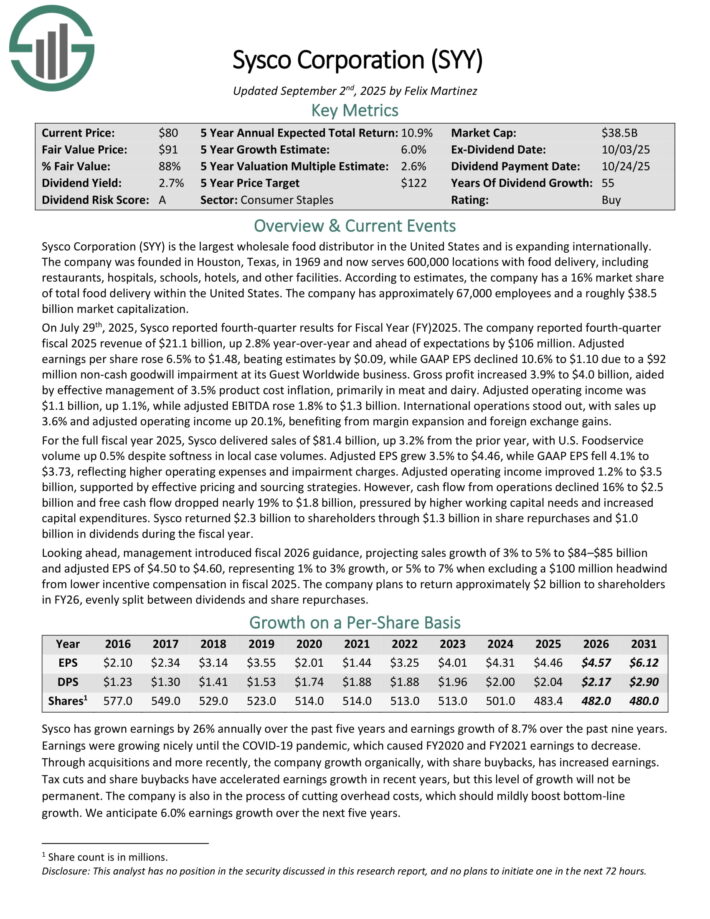

Lack of Change Dividend King: PPG Industries (PPG)

- Consecutive Annual Dividend Will increase: 54

PPG Industries is the world’s largest paints and coatings firm. Its solely opponents of comparable measurement are Sherwin-Williams and Dutch paint firm Akzo Nobel.

PPG Industries was based in 1883 as a producer and distributor of glass (its title stands for Pittsburgh Plate Glass) and right now has roughly 3,500 technical staff situated in additional than 70 international locations at 100 areas.

On July seventeenth, 2025, PPG Industries raised its quarterly dividend 4.4% to $0.71, extending the corporate’s dividend progress streak to 54 consecutive years.

On July twenty ninth, 2025, PPG Industries introduced second-quarter outcomes. For the quarter, income decreased 1% to $4.2 billion, however this was $40 million greater than anticipated. Adjusted earnings-per-share of $2.22 in contrast unfavorably to adjusted earnings-per-share of $2.50 within the prior yr, however was in-line with estimates.

Natural progress was 2% for the interval as greater costs and quantity every added 1% to outcomes. Divestitures lowered year-over-year gross sales by 3%. Income for International Architectural Coatings declined 5% to $1.02 billion as pricing was greater than offset by a 2% decline from quantity and a 4% influence from divestitures.

Efficiency Coatings grew 7% to $1.51 billion on account of a 3% enchancment in quantity and three% contribution from pricing. Foreign money alternate added 1%. Protecting and marine coatings had been once more up for the interval.

PPG Industries repurchased ~$150 million value of shares throughout Q2 and has retired ~$540 million value of shares year-to-date.

Click on right here to obtain our most up-to-date Certain Evaluation report on PPG (preview of web page 1 of three proven beneath):

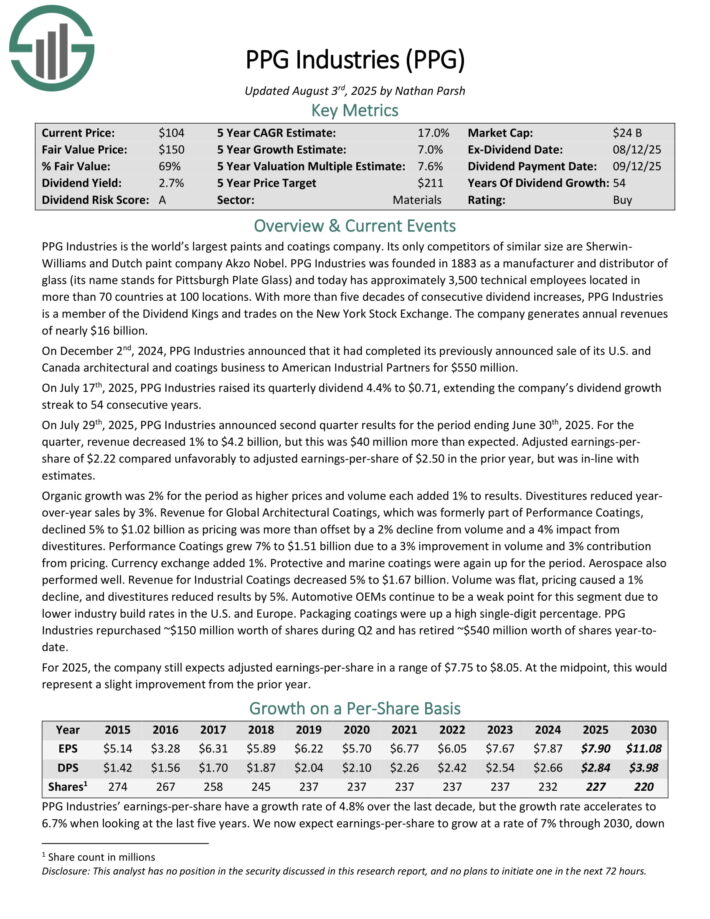

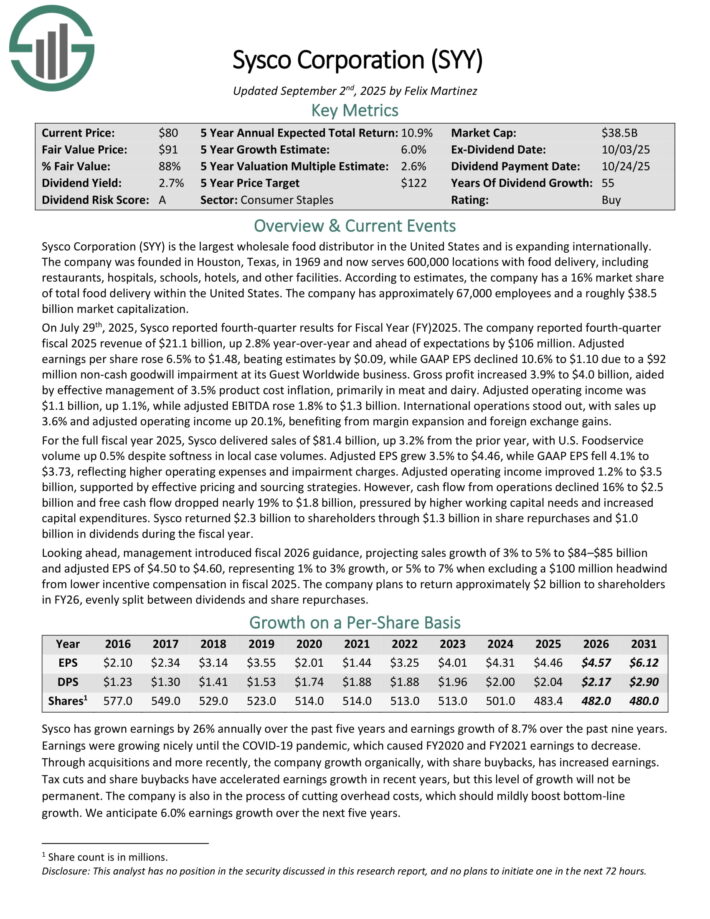

Lack of Change Dividend King: Sysco Corp. (SYY)

- Consecutive Annual Dividend Will increase: 55

Sysco Company (SYY) is the biggest wholesale meals distributor in the USA and is increasing internationally.

The corporate was based in Houston, Texas, in 1969 and now serves 600,000 areas with meals supply, together with eating places, hospitals, colleges, motels, and different services. Based on estimates, the corporate has a 16% market share of whole meals supply inside the USA.

On July twenty ninth, 2025, Sysco reported fourth-quarter outcomes for Fiscal 12 months (FY) 2025. The corporate reported fourth quarter fiscal 2025 income of $21.1 billion, up 2.8% year-over-year and forward of expectations by $106 million.

Adjusted earnings per share rose 6.5% to $1.48, beating estimates by $0.09, whereas GAAP EPS declined 10.6% to $1.10 on account of a $92 million non-cash goodwill impairment at its Visitor Worldwide enterprise. Gross revenue elevated 3.9% to $4.0 billion, aided by efficient administration of three.5% product value inflation, primarily in meat and dairy.

Adjusted working revenue was $1.1 billion, up 1.1%, whereas adjusted EBITDA rose 1.8% to $1.3 billion. Worldwide operations stood out, with gross sales up 3.6% and adjusted working revenue up 20.1%, benefiting from margin enlargement and international alternate positive aspects.

For the complete fiscal yr 2025, Sysco delivered gross sales of $81.4 billion, up 3.2% from the prior yr, with U.S. Foodservice quantity up 0.5% regardless of softness in native case volumes.

Adjusted EPS grew 3.5% to $4.46, whereas GAAP EPS fell 4.1% to $3.73, reflecting greater working bills and impairment expenses. Adjusted working revenue improved 1.2% to $3.5 billion, supported by efficient pricing and sourcing methods.

Money circulate from operations declined 16% to $2.5 billion and free money circulate dropped almost 19% to $1.8 billion, pressured by greater working capital wants and elevated capital expenditures.

Sysco returned $2.3 billion to shareholders via $1.3 billion in share repurchases and $1.0 billion in dividends throughout the fiscal yr.

Trying forward, administration launched fiscal 2026 steering, projecting gross sales progress of three% to five% to $84–$85 billion and adjusted EPS of $4.50 to $4.60, representing 1% to three% progress, or 5% to 7% when excluding a $100 million headwind from decrease incentive compensation in fiscal 2025.

The corporate plans to return roughly $2 billion to shareholders in FY26, evenly cut up between dividends and share repurchases.

Click on right here to obtain our most up-to-date Certain Evaluation report on SYY (preview of web page 1 of three proven beneath):

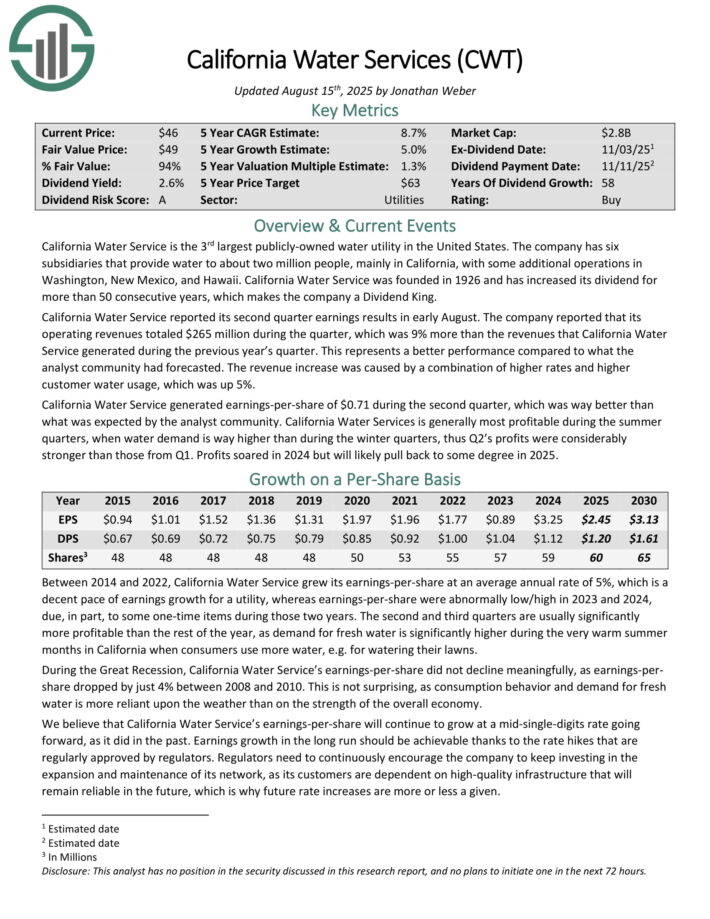

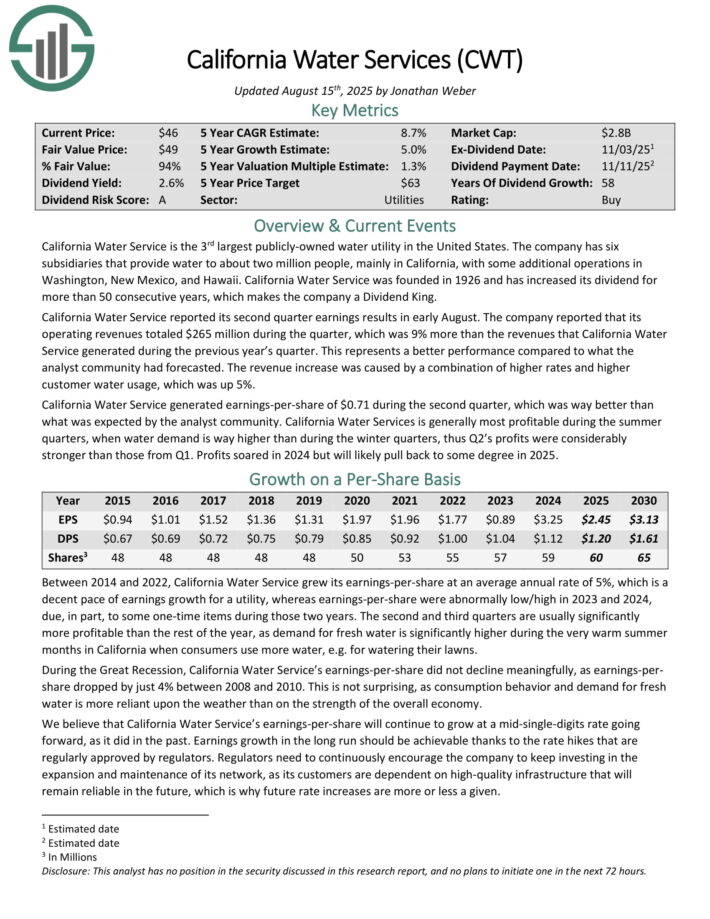

Lack of Change Dividend King: California Water Service (CWT)

- Consecutive Annual Dividend Will increase: 58

California Water Service is the third largest publicly-owned water utility in the USA. The corporate has six subsidiaries that present water to about two million individuals, primarily in California, with some further operations in Washington, New Mexico, and Hawaii.

California Water Service reported its second quarter earnings leads to early August. The corporate reported that its working revenues totaled $265 million throughout the quarter, which was 9% greater than the revenues that California Water Service generated throughout the earlier yr’s quarter.

This represents a greater efficiency in comparison with what the analyst group had forecast. The income enhance was brought on by a mix of upper charges and better buyer water utilization, which was up 5%. California Water Service generated earnings-per-share of $0.71 throughout the second quarter.

California Water Service is a regulated utility, and as such, it doesn’t have to fret about competitors an excessive amount of. The corporate isn’t susceptible to recessions or financial downturns, as customers want recent water irrespective of the power of the economic system.

Click on right here to obtain our most up-to-date Certain Evaluation report on CWT (preview of web page 1 of three proven beneath):

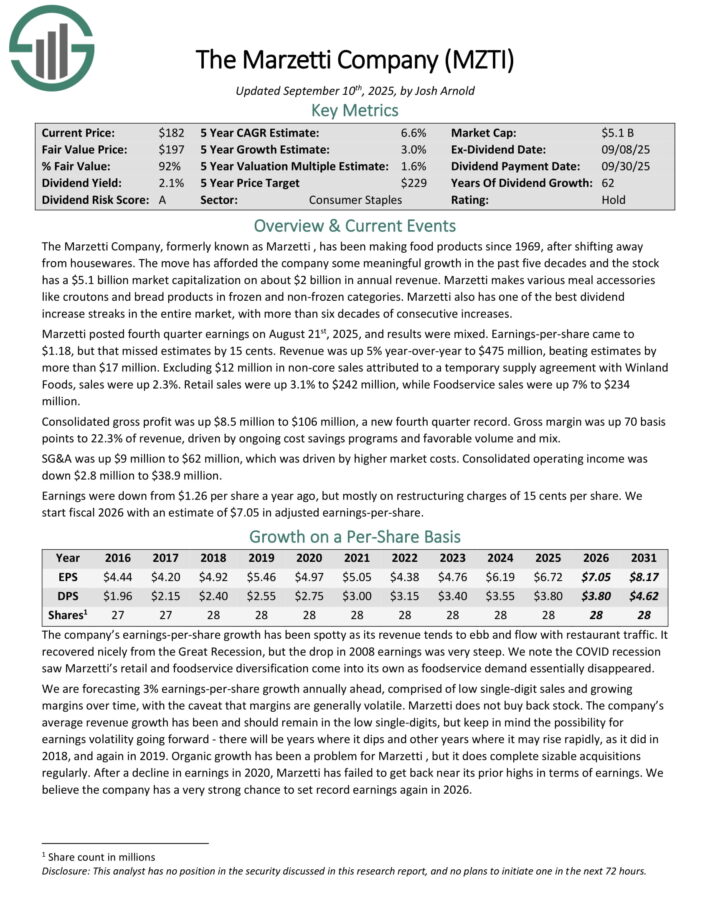

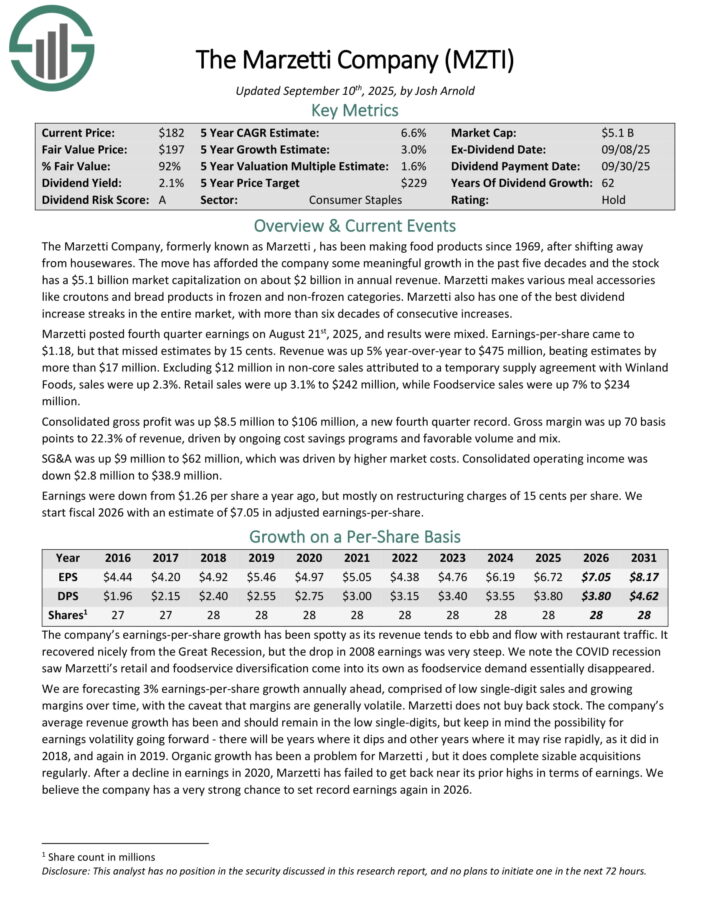

Lack of Change Dividend King: The Marzetti Firm (MZTI)

- Consecutive Annual Dividend Will increase: 62

The Marzetti Firm has been making meals merchandise since 1969, after shifting away from housewares.

Marzetti makes varied meal equipment like croutons and bread merchandise in frozen and non-frozen classes. Marzetti additionally has probably the greatest dividend enhance streaks in the whole market, with greater than six a long time of consecutive will increase.

Marzetti posted fourth quarter earnings on August twenty first, 2025, and outcomes had been combined. Earnings-per-share got here to $1.18, however that missed estimates by 15 cents. Income was up 5% year-over-year to $475 million, beating estimates by greater than $17 million.

Excluding $12 million in non-core gross sales attributed to a short lived provide settlement with Winland Meals, gross sales had been up 2.3%. Retail gross sales had been up 3.1% to $242 million, whereas Foodservice gross sales had been up 7% to $234 million.

Consolidated gross revenue was up $8.5 million to $106 million, a brand new fourth quarter report. Gross margin was up 70 foundation factors to 22.3% of income, pushed by ongoing value financial savings packages and favorable quantity and blend.

SG&A was up $9 million to $62 million, which was pushed by greater market prices. Consolidated working revenue was down $2.8 million to $38.9 million.

Earnings had been down from $1.26 per share a yr in the past, however totally on restructuring expenses of 15 cents per share.

Click on right here to obtain our most up-to-date Certain Evaluation report on MZTI (preview of web page 1 of three proven beneath):

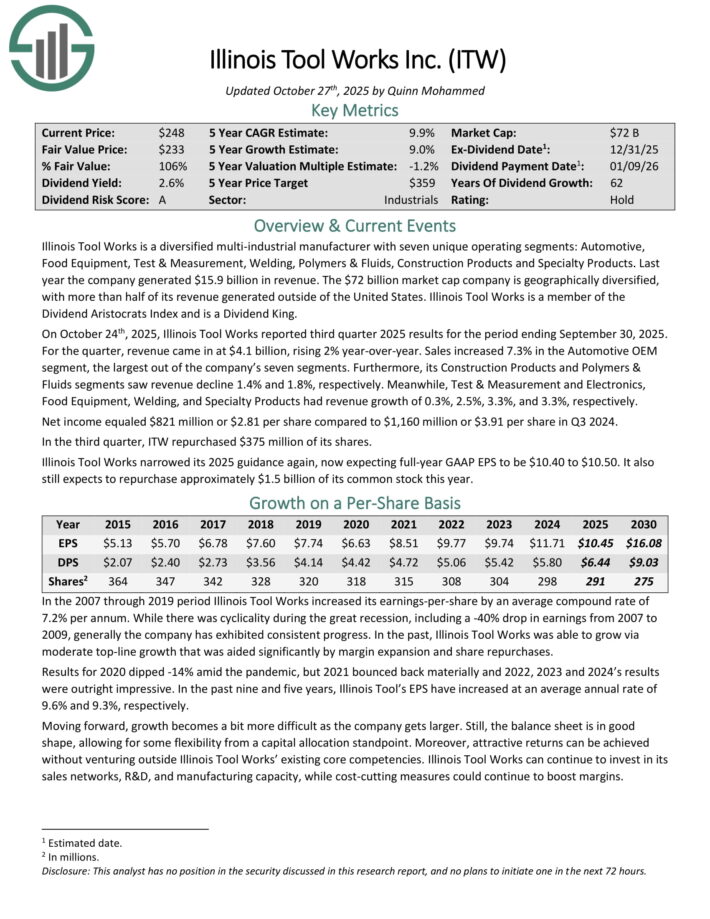

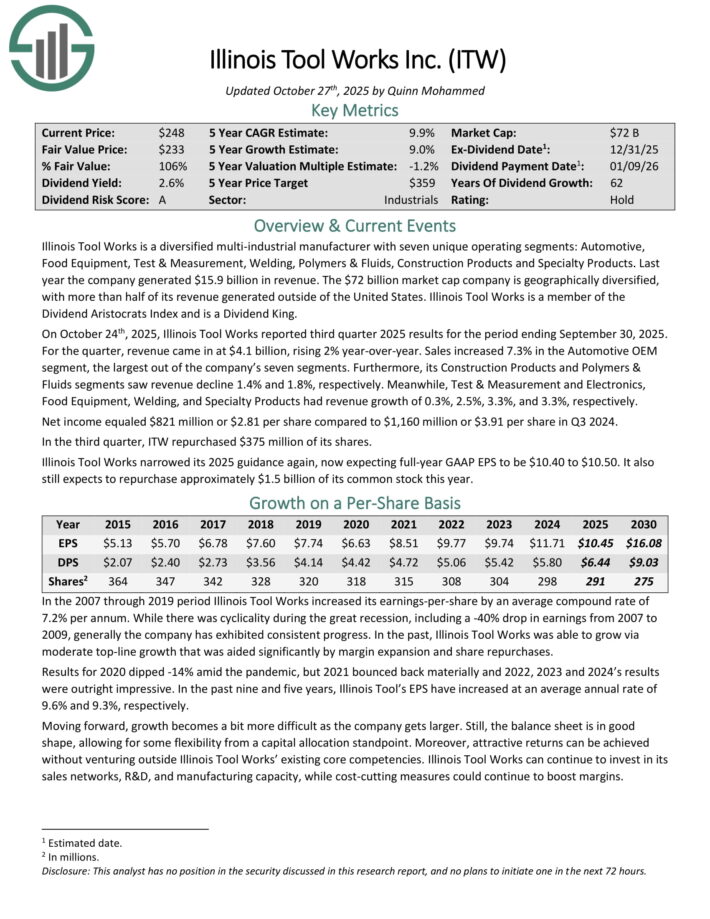

Lack of Change Dividend King: Illinois Software Works (ITW)

- Consecutive Annual Dividend Will increase: 62

Illinois Software Works is a diversified multi-industrial producer with seven distinctive working segments: Automotive, Meals Gear, Check & Measurement, Welding, Polymers & Fluids, Development Merchandise and Specialty Merchandise.

Final yr the corporate generated $15.9 billion in income. The $72 billion market cap firm is geographically diversified, with greater than half of its income generated exterior of the USA.

Illinois Software Works is a member of the Dividend Aristocrats Index and is a Dividend King.

On October twenty fourth, 2025, Illinois Software Works reported third quarter 2025 outcomes for the interval ending September 30, 2025. For the quarter, income got here in at $4.1 billion, rising 2% year-over-year. Gross sales elevated 7.3% within the Automotive OEM phase, the biggest out of the corporate’s seven segments.

Moreover, its Development Merchandise and Polymers & Fluids segments noticed income decline 1.4% and 1.8%, respectively. In the meantime, Check & Measurement and Electronics, Meals Gear, Welding, and Specialty Merchandise had income progress of 0.3%, 2.5%, 3.3%, and three.3%, respectively.

Internet revenue equaled $821 million or $2.81 per share in comparison with $1,160 million or $3.91 per share in Q3 2024. Within the third quarter, ITW repurchased $375 million of its shares.

Illinois Software Works narrowed its 2025 steering once more, now anticipating full-year GAAP EPS to be $10.40 to $10.50. It additionally nonetheless expects to repurchase roughly $1.5 billion of its frequent inventory this yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on ITW (preview of web page 1 of three proven beneath):

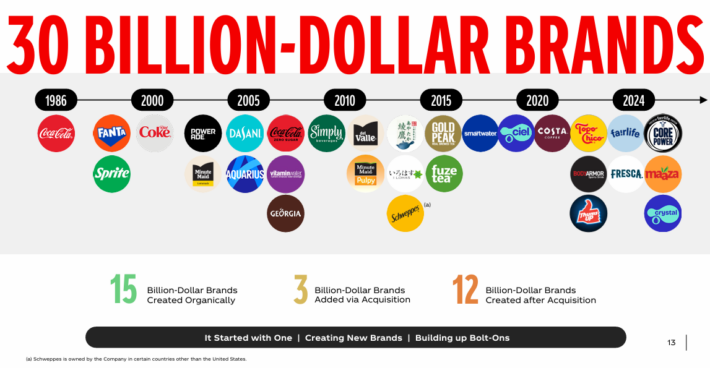

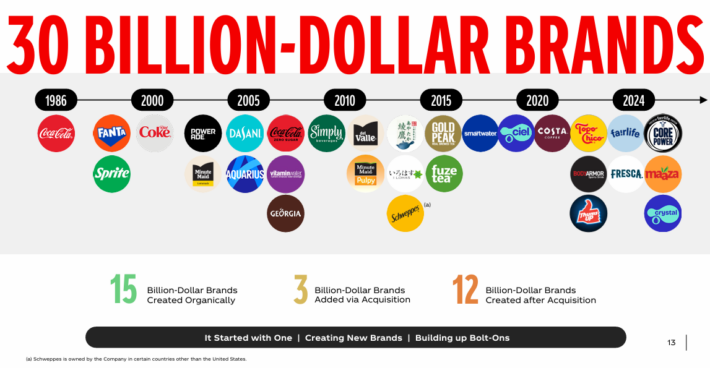

Lack of Change Dividend King: Coca-Cola Co. (KO)

- Consecutive Annual Dividend Will increase: 63

Coca-Cola is the world’s largest beverage firm, because it owns or licenses greater than 500 distinctive non–alcoholic manufacturers. Because the firm’s founding in 1886, it has unfold to greater than 200 international locations worldwide.

Coca-Cola now has 30 billion-dollar manufacturers in its portfolio, which every generate not less than $1 billion in annual gross sales.

Supply: Investor Presentation

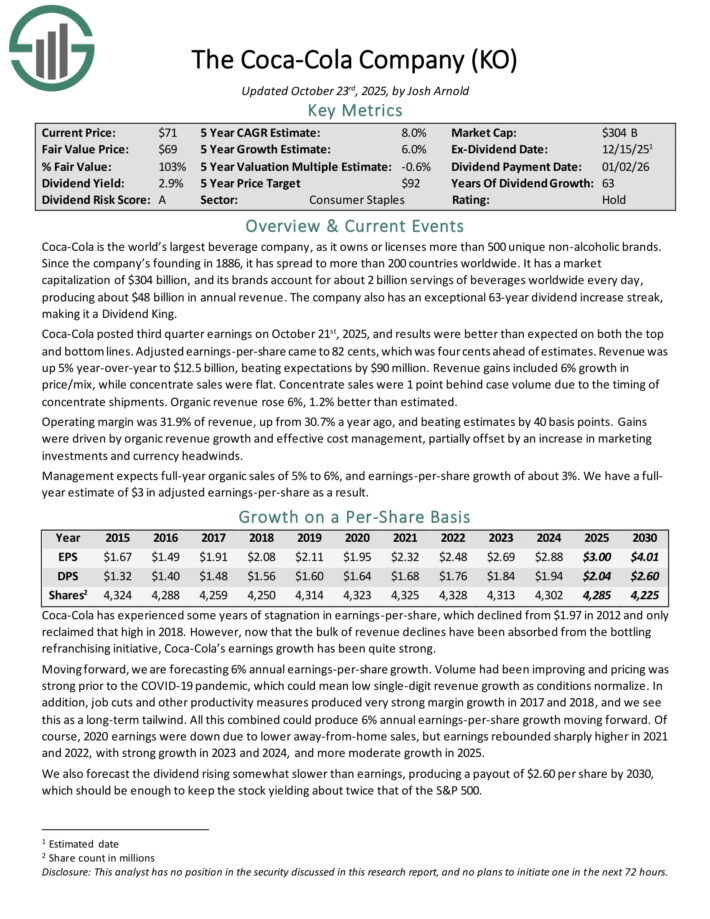

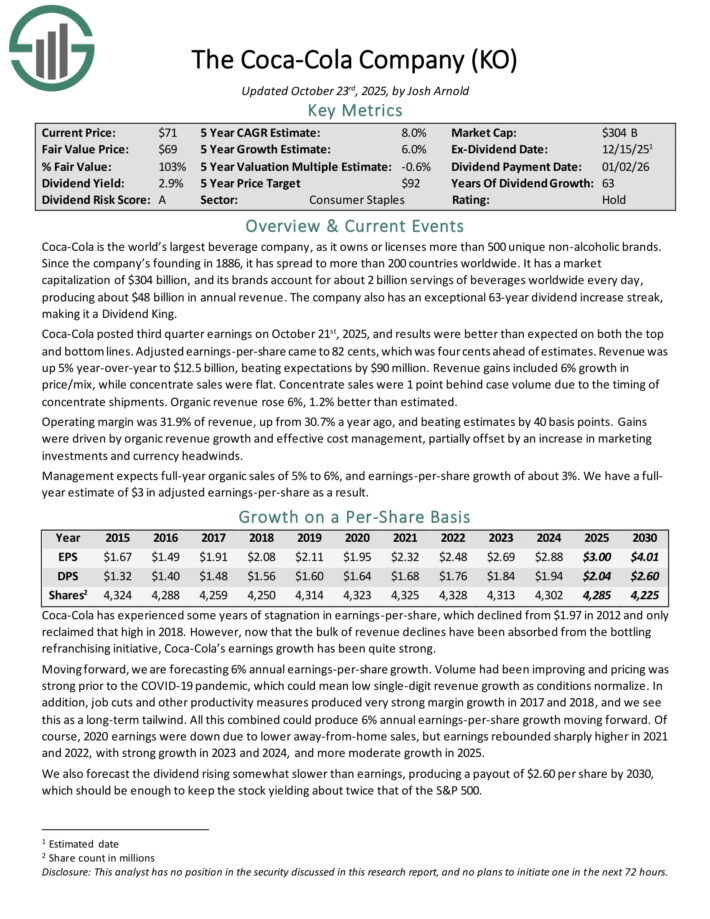

Coca-Cola posted third quarter earnings on October twenty first, 2025, and outcomes had been higher than anticipated on each the highest and backside traces. Adjusted earnings-per-share got here to 82 cents, which was 4 cents forward of estimates. Income was up 5% year-over-year to $12.5 billion, beating expectations by $90 million.

Income positive aspects included 6% progress in worth/combine, whereas focus gross sales had been flat. Focus gross sales had been 1 level behind case quantity as a result of timing of focus shipments. Natural income rose 6%, 1.2% higher than estimated.

Coca-Cola’s aggressive benefits embody its unparalleled suite of beverage manufacturers, in addition to its environment friendly world distribution community. Coca-Cola can also be extraordinarily immune to recessionary environments.

Click on right here to obtain our most up-to-date Certain Evaluation report on KO (preview of web page 1 of three proven beneath):

Lack of Change Dividend King: Colgate-Palmolive (CL)

- Consecutive Annual Dividend Will increase: 64

Colgate-Palmolive has been in existence for greater than 200 years, having been based in 1806. It operates in lots of client staples markets, together with Oral Care, Private Care, Residence Care, and extra just lately, Pet Vitamin.

These segments afford the corporate simply over $20 billion in annual income. Merchandise like toothpaste, cleaning soap, and pet meals have barely modified in a long time. In consequence, Colgate-Palmolive has elevated its dividend for 64 consecutive years.

Colgate posted second quarter earnings on August 1st, 2025, and outcomes had been higher than anticipated on each the highest and backside traces. Adjusted earnings-per-share got here to 92 cents, which was three cents forward of estimates.

Income was up 1% year-over-year to $5.11 billion, beating estimates however $80 million. Internet gross sales had been up 1%, with natural income up 1.8%, together with a 0.6% detrimental influence from decrease personal label pet gross sales.

Gross revenue was down 50 foundation factors to 60.1% of earnings, whereas adjusted gross revenue was down 70 foundation factors to 60.1% of income. Gross margin was impacted by uncooked materials inflation and tariffs, though administration famous these impacts had been barely lessened within the second quarter.

Internet money supplied by operations was $1.48 billion for the primary six months of the yr. The essential Hill’s enterprise, which has fueled a lot of Colgate’s progress lately, was up 5% on an natural foundation, together with 2% quantity positive aspects and three% worth will increase.

Click on right here to obtain our most up-to-date Certain Evaluation report on CL (preview of web page 1 of three proven beneath):

Lack of Change Dividend King: Cincinnati Monetary (CINF)

- Consecutive Annual Dividend Will increase: 65

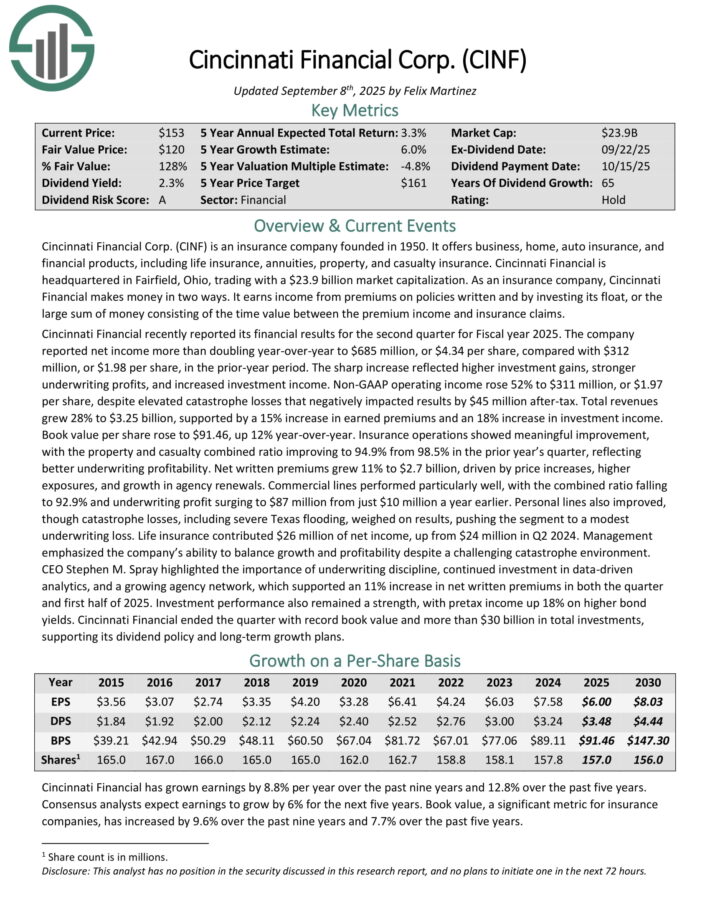

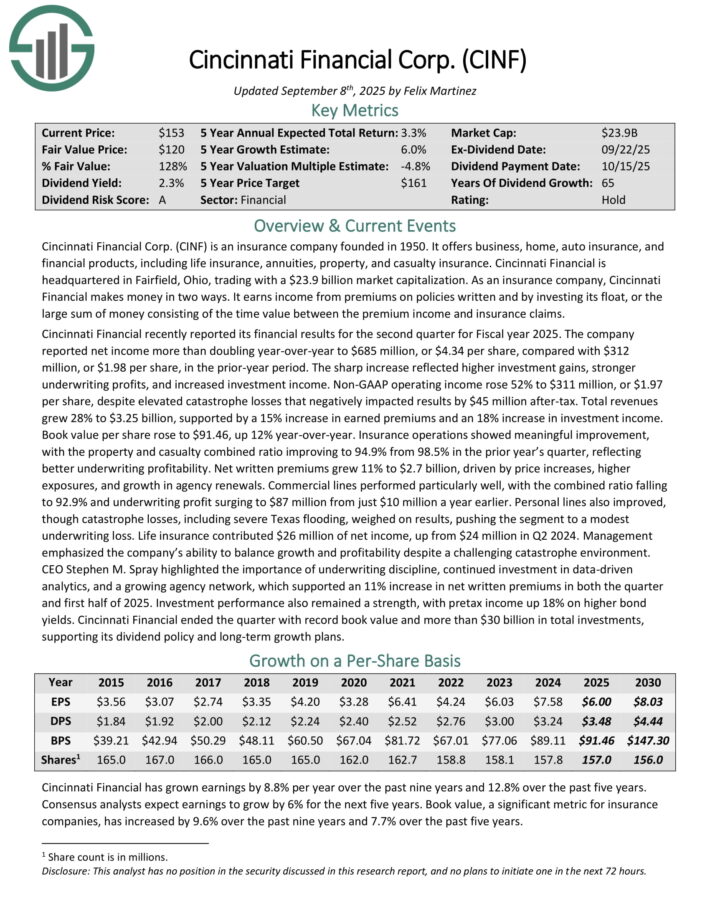

Cincinnati Monetary Corp. (CINF) is an insurance coverage firm based in 1950. It affords enterprise, house, auto insurance coverage, and monetary merchandise, together with life insurance coverage, annuities, property, and casualty insurance coverage.

As an insurance coverage firm, Cincinnati Monetary makes cash in two methods. It earns revenue from premiums on insurance policies written and by investing its float, or the big sum of cash consisting of the time worth between the premium revenue and insurance coverage claims.

Insurance coverage has barely modified over the previous a number of a long time, which has allowed the corporate to keep up over 60 years of annual dividend will increase.

Cincinnati Monetary just lately reported its monetary outcomes for the second quarter for Fiscal yr 2025. The corporate reported internet revenue greater than doubling year-over-year to $685 million, or $4.34 per share, in contrast with $312 million, or $1.98 per share, within the prior-year interval.

The sharp enhance mirrored greater funding positive aspects, stronger underwriting income, and elevated funding revenue.

Non-GAAP working revenue rose 52% to $311 million, or $1.97 per share, regardless of elevated disaster losses that negatively impacted outcomes by $45 million after-tax. Complete revenues grew 28% to $3.25 billion, supported by a 15% enhance in earned premiums and an 18% enhance in funding revenue.

Guide worth per share rose to $91.46, up 12% year-over-year. Insurance coverage operations confirmed significant enchancment, with the property and casualty mixed ratio bettering to 94.9% from 98.5% within the prior yr’s quarter, reflecting higher underwriting profitability.

Internet written premiums grew 11% to $2.7 billion, pushed by worth will increase, greater exposures, and progress in company renewals.

Cincinnati Monetary ended the quarter with report e-book worth and greater than $30 billion in whole investments, supporting its dividend coverage and long-term progress plans.

Click on right here to obtain our most up-to-date Certain Evaluation report on CINF (preview of web page 1 of three proven beneath):

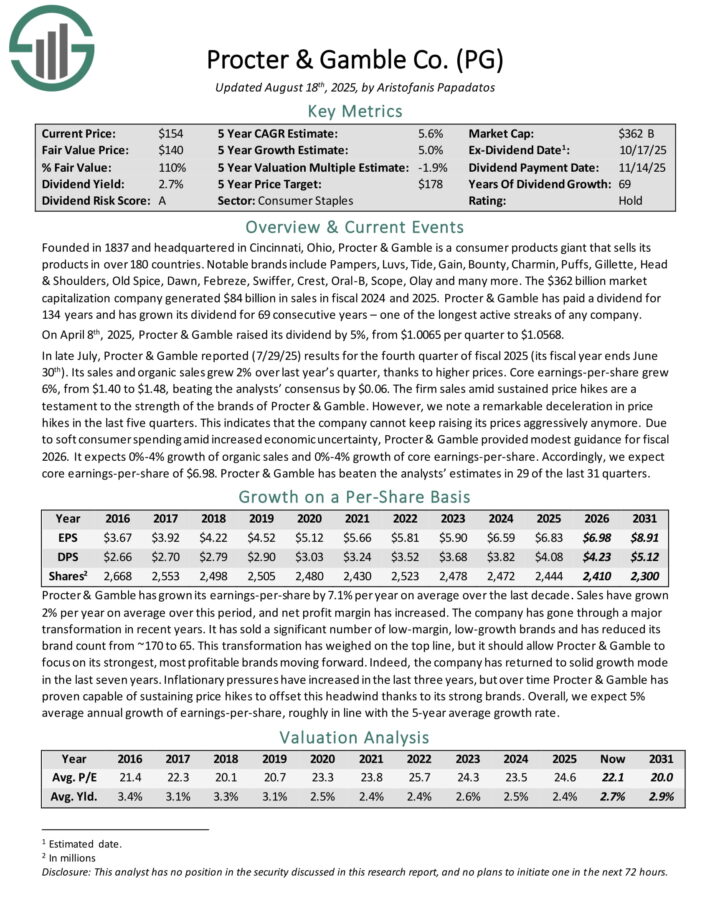

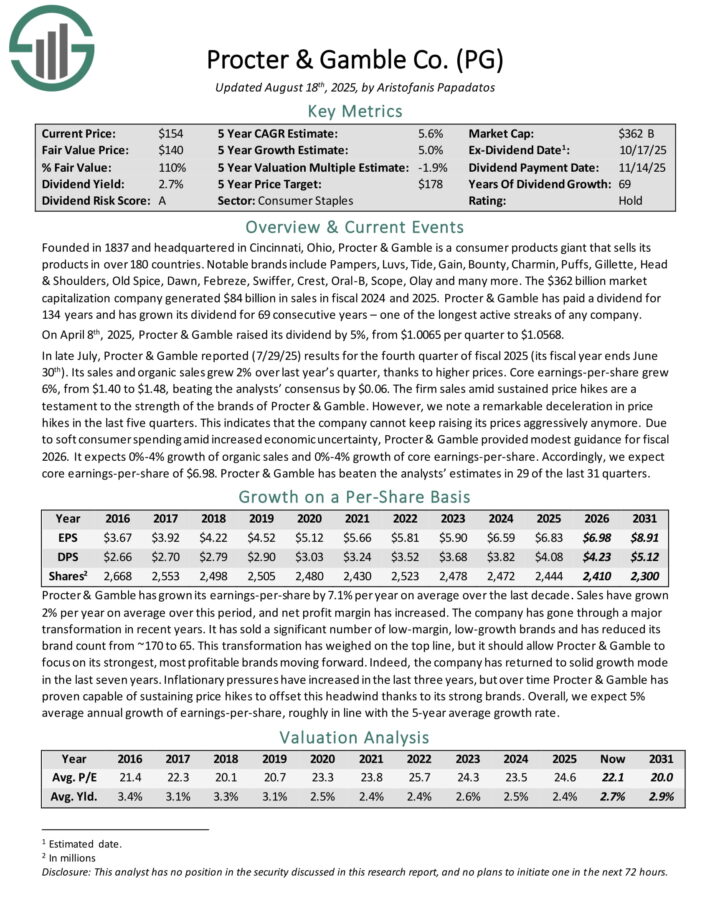

Lack of Change Dividend King: Procter & Gamble (PG)

- Consecutive Annual Dividend Will increase: 69

Procter & Gamble is a client merchandise large that sells its merchandise in over 180 international locations. Notable manufacturers embody Pampers, Luvs, Tide, Achieve, Bounty, Charmin, Puffs, Gillette, Head & Shoulders, Outdated Spice, Daybreak, Febreze, Swiffer, Crest, Oral-B, Scope, Olay and plenty of extra.

The corporate generated $84 billion in gross sales in fiscal 2024 and 2025. Procter & Gamble has paid a dividend for 134 years and has grown its dividend for 69 consecutive years – one of many longest lively streaks of any firm.

In late July, Procter & Gamble reported (7/29/25) outcomes for the fourth quarter of fiscal 2025 (its fiscal yr ends June thirtieth). Its gross sales and natural gross sales grew 2% over final yr’s quarter, due to greater costs. Core earnings-per-share grew 6%, from $1.40 to $1.48, beating the analysts’ consensus by $0.06.

The agency gross sales amid sustained worth hikes are a testomony to the power of the manufacturers of Procter & Gamble. Nonetheless, we observe a exceptional deceleration in worth hikes within the final 5 quarters. This means that the corporate can not preserve elevating its costs aggressively anymore.

As a result of gentle client spending amid elevated financial uncertainty, Procter & Gamble supplied modest steering for fiscal 2026. It expects 0%-4% progress of natural gross sales and 0%-4% progress of core earnings-per-share.

Click on right here to obtain our most up-to-date Certain Evaluation report on PG (preview of web page 1 of three proven beneath):

Lack of Change Dividend King: Northwest Pure Holding (NWN)

- Consecutive Annual Dividend Will increase: 70

NW Pure was based in 1859 and has grown from only a handful of shoppers to serving greater than 760,000 right now. The utility’s mission is to ship pure fuel to its prospects within the Pacific Northwest.

The corporate’s areas served are proven within the picture beneath.

Supply: Investor Presentation

On August 7, 2025, Northwest Pure Holding Firm reported outcomes for the second quarter ended June 30, 2025, exhibiting regular progress in buyer base and fee restoration regardless of seasonal weak spot typical of hotter months.

The corporate recorded internet revenue of $7.4 million, or $0.19 per diluted share, in contrast with $5.8 million, or $0.16 per share, in the identical quarter final yr. Working income totaled $219.6 million, barely down from $222.3 million within the prior yr, as decrease fuel utilization from delicate climate offset the good thing about fee will increase and buyer progress.

Working revenue was $28.9 million, up from $25.7 million, reflecting disciplined value management and contributions from utility margin enchancment. The fuel distribution phase added almost 11,000 new prospects year-over-year, sustaining annual progress of about 1.4%, whereas infrastructure companies contributed modestly to earnings.

Click on right here to obtain our most up-to-date Certain Evaluation report on NWN (preview of web page 1 of three proven beneath):

Extra Studying

If you’re fascinated about discovering different high quality dividend progress shares, the next Certain Dividend assets could also be helpful:

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].